April 2025

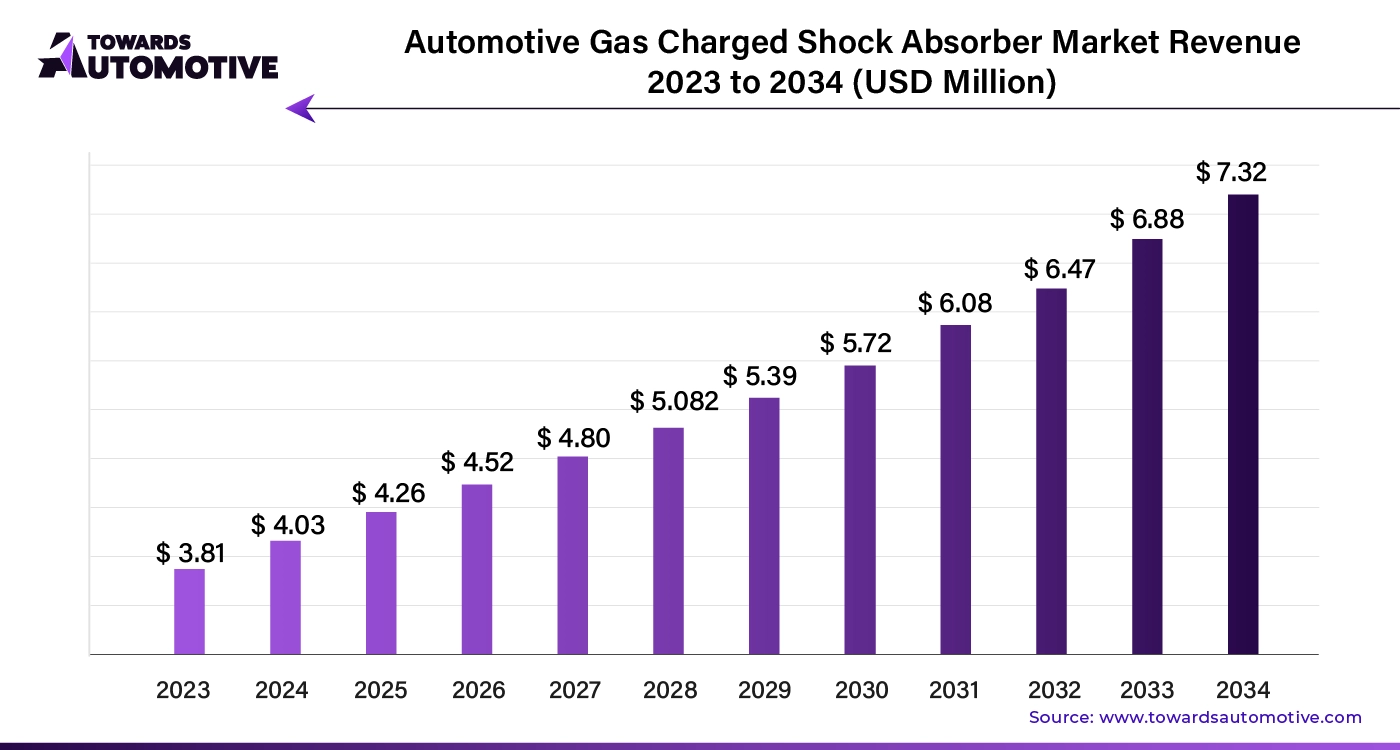

The global automotive gas charged shock absorber market size is calculated at USD 4.03 billion in 2024 and is expected to be worth USD 7.32 billion by 2034, expanding at a CAGR of 5.8% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The rising popularity of crossovers and SUVs is boosting the demand for automotive gas charged shock absorbers, as these vehicles require larger, more robust shock absorbers.

The increasing popularity of aftermarket shock absorbers is creating a positive market outlook for automotive gas charged shock absorbers. Aftermarket options offer a wide selection, improved vehicle performance, and competitive pricing compared to OEM shock absorbers.

Growing consumer preference for premium shock absorbers is driving market growth. Premium shock absorbers enhance ride comfort, improve handling, reduce fade, and increase durability. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

AI is transforming the automotive gas-charged shock absorber market by driving innovation and efficiency. Advanced AI algorithms are optimizing the design and performance of shock absorbers through predictive analytics. This enables manufacturers to create shock absorbers that better respond to various driving conditions, enhancing vehicle stability and safety.

AI-powered data analysis allows for real-time monitoring and adjustments, improving the overall driving experience. Predictive maintenance, driven by AI, helps in identifying potential issues before they lead to failures, reducing downtime and extending the lifespan of shock absorbers. This results in higher customer satisfaction and lower long-term costs.

Furthermore, AI accelerates research and development by simulating different scenarios and testing shock absorber performance under various conditions. This speeds up the innovation process and helps manufacturers stay ahead in a competitive market. By integrating AI, companies can streamline production processes, reduce errors, and achieve greater precision in their products.

The supply chain for the automotive gas charged shock absorber market operates through a streamlined process involving several key stages. Initially, raw materials such as gas cylinders, damping fluids, and metal components are sourced from suppliers. These materials are then transported to manufacturing facilities where shock absorbers are assembled. In these facilities, components are meticulously tested to ensure they meet industry standards and specifications.

Once assembled, the shock absorbers are packaged and distributed through various channels, including direct sales to automotive manufacturers and aftermarket suppliers. Efficient logistics are crucial at this stage to ensure timely delivery to customers across different regions.

The supply chain also incorporates inventory management to balance supply and demand, preventing shortages or overstock situations. Continuous monitoring and coordination between suppliers, manufacturers, and distributors are essential to address any disruptions or delays promptly.

By optimizing each stage of the supply chain, the automotive gas charged shock absorber market can maintain a steady flow of high-quality products, meeting the needs of both original equipment manufacturers (OEMs) and the aftermarket sector effectively.

The automotive gas charged shock absorber market is driven by several core components and industry leaders. Gas charged shock absorbers are essential for improving vehicle ride quality and handling by providing better damping control. The main components include the shock absorber body, piston, valve system, and gas chamber. These components work together to absorb and dissipate energy from road impacts, ensuring a smoother ride.

Major companies such as Monroe (a division of Tenneco Inc.), KYB Corporation, and Sachs (a division of ZF Friedrichshafen AG) are pivotal in this market. Monroe is renowned for its innovative gas-charged technology that enhances vehicle stability and comfort. KYB Corporation provides a wide range of high-performance shock absorbers, leveraging advanced gas charging techniques to improve driving dynamics. Sachs contributes to the market with its precision-engineered products that optimize vehicle handling and safety.

Other notable players include Bilstein and Gabriel, which offer specialized shock absorbers catering to various vehicle types and performance needs. Each company’s contribution focuses on enhancing durability, performance, and driving comfort through continuous innovation and technological advancements in gas charged shock absorber design.

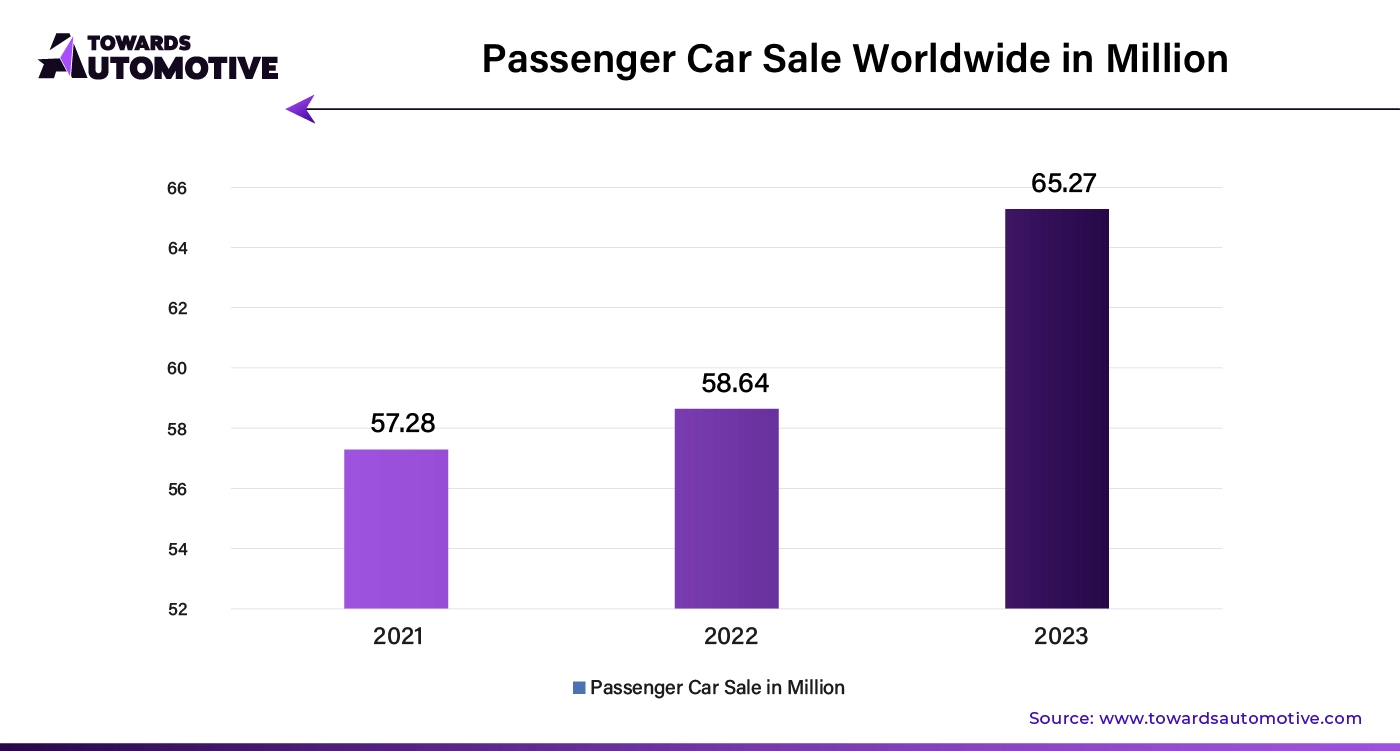

In 2023, the automotive gas-charged shock absorber market is experiencing notable trends. Passenger cars are leading the market with a commanding 56.5% share. This trend is driven by several key factors:

Global government investments in infrastructure and economic growth are boosting passenger car sales, leading to increased demand for both utility and luxury vehicles.

Production and demand for passenger cars are rising in emerging economies, providing a positive outlook for automotive gas-charged shock absorbers.

Leading manufacturers are focusing on product innovation, which is enhancing the appeal and sales of shock absorbers in passenger cars.

The twin-segment shock absorbers are the dominant design type, capturing a significant 80.3% share of the market. This segment's growth is fueled by:

A growing preference for improved vehicle handling and a smoother ride, which twin-segment shock absorbers deliver through their separate oil and gas chambers.

The flexibility of twin-segment shock absorbers, making them suitable for a variety of vehicles, including light vehicles and SUVs. This versatility appeals to both aftermarket and OEM customers.

Canada:

In Canada, the automotive gas charged shock absorber market is projected to grow at a CAGR of approximately 3.8% from 2023 to 2033. This growth is fueled by rising industrial output and a flourishing automotive industry. The introduction of cost-effective, advanced shock absorbers featuring nitrogen gas and velocity-sensitive valves is enhancing both comfort and affordability for consumers.

Germany:

Germany is witnessing a notable growth rate of around 6.2% CAGR in its automotive gas charged shock absorber market through 2033. The rising consumer demand for high-end automotive features and supportive government policies for electric vehicle adoption are significant drivers of this growth. The focus on luxury and comfort in vehicles is pushing up the market for these advanced shock absorbers.

France:

In France, the market for automotive gas charged shock absorbers is expected to grow at a CAGR of about 5.7% over the next decade. The increasing popularity of these shock absorbers among premium car manufacturers, due to their durability and enhanced performance, is driving market expansion. Technological advancements in the automotive sector also contribute to a favorable market outlook.

India:

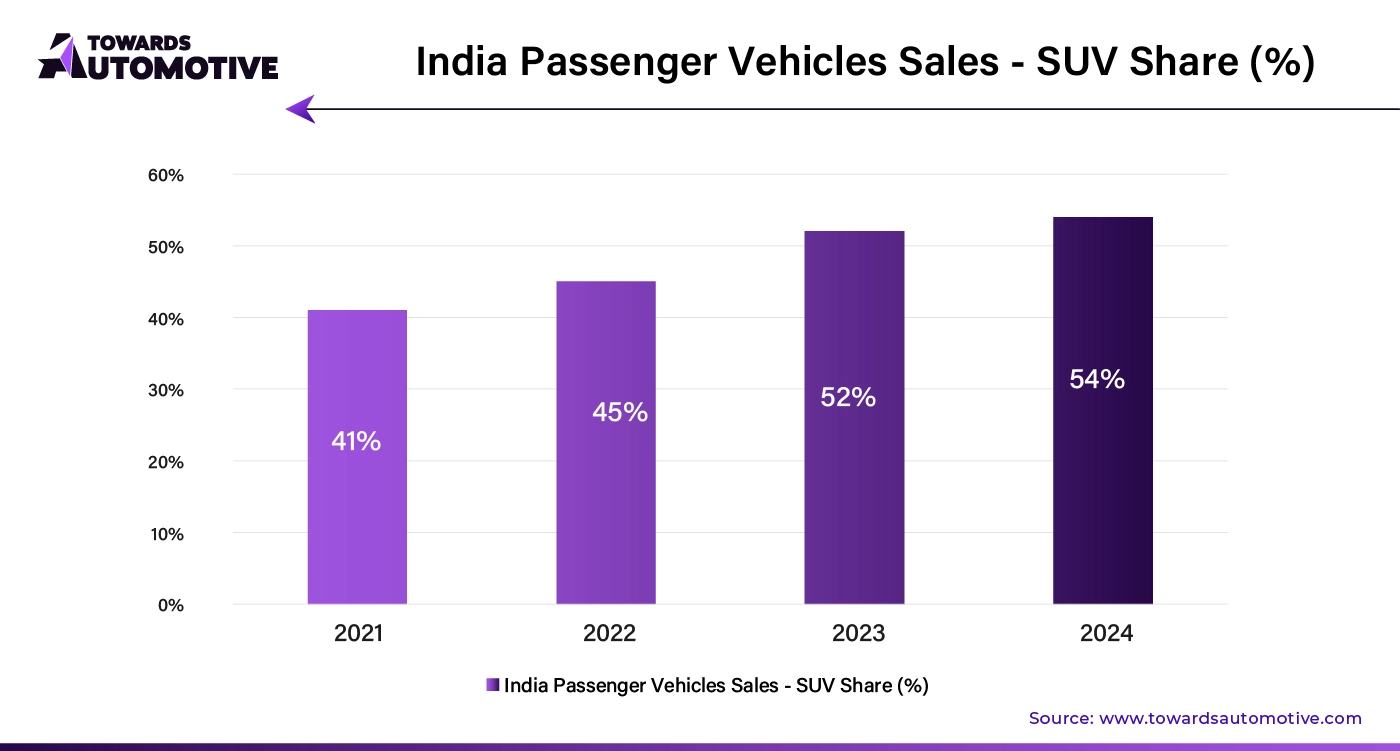

India is projected to experience the fastest growth, with a CAGR of approximately 6.8% from 2023 to 2033. The surge in vehicle production and growing consumer demand for safety and comfort are key factors driving this growth. The rising number of vehicles on the road is significantly boosting the demand for automotive gas charged shock absorbers.

ASEAN:

The ASEAN region is also seeing substantial growth, with a forecasted CAGR of around 6.4% through 2033. Increased demand for performance-enhancing automotive equipment and the strategic expansion of product suppliers into the ASEAN aftermarket are key factors contributing to this growth.

The automotive gas charged shock absorbers market is dominated by a few major players. These companies are focusing on expanding their presence in the Asian aftermarket, where significant opportunities are emerging. Additionally, manufacturers from emerging economies are increasing exports to developed automotive markets.

To address diverse vehicle applications, key players are expanding their product portfolios and investing in research and innovation to enhance performance and durability. Strategic acquisitions and mergers are also being pursued to access advanced technologies and resources.

By Sales Channel

By Vehicle Type

By Design Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us