April 2025

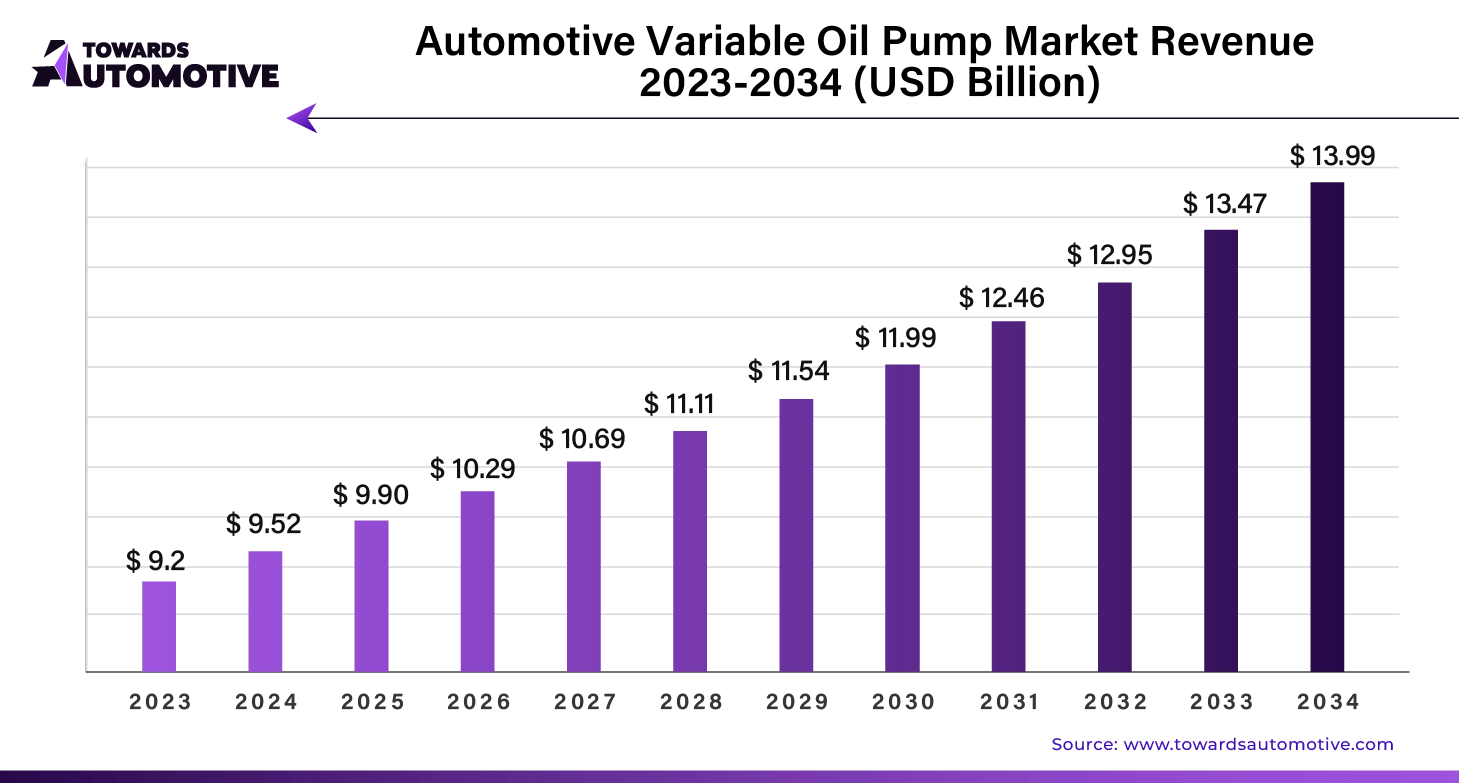

The automotive variable oil pump market is projected to reach USD 13.99 billion by 2034, expanding from USD 9.90 billion in 2025, at an annual growth rate of 3.6% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

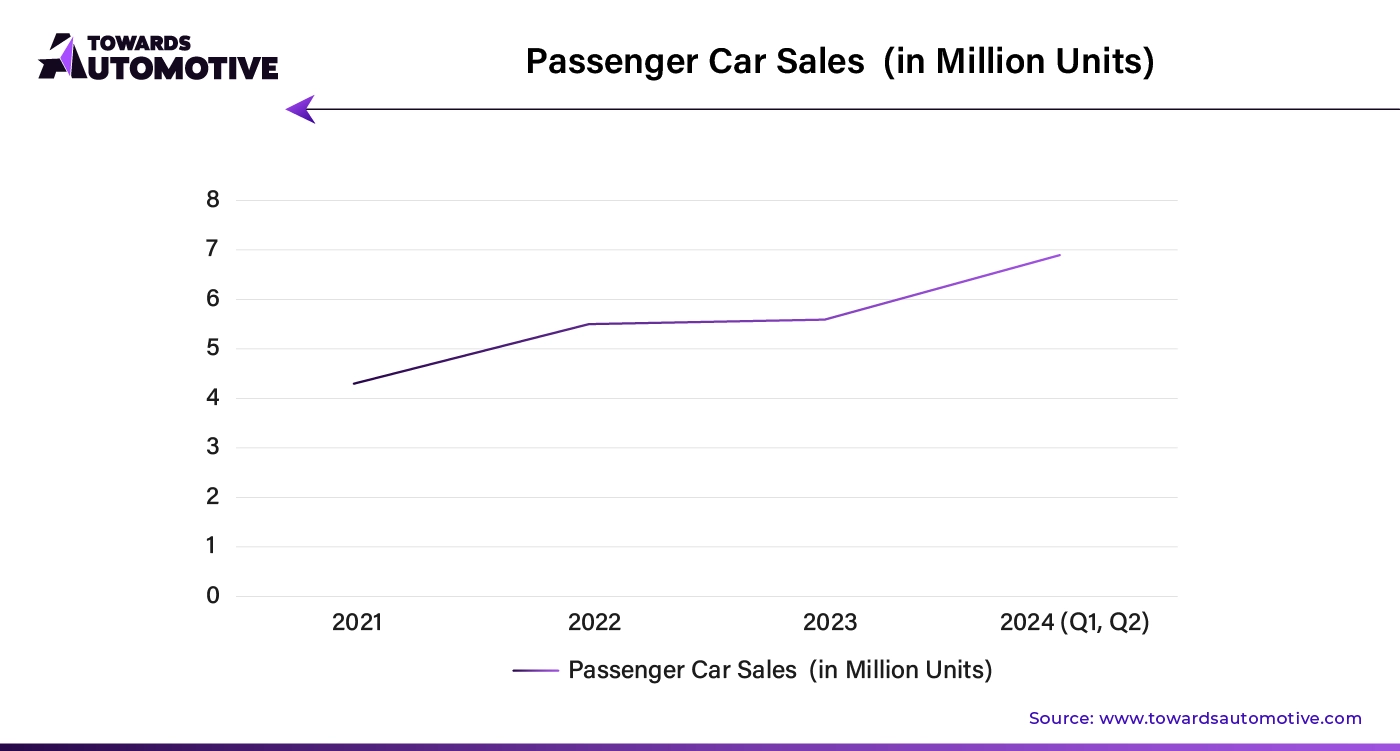

Variable oil pumps are becoming a standard feature across various vehicle categories, with passenger cars leading the charge. As per the International Organization of Motor Vehicle Manufacturers (OICA), global production of passenger cars reached over 65 million units in 2023, accounting for approximately 65 to 75% of total automotive production. This substantial figure underscores the prominence of passenger cars and highlights the growing importance of advanced components like variable oil pumps. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The automotive variable oil pump market faces several challenges, including stringent regulations on vehicular emissions, performance, fuel efficiency, and cost-effectiveness. Regulations such as the Corporate Average Fuel Economy (CAFE) standards are designed to mitigate environmental impact by curbing emissions. To comply with these regulations, manufacturers are compelled to innovate and develop advanced technologies.

For example, the Indian Government's introduction of BS6 emission norms in April 2020 has set new benchmarks for automotive manufacturers, emphasizing the need for efficient and high-performance components. Variable oil pumps play a crucial role in meeting these standards by enhancing the efficiency of lubrication systems, which directly impacts vehicle performance.

The automotive industry's shift towards alternative fuels is accompanied by a notable growth opportunity in the gasoline-driven segment. Despite the rise in electric vehicles and the push to reduce diesel usage, gasoline remains a popular choice due to its relatively lower service intervals and cost-effectiveness. As gasoline-powered vehicles continue to be a significant part of the market, the demand for variable oil pumps in this segment is expected to rise.

In terms of sales channels, the Original Equipment Manufacturer (OEM) segment is projected to dominate the market for automotive variable oil pumps. OEMs are known for their ability to produce high-quality, reliable components that meet rigorous standards. This capability positions them well to cater to the growing demand for variable displacement oil pumps.

Manufacturers are increasingly focusing on customization to meet evolving customer preferences. The development of specialized variable flow oil pumps, such as those that are compact, low-vibration, and brushless, is driving growth in the market. These innovations are essential for automotive manufacturers seeking to offer high-performance and efficient vehicles.

Pump manufacturers are also engaging in strategic efforts to integrate customization into their operations. By providing tailored solutions and securing long-term supply contracts with automakers, they are positioning themselves for sustained growth. The ongoing advancement of compact and high-performance motors and engines further supports the expansion of variable oil pump sales.

The integration of Artificial Intelligence (AI) in the Automotive Variable Oil Pump market is poised to significantly enhance market growth. AI-driven technologies can optimize the performance of variable oil pumps by enabling real-time data analysis and predictive maintenance. By processing vast amounts of data from sensors, AI algorithms can adjust the pump’s operation to match engine requirements, thereby improving fuel efficiency and reducing emissions. This adaptability not only enhances the pump’s lifespan but also lowers maintenance costs, making it an attractive option for automotive manufacturers.

Furthermore, AI can facilitate the development of more efficient and environmentally friendly pumps by simulating different operational scenarios and materials, leading to innovative designs that align with evolving regulatory standards. As the automotive industry shifts towards more sustainable and intelligent systems, the demand for AI-integrated variable oil pumps is expected to grow. This technological advancement will likely drive market expansion by offering superior performance and cost-effectiveness, addressing both consumer demands and industry requirements.

The supply chain for the automotive variable oil pump market is a complex network involving multiple stages, from raw material procurement to end-user delivery. It begins with the sourcing of essential raw materials, such as high-quality metals and polymers, which are vital for manufacturing durable and efficient pumps. Suppliers of these raw materials often work closely with manufacturers to ensure consistent quality and timely delivery.

Manufacturers then use these materials to produce variable oil pumps, incorporating advanced technologies to meet stringent automotive standards. The production process involves several stages, including precision machining, assembly, and quality testing. Manufacturers often rely on just-in-time inventory systems to minimize holding costs and optimize production schedules.

Once produced, the pumps are distributed through a network of wholesalers and distributors who supply them to automotive OEMs (Original Equipment Manufacturers) and aftermarket service providers. Effective logistics management is crucial at this stage to ensure timely delivery and reduce downtime.

The final step in the supply chain involves the installation of these pumps in vehicles and their maintenance, ensuring smooth operations and customer satisfaction. Coordination and communication among all supply chain participants are essential to address challenges and maintain a seamless flow of products from manufacturers to end-users.

The automotive variable oil pump market is shaped by a range of components and key industry players. At its core, a variable oil pump system includes several main components: the pump housing, control valves, rotor, and stator. The pump housing contains the internal components and directs oil flow. Control valves manage the oil pressure, while the rotor and stator work together to adjust the pump’s displacement, optimizing engine performance and efficiency.

Major automotive manufacturers, such as Bosch, Denso, and ZF Friedrichshafen, play crucial roles in this ecosystem. Bosch is known for its advanced variable oil pump technology, which enhances engine efficiency and reduces emissions. Denso provides high-quality pumps that contribute to improved vehicle performance and fuel economy. ZF Friedrichshafen offers innovative solutions that integrate seamlessly with modern engine systems, promoting better drivability and reduced fuel consumption.

In addition, tier-one suppliers and automotive component specialists contribute to the market by developing specialized VOP components and providing maintenance services. Their innovations and expertise ensure that variable oil pumps meet evolving industry standards and performance requirements. Together, these players drive the growth and advancement of the automotive variable oil pump market.

Advancements in Pump Technologies to Reduce Vehicular Emissions

Automobile manufacturers are under increasing pressure to meet stringent global emission standards, leading to a focus on innovative solutions to cut carbon emissions. High-pressure and electric fuel pumps have emerged as effective tools in this effort, potentially reducing emissions by 1.5 to 2 grams per kilometer for 1.8-liter diesel or gasoline engines.

Among the latest innovations are advanced automotive variable oil pumps, which adjust pressure and oil flow based on the engine's needs. This not only enhances lubrication but also minimizes parasitic losses and energy consumption. By improving fuel efficiency and reducing emissions, these pumps help manufacturers comply with environmental regulations, driving their adoption in modern vehicles.

Impact of Rising Automotive Production and Vehicle Parc

The growth in automotive production is directly linked to the increased demand for variable oil pumps. Despite economic fluctuations, global automotive production is projected to grow at a modest annual rate of 3% to 3.5%, with more pronounced growth in emerging markets compared to developed regions. This growth is driven by urbanization and economic stability in these areas.

As the vehicle fleet expands, there will be a growing demand for advanced pump technologies, enhancing vehicle longevity and lubrication systems. This rising production and vehicle parc are expected to spur significant growth in the automotive variable oil pump market.

Growing Demand for Premium Features in Mid-Size Cars

The increasing affluence of the middle class, particularly in countries like India and China, is shifting automotive trends. Consumers now seek premium features in mid-size and compact cars, which were previously exclusive to luxury vehicles. Features such as advanced cabin comfort, anti-lock braking systems, and power steering are becoming standard in these segments.

Mid-size and compact cars, which represent 55% to 65% of global car sales, are prime markets for automotive variable oil pumps. This segment's demand for customized and advanced pumps presents lucrative opportunities for manufacturers.

Challenges: Low Replacement Rates and Aftermarket Potential

Automotive variable oil pumps are integral to transmission, driveline, and auxiliary systems and are infrequently replaced. The replacement rate globally ranges between 0.1% and 1% of the vehicle parc, and technological advancements may further reduce this rate.

This low replacement rate limits aftermarket potential, impacting revenue streams for manufacturers. Additionally, the complexity and specialized nature of these pumps may lead consumers to opt for cheaper alternatives or delay replacements, further constraining growth in the aftermarket segment.

Electric motors are increasingly being used as substitutes for traditional mechanical pumps in the automotive industry. Functions typically performed by hydraulic or power steering pumps can now be achieved with electric motors, driven by the broader trend of electrification in vehicles.

Electric motors offer several advantages, including enhanced efficiency, reduced maintenance, and improved control. As electric and hybrid vehicles become more common, electric coolant pumps and electric power steering systems are becoming standard, showcasing the potential for electric motors to replace conventional pumps.

In the global market, companies are typically classified into different tiers based on their market share, production capacity, and geographical reach. This classification helps in understanding the competitive landscape and the dynamics driving market growth. Here’s a detailed breakdown of the different tiers:

Tier 1 companies are the dominant players in the global sector, capturing a substantial market share ranging from 40% to 45%. These industry leaders are characterized by their high production capacities, extensive product portfolios, and robust global presence.

Key Characteristics:

Examples of Tier 1 Companies:

Tier 2 companies are mid-sized players that, while not as globally dominant as Tier 1, hold significant influence within specific regions. These companies account for approximately 55% to 60% of the overall industry revenue during the forecast period.

Key Characteristics:

Examples of Tier 2 Companies:

The automotive variable oil pump market is experiencing dynamic growth across various global regions, driven by increasing vehicle sales, rising purchasing power, and significant investments in sustainable production processes. This report provides a detailed analysis of market trends in leading countries, highlighting growth rates and factors influencing demand.

India: A Leader in Growth

India is leading the automotive variable oil pump market with a notable growth rate. The market in India is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% from 2024 to 2034. This growth is largely driven by a surge in vehicle sales and improving purchasing power among the Indian population. With a burgeoning middle class and increasing disposable income, the demand for advanced automotive components, including variable oil pumps, is expected to continue rising.

Japan: Steady Advancement

Japan is set to experience a steady growth rate of around 3.9% CAGR during the same period. The country’s well-established automotive industry and technological advancements are key factors contributing to this growth. Japan’s focus on innovation and high-quality manufacturing processes supports the demand for advanced automotive components.

For instance,

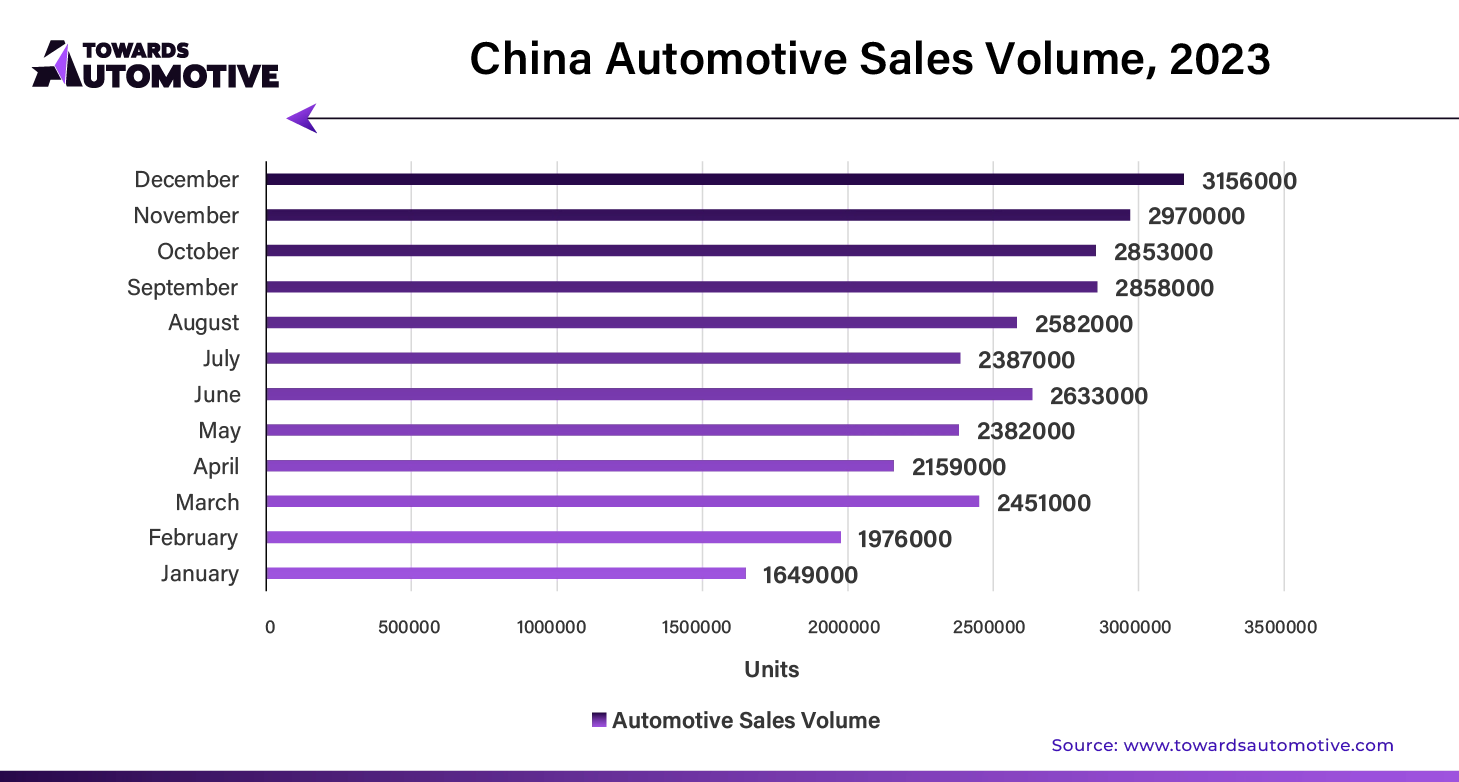

China: Robust Expansion

China, one of the largest automotive markets globally, is anticipated to grow at a CAGR of 3.9% through 2034. The growth is fueled by increasing vehicle sales and substantial investments in clean energy initiatives by automobile manufacturers. Companies like Audi are investing heavily in sustainable production processes in China, which is expected to boost the demand for automotive variable oil pumps. The market value in China is projected to reach approximately USD 2,900 million by 2034.

Germany: Consistent Growth

Germany’s automotive variable oil pump market is forecasted to grow at a CAGR of 3.3% over the next decade. As Europe’s automotive hub, Germany benefits from its strong automotive industry and focus on technological advancements, driving demand for high-performance automotive components.

United States: Significant Market Presence

The United States automotive variable oil pump market is projected to grow at a CAGR of 2.9%, reaching an estimated USD 2,100 million by 2034. Recent acquisitions, such as BorgWarner Inc.’s purchase of Delphi Technologies for USD 3.5 billion, are expected to enhance market dynamics. These acquisitions are poised to strengthen product capabilities and flexibility across various propulsion systems, further boosting demand.

United Kingdom: Growing Demand

In the United Kingdom, the market for automotive variable oil pumps is set to grow at a CAGR of 2.8%, with the total value reaching approximately USD 420 million by 2034. The presence of prominent sports and luxury car manufacturers, including Rolls-Royce, Jaguar, and Aston Martin, along with high registration rates of private vehicles, is expected to drive the demand for automotive components. In January 2022, the UK saw a registration of about 64,000 private vehicles, up from 38,000 in the previous year.

The dominance of OEMs in the Automotive Variable Oil Pump Market

The Original Equipment Manufacturers (OEMs) segment is poised to dominate the automotive variable oil pump market, with a projected market share of approximately 72.5% in 2024. This dominance is driven by OEMs' capability to deliver high-quality, innovative variable displacement oil pumps that adhere to stringent industry standards. The automotive industry is experiencing increasing pressure to comply with strict regulations aimed at reducing vehicle emissions and enhancing fuel efficiency. In response, OEMs are focusing on producing lightweight and fuel-efficient components. This shift is helping meet regulatory requirements and catering to the growing demand for advanced OEM parts in hybrid and luxury vehicles.

Benefits for Passenger Car Manufacturers from Easy Loan Availability

In the passenger car segment, which is expected to capture around 66.8% of the market share in 2024, the availability of automobile financing is proving to be a significant growth driver. The rise in private vehicle ownership, fueled by increasing disposable incomes and the ease of obtaining vehicle loans, is positively impacting this segment. Automobile financing companies are offering attractive loan options that make it easier for individuals to purchase vehicles quickly. In developing nations, where owning a car is often a symbol of high social status, this accessibility to financing is expected to drive up the demand for automotive variable oil pumps in passenger cars. Overall, the market for automotive variable oil pumps is experiencing growth due to technological advancements by OEMs and the increased accessibility of vehicle financing for consumers.

The global automotive variable oil pump market is characterized by significant fragmentation. Leading companies collectively hold around 40% to 45% of the market share, indicating a competitive and diverse industry landscape. Key players dominating this sector include:

These companies are actively working to maintain their competitive edge through substantial investments in research and development. They are focused on innovating new types of vehicles equipped with advanced oil pumps. Additionally, many firms are showcasing their latest products at industry exhibitions and trade fairs to enhance product visibility and attract a broader customer base.

By Fuel Type

By Vehicle Type

By Sale Channels

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us