April 2025

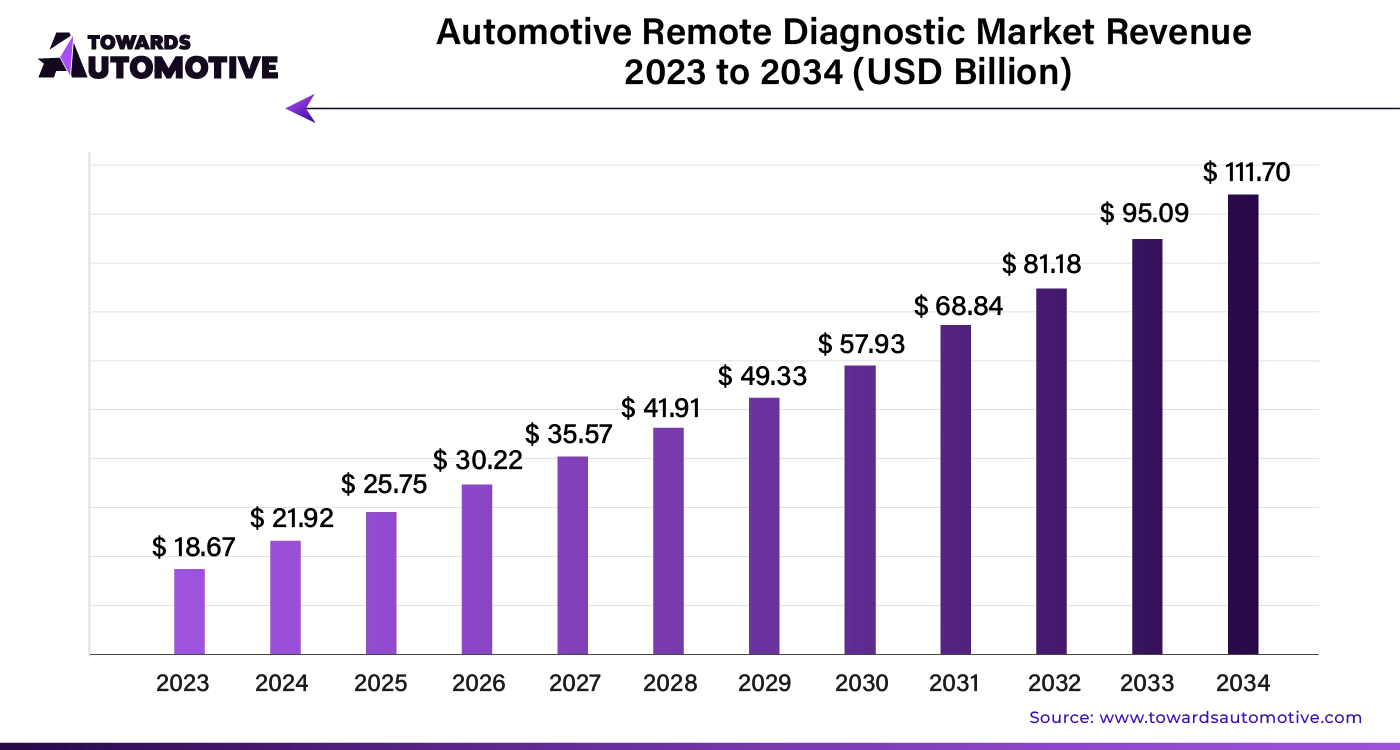

The global automotive remote diagnostic market is forecasted to expand from USD 25.75 billion in 2025 to USD 111.70 billion by 2034, growing at a CAGR of 17.47% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive remote diagnostics industry is booming as connected and autonomous vehicles become more common. These vehicles, equipped with advanced sensors and communication technologies, generate extensive data, creating a prime environment for improved remote monitoring and diagnostics. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

There is a growing demand for remote diagnostic solutions tailored to fleet operators and commercial vehicle suppliers. Customized services such as fleet health monitoring, predictive maintenance, and specialized analytics address specific challenges faced by this sector. Companies that focus on these tailored solutions can capitalize on the increasing need for effective fleet management, establishing themselves as experts in the field.

The integration of artificial intelligence (AI) and machine learning (ML) is transforming automotive remote diagnostics. These technologies enhance the accuracy and complexity of problem detection and prediction. As AI and ML evolve, remote diagnostic systems become more sophisticated, adapting to the complex needs of modern vehicles and positioning companies at the cutting edge of innovation in automotive diagnostics.

Trends:

Opportunities:

Challenges:

Equipment Dominates Market Share

In 2024, equipment is the top product type in the automotive remote diagnostic market, holding a 73% market share. The increasing demand for advanced diagnostic capabilities drives this trend. Modern diagnostic tools address a broad range of issues, including ADAS calibration, electric vehicle diagnostics, and engine and transmission problems. As OEMs embed sophisticated diagnostic features into vehicles, the need for versatile equipment that can handle these systems grows. Technicians and repair specialists seek tools capable of connecting to and diagnosing OEM-integrated systems.

Light Commercial Vehicles (LCVs) Lead Vehicle Type

Light commercial vehicles (LCVs) account for a significant 72% of the automotive remote diagnostic market in 2024. LCVs are critical for fleet operations in industries such as logistics and e-commerce. Remote diagnostics designed for LCVs enhance fleet management by providing real-time tracking, assessment, and optimization of commercial vehicle assets. These tools contribute to increased production and operational efficiency, reduced downtime, and improved business productivity.

Artificial Intelligence (AI) is revolutionizing the automotive remote diagnostics market by enhancing the accuracy and efficiency of vehicle maintenance. AI-driven diagnostics systems analyze vast amounts of vehicle data in real time, allowing for precise identification of issues before they escalate. This proactive approach significantly reduces repair costs and downtime, boosting overall market growth.

AI algorithms process data from various sensors and onboard systems, offering predictive maintenance alerts that help prevent breakdowns and extend vehicle life. By automating diagnostic processes, AI also reduces the need for manual inspections, cutting down labor costs and human error.

Furthermore, AI integration enhances customer experience through personalized recommendations and streamlined service appointments. This technology supports remote diagnostics, enabling real-time problem-solving without the need for physical inspection. As AI continues to evolve, it will drive innovation in vehicle diagnostics, leading to more advanced solutions and increased market expansion.

In the automotive remote diagnostic market, an efficient supply chain is crucial for delivering cutting-edge diagnostic solutions. The supply chain begins with raw materials, which are sourced from reliable suppliers. These materials are then transported to manufacturing facilities where advanced diagnostic tools and software are developed. High-quality control measures ensure that these products meet industry standards before moving on to the next stage.

Once production is complete, finished products are distributed to automotive service centers and dealerships through a well-coordinated logistics network. Timely delivery is essential to meet market demand and avoid service delays. Throughout this process, data analytics play a key role in optimizing inventory levels and predicting supply needs.

Additionally, strong relationships with suppliers and partners are maintained to mitigate risks and address potential disruptions. Continuous feedback from end-users helps refine and improve diagnostic tools, ensuring they remain effective and relevant.

Overall, a streamlined and responsive supply chain supports the rapid deployment of remote diagnostic technologies, enhancing vehicle maintenance and repair efficiency.

The Automotive Remote Diagnostic market ecosystem thrives on several key components and contributions from various companies. At its core, the market is driven by diagnostic tools, data analytics, telematics systems, and software platforms. Companies like Bosch and Delphi Technologies lead in developing advanced diagnostic tools that offer real-time vehicle health monitoring. These tools enable precise fault detection and efficient vehicle maintenance.

Telematics companies such as Verizon Connect and TomTom provide critical infrastructure for data transmission and communication, ensuring seamless connectivity between vehicles and diagnostic systems. Software developers like AUTEL and Launch offer robust diagnostic software that integrates with vehicle electronics to perform comprehensive diagnostics and generate detailed reports.

Data analytics firms, including Siemens and IBM, contribute by analyzing the vast amounts of diagnostic data generated. Their insights help in predicting vehicle issues and optimizing maintenance schedules. Additionally, automakers like Ford and General Motors are integrating remote diagnostic capabilities into their vehicles, enhancing overall vehicle performance and customer satisfaction.

Overall, these companies collaborate to advance automotive diagnostics, making vehicles more reliable and maintenance processes more efficient. Their contributions shape a dynamic and interconnected market landscape.

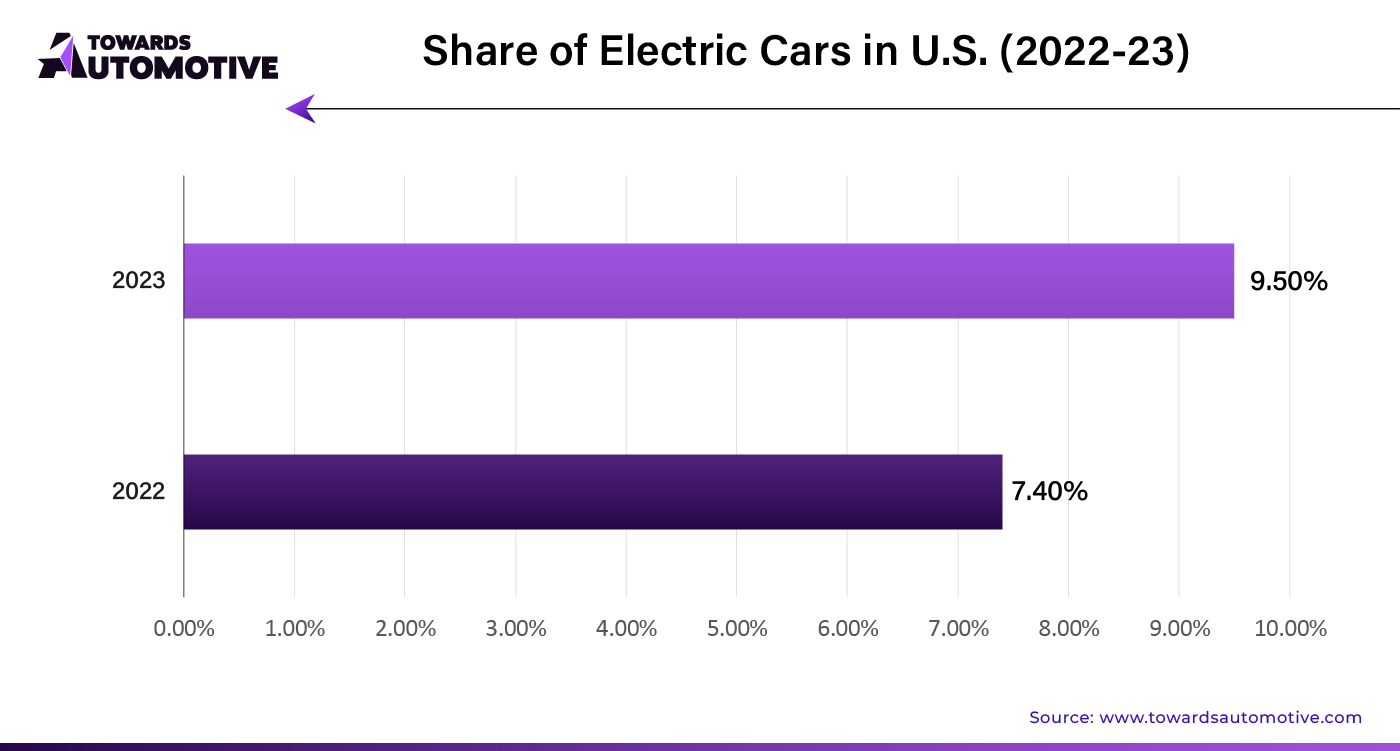

In the U.S., the automotive remote diagnostics market is anticipated to expand at a 16.80% CAGR. The growing shift towards hybrid and electric vehicles is a major catalyst for this growth. Remote diagnostics solutions tailored for electric powertrains are increasingly necessary, reflecting the broader trend toward sustainable transportation. Stricter emission regulations and a focus on environmental sustainability further drive the demand for these technologies.

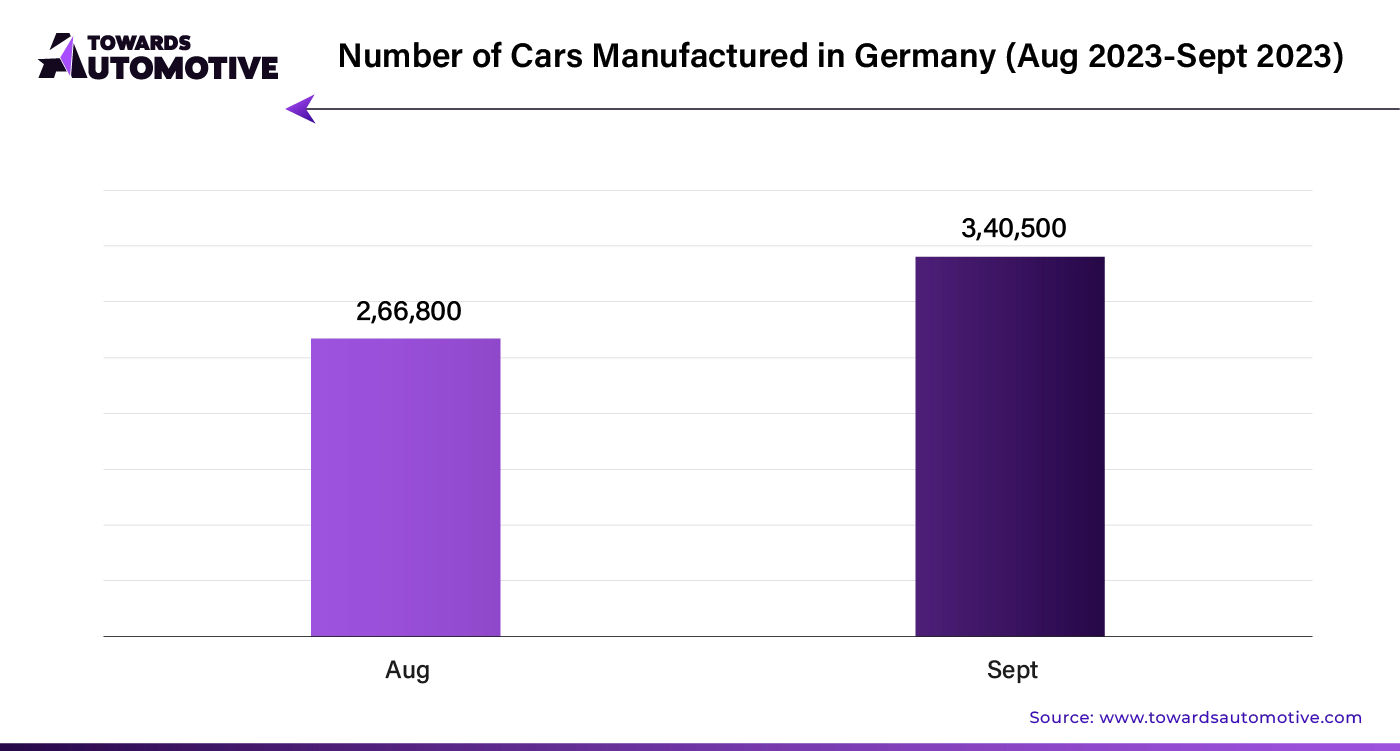

Germany's automotive remote diagnostics market is projected to grow at a 17.20% CAGR. This growth is driven by strong collaborations with premium OEMs and a focus on high-performance vehicles. The demand for advanced diagnostics solutions that meet the needs of luxury cars and high-speed driving on the Autobahn provides a competitive advantage to companies in this sector.

India's automotive remote diagnostics market is expected to grow at a 22.50% CAGR. The rapid expansion of the automotive sector, spurred by increasing disposable incomes and urbanization, supports this growth. The rise in shared mobility services offers opportunities for businesses providing scalable, affordable diagnostics solutions tailored to fleet management.

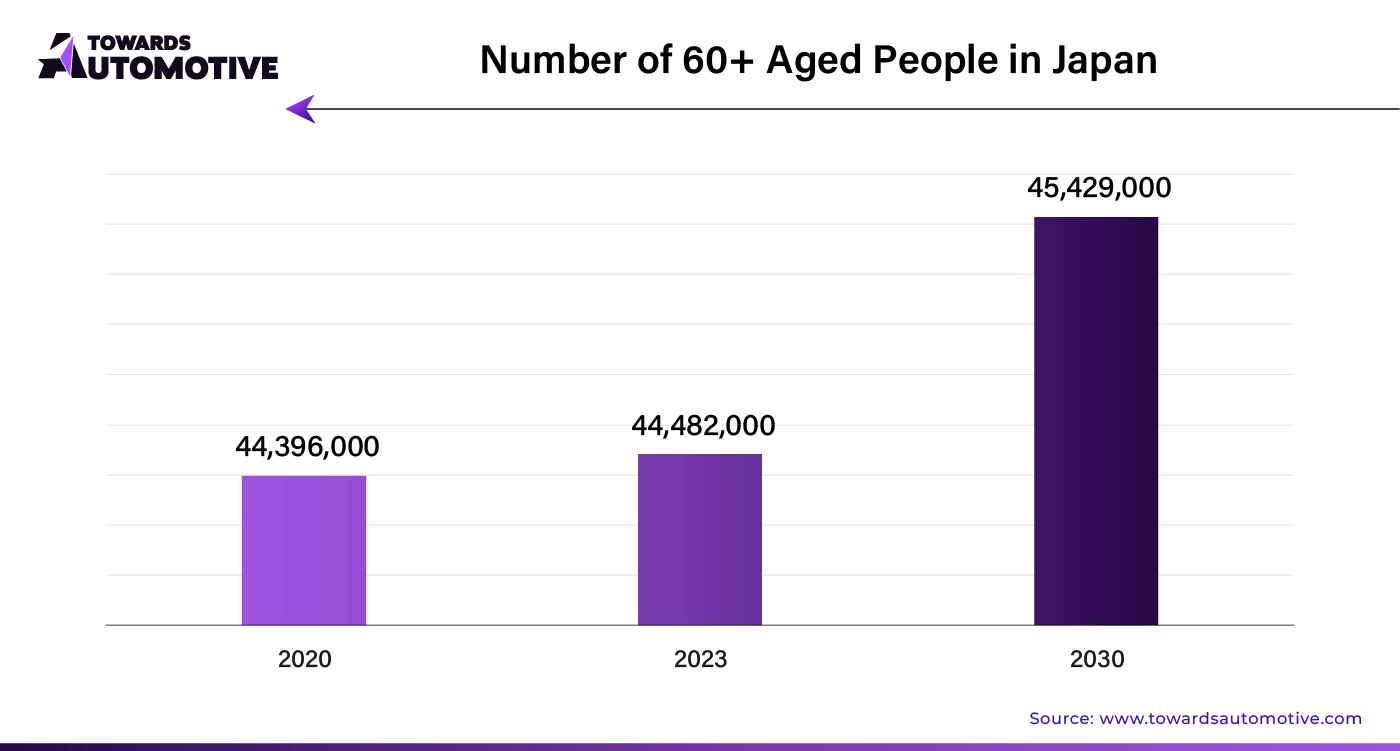

In Japan, the automotive remote diagnostics market is projected to grow at a 16.20% CAGR. Government support for advanced transportation technologies and an aging population drive this demand. Remote diagnostics solutions that enhance safety features and support preventative maintenance align with governmental objectives and address the needs of older drivers.

South Korea's automotive remote diagnostics market is forecasted to thrive at a 23.50% CAGR. The country's focus on electric vehicle production and the integration of AI and machine learning in diagnostic solutions fuel this growth. Companies that incorporate these technologies gain a competitive edge, aligning with South Korea's leadership in EV manufacturing.

The automotive remote diagnostic market is highly competitive, with major players like Delphi Technologies, Continental AG, and Bosch Automotive Service Solutions Inc. battling for market leadership and technological edge. These companies leverage their extensive industry expertise, R&D capabilities, and global presence to deliver advanced remote diagnostic solutions tailored to the evolving needs of the automotive sector.

Recent developments include:

By Product Type

By Vehicle Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us