October 2025

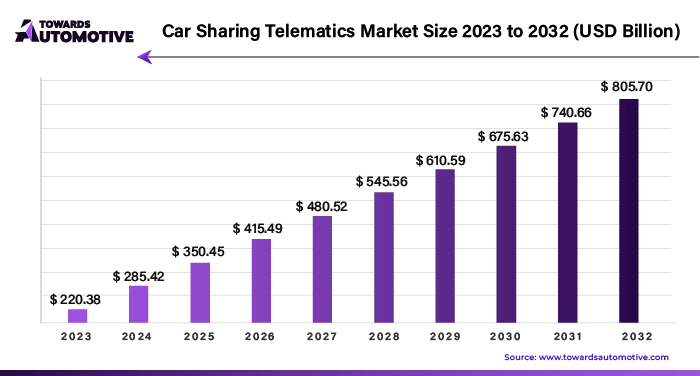

The global car sharing telematics market is projected to reach USD 854.01 million by 2034, growing from USD 348.55 million in 2025, at a CAGR of 10.47% during the forecast period from 2025 to 2034.

The car sharing telematics sector denotes the application of telematics technology in car sharing services. Car sharing offers the opportunity to minimize fleet expenses, promote the adoption of electric vehicles, enhance environmental conservation by decreasing CO2 emissions, and expand car accessibility to additional urban regions. Moreover, it delivers favorable organizational outcomes by facilitating asset sharing among employees. Telematics integrates telecommunications and information processing, facilitating data transmission across vast distances. The car sharing, telematics technology further facilitates several functions including vehicle tracking, remote diagnostics, fleet management, and user authentication.

The car sharing industry is presently experiencing a growth phase projected to persist in the foreseeable future. Despite a temporary setback due to the COVID-19 pandemic, the market has swiftly rebounded over the past two years. Europe, North America, and Asia-Pacific collectively dominate the landscape of car sharing programs and active participants on a global scale. Leading markets encompass Russia, Germany, Italy, France, South Korea, China, and Japan. Additionally, escalating urbanization and traffic congestion in cities have spurred increased demand for alternative mobility solutions. Car sharing services offer convenient and economical transportation alternatives, with telematics technology amplifying the efficiency and user-friendliness of these services.

The rising demand for mobility solution is anticipated to augment the growth of the car sharing telematics market during the forecast period. The trend of global urbanization is leading to increased population concentrations in urban areas, resulting in higher population densities and more severe traffic congestion. In densely populated cities, owning a personal vehicle may not be practical or affordable due to limited parking availability, high ownership costs, and congested roads. Consequently, urban dwellers are turning to alternative transportation solutions that offer efficiency, affordability, and convenience, thus fueling the demand for mobility solutions such as car sharing.

Furthermore, there is a clear shift in consumer preferences and lifestyles, especially among younger demographics such as Millennials and Generation Z. These generations prioritize experiences over ownership, preferring access to goods and services rather than owning them outright. Car sharing services align with this preference by providing on-demand access to vehicles without the long-term commitment and financial burden associated with ownership.

The collection and transmission of sensitive data, such as location information and personal details, raise concerns about privacy and security. The interconnected nature of telematics systems makes them susceptible to data breaches and cyberattacks. Malicious actors may exploit vulnerabilities in the system to gain unauthorized access to sensitive information, disrupt operations, or steal valuable data. Data breaches not only compromise user privacy but also inflict financial losses and damage the reputation of car sharing operators. Furthermore, data privacy and security breaches can undermine user trust and confidence in car sharing services. If users perceive that their personal information, such as location data and payment details, is at risk of being compromised or misused, they may hesitate to use car sharing services or opt for alternative transportation options.

Integration with smart city initiatives presents a significant opportunity for the growth of the car sharing telematics market. Smart city initiatives aim to leverage technology and data to improve urban infrastructure, enhance public services, and promote sustainability. Car sharing services equipped with telematics technology can play a vital role in these initiatives by contributing to more efficient transportation systems and reducing traffic congestion.

By integrating with smart city initiatives, car sharing operators can gain access to valuable data and infrastructure resources that support their services. For example, they can collaborate with city authorities to access real-time traffic data, parking availability information, and infrastructure for electric vehicle charging stations. This integration enables car sharing services to optimize their operations, improve fleet management, and enhance the user experience.

The emergence of 5G technology is transforming the functionalities of car-sharing telematics market. 5G networks provide unmatched speed, bandwidth, and minimal latency, enabling smooth communication and data exchange among vehicles, infrastructure, and backend systems. This rapid connectivity facilitates instantaneous monitoring, management, and communication within car sharing fleets, elevating user satisfaction and operational effectiveness. With 5G technology, car sharing services can introduce innovative features like rapid vehicle reservation, high-definition streaming, and immersive user interfaces, positioning themselves for enhanced competitiveness and market distinction.

The software segment held the largest market share of 30.44% in 2023, primarily driven by the innovations in data analytics and connectivity features. Software solutions in the car sharing telematics systems are increasingly leveraging advanced data analytics techniques to derive valuable insights from the vast amount of data collected from vehicles, users, and infrastructure. These analytics capabilities enable car sharing operators to optimize fleet management, improve operational efficiency, and enhance the overall user experience. For example, data analytics algorithms can analyze vehicle usage patterns, predict demand, and optimize fleet distribution to ensure that vehicles are available when and where they are needed most. Additionally, analytics tools can provide actionable insights into user behavior, preferences, and satisfaction levels, enabling operators to tailor their services to meet evolving customer needs.

Embedded segment dominated the market with share of 50.94% and is expected to grow at a CAGR of 3.73% from 2024 to 2033. Embedded telematics systems are integrated directly into the vehicle's hardware and software, providing a seamless and continuous connection to external networks and systems. Unlike aftermarket solutions that rely on external devices or mobile applications, embedded systems offer built-in connectivity that is always active and reliable. This seamless connectivity enables real-time communication between vehicles, operators, and backend systems, facilitating features such as vehicle tracking, remote diagnostics, and over-the-air updates. As a result, embedded vehicles offer enhanced convenience, reliability, and performance compared to other types of telematics solutions.

Asia Pacific dominated the global car sharing telematics market with 38.92% of the share of the total market in 2023 and is likely to continue the same trend during the forecast period. This is attributable to the rapid urbanization and a growing focus on sustainable transportation practices in the region. Asia Pacific is experiencing significant urbanization, with a large portion of the population migrating from rural areas to urban centers in search of better economic opportunities and living standards. As a result, major cities in countries like China, Japan, and India are witnessing explosive population growth and increasing population densities. This rapid urbanization is exacerbating issues such as traffic congestion, air pollution, and limited parking space, creating a strong demand for alternative transportation solutions like car sharing.

North America is likely to witness substantial growth in the car sharing telematics market during the forecast period. There's a growing awareness of environmental issues and a desire to reduce carbon emissions in North America. Telematics technology enables operators to monitor and optimize the environmental impact of their fleets, contributing to sustainability goals and attracting environmentally conscious consumers. Furthermore, North America is a hub for technological innovation, particularly in the automotive and information technology sectors. The development of advanced telematics solutions, including GPS tracking, remote diagnostics, and connectivity features, enhances the functionality and appeal of car sharing services in the region. Technological advancements drive efficiency, convenience, and user satisfaction, making car sharing a compelling transportation option for North American consumers.

The automotive telematics control unit market is projected to reach USD 2,289.23 billion by 2034, growing from USD 979.64 billion in 2025, at a CAGR of 13.94% during the forecast period from 2025 to 2034.

Automotive Telematics Control Units (TCUs) serve as the brain behind connected car technologies, enabling vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-everything (V2X) communications. TCUs integrate various components and functions, including GPS navigation, wireless connectivity (such as 4G/5G, Wi-Fi, Bluetooth), sensors, processors, and software algorithms, to deliver a wide range of telematics services and functionalities.

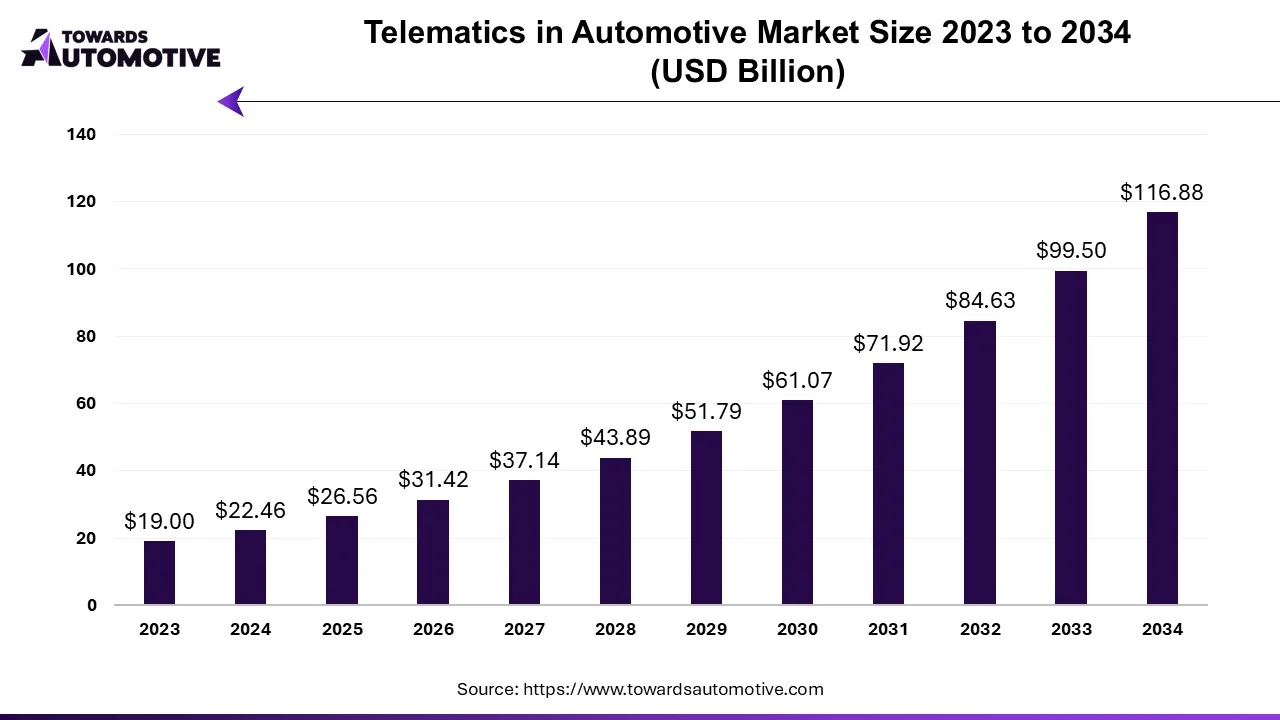

The telematics in automotive market is anticipated to grow from USD 26.56 billion in 2025 to USD 116.88 billion by 2034, with a compound annual growth rate (CAGR) of 18.23% during the forecast period from 2025 to 2034.

The telematics in automotive market is a prominent segment of the fleet management industry. This industry deals in developing telematics solutions for tracking automotives. There are several types of telematics solutions developed in this sector consisting of embedded telematics, integrated telematics, tethered telematics and some others. These solutions are based on different systems including driving assistance system, telematics control unit, global positioning system, vehicle tracking system, vehicular emergency warning and some others.

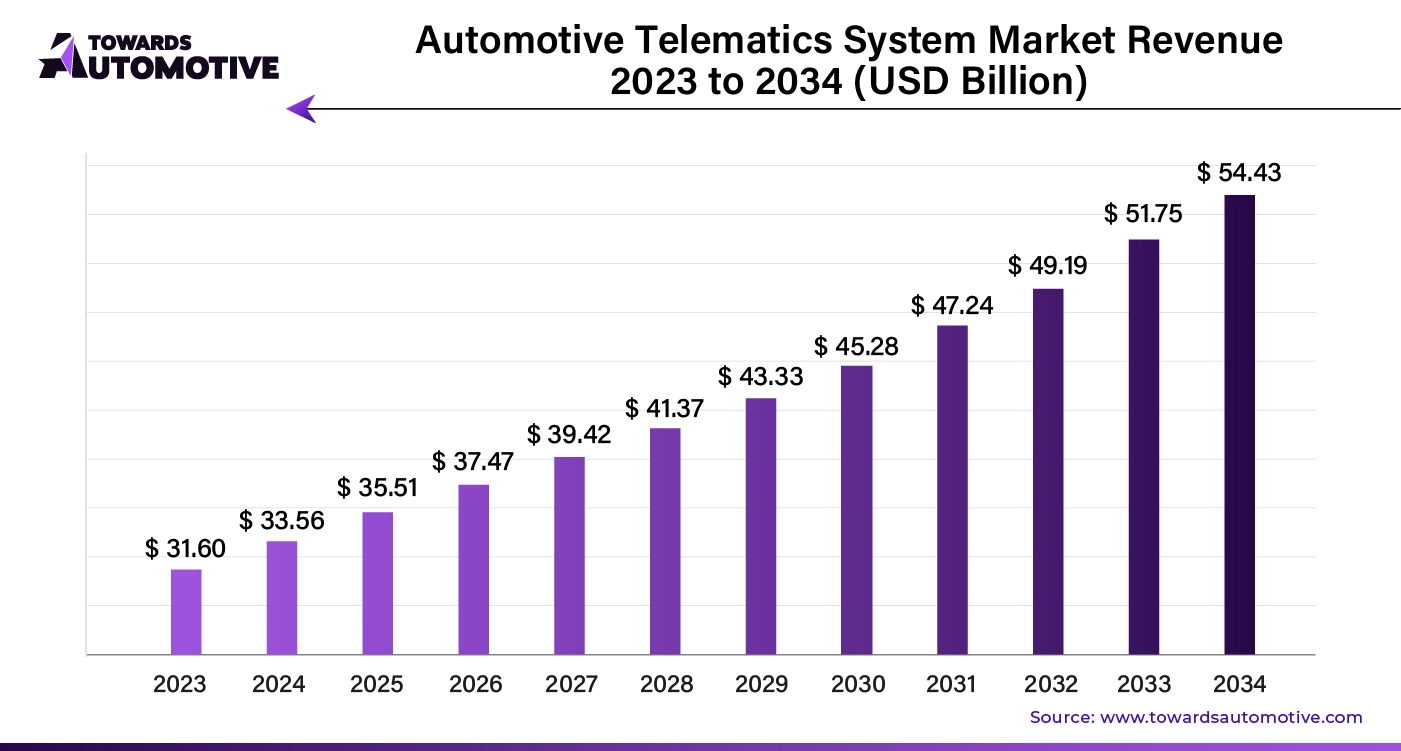

The global automotive telematics system market is expected to increase from USD 35.51 billion in 2025 to USD 54.43 billion by 2034, growing at a CAGR of 5.04% throughout the forecast period from 2025 to 2034.

The automotive telematics system market is experiencing rapid growth driven by advancements in connected vehicle technology and increasing demand for enhanced vehicle safety, navigation, and communication systems. Telematics systems combine telecommunications and informatics to provide real-time data, enabling features such as vehicle tracking, remote diagnostics, and emergency assistance

Some of the key players in car sharing telematics market are Cal/Amp, Geotab Inc., Octo Group S.p.A, INVERS GmbH, Samsara Inc., Ridecell, Inc, Verizon and Vulog, among others.

By Component

By Service

By Form

By Business Model

By Region

October 2025

October 2025

September 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us