April 2025

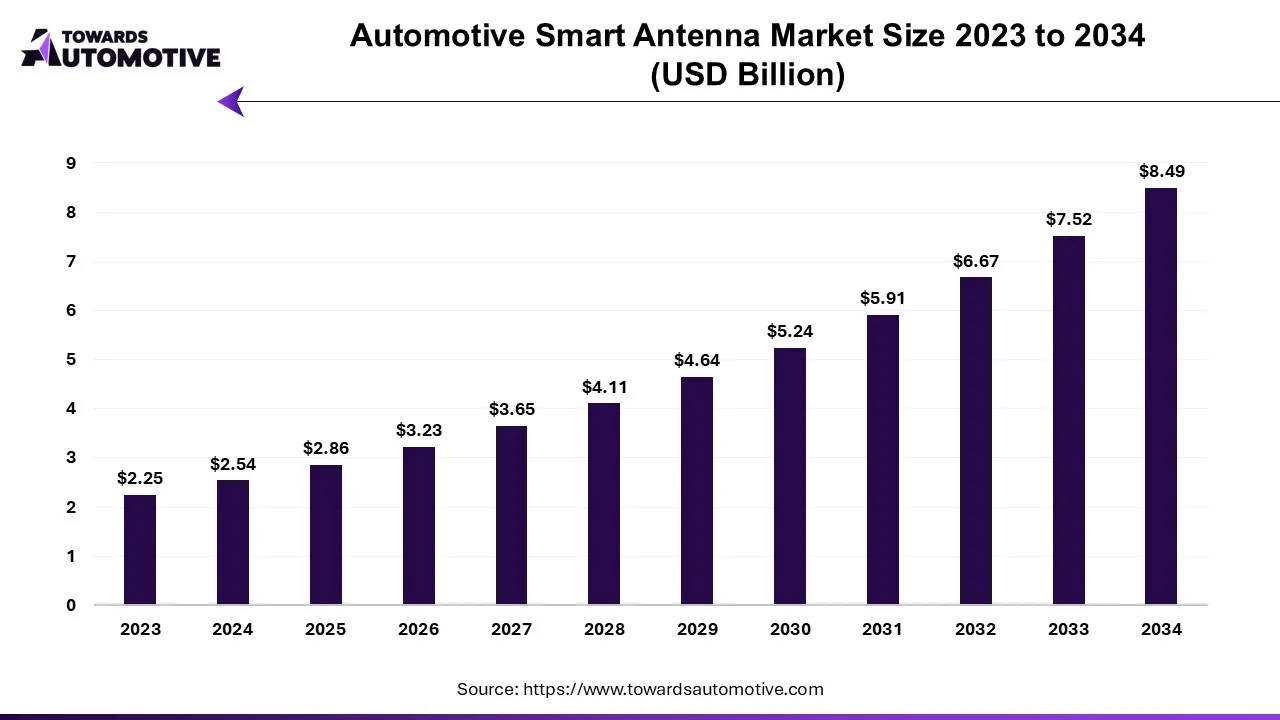

The global automotive smart antenna market size is calculated at USD 2.54 billion in 2024 and is expected to be worth USD 8.49 billion by 2034, expanding at a CAGR of 12.83% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive smart antenna market is experiencing significant growth, driven by the increasing integration of advanced technologies in vehicles. Smart antennas, which are capable of improving connectivity and signal reception, are becoming essential in modern vehicles due to the rising demand for connected car systems. These systems rely on a range of communication technologies such as Wi-Fi, Bluetooth, GPS, and cellular networks to enable features like infotainment, navigation, autonomous driving, and telematics. As automotive manufacturers strive to offer innovative and feature-rich vehicles, smart antennas are playing a crucial role in enhancing the performance of these systems.

The demand for smart antennas is also being propelled by the growing popularity of electric vehicles (EVs) and autonomous vehicles, which require reliable and seamless connectivity to operate efficiently. Moreover, the increasing adoption of advanced driver-assistance systems (ADAS) and the rise of the Internet of Things (IoT) in vehicles are further amplifying the need for robust, high-performance antennas. As vehicles become more connected, the need for antennas that can support multiple frequencies and deliver superior signal quality is becoming more important, driving market growth.

The automotive smart antenna market is also benefiting from advancements in antenna technology, such as the development of multifunctional and integrated antennas that can support a wide range of communication systems. The growing trend of vehicle electrification, as well as the expansion of 5G networks, further contributes to the demand for smart antennas. With a focus on enhancing connectivity, safety, and driving experience, the automotive smart antenna market is poised for continued growth in the coming years.

AI plays a pivotal role in the automotive smart antenna market by enhancing the performance and efficiency of antennas in modern vehicles. As vehicles become increasingly connected and autonomous, the demand for seamless communication systems has risen, and AI helps optimize the functionality of automotive antennas to meet these needs.

AI can improve antenna performance through adaptive beamforming, a technology that allows antennas to dynamically adjust to signal interference and optimize signal reception. This leads to better connectivity in challenging environments, such as urban areas with high interference or on highways with fluctuating signal strengths. By using AI-driven algorithms, smart antennas can intelligently select the best frequency, optimize power usage, and minimize the impact of signal disruptions, ensuring uninterrupted communication between vehicles and external networks.

Furthermore, AI aids in the design and deployment of multi-functional antennas, which can support a variety of communication systems (e.g., Wi-Fi, Bluetooth, GPS, 5G, and cellular networks) within a single device. AI helps in the management of these systems by intelligently switching between frequencies or communication methods based on real-time conditions, ensuring optimal performance for connected car systems.

In autonomous vehicles, AI is critical in facilitating reliable communication between vehicles and infrastructure for safety systems like vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. This allows for real-time data exchange, critical for navigation, traffic updates, and hazard detection, thereby enhancing safety and operational efficiency.

The growing emphasis on vehicle safety is a significant driver of the automotive smart antenna market. As governments worldwide enforce stringent safety regulations and consumers demand advanced safety features, automotive manufacturers are increasingly integrating smart antennas into vehicles to enhance communication systems critical for safety. Smart antennas facilitate seamless connectivity for advanced driver-assistance systems (ADAS), enabling features like collision avoidance, lane departure warnings, and emergency braking systems. These systems rely on real-time data exchange between vehicles, infrastructure, and cloud-based platforms, which is made possible by the robust communication capabilities of smart antennas.

Additionally, the development of vehicle-to-everything (V2X) communication technology has further propelled the adoption of automotive smart antennas. These antennas enable vehicles to communicate with each other, traffic signals, and roadside units, creating an interconnected network that significantly reduces the likelihood of accidents. For instance, V2X communication alerts drivers to potential hazards, such as sudden braking vehicles ahead or upcoming roadblocks, thereby improving situational awareness and enhancing safety.

The adoption of autonomous and semi-autonomous vehicles is another factor driving the demand for smart antennas. These vehicles rely heavily on precise communication systems for navigation, obstacle detection, and decision-making. Smart antennas play a crucial role in enabling these functions, ensuring the safe operation of self-driving vehicles.

Moreover, consumer preference for safer vehicles has prompted automakers to differentiate their offerings with advanced safety features, further driving the demand for smart antennas. With the automotive industry's continued focus on safety and connectivity, the automotive smart antenna market is poised for significant growth, creating opportunities for innovation and technological advancements.

The automotive smart antenna market faces restraints such as high development and installation costs, which can deter adoption, particularly in price-sensitive markets. The complexity of integrating advanced technologies like 5G and V2X communication within vehicles adds to the overall cost and technical challenges. Additionally, concerns over data security and privacy in connected vehicles may hinder consumer trust. Limited infrastructure in developing regions, such as inadequate 5G network coverage, also restricts the widespread implementation of smart antenna systems.

Location-aware smart antennas are transforming the automotive industry by creating significant opportunities in the automotive smart antenna market. These advanced antennas integrate GPS, GNSS, and real-time location-tracking technologies to provide precise and dynamic geolocation data, which is crucial for modern connected vehicles. By enabling location-specific services, such as real-time navigation, geofencing, and enhanced driver assistance systems, these antennas support advanced features like autonomous driving and vehicle-to-everything (V2X) communication. This integration is becoming increasingly essential as the demand for smart and connected vehicles grows globally.

Moreover, location-aware smart antennas enable seamless vehicle tracking and fleet management solutions, offering significant benefits for commercial vehicle operators. These systems enhance operational efficiency by optimizing routes, reducing fuel consumption, and improving delivery timelines. For passenger cars, they facilitate personalized location-based services, including predictive maintenance notifications and roadside assistance, thereby enhancing the overall driving experience.

The rise of shared mobility services, such as ride-hailing and car-sharing platforms, also contributes to the growing demand for location-aware smart antennas. These antennas enable accurate vehicle tracking, ensuring a seamless user experience and improved operational efficiency for mobility service providers. Additionally, the increasing deployment of 5G networks amplifies the potential of these antennas by offering faster and more reliable data transmission, supporting real-time location-based services.

As the automotive industry continues to prioritize safety, connectivity, and efficiency, the adoption of location-aware smart antennas is expected to grow. These innovations not only meet the demands of modern transportation but also create substantial opportunities for market players to develop cutting-edge solutions and gain a competitive edge.

The passenger cars segment held a dominant share of the market. The passenger cars segment plays a significant role in driving the growth of the automotive smart antenna market, primarily due to the increasing adoption of advanced connectivity features in modern vehicles. With the rise of connected and autonomous vehicles, passenger cars are integrating sophisticated communication technologies that rely heavily on smart antennas for seamless data exchange. These antennas support various functions, including navigation, infotainment, vehicle-to-everything (V2X) communication, and safety features, making them essential components in modern car designs.

The growing consumer demand for high-tech features such as in-car Wi-Fi, real-time traffic updates, and streaming services has accelerated the adoption of smart antennas in passenger cars. Automakers are equipping vehicles with antennas that can manage multiple communication channels, including 5G, GPS, Bluetooth, and satellite radio, to meet the expectations of tech-savvy consumers. This demand has been further fueled by the increasing trend of electric and hybrid vehicles, where connectivity is a critical component for optimizing performance and efficiency.

Additionally, stringent safety regulations and mandates for advanced driver-assistance systems (ADAS) in passenger vehicles have bolstered the need for reliable communication systems powered by smart antennas. These antennas enable critical functionalities such as collision avoidance, lane-keeping assistance, and emergency braking by facilitating real-time data exchange with infrastructure and other vehicles.

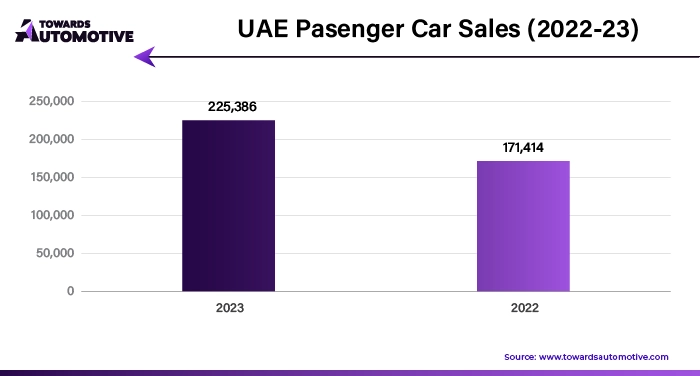

The rising production and sales of passenger cars globally, especially in emerging markets such as Asia Pacific, where urbanization and disposable income are increasing, further contribute to the growth of the smart antenna market. Automakers are leveraging this demand by integrating innovative antenna solutions, ensuring that the passenger car segment continues to drive advancements and growth in the automotive smart antenna market.

The OEM segment led the industry. The OEM (Original Equipment Manufacturer) segment significantly drives the growth of the automotive smart antenna market by fostering the integration of advanced communication systems directly into vehicles during production. As automotive manufacturers increasingly emphasize enhancing vehicle connectivity, OEMs are taking the lead in adopting and embedding smart antennas to deliver seamless communication capabilities. These antennas enable critical features such as vehicle-to-everything (V2X) communication, infotainment systems, GPS navigation, and advanced driver-assistance systems (ADAS), which are becoming standard in modern vehicles.

One of the primary factors boosting the OEM segment's impact is the growing consumer demand for connected cars. Automakers are prioritizing the integration of smart antennas into their vehicle designs to meet this demand and stay competitive in a rapidly evolving market. The ability of smart antennas to support multiple functionalities, such as cellular communication, Wi-Fi, satellite radio, and Bluetooth, makes them an attractive choice for OEMs aiming to provide a superior driving experience.

Moreover, the increasing penetration of electric vehicles (EVs) has further amplified the role of OEMs in the smart antenna market. As EVs rely heavily on connectivity for features such as real-time battery management, over-the-air (OTA) updates, and remote diagnostics, smart antennas have become indispensable components. This trend is particularly evident in technologically advanced regions like North America and Europe, where OEMs are investing in research and development to produce next-generation smart antenna solutions.

Additionally, the OEM segment benefits from the push toward stringent safety regulations globally. Smart antennas enable ADAS features, such as automatic emergency braking and collision warnings, which align with regulatory requirements and consumer expectations for safer vehicles. By embedding these advanced systems during manufacturing, OEMs ensure that their vehicles are equipped with cutting-edge technology, thereby driving the growth of the automotive smart antenna market.

North America dominated the automotive smart antenna market. The automotive smart antenna market in North America is experiencing significant growth due to the increasing adoption of connected vehicles, advancements in automotive technology, and rising consumer demand for enhanced in-car connectivity and infotainment systems.

A primary growth factor is the widespread adoption of connected vehicles across the region. Automakers in North America, such as General Motors, Ford, and Tesla, are increasingly integrating smart antennas into vehicles to support features like vehicle-to-everything (V2X) communication, GPS, Wi-Fi, and 5G connectivity. These technologies enable real-time navigation, remote diagnostics, and advanced safety features, which align with the growing consumer preference for tech-enabled vehicles.

The increasing popularity of electric vehicles (EVs) further drives market growth. North America is a key player in the EV market, with significant investments in EV production and infrastructure. Smart antennas are essential in EVs for enabling over-the-air (OTA) updates, remote control features, and seamless communication with charging stations and other connected systems.

Moreover, advancements in autonomous vehicle technology are creating additional demand for smart antennas. North America, being a hub for autonomous vehicle research and development, relies on smart antennas for enabling real-time data exchange between vehicles, infrastructure, and traffic management systems, ensuring efficient and safe navigation.

Government regulations and support for smart transportation systems and the deployment of 5G networks further boost the market. With increasing investments in smart city projects and connected infrastructure, the automotive smart antenna market in North America is poised for robust growth in the coming years.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The automotive smart antenna market in the Asia-Pacific (APAC) region is witnessing significant growth driven by advancements in automotive technology, increasing vehicle production, and rising demand for connected vehicles. The region’s robust automotive industry and rapid urbanization contribute to this market’s expansion.

One of the key growth factors is the increasing adoption of connected vehicles across countries like China, Japan, South Korea, and India. As consumers demand enhanced in-car connectivity and infotainment systems, automakers in the region are integrating smart antennas to support technologies like 5G, GPS, and vehicle-to-everything (V2X) communication. These systems are essential for enabling real-time navigation, remote diagnostics, and advanced driver assistance systems (ADAS).

The booming electric vehicle (EV) market in APAC also drives the adoption of smart antennas. Governments in the region are heavily promoting EV adoption through subsidies and investments in EV infrastructure, making smart antennas critical for seamless communication between vehicles, charging stations, and other connected ecosystems. Countries like China and South Korea lead in EV production, further boosting the market.

Additionally, the rise in autonomous vehicle development is a significant growth driver. Smart antennas play a vital role in enabling real-time data exchange for autonomous navigation and communication with traffic systems. APAC is becoming a hub for autonomous vehicle research and development, particularly in countries like Japan and Singapore.

Moreover, the rapid deployment of 5G networks and investments in smart city projects across APAC enhance the market’s growth. As these initiatives require robust connectivity solutions, the demand for automotive smart antennas continues to rise, solidifying the region’s position as a key growth driver in the global market.

By Vehicle Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us