April 2025

Senior Research Analyst

Reviewed By

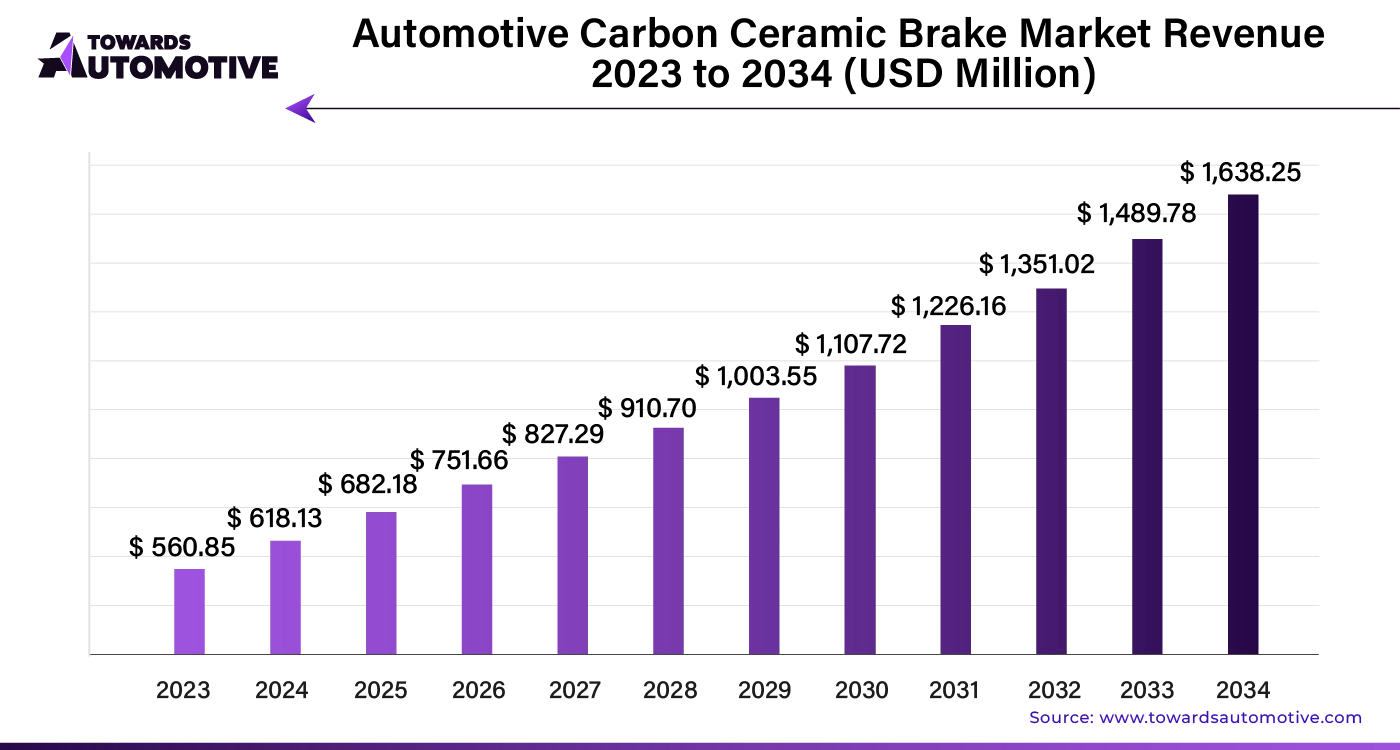

The global automotive carbon ceramic market size is calculated at USD 618.13 million in 2024 and is expected to be worth USD 1638.25 million by 2034, expanding at a CAGR of 10.46% from 2023 to 2034.

As automakers strive to meet stringent safety and emissions regulations, they are increasingly turning to advanced braking technologies, such as carbon ceramic brakes. This shift is largely driven by the need to comply with government standards and enhance vehicle performance.

Carbon ceramic brakes are rapidly gaining popularity, especially in high-end and luxury vehicles. These brakes are known for their exceptional performance, including superior heat resistance, reduced weight, and enhanced durability. They offer a significant upgrade over traditional braking systems, making them a desirable feature for discerning buyers who seek the latest in automotive technology and premium components.

The demand for vehicles equipped with carbon ceramic brakes is growing as consumers look for cutting-edge technology and high-quality parts in their cars. These advanced brakes not only improve driving performance but also add an element of exclusivity and prestige to the vehicles that feature them. Consequently, automakers are incorporating carbon ceramic brakes into their high-end models to attract buyers who value both innovation and luxury. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Automotive carbon ceramic brakes are facing significant market constraints due to their high production costs and limited applications. Unlike traditional steel brakes, which are more affordable and widely used, carbon ceramic brakes are considerably more expensive to manufacture. This premium pricing restricts their adoption primarily to high-performance and luxury vehicles, limiting their overall market growth.

The limited range of vehicles that utilize carbon ceramic brakes further hampers market expansion. These brakes are predominantly found in high-end sports cars and supercars, which narrows their application scope and slows their wider adoption in the automotive industry.

Additionally, advancements in alternative braking materials pose a threat to the competitiveness of carbon ceramic brakes. Innovations in composite materials and improved steel alloys offer cost-effective alternatives that deliver comparable performance. As these alternative materials gain traction, they undermine the demand for carbon ceramic brakes by providing similar benefits at a lower price.

The automotive carbon ceramic brake market showcases key trends, with OEMs and passenger cars emerging as dominant players. Here’s a closer look at the market dynamics:

OEMs at the Forefront of Automotive Carbon Ceramic Brake Sales

Original Equipment Manufacturers (OEMs) are leading the automotive carbon ceramic brake market, holding a commanding 88.7% market share in 2024. OEMs incorporate these advanced braking systems directly into new vehicles during production, ensuring extensive adoption across the industry. This integration supports widespread use of carbon ceramic brakes, recognized for their high performance and dependability.

OEMs' focus on stringent safety and performance standards further boosts the appeal and acceptance of carbon ceramic brakes. Continued partnerships between OEMs and brake manufacturers drive ongoing innovation and refinement of these technologies, keeping the OEM sector at the forefront of market sales.

Passenger Cars Remain the Top Choice for Automotive Carbon Ceramic Brakes

Passenger cars are the leading adopters of automotive carbon ceramic brakes, capturing a significant 98.5% market share in 2024. This preference is driven by the large customer base and increasing demand for high-performance braking systems within this segment. The rise of premium and sports cars, which often feature advanced braking technologies, contributes to the high adoption rates of carbon ceramic brakes.

The superior performance and longevity of carbon ceramic brakes make them the preferred option for passenger vehicles. As the automotive industry advances, the focus on cutting-edge technologies and enhanced safety features continues to solidify the role of carbon ceramic brakes in passenger cars.

AI integration is set to revolutionize the automotive carbon ceramic brake market by driving significant advancements in performance, safety, and efficiency. Through predictive maintenance algorithms, AI can anticipate wear and tear on brake systems, minimizing the risk of failures and ensuring optimal performance. Advanced AI-powered simulations and data analytics enable manufacturers to design more durable and efficient carbon ceramic brakes by predicting how materials will behave under various conditions. This leads to enhanced product development and faster time-to-market for innovative solutions.

AI also improves the customization of braking systems. By analyzing driving patterns and vehicle data, AI can recommend tailored brake solutions for different vehicle types and driving conditions, offering a more personalized driving experience. Moreover, AI-driven quality control systems enhance manufacturing precision, reducing defects and increasing reliability.

As AI continues to advance, it fosters innovation, driving market growth by meeting the increasing demand for high-performance and safety-focused braking solutions. The automotive carbon ceramic brake market will benefit from these technological strides, leading to more efficient, reliable, and customized braking systems in the automotive industry.

The supply chain in the automotive carbon ceramic brake market is a critical component for ensuring product availability and efficiency. Manufacturers start by sourcing high-quality raw materials, including carbon fibers and ceramic powders, from specialized suppliers. These materials are then transported to production facilities where they undergo advanced processing and molding to create brake components.

After production, the components are subjected to rigorous quality checks and testing to meet industry standards. Once approved, they are distributed to automotive manufacturers or aftermarket suppliers through a network of logistics partners. This distribution process often involves warehousing and inventory management to balance supply with demand.

The integration of technology, such as advanced tracking systems and predictive analytics, enhances supply chain efficiency by minimizing delays and optimizing inventory levels. Collaboration between suppliers, manufacturers, and distributors is crucial to adapt to market fluctuations and ensure a steady flow of high-performance brake components to the automotive market.

Efficient supply chain management in this sector not only improves product availability but also drives cost-effectiveness and supports the growth of the automotive carbon ceramic brake market.

The automotive carbon ceramic brake market is driven by a mix of innovation and collaboration among several key players. Companies like Brembo S.p.A. and Akebono Brake Industry Co., Ltd. lead the industry with advanced manufacturing techniques and extensive research. Brembo, renowned for its high-performance braking solutions, integrates cutting-edge technology to enhance brake efficiency and longevity. Akebono specializes in the development of carbon ceramic materials, focusing on improving thermal stability and wear resistance.

Similarly, companies like SGL Carbon SE and CeramTec GmbH contribute by providing specialized carbon fiber and ceramic materials that form the core of high-performance brake systems. SGL Carbon SE supplies carbon fibers that offer superior strength and light weight, crucial for high-end automotive applications. CeramTec enhances brake performance with its advanced ceramic components, ensuring durability and high heat tolerance.

Moreover, companies such as Continental AG and Bosch contribute through their expertise in brake systems' electronic control and integration, optimizing the overall braking performance. Their involvement ensures that carbon ceramic brakes work seamlessly with modern vehicle systems, enhancing safety and efficiency.

Together, these players form a comprehensive ecosystem, advancing automotive braking technology with their specialized products and innovations.

The automotive carbon ceramic brake market showcases varied opportunities across North America, Europe, and Asia Pacific. Here’s a detailed examination of the market dynamics in these significant regions:

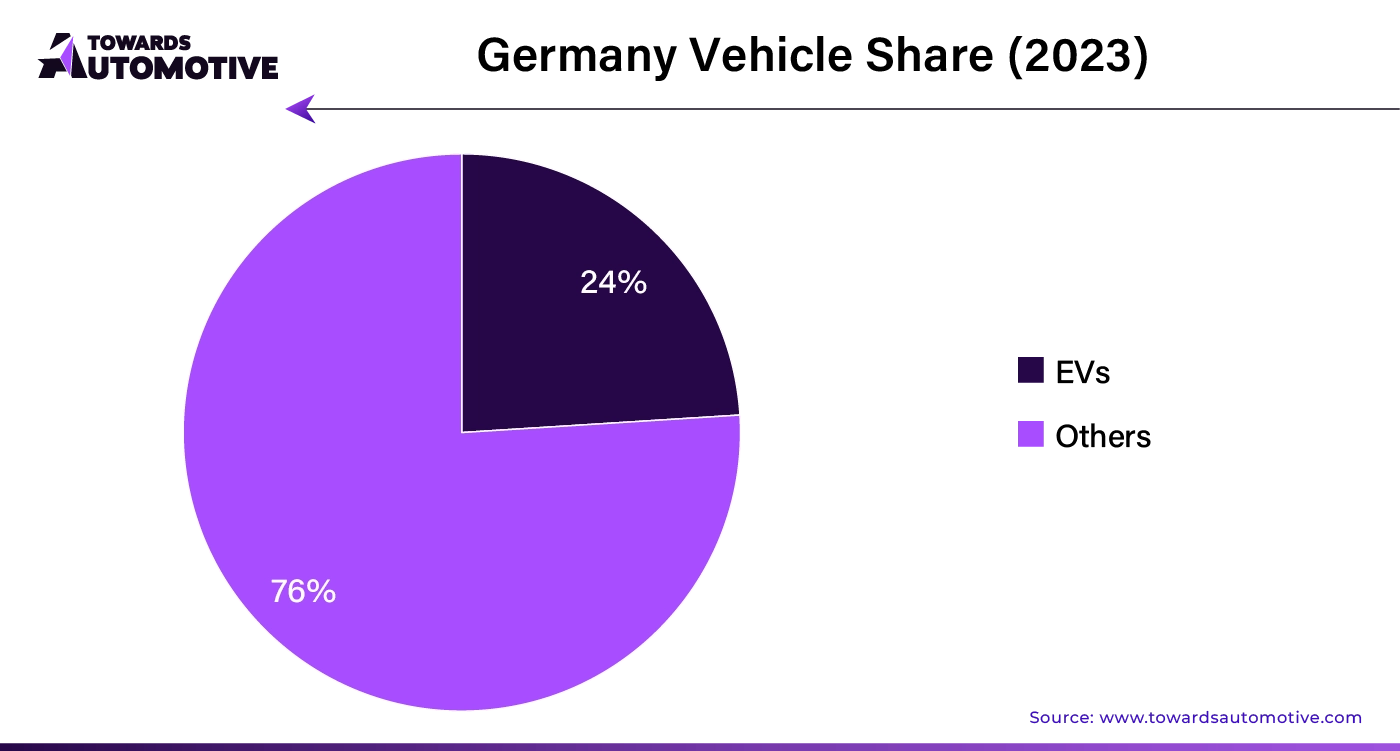

Germany

Germany's automotive sector is recognized for its rigorous vehicle safety standards, positioning carbon ceramic brakes as a preferred option. The country’s thriving aftermarket sector creates substantial opportunities for brake manufacturers targeting high-performance vehicle enthusiasts. Germany’s technology centers and esteemed automotive research institutions further bolster the adoption of these advanced braking systems.

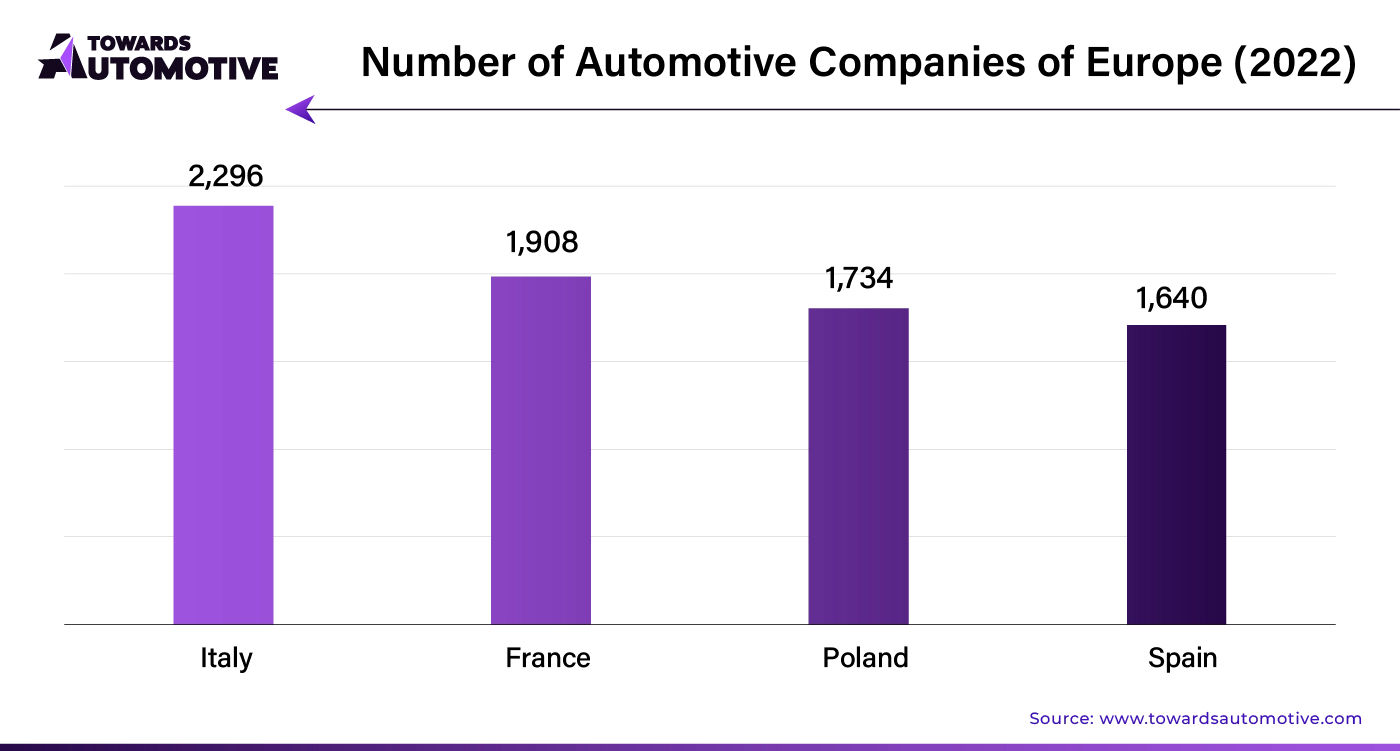

Italy

Italy’s deep-rooted automotive tradition, highlighted by high-performance brands like Ferrari, Lamborghini, and Maserati, drives the demand for carbon ceramic brakes. The country's active participation in major racing events and its strong motorsports culture promote advancements in brake technology. Additionally, Italy’s established carbon composite material producers strengthen the supply chain for these high-performance components.

France

France’s historical connection to motorsports, including iconic events like the 24 Hours of Le Mans, supports the development and validation of advanced automotive carbon ceramic brakes. French government policies favoring emissions reduction and vehicle safety also encourage the use of these sophisticated braking systems.

United Kingdom

The United Kingdom’s stringent safety regulations and emphasis on vehicle performance facilitate the adoption of carbon ceramic brakes. The country’s leading engineering firms and research institutions contribute to the advancement of braking technologies, aligning with its focus on superior vehicle handling and safety.

Spain

Spain benefits from its strategic position in Europe, linking it to major automotive industry hubs. The country’s involvement in motorsports events, such as the World Rally Championship and MotoGP, strengthens the demand for high-performance carbon ceramic brakes. Spain’s role in the global automotive supply chain also enhances its competitive edge in the market.

United States

The United States presents significant opportunities for automotive carbon ceramic brake manufacturers due to its extensive automobile manufacturing base and vibrant aftermarket sector. The country’s continual advancements in material science and production techniques are fostering innovation in braking solutions for both OEM and aftermarket markets.

Canada

In Canada, the adoption of automotive carbon ceramic brakes is driven by the need for enhanced performance in challenging weather conditions. The brakes’ durability and reduced brake dust align with Canada’s focus on sustainability and vehicle safety.

China

China’s push towards greener and advanced automotive technologies is significantly driving the demand for carbon ceramic brakes. The growth in performance-oriented vehicle sales and a trend toward lightweight automotive components are key factors fueling the adoption of these advanced brakes in China.

South Korea

South Korea’s automotive market is witnessing increased demand for sophisticated braking systems, spurred by consumer preference for high-performance vehicles. The focus of South Korean automakers on lightweight and high-performance cars is expected to boost the use of carbon ceramic brakes.

Japan

Japanese automakers are committed to enhancing vehicle safety and performance, which supports the demand for carbon ceramic brakes. Innovations in braking materials and manufacturing techniques by Japanese companies are anticipated to further drive market growth.

Australia

In Australia, the popularity of racing events and a culture focused on performance contribute to the demand for carbon ceramic brakes. The enthusiasm for lightweight, high-performance components among Australian vehicle enthusiasts drives the market for these advanced braking systems.

India

India is experiencing growth in the automotive carbon ceramic brake market due to increasing consumer awareness of advanced braking technologies and safety standards. Government initiatives supporting electric and hybrid vehicles are expected to create additional opportunities for brake manufacturers in India’s automotive sector.

This regional analysis illustrates the diverse factors influencing the automotive carbon ceramic brake market across different geographies, highlighting the various opportunities for manufacturers and stakeholders in the industry.

In the competitive automotive carbon ceramic brake market, several leading manufacturers are making significant strides with their innovative approaches. Prominent players such as BREMBO S.p.A., Surface Transforms PLC, MAT Foundry Group Ltd., Audi AG, and Volkswagen of America, Inc. are pushing the boundaries of brake technology, setting high standards for performance, durability, and safety.

BREMBO S.p.A. continues to lead with cutting-edge technologies, enhancing braking performance and safety. Surface Transforms PLC is renowned for its advanced carbon ceramic materials, contributing to superior braking efficiency. MAT Foundry Group Ltd. offers a range of high-quality products, while Audi AG and Volkswagen of America, Inc. are integrating advanced braking solutions into their high-performance vehicles.

The market dynamics are further influenced by key industry figures such as ALPINA Burkard Bovensiepen GmbH + Co. KG, BRABUS GmbH, and Carroll Shelby International, Inc. These companies bring unique contributions and technological advancements that shape the competitive landscape. ALPINA and BRABUS are known for their bespoke, high-performance vehicles that often feature specialized braking systems, while Carroll Shelby International, Inc. continues to offer innovative solutions for performance-oriented cars.

Additionally, notable automotive brands such as AKEBONO BRAKE INDUSTRY CO., LTD., Automobili Lamborghini S.p.A. (Lamborghini), Rotora, Ferrari N.V., Apollo Automobil GmbH (Gumpert), and Ferrari N.V. are enhancing the market. AKEBONO BRAKE INDUSTRY CO., LTD. is renowned for its high-quality brake components, while Lamborghini and Ferrari are known for integrating advanced braking technologies into their high-performance sports cars. Rotora and Apollo Automobil GmbH (Gumpert) contribute to the market with their specialized braking solutions, catering to the needs of both enthusiasts and industry professionals.

These key automotive carbon ceramic brake manufacturers are continuously working to advance braking technology, collaborating strategically and innovating to meet the evolving needs of the industry. Their efforts ensure the market's sustainability and competitiveness, as they strive to push the limits of vehicle braking systems. As the market continues to grow and diversify, these leading manufacturers remain at the forefront, driving the future of automotive braking technology.

By Vehicle Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us