October 2025

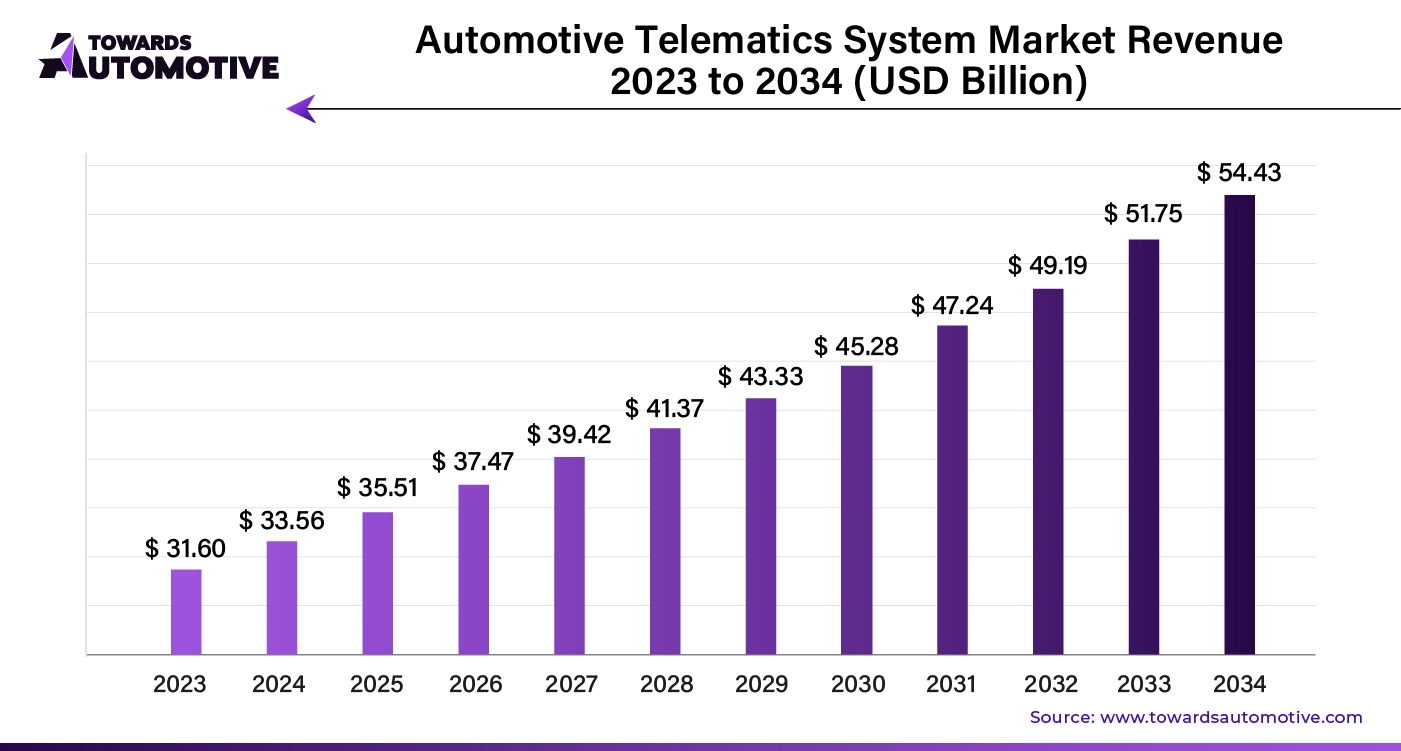

The automotive telematics system market is projected to grow from USD 35.51 billion in 2025 to USD 54.43 billion by 2034 at a CAGR of 5.04 percent. The report provides full segment data by technology type with embedded leading, tethered and integrated as additional categories, by sales channel with OEM leading and aftermarket as the secondary channel, by vehicle type with passenger vehicles holding the largest share and commercial vehicles expanding, and by application including information and navigation, safety and security, fleet management, insurance telematics, and others.

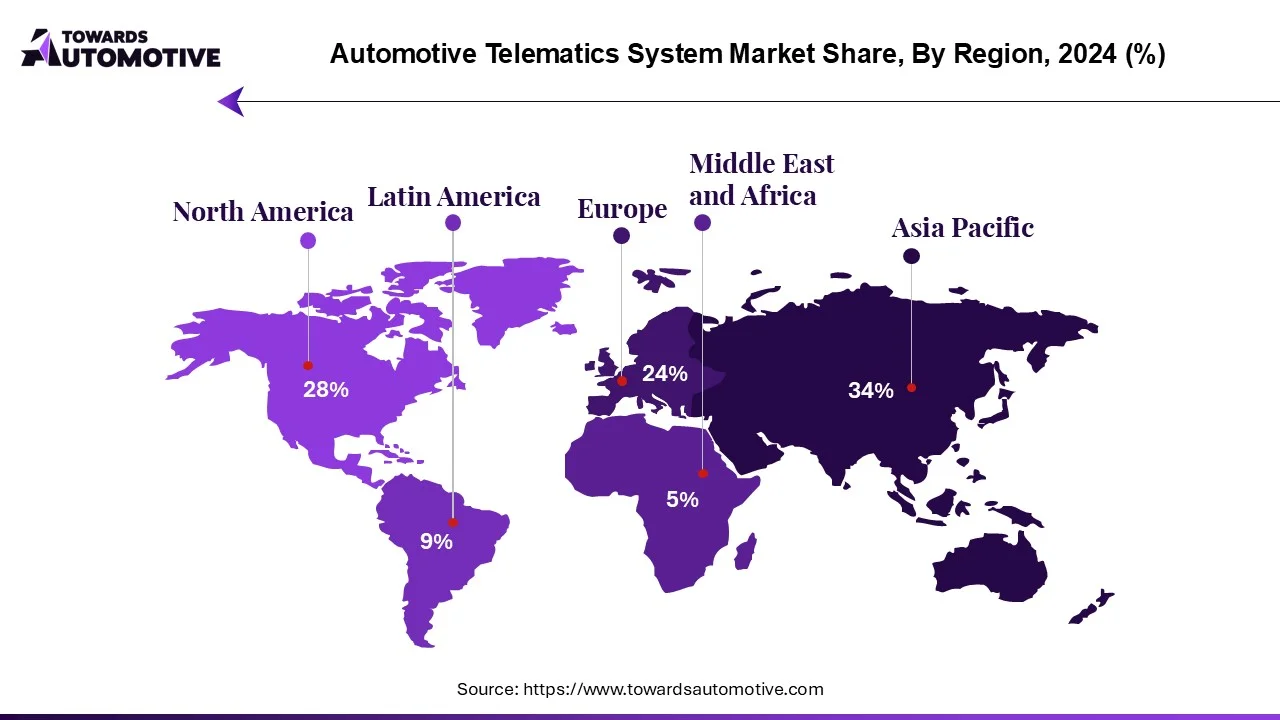

Regional analytics cover North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, with Asia Pacific leading today and North America expected to grow at a significant pace. Company coverage spans Ford Motor Company, Toyota Motor Corporation, Mercedes Benz AG, Volkswagen AG, General Motors, BMW, AB Volvo, Hyundai Motor Company, Tata Motors, and Nissan, with competitive benchmarking on connected services portfolios, partnerships, and over the air capabilities. The study maps the value chain from connectivity silicon and modules through TCU software, cloud and analytics to OEM programs and fleet platforms, adds trade statistics for key hardware and module flows, and includes supplier and integrator mapping across embedded units, eSIMs, antennas, data platforms, cybersecurity and OTA update providers.

The automotive telematics system market is experiencing rapid growth driven by advancements in connected vehicle technology and increasing demand for enhanced vehicle safety, navigation, and communication systems. Telematics systems combine telecommunications and informatics to provide real-time data, enabling features such as vehicle tracking, remote diagnostics, and emergency assistance. Rising consumer preference for in-car connectivity, coupled with stringent government regulations for safety and security, has accelerated the adoption of telematics across passenger and commercial vehicles. The surge in electric vehicles (EVs) and autonomous driving technologies has further bolstered the market, as telematics plays a crucial role in monitoring battery performance, providing software updates, and improving vehicle-to-vehicle communication.

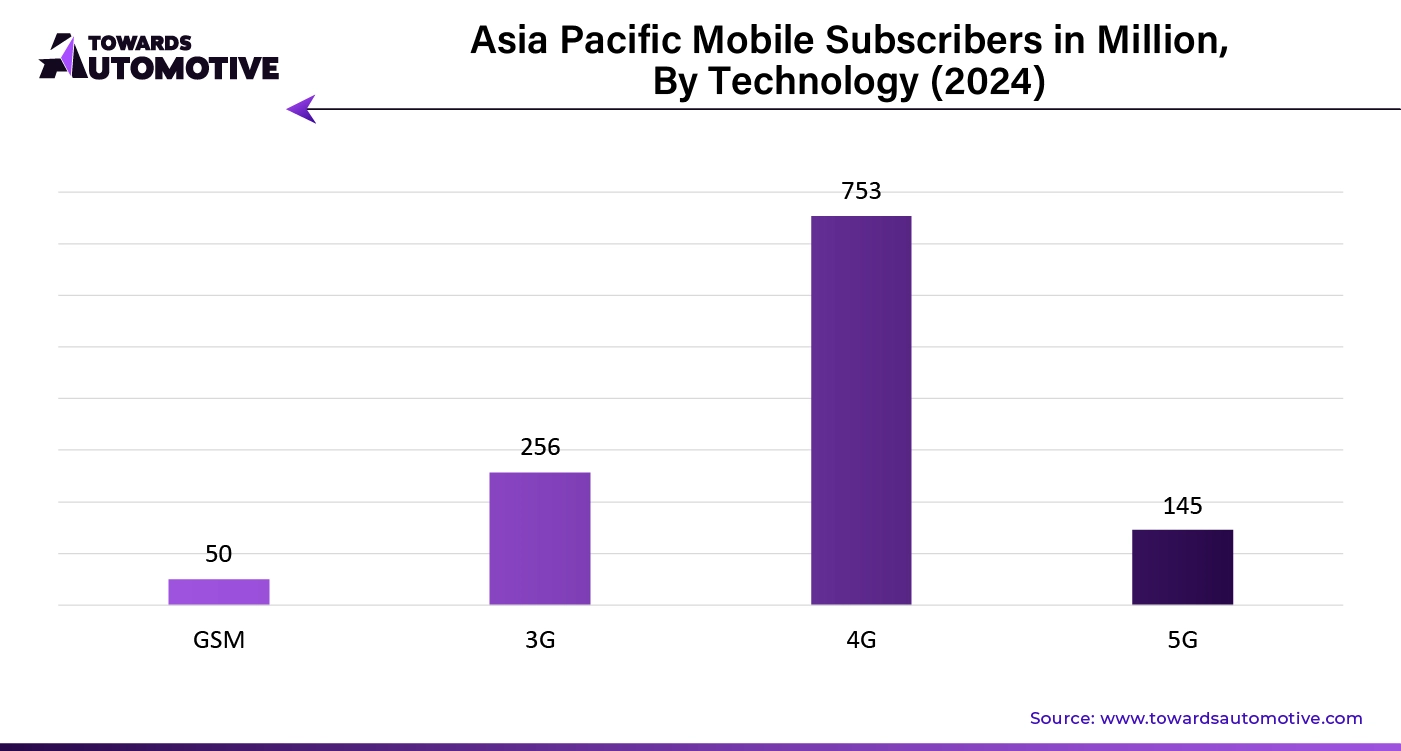

Additionally, fleet management companies are increasingly leveraging telematics solutions to optimize fuel consumption, reduce maintenance costs, and enhance overall operational efficiency. The growing integration of artificial intelligence (AI) and machine learning (ML) into telematics systems has also contributed to the market's evolution by enabling predictive maintenance and advanced driver assistance systems (ADAS). With ongoing innovations in 5G connectivity, the automotive telematics market is poised for continued expansion, particularly in regions like North America, Europe, and Asia Pacific, where the demand for smart mobility solutions is increasing.

The role of Artificial Intelligence (AI) in the automotive telematics system market is transformative, driving the development of more intelligent, responsive, and efficient telematics solutions. AI enhances telematics systems by enabling real-time data processing and decision-making capabilities, which are crucial for applications like predictive maintenance, fleet management, and advanced driver assistance systems (ADAS). AI-powered telematics can analyze vast amounts of data collected from various vehicle sensors to predict potential issues, such as mechanical failures or maintenance needs, before they occur. This predictive capability helps reduce downtime, optimize vehicle performance, and lower maintenance costs.

In fleet management, AI improves route optimization, fuel efficiency, and driver behavior monitoring, leading to safer driving and cost savings. AI-driven algorithms can assess driving patterns, detect risky behaviors, and provide insights that help fleet managers improve safety protocols. Furthermore, AI enables advanced navigation and real-time traffic management by processing data from connected vehicles and infrastructure to offer optimal routes and reduce congestion.

AI also plays a critical role in the development of autonomous driving features within telematics systems. By integrating AI with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, telematics systems can support self-driving technologies, enhancing road safety and driving efficiency. As AI continues to evolve, it will increasingly enable smarter, more adaptive telematics solutions across the automotive industry.

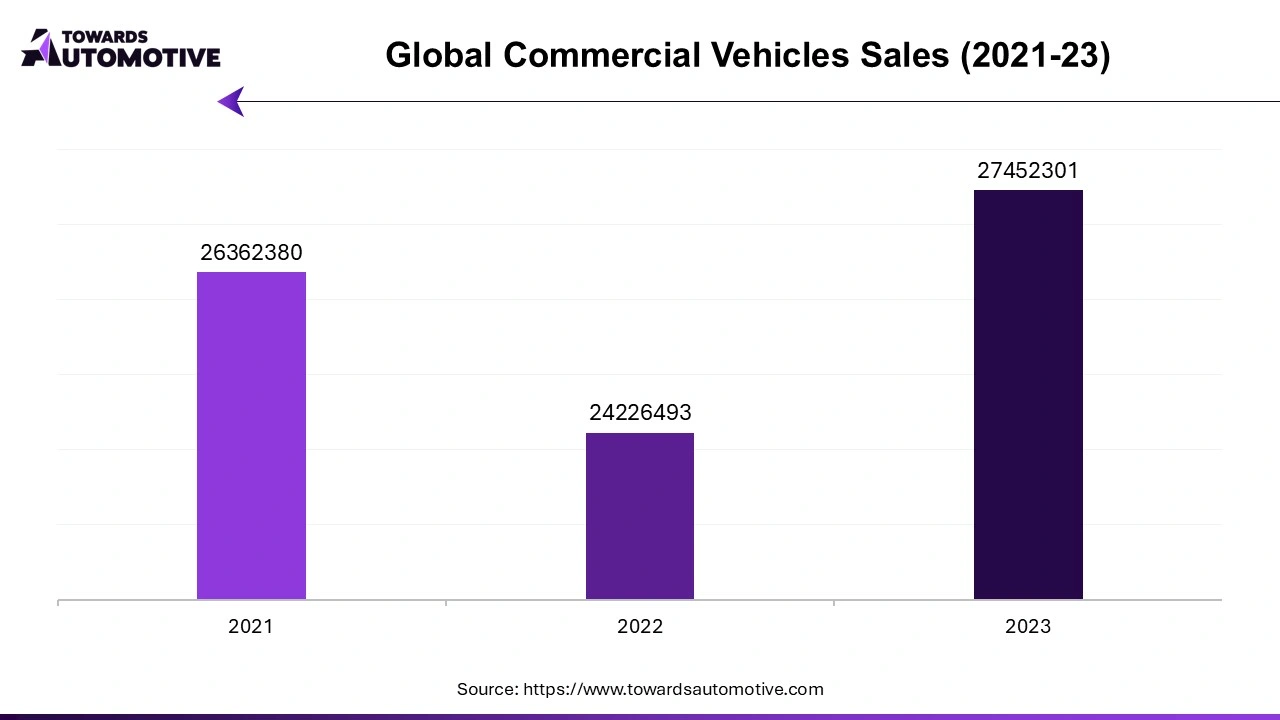

The rising demand for commercial vehicles is significantly driving the growth of the automotive telematics system market. As industries such as logistics, transportation, and construction expand, the need for efficient fleet management and operational optimization has surged. Commercial vehicle operators increasingly rely on telematics systems to monitor vehicle performance, track real-time locations, optimize fuel consumption, and enhance driver safety. The ability to reduce operating costs while ensuring compliance with regulatory requirements, such as electronic logging devices (ELDs) and emissions standards, is a key factor contributing to the adoption of telematics in commercial fleets.

Telematics solutions also offer commercial vehicle operators insights into vehicle maintenance through predictive diagnostics, enabling timely repairs that prevent costly breakdowns. Additionally, telematics helps improve driver behavior by providing data on speeding, harsh braking, and idling, allowing fleet managers to implement training programs that enhance safety and reduce accidents. With the integration of artificial intelligence (AI) and advanced data analytics, telematics systems are becoming even more sophisticated, offering enhanced route optimization, real-time traffic updates, and fuel efficiency monitoring. As demand for commercial vehicles continues to rise globally, especially in sectors like e-commerce and delivery services, the need for advanced telematics solutions is expected to fuel market growth in the coming years.

The automotive telematics system market faces several restraints, including high implementation costs and concerns over data security and privacy. The initial investment in telematics hardware and software can be prohibitive, especially for smaller fleet operators. Additionally, the vast amount of data collected by telematics systems raises concerns about cybersecurity and potential breaches, leading to reluctance in adoption. Regulatory challenges, particularly regarding data protection and compliance with regional standards, also hinder market growth. These factors collectively slow down the widespread integration of telematics technologies in the automotive industry.

The rollout of 5G technology is creating significant opportunities in the automotive telematics system market by enabling faster, more reliable, and low-latency data transmission. With 5G’s ability to handle vast amounts of data at higher speeds, telematics systems can support real-time vehicle-to-everything (V2X) communication, which is crucial for advanced applications like autonomous driving, remote diagnostics, and predictive maintenance. The enhanced connectivity provided by 5G allows telematics systems to process data instantaneously, enabling real-time updates for navigation, traffic management, and route optimization. This not only improves vehicle efficiency but also enhances safety by enabling faster communication between vehicles and infrastructure.

Additionally, 5G’s higher bandwidth allows for more sophisticated telematics features, such as high-definition mapping, augmented reality displays, and enhanced in-car infotainment systems, providing a more immersive and connected driving experience. The ultra-reliable, low-latency capabilities of 5G also facilitate over-the-air (OTA) software updates, allowing automakers to remotely update telematics systems, fix issues, and add new features without requiring physical service. As 5G networks expand globally, they will unlock new opportunities for automotive telematics, particularly in the development of smart cities and autonomous vehicle ecosystems.

The passenger vehicle segment held the largest share of the market. Passenger vehicles are a major driver of growth in the automotive telematics system market, fueled by increasing consumer demand for advanced connectivity, safety features, and real-time vehicle monitoring. Modern drivers expect seamless integration of technology within their vehicles, including navigation, infotainment, and communication systems. Telematics solutions in passenger vehicles cater to these demands by offering a range of features such as real-time traffic updates, GPS navigation, emergency assistance, and remote diagnostics. As automakers strive to meet consumer expectations for smarter and more connected vehicles, the adoption of telematics systems in passenger cars continues to accelerate.

Additionally, telematics enhances vehicle safety through features like automatic crash notification, stolen vehicle tracking, and roadside assistance, which are becoming standard offerings in many new models. Governments across various regions are also imposing stricter safety regulations, requiring the integration of telematics for enhanced vehicle security and crash reporting, further driving market growth.

The rising adoption of electric vehicles (EVs) is another key factor, as telematics plays a critical role in managing battery performance, monitoring charging stations, and optimizing energy use. Moreover, as more vehicles come equipped with advanced driver assistance systems (ADAS), telematics solutions are essential for enabling real-time data processing and communication between vehicles and infrastructure. The growing popularity of connected and autonomous vehicle technologies, coupled with consumer demand for enhanced driving experiences, is propelling the adoption of telematics in the passenger vehicle segment, making it a significant growth contributor to the overall automotive telematics market.

The embedded segment dominated the industry. The embedded segment plays a pivotal role in driving the growth of the automotive telematics system market, as automakers increasingly prioritize integrating telematics systems directly into vehicles at the manufacturing stage. Embedded telematics systems are built into the vehicle's hardware, providing a seamless and reliable connection without the need for external devices like smartphones or third-party apps. This direct integration enhances the overall performance and functionality of telematics features such as real-time navigation, vehicle diagnostics, emergency services, and fleet management, ensuring a more consistent user experience.

One of the key advantages of embedded telematics is the always-on connectivity, enabled by dedicated cellular networks. This constant connection allows for features such as over-the-air (OTA) updates, enabling manufacturers to remotely provide software updates, security patches, and new functionalities without requiring the vehicle to visit a service center. Moreover, embedded telematics systems offer enhanced security, as they are less vulnerable to connectivity disruptions and external hacking attempts compared to bring-your-own-device (BYOD) or tethered systems.

Embedded telematics also plays a critical role in the evolution of connected and autonomous vehicles. By allowing vehicles to communicate with each other (V2V) and with surrounding infrastructure (V2I), these systems support the development of smart transportation networks and autonomous driving technologies. The growing adoption of electric vehicles (EVs) and the push for vehicle electrification further fuel demand for embedded telematics, as they assist in monitoring battery health, energy consumption, and charging station integration. This widespread adoption across various vehicle types, especially in high-end and electric models, is driving significant growth in the automotive telematics market.

The OEM segment led the industry. The OEM segment plays a crucial role in driving the growth of the automotive telematics system market as vehicle manufacturers increasingly incorporate telematics systems into their new models to meet rising consumer demand for connected vehicles. Original Equipment Manufacturers (OEMs) integrate telematics directly into the vehicle's design during production, ensuring seamless functionality, superior quality control, and robust compatibility with other in-car systems. This built-in approach enhances the user experience by providing features such as real-time navigation, remote diagnostics, and vehicle tracking, while ensuring reliability and longevity, as opposed to aftermarket or third-party solutions.

One of the key growth drivers within the OEM segment is the growing adoption of advanced safety and security features. OEMs are incorporating telematics for features like automatic emergency response, stolen vehicle recovery, and remote immobilization, which are becoming standard in many vehicles. These telematics features not only improve safety but also align with increasing regulatory requirements, particularly in regions where governments are mandating advanced safety systems for new vehicles.

Additionally, the OEM segment benefits from over-the-air (OTA) updates, which enable automakers to update software, introduce new functionalities, and fix bugs without the need for physical service visits. This capability is highly appealing to consumers, driving the demand for OEM telematics solutions. The increasing production of electric vehicles (EVs) and autonomous vehicles further boosts the OEM segment, as telematics is critical for managing EV charging, battery performance, and autonomous driving features. With the continuous evolution of connected car technology, the OEM segment remains a significant driver of growth in the automotive telematics market.

Asia Pacific dominated the automotive telematics system market. In the Asia Pacific region, rapid urbanization, the rising demand for fleet management solutions, and the introduction of 5G connectivity are pivotal drivers of growth in the automotive telematics market. As cities across the region expand and populations increase, the need for efficient and intelligent transportation solutions becomes more pressing. Urbanization leads to higher vehicle density, which necessitates advanced telematics systems to manage traffic flow, provide real-time navigation, and ensure road safety.

Simultaneously, the growing demand for fleet management solutions in sectors such as logistics, transportation, and e-commerce is spurring the adoption of telematics. Fleet operators require advanced telematics systems to optimize routes, monitor vehicle performance, manage fuel consumption, and ensure driver safety. The ability to track and manage fleets effectively enhances operational efficiency and reduces costs, driving the market's growth.

The introduction of 5G connectivity further accelerates this growth by enabling high-speed, low-latency data transfer, which is crucial for advanced telematics applications. With 5G, telematics systems can support sophisticated features such as real-time vehicle-to-everything (V2X) communication, enhanced vehicle-to-vehicle (V2V) interactions, and seamless integration with smart city infrastructure. This connectivity enables more reliable and responsive telematics solutions, fostering the development of autonomous driving technologies and advanced driver assistance systems (ADAS). Together, these factors create a robust environment for the expansion of the automotive telematics market in Asia Pacific, addressing the evolving needs of urban transport and connected mobility.

North America is anticipated to grow with a significant CAGR during the forecast period. In North America, the automotive telematics system market is significantly driven by fleet management needs, consumer preferences for safety, and stringent government regulations and safety standards. Fleet management requirements are a major growth factor, as businesses across industries seek advanced telematics solutions to enhance operational efficiency. Fleet operators use telematics for real-time vehicle tracking, route optimization, fuel management, and maintenance monitoring. These capabilities help reduce costs, improve safety, and increase overall fleet performance, driving robust market demand.

Consumer preferences for safety and convenience are also pivotal. Modern drivers increasingly expect their vehicles to offer advanced safety features such as automatic emergency response, collision avoidance, and real-time diagnostics. Telematics systems deliver these features by providing critical data on vehicle health, driving behavior, and crash detection, which enhances safety and offers peace of mind. The growing desire for connected and smart vehicle experiences further fuels demand for integrated telematics solutions.

Moreover, government regulations and safety standards in North America, such as mandatory electronic logging devices (ELDs) for commercial vehicles and stringent safety requirements, are pushing the adoption of telematics. Compliance with these regulations necessitates the implementation of telematics systems that can track and report critical data, ensuring regulatory adherence and improving safety on the roads.

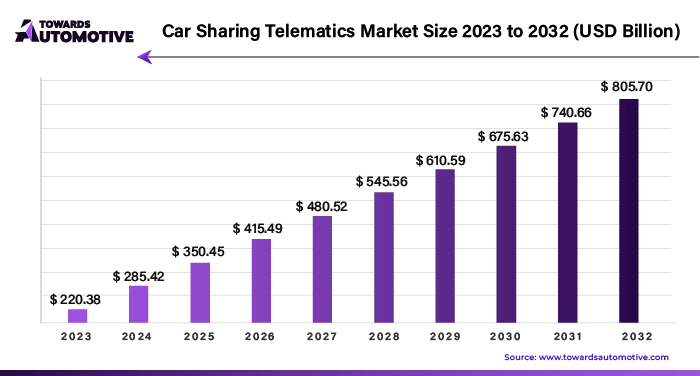

The global car sharing telematics market is projected to reach USD 854.01 million by 2034, growing from USD 348.55 million in 2025, at a CAGR of 10.47% during the forecast period from 2025 to 2034.

The car sharing telematics sector denotes the application of telematics technology in car sharing services. Car sharing offers the opportunity to minimize fleet expenses, promote the adoption of electric vehicles, enhance environmental conservation by decreasing CO2 emissions, and expand car accessibility to additional urban regions. Moreover, it delivers favorable organizational outcomes by facilitating asset sharing among employees.

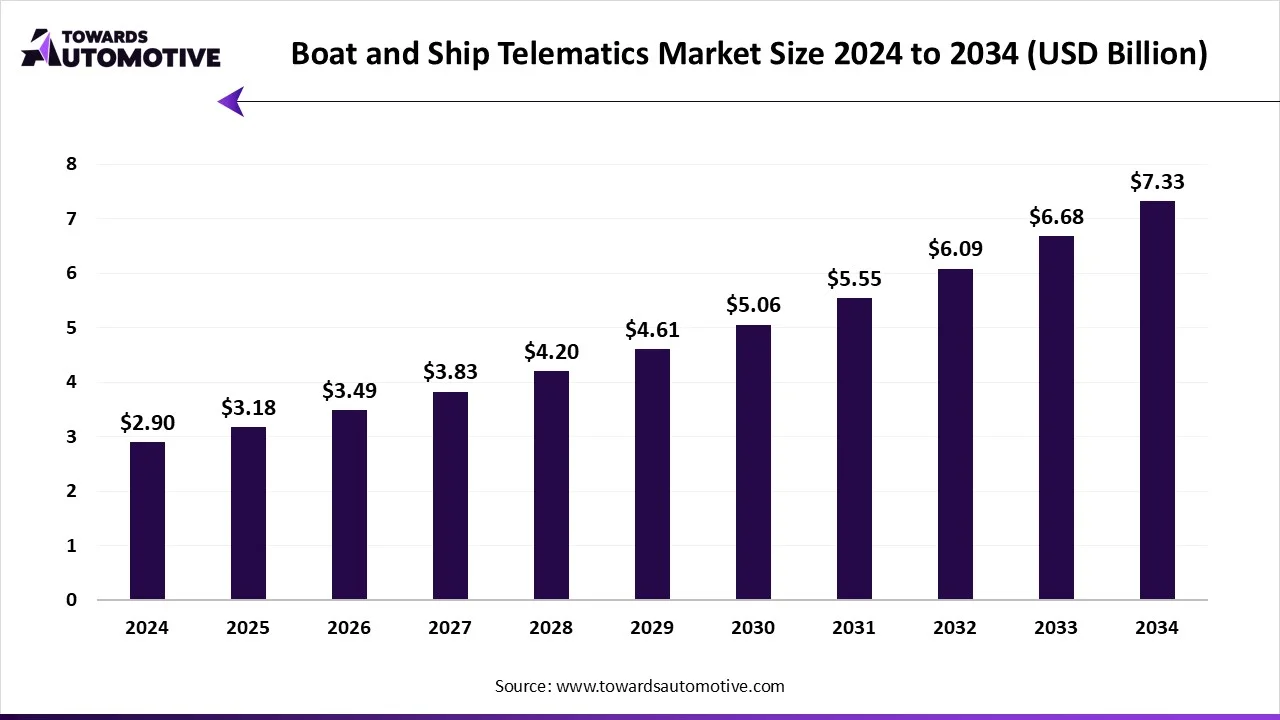

The boat and ship telematics market is projected to reach USD 7.33 billion by 2034, expanding from USD 3.18 billion in 2025, at an annual growth rate of 9.72% during the forecast period from 2025 to 2034.

The boat and ship telematics market is a prominent branch of the marine industry. This industry deals in developing solutions for tracking boats and ships across the world. There are various components of these solutions including hardware, software and services. These solutions use different types of technologies such as GPS tracking, satellite communication, IoT enabled devices, telematics software and some others.

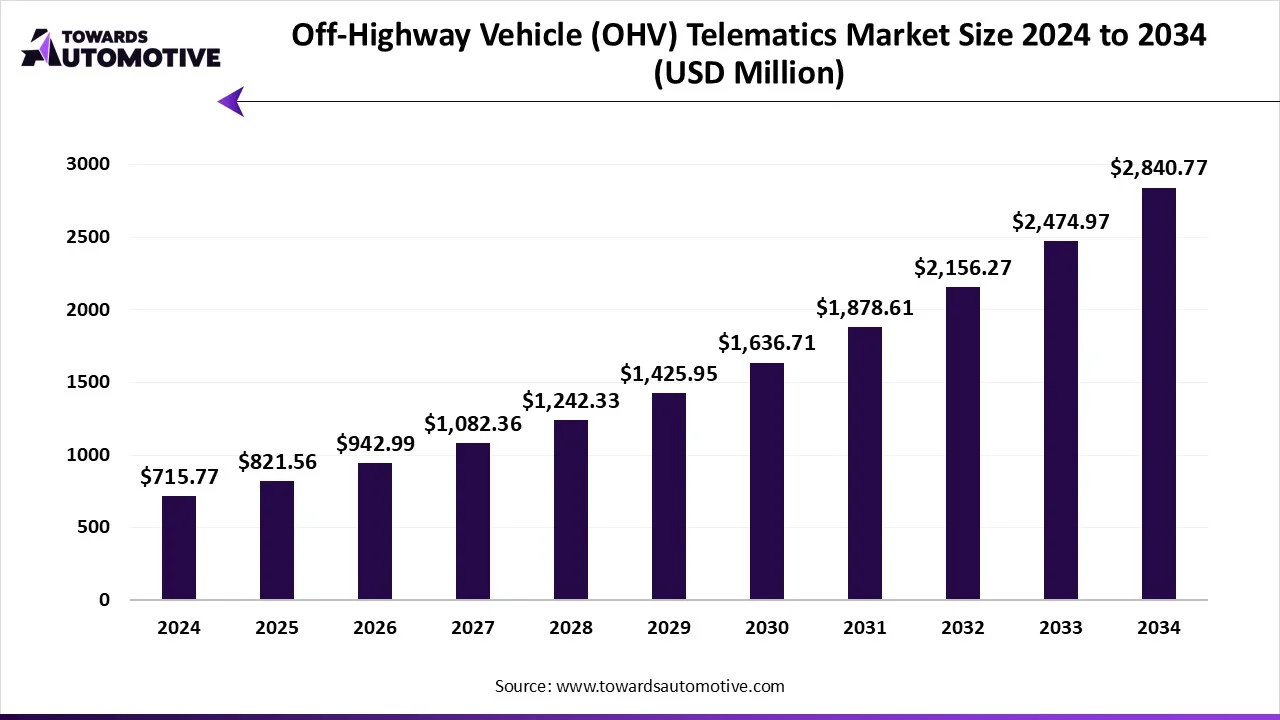

The off-highway vehicle (OHV) telematics market is projected to reach USD 2840.77 million by 2034, expanding from USD 821.56 million in 2025, at an annual growth rate of 14.78% during the forecast period from 2025 to 2034. The increasing demand for advanced equipment from the construction sector along with integration of advanced technologies in telematics solutions has boosted the market expansion.

The off-highway vehicle (OHV) telematics market is a prominent sector of the automotive industry. This industry deals in developing telematics solutions for off-highway vehicles. There are various components developed of these solutions comprising of hardware, software, connectivity solutions and some others.

By Technology Type

By Solution

By Vehicle Type

By Sales Channel

By Application Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us