April 2025

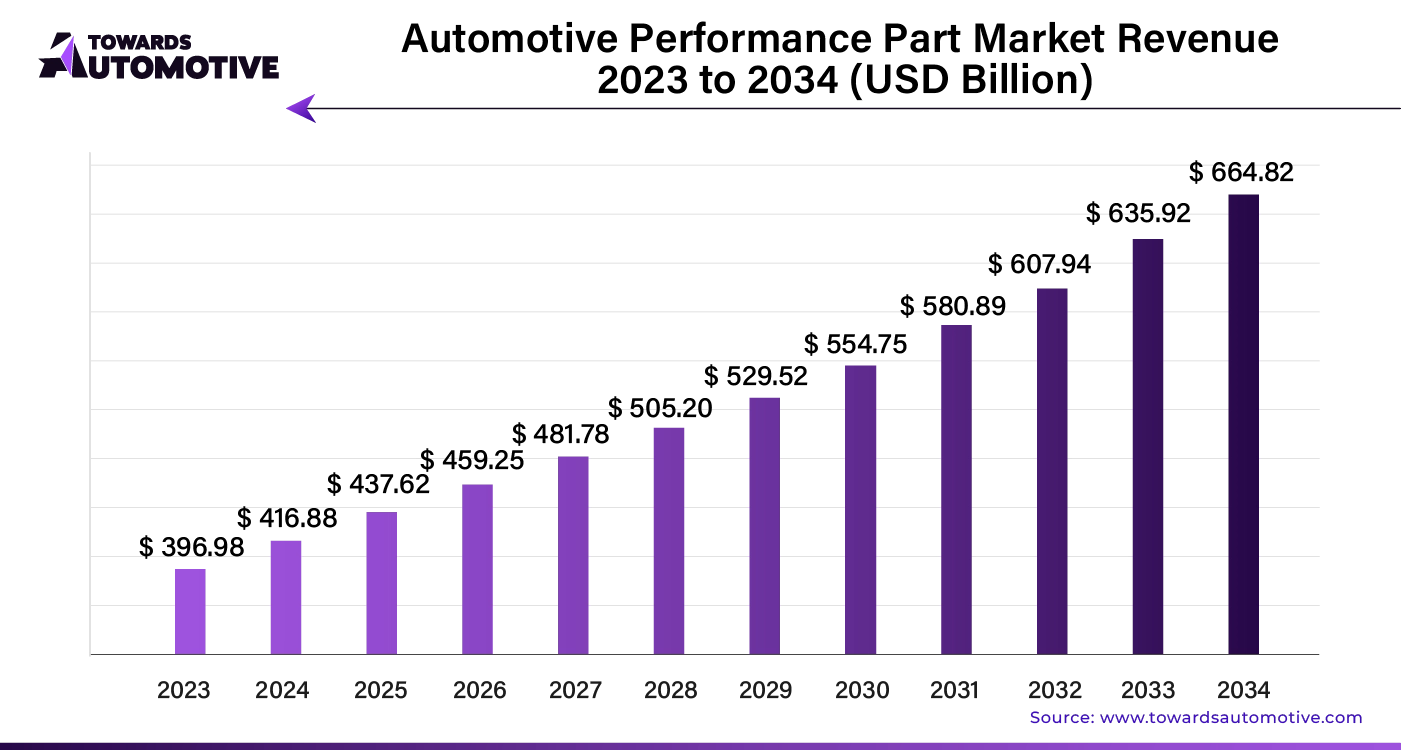

The global automotive performance part market size is calculated at USD 416.88 billion in 2024 and is expected to be worth USD 664.82 billion by 2034, expanding at a CAGR of 4.94%.

Unlock Infinite Advantages: Subscribe to Annual Membership

Advancements in 3D printing technology are revolutionizing the manufacturing of automotive performance parts, enabling companies to deliver custom-designed components at lower production costs and with quicker turnaround times. This innovation in on-demand manufacturing reduces inventory expenses, enhances production efficiency, and allows businesses to swiftly adapt to changing consumer demands.

The ability to offer personalized solutions tailored to individual customer needs is transforming consumer satisfaction and loyalty. 3D printing facilitates rapid prototyping and iterative design, driving innovation and keeping businesses ahead in the competitive automotive sector.

A prime example of this shift is Autentica Car Parts, which entered the market in November 2023. Based at Sci-Tech Daresbury, Autentica has launched a groundbreaking platform that can cut non-production costs by up to 70% and reduce transport emissions by 40%. This platform is designed to enable equipment manufacturers to distribute 3D-printed automotive performance parts to authorized dealers, repair centers, and distributors efficiently.

As the automotive industry continues to evolve, the adoption of 3D printing technology is poised to play a crucial role in driving innovation and meeting the demands of a dynamic market. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Automotive performance parts manufacturers are embracing lightweight materials like carbon fiber, titanium, and aluminum to enhance vehicle performance while ensuring durability. These materials help reduce the overall weight of vehicles, leading to improved speed, handling, and fuel efficiency.

Technological advancements are revolutionizing the market as manufacturers integrate intelligent components such as sensors, communication options, and electronic control units (ECUs) into performance parts. These innovations allow for more precise tuning and greater control over vehicle performance.

There is a growing demand for performance-oriented trucks and SUVs. Consumers increasingly seek practical vehicles that also deliver superior performance, leading to a surge in interest in high-performance parts for these larger vehicles.

Environmental concerns are influencing the market as well. Manufacturers are developing high-performance auto parts with eco-friendly features, such as energy-efficient designs and sustainable materials, in response to the growing emphasis on reducing carbon footprints.

Additionally, there's a trend towards blending classic design elements with modern engineering. Many performance parts now combine vintage aesthetics with state-of-the-art technology, appealing to enthusiasts who appreciate both nostalgia and advanced performance.

Companies have significant opportunities to boost brand visibility and drive sales through motorsports and racing sponsorships. These events offer a platform to showcase products to a targeted audience passionate about performance.

The rise of digital technology presents a chance for businesses to offer cloud-based platforms and mobile apps for remote tuning and performance optimization. These tools provide consumers with convenient solutions to enhance their vehicles' performance from anywhere.

The expansion of the global automotive industry opens doors for performance parts manufacturers to explore emerging markets. As automotive demand grows in new regions, manufacturers can tap into these markets with their innovative products.

The emergence of electric, hybrid, and autonomous vehicles creates new opportunities for specialized performance parts tailored to these advanced vehicle types. Manufacturers can capitalize on this shift by developing components that enhance the performance of these cutting-edge vehicles.

Customization and personalization are increasingly popular, particularly among younger consumers. This trend presents a lucrative opportunity for manufacturers to offer performance parts that cater to individual preferences and unique vehicle modifications.

One major challenge is the risk of intellectual property infringement and counterfeiting. Unlawful duplication of performance parts by competitors or counterfeiters can damage a company's brand reputation, revenue, and market share.

Additionally, evolving emissions regulations and vehicle standards pose a challenge for performance parts manufacturers. Staying compliant with these changing regulations requires continuous adaptation and innovation, which can impact product development and sales strategies.

AI integration is set to significantly enhance the automotive performance parts market by driving innovation and efficiency. By leveraging AI technologies, manufacturers can optimize design processes, streamline production, and improve quality control. AI-driven design tools allow for rapid prototyping and testing of new performance parts, ensuring that only the most effective solutions reach the market. These tools can analyze vast amounts of data to predict performance outcomes and identify potential issues before they arise.

Furthermore, AI-powered predictive maintenance systems will help extend the lifespan of automotive parts by identifying wear and tear before it leads to failure. This not only boosts the reliability of performance parts but also reduces overall maintenance costs for consumers.

AI is also transforming supply chain management by optimizing inventory levels and forecasting demand more accurately. This leads to reduced lead times and lower production costs. As a result, the automotive performance parts market is expected to experience accelerated growth, driven by enhanced efficiency, innovation, and customer satisfaction. The integration of AI technologies positions the market for a dynamic evolution, paving the way for more advanced and reliable automotive components.

In the automotive performance parts market, an efficient supply chain is crucial for meeting the demands of performance enthusiasts and manufacturers. The supply chain begins with raw material suppliers who provide high-quality metals, composites, and other components essential for performance parts. These materials are then delivered to specialized manufacturers who design and produce the parts, ranging from turbochargers to high-performance brakes.

Once manufactured, these parts move through distribution channels that include wholesalers and retailers. Effective logistics ensure that performance parts reach various markets promptly, minimizing delays and maintaining inventory levels. The rise of e-commerce has further streamlined this process, allowing customers to order parts directly from manufacturers or authorized dealers online.

To stay competitive, companies must also integrate advanced technologies like inventory management systems and predictive analytics to anticipate demand and adjust supply chains accordingly. Collaborations with logistics providers and strategic sourcing of materials help mitigate risks and enhance the efficiency of the supply chain.

Overall, a robust and responsive supply chain is vital for meeting market demands and ensuring the availability of high-quality performance parts for automotive enthusiasts and professionals.

The automotive performance parts market thrives on several core components that enhance vehicle performance. These include engine components, suspension systems, braking systems, and aerodynamic kits. Each part plays a crucial role in improving speed, handling, and overall vehicle efficiency.

Major companies drive the market by innovating and expanding their product offerings. For instance, companies like Bosch and Magna International focus on advanced engine management systems and high-performance suspension components. Their technologies enhance engine efficiency and driving dynamics. Meanwhile, brands like Brembo and Eibach specialize in high-performance braking systems and suspension kits, respectively, delivering superior safety and ride quality.

Additionally, companies such as HKS and Mugen are renowned for their aftermarket modifications and tuning parts, offering enthusiasts the ability to customize their vehicles for better performance. These contributions by various players not only fuel market growth but also ensure that consumers have access to cutting-edge technology that meets their performance needs.

Together, these components and companies create a dynamic ecosystem, continuously pushing the boundaries of automotive performance and driving innovation in the market.

Power Adders Take the Lead

In 2024, power adders dominate the automotive performance parts market, capturing 37.10% of the market share. These components offer a cost-effective way to boost vehicle performance compared to other modifications, making them an appealing option for enthusiasts on a budget. Despite their affordability, power adders provide substantial performance gains, attracting a diverse range of vehicle owners.

Their versatility is a key factor in their widespread appeal. Power adders are compatible with numerous vehicle types and brands, including sports cars, muscle cars, trucks, and SUVs. This adaptability allows enthusiasts to customize their performance enhancements according to their specific needs and objectives, fostering broad acceptance across various vehicle categories.

Passenger Cars: The Top Performer

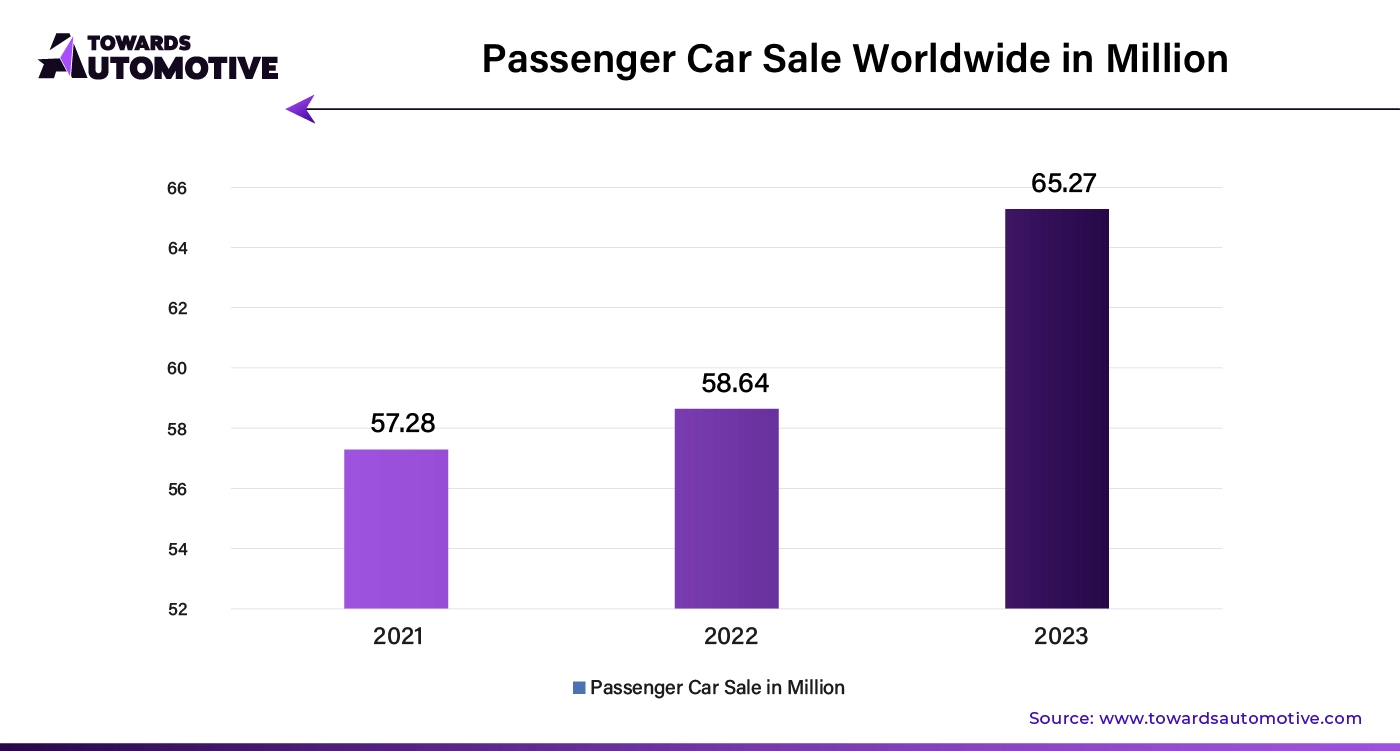

Passenger cars lead the market for automotive performance parts, holding a significant 75.00% of the market share in 2024. This trend reflects a growing demand for performance enhancements among passenger car owners, driven by advancements in manufacturing and engineering.

Automakers, aftermarket suppliers, and automotive influencers are driving this demand through endorsements, targeted advertising, and promotional efforts. These strategies showcase the advantages of aftermarket tuning parts and encourage consumers to invest in modifications that enhance their driving experience.

Technological progress in passenger cars, such as improved powertrains, digital control systems, and lightweight materials, facilitates the integration of aftermarket parts. As these vehicles become more sophisticated, they offer a strong platform for performance upgrades, further boosting the demand for automotive performance parts.

United States: Classic Car Revival Spurs Market Growth

In the United States, the automotive performance parts market is projected to grow at a 2.9% CAGR from 2024 to 2034. This expansion is largely driven by a renewed interest in restoring and modifying classic cars. Enthusiasts are increasingly turning to businesses specializing in retro-modern enhancements and performance parts for vintage vehicles, indicating a strong market for high-quality restoration components.

Additionally, the DIY trend is contributing to market growth, as more American car enthusiasts engage in aftermarket modifications to personalize their vehicles. This trend presents significant opportunities for companies to offer a diverse range of performance parts tailored to the needs of DIY enthusiasts.

Germany: Racing Heritage Fuels Demand for High-Performance Parts

Germany's automotive performance parts market is expected to experience a 2.8% CAGR over the next decade. The country’s storied racing history and prestigious automotive brands like Porsche, BMW, and Mercedes-Benz drive a culture that values high performance. Iconic events such as the Nürburgring 24 Hours underscore the demand for premium performance parts that enhance acceleration, speed, and handling.

Furthermore, Germany’s Autobahn, with its unrestricted speed limits on certain stretches, encourages vehicle owners to seek out parts that improve their car’s performance. Businesses can capitalize on this niche by offering customized enhancements that cater specifically to Autobahn driving conditions.

Japan: Hybrid Innovations Drive Market Expansion

Japan’s automotive performance parts market is forecasted to grow at a 4.1% CAGR through 2034, propelled by the country’s leadership in hybrid and performance hybrid vehicle technology. With key players like Toyota and Honda leading the charge, there is an increasing demand for performance modifications in hybrid powertrains, including advanced hybrid controllers, battery improvements, and regenerative braking systems.

This trend offers businesses opportunities to innovate and provide performance solutions that meet both environmental and performance needs of Japanese consumers.

China: Electric Vehicle Boom Creates New Market Opportunities

China’s automotive performance parts market is anticipated to expand at a 5.3% CAGR from 2024 to 2034, driven by the country’s rapid growth in electric vehicles (EVs). As the world’s largest EV market, China presents substantial opportunities for performance parts tailored to electric cars.

Consumers are seeking performance upgrades such as advanced electric motors, improved battery systems, and innovative power management solutions. Businesses can tap into this demand by developing products that enhance the power, range, and overall driving experience of electric vehicles.

India: Tuning Culture Drives Rapid Market Growth

In India, the automotive performance parts market is projected to grow at a remarkable 7.3% CAGR over the next decade. This growth is fueled by a rising tuning and modification culture, with enthusiasts eager to customize their vehicles. The trend towards car personalization and performance enhancements highlights a dynamic market for aftermarket parts.

Companies can take advantage of this trend by offering a wide range of performance components and customization options that cater to the specific tastes and preferences of Indian consumers, tapping into a rapidly expanding segment eager for vehicle enhancements.

These insights reflect diverse opportunities across global markets, each influenced by unique cultural and technological factors.

The automotive performance parts market is fiercely competitive, with numerous manufacturers vying for dominance. Major players, including well-established brands and emerging competitors, continuously push the envelope by investing heavily in research and development. Their goal is to distinguish their products and secure a competitive edge.

These companies compete across multiple dimensions: product quality, performance, reliability, brand reputation, and pricing strategies. As consumers increasingly seek to enhance and personalize their vehicles for better performance, the industry remains dynamic and highly competitive. Manufacturers must constantly evolve and adapt to meet the ever-changing demands and preferences of their clientele.

By Product Type

By Vehicle Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us