April 2025

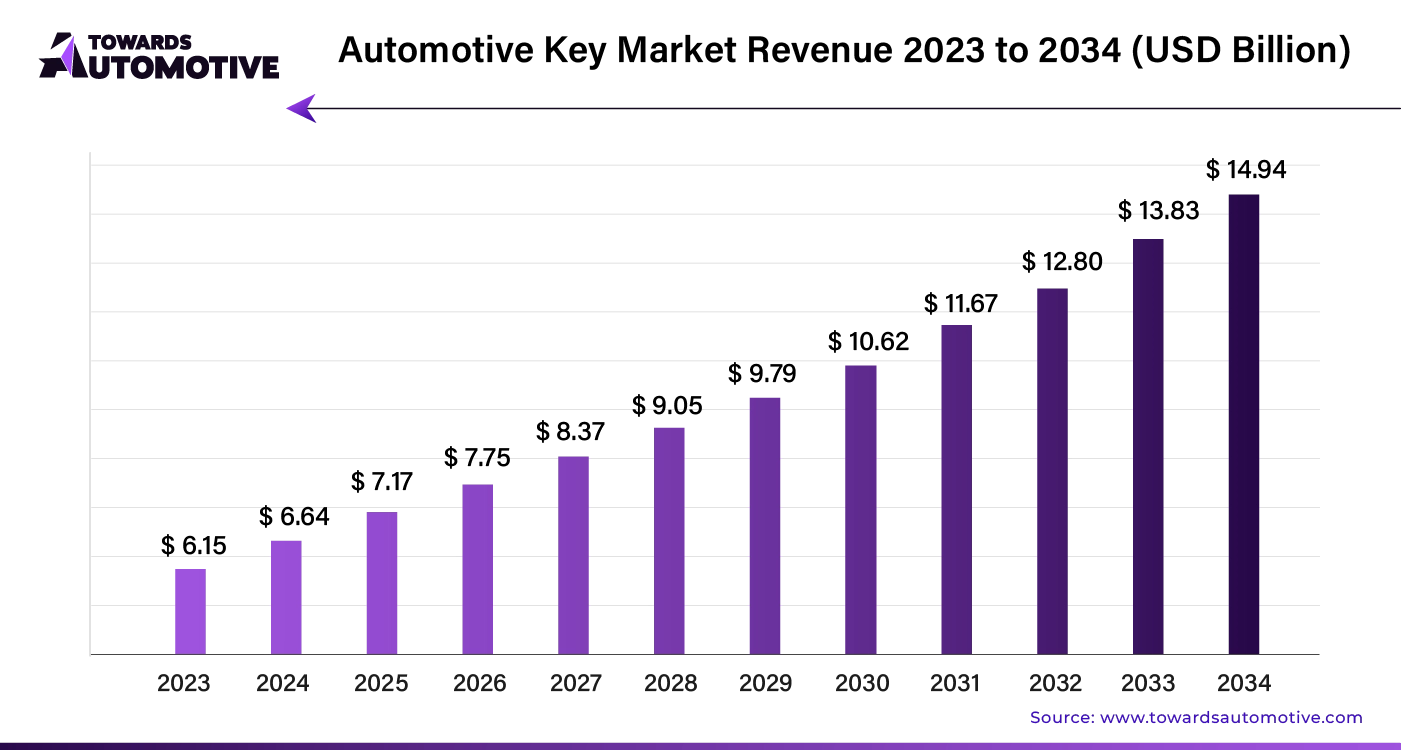

The global automotive key market size is calculated at USD 6.64 billion in 2024 and is expected to be worth USD 14.94 billion by 2034, expanding at a CAGR of 8% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive key market is thriving, fueled by the global growth in vehicle production. Increasing demand for both passenger cars and commercial vehicles is directly boosting the need for automotive keys. Technological advancements, such as the adoption of transponder keys for enhanced security, are further driving this market. As car ownership rises in emerging economies and technology continues to evolve, the automotive key market is set for sustained growth.

CHINA CAR PRODUCTION (2023)

Unit:10000,%

| Volume | Jan - Dec | MoM | YoY | YoY Jan - Dec | |

| Cars | 307.9 | 3016.1 | -0.5 | 29.2 | 11.6 |

| Passenger Cars (PC) | 271.3 | 2612.4 | 0.3 | 27.7 | 9.6 |

| Cars | 124.0 | 1150.8 | 7.0 | 23.3 | 2.9 |

| MPV | 11.7 | 111.2 | 7.4 | 29.6 | 16.8 |

| SUV | 133.0 | 1324.2 | -5.8 | 33.3 | 16.3 |

| Crossed Passenger Cars | 2.6 | 26.2 | 4.7 | -14.7 | -17.2 |

The automotive key market has evolved significantly to combat increasingly sophisticated theft methods. Leading manufacturers are now integrating advanced security features into their products, enhancing customer confidence and ensuring the safety of both vehicles and their occupants. The industry's focus on staying ahead of emerging threats drives continuous innovation in key technologies, resulting in stronger vehicle protection. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The key blank market is experiencing growth due to the increasing need for duplicate and replacement keys in the automotive industry. As more people own vehicles, the demand for key-cutting services rises, driven by lost or damaged keys.

Lifestyle changes have also contributed to this trend. Many car owners now opt for additional keys for family members, both for convenience and as a safeguard against losing the primary key. This growing consumer need underscores the expanding market for automotive keys.

The automotive key market is increasingly challenged by the high replacement costs and technological complexity of advanced key technologies, particularly transponder keys. These keys, equipped with RFID chips and electronic components, are more expensive to produce, which directly impacts the cost to consumers.

Replacement costs for these advanced keys can range from $40 to over $100, depending on the automaker and key design. This price variation is due to the transponder chip's cost and the specialized equipment needed to program the key to the car's computer. Additionally, programming key fobs often incurs extra fees, with some dealerships also charging for labor.

These high costs deter many consumers from adopting the latest key technologies, especially when faced with the potential expense of replacing a lost or damaged key.

The integration of artificial intelligence (AI) is set to revolutionize the automotive industry, significantly enhancing market growth. AI will streamline vehicle design by optimizing engineering processes, which accelerates innovation and reduces development time. Advanced algorithms will enable more accurate predictions for market trends and consumer preferences, guiding manufacturers in tailoring their products to meet evolving demands.

In manufacturing, AI-driven automation will enhance production efficiency and reduce operational costs. AI-powered quality control systems will improve product reliability and safety by identifying defects with greater precision. Additionally, AI will facilitate the development of autonomous driving technologies, leading to new business models and opportunities in ride-sharing and transportation services.

AI's ability to analyze vast amounts of data will drive smarter decision-making, optimizing supply chain management and reducing waste. As AI systems become more integrated into automotive operations, they will not only enhance vehicle performance but also support sustainability goals by improving fuel efficiency and reducing emissions.

In the automotive market, the supply chain operates as a synchronized system, connecting raw material suppliers, manufacturers, distributors, and retailers. The process begins with sourcing raw materials, which are then delivered to manufacturing plants where parts are assembled into vehicles. Manufacturers rely on just-in-time (JIT) inventory management to reduce waste and ensure efficient production.

Once vehicles are assembled, logistics providers handle the transportation to distribution centers. From there, the vehicles are allocated to dealerships based on demand forecasts. The entire supply chain emphasizes collaboration and real-time communication among stakeholders to respond quickly to market fluctuations and customer demands.

Digital tools like predictive analytics and IoT devices play a crucial role in monitoring and optimizing each stage of the supply chain, ensuring transparency and minimizing disruptions. The goal is to deliver high-quality vehicles to customers on time while keeping costs low and maintaining a sustainable operation. This streamlined approach not only enhances customer satisfaction but also strengthens the competitiveness of automotive companies in a dynamic market.

The automotive market ecosystem comprises several key components, each playing a vital role in vehicle production. Automakers lead the industry by designing and manufacturing vehicles, setting the standard for quality and innovation. Tier 1 suppliers, such as Bosch and Continental, provide critical systems like braking and electronics.

Tier 2 and 3 suppliers contribute specialized parts, including sensors and wiring, ensuring a steady flow of materials. Raw material suppliers, including steel and aluminum producers, supply the foundational elements for vehicle construction. Technology firms, like NVIDIA and Google, contribute advanced software and autonomous driving systems, enhancing vehicle intelligence.

Logistic companies, such as DHL and FedEx, manage the complex supply chains, ensuring timely delivery of components. Retailers and dealerships bridge the gap between manufacturers and consumers, driving sales and after-sales services. Finally, financial institutions offer leasing and financing options, enabling customers to purchase vehicles. Each of these players interacts in a tightly knit network, where collaboration and efficiency are paramount for maintaining market competitiveness.

2019-2023: Electric Vehicle Surge and Autonomous Advances

Government incentives and growing environmental concerns fueled a surge in electric vehicle adoption. Meanwhile, advancements in autonomous driving technology gained traction, with digitalization transforming the customer experience through personalized services and enhanced connectivity.

2023-2029: The Rise of Electric Vehicles and Mobility-as-a-Service

Electric vehicles began to outpace conventional internal combustion engine cars in market share. Mobility-as-a-Service (MaaS) platforms reshaped car ownership models, while modern safety features and AI-powered systems became standard, improving vehicle efficiency and safety.

2029-2034: The Era of Fully Autonomous Vehicles and Sustainable Innovation

The proliferation of fully autonomous vehicles led to significant changes in transportation infrastructure and urban planning. Innovations in materials and manufacturing, driven by circular economy principles and sustainability, became key. AI and big data analytics enabled highly individualized mobility solutions, tailored to specific preferences and lifestyles.

The transponder keys segment is projected to be the fastest-growing segment, with an expected compound annual growth rate (CAGR) of 7.9% from 2024 to 2034. This growth underscores increasing consumer confidence in the reliability and effectiveness of transponder keys for car security. As adoption rates rise, these keys align with industry standards and modern vehicle security regulations. By the end of 2023, the transponder keys market segment is anticipated to reach approximately US$ 13,800 million, with demand expected to continue its upward trajectory over the next decade.

For vehicle types, the passenger car segment is set to remain the market leader, maintaining its top position through 2034. This segment is forecasted to grow at a CAGR of 7.6% during the same period. Contributing factors include rising disposable income and the continuous expansion of the global automotive sector, which has spurred increased production and sales of passenger cars. The focus on enhancing vehicle security has driven demand for advanced automotive keys, with manufacturers integrating state-of-the-art security features to prevent theft and improve safety.

The global automotive key industry is witnessing notable changes, with key trends emerging across major economies such as India, China, Japan, Germany, and the United States.

India is leading in growth, with a projected Compound Annual Growth Rate (CAGR) of 9.8%. The market is anticipated to reach approximately US$ 1,290 million by 2034. This growth is driven by the need for affordable and dependable key technologies, coupled with an increasing focus on anti-theft features. Additionally, the adoption of smartphone-based keyless entry systems is becoming more prevalent, particularly among the tech-savvy urban population.

China stands out in terms of market size, expected to achieve around US$ 4,950 million by 2034. The country’s automotive key market is significantly shaped by the rising integration of IoT technologies and voice recognition features, reflecting China's commitment to smart connectivity. The growing shift towards electric vehicles is also boosting demand for eco-friendly and lightweight key solutions.

Japan, with a CAGR of 9.2%, is recognized for its focus on precision and artistry in automotive key systems, projected to reach about US$ 1,100 million by 2034. The market is characterized by minimalist designs that appeal to urban consumers and a strong emphasis on sustainability through energy-efficient technologies and environmentally friendly materials.

Germany, growing at a 5.0% CAGR, is influenced by its advancements in autonomous driving technology. The market, expected to reach roughly US$ 380 million by 2034, is seeing increased demand for multifunctional keys that integrate various vehicle control features. The luxury automotive sector drives the need for high-quality materials and customized key designs.

In the United States, the automotive key market is projected to grow at a 4.5% CAGR, reaching approximately US$ 1,300 million by 2034. This growth is propelled by the demand for advanced keyless entry systems and high-tech security features. The rise in electric vehicle adoption and strict regulatory standards for vehicle safety and anti-theft measures are also fostering innovation in the market.

Prominent manufacturers like Bosch, Continental AG, and Denso Corporation are setting industry standards with their innovative and reliable automotive key solutions. These companies drive technological advancements and set benchmarks for excellence.

Valeo, Hella GmbH & Co. KGaA, and Lear Corporation are also key players, competing fiercely in the automotive key market. Their strong focus on quality and expertise in automotive electronics makes them formidable contenders.

Startups such as Alps Alpine Co., Ltd. and Silca S.p.A. are shaking up the industry with novel solutions that challenge traditional approaches and push the boundaries of technology.

Global vendors like Hyundai Mobis, Magna International Inc., and Aptiv PLC bring diverse perspectives and leverage extensive resources to offer comprehensive automotive key solutions.

The dynamic and competitive automotive key market continues to evolve, driving advancements in vehicle security, comfort, and connectivity.

Automotive Keys Group (AKG): In April 2021, AKG acquired International Key Supply (IKS), a specialized provider of automotive keys, remotes, and related accessories. This strategic acquisition expanded AKG's product offerings and strengthened its e-commerce presence.

Strattec: Strattec invested approximately $10.8 million in 2021 and $9.8 million in 2020 in research and development, focusing on automotive access control. Their efforts include enhancing vehicle access through electronic interlocks and improving the communication of authorization data between consumers and vehicles, with a strong emphasis on product development efficiency and continuous quality improvements.

By Product Type

By Vehicle Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us