April 2025

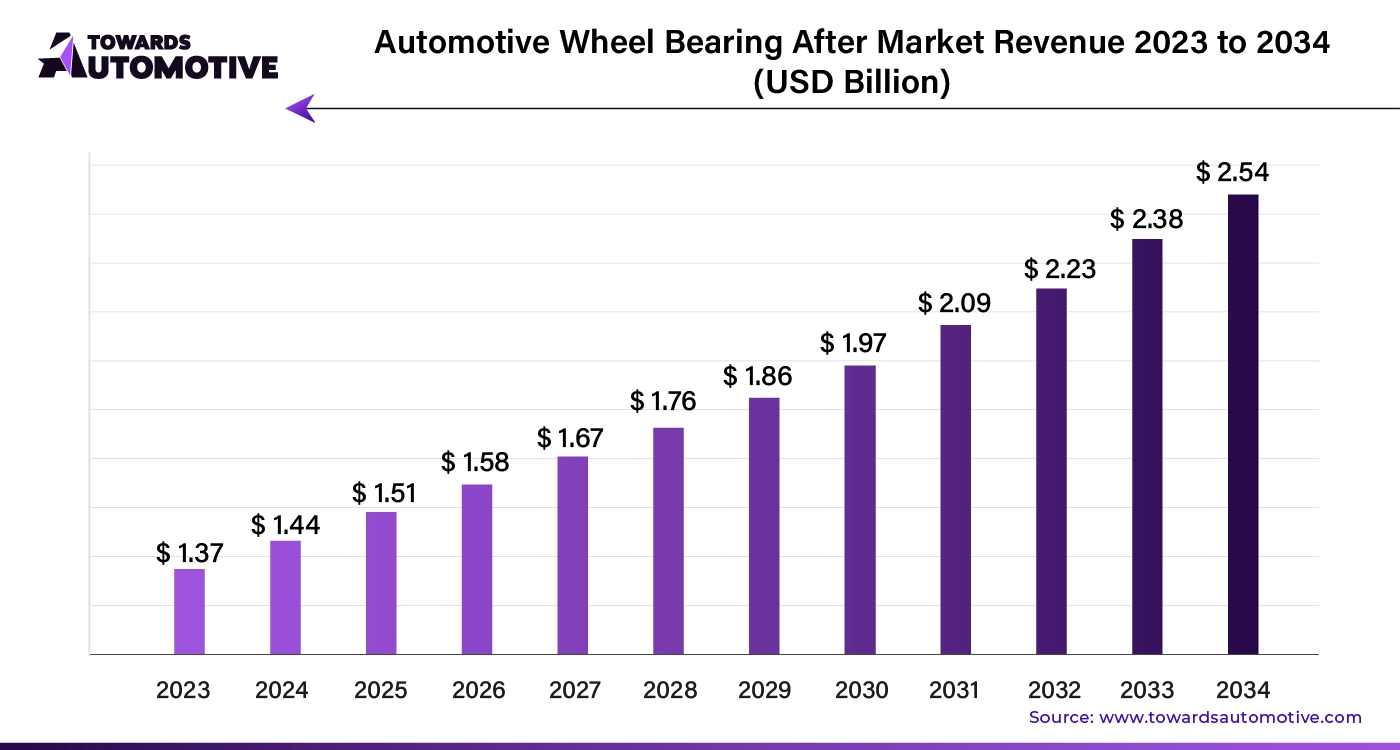

The global automotive wheel bearing aftermarket size is calculated at USD 1.44 billion in 2024 and is expected to be worth USD 2.54 billion by 2034, expanding at a CAGR of 4.80% from 2024to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Automotive wheel bearings are crucial for transferring power from the driving axle to the wheels, making them essential for all types of vehicles, from passenger cars to commercial trucks. As urban areas expand, the demand for wheel bearings is expected to rise, creating significant opportunities in the automotive aftermarket. Wheel hubs, which connect the wheel to the vehicle and support its weight while allowing smooth axle rotation, are becoming increasingly important. The growth in both passenger and commercial vehicle production, especially in emerging markets, is driving up the demand for these components. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

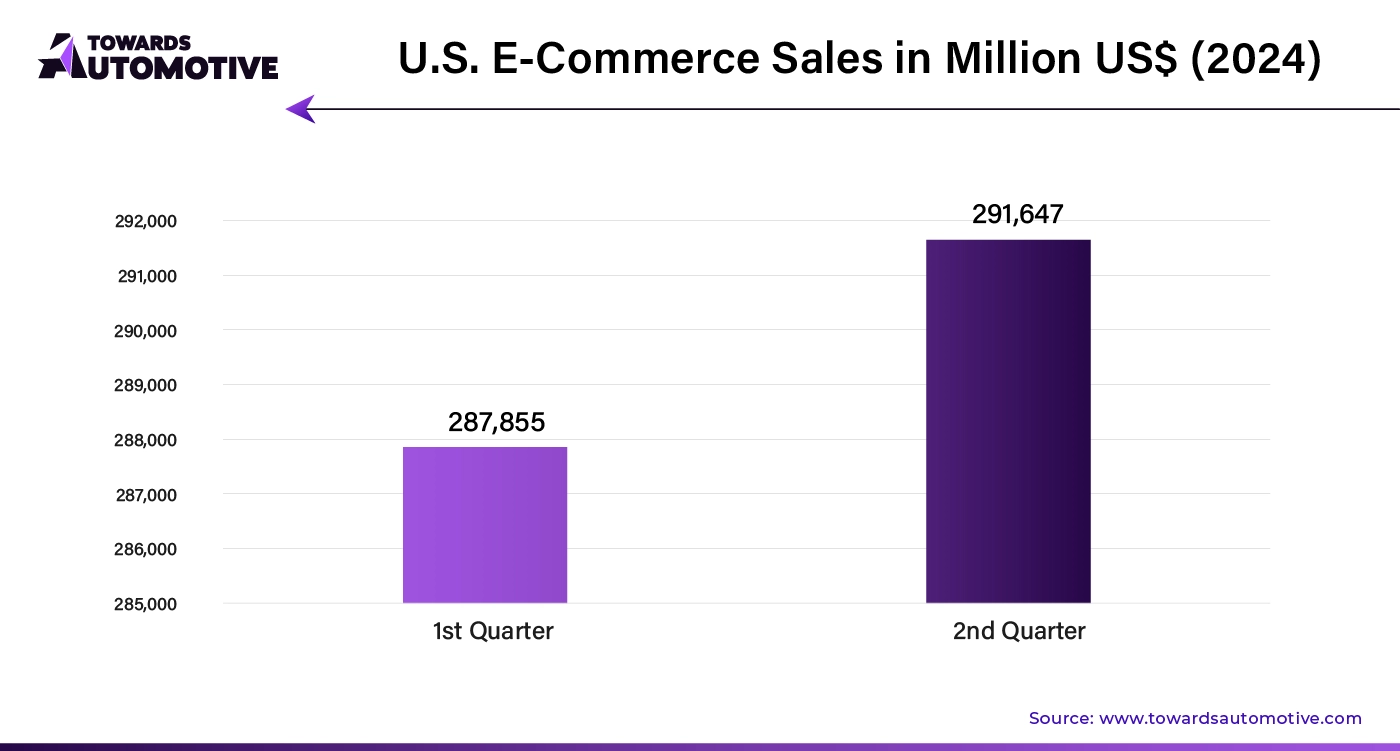

The growth of the automotive industry, with rising vehicle sales and production, boosts the wheel bearing aftermarket. Advances in bearing technology have led to more durable bearings, extending replacement intervals. The surge in e-commerce has made aftermarket parts, including wheel bearings, more accessible to consumers. Increased urbanization and global trade result in more vehicles on the road, leading to higher wear and tear and a greater need for replacements. Additionally, technology improvements, such as sensors in wheel bearings that monitor performance, are becoming crucial drivers of market expansion.

The high cost of automotive wheel bearings is a major barrier to market growth. The pandemic has exacerbated this issue by causing labor shortages and disrupting the supply of raw materials, which has slowed production and distribution. Additionally, the rise of electric vehicles (EVs) is likely to further constrain market demand, as EVs use fewer wheel bearings compared to internal combustion engine (ICE) vehicles.

AI is revolutionizing the automotive wheel bearing market by driving innovation and efficiency. Advanced AI algorithms enhance design processes, enabling the creation of more durable and high-performance wheel bearings. By utilizing AI for predictive maintenance, manufacturers can anticipate potential failures and reduce downtime, leading to more reliable and longer-lasting products.

AI-powered data analytics improve quality control by identifying defects and inconsistencies in real-time during production. This capability ensures that only the highest quality bearings reach the market, enhancing customer satisfaction and reducing warranty claims. Additionally, AI-driven simulations optimize wheel bearing designs, enabling quicker adaptation to changing automotive standards and consumer demands.

The integration of AI also streamlines supply chain management, facilitating just-in-time manufacturing and reducing inventory costs. Through smart automation, AI enhances production efficiency and scalability, allowing companies to meet increasing demand with greater agility.

Overall, AI's role in the automotive wheel bearing market accelerates innovation, improves product quality, and optimizes manufacturing processes, driving significant market growth and positioning companies for future success.

In the automotive wheel bearing market, an efficient supply chain is crucial for meeting demand and maintaining competitive advantage. The supply chain begins with raw material suppliers who provide steel and other essential components. Manufacturers then process these materials into wheel bearings using advanced machinery and technology.

The production phase involves precision engineering to ensure the bearings meet stringent quality standards. Once manufactured, the wheel bearings are distributed to automotive assembly plants and aftermarket suppliers. Effective logistics management is key here, ensuring timely delivery to avoid production delays.

Post-distribution, the wheel bearings enter the retail and service sectors, where they are sold to repair shops and end-users. Real-time inventory management systems help in tracking stock levels and forecasting demand, reducing the risk of overstocking or shortages.

Collaboration among suppliers, manufacturers, and distributors is essential to streamline processes and reduce lead times. By focusing on transparency and efficiency throughout the supply chain, companies can enhance product availability, reduce costs, and improve customer satisfaction in the automotive wheel bearing market.

The automotive wheel bearing market consists of several key components and contributors. Major components include the bearing itself, seals, and lubrication systems. Bearings are essential for reducing friction between the wheel and the axle, ensuring smooth vehicle operation. Seals protect bearings from contaminants, while lubrication systems maintain optimal performance.

Leading companies in this market play crucial roles. For instance, SKF and Timken provide high-quality bearings known for durability and precision. NTN and NSK offer innovative solutions that enhance vehicle efficiency and safety. These companies contribute to advancements in bearing technology, such as improved materials and design enhancements that extend service life and performance.

Additionally, companies like Schaeffler and JTEKT focus on integrating advanced technologies into wheel bearings, such as sensors that monitor performance in real-time. Their innovations help in reducing maintenance costs and improving vehicle safety.

Overall, the automotive wheel bearing market ecosystem is supported by these companies’ expertise in engineering, manufacturing, and technological innovation, all working together to enhance vehicle performance and reliability.

United States: Market Leader with Robust Growth

The United States leads the automotive wheel bearing aftermarket due to its substantial vehicle population and the prevalence of DIY repairs. With a forecasted CAGR of approximately 4.7% through 2033, the U.S. remains the top region for sales. The strong presence of professional automotive repair and maintenance services further drives demand. E-commerce and online sales have expanded, increasing accessibility to aftermarket wheel bearings. Additionally, regulatory standards and heightened consumer awareness about safety and quality contribute to a thriving market.

India: Fastest Growing Market

India is witnessing the fastest growth in the automotive wheel bearing aftermarket, with an expected CAGR of around 6.3% by 2033. This rapid growth is driven by rising vehicle ownership and increasing consumer awareness about vehicle maintenance and safety. While price sensitivity leads to a preference for affordable options, both organized and unorganized sectors cater to the diverse market. India's stringent environmental regulations and increasing demand for passenger and commercial vehicles are expected to further boost the aftermarket.

China: Steady Expansion Driven by Technology

China's automotive wheel bearing aftermarket is steadily expanding, with a projected CAGR of about 4.0% through 2033. The country's growing vehicle market and large vehicle population create significant demand. Chinese bearing manufacturers, having made substantial advancements in technology and production methods, are positively impacting market expansion. The rise of e-commerce platforms and a diverse range of aftermarket products also contribute to the market's growth.

Germany: Stable Growth with High Standards

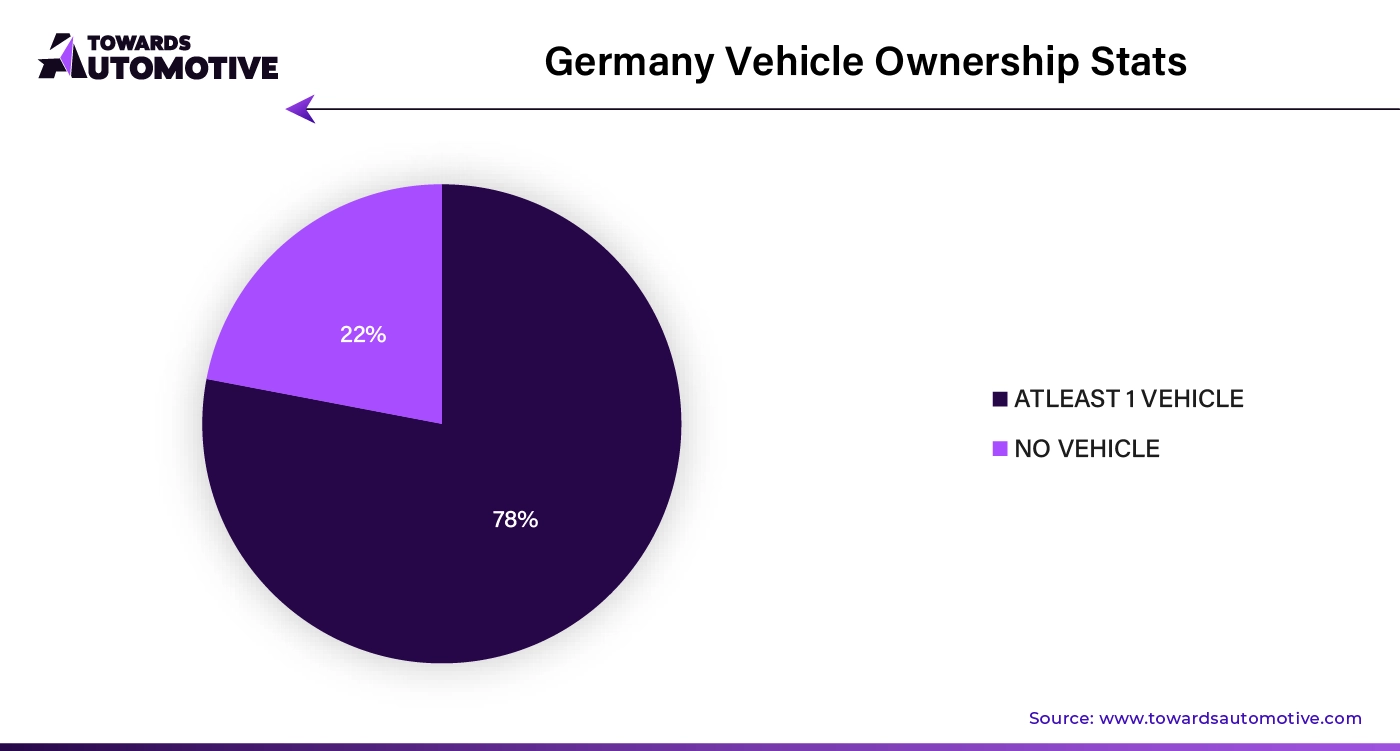

Germany, renowned for its strong automotive sector, is expected to achieve a CAGR of approximately 4.0% by 2033. The country’s preference for OEM and high-quality aftermarket parts, driven by rigorous vehicle safety and quality standards, supports steady market growth. High vehicle ownership rates and a well-established professional repair industry further bolster the automotive wheel bearing aftermarket in Germany.

While the U.S. leads the market in terms of size and influence, India is experiencing the fastest growth driven by increased vehicle sales and consumer awareness. China benefits from technological advancements and a growing vehicle market, while Germany maintains stable growth with a focus on quality and standards.

In the automotive wheel bearing aftermarket, the passenger car segment remains the leading category, holding a significant market share of approximately 73% in 2023. This dominance is driven by the increasing demand for passenger vehicles, as more consumers are willing to invest in a diverse range of cars, including high-end models. As a result, this growth in passenger car sales creates ample opportunities for automotive wheel bearings in the aftermarket.

Conversely, the tapered roller bearings segment is experiencing the most rapid expansion. This segment is expected to represent around 32% of the market in 2023. Tapered roller bearings are favored for their capability to support both radial and axial loads, making them well-suited for high-load applications such as automotive wheel hubs, heavy machinery, and industrial equipment. Their durability and precision also make them ideal for use in demanding applications like machine tool spindles and precision gearboxes.

In response to increasing competition, automotive wheel-bearing aftermarket players are adopting various strategies. Many are focusing on launching new products to capture market share in emerging regional markets.

One notable trend is the introduction of ball bearings with integrated sensor units. These sensors enable digital tracking of rotational speeds, axial displacement, acceleration, deceleration, and load-bearing capacity. Integrated bearings, which combine multiple components into one, are gaining popularity for their efficiency and effectiveness.

In 2020, Continental AG launched advanced prop shaft bearings designed to reduce vibration transmission to the chassis and limit the movement of engine shafts. NTN Corporation, a leading Japanese bearing manufacturer, focuses on delivering durable and high-quality automotive wheel bearings tailored for the aftermarket. Similarly, NSK Ltd., also from Japan, invests in research and development to provide innovative and high-performance wheel bearings globally.

By Sales Channel

By Vehicle Type

By Product Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us