April 2025

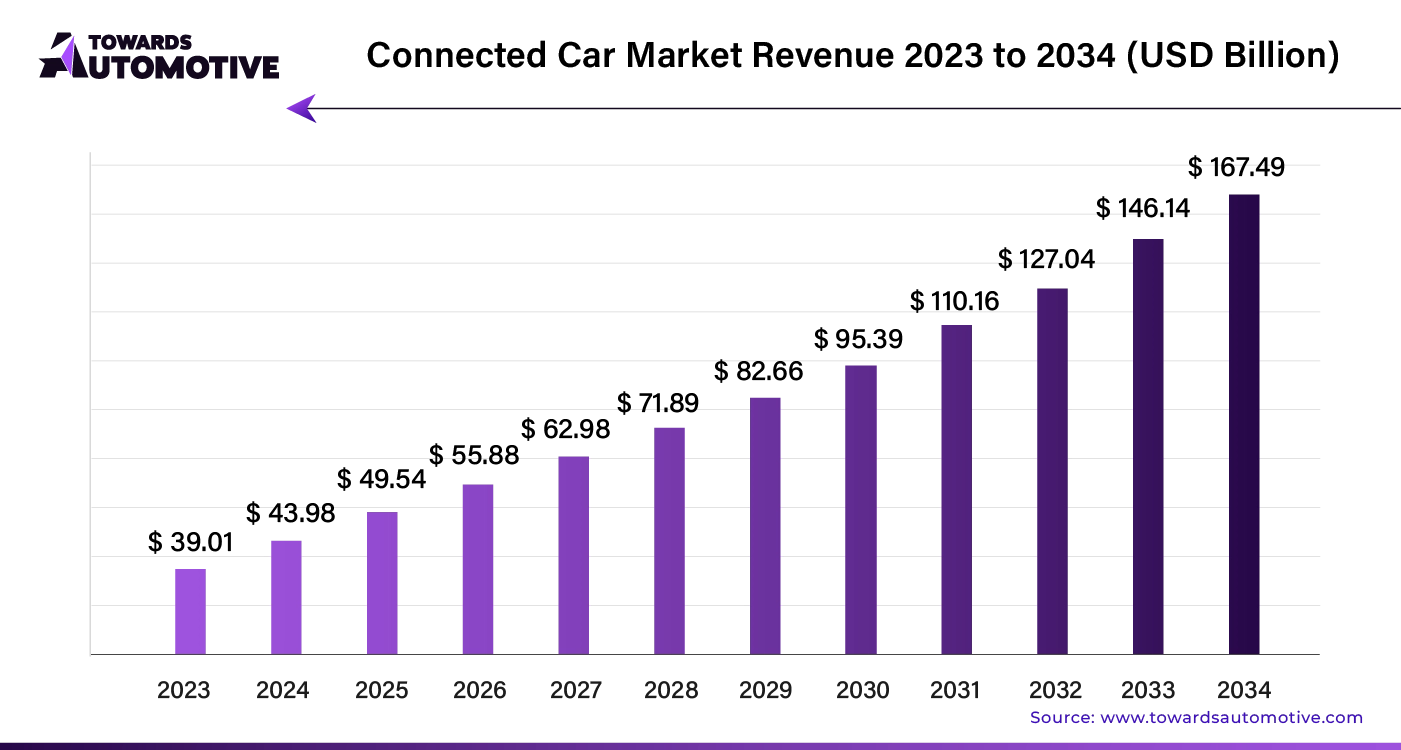

The connected car market is forecasted to expand from USD 49.54 billion in 2025 to USD 167.49 billion by 2034, growing at a CAGR of 12.9% from 2025 to 2034.The automotive sector has seen significant progress in recent years, with substantial investments in the advancement and adoption of AI and advanced connectivity features.

Unlock Infinite Advantages: Subscribe to Annual Membership

Technological advancements have transformed the automotive industry, making modern vehicles more advanced and user-friendly than ever before. The integration of cutting-edge features and innovations has significantly enhanced the driving experience, focusing on comfort, aesthetics, and performance.

One of the major breakthroughs in recent years is the shift toward Artificial Intelligence (AI) and Machine Learning (ML). These technologies are not just enhancing the driving experience but also providing new levels of comfort and style. AI and ML are now integral to vehicle systems, offering sophisticated features such as adaptive cruise control, automated parking, and personalized driving settings.

Cloud-based technologies have further revolutionized the industry by enabling automakers to gather and analyze vast amounts of data from connected vehicles. This data provides valuable insights into driver behavior, vehicle performance, and driving patterns. Automakers use these insights to develop innovative connected car services that enhance both the driving experience and road safety. For instance, real-time data can help in predictive maintenance, reducing the likelihood of breakdowns and improving overall vehicle reliability.

The automotive industry is also witnessing a significant shift from traditional fuel-based vehicles to electric and hybrid models. This transformation is supported by governments worldwide, which are promoting intelligent transportation systems in major cities. From electric bicycles to advanced public transportation solutions, this shift is occurring rapidly. Many Original Equipment Manufacturers (OEMs) are at the forefront of this change, developing smart transportation solutions that contribute to a more sustainable and efficient future. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) communications are emerging as critical components in enhancing road safety and traffic management. For example, the United States Department of Transportation has proposed the integration of V2V communication technology to help reduce accidents and improve passenger safety. By allowing vehicles to communicate with each other and with road infrastructure, this technology aims to create a more connected and safer driving environment.

The Asia Pacific region is witnessing significant growth in connected vehicle technology. Japan leads globally in connected vehicle penetration, thanks to its advanced automotive industry and early adoption of new technologies. China is also making notable strides, with rapid growth in the connected car sector. Meanwhile, Germany remains a key player in producing and using advanced vehicles, while North America continues to support research and development in automotive technologies.

Overall, the integration of advanced technologies in the automotive sector is driving innovation and improving the driving experience. As the industry continues to evolve, the focus on AI, cloud-based solutions, and connected car features will play a crucial role in shaping the future of transportation.

Artificial Intelligence (AI) is revolutionizing the connected car market, fueling rapid growth and transforming driving experiences. By integrating AI, connected cars gain the ability to process vast amounts of data in real-time, enabling more advanced features and enhanced safety measures. AI-driven systems improve navigation by analyzing traffic patterns, predicting route changes, and providing optimal driving suggestions. This reduces travel time and increases efficiency.

In terms of safety, AI enhances vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, allowing cars to share critical information about road conditions, hazards, and traffic signals. This connectivity helps prevent accidents and improves overall road safety. AI also enables personalized in-car experiences, such as adaptive infotainment systems that learn user preferences and offer tailored content.

Additionally, AI supports predictive maintenance by monitoring vehicle performance and diagnosing potential issues before they become critical. This reduces downtime and maintenance costs. As AI technologies continue to evolve, they promise even greater advancements, driving further growth in the connected car market. Overall, AI integration is set to redefine automotive innovation, making connected cars smarter, safer, and more efficient.

In the rapidly evolving connected car market, an efficient supply chain is crucial for delivering advanced technological solutions to consumers. The supply chain begins with sourcing high-quality components from global suppliers, including sensors, microchips, and communication modules. These components are then transported to manufacturing facilities, where they are integrated into vehicle systems.

Manufacturers collaborate closely with technology providers to ensure compatibility and performance of connected features. Once assembled, the connected car units undergo rigorous testing to ensure reliability and compliance with industry standards. Finished products are then distributed to automotive dealers and service centers, leveraging a well-coordinated logistics network.

Key to this process is real-time data sharing and communication between all stakeholders. This transparency helps to streamline inventory management, reduce lead times, and quickly address any disruptions. Additionally, a robust after-sales service network ensures timely support and maintenance, enhancing the overall customer experience.

Overall, a well-orchestrated supply chain in the connected car market is essential for delivering innovative, reliable, and high-quality vehicles to the market efficiently.

The Connected Car Market ecosystem is driven by several key components and players that enhance vehicle connectivity and user experience. Central to this ecosystem are automotive manufacturers, technology providers, and telecommunication companies. Automotive manufacturers like Toyota and Ford integrate advanced connectivity features into their vehicles, ensuring seamless communication between cars and external networks. Technology providers, such as Qualcomm and NVIDIA, supply the hardware and software necessary for data processing, real-time analytics, and vehicle-to-everything (V2X) communication.

Telecommunication companies, including AT&T and Verizon, play a crucial role by offering the cellular networks that enable data transmission between vehicles and infrastructure. These companies provide the necessary bandwidth and coverage for applications such as real-time traffic updates, remote diagnostics, and over-the-air software updates. Additionally, cloud service providers like Amazon Web Services and Microsoft Azure support the storage and processing of vast amounts of data generated by connected vehicles.

Together, these stakeholders create a robust ecosystem that supports innovations in autonomous driving, improved safety features, and enhanced user experiences. Their combined efforts ensure that connected vehicles can operate efficiently, securely, and in sync with the broader digital environment.

Key Industry Highlights: Clamor for Safety and Security Features

The automotive industry is rapidly evolving, driven by heightened consumer interest in connected car services and the broader adoption of IoT and cloud-based technologies. This growth has prompted a surge in market opportunities for cybersecurity solutions tailored to connected cars, as concerns over vehicle security have become increasingly prominent.

Leading companies are focusing on delivering high-speed connectivity, precise location sharing, and efficient tracking to address these safety issues. The advent of autonomous driving technology has also introduced new safety requirements, necessitating advanced specifications to ensure a fully autonomous driving experience.

The rising incidence of road traffic accidents, which claim approximately 1.35 million lives globally each year according to the World Health Organization, has further fueled the demand for improved vehicle safety. In response, manufacturers are integrating sophisticated safety features such as lane departure warnings, pedestrian detection systems, and automatic braking technology to enhance road safety.

Smart city initiatives are also reshaping the connected car landscape, driving many manufacturers to transition towards fuel-free vehicles. These developments underscore the automotive sector's ongoing transformation towards greater safety and sustainability.

Demand for Convenience and Comfort Specs

Modern consumers are increasingly seeking ways to stay connected and entertained while on the road. In response, automakers are enhancing car interiors with advanced infotainment systems, voice recognition capabilities, and seamless smartphone integration. These innovations are designed to elevate both the driving experience and overall convenience.

The integration of artificial intelligence (AI) and machine learning (ML) has revolutionized the connected car industry. These technologies enable vehicles to automatically adjust seats, regulate air conditioning, and operate entertainment applications, offering a more personalized and enjoyable driving experience.

Rise of Ride-Sharing Services

The surge in ride-sharing popularity has prompted auto manufacturers to develop solutions tailored to this growing market. Innovations include real-time data sharing, enhanced communication features, and improved passenger experiences. These advancements are essential for meeting the evolving needs of ride-sharing companies and their users.

The adoption of IoT and cloud-based technologies has further accelerated the development of connected car services. Remote diagnostics, over-the-air software updates, and predictive maintenance are now standard features that enhance vehicle performance and user convenience.

Overall, the automotive industry is witnessing a dynamic shift towards enhanced safety, comfort, and connectivity, driven by technological advancements and changing consumer expectations.

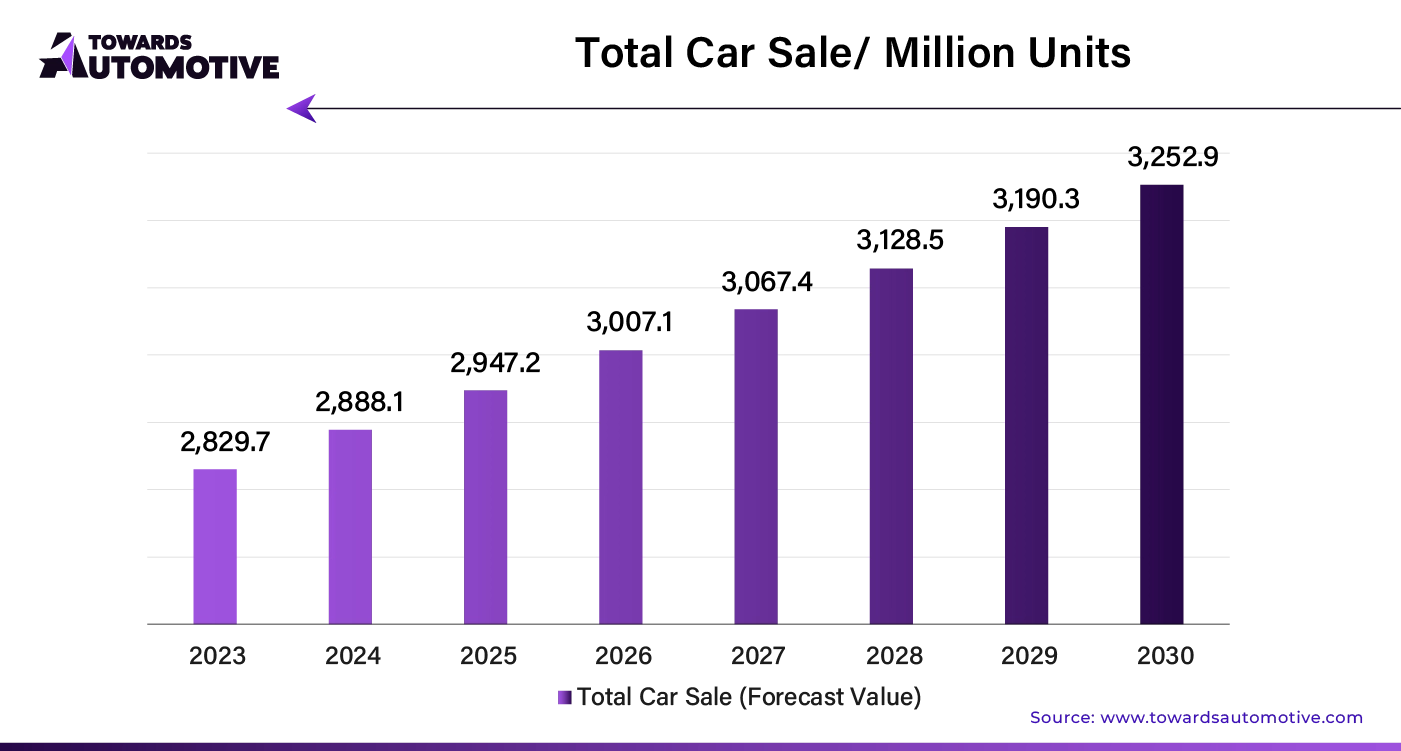

Rising sale of the vehicles has risen the demand for the connected cars services which is estimated to drive the growth of the connected car market over the forecast period.

The connected car market is rapidly evolving, driven by advancements in network technologies and communication methods. Among these, 5G stands out as a transformative force, while Vehicle-to-Vehicle (V2V) communication is instrumental in enhancing road safety and efficiency. Here’s a detailed look at how these elements are shaping the future of connected vehicles.

5G Network Technology Value Share (2024): 60%

5G technology is at the forefront of the connected car revolution, primarily due to its remarkable speed, low latency, and reliable connectivity. As one of the most advanced network technologies available, 5G addresses the critical needs of connected car applications, ensuring seamless integration and operation.

Key Benefits of 5G in Connected Cars:

The impact of 5G is significant, with the technology expected to capture around 60% of the connected car network technology market share by 2024. This dominance reflects the technology’s pivotal role in enhancing autonomous driving capabilities and offering advanced in-car entertainment services.

V2V Communication Value Share (2024): 65%

Vehicle-to-Vehicle (V2V) communication is a critical component of the connected car landscape, offering a secure and reliable method for vehicles to exchange information. This communication type is essential for developing innovative services that enhance road safety and driving efficiency.

Advantages of V2V Communication:

In 2024, V2V communication is expected to hold approximately 65% of the connected car communication market share. Its substantial share underscores its importance in the advancement of connected car technologies and its role in enhancing both safety and efficiency on the road.

The connected car market is experiencing rapid growth globally, driven by advancements in technology, increased consumer demand, and significant investments in innovation. Among the top leaders in this sector are Germany, Italy, the United Kingdom, the United States, and South Korea. Each of these countries is making substantial strides in the connected car industry, contributing to a dynamic and competitive global market.

Germany: Leading the Charge with Innovation

Germany, renowned for its robust automotive sector and advanced machinery, is at the forefront of the connected car market. With a projected CAGR of 13.9% from 2024 to 2034, Germany is set to maintain its leadership position in this industry. The country’s dominance is driven by its strong presence of multinational automotive companies and a high rate of technological integration.

The German automotive sector benefits from significant investments in cybersecurity for connected vehicles, enhancing safety and reliability. Recent innovations, such as Bosch’s new MEMS sensor, the SMI230, highlight Germany's commitment to advancing connected car technologies. This sensor improves the accuracy of vehicle movement visualization, contributing to enhanced navigation and overall driving experience.

Italy: A Strong Contender in the European Market

Italy follows closely with a projected CAGR of 13.1% over the same period. The country’s growth in the connected car market is fueled by its strong automotive industry and increasing adoption of advanced technologies. Italian manufacturers are focusing on integrating sophisticated connectivity features into vehicles, driving market expansion and innovation.

United Kingdom: Expanding Market with Strategic Investments

The United Kingdom is expected to achieve a CAGR of 12.8% from 2024 to 2034, reflecting its growing role in the connected car industry. The UK is leveraging its technological expertise and regulatory frameworks to boost the adoption of connected car technologies. Investments in research and development are central to the country’s strategy, with significant contributions to vehicle safety and connectivity.

United States: Driving Growth with Cutting-Edge Research

In the North American region, the United States stands out with a projected CAGR of 12.7% through 2034. The country’s growth is driven by stringent vehicle safety standards, increasing demand for vehicle-to-vehicle connectivity, and the integration of IoT technologies in the automotive sector.

The establishment of research centers, such as Ford Motor Co.’s new Atlanta Research and Innovation Center, underscores the United States' commitment to advancing connected car technologies. This facility focuses on accelerating digital transformation, developing new technologies, and exploring partnerships for research in connected mobility. Innovations in artificial intelligence and mobility are key to the United States' expanding role in the global connected car market.

South Korea: Harnessing Technology for Market Growth

South Korea, with a projected CAGR of 12.1% through 2034, is making significant strides in the connected car sector. The country’s technological expertise and strong automotive industry are driving growth, supported by a tech-savvy consumer base and government initiatives.

The South Korean government’s smart transportation and smart city projects are crucial in fostering industry growth. Incentives and subsidies aimed at reducing traffic congestion and improving road safety are driving demand for connected car technologies. Notable collaborations, such as LG Uplus Corp.’s agreement to provide exclusive wireless communication services to Hyundai Motor Group, highlight South Korea's advancements in connected vehicle technologies.

The automotive industry is witnessing a significant shift with the integration of advanced connectivity and safety features in vehicles. The latest innovations enable real-time data exchange, allowing vehicles to communicate not only with each other but also with infrastructure elements. This seamless communication enhances safety and driving experience. Leading manufacturers are investing heavily in developing cutting-edge features and opening new research facilities to drive the future of safer and more technologically advanced driving.

By Network Technology

By Communication Type

By Application

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us