April 2025

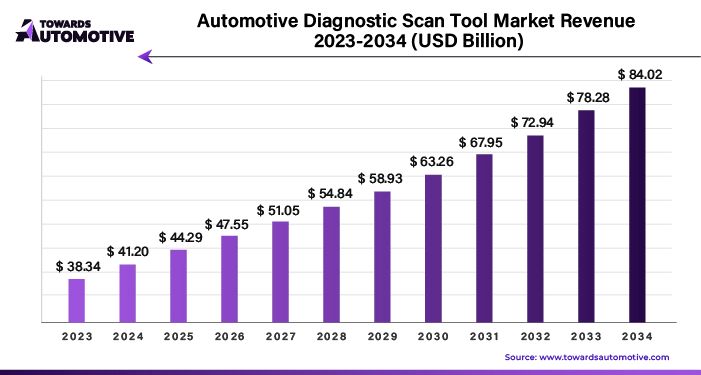

The automotive diagnostic scan tool market is forecasted to expand from USD 44.29 billion in 2025 to USD 84.02 billion by 2034, growing at a CAGR of 7.4% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive industry is on the brink of a transformative period driven by rapid technological advancements, evolving regulatory requirements, and shifting industry dynamics. Key trends such as the rise of electric vehicles (EVs), the development of autonomous driving technologies, and the proliferation of connected car features are set to reshape vehicle architectures and significantly influence diagnostic capabilities. This article explores the anticipated changes in automotive diagnostics and the emerging opportunities and challenges for manufacturers and service providers. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Current Trends and Immediate Future

In the short term, the automotive diagnostics sector is expected to see steady growth. This growth will be fueled by increased investments from automotive manufacturers and aftermarket service providers in advanced diagnostic scan tools. These tools are anticipated to feature enhanced capabilities, including:

Medium to Long-Term Developments

As we move further into the forecast period, the automotive diagnostics sector is poised for rapid evolution. Several factors are expected to drive this change:

Emerging Opportunities

The rise of mobility-as-a-service (MaaS) models and shared mobility platforms is creating fresh opportunities for diagnostic scan tool manufacturers. As the industry shifts towards a service-oriented and data-driven approach, the following trends are expected:

Artificial Intelligence (AI) is poised to transform the Automotive Diagnostic Scan Tool market, driving unprecedented growth and innovation. AI's integration into diagnostic tools enhances their capabilities by enabling real-time data analysis, predictive maintenance, and advanced problem-solving. AI-powered tools can analyze vast amounts of vehicle data more efficiently than traditional methods, identifying issues with greater accuracy and speed.

These intelligent systems utilize machine learning algorithms to detect patterns and anomalies, predicting potential failures before they occur. This proactive approach not only improves vehicle reliability but also reduces repair costs and downtime. Additionally, AI-driven diagnostic tools offer intuitive user interfaces and advanced diagnostics that simplify complex repairs for technicians.

The integration of AI also supports enhanced decision-making through data-driven insights, streamlining the repair process and ensuring optimal vehicle performance. As AI continues to evolve, its applications in the automotive diagnostic sector will become increasingly sophisticated, further boosting market growth. By improving efficiency and accuracy, AI is set to revolutionize automotive diagnostics, offering significant benefits to both automotive professionals and consumers.

In the automotive diagnostic scan tool market, the supply chain is a complex network ensuring timely production and delivery of diagnostic equipment. It begins with the procurement of raw materials and components, which are sourced from global suppliers. These components include microprocessors, sensors, and communication modules, critical for the functionality of diagnostic tools.

Manufacturers then assemble these parts into finished products at their facilities. The assembly process often involves quality control to ensure that each tool meets industry standards and performs accurately. Once assembled, the diagnostic tools are distributed to various channels, including wholesalers, retailers, and directly to automotive service providers.

Logistics play a crucial role, with efficient transportation and warehousing strategies needed to manage inventory and ensure timely delivery. Market demand fluctuations can affect supply chain operations, requiring manufacturers to adapt their production and inventory management.

Additionally, technological advancements are being integrated into the supply chain, such as real-time tracking systems and automated inventory management, to enhance efficiency and reduce lead times. Overall, a streamlined supply chain in the automotive diagnostic scan tool market ensures that high-quality tools are readily available to meet the needs of the automotive repair industry.

The Automotive Diagnostic Scan Tool Market comprises several critical components and contributors that drive its growth and evolution. Central to the market are diagnostic tools and equipment designed to identify and troubleshoot issues within vehicles. These tools range from basic OBD-II scanners to advanced diagnostic systems capable of complex analysis and repair solutions.

Major companies like Bosch, Delphi Technologies, and Snap-on offer a diverse range of diagnostic tools that cater to both professional technicians and DIY enthusiasts. Bosch’s offerings include advanced scan tools with integrated data analysis features, while Delphi Technologies provides comprehensive solutions for automotive diagnostics and repair. Snap-on is renowned for its high-performance tools and user-friendly interfaces.

Emerging players such as Autel and Launch Tech bring innovation with their state-of-the-art diagnostic equipment, featuring wireless connectivity and cloud-based functionalities. These companies focus on integrating the latest technology to enhance diagnostic accuracy and efficiency.

Additionally, software companies like Mitchell 1 and Identifix contribute by providing extensive repair databases and diagnostic software, which are integral to the effective use of scan tools.

Together, these companies create a robust ecosystem that supports a wide range of diagnostic needs, from basic vehicle maintenance to complex troubleshooting.

The automotive diagnostic tools industry is undergoing significant transformation due to rapid advancements in vehicle technology and changing market dynamics. As modern vehicles become increasingly complex with advanced electronic systems and connectivity features, the demand for sophisticated diagnostic scan tools is growing. This article explores the key industry highlights, including rising complexity, challenges, and emerging opportunities in the automotive diagnostic tools sector.

Rising Complexity of Modern Vehicles Driving Demand

The automotive industry is witnessing a surge in technological advancements, which has significantly increased the complexity of modern vehicles. Today's vehicles are equipped with a multitude of electronic systems, advanced car sensors, and onboard computers that enhance performance and safety. As a result, diagnostic scan tools must evolve to keep pace with these advancements.

Challenges Hindering Growth

Despite the growing demand, several challenges are impacting the widespread adoption of advanced diagnostic scan tools.

Opportunities for Expansion

The evolving automotive landscape presents several opportunities for growth and innovation in the diagnostic tools sector.

Key Trends Shaping the Industry

Several trends are influencing the future direction of automotive diagnostic tools.

India’s Automotive Aftermarket Industry: A Surge in Diagnostic Solutions Demand

India’s automotive diagnostic scan tool market is witnessing substantial growth, fueled by the expansion of the country's automotive aftermarket sector. The rising vehicle ownership and the need for efficient diagnostic solutions are key drivers of this trend.

The landscape of India’s automotive industry is rapidly evolving, with a significant increase in the number of independent repair shops, service centers, and aftermarket retailers. These entities cater to a diverse clientele and are pushing the demand for advanced diagnostic tools.

Technological advancements are at the forefront of this growth. Diagnostic scan tools are increasingly incorporating features such as wireless connectivity, cloud-based diagnostics, and predictive analytics. These innovations enable mechanics and technicians to diagnose a wide range of vehicle issues more effectively across various makes and models.

The shift towards these sophisticated tools is indicative of a broader trend within the Indian automotive market, highlighting the growing importance of technological integration in automotive repair and maintenance.

Spain’s Adoption of Advanced Diagnostic Tools: A Market on the Rise

In Spain, the automotive diagnostic scan tool market is experiencing steady growth, driven by the country’s automotive aftermarket sector. This sector includes a mix of independent repair shops, dealership service centers, and aftermarket retailers, all contributing to a dynamic market environment.

Several factors influence the market, including the composition of the vehicle fleet, regulatory requirements, and technological advancements. Spain’s automotive industry is increasingly adopting advanced diagnostic tools that offer features like real-time data streaming, system diagnostics, and remote diagnostics capabilities.

The demand for these advanced tools is growing as they address complex vehicle issues and support the latest automotive technologies. The shift towards more sophisticated diagnostic solutions reflects the country’s commitment to improving vehicle maintenance and repair processes.

Canada’s Progressive Approach to Automotive Diagnostic Technologies

Canada’s automotive diagnostic scan tool market is marked by steady growth, driven by vehicle ownership rates, increasing aftermarket service demands, and ongoing technological innovations. The market comprises a diverse array of automotive repair shops, dealership service centers, and aftermarket retailers.

Technological advancements are playing a significant role in shaping Canada’s automotive industry. Diagnostic scan tools are increasingly featuring wireless connectivity, cloud-based diagnostics, and predictive analytics. These innovations are essential for diagnosing complex vehicle issues, supporting advanced automotive systems, and enhancing overall service efficiency.

The progressive adoption of these novel technologies in Canada reflects a broader trend of integrating advanced solutions to improve automotive diagnostics and repair processes. As the industry continues to evolve, the demand for cutting-edge diagnostic tools is expected to grow, driving further advancements in the market.

In the rapidly evolving automotive industry, precision and efficiency in vehicle diagnostics and performance testing are paramount. Two key technologies that are increasingly shaping this sector are dynamometers and Wi-Fi automotive diagnostic tools. These tools are enhancing the capabilities of automotive diagnostics, ensuring vehicles meet performance and emissions standards while offering convenience and flexibility in data management.

1. Chassis Dynamometers

Chassis dynamometers are essential for evaluating vehicle performance and emissions under simulated driving conditions. By placing a vehicle on rollers that simulate road conditions, technicians can accurately measure various performance parameters such as horsepower, torque, and exhaust emissions. This type of dynamometer provides a controlled environment where vehicle systems can be tested thoroughly, ensuring compliance with regulatory standards and identifying potential issues before they reach consumers.

2. Engine Dynamometers

Engine dynamometers focus on measuring the performance characteristics of internal combustion engines. These devices test engines in isolation, evaluating factors such as power output, fuel efficiency, and engine response under different loads and conditions. Engine dynamometers are critical for engine development, performance tuning, and troubleshooting engine-related issues.

3. Hydraulic Dynamometers

Hydraulic dynamometers utilize hydraulic fluid to load and control the output of engines or drivetrain components during testing. This type of dynamometer is particularly useful for assessing the performance and durability of components under varying loads. It provides precise control over the testing conditions, making it valuable for research and development as well as for quality control in manufacturing.

1. Growing Demand for Wireless Connectivity

The automotive industry is experiencing a surge in the complexity and sophistication of vehicle electronic systems. Modern vehicles are equipped with numerous sensors and electronic control units, necessitating advanced diagnostic tools to manage and interpret the data generated. Wi-Fi automotive diagnostic tools are increasingly being adopted due to their ability to provide wireless connectivity, which simplifies the diagnostic process and enhances overall efficiency.

2. Benefits of Wi-Fi Diagnostic Tools

Wi-Fi diagnostic tools offer several advantages:

The automotive diagnostic scan tool market is experiencing a high level of competition, driven by various dynamic factors shaping the industry. Technological advancements and evolving customer needs are prompting companies to innovate continuously, resulting in the development of advanced diagnostic tools with enhanced features and capabilities. The competitive environment is expected to intensify due to several key trends and activities:

Technological Innovations

Companies in the automotive diagnostic scan tool sector are heavily investing in technology to offer cutting-edge solutions. Enhanced features, improved performance, and comprehensive capabilities are becoming critical differentiators. As new technologies emerge, companies are focusing on developing tools that not only diagnose faults accurately but also offer advanced functionalities such as real-time data analysis, cloud connectivity, and integration with other automotive systems.

Consolidation and Strategic Moves

The industry is witnessing increased consolidation, with mergers and acquisitions becoming a prevalent strategy for companies looking to strengthen their market positions. This consolidation allows companies to expand their product portfolios, access new markets, and leverage synergies to enhance their competitive edge. Companies are pursuing strategic partnerships and acquisitions to diversify their offerings and tap into emerging market opportunities.

Expansion into Emerging Markets

Emerging markets such as Asia Pacific, Latin America, and Africa are becoming key areas of focus for automotive diagnostic scan tool companies. The growing vehicle ownership, urbanization, and rising disposable income levels in these regions present significant growth opportunities. Companies are investing in building a robust presence in these markets, establishing distribution networks, and forming local partnerships to capture the increasing demand for diagnostic tools and aftermarket services.

Strategic Collaborations

To navigate the competitive landscape effectively, companies are engaging in strategic collaborations. These partnerships enable them to access new technologies, expand their market reach, and enhance their product offerings. Companies that can forge strong alliances and integrate innovative solutions into their diagnostic tools will be better positioned to meet the diverse needs of their customers and stay ahead of the competition.

By Tool Type

By Mobility Type

By Connectivity Type

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us