April 2025

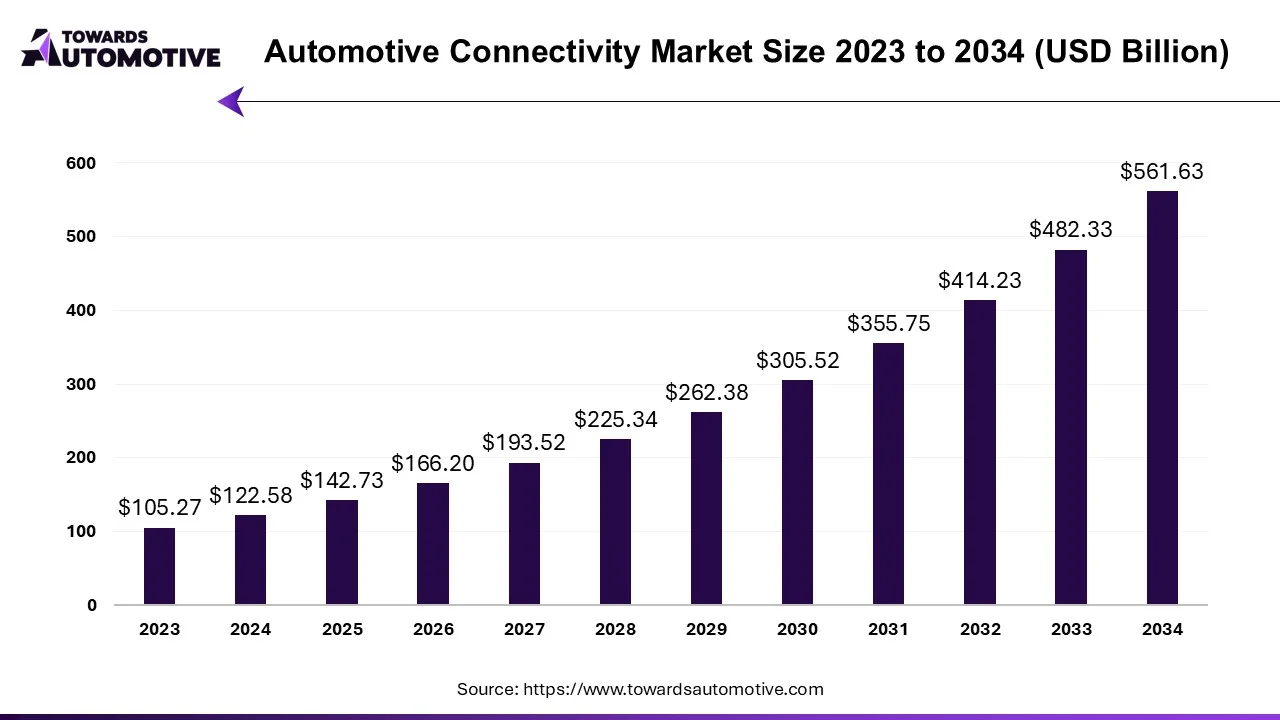

The automotive connectivity market size is forecast to grow at a CAGR of 16.44%, from USD 142.73 billion in 2025 to USD 561.63 billion by 2034, over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

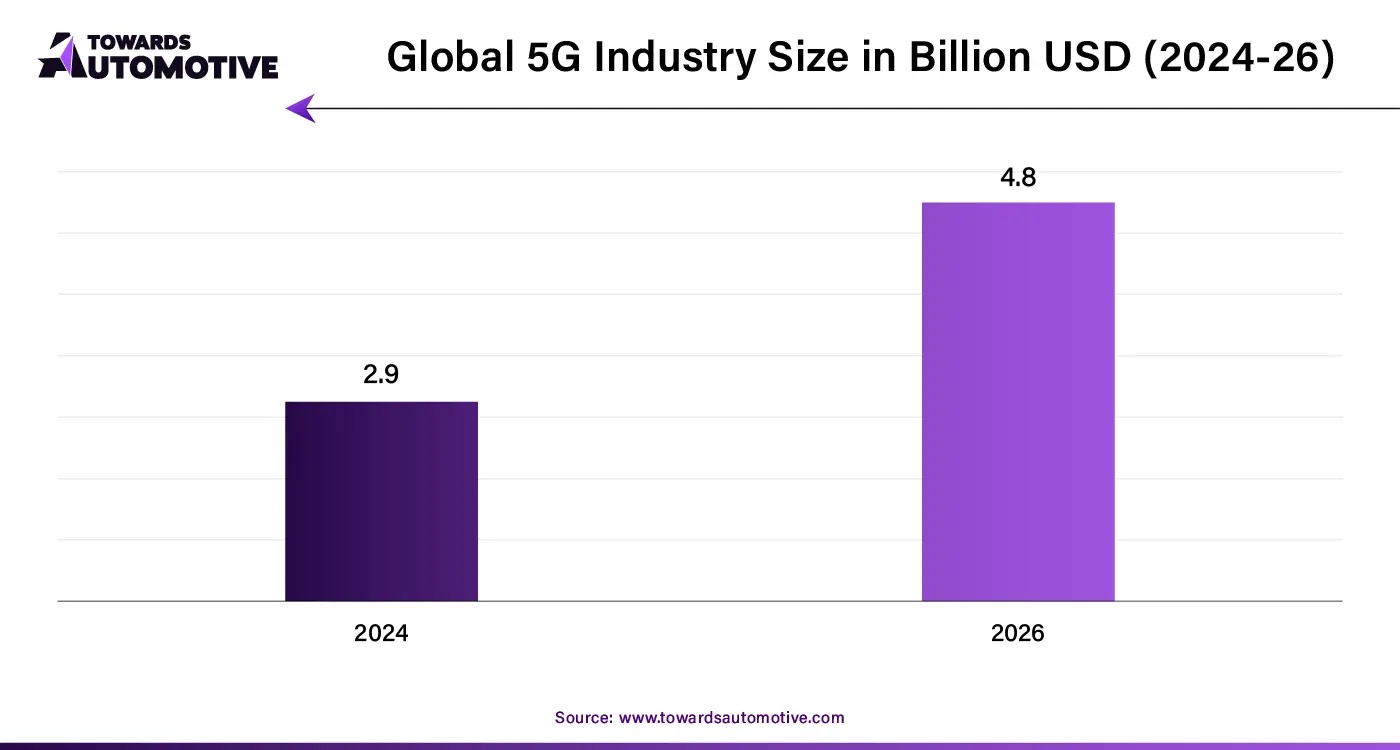

The automotive connectivity market is a prominent branch of the automotive technology sector. This industry deals in providing automotive connectivity solutions to consumers around the world. There are different types of connectivity developed in this sector consisting of embedded connectivity, tethered connectivity and integrated connectivity. These connectivity modules are designed for different vehicles comprising of passenger cars and commercial vehicles. The rapid developments in the 5G infrastructure coupled with advancements in ADAS technology has contributed to significantly to the industrial development. This market is projected to rise drastically with the growth of the overall automotive sector across the globe.

In September 2023, Mr. Jason Ho, the Chairman of Taisys Group made an announcement stating that, “The launch of the iConnect platform marks a significant milestone for Taisys India. We believe that connectivity is the future of mobility, and industry leaders Lumax Ituran reaffirms our commitment to shaping that future through groundbreaking technology.”

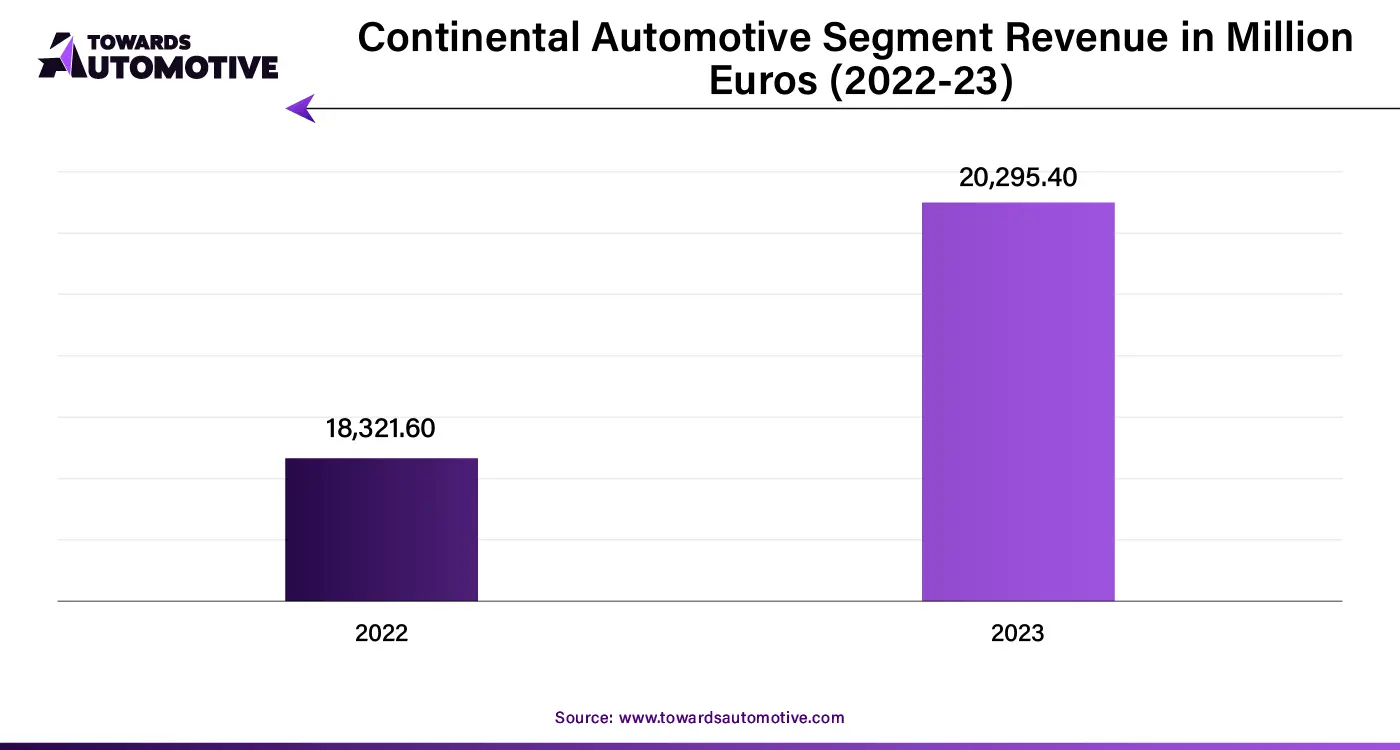

The automotive connectivity market is a fragmented industry with the presence of numerous dominant players. Some of the prominent companies in this industry comprises of Denso, Continental, Bosch, Qualcomm, NXP Semiconductors, Harman, Verizon and some others. These market players are constantly engaged in developing advanced technologies for enhancing connectivity in vehicles and adopting strategies such as launches, collaborations, partnerships and some others to sustain their dominant position in this industry.

By Technology

By Connectivity Solutions

By Service

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us