October 2025

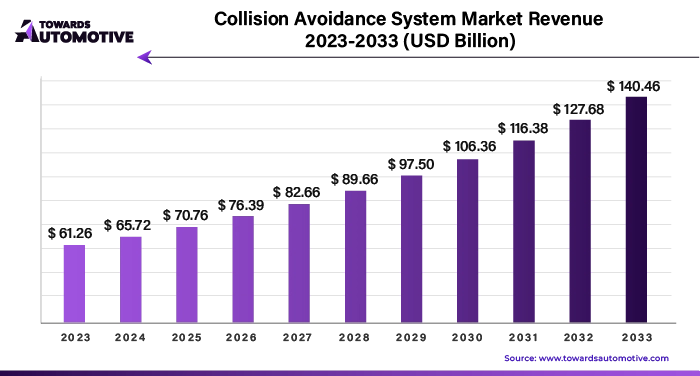

The global collision avoidance system market is forecasted to expand from USD 72.53 billion in 2025 to USD 155.07 billion by 2034, growing at a CAGR of 8.81% from 2025 to 2034.

The collision avoidance system market is rapidly evolving, driven by advancements in technology and increasing safety regulations across the automotive industry. These systems are designed to detect potential collisions and intervene to prevent accidents, significantly enhancing vehicle safety for both drivers and pedestrians. The growing awareness of road safety and the rising number of traffic fatalities have propelled demand for innovative solutions that can mitigate collision risks.

Key technologies in collision avoidance systems include radar, LiDAR, cameras, and ultrasonic sensors, which work together to provide comprehensive situational awareness. These systems often incorporate advanced driver assistance systems (ADAS), enabling features such as automatic emergency braking, lane departure warning, and adaptive cruise control. The integration of artificial intelligence and machine learning further enhances the capabilities of these systems, allowing for more accurate predictions of potential hazards and enabling real-time decision-making.

Moreover, government mandates and consumer preferences for enhanced safety features are driving automakers to adopt collision avoidance technologies. As a result, the market is experiencing significant growth, with investments in research and development leading to more sophisticated and reliable systems. As the automotive landscape shifts towards greater automation and connectivity, the collision avoidance system market is poised for further expansion, playing a critical role in reducing accidents and improving overall road safety.

Artificial Intelligence (AI) plays a pivotal role in the collision avoidance system market by enhancing the accuracy, efficiency, and overall effectiveness of these safety technologies. AI algorithms are integrated into collision avoidance systems to analyze vast amounts of data from various sensors, such as radar, LiDAR, and cameras, in real time. This analysis allows the system to identify potential hazards, predict the behavior of surrounding objects, and determine the best course of action to avoid collisions.

One of the key applications of AI in this market is in the development of advanced driver assistance systems (ADAS). AI-powered systems can learn from past driving experiences and adapt to changing conditions, making them more effective at detecting obstacles, pedestrians, and other vehicles. Through machine learning, these systems continuously improve their performance by learning from new data, thereby increasing their reliability and accuracy over time.

AI also facilitates better decision-making processes within collision avoidance systems. It can prioritize threats based on their proximity and potential impact, allowing the system to execute evasive maneuvers or emergency braking when necessary. Furthermore, AI contributes to the development of more sophisticated features, such as lane-keeping assistance and adaptive cruise control, which enhance overall driving safety.

As the automotive industry moves toward greater automation and connectivity, AI's role in collision avoidance systems will become even more critical. The integration of AI technologies will not only improve safety outcomes but also support the advancement of autonomous driving capabilities, paving the way for a future with fewer accidents and enhanced road safety.

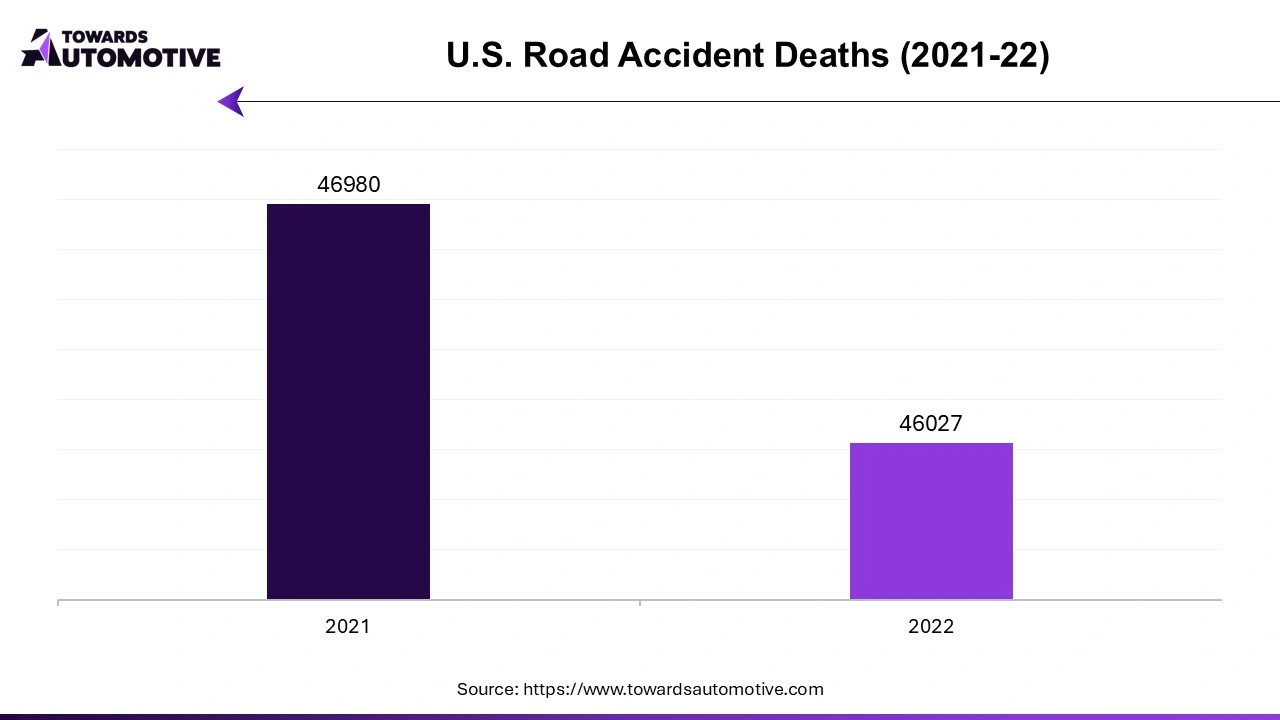

The increasing cases of road accidents are a significant driver of growth in the collision avoidance system market, as stakeholders seek effective solutions to enhance vehicular safety and reduce fatalities. As global traffic volumes rise, the incidence of accidents—often resulting from human error, distracted driving, or adverse weather conditions—has escalated. According to the World Health Organization, road traffic accidents claim over 1.3 million lives annually, underscoring the urgent need for advanced safety technologies. In response, automotive manufacturers and technology companies are investing heavily in collision avoidance systems to address this critical public safety concern.

Collision avoidance systems utilize a combination of sensors, cameras, and algorithms to detect potential hazards and provide warnings or automatic interventions, such as braking or steering adjustments. As awareness of road safety issues grows, consumers are increasingly demanding vehicles equipped with these systems, driving manufacturers to prioritize their development and integration. Furthermore, governments and regulatory bodies are implementing stricter safety standards that mandate the inclusion of advanced driver assistance systems (ADAS) in new vehicles, further propelling market growth.

The rising cost of road accidents, both in terms of human life and economic impact, is also prompting businesses and insurers to advocate for collision avoidance technologies. Companies recognize that investing in these systems can lead to lower insurance premiums, fewer claims, and a safer workforce, particularly for fleets of commercial vehicles.

The collision avoidance system market faces several restraints that may hinder its growth. One significant challenge is the high cost of advanced sensor technologies and the integration of complex systems, which can be a barrier for both manufacturers and consumers. Additionally, the varying regulatory standards across regions can complicate compliance efforts, leading to increased development times and costs. Furthermore, concerns regarding data privacy and security in connected vehicle systems may deter consumers from adopting these technologies. Finally, the reliance on technology may lead to overconfidence among drivers, potentially resulting in complacency and a decrease in safe driving practices.

Vehicle-to-Everything (V2X) communication is a transformative technology that creates significant opportunities in the collision avoidance system market by enhancing vehicle safety and efficiency. V2X enables vehicles to communicate with each other and with surrounding infrastructure, including traffic signals, road signs, and even pedestrians' mobile devices. This connectivity allows vehicles to share real-time information about their speed, direction, and intended maneuvers, significantly improving situational awareness for drivers and automated systems alike.

By integrating V2X communication into collision avoidance systems, manufacturers can enhance the accuracy and effectiveness of these technologies. For instance, vehicles can receive alerts about potential hazards ahead, such as accidents or road obstructions, allowing them to take preventive actions like altering speed or changing lanes. Moreover, V2X can facilitate coordinated traffic flow, reducing congestion and enhancing overall road safety.

As cities evolve into smart environments, the demand for V2X-enabled collision avoidance systems is expected to rise. Governments and urban planners are increasingly recognizing the importance of V2X communication in developing intelligent transportation systems that prioritize safety and efficiency. Additionally, the growing emphasis on connected vehicle technology will encourage collaboration among automotive manufacturers, technology firms, and infrastructure providers, creating a fertile ground for innovation.

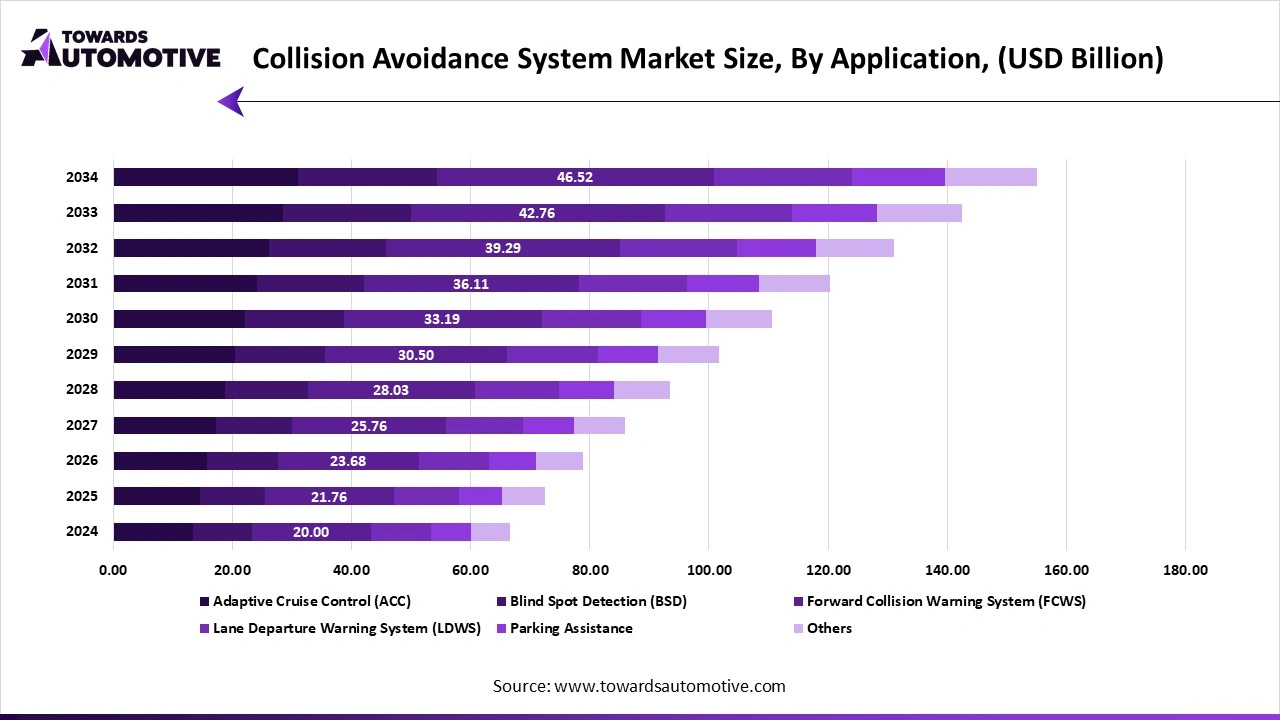

The adaptive cruise control (acc) segment led the industry. The adaptive cruise control (ACC) segment is significantly driving the growth of the collision avoidance system market, offering a blend of convenience and enhanced safety for drivers. ACC systems automatically adjust a vehicle's speed to maintain a safe following distance from the vehicle ahead, making long-distance travel more comfortable and reducing driver fatigue. This technology utilizes sensors such as radar and cameras to monitor surrounding traffic, enabling real-time adjustments to speed.

As traffic congestion increases, the demand for advanced driver assistance systems (ADAS) like ACC is surging. Consumers are becoming more aware of the benefits associated with these systems, not only for comfort but also for safety. By preventing rear-end collisions and reducing the risk of accidents in stop-and-go traffic, ACC plays a crucial role in enhancing overall road safety.

Moreover, regulatory bodies worldwide are implementing stricter safety standards, further propelling the adoption of ACC and other collision avoidance technologies. Automakers are increasingly integrating ACC into their vehicles to meet these regulations and to appeal to safety-conscious consumers.

Additionally, advancements in AI and sensor technologies are enhancing the capabilities of ACC systems, making them more responsive and reliable. The growing trend toward electrification and the development of connected and autonomous vehicles also contribute to the expansion of the ACC segment within the collision avoidance system market. As ACC becomes a standard feature in new vehicles, its influence on market growth will continue to be substantial, driving further innovations in collision avoidance technologies.

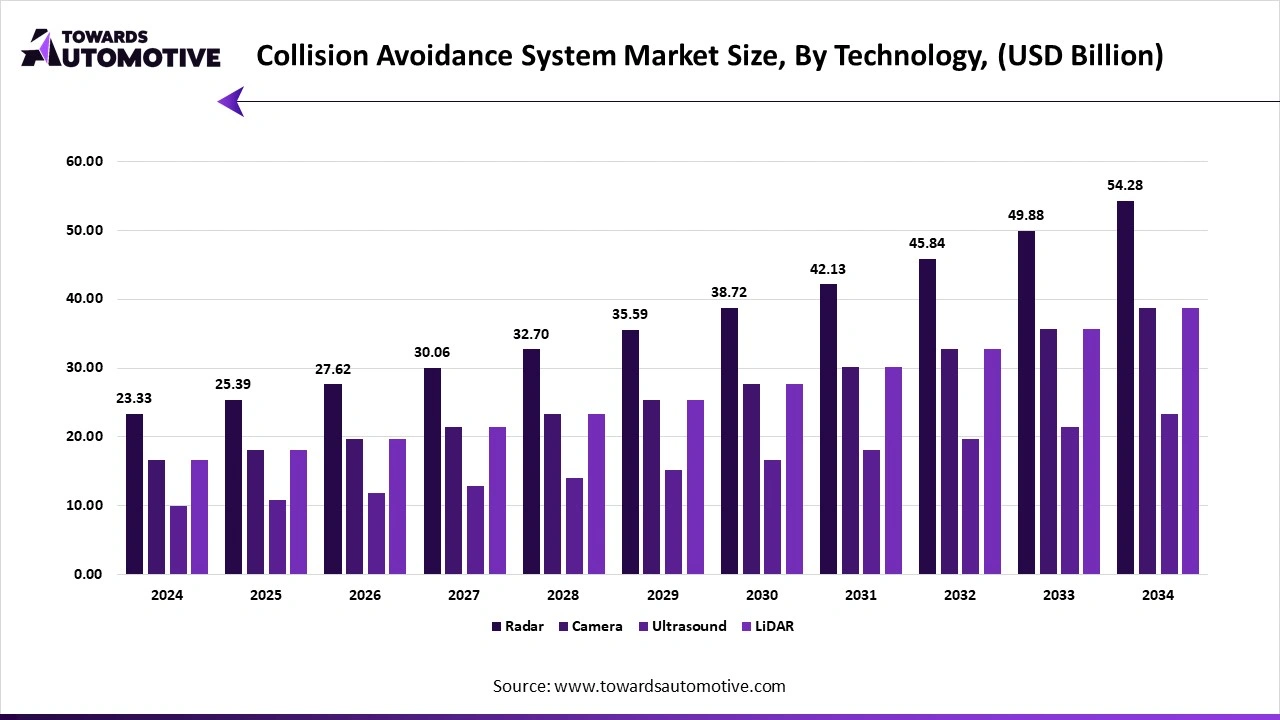

The radar segment held a dominant share of the market. The radar segment is a critical driver of growth in the collision avoidance system market, playing a vital role in enhancing vehicle safety and performance. Radar technology is integral to many advanced driver assistance systems (ADAS), enabling vehicles to detect and monitor their surroundings in real time. This technology employs radio waves to measure the distance, speed, and direction of nearby objects, allowing for accurate assessment of potential collision risks.

As traffic congestion and road safety concerns continue to rise, the demand for effective collision avoidance solutions has surged, propelling the adoption of radar-based systems. Radar’s ability to function in various weather conditions, such as rain, fog, and snow, sets it apart from other sensor technologies, ensuring consistent performance and reliability. This adaptability enhances the overall effectiveness of collision avoidance systems, making them increasingly attractive to both consumers and manufacturers.

Moreover, the integration of radar with other technologies, such as cameras and LiDAR, creates a comprehensive safety net that improves situational awareness for drivers. As automakers prioritize safety features to meet regulatory requirements and consumer expectations, radar systems are being incorporated into a growing number of vehicles, including passenger cars and commercial fleets.

The advancements in radar technology, such as improved resolution and range, are further driving market growth, enabling the development of sophisticated features like adaptive cruise control, blind-spot detection, and emergency braking. As the automotive industry evolves towards greater automation, the radar segment's impact on the collision avoidance system market is expected to expand, fostering innovations that enhance road safety and driver assistance.

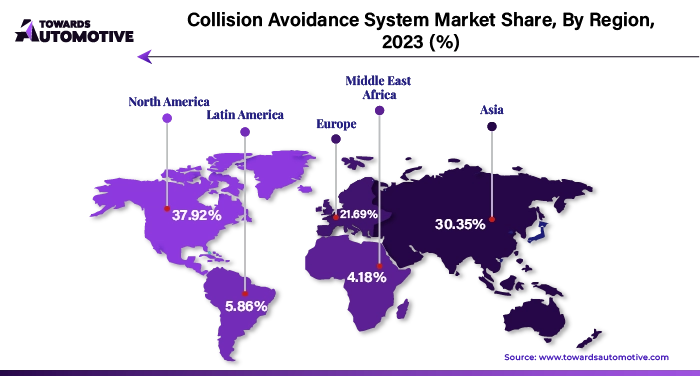

Europe dominated the collision avoidance system market. Technological advancements, coupled with increasing consumer demand for Advanced Driver Assistance Systems (ADAS) and a focus on sustainable transportation, are significantly driving the growth of the collision avoidance system market in Europe. Rapid innovations in sensor technologies, such as radar, LiDAR, and cameras, have enhanced the capabilities of collision avoidance systems, enabling vehicles to detect and respond to potential hazards with greater accuracy and speed. These advancements are crucial in developing sophisticated ADAS features that not only improve safety but also enhance overall driving experiences.

As consumers become more aware of the benefits associated with these technologies, including improved safety, convenience, and potential insurance savings, the demand for vehicles equipped with collision avoidance systems is rising. European drivers increasingly prioritize safety features, pushing automakers to integrate ADAS into their offerings to remain competitive in a crowded market.

Furthermore, the emphasis on sustainable transportation is reshaping the automotive landscape in Europe, as governments and organizations aim to reduce carbon emissions and promote cleaner vehicle technologies. Collision avoidance systems play a vital role in the development of electric and autonomous vehicles, contributing to safer driving environments while supporting the transition to more eco-friendly transportation solutions. This synergy between technological advancements, consumer expectations, and sustainable initiatives not only propels the growth of the collision avoidance system market but also positions Europe as a leader in automotive safety and innovation. As these trends continue to evolve, the market is set to experience sustained growth in the coming years.

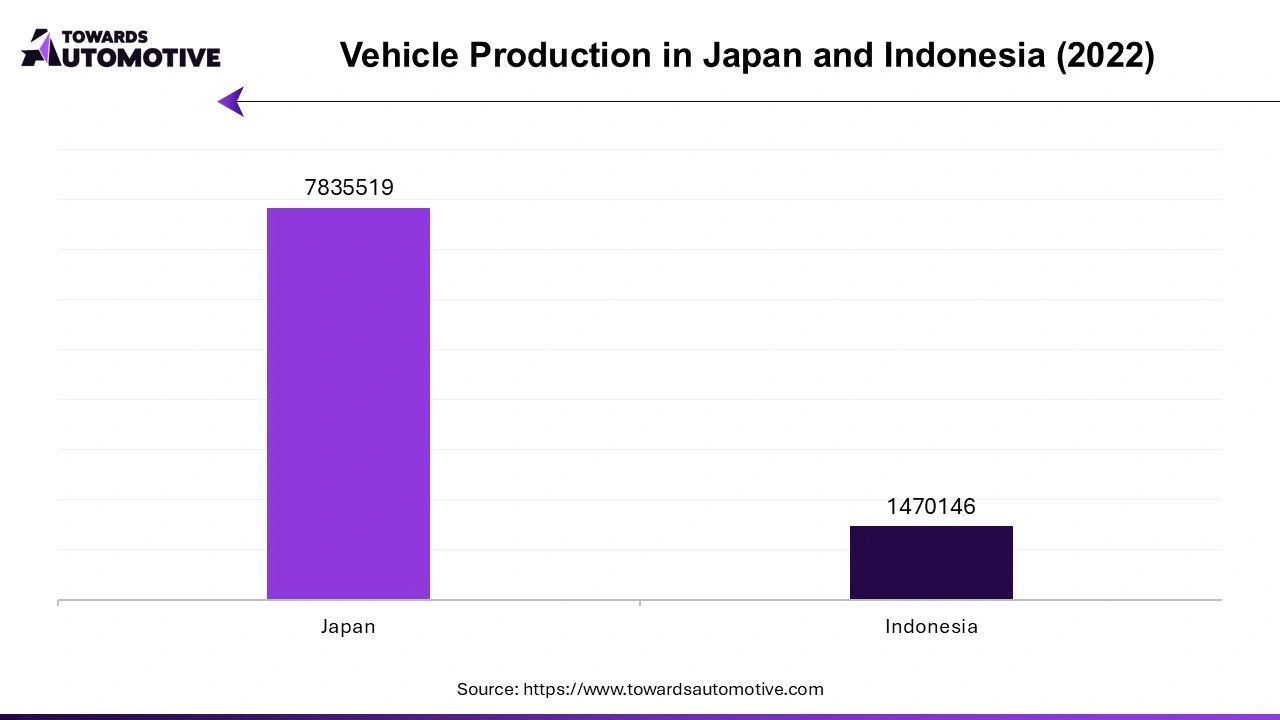

Asia Pacific expected to grow with the highest CAGR during the forecast period. Rising vehicle production and sales, growing awareness of road safety, and significant investment in research and development (R&D) and innovation are key drivers propelling the growth of the collision avoidance system market in the Asia-Pacific (APAC) region. As one of the largest automotive markets globally, APAC experiences substantial increases in vehicle production, particularly in countries like China, India, and Japan. This surge in vehicle sales directly correlates with heightened demand for advanced safety features, including collision avoidance systems. Consumers are increasingly prioritizing safety, prompting automakers to integrate these technologies into their vehicles to meet market expectations and regulatory requirements.

Additionally, the growing awareness of road safety among the public and governments is driving the demand for innovative safety solutions. With alarming statistics related to road traffic accidents, there is a collective push for implementing systems that enhance vehicle safety, leading to stricter regulations that encourage or mandate the adoption of collision avoidance technologies.

Furthermore, substantial investments in R&D and innovation by automotive manufacturers and technology companies are fostering the development of advanced sensor technologies, such as radar and LiDAR. These innovations are crucial in improving the effectiveness and affordability of collision avoidance systems, making them more accessible to consumers. As these factors converge, they create a conducive environment for the rapid expansion of the collision avoidance system market in the APAC region, positioning it as a pivotal segment within the broader automotive industry.

By Technology

By Application

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us