April 2025

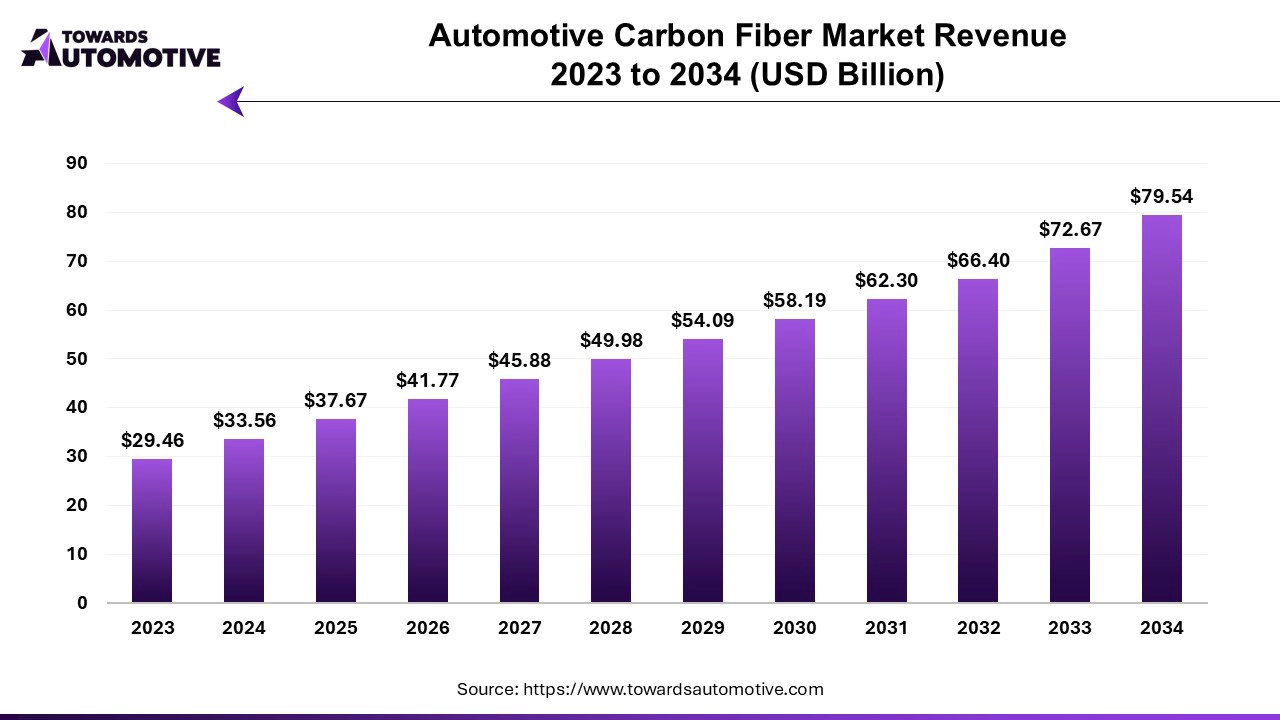

The global automotive carbon fiber market is anticipated to grow from USD 37.67 billion in 2025 to USD 79.54 billion by 2034, with a compound annual growth rate (CAGR) of 9.45% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive carbon fiber Market is witnessing significant growth due to increasing demand for lightweight, high-performance materials in the automotive industry. Carbon fiber, known for its strength and durability, is extensively used in automotive manufacturing to reduce vehicle weight and enhance fuel efficiency. As governments and regulatory bodies worldwide impose stricter emissions standards, automakers are shifting towards carbon fiber to improve fuel economy and reduce carbon emissions. This material’s lightweight properties allow vehicles to achieve higher performance while consuming less fuel, making it an attractive option for manufacturers.

In addition to environmental benefits, carbon fiber is highly valued in the production of high-performance and luxury vehicles. Its strength and rigidity provide better structural integrity, improved handling, and enhanced safety. Electric vehicles (EVs), which are gaining popularity globally, also benefit from carbon fiber, as lightweight materials help to extend battery range and improve overall efficiency.

Technological advancements in carbon fiber production and manufacturing processes are further driving market growth. These innovations reduce production costs and enable wider use in mass-market vehicles, making carbon fiber more accessible across the automotive spectrum. The rise in electric and hybrid vehicles, along with growing consumer demand for environmentally friendly and high-performance cars, is expected to continue fueling the expansion of the automotive carbon fiber market. With increasing investments in research and development, carbon fiber is becoming a key material for the future of sustainable and efficient automotive design.

Artificial intelligence (AI) plays a transformative role in the Automotive Carbon Fiber Market, enhancing production efficiency, material design, and overall product quality. In carbon fiber manufacturing, AI-driven systems are being integrated into production lines to automate processes, optimize resource use, and minimize waste. For instance, AI-powered tools can monitor fiber placement, resin application, and curing processes in real-time, ensuring precision and consistency while reducing defects and material wastage. This leads to cost savings and faster production cycles, making carbon fiber more accessible to automakers.

AI also aids in the design and optimization of carbon fiber components. Using AI algorithms and machine learning models, manufacturers can simulate and analyze various material configurations and predict how different composites will perform under specific conditions. This allows engineers to create lightweight yet stronger automotive components tailored to meet the demands of modern vehicles, such as electric and autonomous cars. By leveraging AI, designers can achieve optimal balance between weight reduction and structural integrity.

Furthermore, AI contributes to predictive maintenance and quality control in carbon fiber manufacturing. Machine learning algorithms can detect early signs of equipment failure or process deviations, allowing manufacturers to address issues before they impact production. This reduces downtime and ensures the consistent high quality of carbon fiber products. Overall, AI is driving innovation in the automotive carbon fiber market by streamlining production, improving material performance, and supporting the development of more efficient, eco-friendly vehicles.

The increasing demand for lightweight materials is a major driver of growth in the Automotive Carbon Fiber Market. As automakers seek to improve fuel efficiency and meet stringent emission regulations, the need for materials that reduce vehicle weight without compromising strength is rising. Carbon fiber is becoming the material of choice due to its exceptional strength-to-weight ratio. Compared to traditional materials like steel and aluminum, carbon fiber is much lighter, which helps reduce the overall mass of vehicles. This leads to enhanced fuel efficiency, lower emissions, and better performance, all critical factors for meeting modern automotive standards.

In addition to fuel efficiency, the shift towards electric vehicles (EVs) is further fueling the demand for carbon fiber. EVs require lightweight materials to offset the weight of heavy batteries and improve overall range. By incorporating carbon fiber components, EV manufacturers can significantly reduce vehicle weight, leading to extended driving ranges and enhanced energy efficiency, which are key selling points for electric vehicles.

Moreover, carbon fiber’s durability and rigidity offer safety and performance benefits, making it an attractive material for high-performance and luxury vehicles. As consumer demand for fuel-efficient, eco-friendly, and high-performance cars continues to rise, automakers are increasingly adopting carbon fiber in vehicle structures, body panels, and interior components.

With growing environmental concerns and advances in manufacturing processes that reduce the cost of carbon fiber, the automotive industry's demand for lightweight materials is expected to further boost the growth of the automotive carbon fiber market.

The Automotive Carbon Fiber Market faces several restraints, primarily due to the high production costs and the complex manufacturing process. Carbon fiber is expensive to produce, limiting its adoption in mass-market vehicles and making it more common in high-performance and luxury cars. Additionally, the difficulty in recycling carbon fiber raises sustainability concerns, as the material is not easily reusable compared to metals like steel or aluminum. Lastly, limited production capacity further restricts its widespread use, as manufacturers struggle to meet the rising demand across various industries.

Resin Transfer Molding (RTM) is creating significant opportunities in the Automotive Carbon Fiber Market by streamlining production processes and reducing costs, making carbon fiber more accessible for mass-market vehicles. RTM is an efficient manufacturing technique that involves injecting resin into a mold containing dry carbon fiber preforms. This method allows for faster production cycles compared to traditional carbon fiber manufacturing processes, which are often slow and labor-intensive. As a result, RTM helps in lowering production costs, enabling automakers to incorporate carbon fiber components into a wider range of vehicles.

One of the key advantages of RTM is its ability to produce complex shapes with high precision and minimal waste, which is crucial in automotive design. This opens up new possibilities for creating lightweight yet durable carbon fiber components, such as body panels, structural parts, and even battery enclosures for electric vehicles. Additionally, the scalability of RTM makes it suitable for high-volume production, further promoting the use of carbon fiber in mainstream automotive manufacturing.

As automakers increasingly prioritize fuel efficiency and emissions reduction, the adoption of RTM in carbon fiber production offers a promising pathway to meet these goals while maintaining cost efficiency and quality.

The OEM segment held the largest share of the market. The OEM (Original Equipment Manufacturer) segment plays a pivotal role in driving the growth of the Automotive Carbon Fiber Market by incorporating lightweight carbon fiber components into vehicle designs to meet performance and efficiency demands. Automakers are increasingly focusing on reducing vehicle weight to improve fuel efficiency, meet stringent emission regulations, and enhance overall performance. Carbon fiber, known for its high strength-to-weight ratio, is being embraced by OEMs as an ideal material for manufacturing lightweight vehicle structures, body panels, and interior components.

OEMs, especially in the luxury and high-performance vehicle sectors, have been at the forefront of adopting carbon fiber. These manufacturers are leveraging the material to improve aerodynamics, safety, and fuel economy while maintaining vehicle rigidity and structural integrity. As the demand for electric vehicles (EVs) grows, OEMs are using carbon fiber to offset the weight of heavy battery systems, extending driving range and efficiency.

Moreover, advancements in carbon fiber production processes, such as resin transfer molding (RTM) and automated manufacturing, have made it easier for OEMs to scale the use of carbon fiber in their production lines, driving widespread adoption and fueling market growth.

The structural assembly segment dominated the industry. The structural assembly segment is a key driver of growth in the Automotive Carbon Fiber Market by enabling the integration of lightweight, high-strength materials into critical vehicle components. Carbon fiber’s exceptional strength-to-weight ratio makes it an ideal choice for structural assemblies such as chassis, frames, and load-bearing parts. These assemblies are crucial for maintaining the integrity and safety of the vehicle while reducing its overall weight, which enhances fuel efficiency and performance.

As automotive manufacturers focus on meeting stringent emissions standards and improving fuel economy, the demand for lightweight materials in structural assemblies is increasing. Carbon fiber helps reduce the weight of these assemblies without compromising strength or durability, making vehicles more energy-efficient and responsive. This is particularly important for electric vehicles (EVs), where reducing weight is key to extending driving range and improving battery efficiency.

Additionally, advancements in manufacturing technologies, such as automated fiber placement (AFP) and resin transfer molding (RTM), have made it easier to integrate carbon fiber into structural assemblies at a lower cost and higher production speed. This widespread application in structural parts is driving the growth of the automotive carbon fiber market.

The two-wheeler segment led the market. The two-wheeler segment is increasingly contributing to the growth of the Automotive Carbon Fiber Market by adopting lightweight carbon fiber components to enhance performance, fuel efficiency, and overall design. Carbon fiber's superior strength-to-weight ratio makes it an attractive material for two-wheelers, where reducing weight is crucial for improving speed, maneuverability, and fuel economy. Manufacturers of motorcycles and scooters are increasingly integrating carbon fiber in parts such as frames, wheels, swingarms, and body panels to achieve these performance enhancements.

In the high-performance motorcycle segment, where speed and agility are paramount, carbon fiber’s lightweight nature helps improve acceleration and handling. Additionally, as electric two-wheelers gain popularity, the demand for carbon fiber is increasing because it helps offset the weight of heavy batteries, making the vehicles more energy-efficient and extending their range. The use of carbon fiber also provides durability, helping to improve the safety and lifespan of two-wheelers.

Moreover, the two-wheeler segment’s growing focus on aesthetic appeal and modern design is driving demand for carbon fiber, as the material’s sleek appearance adds a premium touch. These factors collectively contribute to the expansion of the automotive carbon fiber market.

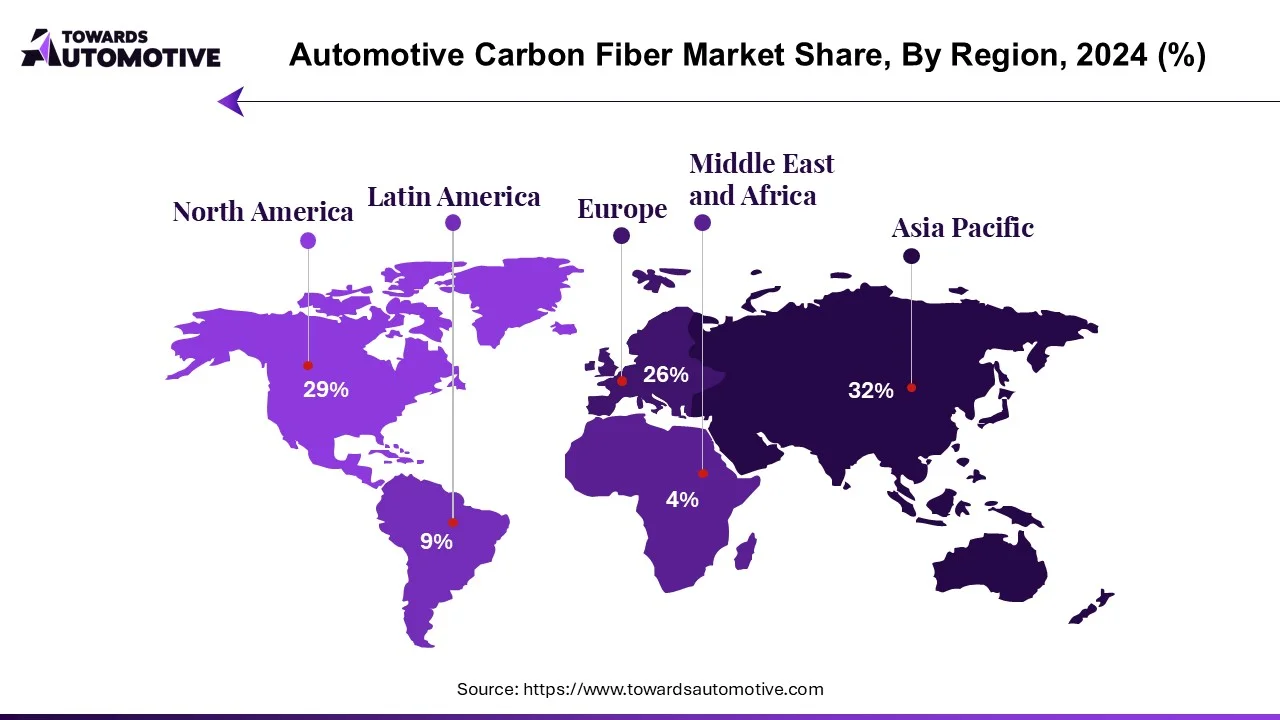

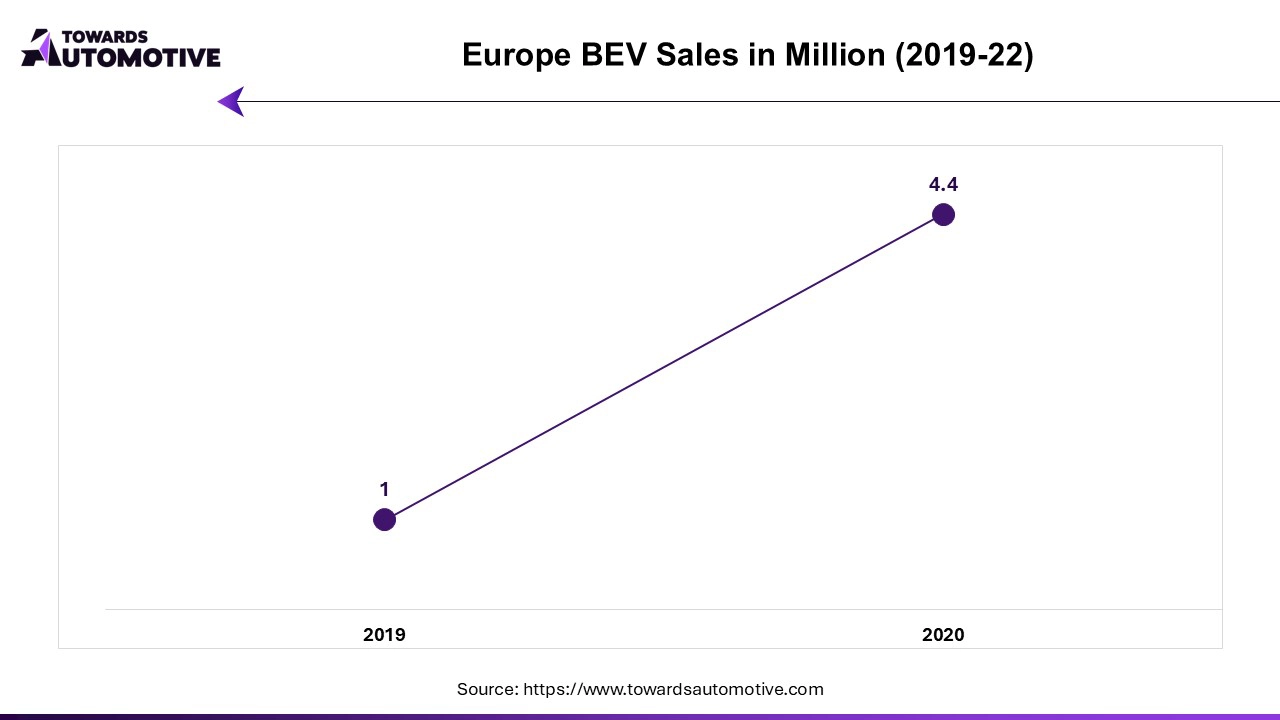

Europe dominated the automotive carbon fiber market. In Europe, the automotive carbon fiber market is experiencing notable growth due to several intertwined factors. A primary driver is the high demand for electric vehicles (EVs). As the continent accelerates its shift towards sustainable transportation, EV manufacturers are increasingly turning to carbon fiber to reduce vehicle weight and improve energy efficiency. The lightweight properties of carbon fiber help offset the weight of heavy batteries, thereby extending driving range and enhancing performance—key considerations for EV consumers and manufacturers alike.

Consumer preference for performance and luxury is another significant factor. European automotive buyers often prioritize high-performance and premium features, which drive the use of advanced materials like carbon fiber. This material is favored for its ability to enhance vehicle aesthetics, boost acceleration, and improve handling without compromising strength. High-end and performance-oriented models frequently incorporate carbon fiber in components such as body panels, interior trim, and structural elements to appeal to discerning consumers.

Additionally, stringent emission regulations across Europe compel automakers to seek innovative solutions to meet environmental standards. The European Union’s rigorous emission targets necessitate reductions in vehicle weight to improve fuel efficiency and lower CO2 emissions. Carbon fiber, with its superior strength-to-weight ratio, provides a practical solution for meeting these regulatory requirements while maintaining vehicle safety and performance.

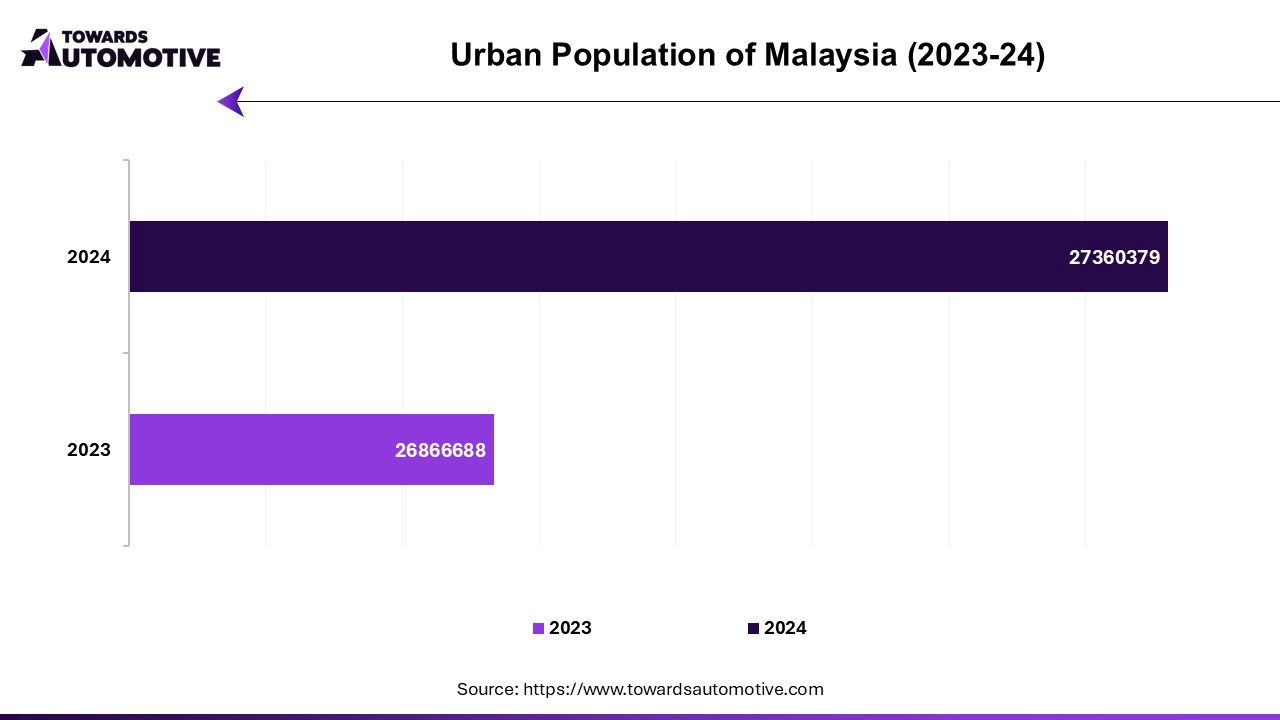

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The automotive carbon fiber market in the Asia Pacific region is witnessing substantial growth due to several key factors, including the growing automotive industry, rapid urbanization, and increased investment in research and development (R&D). The region’s automotive industry is expanding rapidly, with major players in countries like China, Japan, and South Korea pushing for innovations in vehicle design and performance. As consumer demand for advanced and efficient vehicles rises, automakers are increasingly incorporating carbon fiber to achieve lighter and more fuel-efficient designs. This material's strength-to-weight ratio makes it ideal for enhancing vehicle performance and meeting the evolving needs of the market.

Rapid urbanization across Asia Pacific is another significant driver of growth in the carbon fiber market. As urban areas expand and infrastructure projects increase, there is a heightened need for vehicles that offer improved efficiency and lower emissions. Carbon fiber’s lightweight properties align with these requirements, providing a solution for manufacturers aiming to produce vehicles that are not only lighter but also more responsive and fuel-efficient.

Additionally, increased investment in R&D is accelerating advancements in carbon fiber technology. Automotive companies and research institutions are focusing on developing innovative applications and improving production processes for carbon fiber. This includes enhancing manufacturing efficiency, reducing costs, and exploring new uses for the material. Such investments are critical in making carbon fiber more accessible and affordable, thereby driving its broader adoption in the automotive sector.

By Sales Channel

By Application

By Material

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us