April 2025

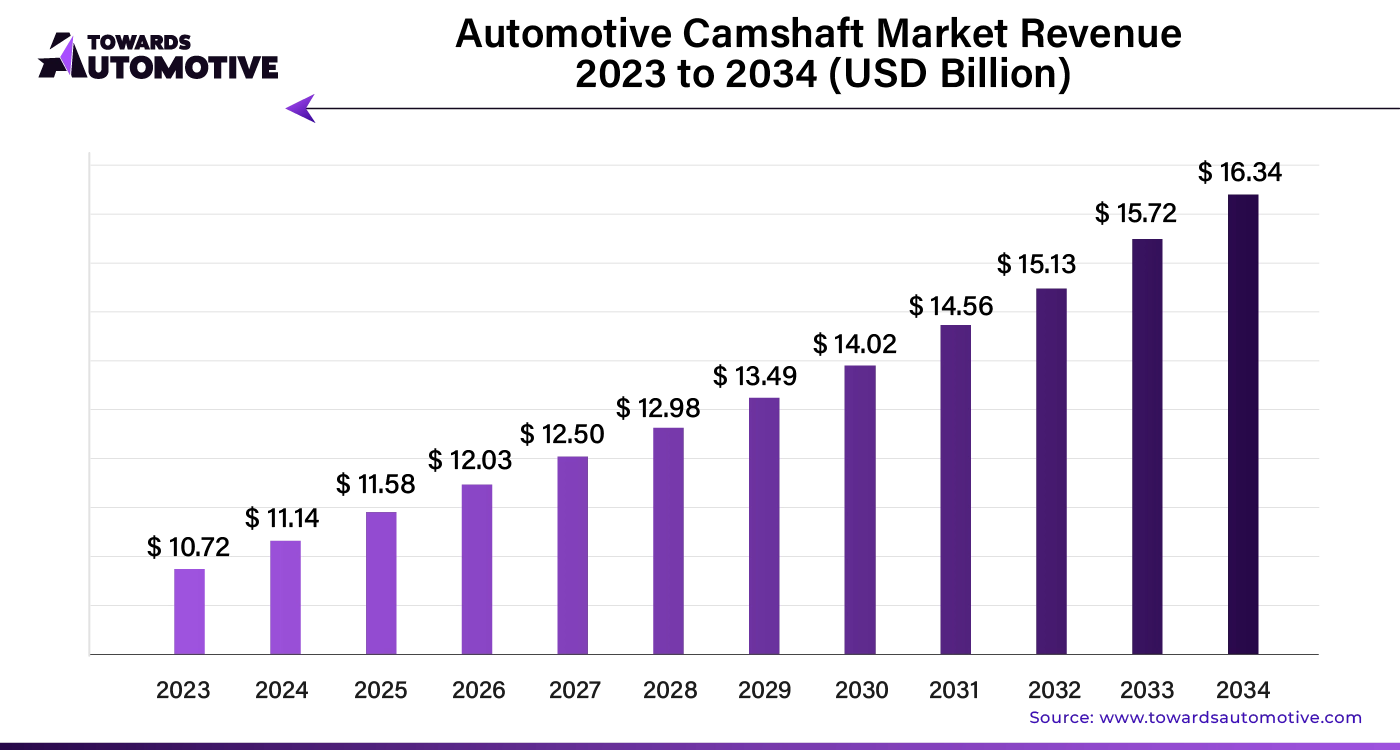

The global automotive camshaft market size is calculated at USD 11.14 billion in 2024 and is expected to be worth USD 16.34 billion by 2034, expanding at a CAGR of 3.9% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The increasing sales of vehicles worldwide are significantly driving the demand for automotive camshafts. As consumers continue to purchase new vehicles, the need for efficient and reliable camshaft systems is rising. This trend is further bolstered by the growing market for engine replacements, particularly as older and outdated engines are phased out in favor of more modern, high-performance alternatives.

A prominent trend gaining traction in the market is the rising popularity of double overhead camshafts (DOHC). Automotive manufacturers are increasingly adopting DOHC technology due to its ability to enhance engine performance and improve fuel efficiency. This shift towards DOHC is expected to be highly profitable for camshaft manufacturers, as it aligns with the industry’s focus on delivering more powerful and efficient engines.

Engine downsizing is another crucial trend influencing the market. As automakers seek to reduce engine size without compromising performance, the demand for specialized camshafts designed for smaller, more efficient engines is growing. This trend also presents opportunities in the aftermarket sector, where consumers are seeking to upgrade or replace their vehicle’s camshafts with more advanced options. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Manufacturers are also responding to the implementation of stricter emission regulations by optimizing camshaft designs to enhance engine control and reduce emissions. These regulatory pressures are driving investment in research and development, with key players focusing on innovations that deliver both higher performance and cleaner emissions.

AI integration is set to revolutionize the automotive camshaft market, driving significant growth and innovation. By incorporating AI-driven technologies, manufacturers can optimize camshaft design and production processes, enhancing precision and efficiency. AI algorithms can analyze vast amounts of data to identify the most efficient designs, reducing material waste and production costs. Moreover, AI-powered predictive maintenance systems can monitor the performance of camshafts in real-time, identifying potential issues before they lead to costly breakdowns. This not only extends the lifespan of camshafts but also ensures the reliability of vehicles.

Furthermore, AI facilitates the development of advanced camshaft systems tailored to the demands of modern engines, including those in electric and hybrid vehicles. As the automotive industry shifts towards more sustainable and efficient powertrains, AI’s role in optimizing camshaft functionality will become increasingly vital. By streamlining production, improving product quality, and enabling cutting-edge innovations, AI is poised to be a key driver of growth in the automotive camshaft market.

The supply chain in the automotive camshaft market plays a crucial role in ensuring timely production and delivery of high-quality components. It begins with the procurement of raw materials such as cast iron, steel, and aluminum from trusted suppliers. These materials are then sent to manufacturers who forge and machine the camshafts, adhering to stringent quality standards to meet the specific requirements of various automotive engines.

Next, the finished camshafts are distributed to automotive manufacturers and aftermarket distributors. These stakeholders depend on an efficient logistics network to minimize lead times and ensure that camshafts reach assembly lines and repair shops without delay. The supply chain also involves close collaboration with technology providers to integrate advanced manufacturing techniques, such as precision machining and heat treatment, which enhance product performance and durability.

As the automotive industry increasingly shifts toward electric and hybrid vehicles, the supply chain must adapt by sourcing materials suitable for new engine designs and optimizing processes for sustainability. Overall, a well-coordinated supply chain is essential for maintaining competitiveness in the rapidly evolving automotive camshaft market.

The automotive camshaft market is driven by a network of manufacturers, suppliers, and technological innovators, all playing pivotal roles in its growth. The main components of this ecosystem include camshaft manufacturers, raw material suppliers, OEMs (Original Equipment Manufacturers), and aftermarket service providers.

Camshaft manufacturers focus on precision engineering, using advanced materials like steel, cast iron, and aluminum alloys to enhance performance and durability. Major players such as MAHLE GmbH, Thyssenkrupp, and Bharat Forge lead the market with their cutting-edge manufacturing technologies and strong global presence.

Raw material suppliers contribute by providing high-quality alloys essential for producing robust camshafts. Companies like ArcelorMittal and NSSMC ensure a steady supply of materials, fostering innovation in the production process.

OEMs, including giants like General Motors and Ford, integrate these camshafts into their engines, emphasizing efficiency, fuel economy, and reduced emissions. Meanwhile, aftermarket service providers cater to the replacement and maintenance needs, ensuring the longevity and performance of vehicles.

This interconnected ecosystem, with each player contributing their expertise, drives the continuous evolution and expansion of the automotive camshaft market.

The automotive camshaft market is witnessing a strong preference for cast camshafts, projected to dominate the global market with an estimated 77.80% value share by 2024. This trend highlights the significant role cast camshafts play in the automotive industry, especially as they cater to the rising demand for passenger and commercial vehicles.

The surge in vehicle purchases, driven by the growing purchasing power in developing countries and increasing infrastructural investments, has created substantial opportunities for cast camshaft manufacturers. These camshafts offer a cost-effective solution, particularly in mass production, making them a favored choice across various vehicle applications. Furthermore, ongoing advancements in material science and design are enabling manufacturers to produce lighter, more efficient cast camshafts, contributing to improved fuel efficiency and engine performance.

In addition to their cost benefits, cast camshafts are gaining traction due to increasingly stringent government regulations on vehicle emissions. As emission standards become more rigorous, the demand for components that help reduce emissions and optimize engine performance, like cast camshafts, is on the rise.

Passenger Cars Lead the Way in Camshaft Demand

Passenger cars are expected to dominate the automotive camshaft market, accounting for a significant 60.10% value share by 2024. This dominance is driven by the growing purchasing power of consumers in developing nations, coupled with the increasing availability of financing options and loans from banks and financial institutions, which is driving car ownership.

The shift towards personal transportation, particularly in regions where public transport infrastructure is lacking, further boosts the demand for passenger cars. Consumers are drawn to the convenience, flexibility, and variety of options that passenger cars offer, making them a preferred choice over public transportation.

Manufacturers are responding to this demand by offering a diverse range of passenger cars tailored to meet the varying needs and budgets of consumers. This wide selection enhances the buying experience, further driving the market's growth.

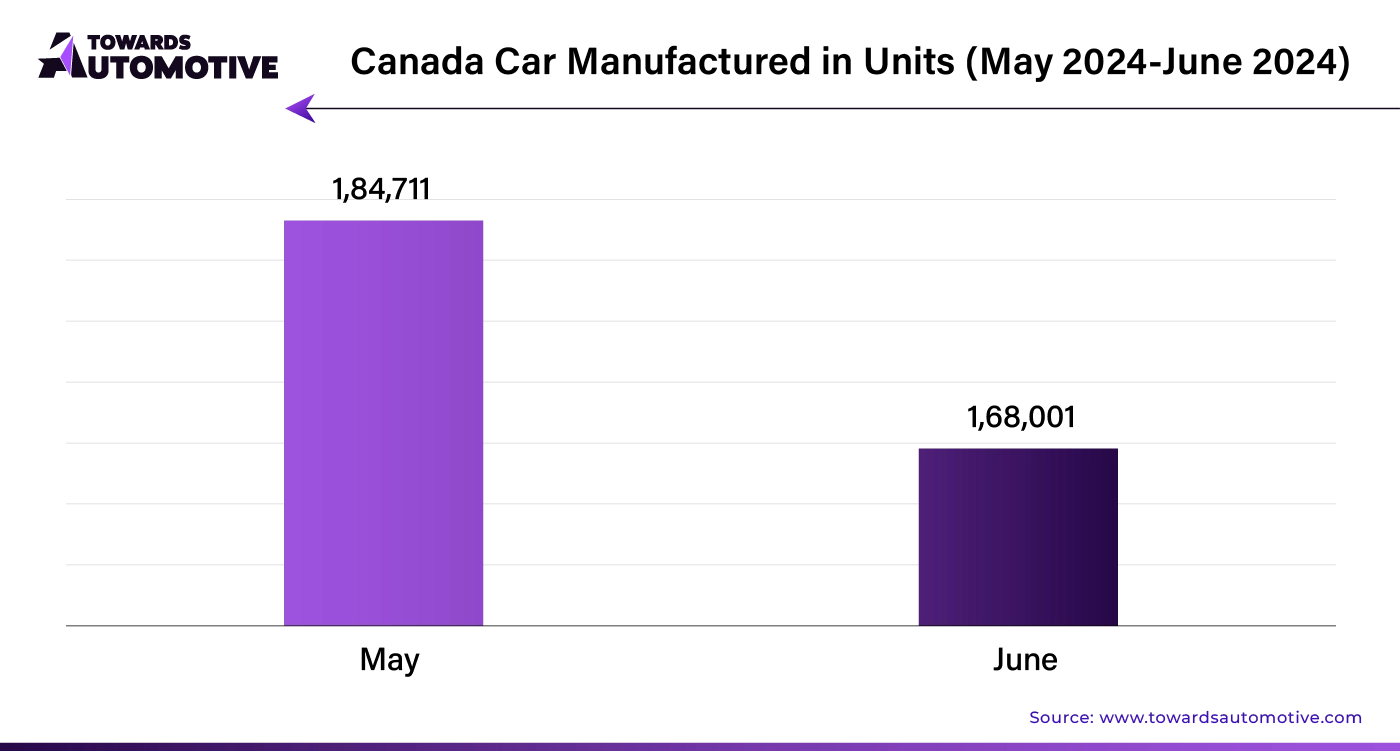

Canada's Automotive Camshaft Market Driven by Rising Automotive Sales

Canada's automotive camshaft market is witnessing a steady increase in sales, with growth slightly ahead of the pace observed in the United States. This trend is largely fueled by Canada's expanding population, leading to a higher demand for automobiles. As a result, the Canadian automotive camshaft market is expected to grow at a compound annual growth rate (CAGR) of approximately 3.1% over the next decade.

The growing demand for passenger and commercial vehicles is directly linked to the need for more engines, thereby boosting automotive camshaft sales. Several significant developments are shaping Canada's market landscape. For instance, in December 2022, Delphi Technologies announced the expansion of its product line by adding 19 parts to its Sparta fuel pump line and 138 parts to its main product line, including engine camshaft position sensors. This highlights the increasing demand for advanced automotive components in Canada.

Additionally, in October 2022, Canada commenced the production of the CR-V hybrid, a move expected to significantly impact the market. The CR-V hybrid is anticipated to account for nearly 50% of CR-V sales, further driving the demand for automotive camshafts.

Germany Leads Innovation in Next-Generation Camshafts for Reduced Carbon Emissions

Germany remains a leader in the European automotive industry, home to major manufacturers such as Mercedes-Benz and Volkswagen. As the automotive sector continues to grow, so does the demand for automotive camshafts, with the market projected to achieve a 3.2% CAGR through 2034.

German manufacturers are pioneering innovation, focusing on the development of next-generation camshafts that are both lighter and more efficient. These advanced camshafts are designed to enhance fuel economy and reduce carbon emissions, aligning with Germany's rigorous environmental standards. The ongoing improvements in materials and design are positioning Germany as a key player in the global camshaft market.

France's Automotive Camshaft Market Boosted by Lightweight Component Development

France is a significant contributor to the European automotive camshaft market, with the industry expected to grow at a steady CAGR of around 4.3% from 2024 to 2034. The increasing sales of passenger vehicles in France are a primary driver of this growth, as consumers demand more efficient and eco-friendly vehicles.

French manufacturers are actively involved in developing lighter camshaft modules to meet this demand. In May 2020, a collaboration between SBHPP/Vyncolit, The Georges Pernoud Group, MAHLE Group, Daimler, and Fraunhofer Institute for Chemical Technology resulted in the creation of a prototype camshaft module that is lighter than traditional aluminum versions. This innovation reduces vehicle weight and contributes to lower fuel consumption, making it a valuable advancement in the market.

India's Automotive Camshaft Market Set for Robust Growth

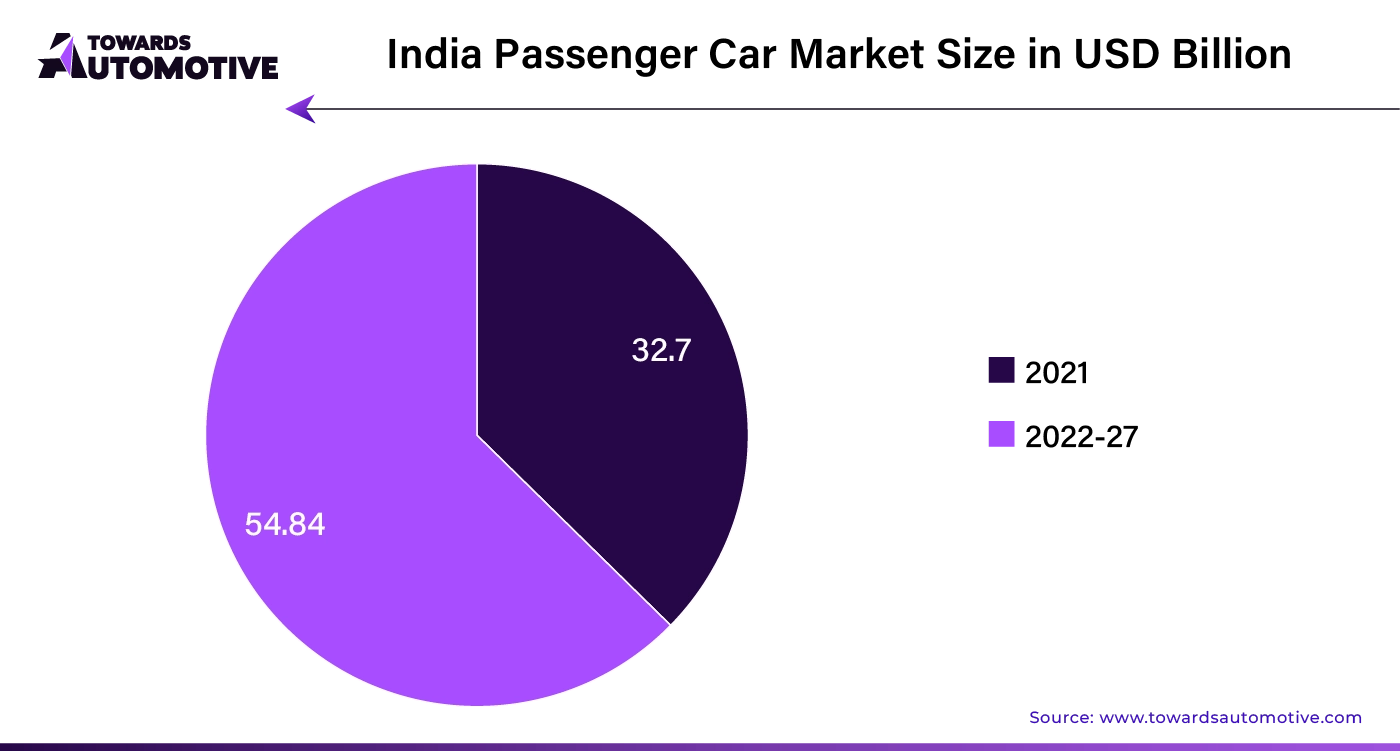

India is emerging as a vital market for automotive camshafts within the Asia Pacific region, with a projected growth rate of 5.0% CAGR, the highest among the countries analyzed. The market's potential is attracting key players and investors, who see India as an attractive investment opportunity.

Recent technological advancements in automotive camshafts are expected to drive demand in India. For example, in June 2023, Solapur-based Precision Camshafts developed a retrofitting technology for the Light Commercial Vehicle (LCV) segment, with the first product rollout scheduled within the next few months. With a potential retrofitting market of around 2 million vehicles in India, even a modest conversion to electric vehicles could result in substantial volumes for the company.

China's Automotive Camshaft Market Driven by Stringent Emission Standards

China's automotive camshaft market is experiencing steady growth, with sales increasing at a CAGR of approximately 4.3%. The country plays a critical role in the regional market, particularly in terms of vehicle production, which drives the demand for automotive components like camshafts.

A significant trend in China is the shift towards double overhead camshafts (DOHC), which are preferred for their power and efficiency. These engines require more camshafts due to a higher number of valves, increasing overall demand. Additionally, China's stringent emission standards are pushing manufacturers to develop lightweight, fuel-efficient engines, often achieved through DOHC technology. This regulatory push is further elevating the demand for advanced camshafts in the country.

Key players in the automotive camshaft market are adopting a variety of strategies to gain a competitive edge in this dynamic industry. A significant focus for many companies is on advancing casting techniques and experimenting with new alloys. These innovations are driven by the need to produce camshafts that are not only stronger and lighter but also more resistant to wear and tear. Such improvements are crucial for enhancing fuel efficiency, prolonging engine life, and reducing emissions—factors that are becoming increasingly important in today’s automotive landscape.

Moreover, manufacturers are integrating Variable Valve Timing (VVT) systems into their camshaft designs. This technology allows engines to optimize performance under different operating conditions, effectively meeting the growing consumer demand for vehicles that are both powerful and fuel-efficient.

In addition to technological advancements, market players are focusing on building robust relationships with automakers. By doing so, suppliers can secure long-term contracts, ensuring a steady demand for their products. The competitive landscape is also witnessing consolidation, with larger companies acquiring smaller firms or merging with competitors to boost profitability and market share.

By Type

By Vehicle Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us