December 2025

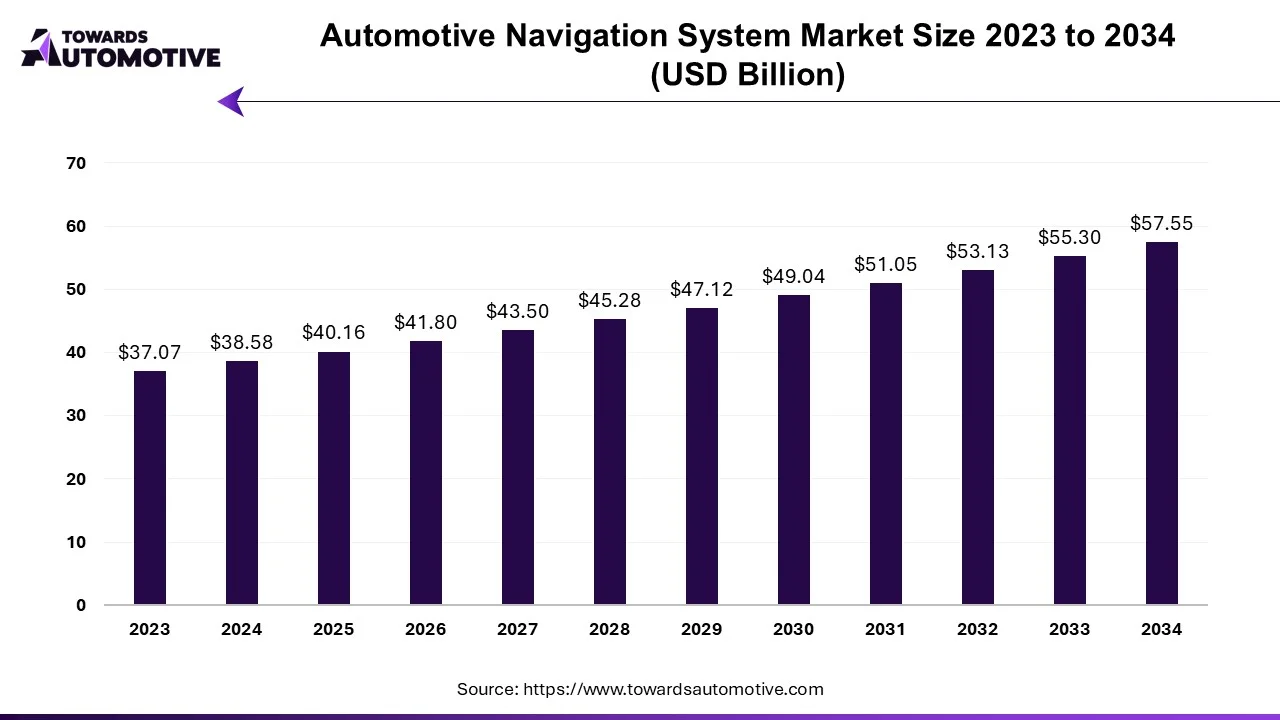

The automotive navigation systems market is projected to reach USD 57.55 billion by 2034, expanding from USD 40.16 billion in 2025, at an annual growth rate of 4.08% during the forecast period from 2025 to 2034.

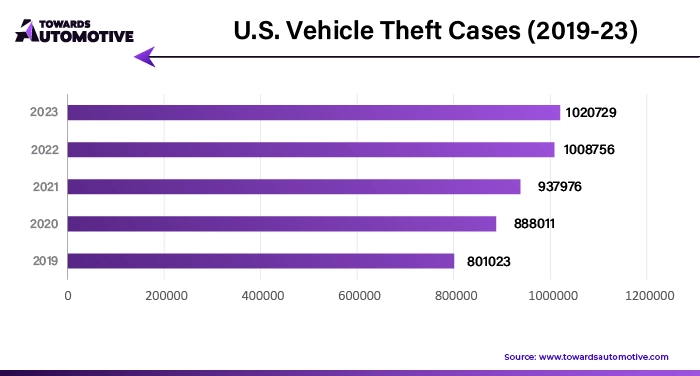

The automotive navigation systems market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of navigation solutions for the automotive sector. There are various types of devices manufactured in this sector consisting of in-dash navigation system, portable navigation system, mobile navigation system and some others. These devices are designed for different types of vehicles comprising of passenger car, heavy commercial vehicles, light commercial vehicles and others. It is available in a well-defined distribution channel including OEMs and aftermarket. The growing vehicle theft cases in different parts of the world has boosted the market expansion. This market is likely to rise drastically with the growth of the software industry across the globe.

The in-dash navigation systems segment held a dominant share of the market. The growing adoption of advanced navigation systems for deriving locations easily has boosted the market growth. Also, the integration of advanced navigation tools in automotive infotainments systems along with rapid advancements in navigation technology is playing a vital role in shaping the industrial expansion. Moreover, the availability of these navigation systems in various online platforms such as Amazon, Flipkart, Chroma and some others is anticipated to foster the growth of the automotive navigation systems market.

The mobile navigation systems segment is likely to rise with a significant growth rate during the forecast period. The rapid advancements in 5G technology along with rapid proliferation of smart phones has boosted the market expansion. Also, the availability of several advanced navigation apps in Play store and Apps Store is playing a positive role in shaping the industry. Additionally, numerous benefits of these systems including real-time traffic updates, cost-effective, convenience and familiarity, integration with other vehicle systems and some others is projected to drive the growth of the automotive navigation systems market.

The electric vehicle segment held the largest share of the market. The growing demand for eco-friendly transportation solutions has boosted the industrial expansion. Also, numerous government initiatives aimed at rising EV awareness among the people is further contributing to the market growth. Moreover, rapid integration of navigation systems in electric vehicles to identify locations quickly is predicted to drive the growth of the automotive navigation systems market.

The ICE segment is anticipated to witness rapid growth during the forecast period. The growing sales of gasoline-powered supercars in countries such as the U.S., UK, Italy, France, Canada and some others has driven the industrial growth. Also, the increasing demand for heavy-duty trucks from several industries such as mining, construction, oil &gas and some others is further adding to the market expansion. Moreover, the rising adoption of latest navigation tools by fleet operators along with rapid sales of diesel-powered vehicles in different regions is likely to drive the growth of the automotive navigation systems market.

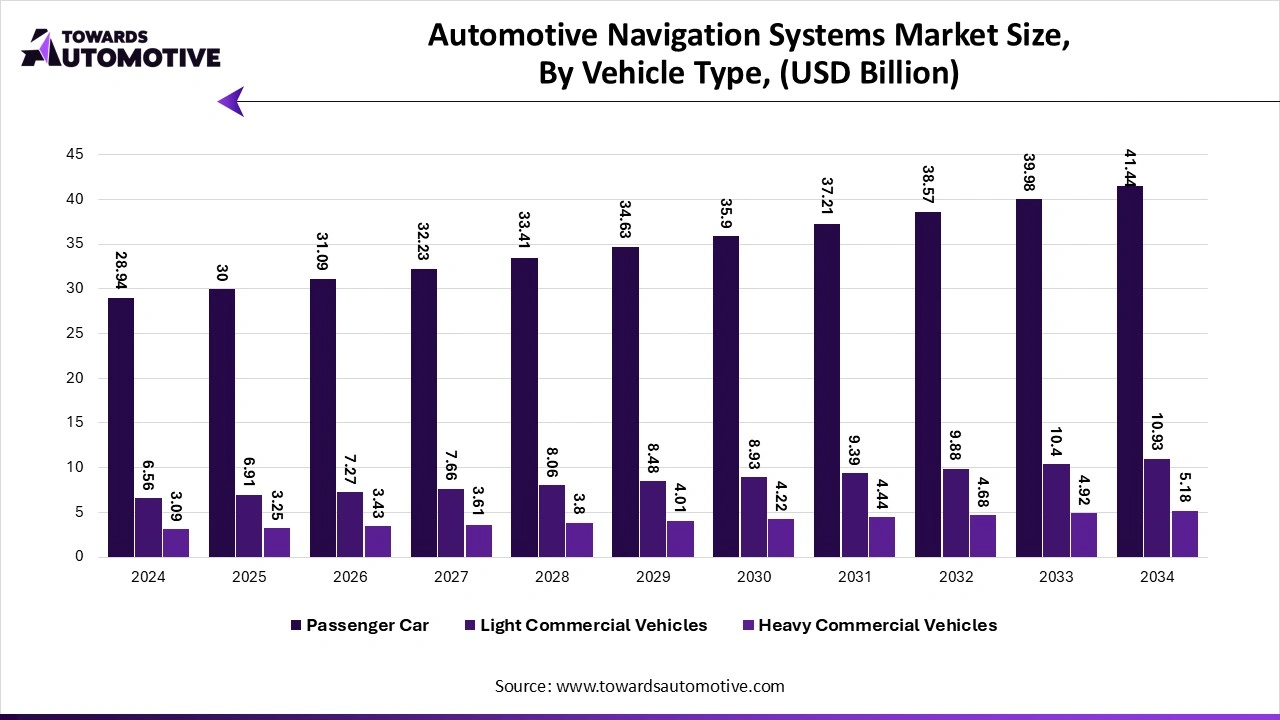

The passenger car segment dominated this industry. The rising demand for luxury cars among rich-class people has boosted the market growth. Additionally, the growing adoption of PHEVs in developing nations such as India, Vietnam, Argentina and some others is playing a crucial role in shaping the industrial landscape. Moreover, the integration of advanced navigation tools in passenger cars to enhance the driving experience is anticipated to boost the growth of the automotive navigation systems market.

The light commercial vehicles segment is predicted to rise with a significant CAGR during the forecast period. The growing sales of light commercial vehicles in mid-income countries such as India, Vietnam, Indonesia and some others has boosted the market expansion. Also, rise in number of fleet operators dealing in LCVs coupled with surge in LCV theft cases is further contributing positively for the industrial growth. Moreover, the increasing adoption of LCEVs along with availability of various navigation tools designed for LCVs is likely to propel the growth of the automotive navigation systems market.

The aftermarket segment led this industry. The growing demand for aesthetic navigation devices among car owners has boosted the market growth. Also, the rise in number of car detailing shops in different parts of the world is contributing to the industrial expansion. Additionally, the availability of navigation solutions in aftermarket platforms is likely to propel the growth of the automotive navigation systems market.

The OEM segment is predicted to rise with a considerable CAGR during the forecast period. The growing demand for genuine automotive components has boosted the market expansion. Also, the rapid investment by OEMs for developing advanced navigation solutions is contributing significantly to the industrial growth. Additionally, the increasing consumer preference towards high-quality products is expected to boost the growth of the automotive navigation systems market.

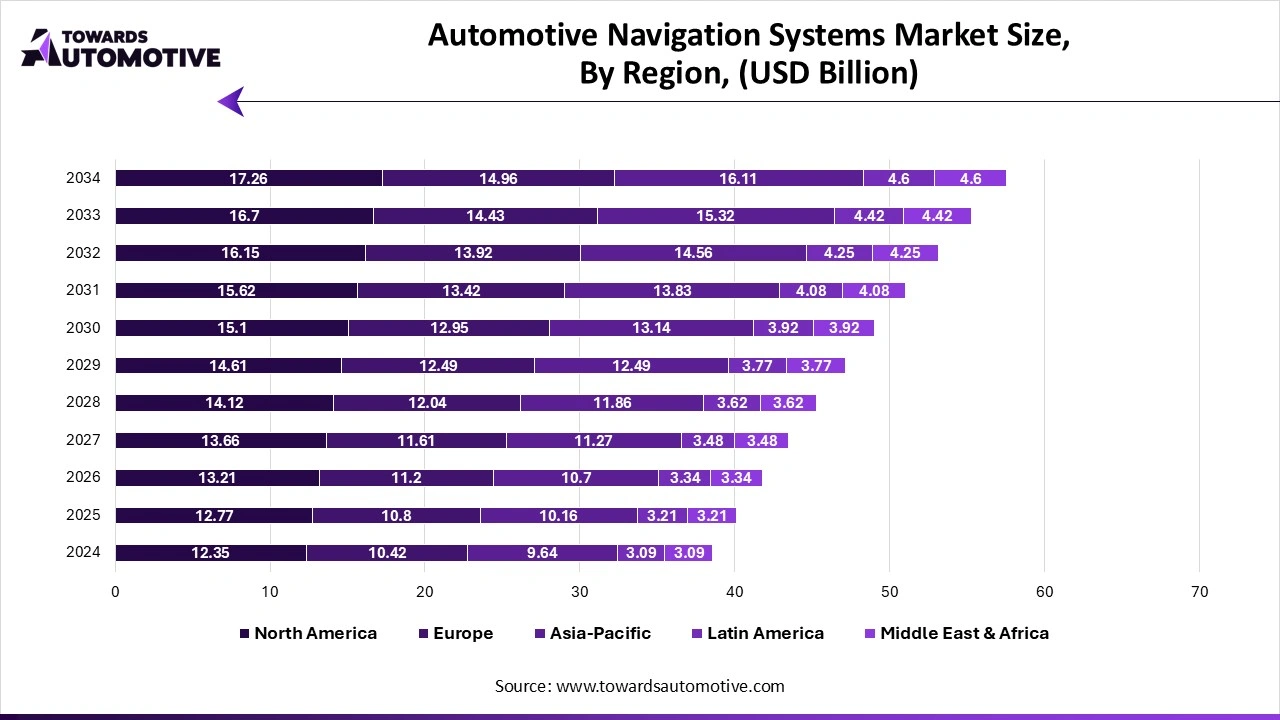

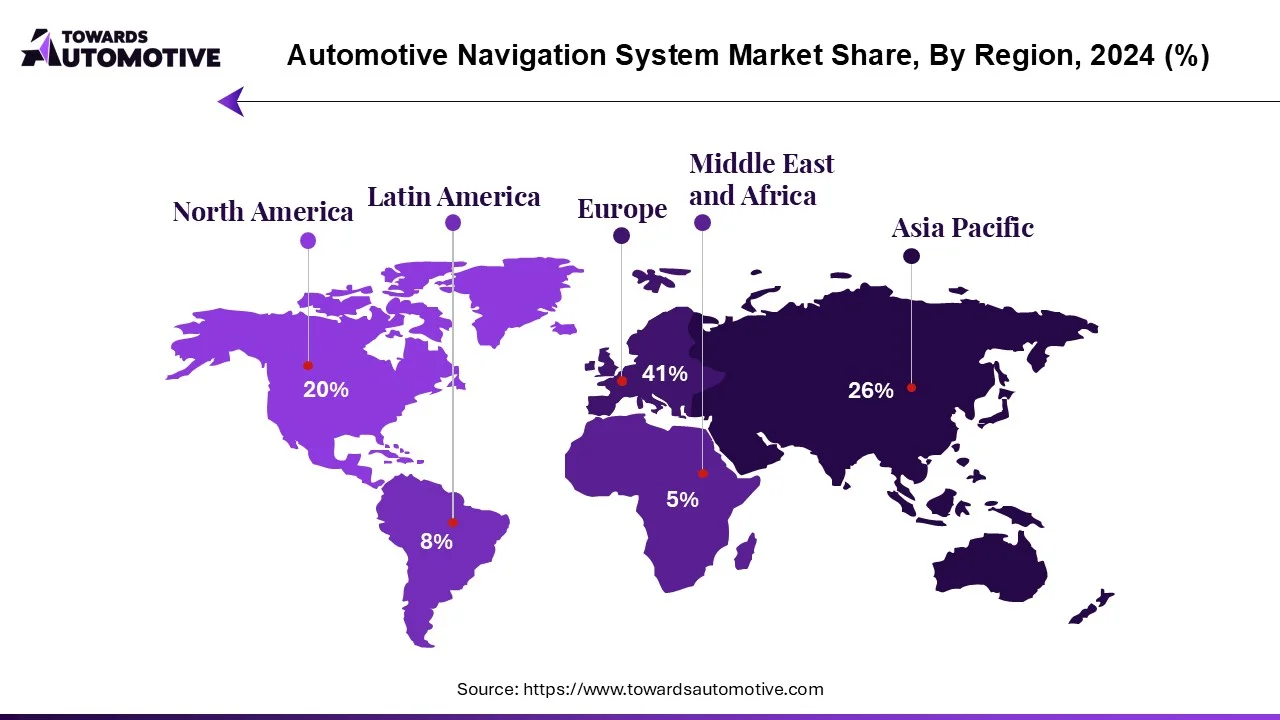

North America held the highest share of the automotive navigation systems market. The growing demand for autonomous vehicles along with rapid investment in AV industry in countries such as the U.S. and Canada has boosted the market growth. Also, the presence of several automotive brands such as Ford, Chevrolet, General Motors, Tesla and some others is playing a vital role in shaping the industrial landscape. Moreover, the increasing adoption of advanced navigation solutions by car owners is expected to boost the growth of the automotive navigation systems market in this region.

U.S. is the major contributor in this region. The growing demand for luxury vehicles along with technological advancements in automotive sector has boosted the market growth. Additionally, the rapid integration of ADAS in vehicles coupled with launch of several satellites to enhance navigation experience is driving the market expansion.

Asia Pacific is expected to grow with the highest growth rate during the forecast period. The rising production and sales of automotives in countries such as China, India, Japan, South Korea and some others has boosted the market growth. Also, surge in demand for in-dash navigation systems along with availability of navigation solutions in online platforms is contributing significantly to the industrial expansion. Moreover, the presence of several market players such as JVCKenwood, Denso, Pioneer Corporation and some others is likely to drive the growth of the automotive navigation systems market in this region.

China and Japan are the significant contributors in this region. In China, the market is generally driven due to the rise in number of vehicle theft cases along with advancements in automotive technology. In Japan, the advancements in technologies such as AI and 5G coupled with presence of several automotive brands such as Mitsubishi, Toyota, Mazda and some others contributes significantly to the industrial expansion.

The automotive navigation systems market is a highly competitive industry with the presence of a numerous dominating players. Some of the prominent companies in this industry consists of TomTom, Continental, Alpine, Robert Bosch GmbH, Faurecia, Clarion, Garmin Ltd., NNG Software, Denso, Aisin Seiki, Harman and some others. These companies are constantly engaged in developing high-quality navigation systems for automotives and adopting numerous strategies such as partnerships, launches, acquisitions, joint ventures, collaborations, business expansions and some others to maintain their dominant position in this industry. For instance, in November 2024, TomTom partnered with CARIAD. This partnership is done for integrating an advanced navigation system for the Volkswagen vehicles. Also, in August 2024, Garmin launched a new GPS navigator. This new GPS navigator is designed for enhancing the navigation experience in trucks.

By Device Type

By Propulsion

By Vehicle Type

By Sales Channel

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us