April 2025

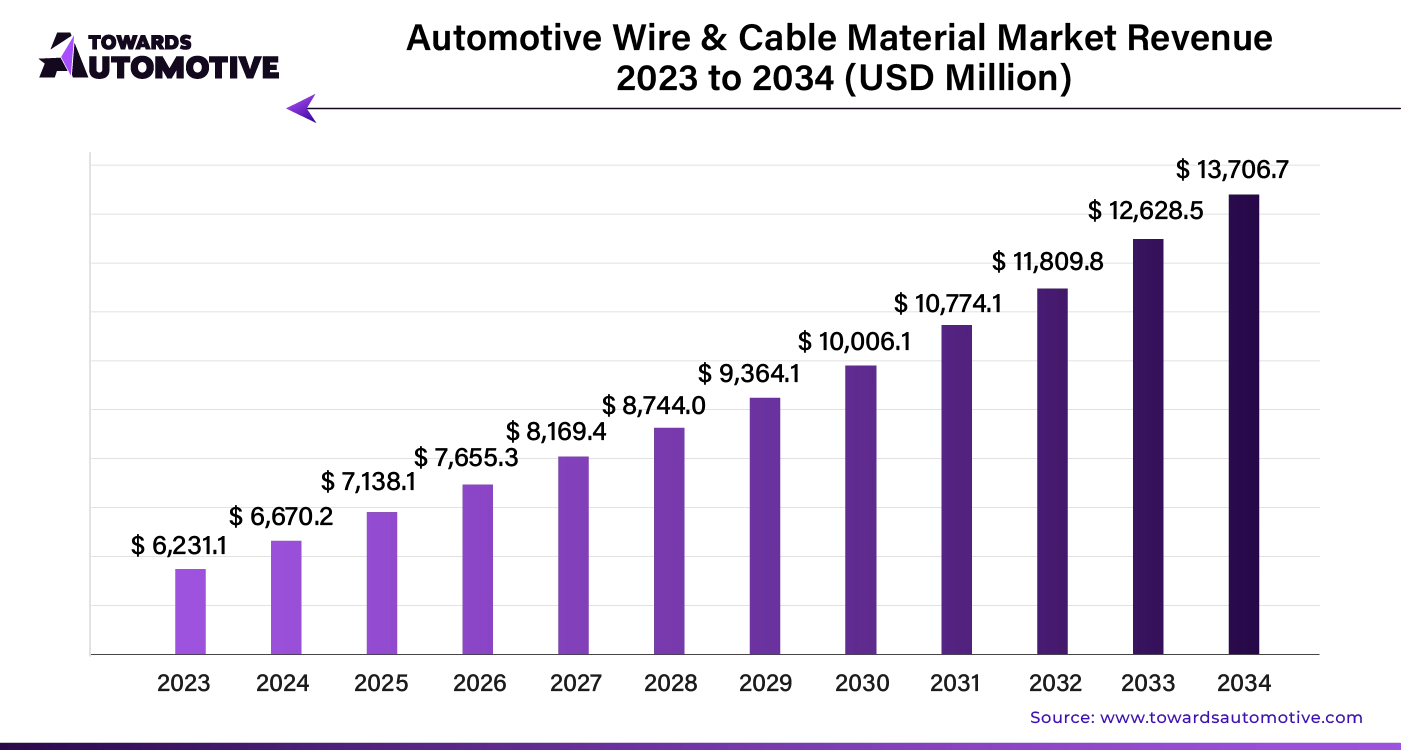

The global automotive wire & cable material market size is calculated at USD 6,670.2 million in 2024 and is expected to be worth USD 13,706.7 million by 2034, expanding at a CAGR of 7% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive wire and cable material market has experienced substantial growth from 2018 to 2022. This expansion stems from technological advancements, stricter regulatory standards, sustainability efforts, and the industry's shift towards electrification and enhanced connectivity.

Manufacturers are innovating to produce high-performance, durable wires and cables that meet stringent safety regulations and address the evolving demands of modern vehicles. This evolution includes the need for specialized insulation designed for high-voltage applications, as the automotive sector focuses on improving fuel efficiency through weight reduction.

The growing demand for lightweight wiring materials that maintain high performance while reducing vehicle weight is a key market driver. This trend is expected to accelerate the adoption of advanced materials, such as composite cables, paving the way for significant market development. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Automotive wire and cable materials serve a broad spectrum of vehicles, including traditional internal combustion engines, hybrids, and electric models. As automotive technology advances—encompassing features like autonomous driving, advanced infotainment systems, and enhanced safety mechanisms—the need for sophisticated and specialized wires and cables intensifies.

The ongoing quest for innovative solutions to fuel-efficient vehicles will continue to influence the market, driving increased demand for automotive wire and cable materials in the coming years.

Advancements in Automotive Technology Boost Demand for Advanced Wiring Materials

The evolution of automotive technology is transforming vehicle design, emphasizing advanced electronic systems and improved connectivity. This shift drives a rising demand for sophisticated automotive wire and cable materials. Modern vehicles integrate complex electrical systems, including sensors, communication modules, entertainment systems, and autonomous driving technologies. These innovations require specialized wiring solutions to manage diverse functions efficiently. Manufacturers are responding with high-bandwidth cables, enhanced shielding techniques, and durable wiring harnesses to meet these needs. As automotive technology progresses, the demand for advanced wiring solutions remains a key factor in the market’s growth.

Consumer Demand for Efficiency Fuels Sales of Advanced Automotive Cables

Consumers increasingly seek vehicles with better fuel efficiency, enhanced performance, and advanced technological features. This growing demand is pushing automakers to incorporate more complex electrical systems, which in turn drives the need for advanced wiring materials. To meet these requirements, manufacturers are developing high-performance cables capable of handling higher power loads while ensuring efficiency and reliability. This trend underscores the correlation between consumer preferences for advanced electrical systems and the rising need for sophisticated wiring solutions.

Emerging Automotive Markets Propel Wire and Cable Market Growth

The expansion of automotive markets in emerging economies significantly contributes to the growth of the automotive wire and cable materials market. Rising disposable incomes, urbanization, and infrastructure development in these regions are increasing vehicle demand. This surge necessitates high-quality wires and cables to support the electrical systems in modern vehicles. Manufacturers are focusing on these markets by providing reliable and technologically advanced wiring solutions, driving overall market expansion.

Global Safety Standards Influence Automotive Wire and Cable Market

Stringent safety and regulatory standards set by governing bodies impact the automotive wire and cable materials market. These standards dictate the quality, durability, and performance of wiring components in vehicles. Manufacturers must adhere to these regulations, which requires significant investment in research and development. Ensuring compliance with safety standards leads to the creation of advanced materials and technologies that enhance vehicle reliability and safety.

AI integration is revolutionizing the automotive wire and cable material market, driving significant growth and innovation. By enhancing design processes, AI enables the creation of more efficient and durable materials. AI-powered predictive maintenance systems monitor the performance of wires and cables in real-time, reducing downtime and extending their lifespan. This predictive capability allows manufacturers to anticipate and address potential issues before they escalate, leading to improved reliability and safety.

Moreover, AI facilitates the development of advanced materials with superior electrical and thermal properties. Through machine learning algorithms, manufacturers can optimize material compositions and production techniques, resulting in higher-quality products that meet the evolving demands of the automotive industry. AI also streamlines supply chain management, enhancing inventory control and reducing lead times.

As the automotive sector increasingly embraces electric and autonomous vehicles, the demand for advanced wire and cable materials rises. AI's role in accelerating research and development, coupled with its efficiency improvements, positions it as a key driver of market growth. The integration of AI thus promises to enhance both the performance and market appeal of automotive wire and cable materials.

The supply chain in the automotive wire and cable material market plays a crucial role in ensuring the efficient production and distribution of high-quality components. Manufacturers source raw materials from diverse suppliers, including copper, aluminum, and polymers. These materials undergo rigorous testing and processing to meet automotive standards for durability and performance.

Once processed, the materials are distributed to automotive component manufacturers, where they are integrated into various vehicle systems, including power distribution, communication networks, and safety features. Effective logistics and inventory management are essential to balance supply with fluctuating demand, minimizing delays and excess costs.

The supply chain also involves close collaboration between manufacturers, suppliers, and automotive OEMs (original equipment manufacturers) to address quality control, regulatory compliance, and technological advancements. This collaboration ensures that materials meet stringent industry standards and support innovations in vehicle design and functionality.

Overall, optimizing the supply chain in this market requires streamlined operations, strategic partnerships, and advanced technologies to maintain efficiency and competitiveness in the evolving automotive industry.

The automotive wire and cable material market thrives on several core components and contributions from leading companies. At the heart of this ecosystem are key materials including copper, aluminum, and specialized polymers. These materials are essential for producing reliable and durable wires and cables used in vehicles.

Major companies like Nexans, Prysmian Group, and Sumitomo Electric Industries play pivotal roles. Nexans, for instance, focuses on advanced insulation materials that enhance safety and performance. Prysmian Group emphasizes innovations in cable design to meet the growing demand for high-speed data transmission. Sumitomo Electric Industries excels in developing lightweight, heat-resistant cables that improve fuel efficiency and vehicle performance.

Additionally, emerging players and technology innovators are contributing to the market’s growth. Companies are integrating AI and IoT technologies to develop smart cables that offer enhanced diagnostics and performance monitoring.

Overall, the automotive wire and cable material market is propelled by advancements in material science and technological innovation, driven by contributions from both established and emerging companies.

Dependence on Diverse Raw Materials

The automotive wire and cable material market faces significant challenges due to its reliance on various raw materials. Essential components like polymers, plastics, and specialized coatings are crucial for manufacturing. Polymers and plastics provide vital insulation and protection against environmental factors such as heat and moisture, ensuring durability and reliability. Specialized coatings enhance wires and cables with features like fire and chemical resistance, affecting performance and safety.

Difficulty in Keeping Up with Technological Advancements

The fast-paced technological evolution in the automotive industry complicates market growth. As vehicles adopt advanced technologies—such as autonomous driving, electrification, and sophisticated sensors—the demand for high-performance wiring solutions increases. This constant need for innovation forces manufacturers to invest heavily in research and development to produce wires and cables that meet the latest automotive standards.

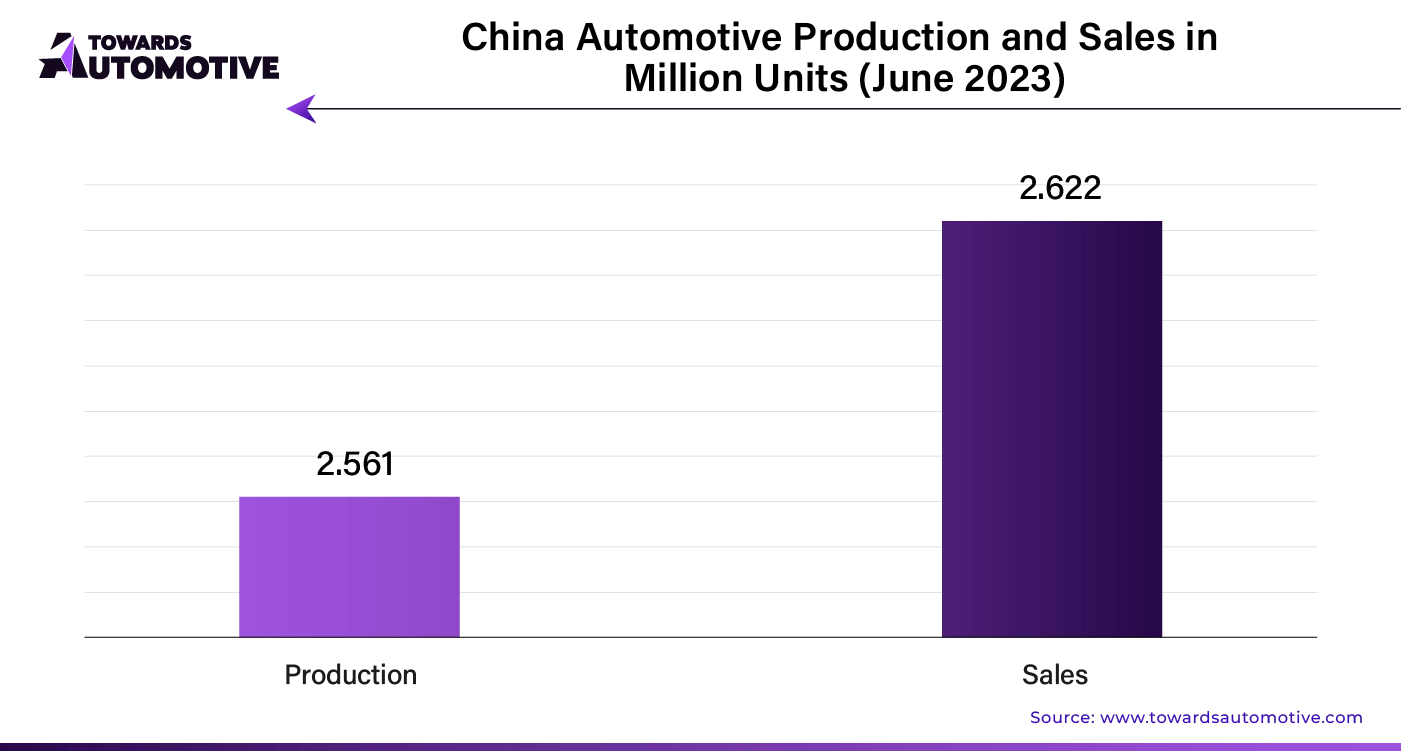

China: Leading the Charge in Automotive Wire & Cable Material Demand

China remains the dominant player in the automotive wire and cable material market, with a projected value of $3,800 million by 2033. The market is growing at a robust CAGR of 6.1%, driven by the country's expanding automotive sector. As China solidifies its global automotive position, the demand for advanced, durable wiring solutions increases, spurred by rising car sales and production.

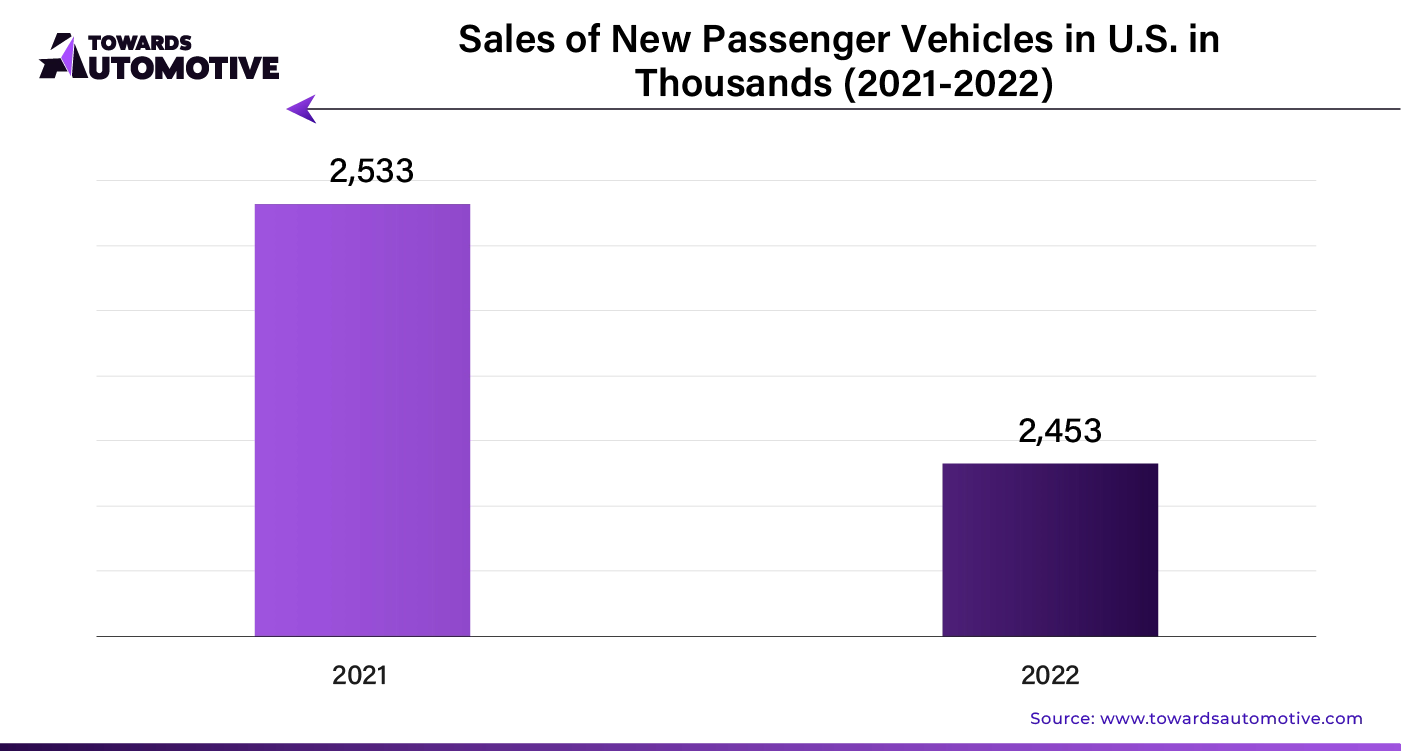

United States: Driving Growth with Electric Vehicle Innovations

In the United States, the automotive wire and cable material market is expected to reach $1,400 million by 2033, growing at a CAGR of 5.8%. The surge in electric and hybrid vehicles, alongside advanced driver-assistance systems (ADAS), fuels this growth. The demand for sophisticated wiring for electric components and safety features propels the market forward.

Japan: A Market Fueled by Domestic Brand Excellence

Japan's automotive wire and cable material market, valued at $640 million by 2033, is expanding at a CAGR of 6.8%. The country's strong domestic automotive brands, such as Sumitomo Electric Industries Ltd. and Yazaki Corporation, drive demand for high-quality wiring solutions. Japan's focus on technology and sustainability enhances its market presence.

Brazil: Rapid Growth Driven by Foreign Investment and Electric Vehicles

Brazil's automotive wire and cable material market is set to grow to $610 million by 2033, with a promising CAGR of 7.2%. The rise in electric and hybrid vehicle production and the country's focus on advanced safety features boost demand. Foreign investment and growing automotive production further stimulate market expansion.

The automotive wire and cable materials market exhibits clear trends in segment growth and dominance. PVC (Polyvinyl Chloride) stands out as the leading material type, with an anticipated Compound Annual Growth Rate (CAGR) of 6.4% from 2023 to 2033. PVC automotive wires are prized for their durability, flexibility, and resistance to moisture, oils, and chemicals, making them highly versatile. These wires offer crucial insulation and protection for automotive electrical cables, contributing to their widespread use. This segment is projected to capture about 48.5% of the market volume in 2023 and is expected to reach a valuation of approximately USD 1,950 million by 2033.

In contrast, passenger vehicles are set to maintain their leading role in the automotive wire and cable materials market. This segment is forecasted to grow at the highest rate, with a CAGR of 7.0% throughout the forecast period. Passenger vehicles constitute a major application area for automotive wires and cables, essential for transferring electrical data and power across various vehicle systems. The rising need for high-performance cable materials in these vehicles, particularly in electric and hybrid models, highlights their importance in supporting critical features such as climate control and charging systems. By 2033, the passenger vehicles segment is projected to achieve a market valuation of USD 8,500 million.

The automotive wire and cable material market is concentrated, with the top players holding around 60% to 65% of the market share. Leading companies focus on cost-effective solutions, benefiting from economies of scale, while others prioritize sustainability by using recycled materials and eco-friendly production methods.

Technological advancements, such as lightweight materials for better fuel efficiency, also differentiate key players. Strategic partnerships with automakers and suppliers enhance market presence, and ongoing research helps companies adapt to regulatory changes and shifting consumer preferences.

By Material Type

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us