April 2025

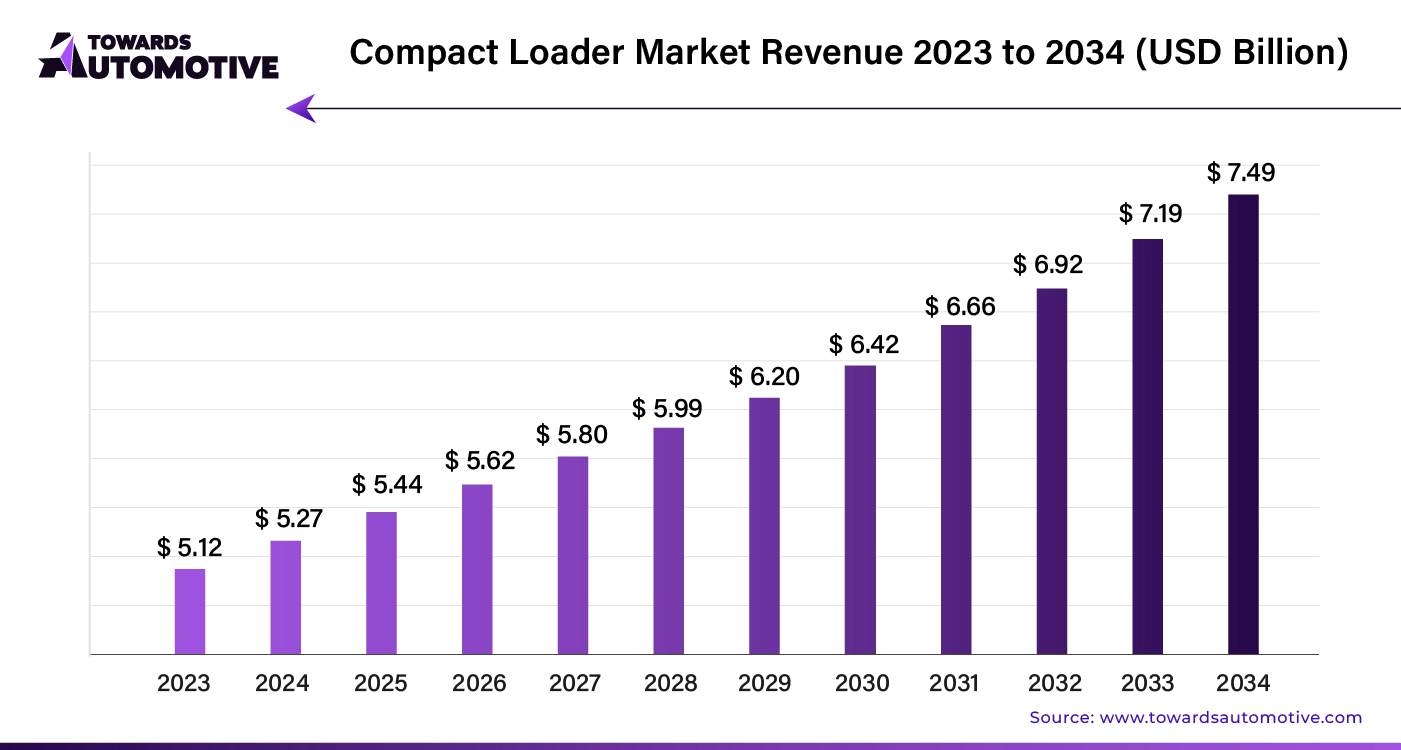

The compact loader market is expected to increase from USD 5.44 billion in 2025 to USD 7.49 billion by 2034, growing at a CAGR of 3.13% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Technological advancements offer significant opportunities for compact loaders to enhance efficiency, environmental sustainability, and user-friendliness. Integrating telematics, automation, and IoT solutions can reduce downtime and boost productivity.

To stand out in the market, compact loader manufacturers should offer customizable solutions tailored to various sectors and applications. Custom add-ons and accessories can improve adaptability and attract a wider range of clients. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

As environmental concerns rise, there is increasing demand for eco-friendly equipment. Manufacturers can position themselves as leaders in sustainability by developing compact loaders with reduced fuel consumption, emissions, and pollutants, using alternative power sources such as hybrid or electric engines.

Investing in operator education and training enhances safety, efficiency, and satisfaction. Manufacturers can offer certifications, on-site workshops, and online training modules to help users maximize their equipment's potential.

Economic downturns decrease the demand for compact loaders by reducing infrastructure and construction projects. Rising raw material costs make it challenging for manufacturers to keep prices competitive. In regions with slow or nonexistent infrastructure development, the demand for compact loaders remains low. Political and economic factors causing construction delays further hinder market growth. Additionally, a shortage of skilled operators limits the adoption and effective use of compact loaders.

The integration of artificial intelligence (AI) into the compact loader market is poised to drive significant growth and innovation. AI technologies enhance compact loaders by improving operational efficiency, safety, and productivity. AI-driven systems optimize machine performance through real-time data analysis, enabling predictive maintenance and reducing downtime. This predictive capability allows operators to address potential issues before they become critical, ensuring continuous operation and extending the equipment's lifespan.

Furthermore, AI enhances precision and accuracy in load handling and terrain navigation, reducing the likelihood of errors and accidents. Machine learning algorithms enable loaders to adapt to varying conditions and user preferences, providing a customized experience and increasing overall effectiveness. AI-powered automation also streamlines workflow by reducing the need for manual intervention, thereby minimizing labor costs and enhancing operational efficiency.

The growing demand for smarter, more efficient construction and industrial machinery fuels the adoption of AI in compact loaders. As AI technology advances, its integration into compact loaders will continue to propel market growth, driving innovations that meet the evolving needs of industries worldwide.

In the compact loader market, an efficient supply chain is crucial for meeting demand and maintaining competitive advantage. The supply chain begins with the procurement of raw materials such as steel, hydraulic components, and electronic systems. Suppliers must deliver these materials on time to avoid production delays. Manufacturers then assemble these components into compact loaders, ensuring adherence to quality standards and regulatory requirements.

Once assembled, compact loaders are distributed through a network of dealerships and distributors. Effective logistics management is essential to ensure timely delivery to various regions. Real-time tracking systems help monitor shipments and manage inventory levels efficiently.

Post-sales, the supply chain includes providing spare parts and maintenance services. This aspect requires coordination with parts suppliers and service centers to ensure quick response times for repairs and replacements.

The compact loader market ecosystem comprises several critical components and contributors. At its core, the ecosystem includes compact loaders themselves, attachment tools, and key market players.

Compact loaders, which come in various sizes and configurations, are crucial for diverse applications such as construction, landscaping, and agriculture. Attachments like buckets, grapples, and forks enhance the versatility of these machines.

Companies play pivotal roles in this ecosystem. Major manufacturers like Caterpillar and Bobcat design and produce high-performance compact loaders, driving innovation with advanced features and technology. John Deere and Kubota offer a range of loaders that cater to different operational needs, from small-scale to heavy-duty tasks.

Additionally, suppliers such as JCB and CASE Construction Equipment provide specialized attachments and accessories that expand the functionality of loaders. Rental companies like Sunbelt Rentals and Herc Rentals contribute by offering equipment access to users without the need for ownership.

Together, these components and companies create a dynamic and responsive compact loader market, addressing the evolving needs of various industries.

Compact track loaders are dominating the market due to their adaptability, flexibility, and efficiency, especially in the construction industry. With a market share of 39% in 2024, they excel in both delicate landscaping and heavy-duty construction tasks. Their low ground disturbance makes them perfect for sensitive environments, and their compatibility with various attachments increases their usability across different applications.

In the construction sector, compact loaders hold a 46% share in 2024. Their versatility and ability to operate in confined spaces make them essential for handling diverse tasks on job sites. As urbanization and infrastructure development expand, the demand for compact loaders remains robust. This growth offers significant opportunities for compact loader manufacturers in the evolving global construction market.

Australia:

The compact loader market in Australia is set to grow with an anticipated CAGR of 4.6% from 2024 to 2034. The country’s focus on urban development and agriculture drives demand for versatile equipment. Compact loaders are increasingly utilized in construction, landscaping, and farming, making Australia a key market for manufacturers.

China:

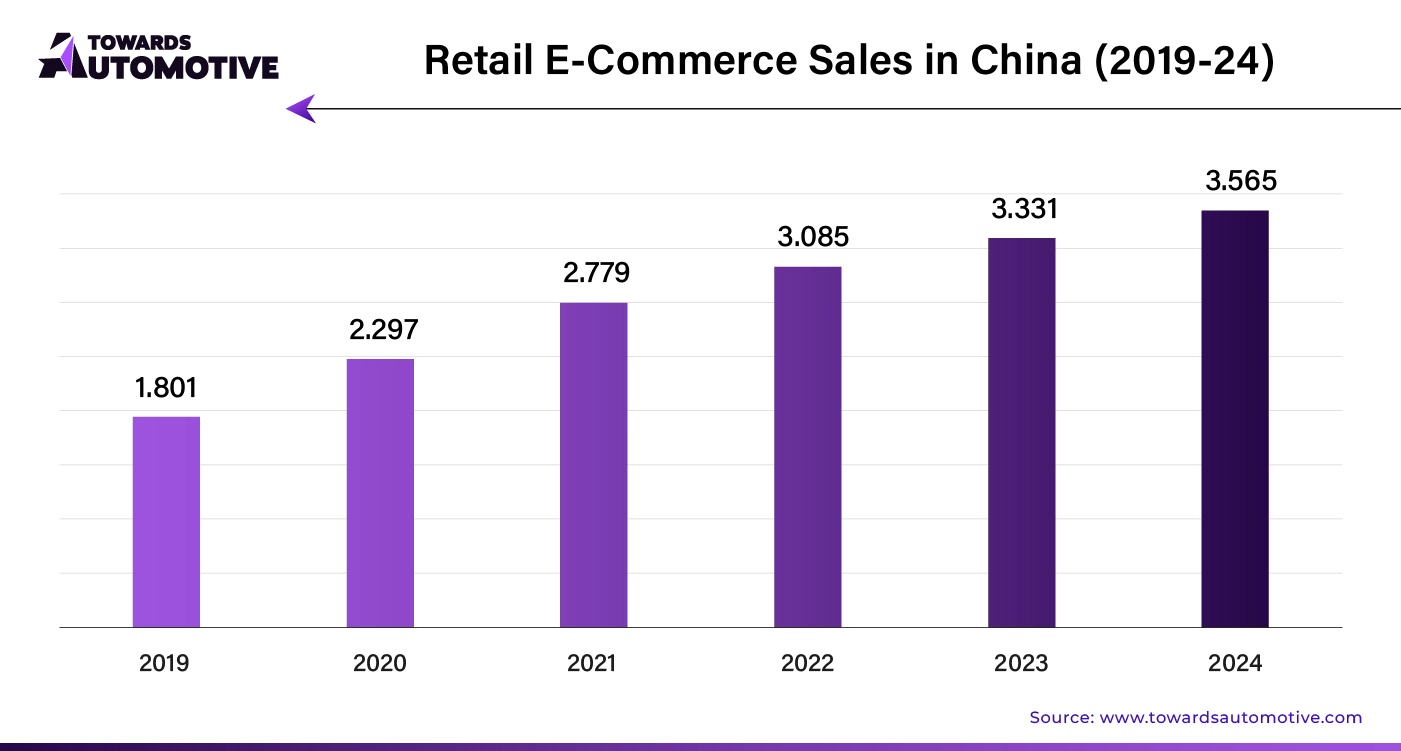

China’s compact loader market is projected to expand at a CAGR of 4.3% over the next decade. Urbanization and government support for rural infrastructure are major growth drivers. The growing e-commerce sector also boosts demand for compact loaders in logistics and warehousing.

India:

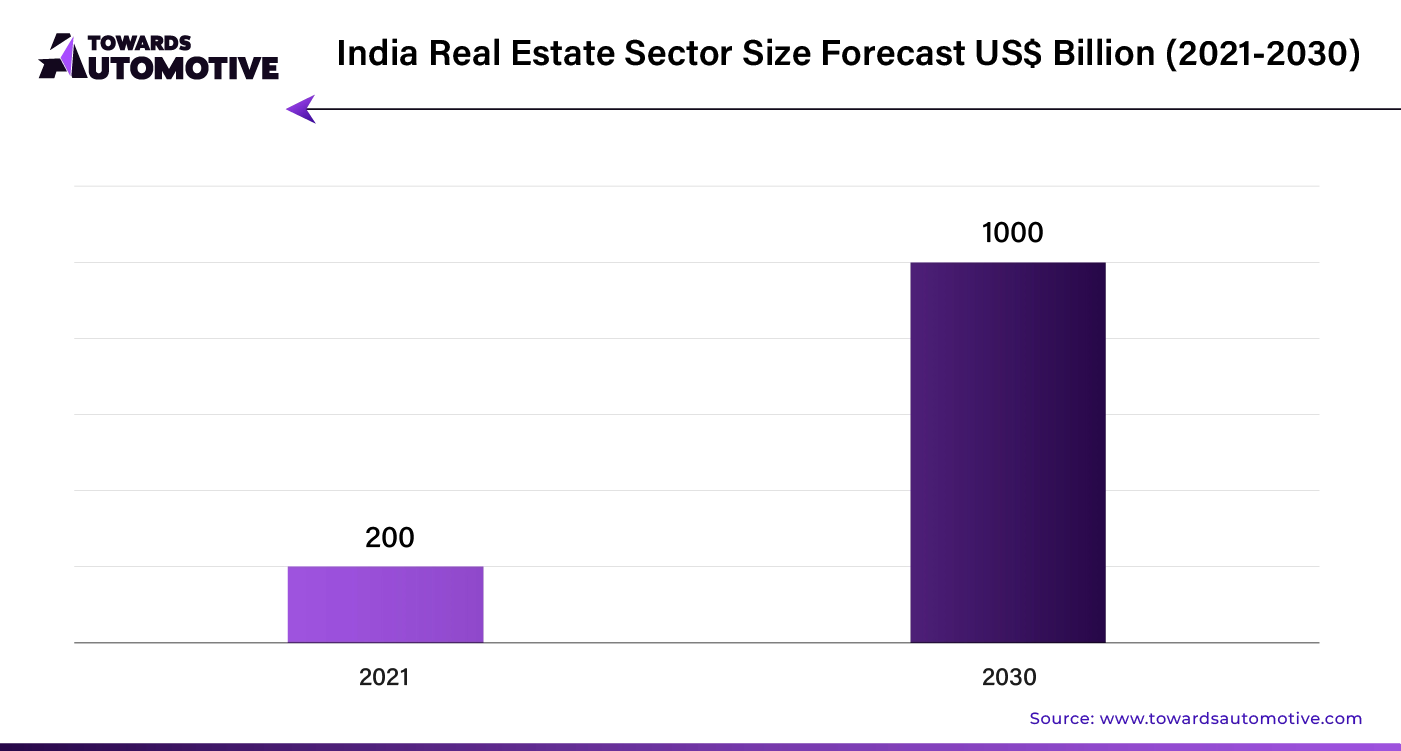

In India, the compact loader market is expected to grow with a CAGR of 4.2%. These loaders play a crucial role in agriculture for tasks like harvesting and plowing. India's waste management initiatives and the "Made in India" campaign further support market growth through local production and technological advances.

Germany:

Germany’s compact loader market is forecasted to grow at a CAGR of 2.7%. The demand is driven by the need for eco-friendly and energy-efficient machinery in agriculture and construction. Additionally, compact loaders are used for snow removal and material handling across various industrial applications.

United States:

The compact loader market in the United States is growing with a CAGR of 1.8%. The construction sector’s emphasis on material handling and adaptability is a key driver. Compact loaders are also increasingly used in forestry, landscaping, and residential construction for enhanced efficiency and cost-effectiveness.

The industry remains dynamic as these major players focus on technological advancements and operational efficiency to meet market trends and consumer expectations.

By Application

By Product Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us