April 2025

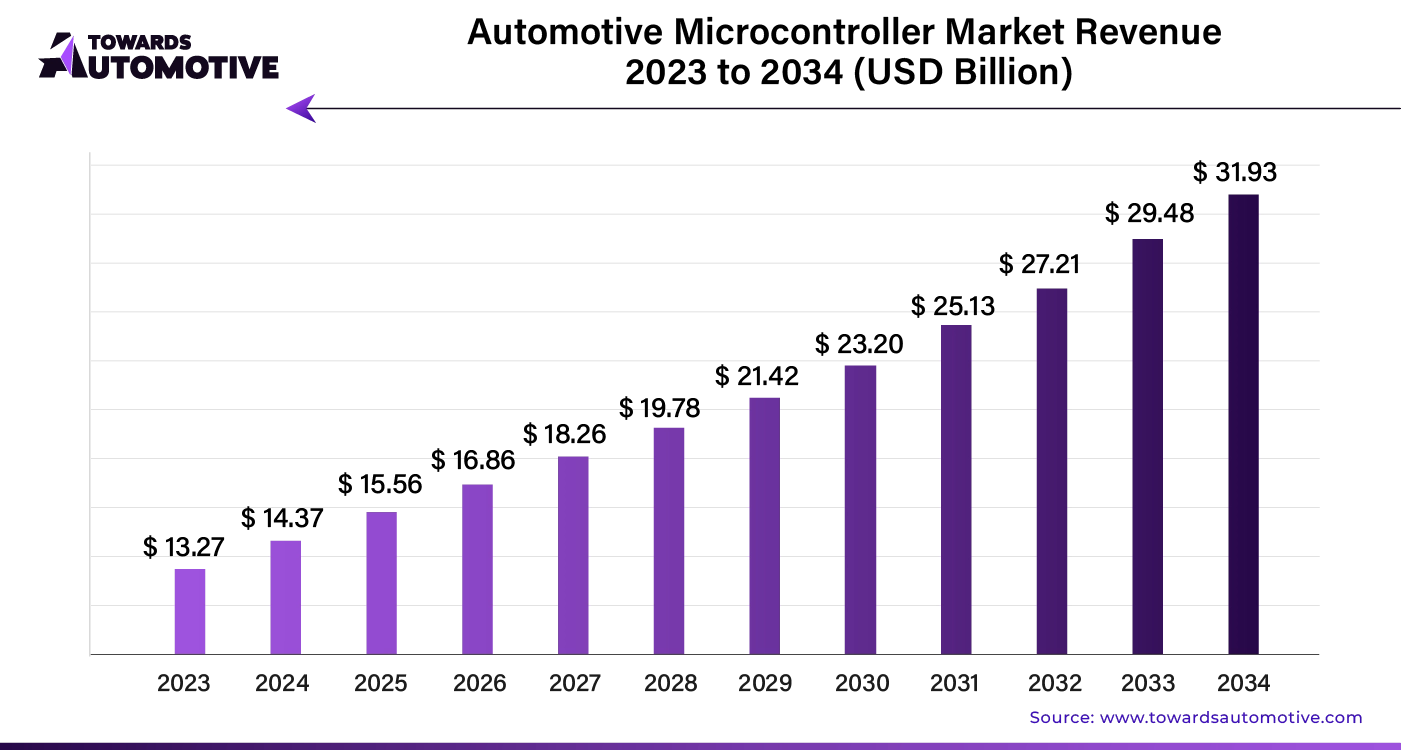

The automotive microcontroller market is anticipated to grow from USD 15.56 billion in 2025 to USD 31.93 billion by 2034, with a compound annual growth rate (CAGR) of 8.31% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

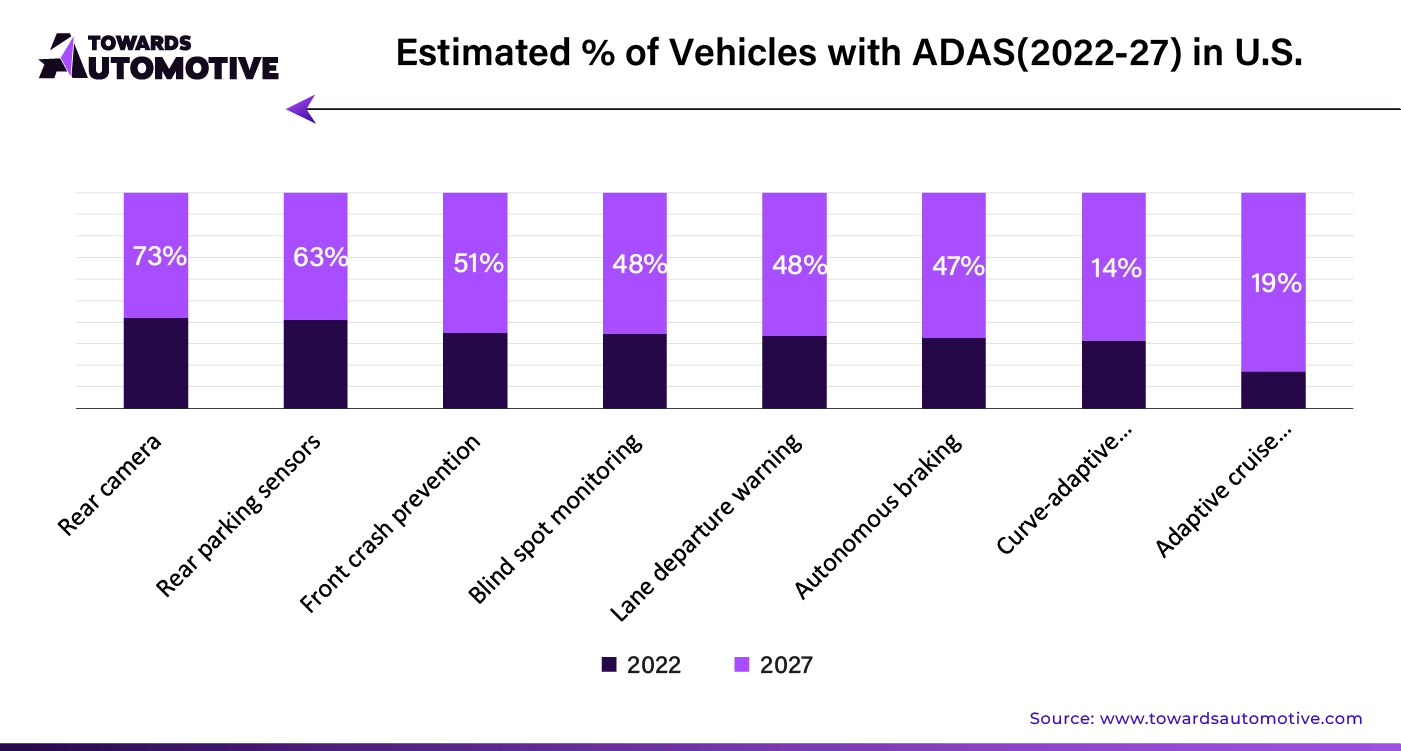

The growing demand for electric vehicles (EVs) is driving the need for advanced microcontrollers, particularly in systems like advanced driver assistance (ADAS), lane change warnings, surround-view cameras, automated braking, and blind spot detection. Hybrid electric vehicles are also gaining global traction due to their energy efficiency, requiring more microcontrollers than traditional vehicles.

Automakers are increasingly adopting reduced instruction set computer (RISC-V) solutions, valued for their flexibility, customization, and long-term innovation. The RISC-V ecosystem is rapidly expanding globally, becoming a popular choice for microcontrollers in the automotive industry. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The integration of AI in automotive microcontrollers is revolutionizing the market, driving significant growth by enhancing vehicle performance and safety. AI-powered microcontrollers enable real-time data processing, which optimizes engine efficiency, improves fuel consumption, and reduces emissions. These advancements support the development of autonomous driving systems, where AI algorithms process vast amounts of data to make split-second decisions, ensuring safer driving experiences. Moreover, AI enhances predictive maintenance capabilities, reducing vehicle downtime and maintenance costs. As the demand for electric and autonomous vehicles rises, AI-driven microcontrollers are becoming essential components, pushing the market forward. By enabling smarter, more efficient vehicles, AI integration in automotive microcontrollers is set to drive substantial market growth.

The supply chain in the automotive microcontroller market is evolving to meet growing demand and technological advancements. Manufacturers are increasingly focusing on vertical integration to enhance control over production processes and ensure a steady supply of essential components. This approach reduces dependency on external suppliers, minimizing disruptions.

Strategic partnerships with semiconductor foundries are becoming more common, allowing companies to secure a consistent supply of microcontrollers. In addition, just-in-time inventory management practices are being adopted to optimize storage costs and reduce lead times. Suppliers are also enhancing transparency by leveraging advanced tracking systems, ensuring real-time visibility across the supply chain.

The shift towards localizing production, particularly in regions like the United States and Europe, is further streamlining operations. This localization reduces transportation costs and mitigates risks associated with geopolitical tensions. As a result, the supply chain in the automotive microcontroller market is becoming more resilient, efficient, and capable of adapting to market demands.

Tinned steel is set to remain the preferred material for automotive microcontrollers, with its sales projected to command a significant market share. Copper alloys are also expected to hold strong demand as the second most sought-after material for in-vehicle microcontrollers.

The expansion of raw material sources and the enhancement of international trade channels are likely to drive down costs and boost the production of affordable automotive microcontrollers during the forecast period.

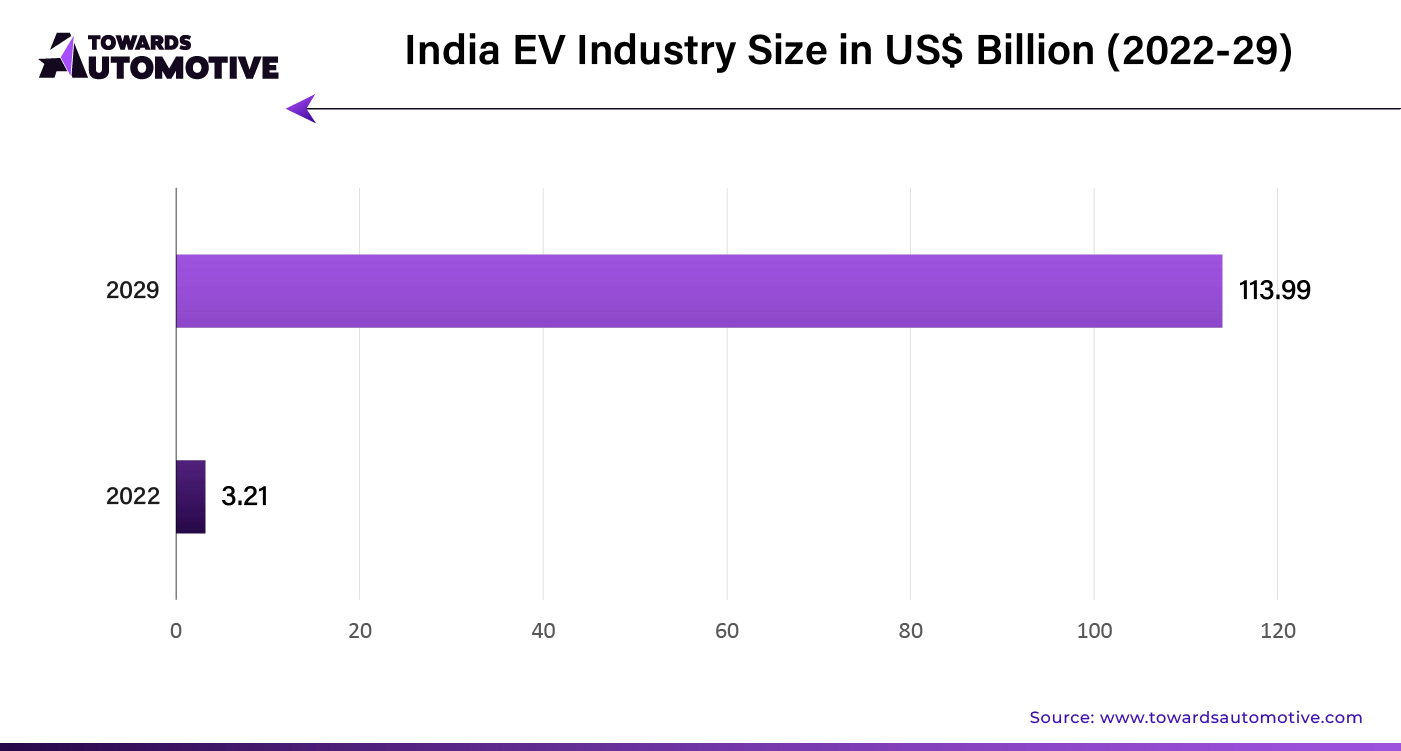

With the rise of electric vehicles, the demand for automotive microcontrollers has surged, particularly for managing electric drivetrains, battery systems, and power distribution. Growing concerns about global warming have led many nations to implement regulations and promote electric mobility, further driving the sales of automotive microcontrollers.

The automotive microcontroller market ecosystem is driven by key components, including microcontrollers, semiconductors, sensors, and software solutions. Microcontrollers, the core of this ecosystem, manage and control various vehicle functions, from engine management to advanced driver-assistance systems (ADAS).

Leading companies like NXP Semiconductors, Infineon Technologies, and Renesas Electronics are pivotal in developing high-performance microcontrollers that meet the growing demands of electric and autonomous vehicles. These companies invest heavily in R&D to innovate and enhance processing power, energy efficiency, and safety features. Additionally, semiconductor manufacturers such as Texas Instruments and STMicroelectronics contribute essential components like power management ICs, which optimize the performance of automotive microcontrollers.

Meanwhile, software companies like Bosch and Continental provide the necessary platforms and integration services, enabling seamless communication between microcontrollers and other vehicle systems. This collaboration among hardware and software providers ensures the development of robust, efficient, and secure automotive systems, driving the industry's evolution toward smarter and safer vehicles. Each player’s contribution is crucial in shaping the future of the automotive microcontroller market, ensuring it meets the industry's dynamic requirements.

United States: Advancing Automotive Technology The U.S. market is set to grow at a CAGR of 6.6% from 2024 to 2034, driven by advancements in automotive technology. The development of advanced driver assistance systems (ADAS) featuring automatic emergency braking, lane departure warning, and collision avoidance is key. As connected car technology rises in popularity, microcontrollers in automotive embedded systems have become essential for enabling communication between vehicle systems and external networks.

Germany: Leading Europe with Superior Power Management Germany is expected to dominate the European automotive microcontroller market, growing at a CAGR of 5.3%. The increasing demand for microcontrollers with enhanced power management capabilities supports Europe’s sustainability goals. Additionally, stringent safety standards and traffic regulations are propelling the adoption of vehicle control microcontrollers in the region.

China: Expanding Global Reach China’s automotive microcontroller industry is projected to grow at an impressive 12.3% CAGR through 2034. This growth is fueled by rising demand from neighboring industrializing economies and the increasing need for adaptive microcontrollers capable of real-time sensor data processing.

India: Riding the Wave of Electric Mobility India’s automotive microcontroller market is set to expand at a 10.9% CAGR over the forecast period. The country’s growing adoption of microprocessor units is focused on improving vehicle reliability and reducing maintenance costs. The surge in control unit usage in electric two- and three-wheelers presents significant opportunities in the automotive embedded system landscape.

Australia: Embracing Modern Automotive Features Australia is witnessing a robust demand for automotive microcontrollers, with a projected CAGR of 8.5%. The increasing use of hybrid and electric vehicles is driving this growth, alongside the rising adoption of vehicle electronic control units (ECUs) to meet consumer demands for advanced in-car entertainment, navigation, and connectivity features.

Mid-size passenger vehicles are significantly boosting the demand for automotive microcontrollers, with this segment expected to secure approximately 24% of the market share by 2024. Microcontrollers in these vehicles play a crucial role in enhancing transmission systems, providing smooth gear transitions, and improving fuel efficiency. The push towards lighter mid-sized passenger vehicles is likely to further increase microcontroller applications in this segment.

In addition, electronic power steering systems are experiencing notable growth, anticipated to represent around 38% of the automotive microcontroller market in 2024. This rise is driven by the growing adoption of electronic power steering in both passenger and commercial vehicles. Furthermore, brake control systems and airbags are expected to remain key applications for automotive microcontrollers in the foreseeable future.

The automotive microcontroller market has traditionally been concentrated, with only a few manufacturers possessing the technical expertise and infrastructure needed to compete globally. However, increased government support for establishing original equipment manufacturing (OEM) industries in emerging economies is leading to a more fragmented market.

By Material Type

By Vehicle Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us