April 2025

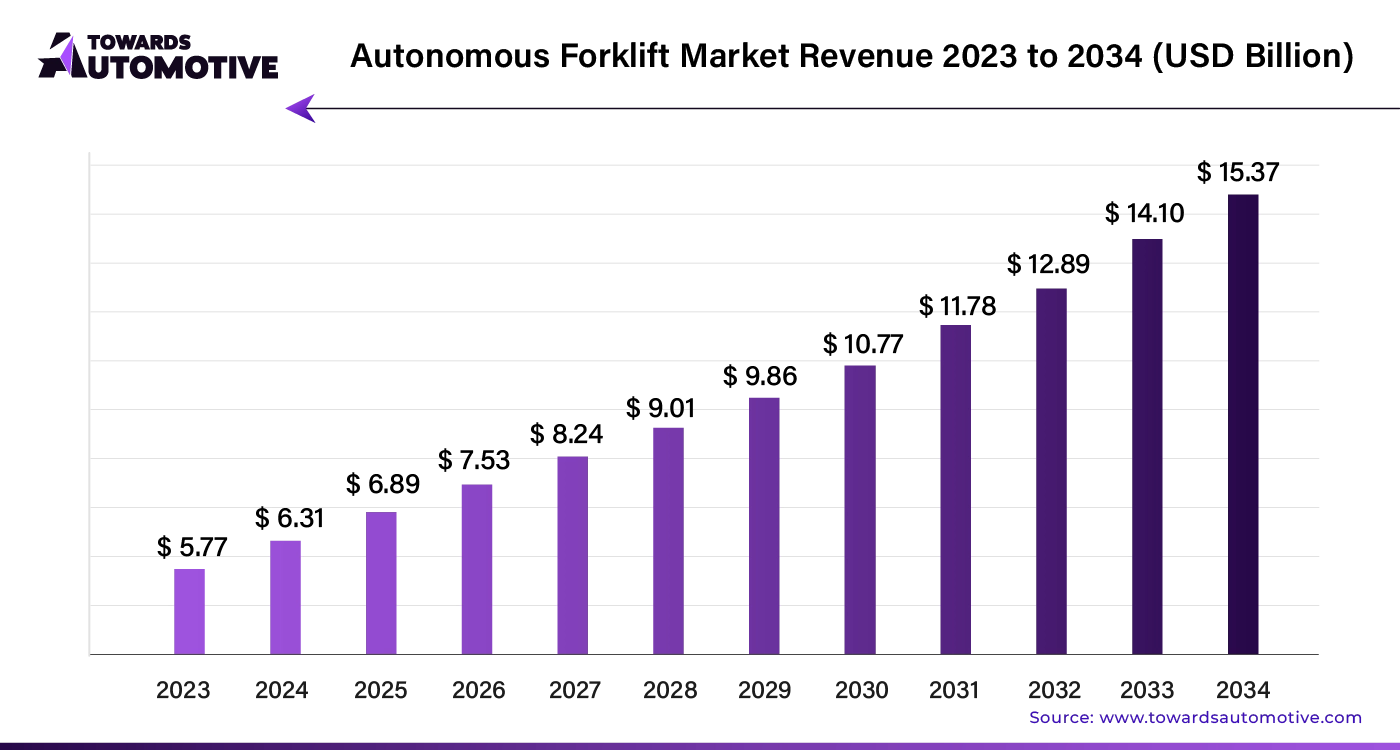

The autonomous forklift market is forecasted to expand from USD 6.89 billion in 2025 to USD 15.37 billion by 2034, growing at a CAGR of 9.2% from 2025 to 2034. In recent years, the autonomous forklift market has experienced significant growth, largely driven by increased automation in manufacturing units.

Unlock Infinite Advantages: Subscribe to Annual Membership

Manufacturing industries across developed and developing nations, including Germany, the United Kingdom, South Korea, and China, are rapidly embracing autonomous forklifts. These advanced machines are revolutionizing warehouse operations by enhancing storage density, optimizing production flows, and significantly reducing labor costs. By automating material handling processes, companies are not only cutting expenses but also improving overall operational efficiency.

In the warehousing and distribution sectors, self-directed forklifts have become indispensable. These industries are leveraging autonomous forklifts to streamline the loading and unloading of goods, a crucial part of the supply chain. As businesses increasingly prioritize efficient inventory management, these forklifts play a vital role in enhancing supply chain operations. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

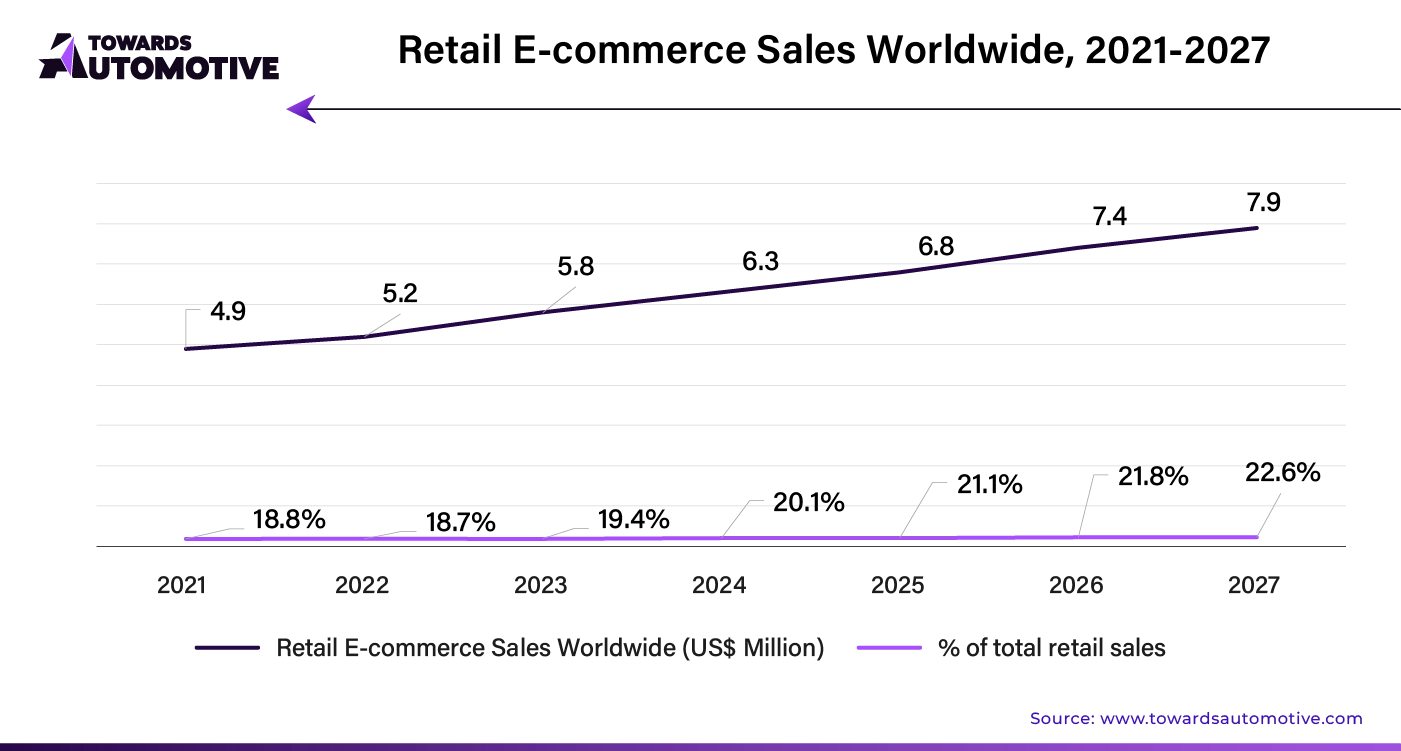

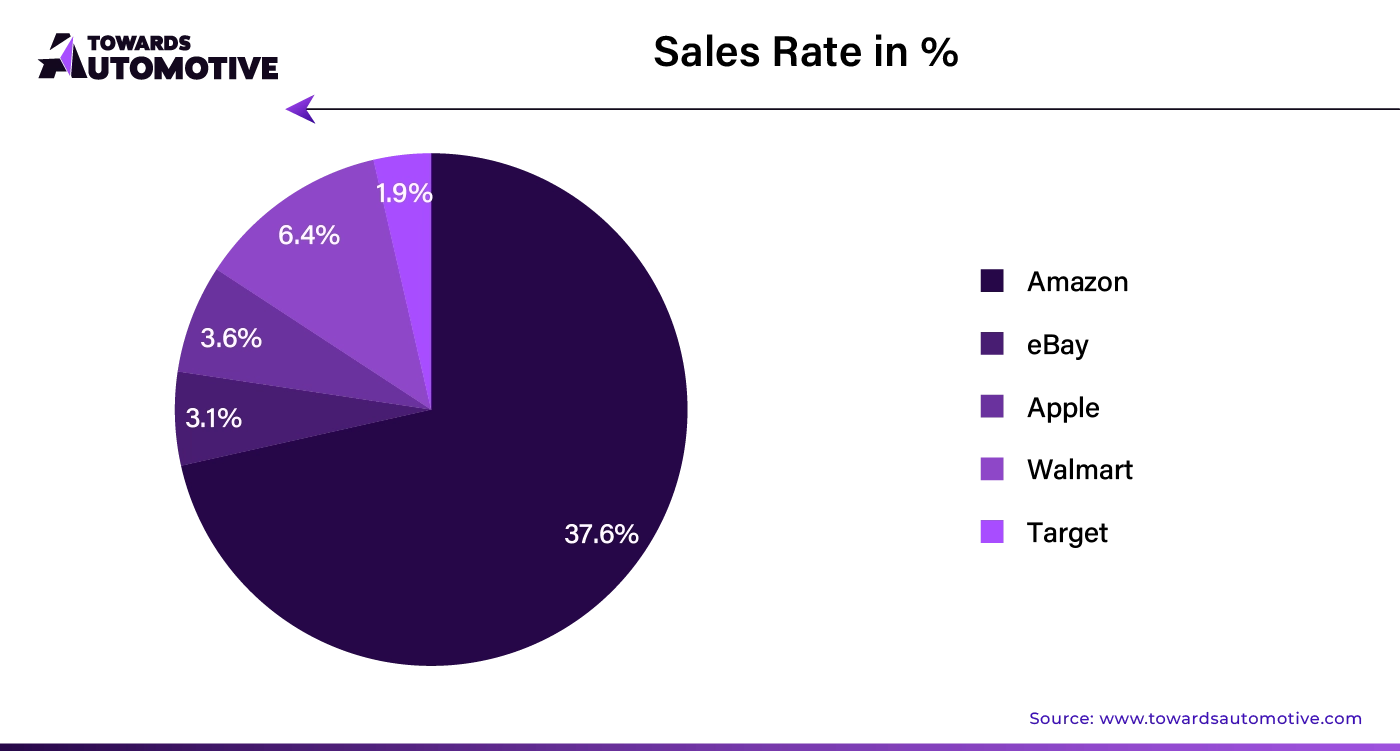

The eCommerce boom in countries like China, the United Kingdom, India, and Japan is a major catalyst driving the growth of the autonomous forklift market. As online shopping continues to grow, the need for faster and more efficient warehousing solutions has never been greater. Autonomous forklifts are meeting this demand by providing a seamless, automated solution for managing large volumes of goods.

The automotive industry, particularly in countries renowned for their automotive manufacturing such as South Korea, Japan, and Germany, is also experiencing a surge in demand for autonomous forklifts. These forklifts are essential in streamlining material handling within manufacturing plants and warehouses, contributing to increased productivity and efficiency.

Even in the food and beverage industry, autonomous forklifts are gaining traction. They are being used to safely and efficiently handle and transport goods, ensuring that operations run smoothly in a sector where precision and hygiene are paramount.

A key factor driving the adoption of autonomous forklifts is the integration of collaborative robots, or cobots. These robots are designed to work alongside human operators, enhancing flexibility and productivity in dynamic warehouse environments. As engineering and technology continue to advance, the collaboration between humans and cobots promises to further increase industrial efficiency, paving the way for even greater adoption of autonomous forklifts in the future.

The widespread adoption of autonomous forklifts is not just a trend; it represents a significant shift in how industries operate, driving efficiency, reducing costs, and enabling businesses to stay competitive in a fast-paced global market.

AI and Advanced Sensor Technology Boost Autonomous Forklift Adoption

In recent years, the integration of artificial intelligence (AI) and advanced sensor technology has revolutionized the design and functionality of autonomous forklifts. These cutting-edge innovations have significantly enhanced the capabilities of forklifts, driving their widespread adoption across various industrial sectors. As a result, businesses are increasingly relying on autonomous forklifts to streamline operations, improve safety, and boost overall efficiency.

AI and Machine Learning: Transforming Forklift Operations

The marriage of AI and machine learning algorithms with autonomous forklifts has been a game-changer for industries. These intelligent machines are now capable of learning and adapting to their operational environments in real-time. By processing data from their surroundings, they can make informed decisions, optimize workflows, and enhance safety measures. This technological leap allows companies to reduce human error, minimize downtime, and achieve higher levels of productivity.

Industry 4.0 and the Rise of Autonomous Forklifts

The global push towards Industry 4.0 has further accelerated the adoption of autonomous forklifts. In both developed and emerging economies, these smart machines are becoming indispensable tools in manufacturing and logistics operations. European countries like Germany and Italy, where the automotive industry is a dominant force, are leading the charge in integrating autonomous forklifts into their production lines and supply chains. This shift is not only improving operational efficiency but also enabling companies to stay competitive in a rapidly evolving market.

Challenges for Small Businesses: High Upfront Costs

Despite the numerous benefits of autonomous forklifts, the high initial investment required to acquire them remains a significant barrier, particularly for small businesses. The cost of purchasing these advanced machines, coupled with the expense of hiring or training skilled professionals to operate and maintain them, can be prohibitively expensive for companies with limited financial resources. As a result, many small-scale enterprises are hesitant to invest in this technology, despite the long-term gains it promises. This financial hurdle continues to slow the adoption of autonomous forklifts on a global scale, particularly among smaller businesses.

The supply chain in the autonomous forklift market will function efficiently by leveraging advanced technologies and strategic partnerships. Manufacturers will begin by sourcing high-quality sensors, AI systems, and batteries from trusted suppliers. These components will be assembled into forklifts, ensuring each machine meets the highest standards of safety and performance.

Once assembled, the autonomous forklifts will be tested rigorously before being distributed to warehouses and distribution centers globally. Logistics companies will then handle the transportation, using real-time tracking systems to monitor shipments and ensure timely deliveries.

Upon arrival, customers will integrate these forklifts into their operations, enhancing productivity and reducing labor costs. Maintenance and software updates will be managed through a network of service providers, ensuring the forklifts remain operational with minimal downtime. Data collected from the forklifts in operation will be analyzed to optimize supply chain efficiency further.

In summary, the supply chain in the autonomous forklift market will rely on a seamless flow of information, robust partnerships, and continuous innovation to meet the growing demand for automation in material handling. This approach will result in a responsive, agile supply chain capable of adapting to market needs.

Rising trend of Online Shopping has risen the demand of the autonomous forklift which is estimated to drive the growth of the autonomous forklift market over the forecast period.

The Autonomous Forklift market thrives on several key components, including advanced sensors, navigation systems, artificial intelligence (AI), and robust software platforms. These elements work together to enable forklifts to operate independently, enhancing efficiency and safety in warehouses and manufacturing facilities.

Leading companies play a vital role in this ecosystem. For example, Toyota Industries integrates cutting-edge AI and machine learning algorithms into its forklifts, allowing for precise navigation and obstacle detection. Caterpillar Inc. focuses on developing rugged, reliable forklifts with advanced automation features, ensuring durability in harsh industrial environments. KION Group leverages its expertise in logistics to offer comprehensive solutions that combine autonomous forklifts with warehouse management systems, optimizing overall operations. Meanwhile, Mitsubishi Logisnext contributes by incorporating IoT (Internet of Things) connectivity, enabling real-time monitoring and predictive maintenance of autonomous forklifts.

These companies, along with others, drive innovation in the Autonomous Forklift market, shaping an ecosystem that is increasingly efficient, safe, and intelligent. Their contributions ensure that autonomous forklifts become integral to modern logistics and manufacturing processes, paving the way for a future where automation dominates material handling.

The autonomous forklift industry is evolving rapidly, driven by advancements in technology and the increasing demand for efficient material handling solutions. The industry can be broadly categorized based on tonnage, type, navigation system, sales channel, and application. Among these, two segments are particularly noteworthy: medium-sized autonomous forklifts (based on tonnage) and indoor forklifts (based on type). Here’s a closer look at the trends driving growth in these categories.

Growing Popularity of Medium-Sized Autonomous Forklifts

Autonomous forklifts are typically segmented into three categories based on their lifting capacity: less than 5 tons, 5 to 10 tons, and more than 10 tons. Among these, medium-sized forklifts, with a capacity ranging from 5 to 10 tons, have emerged as a dominant segment in the market. As of 2024, these forklifts account for approximately 36.4% of the market share.

| Segment: | 5 to 10 Tons (Tonnage) |

| Value Share (2024): | 36.4% |

The growing preference for medium-sized autonomous forklifts can be attributed to their ability to strike a perfect balance between lifting capacity and maneuverability. These forklifts are versatile, making them ideal for various applications across different industries, from manufacturing and logistics to retail and warehousing.

Their design enables them to handle substantial loads while maintaining the agility required to navigate efficiently through warehouse environments. This combination of strength and flexibility has made them a preferred choice for businesses looking to optimize their material handling operations.

High Demand for Indoor Autonomous Forklifts

When it comes to the type of autonomous forklifts, they are generally classified into indoor and outdoor variants. The indoor segment, designed specifically for use within enclosed spaces such as warehouses, distribution centers, and manufacturing facilities, has seen significant demand. In 2024, indoor autonomous forklifts are estimated to hold a market share of around 68.5%.

| Segment: | Indoor (Type) |

| Value Share (2024): | 68.5% |

The increasing demand for indoor forklifts is largely driven by their ability to operate with precision in tight and confined spaces. These forklifts are engineered to maneuver through narrow aisles and tight corners, minimizing the risk of accidents and damage to goods and infrastructure. Their precision and safety features make them indispensable in environments where space is at a premium and operational efficiency is critical.

Moreover, the rising trend of automation in warehousing and distribution, coupled with the need for efficient inventory management, has further propelled the demand for indoor autonomous forklifts. As businesses continue to seek ways to enhance productivity and safety, the adoption of these forklifts is expected to grow steadily.

As industrialization accelerates across Asia and other parts of the world, strategic government investments are playing a pivotal role in modernizing industries and driving the adoption of advanced technologies. This trend is particularly evident in countries like South Korea, India, Japan, the United States, and the United Kingdom, where the autonomous forklift market is poised for significant growth over the next decade.

South Korea: Strong Manufacturing Sector Fuels Autonomous Forklift Growth

South Korea is emerging as a key player in the autonomous forklift market, with a projected CAGR of 9.7% from 2024 to 2034. The country's robust manufacturing sector—particularly in automotive, electronics, and shipbuilding—has been a major driver of this growth. These industries demand advanced solutions to enhance productivity, efficiency, and competitiveness. In response, the South Korean government has launched initiatives like the 'Smart Factory' program, which promotes the adoption of autonomous forklifts as a means to modernize production processes. As these initiatives gain traction, the demand for autonomous forklifts in South Korea is expected to rise substantially.

India: Rapid Industrialization and Infrastructure Development Drive Demand

India is also set to experience substantial growth in the autonomous forklift market, with a forecasted CAGR of 9.5% through 2034. The country's rapid industrialization, coupled with significant infrastructure development, is fueling demand for advanced material handling solutions. The Indian government’s focus on modernizing its industrial base and improving logistics efficiency has led to increased investments in automation, including autonomous forklifts. This trend is expected to continue as businesses seek to optimize operations and reduce labor costs, further boosting the market for autonomous forklifts in India.

Japan: Technological Advancements and Aging Workforce Create Opportunities

Japan, known for its technological prowess, is projected to see its autonomous forklift market grow at a CAGR of 9.4% over the next decade. The country faces unique challenges, such as an aging workforce, which is driving the adoption of automation technologies in various industries. Japan’s strong focus on innovation and its early adoption of robotics in manufacturing and logistics have positioned it as a leader in the autonomous forklift market. As the country continues to innovate and address its labor shortages, the demand for autonomous forklifts is expected to rise significantly.

United States: eCommerce Boom and Technological Innovation Propel Market Growth

In the United States, the autonomous forklift market is expected to grow at a CAGR of 8.8% from 2024 to 2034. The U.S. is home to some of the world’s most advanced robotics companies, which continually drive innovation in autonomous forklift technologies. The widespread availability of these forklifts, coupled with the rapid expansion of eCommerce, has led to increased demand in warehouses, storage facilities, and factory outlets. As the eCommerce sector continues to grow, so too will the need for efficient and automated material handling solutions, making the U.S. a key market for autonomous forklifts.

United Kingdom: Modernization of Warehousing Sector Boosts Demand

The United Kingdom is positioned as one of the most lucrative markets for autonomous forklifts in Europe, with an anticipated CAGR of 9.4% through 2034. The country’s warehousing sector has undergone significant modernization in recent years, driven by its proximity to technologically advanced nations like Germany and Italy. The focus on automation and reducing labor dependency has made autonomous forklifts essential for companies looking to enhance operational efficiency. As a result, the U.K. has become one of the largest consumers of autonomous forklifts globally, with demand expected to continue growing in the coming years.

Several key players in the autonomous forklift market are fiercely competing for global dominance. These companies, with their extensive experience and long-standing presence in the industry, have built a loyal customer base that spans continents.

Their marketing reach extends beyond borders, allowing them to make significant inroads into developing and underdeveloped regions. By collaborating with local manufacturers, they are effectively transferring their cutting-edge products and technologies to these markets. This strategic approach not only expands their global footprint but also helps them to cater to the unique needs of these regions.

These industry developments highlight the rapid advancements and strategic maneuvers in the autonomous forklift market as companies vie for leadership in this transformative sector.

By Tonnage

By Navigation Technology

By Type

By Sales Channel

By Application

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us