April 2025

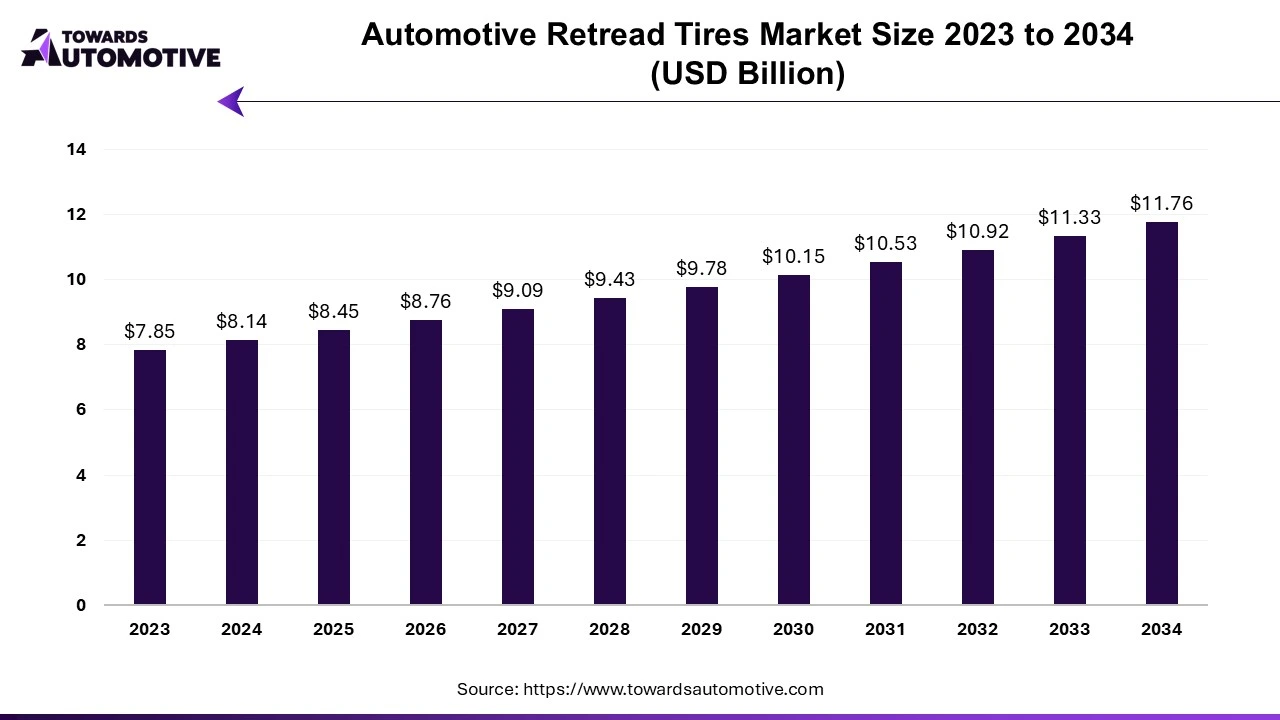

The automotive retread tires market is anticipated to grow from USD 8.45 billion in 2025 to USD 11.76 billion by 2034, with a compound annual growth rate (CAGR) of 3.74% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

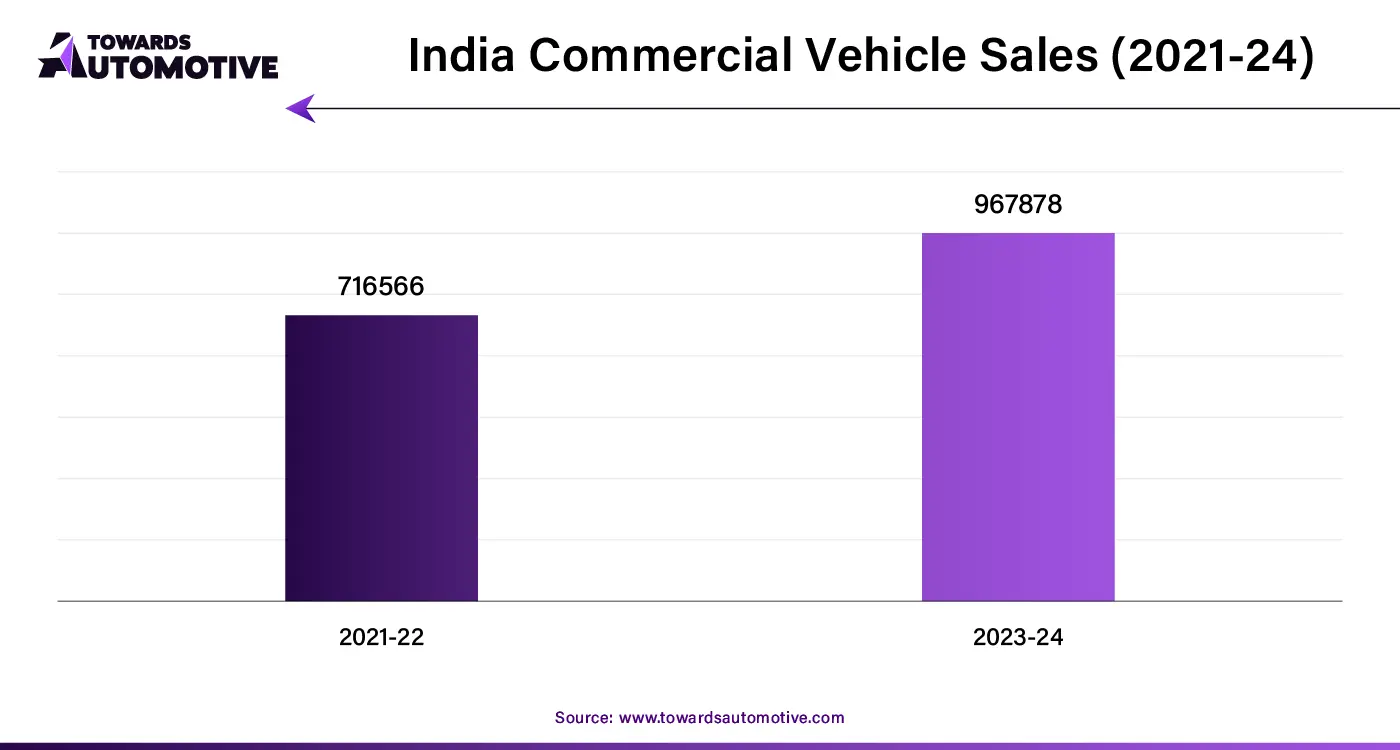

The automotive retread tires market is a crucial branch of the automotive industry. This industry deals in manufacturing and distribution of remolded tires across the world. There are several processes used in this sector consisting of pre-cure and mold-cure. The molded tires are available in a well-defined sales channel comprising of OEM and aftermarket. It is designed for different vehicles consisting of passenger cars, heavy commercial vehicles, light commercial vehicles and some others. The rising demand for commercial vehicles across the globe has contributed to the industrial growth. This market is expected to rise significantly with the growth of the tires industry in different parts of the world.

In May 2024, Pierluigi Cumo, the vice-president of Michelin announced that,” The innovative Michelin X Works D pre-mold retread delivers outstanding traction, durability and wear resistance for on and off-road fleets, reflecting our dedication to sustainability now and into the future.”

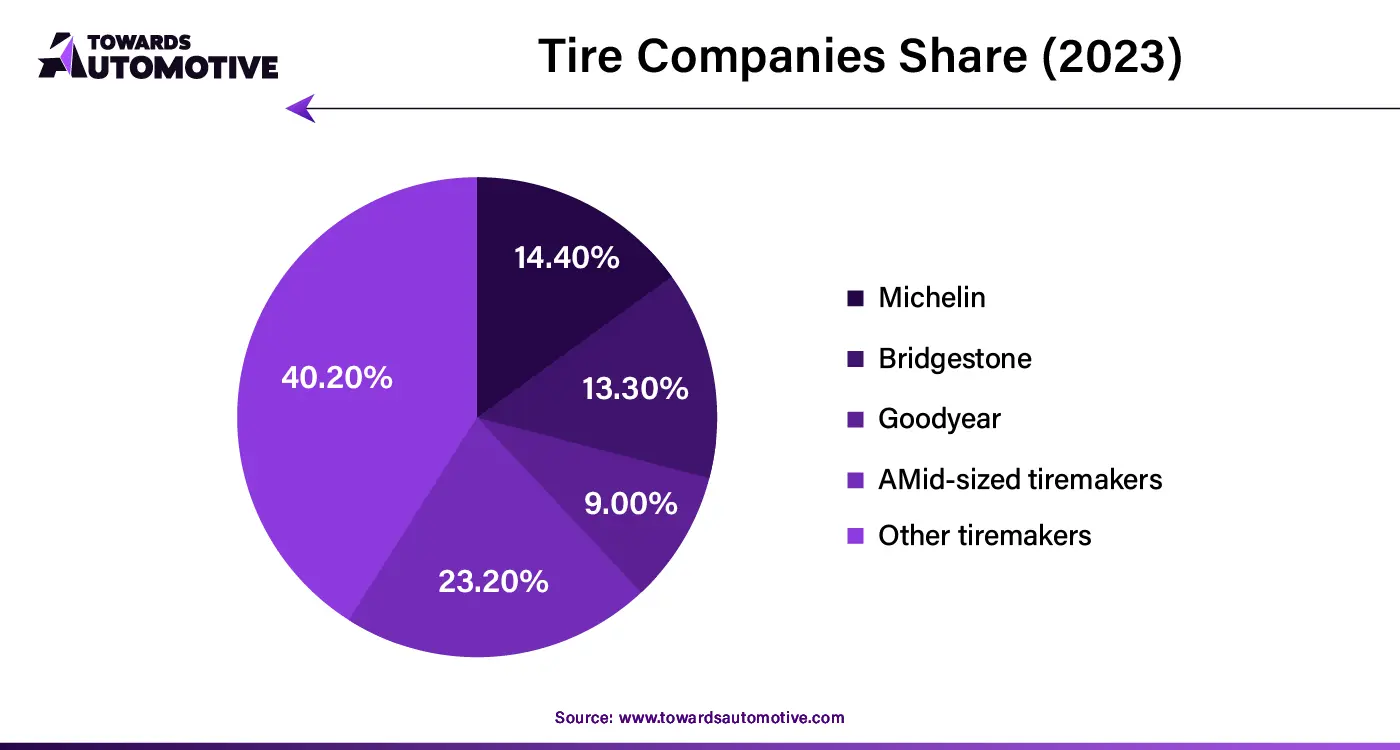

The automotive retread tires market is a highly fragmented industry with the presence of various dominant players. Some of the prominent companies ruling this industry comprises of Michelin, The Goodyear Tire & Rubber Company, Bridgestone, Marangoni S.p.A, Nokian Tyre, and some others. These market players are constantly engaged in retreading automotive tires and adopting several strategies to sustain their dominant position in this industry.

By Process Type

By Sales Channel

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us