April 2025

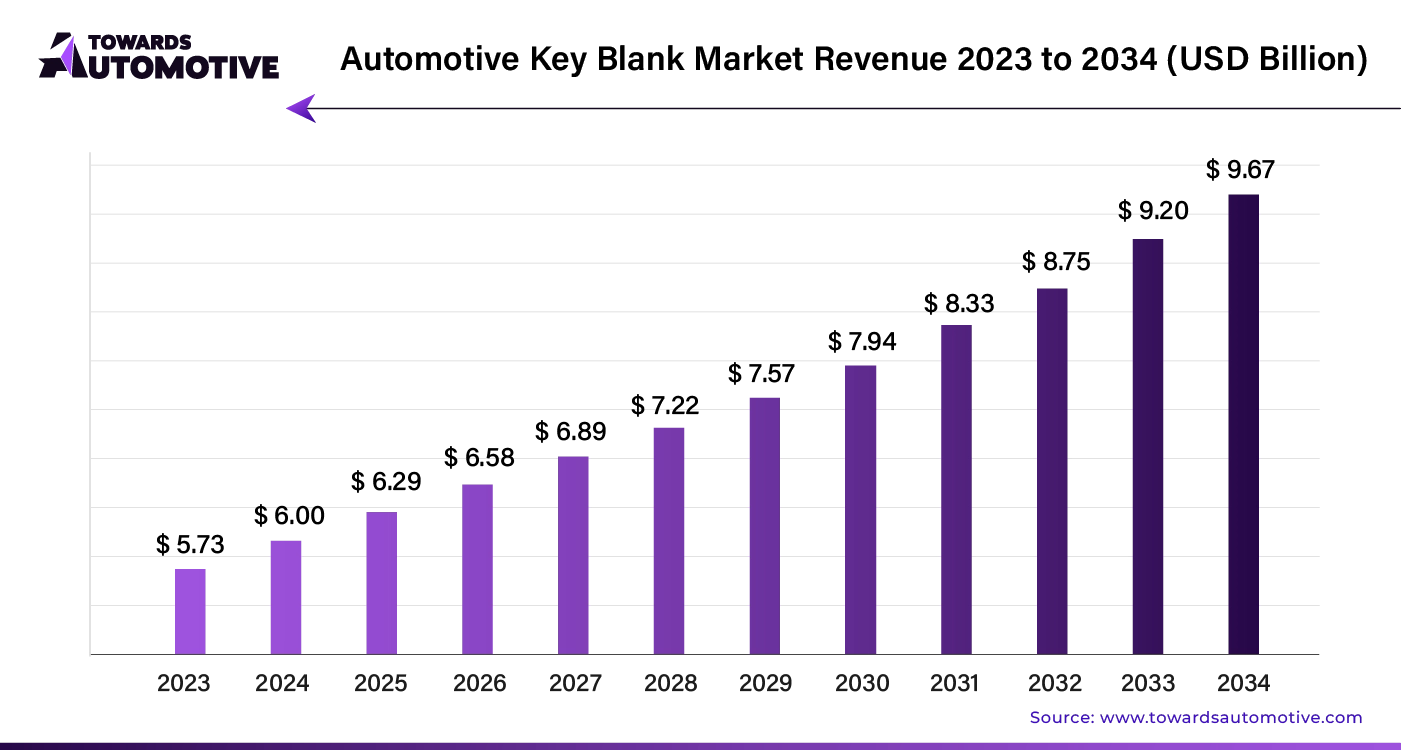

The global automotive key blank market size is calculated at USD 6.00 billion in 2024 and is expected to be worth USD 9.67 billion by 2034, expanding at a CAGR of 4.70% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

As global vehicle ownership rises due to urbanization and economic growth, the demand for automotive key blanks also increases. The advent of electronic key systems, such as transponder keys and keyless entry systems, drives the need for specialized key blanks. With vehicles becoming more advanced, the demand for technologically sophisticated key blanks continues to grow.

The replacement market drives significant demand for automotive key blanks. As vehicles age, owners often replace key blanks due to wear, tear, or loss. Advances in key technologies also encourage upgrades, sustaining demand for newer, more sophisticated key blanks.

Growing concerns about vehicle security further boost the demand for high-security key blanks. Both manufacturers and consumers seek keys with advanced features to prevent theft and enhance vehicle protection, prompting the development of more secure key solutions.

The rise in smart key systems has led companies to align their offerings with the need for key blanks compatible with these technologies. They are focusing on developing key blanks that integrate smoothly with electronic and wireless entry systems.

As global vehicle fleets expand, the demand for automotive key blanks increases. Companies are scaling their production to meet this growing need, ensuring an adequate supply of key blanks for new vehicle acquisitions. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Biometric Integration

To enhance security, key blank manufacturers are developing biometric solutions. New key blanks compatible with thumbprints and retina scans address rising security concerns in the automotive sector.

Rise of Electric and Autonomous Vehicles

The shift toward electric and autonomous vehicles is changing key technologies. Electric vehicles (EVs) often use proximity keys or digital access methods, influencing the traditional key blank market. Manufacturers are adapting by creating key blanks tailored to these modern vehicle needs.

Customization and Personalization Demands

Consumers increasingly seek customized and personalized products, including automotive key blanks. Trends include branded key blanks, unique designs, and customizable features. Companies are responding by offering a variety of attractive and personalized key blanks.

Collaborations with Automotive OEMs

Key blank manufacturers are partnering with automotive original equipment manufacturers (OEMs) to drive innovation. These collaborations ensure that key blanks align with the latest vehicle models and evolving automotive technologies.

Consumer Awareness and Education

Growing consumer awareness of key technologies and security features is impacting purchasing decisions. Manufacturers are investing in educating consumers about advanced key solutions to help them understand the various key blank options available.

AI integration is revolutionizing the automotive key blank market by enhancing efficiency and driving innovation. As automotive manufacturers increasingly adopt AI technologies, they are streamlining key blank production and improving precision. AI-powered systems enable manufacturers to predict demand patterns more accurately, reducing excess inventory and optimizing supply chains.

Advanced AI algorithms facilitate real-time monitoring of production processes, identifying and addressing potential issues before they affect product quality. This proactive approach enhances manufacturing efficiency and ensures that key blanks meet rigorous industry standards.

Additionally, AI-driven data analytics provide insights into consumer preferences, enabling companies to develop customized key blanks that meet specific market demands. This tailored approach fosters greater customer satisfaction and drives market growth.

The integration of AI in the automotive key blank sector also supports the development of smart keys with advanced security features. AI enhances the encryption and authentication processes, making vehicles more secure against theft.

Overall, AI integration is accelerating growth in the automotive key blank market by optimizing production, improving product quality, and driving innovation in security features.

The automotive key blank market relies on a streamlined supply chain to ensure efficiency and product availability. Manufacturers source raw materials from suppliers, which are then processed into key blanks. These blanks undergo rigorous quality checks before reaching the assembly stage. Automotive companies and aftermarket suppliers distribute the finished products through a network of distribution channels.

Efficient supply chain management is crucial for minimizing lead times and reducing costs. Real-time tracking systems and data analytics play a significant role in monitoring inventory levels, forecasting demand, and managing production schedules. Collaboration between manufacturers, suppliers, and distributors helps to mitigate disruptions and maintain a steady flow of key blanks to meet market demands.

To stay competitive, companies must focus on strengthening relationships with suppliers, optimizing logistics, and investing in technology for better visibility and control. By enhancing these aspects, the automotive key blank market can achieve greater efficiency, cost-effectiveness, and responsiveness to market changes.

The automotive key blank market comprises essential components including key blanks, key cutting machines, and transponder chips. Key blanks are the primary raw material, providing the base for all automotive keys. Key cutting machines, both manual and automated, are crucial for shaping these blanks into functional keys. Transponder chips are integrated into modern keys to enhance security and functionality.

Companies play significant roles in this ecosystem. Key manufacturers like Silca, JMA, and Ilco produce a wide variety of key blanks suited for different automotive brands. These companies focus on innovation, ensuring their products meet the latest security standards and technological advancements.

Key cutting machine producers, such as HPC and X-Y Tools, provide the tools needed to create precise cuts on key blanks. Their advancements in technology improve efficiency and accuracy in key duplication processes.

Furthermore, companies specializing in transponder technology, including companies like ID Pro and T5, are essential for integrating security features into keys, enhancing vehicle protection against theft.

Together, these components and companies drive the automotive key blank market, ensuring a secure and efficient key management system for vehicles.

Transponder Keys: Market Dominance Transponder keys lead the automotive key blank industry, commanding a substantial 91.78% share of the market in 2024. Their advanced security features offer robust protection against theft, making them highly desirable. As more vehicles adopt transponder technology, the demand for compatible key blanks increases. The replacement market for these keys is also growing as older vehicles with transponder systems age. Manufacturers are introducing innovative designs and customization options to meet evolving consumer needs.

Passenger Cars: Fastest Growing Segment The passenger car segment is the fastest-growing category, projected to secure 63.29% of the automotive key blank market in 2024. This growth is fueled by rising passenger car ownership. Consumers prefer key blanks that are both attractive and customizable, which drives demand in this segment. The adoption of advanced keyless entry systems in passenger cars further boosts the market for related key blanks. Additionally, the aftermarket for passenger car key blanks is expanding as vehicle owners seek replacements and upgrades for their aging key systems.

United States

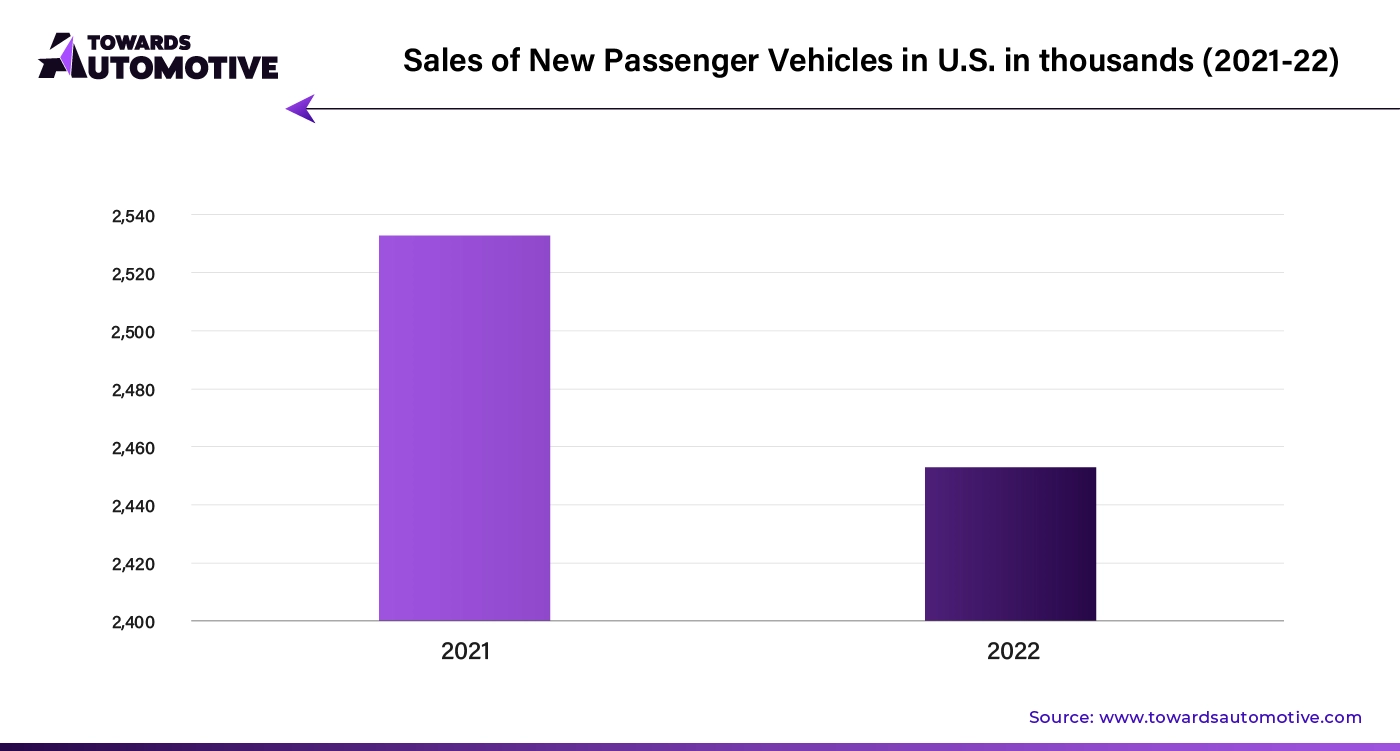

The automotive key blank market in the United States is projected to grow at an annual rate of 4.7% from 2024 to 2034. The consistent need for replacement keys for older vehicles ensures a stable demand. Increasing interest in eco-friendly options may lead to the development of more sustainable key blanks. Advances in connected car technologies could influence future key blank functionalities. Additionally, a heightened focus on vehicle security drives the demand for advanced key technologies with anti-theft features.

Germany

Germany’s automotive key blank market is expected to expand at an annual growth rate of 5.3% through 2034. As a major global auto exporter, Germany experiences high demand for key blanks. Ongoing innovations in key blank technology support market advancement. The luxury and high-performance vehicle sectors create a demand for premium key blanks. Strict safety standards require high-quality key blanks, benefiting well-established market players. Germany's developed aftermarket infrastructure also ensures steady demand for replacement and spare key blanks.

China

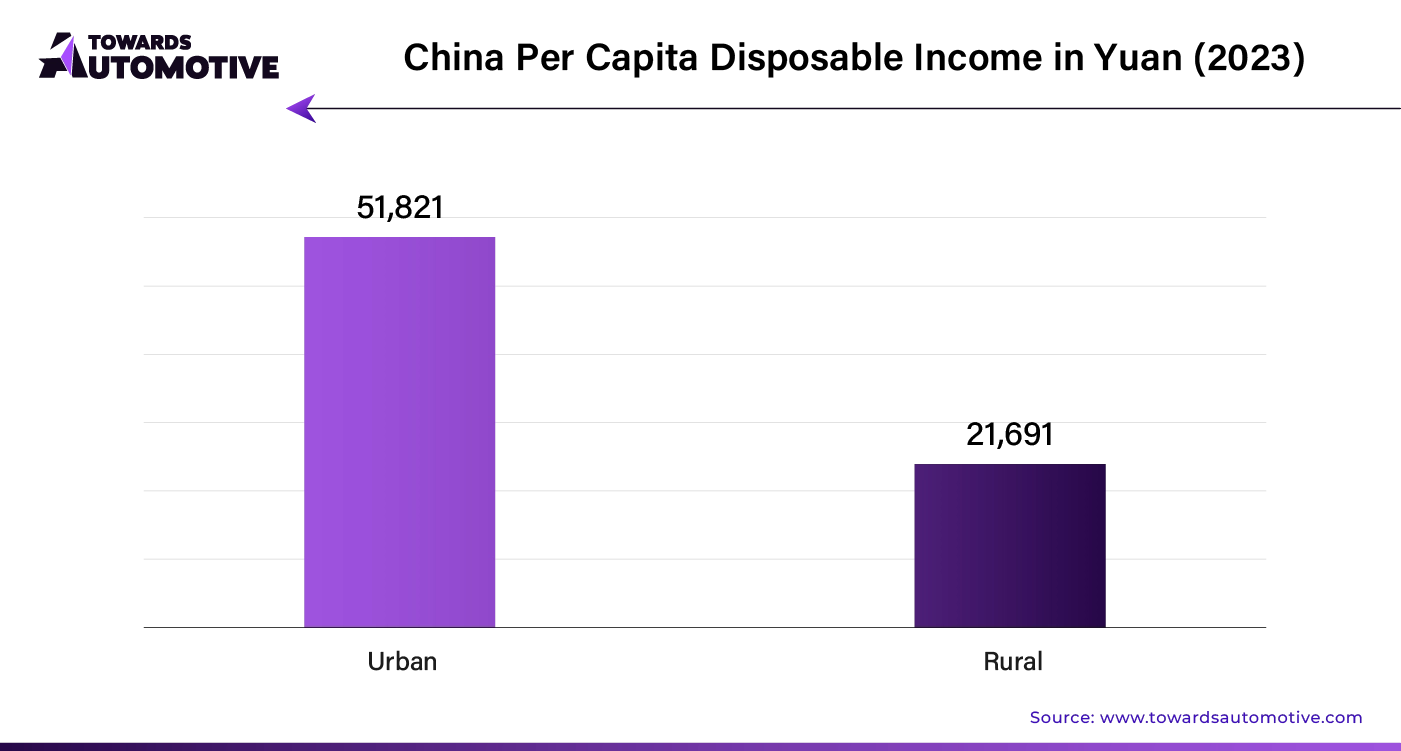

China is the fastest-growing market for automotive key blanks, with a projected annual growth rate of 6.8% through 2034. The rapid expansion in car production drives demand for replacement and spare key blanks. Increasing disposable income and a desire for personalized vehicles boost interest in premium key blanks. Supportive local manufacturing policies and technological advancements further enhance market growth. Stringent regulations and anti-counterfeiting measures offer opportunities for legitimate manufacturers to excel.

India

India’s automotive key blank market is anticipated to grow at an annual rate of 7.0% from 2024 to 2034. Rising vehicle ownership in urban areas fuels the demand for key replacements and spares. The growing popularity of budget-friendly cars drives the need for cost-effective key blanks. The expanding car repair and maintenance sector supports higher demand for key blanks. Localization initiatives and skill development efforts benefit the domestic industry. Increased concerns about vehicle security also lead to higher adoption of advanced key technologies.

Australia

Australia's market for automotive key blanks is projected to grow at a moderate annual rate of 4.6% through 2034. The increasing number of vehicles, particularly SUVs and pickup trucks, drives demand. Dependence on imported vehicles creates a need for compatible key blanks. Growing interest in car customization and modifications boosts demand for specialty key blanks. Local manufacturers see opportunities due to challenges in parts distribution.

China and India are the fastest-growing markets, with China leading in growth rate and India showing significant potential. Germany remains dominant in terms of high-quality standards and technological advancement, while the United States and Australia exhibit steady growth with unique market dynamics.

The automotive key blank industry is highly competitive, with companies investing heavily in research and development to pioneer advanced key blank technologies. Key players focus on integrating smart features, biometric authentication, and innovative materials to boost security and functionality.

Strategic partnerships between key players and automotive original equipment manufacturers (OEMs) are crucial. These alliances ensure that key blank solutions align with the latest vehicle models, enhancing compatibility and market responsiveness.

Competition is global, with major companies targeting established markets like the United States, Germany, China, India, and Australia, as well as emerging automotive economies. This global reach helps companies cater to varied consumer preferences and market conditions.

In the aftermarket segment, competition is fierce as companies offer a wide range of replacement key blanks. They address the needs of vehicle owners looking to upgrade or replace aging key systems.

Building a strong brand and earning consumer trust are vital. Companies that position themselves as reliable, secure, and innovative tend to attract a loyal customer base, influencing buying decisions.

By Product Type

By Material Type

By Vehicle Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us