April 2025

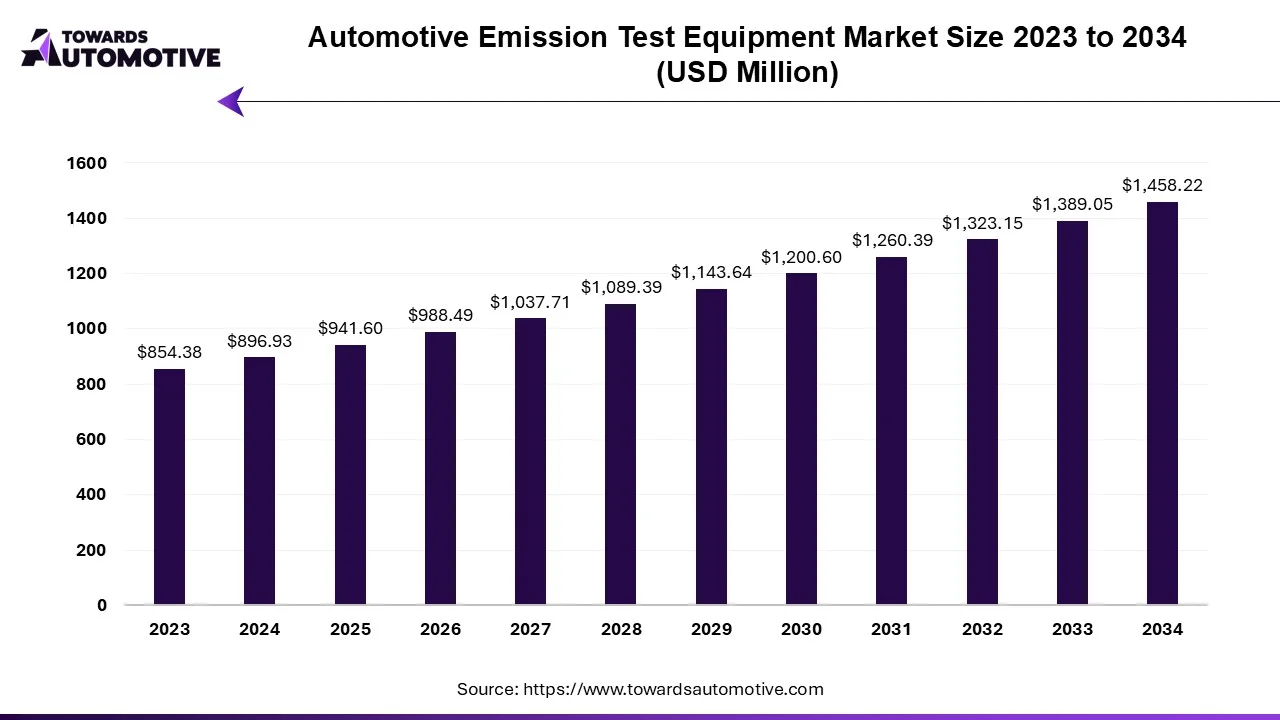

The global automotive emission test equipment market is expected to increase from USD 941.6 million in 2025 to USD 1458.22 million by 2034, growing at a CAGR of 4.98% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive industry is undergoing a paradigm shift driven by increasing environmental concerns, stringent regulatory mandates, and technological advancements. Among the critical aspects of this transformation is the focus on reducing vehicle emissions to mitigate air pollution and combat climate change. As a result, the demand for automotive emission test equipment has surged, reflecting the industry's commitment to enhancing environmental sustainability.

The automotive emission test equipment market is primarily driven by stringent regulatory standards aimed at reducing vehicle emissions and mitigating environmental pollution. Technological advancements, such as the integration of artificial intelligence and machine learning, are enhancing the accuracy and efficiency of testing procedures, while rising environmental awareness among consumers and policymakers is fostering a greater emphasis on emission reduction efforts. The expansion of electric and hybrid vehicles is reshaping testing requirements, driving demand for specialized equipment.

The stringent regulatory standards imposed by governments worldwide are pivotal in propelling the automotive emission test equipment market forward. With a growing emphasis on environmental sustainability, authorities are tightening emission regulations to combat air pollution and address the urgent challenges posed by climate change.

For Instance,

These regulations mandate lower emissions thresholds for vehicles, necessitating the adoption of sophisticated testing equipment capable of accurately measuring pollutants. Consequently, there is an increase in demand for advanced emission testing technologies that can ensure compliance with these stringent standards.

The proliferation of stringent emission regulations worldwide has spurred original equipment manufacturers (OEMs) to rigorously test their vehicles to ensure compliance. Modern vehicles, including hybrid cars featuring hybrid powertrains, necessitate diverse testing equipment such as mobile-based solutions. However, a limited number of companies, exemplified by Intertek (UK), Ricardo (UK), and Horiba (Japan), offer testing solutions tailored for hybrid vehicles. Consequently, many automobile manufacturers opt to outsource these testing services, driving up the overall cost of vehicle production and impacting sales. The testing of hybrid cars demands advanced research due to their unique requirements, emphasizing the need for specialized testing equipment. The dearth of research and development facilities dedicated to automotive testing jeopardizes the advancement and innovation of products, thereby compromising the quality of vehicle testing processes.

The rapid evolution of automotive technologies offers a fertile ground for innovation in emission test equipment, presenting an opportune moment for market players to pioneer advanced testing solutions. By harnessing cutting-edge technologies like artificial intelligence (AI), machine learning (ML) and sensor integration, companies can push the development of next-generation emission test equipment.

Moreover, advancements in data analytics and predictive modeling enable predictive maintenance, minimizing downtime and optimizing equipment performance. By embracing technological innovation, market players can not only meet but exceed customer expectations for accuracy, reliability, and efficiency in emission testing.

Utilizing remote-sensing technology is crucial for measuring exhaust emissions from vehicles during regular on-road operation, forming an integral component of any effective system aimed at controlling air pollution in the transportation sector. As regulatory standards for vehicle emissions become increasingly stringent worldwide, there is a growing demand for innovative solutions to accurately measure and monitor emissions levels. A commonly employed method for in-use vehicle emissions testing involves the utilization of a portable emissions measurement system (PEMS).

Presently, two primary commercial suppliers of remote sensing equipment and testing services operate in the United States and the European Union Hager Environmental and Atmospheric Technologies (HEAT) and Opus Inspection. Both companies have devised remote sensing systems adhering to similar overarching principles. The market for automotive emission test equipment stands to benefit from the expansion of such remote-sensing technology applications.

The emission test equipment segment captured a substantial market share of 45.08% in 2023. The increasing regulations aimed at reducing harmful pollutants such as carbon monoxide (CO), nitrogen oxides (NOx), and particulate matter (PM) necessitate the use of advanced emission test equipment to ensure adherence to emission limits. With growing concerns about air quality and climate change, there is a concerted effort to minimize vehicular emissions and mitigate their environmental impact. This awareness drives the adoption of emission test equipment as important tool in monitoring and reducing pollution levels.

The passenger car segment held considerable market share in 2023. The shifting consumer preferences and lifestyles have fueled the demand for passenger cars as a primary mode of personal transportation. With increasing urbanization, rising disposable incomes, and changing mobility patterns, passenger cars offer convenience, flexibility, and autonomy, making them a preferred choice for individuals and families alike. Furthermore, as authorities intensify their focus on reducing vehicle emissions to mitigate air pollution and combat climate change the demand for advanced emission test equipment for passenger cars also surges.

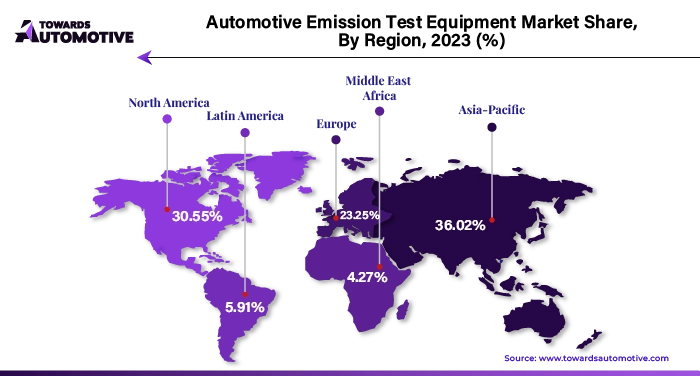

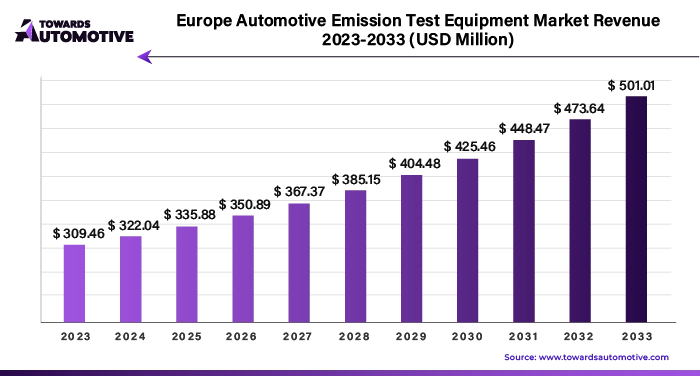

Europe dominated the market with 36.22% of shares in the global automotive emission test equipment market. Europe has some of the strictest emission regulations globally, such as the Euro standards, which mandate lower emissions of various pollutants. Compliance with these regulations necessitates the use of advanced emission test equipment, driving demand in the market. Additionally, there is a strong importance of environmental protection and sustainability in Europe. Increasing awareness among consumers, policymakers, and industry stakeholders about the environmental impact of vehicle emissions fuels the demand for emission test equipment to ensure compliance with emissions standards and reduce pollution levels.

Asia Pacific is expected to grow at a fastest CAGR of 6.02% during the forecast period. Governments across the region are introducing initiatives and incentives to promote the adoption of cleaner and more fuel-efficient vehicles. These initiatives often include subsidies, tax breaks, and other incentives for electric vehicles and hybrids. To qualify for these incentives, vehicles must undergo rigorous emission testing, driving the demand for emission test equipment. Furthermore, the region is home to some of the world's largest automotive markets, including China, Japan and India. The expansion of the automotive industry in these countries has led to an increased focus on emission control and regulation, driving the demand for emission test equipment.

Some of the key players in automotive emission test equipment market are Opus Inspection, Inc., AVL List GmbH, Applus+, HORIBA, Ltd., CAPELEC, GEMCO Equipment Ltd., SGS SA, TEXA S.p.A., ETAS, and TUV Nord Group, among others.

By Solution

By Application

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us