April 2025

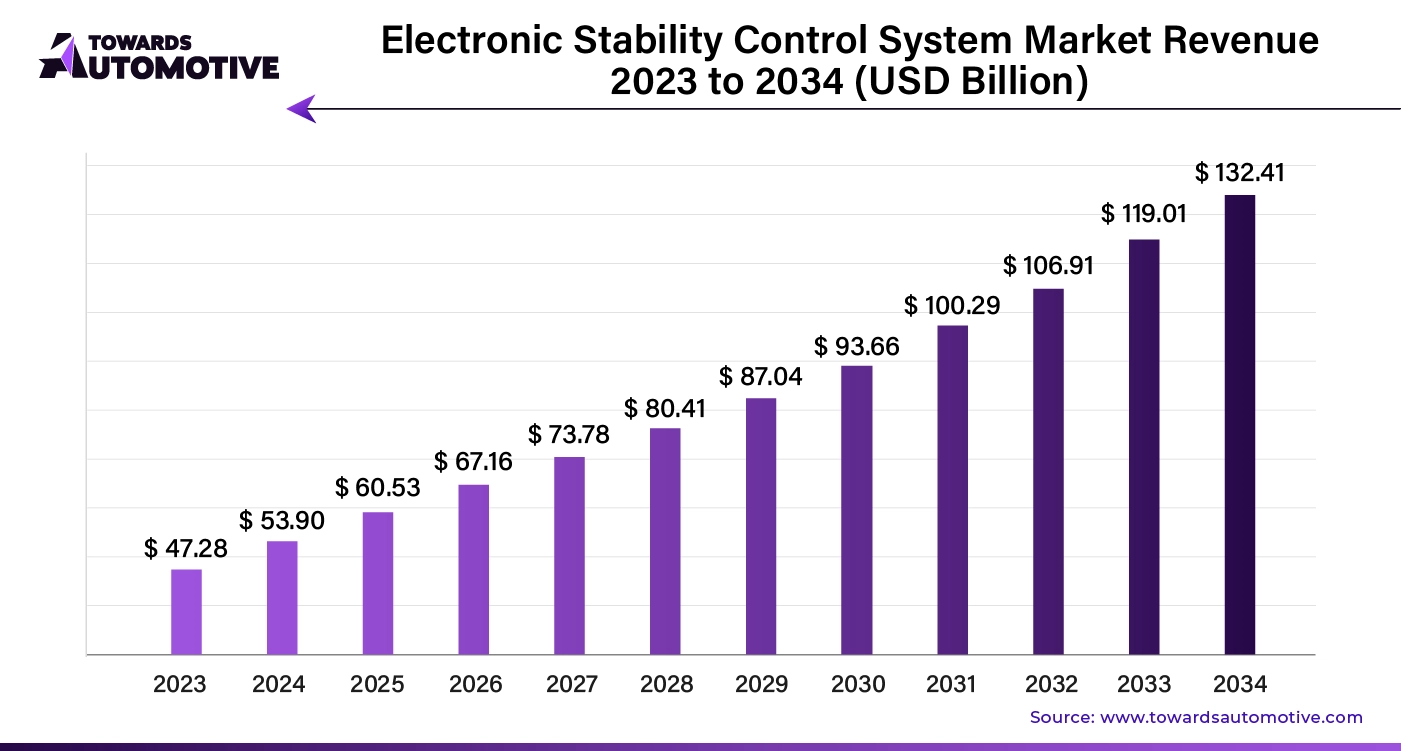

The global automotive electronic stability control System market is projected to reach USD 132.41 billion by 2034, expanding from USD 60.53 billion in 2025, at an annual growth rate of 11.34% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Electronic Stability Control (ESC) System Market is experiencing significant growth driven by increasing demand for vehicle safety features and stringent government regulations. ESC systems are designed to improve vehicle stability by detecting and reducing the loss of traction, thereby preventing skidding and accidents. This technology is becoming a standard feature in modern vehicles, particularly in regions like North America and Europe, where safety regulations mandate its integration. The rising number of road accidents and consumer awareness regarding vehicle safety are key factors driving market expansion. Additionally, the growing adoption of electric and autonomous vehicles is fueling the demand for advanced safety systems, including ESC. Technological advancements, such as the integration of ESC with other safety systems like anti-lock braking (ABS) and traction control, are further boosting market growth. In emerging economies, increasing disposable income and improving road infrastructure are encouraging consumers to invest in vehicles equipped with advanced safety features, thus propelling the ESC market. Moreover, partnerships between automakers and technology providers are fostering innovation in ESC systems, enhancing their efficiency and reliability. As the automotive industry continues to evolve, the ESC system market is expected to witness sustained growth.

AI plays a transformative role in the Electronic Stability Control (ESC) System Market by enhancing the precision, responsiveness, and predictive capabilities of ESC systems. Traditional ESC systems rely on sensors to monitor vehicle dynamics and intervene during loss of traction. With AI integration, these systems can process vast amounts of real-time data, predict potential skidding or instability scenarios more accurately, and activate corrective measures faster than conventional systems. AI algorithms can analyze driving patterns, road conditions, and weather data to predict and prevent instability before it occurs, further improving vehicle safety.

AI also enables the ESC system to work seamlessly with other advanced vehicle safety technologies like Advanced Driver Assistance Systems (ADAS) and autonomous driving features. This integration ensures that ESC systems adapt to complex driving environments, enhancing performance in electric and autonomous vehicles where quick decision-making is critical. AI’s ability to learn from data and continuously improve the system's functionality makes it an essential driver in the future of ESC technology. Moreover, AI-driven ESC systems can reduce false interventions, thus improving driving comfort and efficiency, further boosting their adoption in the automotive industry.

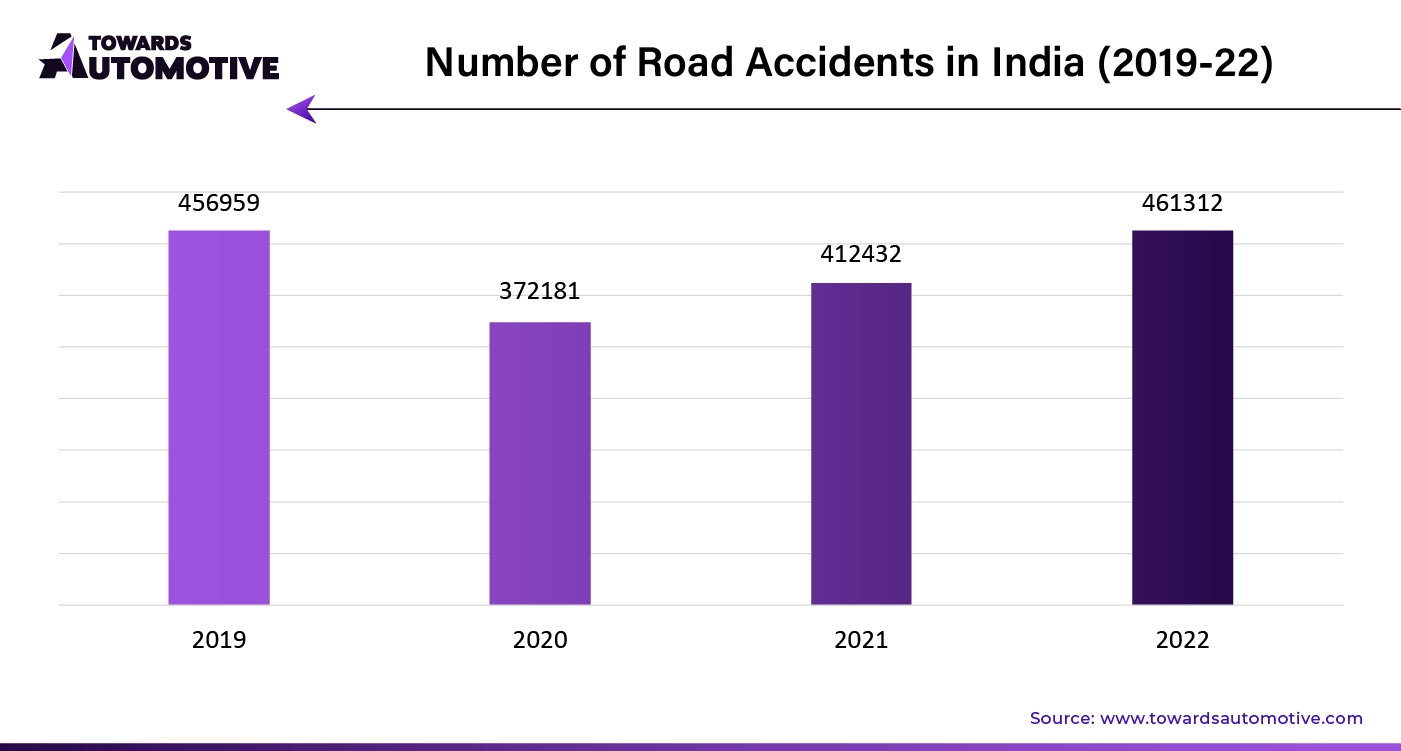

The rising number of road accidents is a significant driver of growth in the Electronic Stability Control (ESC) System Market. As road safety concerns escalate globally, governments and regulatory bodies are increasingly mandating the installation of ESC systems in vehicles to reduce accident rates caused by loss of vehicle control. ESC systems play a crucial role in preventing skidding and rollovers by detecting instability and applying corrective measures, such as reducing engine power and selectively braking individual wheels. This technology has proven to be highly effective in reducing the risk of crashes, particularly in adverse driving conditions like wet or icy roads.

With the global surge in road traffic, both in developed and emerging economies, accidents have become a critical concern for consumers, governments, and vehicle manufacturers alike. According to the World Health Organization (WHO), approximately 1.3 million people die each year due to road traffic crashes, while millions more are injured or disabled. This alarming statistic has fueled demand for advanced safety features like ESC, especially as consumers become more safety-conscious.

In response to the growing emphasis on road safety, many countries have made ESC systems mandatory in new vehicles, further driving market growth. For example, the European Union and the United States require all new passenger cars to be equipped with ESC systems, while other regions are adopting similar regulations. The rising cases of road accidents are not only influencing regulatory frameworks but are also pushing automakers to prioritize safety innovations, making ESC systems a standard feature in a broader range of vehicles. As a result, the ESC market is expected to continue expanding in the coming years.

The Electronic Stability Control (ESC) System Market faces several restraints that could limit its growth. High installation and maintenance costs of ESC systems can be a deterrent for cost-sensitive consumers, especially in emerging markets. Additionally, the complexity of integrating ESC with existing vehicle platforms may pose challenges for manufacturers, leading to increased production costs. In regions with less stringent safety regulations, the adoption of ESC systems remains slower, further hindering market expansion. Lastly, the lack of consumer awareness in certain markets about the benefits of ESC technology could also restrain widespread implementation and growth.

The integration of Electronic Stability Control (ESC) systems with Advanced Driver Assistance Systems (ADAS) presents significant opportunities for growth in the ESC market. ADAS technologies, such as lane-keeping assist, adaptive cruise control, and automatic emergency braking, are designed to enhance vehicle safety by assisting drivers in maintaining control and avoiding accidents. When combined with ESC systems, which prevent skidding and loss of traction, the result is a more comprehensive and intelligent safety solution. This integration allows the ESC system to work more seamlessly with ADAS, ensuring real-time adjustments to vehicle stability based on changing road conditions, driver behavior, and external threats.

As the automotive industry increasingly adopts ADAS technologies, the need for ESC systems that can interface and coordinate with these advanced safety features grows. By merging ESC with ADAS, manufacturers can offer vehicles with enhanced safety performance, particularly in complex driving scenarios where multiple safety systems need to collaborate. This is especially critical in the development of semi-autonomous and autonomous vehicles, where ESC systems must operate without direct human input.

Furthermore, the integration of ESC and ADAS creates opportunities for innovation in predictive safety technologies. AI and machine learning algorithms can be leveraged to analyze data from ADAS sensors and predict potential skidding or loss of control scenarios before they occur, allowing ESC systems to take preemptive action. This not only improves vehicle safety but also enhances consumer confidence in both ADAS and ESC technologies. As a result, the integration of ESC with ADAS is expected to be a key driver of market growth, especially as regulatory bodies push for higher safety standards and as consumers demand more advanced safety features in vehicles.

The hydraulic motor segment held the largest share of the market. Hydraulic motors play a crucial role in driving the growth of the Electronic Stability Control (ESC) System Market by enhancing the precision and efficiency of ESC mechanisms. ESC systems rely on hydraulic components to apply targeted braking force to individual wheels, preventing skidding or loss of vehicle control in challenging driving conditions. Hydraulic motors, which convert hydraulic pressure into mechanical energy, enable ESC systems to execute these braking actions with greater speed and accuracy. This capability is particularly important for high-performance vehicles and in situations where rapid intervention is required to prevent accidents, such as on slippery roads or during sharp turns.

The use of hydraulic motors in ESC systems is also expanding due to advancements in hydraulic technology. These motors now offer improved reliability, reduced energy consumption, and faster response times, all of which contribute to more effective ESC system performance. As automakers seek to enhance vehicle safety, the incorporation of advanced hydraulic components becomes essential to meet increasing consumer expectations for stability and control.

Additionally, hydraulic motors' ability to operate efficiently under varying pressure conditions makes them ideal for ESC systems in different vehicle segments, from passenger cars to heavy-duty trucks. Their robustness and durability ensure long-term performance, reducing the need for frequent maintenance and lowering overall system costs, which encourages manufacturers to integrate ESC systems equipped with hydraulic motors into more vehicle models.

As global road safety regulations become more stringent, the demand for efficient ESC systems that can respond swiftly in real-time situations is growing. The role of hydraulic motors in improving ESC system responsiveness and effectiveness is thus a key factor driving market growth, especially as automotive manufacturers increasingly prioritize advanced safety technologies.

The passenger vehicle segment led the industry. Passenger vehicles are a key driver of growth in the Electronic Stability Control (ESC) System Market, as increasing consumer demand for safety features in everyday vehicles pushes automakers to adopt ESC systems more widely. ESC technology, which helps prevent skidding and loss of control during emergency maneuvers, is becoming a standard safety feature in modern passenger vehicles due to growing safety awareness and regulatory mandates. Governments in regions like North America, Europe, and Asia Pacific have implemented strict safety regulations requiring ESC systems in all new passenger vehicles, thereby boosting market demand.

The rising production and sales of passenger vehicles globally, especially in emerging markets, further propel the ESC market. As urbanization and disposable income increase, more consumers are investing in vehicles that offer advanced safety features. ESC systems, which enhance vehicle stability and control, appeal to safety-conscious buyers, particularly those in regions with challenging driving conditions such as icy, wet, or mountainous terrains.

In addition, the growing trend toward electric and autonomous passenger vehicles creates more opportunities for ESC system integration. As electric vehicles (EVs) become more mainstream, automakers are focusing on equipping them with sophisticated safety systems, including ESC, to ensure they meet safety standards and appeal to a broader customer base. Autonomous vehicles also require more advanced ESC systems to operate safely without human input, further driving demand.

Passenger vehicle manufacturers are increasingly highlighting ESC systems as a key selling point, emphasizing their role in reducing accidents and improving vehicle handling. This, coupled with rising consumer awareness about road safety, is expected to continue driving the growth of the ESC system market in the passenger vehicle segment.

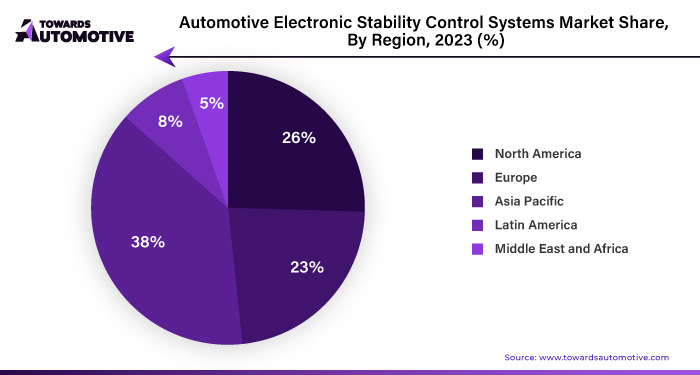

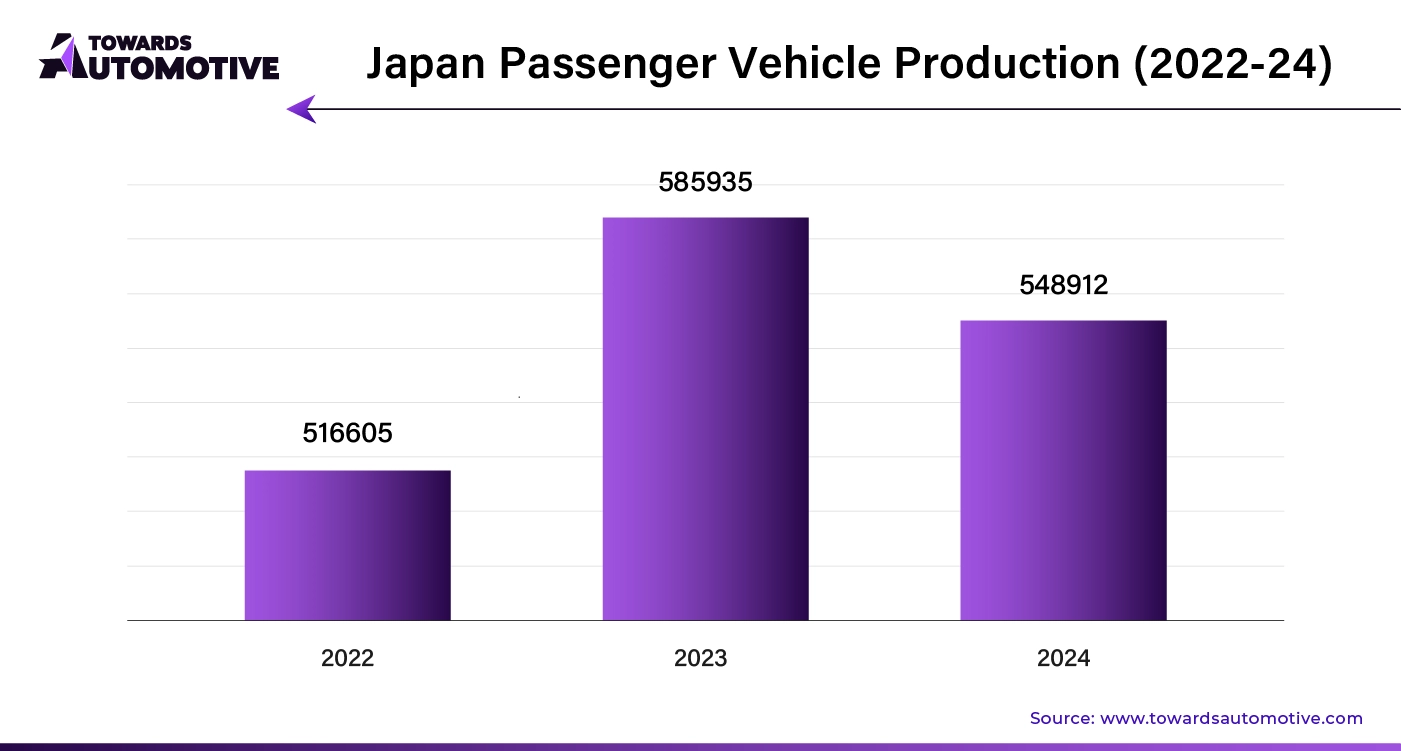

Asia Pacific dominated the electronic stability control system market. The increasing production and sales of automobiles, coupled with stringent government regulations and rising consumer awareness about vehicle safety, are key factors driving the growth of the Electronic Stability Control (ESC) System Market in the Asia Pacific (APAC) region. APAC is home to some of the largest automotive markets, including China, India, Japan, and South Korea, where the demand for passenger and commercial vehicles is steadily rising. As automakers ramp up production to meet this demand, they are increasingly integrating advanced safety features like ESC systems to enhance vehicle stability and reduce the risk of accidents. This surge in vehicle production directly fuels the growth of the ESC market.

Government regulations mandating the installation of ESC systems in new vehicles are another major driver of market growth. Countries such as Japan, China, and South Korea have introduced stringent safety standards that require automakers to equip their vehicles with ESC technology to improve road safety. These regulations not only ensure higher safety standards but also compel manufacturers to comply, significantly boosting the demand for ESC systems across the region.

Additionally, rising consumer awareness about vehicle safety is contributing to the growing adoption of ESC systems in APAC. With the increasing number of road accidents and fatalities, consumers are becoming more safety-conscious and are actively seeking vehicles equipped with advanced safety features. This trend is particularly strong in urban areas where disposable incomes are rising, and consumers are more inclined to invest in safer, technologically advanced vehicles.

North America is expected to grow with a significant CAGR during the forecast period. Safety concerns, the shift toward electric and autonomous vehicles, and technological advancements are pivotal factors driving the growth of the Electronic Stability Control (ESC) System Market in North America. With road safety being a top priority for both consumers and regulatory bodies, there is increasing awareness of the importance of advanced safety technologies in preventing accidents. The National Highway Traffic Safety Administration (NHTSA) mandates that all new passenger vehicles in the U.S. are equipped with ESC systems, which has significantly boosted demand. Consumers are more likely to choose vehicles that include such features, leading to greater adoption across various segments.

Moreover, the ongoing transition toward electric and autonomous vehicles presents new opportunities for the ESC market. As automakers embrace electrification, they are focusing on incorporating advanced safety systems, including ESC, to meet both consumer expectations and regulatory requirements. Electric vehicles (EVs), in particular, often have a lower center of gravity, which can enhance stability; however, they still require sophisticated ESC systems to ensure optimal performance, especially during rapid acceleration or adverse weather conditions.

Additionally, technological advancements are enhancing the capabilities and effectiveness of ESC systems. Integrating ESC with other advanced driver assistance systems (ADAS) enables vehicles to respond more intelligently to various driving scenarios, further improving stability and safety. Innovations in sensor technology and data analytics allow for more accurate real-time assessments of vehicle dynamics, enabling ESC systems to intervene proactively to prevent loss of control. As a result, the combination of heightened safety concerns, the rise of electric and autonomous vehicles, and ongoing technological advancements are collectively propelling the growth of the ESC System Market in North America.

By Vehicle Type

By Component

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us