April 2025

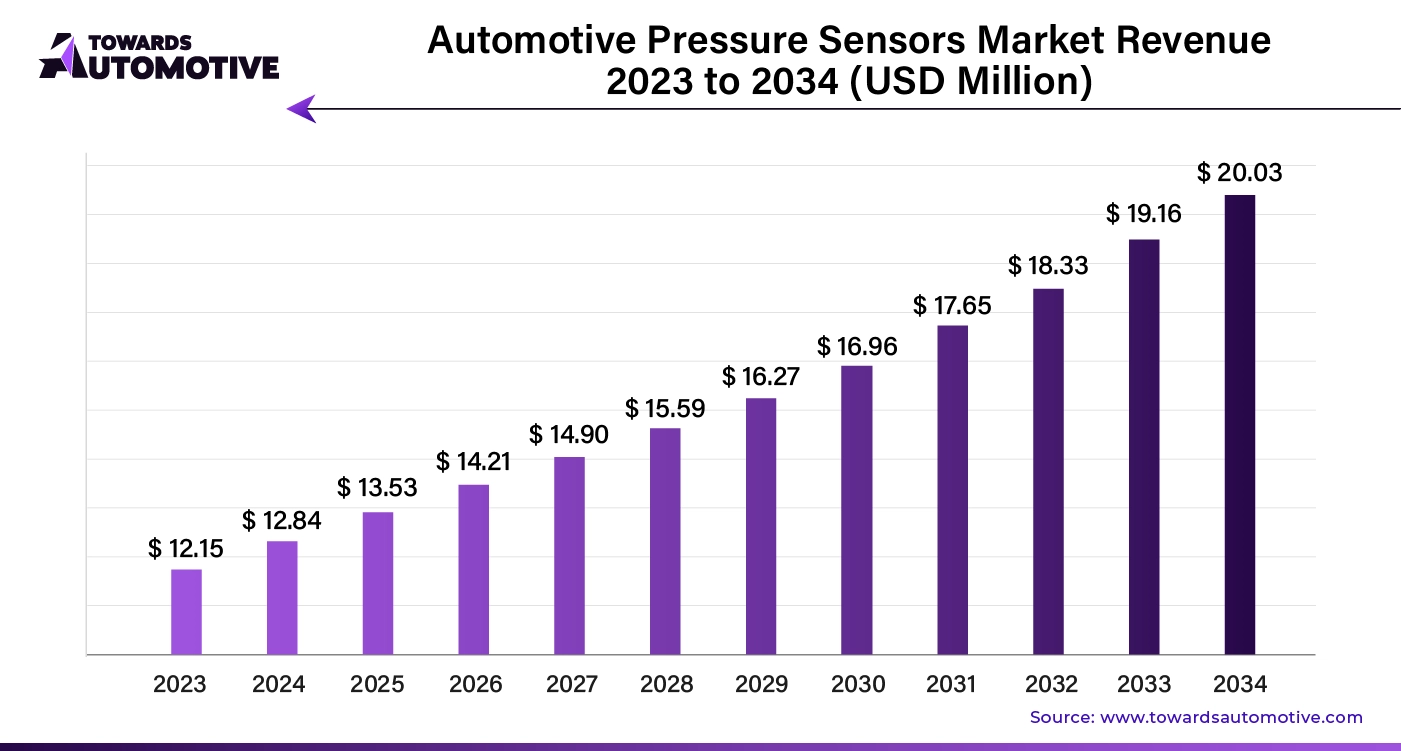

The global automotive pressure sensor market size is calculated at USD 12.84 billion in 2024 and is expected to be worth USD 20.03 billion by 2034, expanding at a CAGR of 4.67% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive pressure sensors market is experiencing robust growth, driven by the increasing demand for advanced safety and emission control systems. Pressure sensors play a crucial role in monitoring and regulating various automotive systems, including tire pressure monitoring systems (TPMS), engine control, fuel systems, and braking systems. With the rise of stringent emission regulations across the globe, automotive manufacturers are incorporating pressure sensors to ensure efficient fuel combustion and reduced emissions, thereby complying with environmental standards.

Additionally, the growing adoption of electric vehicles (EVs) has further fueled the demand for pressure sensors, as these sensors are vital for battery management, cooling systems, and energy efficiency. The integration of advanced driver assistance systems (ADAS) and the push toward autonomous driving are also boosting the need for pressure sensors, which are essential for ensuring real-time monitoring of vehicle components and optimizing safety features.

Moreover, consumer demand for enhanced vehicle performance, fuel efficiency, and safety is encouraging automakers to deploy advanced pressure sensor technologies across a wider range of vehicle segments. Technological advancements, such as miniaturization and the development of more accurate and reliable sensors, are further expanding their applications, making the automotive pressure sensors market a key growth area within the automotive industry.

Artificial intelligence (AI) is playing an increasingly vital role in the automotive pressure sensors market by enhancing the accuracy, efficiency, and functionality of sensor systems. AI-driven algorithms and machine learning techniques are being integrated into pressure sensors to enable more precise data analysis and real-time decision-making. This is particularly important in advanced applications like engine management, tire pressure monitoring systems (TPMS), and brake control, where accurate pressure readings are essential for optimizing vehicle performance, fuel efficiency, and safety.

AI enhances the capability of pressure sensors by enabling predictive maintenance and fault detection. Through continuous monitoring of sensor data, AI systems can identify patterns that may indicate potential issues or failures in the vehicle’s components, allowing for proactive maintenance before significant problems occur. This helps reduce downtime, extend vehicle lifespan, and improve overall reliability.

Moreover, in the context of autonomous driving and advanced driver assistance systems (ADAS), AI-powered pressure sensors are crucial for managing the complex data from various vehicle systems. AI enables these sensors to process and respond to changes in pressure in real-time, contributing to improved vehicle control, stability, and safety. The combination of AI and pressure sensors is also driving innovations in electric vehicles (EVs), optimizing energy usage, battery management, and thermal regulation.

Tire Pressure Monitoring Systems (TPMS) significantly drive the growth of the Automotive Pressure Sensors Market by enhancing vehicle safety, performance, and regulatory compliance. TPMS are essential systems that monitor the air pressure within vehicle tires and alert drivers when pressure levels drop below the recommended range. This feature has become increasingly important, as underinflated tires can lead to reduced fuel efficiency, increased tire wear, and a higher risk of accidents due to poor handling or blowouts.

The adoption of TPMS is largely driven by government regulations that mandate their inclusion in new vehicles. In regions such as North America, Europe, and parts of Asia, regulatory bodies have implemented laws requiring the installation of TPMS in all passenger vehicles to improve road safety and reduce accidents. For example, the U.S. has mandated TPMS in all light vehicles since 2007 under the TREAD Act. These regulations have accelerated the demand for pressure sensors, which are the core components of TPMS.

Moreover, rising consumer awareness of vehicle safety and fuel efficiency has fueled the adoption of TPMS, further driving market growth. As more automakers integrate TPMS into their models to meet safety standards and consumer expectations, the demand for pressure sensors continues to rise.

The Automotive Pressure Sensors Market faces several restraints that could hinder its growth. High production and integration costs of advanced sensor technologies can increase vehicle prices, potentially limiting adoption in cost-sensitive markets. Additionally, technical challenges, such as ensuring sensor accuracy and durability under extreme automotive conditions, can complicate development and usage. Moreover, fluctuations in raw material prices, particularly for semiconductors, can affect the production costs of pressure sensors. Lastly, the slow adoption of these sensors in developing regions due to limited awareness and infrastructure can further restrain market expansion.

The adoption of Advanced Driver Assistance Systems (ADAS) creates significant opportunities in the Automotive Pressure Sensors Market by enhancing vehicle safety, performance, and efficiency. ADAS technologies, such as electronic stability control, adaptive cruise control, and tire pressure monitoring systems (TPMS), rely heavily on accurate data from pressure sensors to function effectively. As automakers increasingly incorporate these systems into new vehicle models to meet consumer demand for enhanced safety features, the need for advanced pressure sensors becomes more pronounced.

Additionally, regulatory mandates in many regions require the integration of ADAS features in new vehicles, further driving the demand for pressure sensors. These sensors are essential for monitoring tire pressure, ensuring optimal performance, and preventing accidents caused by under-inflated tires. Furthermore, as vehicle manufacturers focus on creating smarter, more connected vehicles, pressure sensors that can communicate with other automotive systems will be in high demand. This integration facilitates improved vehicle control and predictive maintenance, enhancing the overall driving experience. The growing trend towards electrification and the rise of connected vehicles also contribute to the need for innovative pressure sensor solutions. In summary, the expanding adoption of ADAS is a crucial factor that opens up numerous opportunities for growth in the Automotive Pressure Sensors Market.

The position sensor segment held the largest share of the market. Position sensors play a vital role in driving the growth of the Automotive Pressure Sensors Market by enhancing the accuracy and functionality of various vehicle systems. These sensors are essential for detecting and monitoring the position of key automotive components such as the throttle, brake pedals, steering systems, and transmission controls. In conjunction with pressure sensors, they help ensure optimal vehicle performance, fuel efficiency, and safety, which are critical factors for automotive manufacturers and consumers alike.

In engine management systems, for instance, position sensors monitor the throttle valve's position, while pressure sensors measure the air-fuel ratio, ensuring proper combustion and efficient engine operation. This collaboration of position and pressure sensors is essential in optimizing fuel consumption, reducing emissions, and complying with increasingly stringent global emission standards. As governments enforce stricter environmental regulations, the demand for integrated sensor systems, including position and pressure sensors, continues to rise.

Position sensors are also crucial in the development and implementation of Advanced Driver Assistance Systems (ADAS). ADAS features, such as adaptive cruise control, automatic braking, and lane-keeping assist, require precise positional feedback to operate effectively. Pressure sensors, working alongside position sensors, help monitor tire pressure, braking force, and steering conditions, contributing to enhanced vehicle safety and control. As ADAS adoption becomes more widespread, driven by consumer demand and regulatory mandates, the need for advanced sensor systems grows, positively impacting the pressure sensors market.

Furthermore, the shift toward electric and hybrid vehicles has increased the demand for both position and pressure sensors. In electric vehicles (EVs), position sensors monitor the location of components like motors and actuators, while pressure sensors track battery pressure, cooling systems, and air conditioning units. These sensors ensure that EVs operate efficiently and safely, which is critical as the electric vehicle market expands globally.

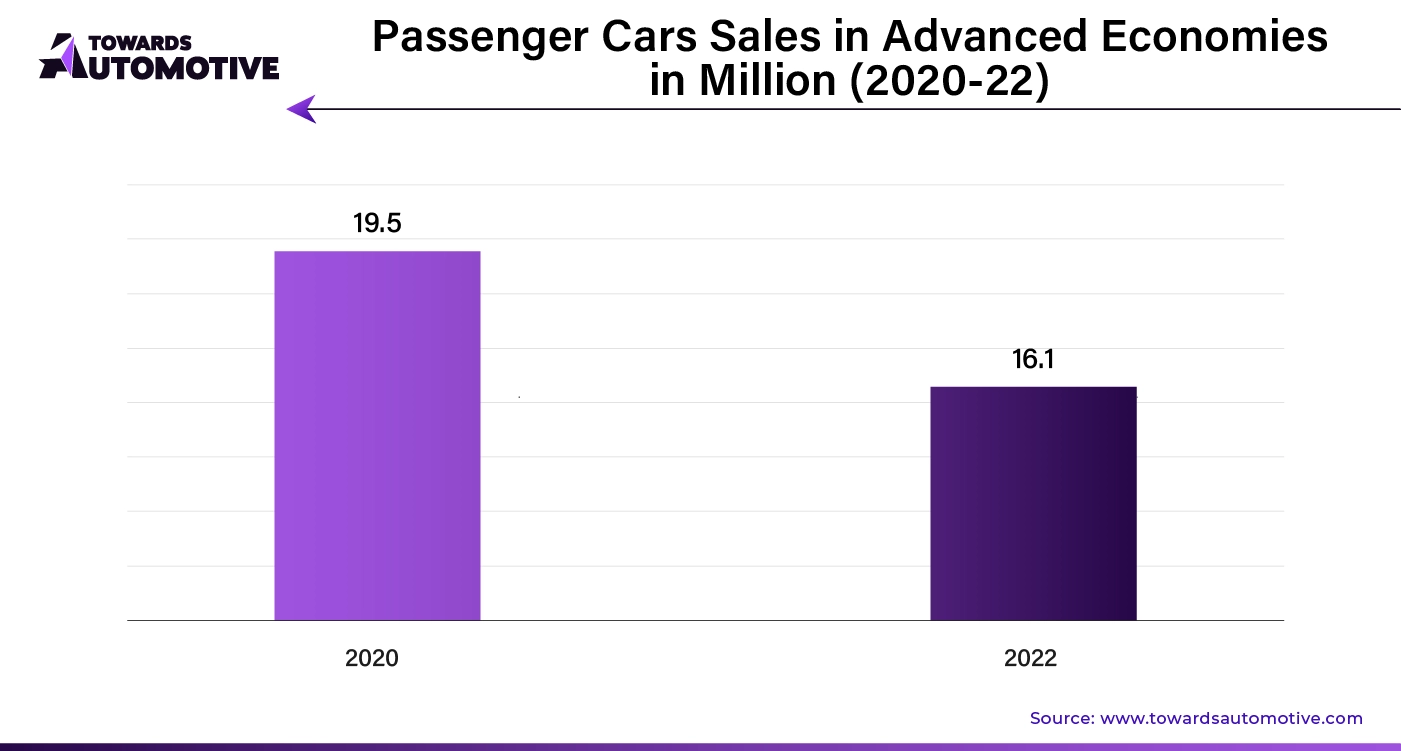

The passenger car segment led the industry. Passenger cars are a significant driver of the Automotive Pressure Sensors Market, as they account for the largest share of vehicle production and sales worldwide. The increasing demand for passenger cars, particularly in developing regions, has led to higher integration of advanced technologies that rely heavily on pressure sensors. These sensors are essential in ensuring the safety, performance, and efficiency of modern vehicles, contributing to their widespread adoption in passenger cars.

One of the primary uses of pressure sensors in passenger cars is in engine management systems. Pressure sensors monitor air intake, fuel pressure, and exhaust emissions, allowing the vehicle to optimize engine performance, reduce fuel consumption, and comply with strict emission regulations. As governments worldwide, including in North America and Europe, continue to enforce stringent environmental standards, the use of pressure sensors in passenger cars has become essential for automakers to meet these requirements.

Passenger cars are also adopting Advanced Driver Assistance Systems (ADAS) at a rapid pace, driven by consumer demand for safer vehicles and regulatory mandates for enhanced safety features. ADAS functions like tire pressure monitoring systems (TPMS), electronic stability control, and adaptive cruise control rely on pressure sensors to provide real-time data on tire and system pressures. This information ensures that the vehicle maintains optimal safety conditions, reducing the risk of accidents and improving overall driving experience.

The growing popularity of electric and hybrid passenger cars is another factor contributing to the growth of the Automotive Pressure Sensors Market. In electric vehicles (EVs), pressure sensors are used in battery management systems to monitor temperature and pressure conditions, ensuring safe operation. As the adoption of EVs accelerates due to environmental concerns and government incentives, the demand for pressure sensors in these vehicles is expected to rise.

In summary, the increasing production of passenger cars, coupled with the growing integration of ADAS and the shift toward electric vehicles, is driving the demand for automotive pressure sensors. These sensors play a critical role in enhancing vehicle performance, safety, and environmental compliance, making passenger cars a key contributor to the growth of the Automotive Pressure Sensors Market.

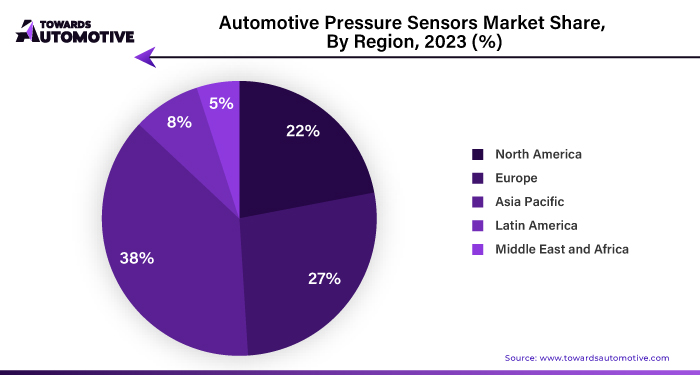

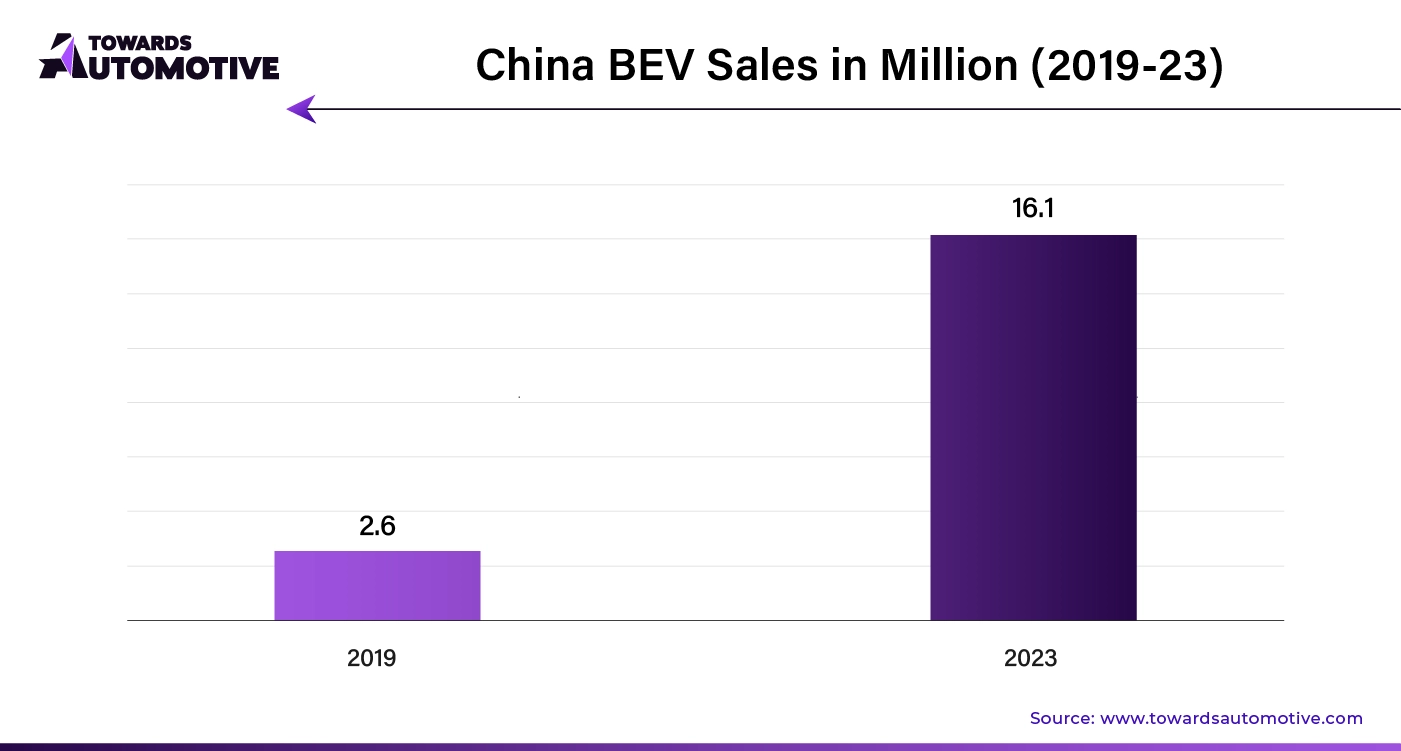

Asia Pacific dominated the automotive pressure sensors market. The increasing demand for electric vehicles (EVs), growth in the automotive aftermarket, and rising consumer demand for safety and efficiency are key factors driving the growth of the automotive pressure sensors market in the Asia Pacific (APAC) region. With governments in countries like China, India, and Japan promoting EV adoption through incentives and subsidies, the region has seen a surge in EV sales. EVs rely heavily on pressure sensors to monitor critical systems such as battery management, tire pressure, and braking, leading to a higher demand for these sensors.

Additionally, the expanding automotive aftermarket in APAC, driven by the growing number of vehicles on the road, is contributing to market growth. As older vehicles require regular maintenance and replacement parts, the demand for pressure sensors in the aftermarket is increasing, particularly for systems like tire pressure monitoring and engine control.

Rising consumer awareness of vehicle safety and fuel efficiency is another significant driver. Pressure sensors are essential in advanced safety features like anti-lock braking systems (ABS) and tire pressure monitoring systems (TPMS), as well as in optimizing fuel consumption through precise engine management. As consumers prioritize these features, automakers in APAC are increasingly integrating pressure sensors, fueling market growth in the region.

North America is expected to grow with a significant CAGR during the forecast period. The expansion of automotive manufacturing, rising demand for Advanced Driver Assistance Systems (ADAS), and stringent emission regulations are key drivers of growth in the Automotive Pressure Sensors Market in North America. With a strong automotive manufacturing base, the region has seen increased production of vehicles equipped with advanced pressure sensor technologies. This expansion supports the growing need for pressure sensors that enhance vehicle safety, performance, and efficiency.

The rising demand for ADAS, particularly in features like tire pressure monitoring systems (TPMS) and other safety-critical functions, further accelerates this market. Consumers are increasingly seeking vehicles with enhanced safety features, while regulatory bodies mandate the inclusion of these systems, boosting pressure sensor adoption.

Moreover, stringent emission regulations enforced by agencies like the Environmental Protection Agency (EPA) have compelled manufacturers to improve engine efficiency and reduce emissions. Pressure sensors play a critical role in monitoring and controlling emissions, ensuring vehicles meet these regulatory standards. As automakers push for compliance with these environmental regulations, the demand for pressure sensors continues to rise.

By Type

By Application

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us