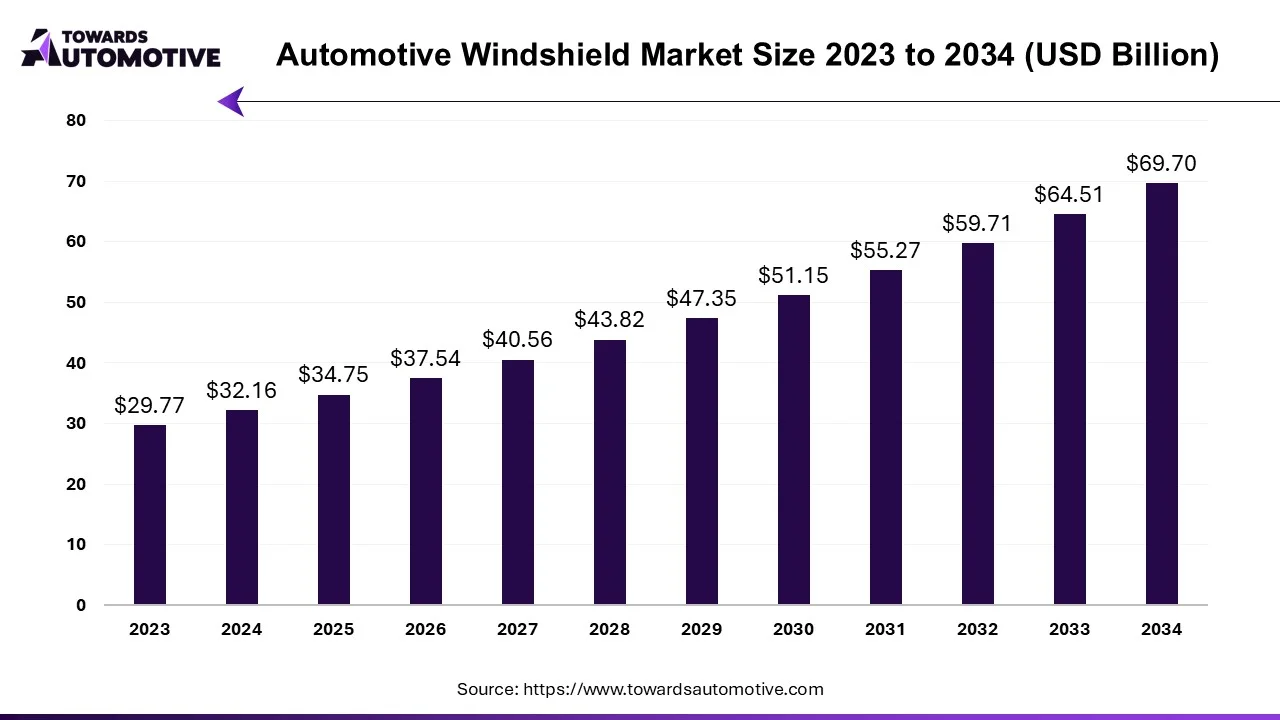

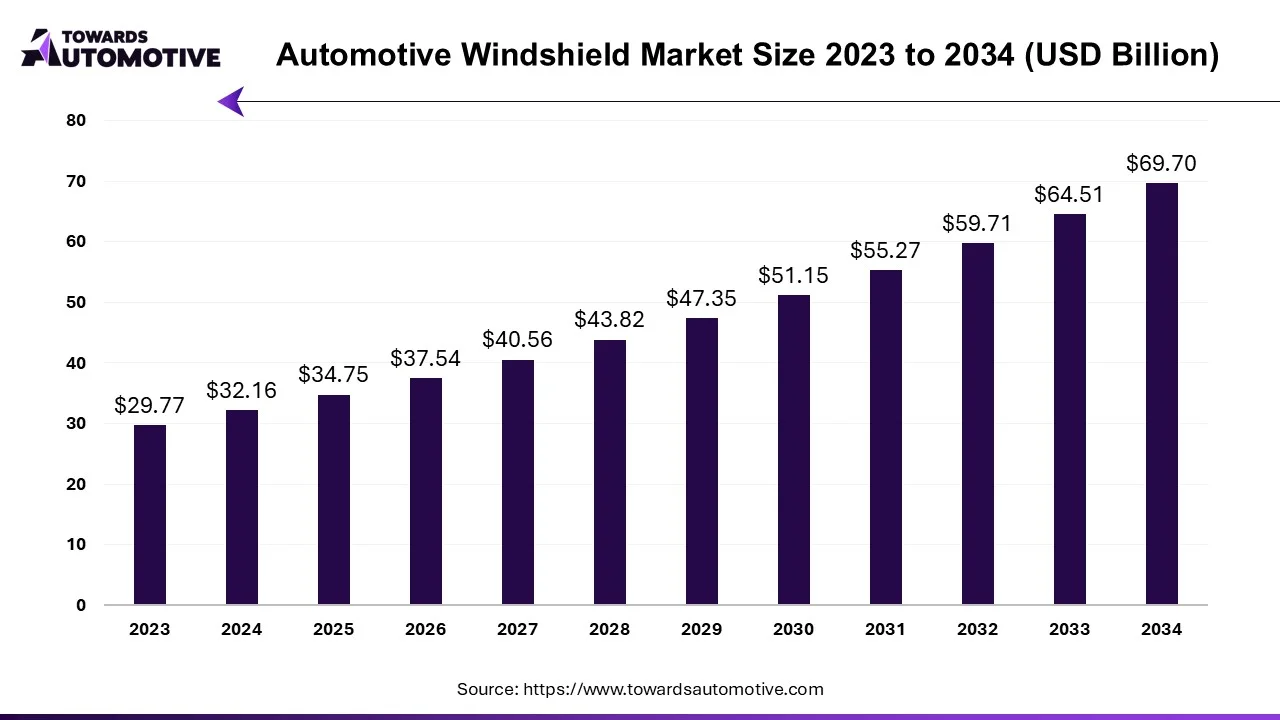

Automotive Windshield Market Size, Demand and Trends Analysis 2034

The automotive windshield market size is projected to reach USD 69.7 billion by 2034, growing from USD 34.75 billion in 2025, at a CAGR of 8.04% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Introduction

The automotive windshield market is a crucial sector of the automotive materials industry. This industry deals in manufacturing and distribution of windshield for automotives. There are various types of glass used in the production of automotive windshields such as tempered glasses and laminated glasses. These windshields are placed in numerous position such as front and rear. It is designed for several types of vehicles including passenger cars, light commercial vehicles, heavy commercial vehicles and others. The growing sales of commercial vehicles around the globe has contributed significantly to the industrial expansion. This market is expected to rise drastically with the growth of the automotive sector in different parts of the world.

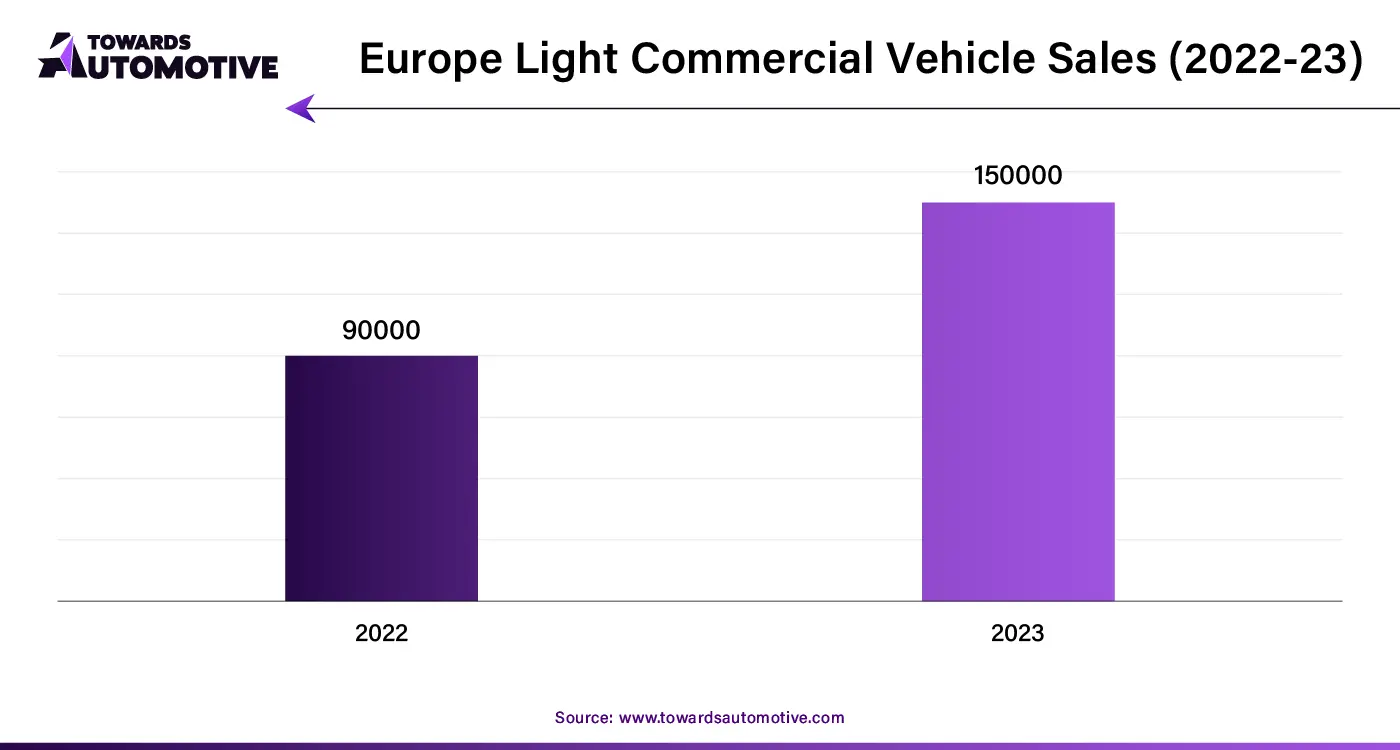

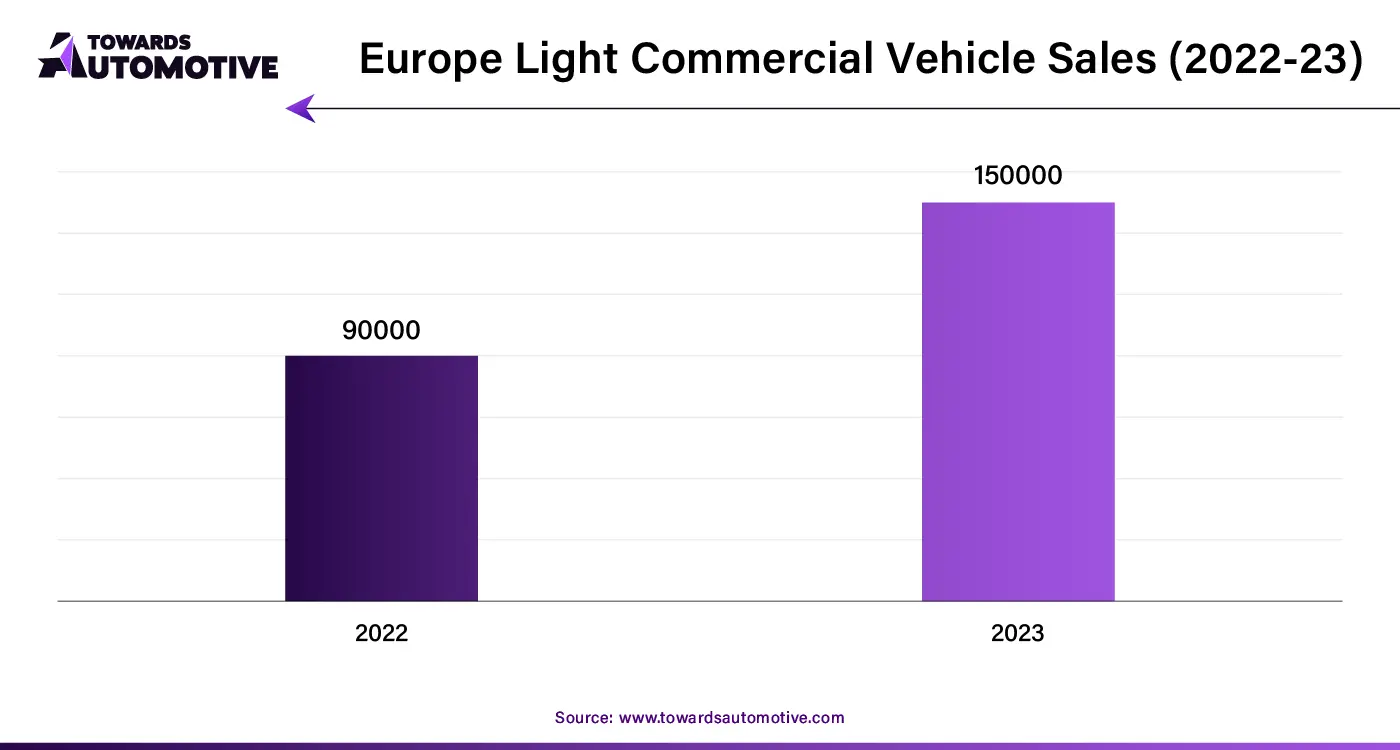

- According to the International Energy Agency, around 90000 light commercial vehicles were sold in Europe in 2022 that increased to 150000 in 2023.

Highlights of the Automotive Windshield Market

- Asia Pacific held the dominant share of the automotive windshield market due to the rising sales and production of automotives in this region.

- North America is expected to grow with a significant CAGR due to the growing adoption of smart windshields along with presence of numerous windshield brands in U.S. and Canada.

- The passenger cars segment dominated the market due to the increasing demand for hatchbacks in developing nations.

- The front segment led the market due to the rapid investment by windshield manufacturers for developing high-quality windshields to protect drivers from wind, debris and other elements.

Automotive Windshields: Recent Trends

- Some companies are developing advanced windshield to enhance ADAS capabilities for improving driving experience and safety in vehicles. For instance, in August 2023, AGC launched FIR sensor-enabled windshield for vehicles. This windshield is designed to improve the ADAS capabilities and enhances visibility while driving.

- Several partnerships are taking place in the industry for manufacturing automotive windshields with advanced features. For instance, in October 2024, Hyundai Mobis partnered with Zeiss. This partnership is aimed at developing a holographic windshield display for automotives.

- Rapid investment for developing heated windshield for automotives is an ongoing trend in this industry and several market players are engaged in manufacturing these windshields to sustain in this competitive industry. For instance, in December 2024, Genesis announced to use heated windscreen technology in their vehicles. These heated windscreens are developed by Hyundai Motor Group.

- Automotive manufacturers have started adopting strong automotive windshields for improving consumer experience and enhancing reliability. For instance, in April 2024, Jeep launched Facelifted Wrangler. This car comes with Gorilla Glass windshield and other advanced features.

Industry Leader Announcement

In March 2024, Todd Fencak, the CEO of PGW Auto Glass announced that,” We are excited to announce the launch of ‘Everything Autoglass,’ a comprehensive set of business tools that will help our customers succeed. Everything Autoglass was created to provide installers with a low-cost, advanced technology that encompasses all aspects of shop management.”

Competitive Landscape

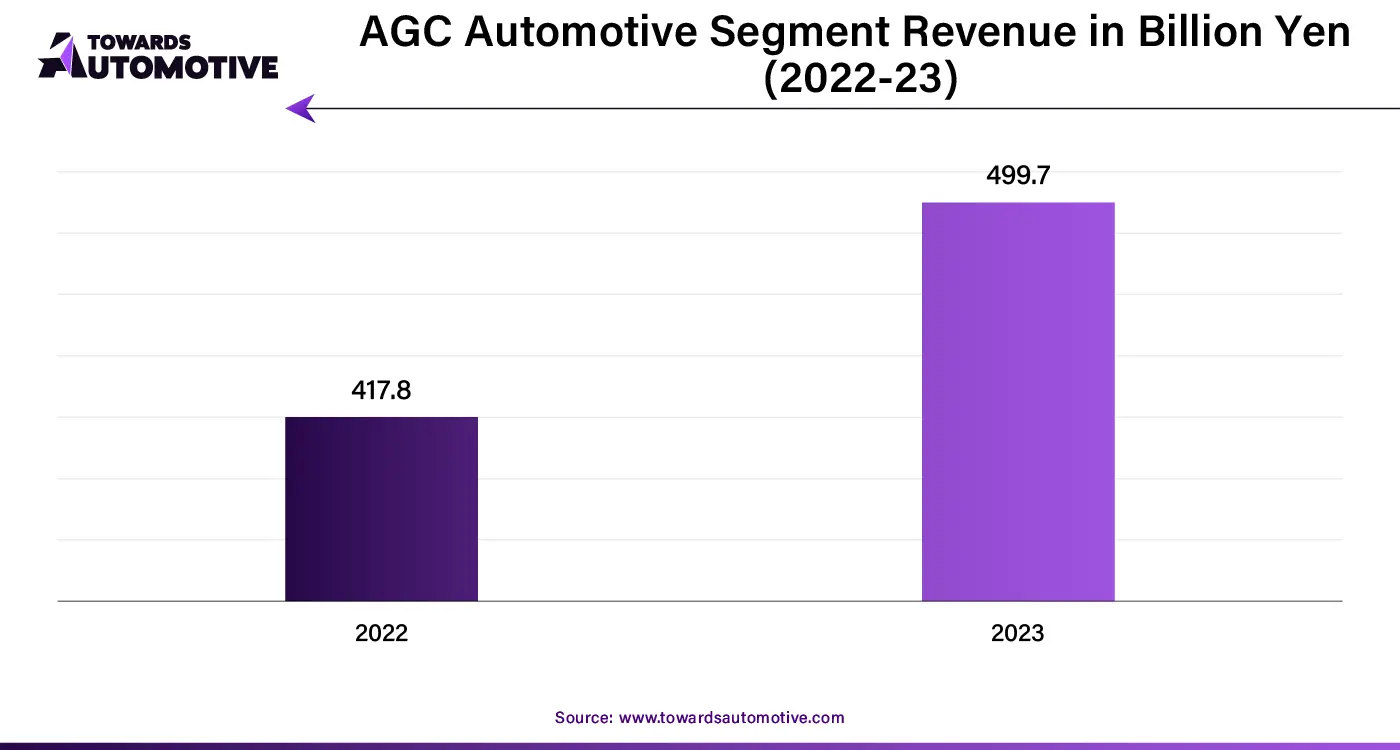

The automotive windshield market is a highly developed industry with the presence of several dominant players. Some of the important players in this industry consists of AGC Inc. (Japan), SAINT-GOBAIN (France), Nippon Sheet Glass Co., Ltd (Japan), ÅžiÅŸecam (Turkey), Central Glass Co., Ltd. (Japan), Guardian Glass (U.S.) and some others. These market players constantly engaged in developing windshields for automotives and adopting numerous strategies including business expansion, launches, investment, partnerships and some others to maintain their dominant position in this industry.

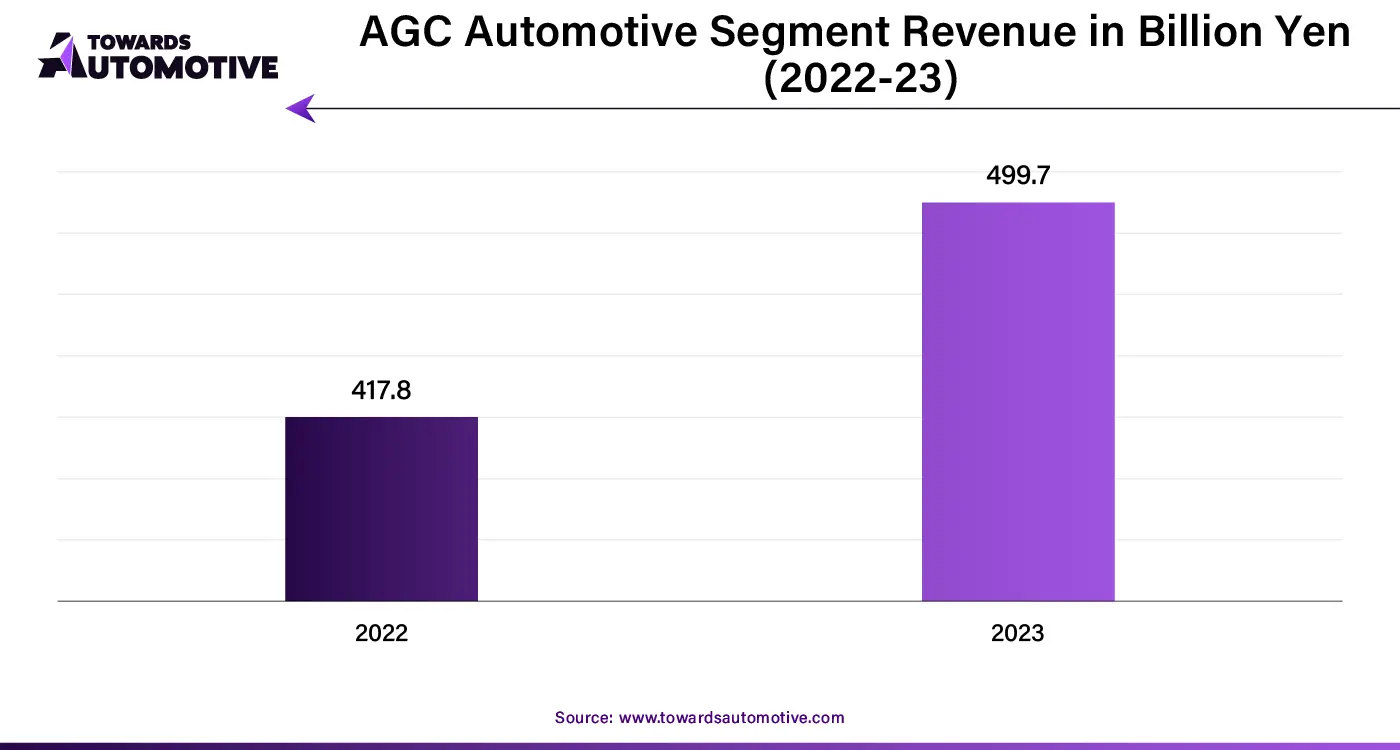

- According to the annual report of AGC, the revenue of automotive segment in 2022 was 417.8 billion yen that increased to 499.7 billion yen in 2023.

Market Segmentations

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Position

By Glass Type

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa