December 2025

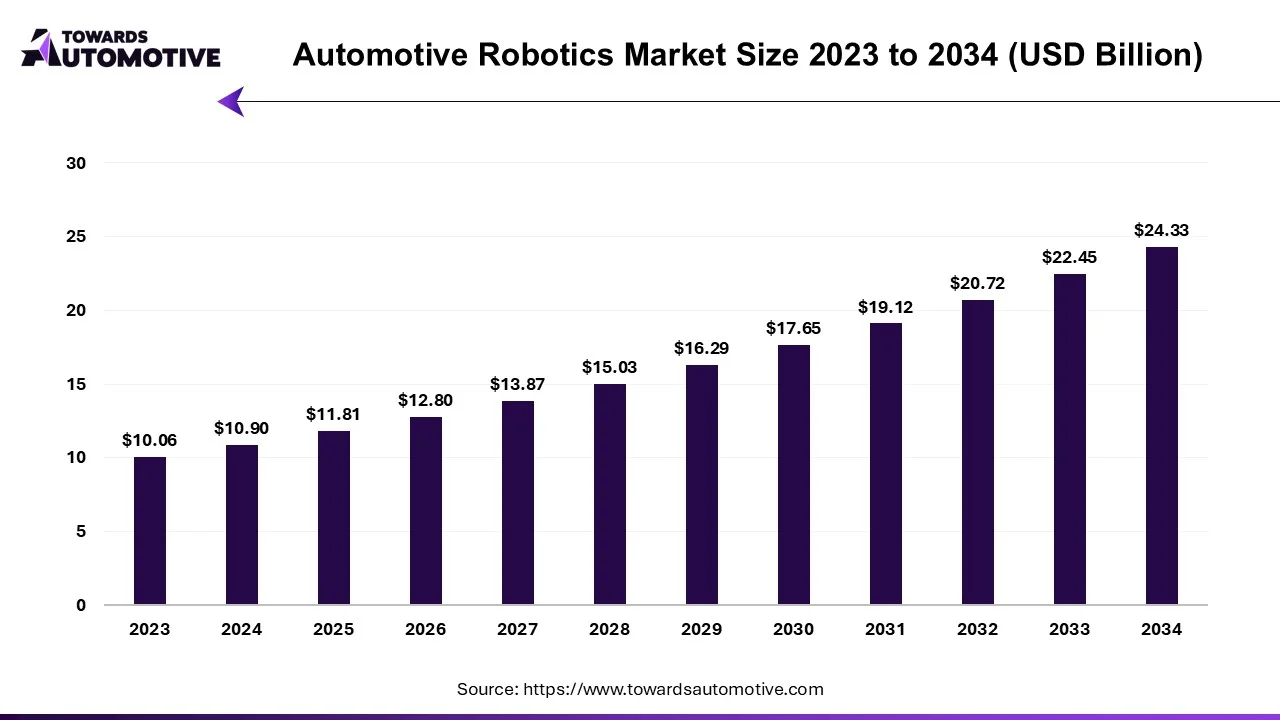

The automotive robotics market is expected to increase from USD 11.81 billion in 2025 to USD 24.33 billion by 2034, growing at a CAGR of 8.36% throughout the forecast period from 2025 to 2034.

The automotive robotics market is a prominent segment of the robotics industry. This industry deals in manufacturing and distribution of robots for operating in automotive sector. There are several types of robots developed in this sector comprising of articulated robots, SCARA robots, Delta robots, collaborative robots and others. These robots are used for various application in automotive industry consisting of welding, painting, assembly, material handling and some others. The end-users of this sector include passenger car manufacturers, commercial vehicle companies and electric vehicle brands. The growing adoption of robots in automotive sector for performing several tasks has boosted the market growth. This market is expected to rise significantly with the growth of the automotive industry around the globe.

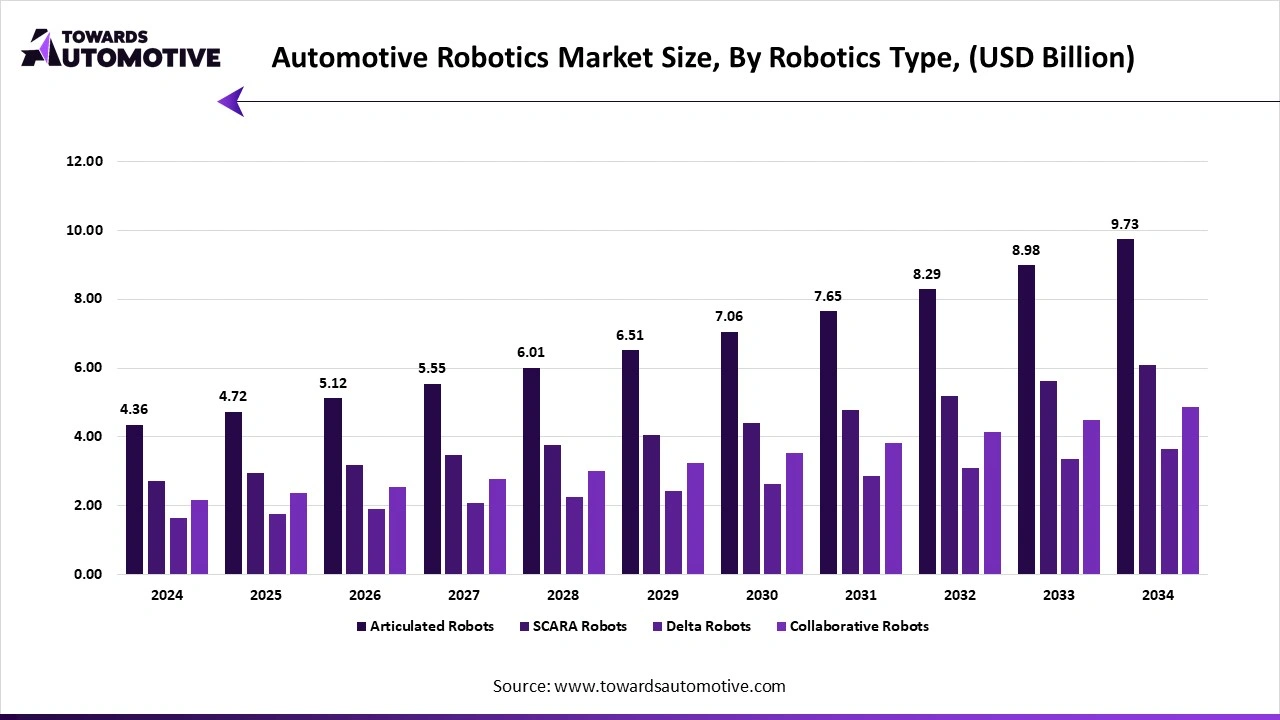

The articulated robots segment held a dominant share of the market. The growing adoption of articulated robots in automotive sector for automating tasks has boosted the market expansion. Additionally, the rising application of these robots in automotive industry for performing various operations such as material handling, welding, assembly, packing and some others is playing a vital role in shaping the industrial landscape. Moreover, several advantages of these robots including high degree of freedom, versatility, precision, increased flexibility, improved safety, consistency and some others is projected to boost the growth of the automotive robotics market.

The SCARA robots segment is likely to rise with a significant growth rate during the forecast period. The rising use of SCARA robots in automotive industry for manufacturing automotive components has boosted the market growth. Also, the growing application of these robots for operating high-speed tasks such as screwdriving and material handling is contributing to the industrial growth. Moreover, SCARA robots can perform several tasks in automotive sector including assembly line automation, subassembly work, battery assembly and some others is predicted to foster the growth of the automotive robotics market.

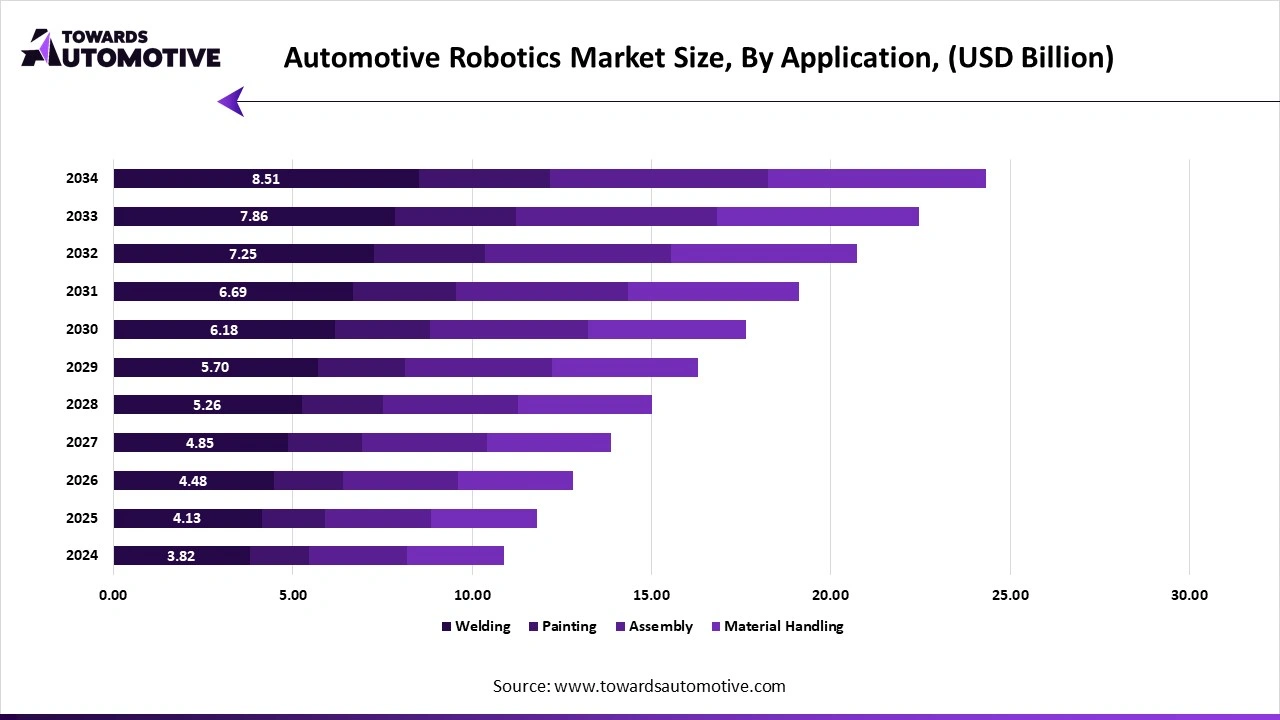

The welding segment held the largest share of the market. The growing adoption of SCARA robots and articulated robots in automotive sector for welding purposes has boosted the market growth. Also, numerous automotive companies have started deploying robots for welding as it helps in enhancing the productivity and ensures less dependency on workers, thereby helping the industry to prosper in a positive direction. Additionally, there are numerous advantages of robotic welding consisting of higher weld quality and consistency, cost savings, improved safety, flexibility and adaptability, and some others is anticipated to drive the growth of the automotive robotics market.

The painting segment is anticipated to witness rapid growth during the forecast period. The rising use of cartesian robots and SCARA robots in automotive industry for painting related applications has boosted the market expansion. Also, numerous robotics brands are developing advanced robots for enhancing automotive painting, thereby fostering the industrial growth. Moreover, there are various advantages of robotic painting including enhanced quality and consistency, increased speed and accuracy, reduced waste, improved worker safety, potential cost savings and some others is likely to boost the growth of the automotive robotics market.

The passenger cars segment dominated this industry. The growing sales and production of passenger vehicles around the world has boosted the market expansion. Additionally, the rising investment by automotive brands for deploying robots to enhance the manufacturing capacity of passenger vehicles is contributing significantly to the industrial growth. Moreover, the increasing adoption of SCARA robots by passenger car manufacturers for operating several tasks such as welding and painting is likely to propel the growth of the automotive robotics market.

The commercial vehicles segment is predicted to rise with a significant CAGR during the forecast period. The growing demand for heavy trucks from several sectors including mining, construction, electronics and some others has driven the market expansion. Also, rapid adoption of robotic solutions in commercial vehicle production facilities to enhance the manufacturing output is playing a vital role in shaping the industry in a positive direction. Moreover, several collaborations and joint ventures among commercial vehicle companies and robotics brands is expected to boost the growth of the automotive robotics market.

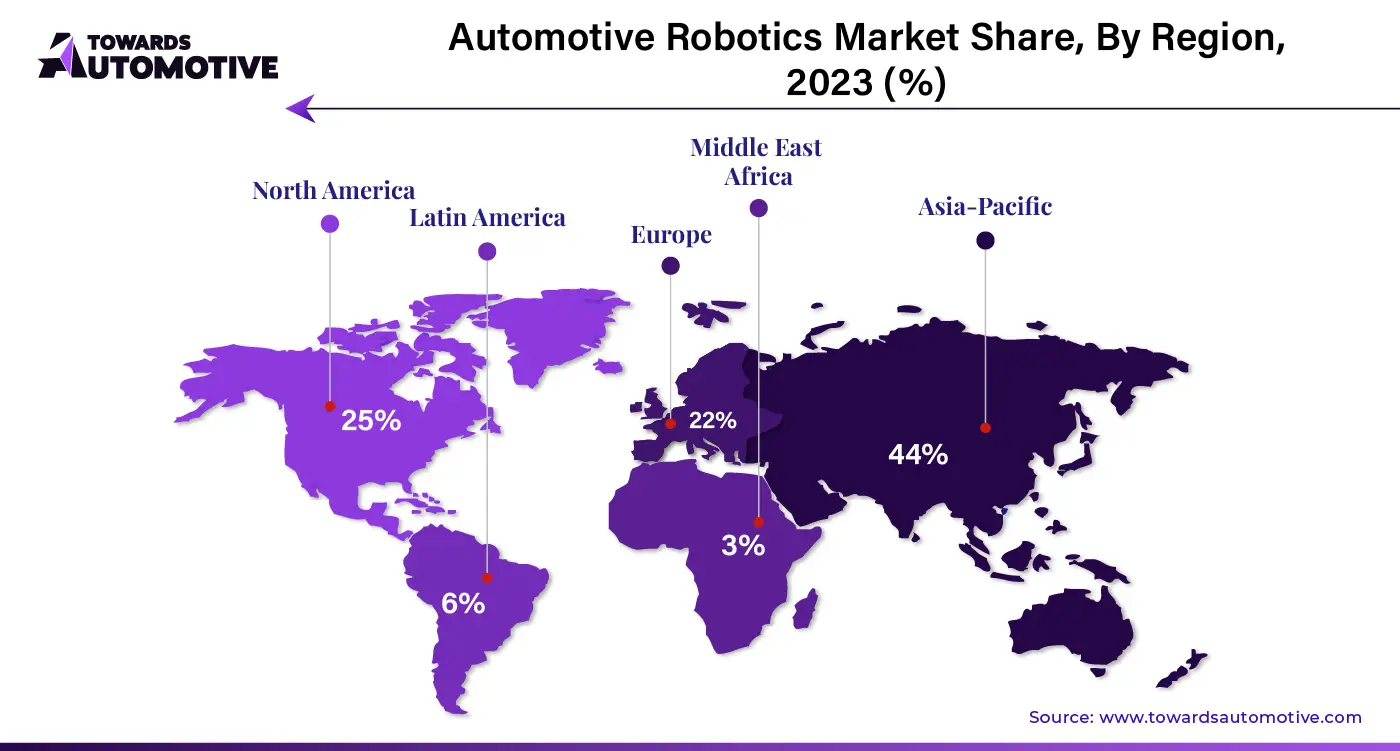

North America held the highest share of the automotive robotics market. The growing development in the automotive sector in countries such as the U.S. and Canada has boosted the market expansion. Additionally, the rising demand for electric vehicles along with rapid adoption of robots in automotive sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several robotic companies such as Boston Dynamics, Agility Robotics, Locus Robotics, Barrett Technology and some others is expected to propel the growth of the automotive robotics market in this region.

U.S. dominated the market in this region. The growing demand for luxury vehicles along with rapid investment by automotive brands for enhancing automation has boosted the market growth. Also, the presence of several automotive brands such as Tesla, Ford, Rivian, General Motors and some others is contributing to the overall industrial expansion.

Asia Pacific is expected to grow with the highest growth rate during the forecast period. The growing sales and production of commercial vehicles in countries such as China, India, Japan, Indonesia, South Korea and some others has boosted the market expansion. Also, the rise in number of automotive component manufacturers coupled with rapid adoption of SCARA robots in automotive sector is further adding to the industrial growth. Moreover, the presence of several robotics giants such as Kawasaki, Denso, NachiFujikoshi, Yaskawa Electric and some others is accelerating the growth of the automotive robotics market in this region.

China and Japan contributes significantly in this region. In China, the market is generally driven by the growing sales of passenger vehicles coupled with technological advancements in automotive sector. In Japan, the increasing adoption of robots in automotive sector along with presence of several robot manufacturers drives the market growth.

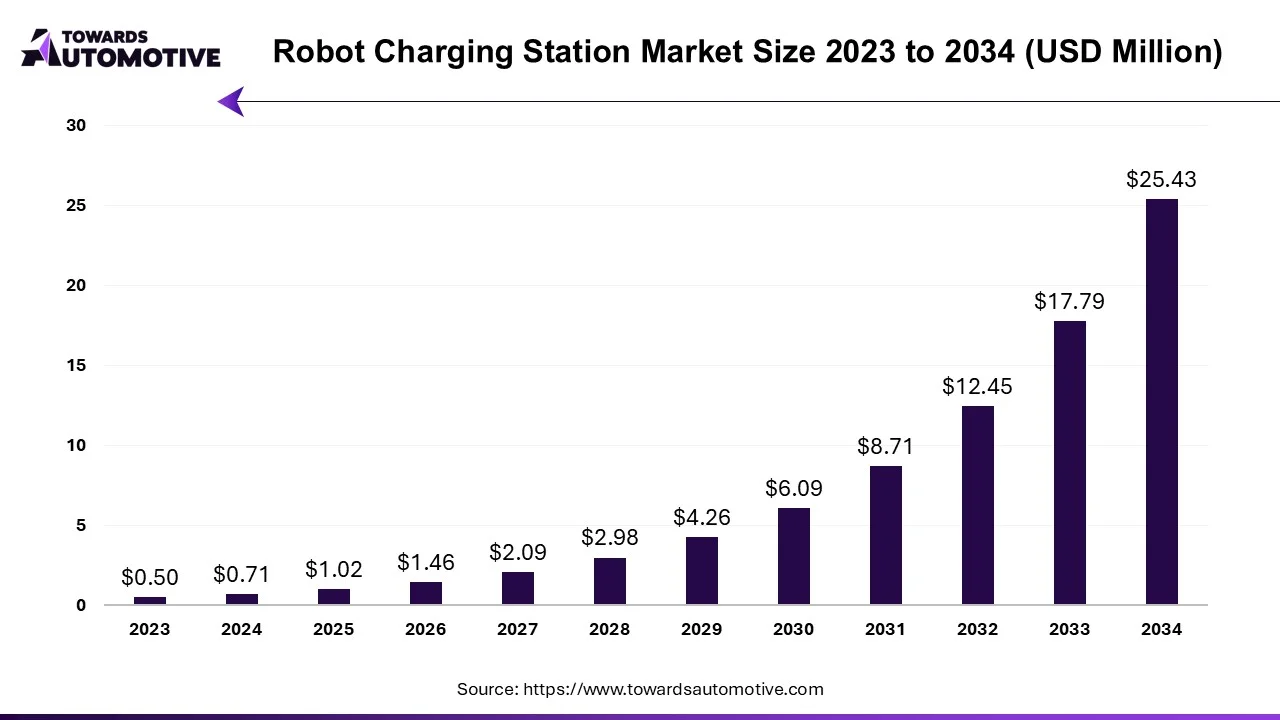

The robot charging station market is forecast to grow at a CAGR of 42.93%, from USD 1.02 million in 2025 to USD 25.43 million by 2034, over the forecast period from 2025 to 2034.

The robot charging station market is an integral sector of the electric vehicle industry. This industry deals in distribution of power supply devices used for charging electric vehicles. There are several types of charging stations covered under this industry consisting of fixed charging stations and mobile charging stations. These charging stations comprises of different level of charging such as Level 1, Level 2 and Level 3. It finds application in several end-user sector including parking facilities, airports, retail centers & malls and some others. The growing sales of electric vehicles in different parts of the world has boosted the industrial expansion. This market is projected to rise significantly with the growth of the robotics sector around the globe.

The robotaxi market is expected to increase from USD 2.92 billion in 2025 to USD 969.63 billion by 2034, growing at a CAGR of 90.63% throughout the forecast period from 2025 to 2034. The increasing popularity of autonomous vehicles coupled with technological advancements in the ADAS system has driven the market expansion.

Additionally, rapid investment by the automotive companies for developing driverless cars along with scarcity of drivers in developed nations is playing a vital role in shaping the industrial landscape. The advancements in IoT and sensor technology is expected to create ample growth opportunities for the market players in the future.

The robotaxi market is a crucial branch of the automotive industry. This industry deals in the development and distribution of robotaxis across the world. There are different types of vehicles developed in this sector comprising of passenger cars, vans & shuttles, purpose-built autonomous vehicles and some others. These cars are used for operating numerous types of services including ride-hailing services, car-sharing services, corporate & campus shuttle services, last-mile delivery services and some others. The end-users of this sector comprise of ride-hailing companies, automotive OEMs, technology providers, fleet operators and MaaS providers. This market is expected to rise significantly with the growth of the mobility sector in different parts of the globe.

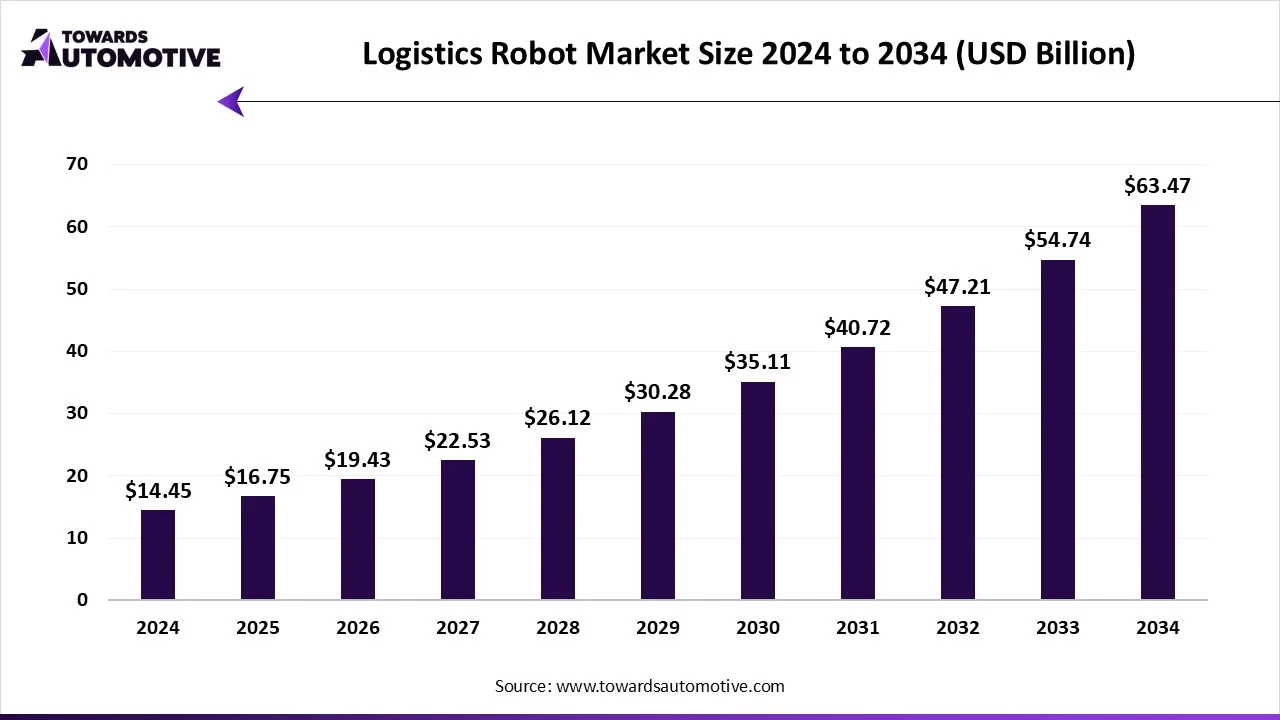

The logistics robot market is forecast to grow at a CAGR of 15.95%, from USD 16.75 billion in 2025 to USD 63.47 billion by 2034, over the forecast period from 2025 to 2034. The growing adoption of automated solutions in the logistics sector coupled with technological advancements in the robotic industry has driven the market expansion.

Additionally, the rising application of automated guided vehicles (AGVs) in the retail industry along with rapid investment by market players for opening up new production facilities is playing a vital role in shaping the industrial landscape. The integration of AI and ML in AMRs is expected to create ample growth opportunities for the market players in the future.

The logistics robot market is a prominent sector of the robotics & automation industry. This industry deals in manufacturing and distribution of robots designed for the logistics sector. There are several types of robots developed in this sector comprising of automated guided vehicles (AGVs), autonomous mobile robots (AMRs), robotic arms, drones, palletizing & depalletizing robots, hybrid & collaborative robots (cobots) and some others. These robots perform numerous functions consisting of picking & sorting, transportation & material handling, loading & unloading, packaging & palletizing, last-mile delivery, inventory management & cycle counting, and some others. The end-users of these robots consist of e-commerce & retail, manufacturing, food & beverage, healthcare & pharmaceuticals, 3PL & supply chain providers, postal & parcel delivery, aerospace & defense logistics and some others. This market is expected to rise significantly with the growth of the e-commerce sector in different parts of the world.

The automotive robotics market is a highly competitive industry with the presence of a numerous dominating players. Some of the prominent companies in this industry consists of Acieta, LLC., Comau S.p.A., Denso Corporation, Epson America, Inc., FANUC CORPORATION, Kawasaki Heavy Industries, Ltd., KUKA AG, Mitsubishi Electric Corporation, Shibaura Machine, Nachi-Fujikoshi Corp., Neura Robotics GmbH and some others. These companies are constantly engaged in developing robots for the automotive sector and adopting numerous strategies such as partnerships, acquisitions, joint ventures, collaborations, business expansions, launches, and some others to maintain their dominant position in this industry. For instance, in April 2025, Shibaura Machine launched a new series of robots. These robots are designed for operating several tasks in the automotive sector. Also, in November 2024, FANUC launched M-950iA. M-950iA is a heavy-weight industrial robot designed for lifting automotive components.

By Application

By Robotics Type

By Vehicle Type

By Technology

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us