March 2025

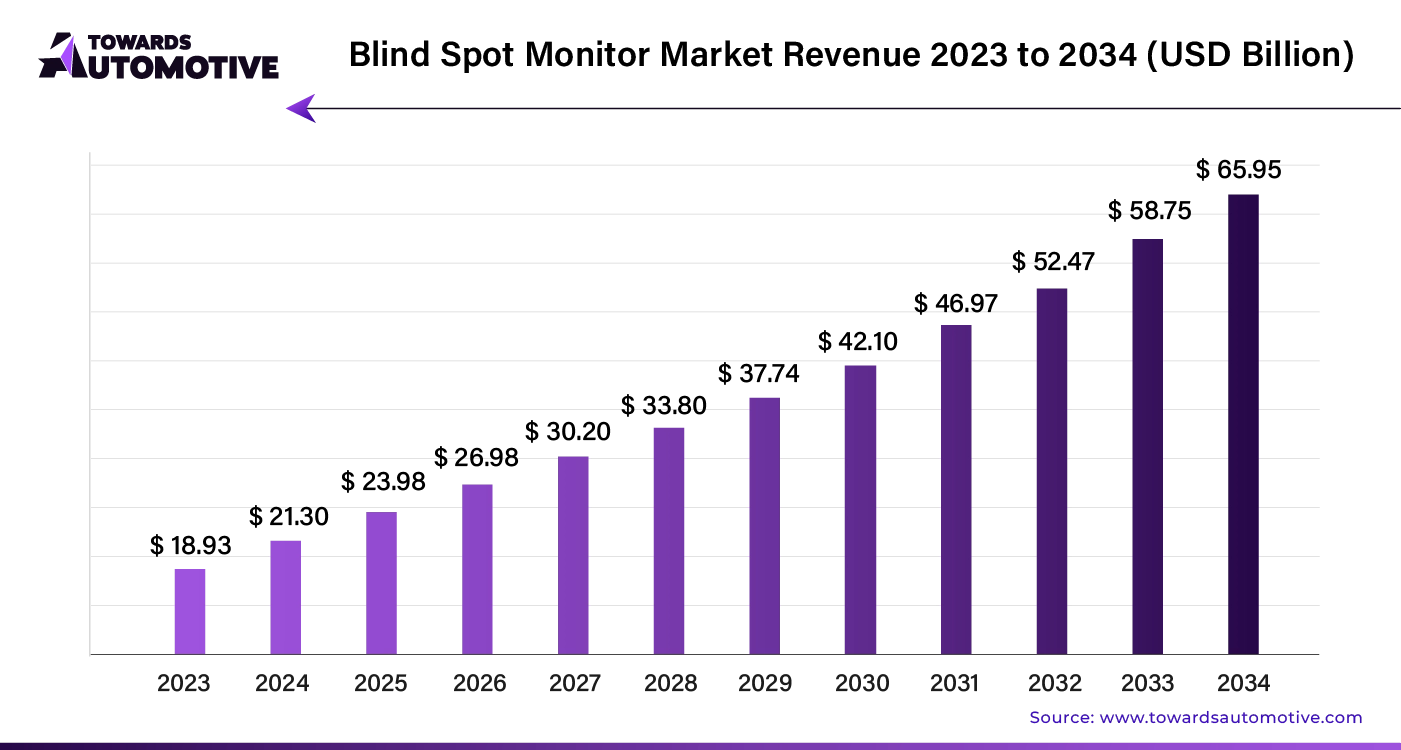

The global blind spot monitor market size is calculated at USD 21.30 billion in 2024 and is expected to be worth USD 65.95 billion by 2034, expanding at a CAGR of 12.5% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Demand for premium vehicles is driving growth in the blind spot monitor market. Rising government investments and the integration of automation and active safety systems are further boosting sales. Increased road safety concerns, the deployment of advanced sensor technology, and the development of multi-camera systems are contributing to this growth. Leading automakers are also installing advanced blind spot monitors in self-driving vehicles.

The rising adoption of connected vehicle technology, which provides real-time data on nearby vehicles to prevent blind spot accidents, is enhancing blind spot monitoring systems. Stringent government regulations aimed at improving vehicle safety are driving the increased use of blind spot monitors. Additionally, growing consumer demand for vehicles with blind spot monitoring features is fueling market growth, particularly in the Asia Pacific region. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

img

Artificial Intelligence (AI) is transforming the Blind Spot Monitor (BSM) market by driving significant advancements in safety and performance. AI-powered systems enhance BSMs through superior object detection and real-time decision-making capabilities. By utilizing machine learning algorithms, these systems can analyze data from multiple sensors with greater accuracy, reducing false alerts and improving driver safety.

AI integration allows for adaptive learning, meaning BSM systems can evolve based on driving patterns and environmental changes. This continuous improvement leads to more reliable performance and quicker response times, further boosting market demand. Additionally, AI enhances the system’s ability to identify and categorize objects in various weather conditions, making BSMs more versatile and effective.

The increased safety benefits and technological advancements offered by AI are attracting major automotive manufacturers, thereby fueling market growth. As AI technology becomes more sophisticated, it will likely reduce costs and expand the adoption of BSM systems across different vehicle segments. Overall, AI is set to revolutionize the Blind Spot Monitor market, driving innovation and growth.

In the Blind Spot Monitor (BSM) market, the supply chain plays a crucial role in delivering high-quality products efficiently. The process begins with raw material procurement, where suppliers provide essential components such as sensors and microprocessors. These materials are then transported to manufacturing facilities, where they undergo assembly and rigorous testing to ensure they meet industry standards.

Manufacturers focus on optimizing production lines to enhance efficiency and reduce lead times. They coordinate closely with component suppliers to manage inventory levels, preventing shortages or overstock situations. After assembly, the finished BSM units are subjected to final quality checks before being distributed to wholesalers and retailers.

Logistics companies handle the transportation of products from manufacturers to distribution centers and ultimately to end-users. This phase involves managing shipping routes, tracking deliveries, and ensuring timely arrival. The integration of advanced tracking technologies helps in monitoring shipments and mitigating delays.

Efficient supply chain management in the BSM market ensures that products are available to consumers promptly while maintaining high standards of quality and reliability. This streamlined approach not only enhances customer satisfaction but also boosts market competitiveness.

The Blind Spot Monitor (BSM) market ecosystem comprises several key components, each playing a vital role in enhancing vehicle safety. The primary components include sensors, cameras, and alert systems. Sensors, such as radar or ultrasonic devices, detect vehicles in the blind spots. Cameras provide visual feedback to the driver, while alert systems use visual or auditory signals to warn of potential dangers.

Major companies contribute significantly to this ecosystem. Bosch and Continental lead in developing advanced radar and camera technologies, improving detection accuracy and system reliability. Denso specializes in integrating these technologies into vehicle control systems, enhancing overall performance. Valeo focuses on creating user-friendly alert systems that ensure timely driver notifications. Aptiv excels in integrating BSM technology with vehicle electronics and connectivity features, advancing system intelligence.

In addition, Magna International and Harman contribute to improving the software and data processing aspects of BSM systems, ensuring seamless operation and integration with other safety features. These companies collectively drive innovation and quality in the Blind Spot Monitor market, enhancing vehicle safety and driver confidence.

As governments implement stricter traffic safety regulations, various automotive safety technologies are experiencing growth. The Automotive ADAS (Advanced Driver Assistance Systems) market leads with a notable CAGR of 12.5% from 2024 to 2034. This growth is driven by ongoing innovations from manufacturers to keep ADAS systems relevant.

Blind Spot Monitor Market:

CAGR (2024 to 2034): 11.8%

Automotive Active Safety System Market:

CAGR (2024 to 2034): 11%

Automotive ADAS Market:

CAGR (2024 to 2034): 12.5%

The blind spot monitor industry is experiencing notable growth across several countries, including the United States, the United Kingdom, China, Japan, and South Korea. Here’s a summary of the projected growth rates and market dynamics driving this expansion:

| Growth Rates by Country (2024 to 2034) | |

| United States | 12.40% |

| United Kingdom | 13.20% |

| China | 12.60% |

| Japan | 13.60% |

| South Korea | 14.10% |

United States: Strong Growth Driven by Safety Initiatives

In the United States, the blind spot monitor market is expected to reach $12 billion by 2034, growing at a rate of 12.4% CAGR. Key factors fueling this growth include:

United Kingdom: Robust Expansion with Focus on Safety Features

The UK market is projected to grow at 13.2% CAGR, reaching $2.8 billion by 2034. Drivers of this growth include:

China: Electrification Boosts Market Demand

In China, the blind spot monitor market is forecasted to reach $10.5 billion by 2034, growing at 12.6% CAGR. Key growth drivers are:

Japan: High Growth Driven by Advanced Technologies

Japan’s market is set to grow at 13.6% CAGR, reaching $7.5 billion by 2034. Contributing factors include:

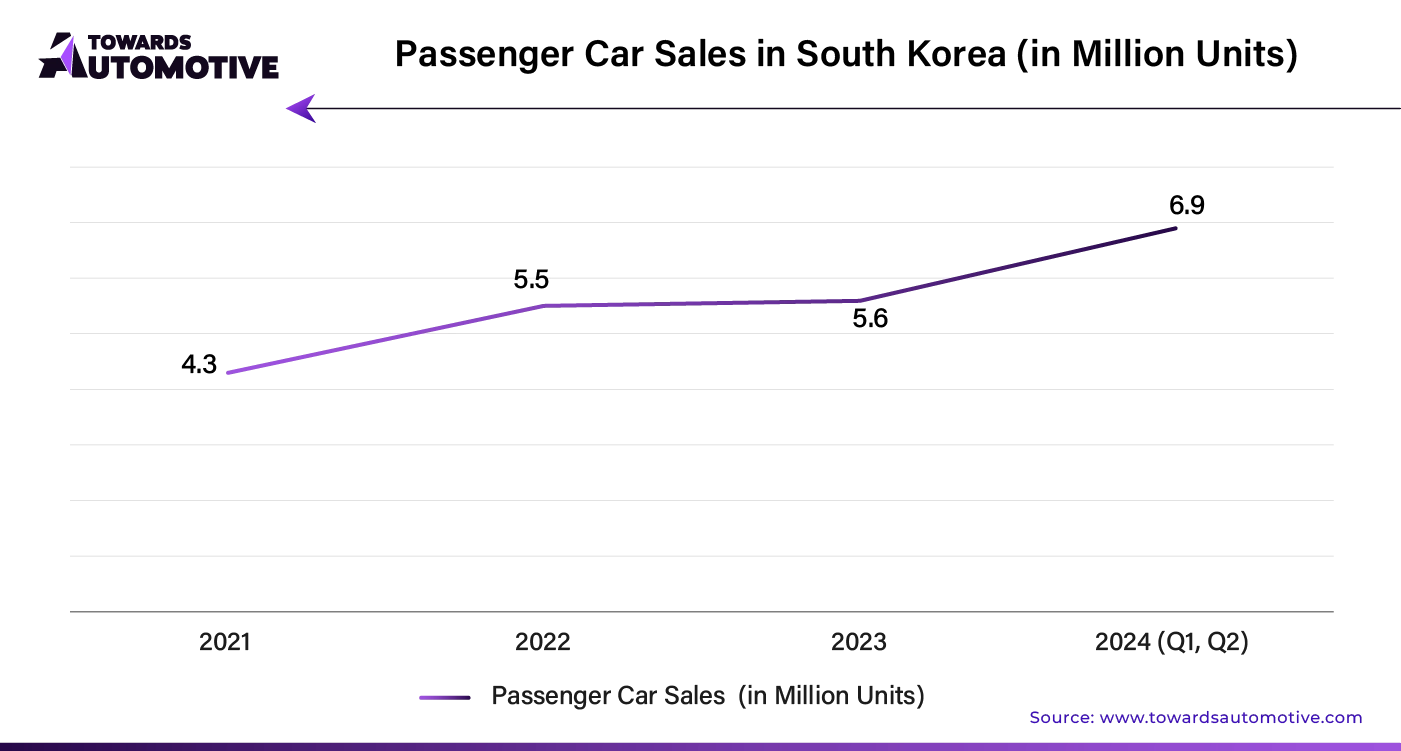

South Korea: Leading Growth with Technological Advancements

South Korea is projected to see the highest growth rate of 14.1% CAGR, with the market reaching $4.3 billion by 2034. Factors driving this growth include:

Passenger Cars: Market Leader

| Top Vehicle Type | Passenger Cars |

| Market Share in 2024 | 11.5% |

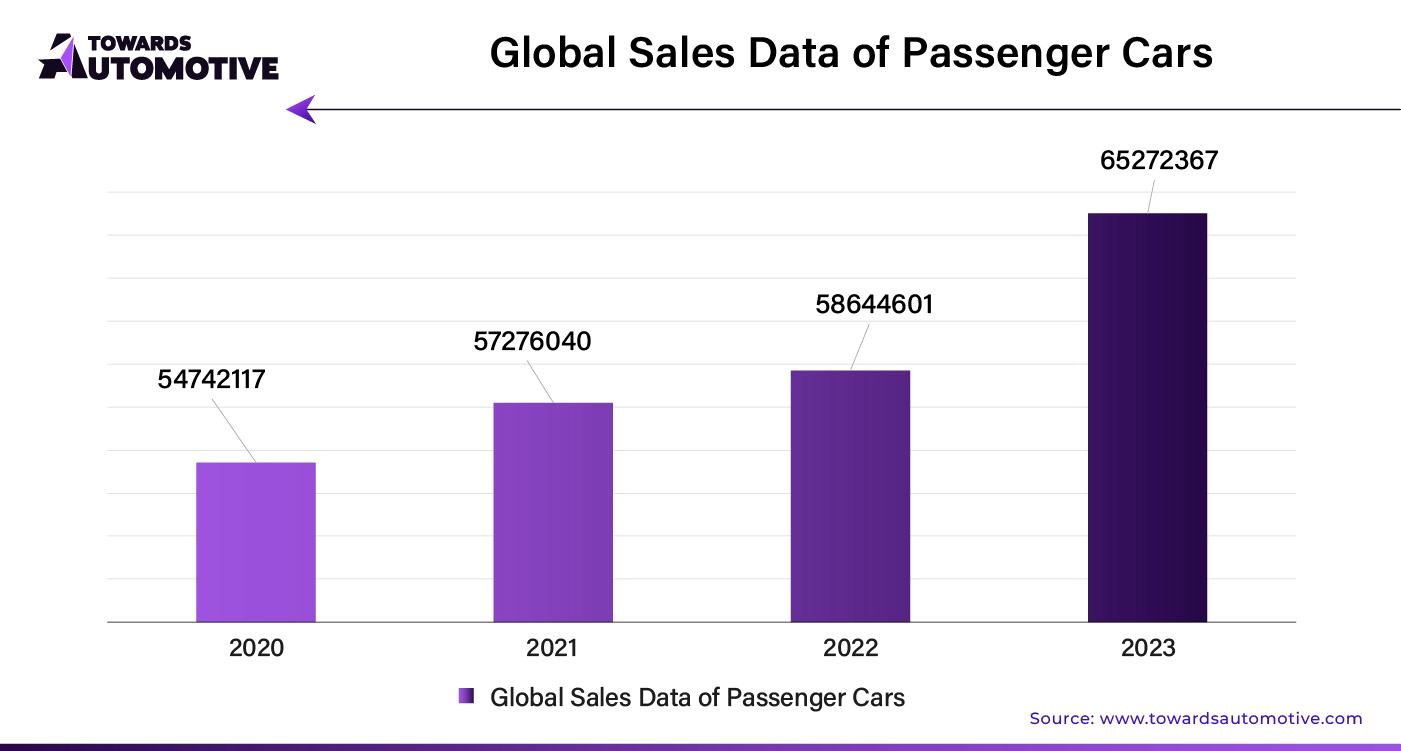

Passenger cars are at the forefront of the blind spot monitor market. This dominance stems from stringent safety regulations mandating driver assistance systems, growing production and demand for passenger cars, and ongoing technological advancements. Automakers are heavily investing in research and development, which makes blind spot detection systems more affordable and adaptable.

Ultrasonic Components: Rapid Growth

| Top Component Type | Ultrasonic |

| Market Share in 2024 | 11.7% |

| Estimated CAGR | 11.5% through 2034 |

Ultrasonic components are showing significant growth. Their cost-effectiveness compared to cameras and RADAR, strong performance in various weather conditions, and ease of integration into existing vehicle systems contribute to their rising popularity. Although their CAGR has slightly decreased from 17.4% previously, they continue to be highly favored.

The blind spot monitor market is highly competitive, with established giants leveraging their long-standing reputation. New entrants can adopt several strategies to gain a stronger foothold:

By Component Type

By Sales Channel

By Vehicle Type

By Region

March 2025

March 2025

February 2025

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us