March 2025

The global construction equipment tyres market is forecasted to expand from USD 10.60 billion in 2025 to USD 18.45 billion by 2034, growing at a CAGR of 6.32% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The construction equipment tires market is an important segment of the global construction and infrastructure ecosystem, supporting the efficient operation of heavy machinery across diverse industries. These tires are designed to endure extreme conditions, including rugged terrains, heavy loads, and varying weather environments, making them indispensable for construction, mining, and agricultural activities.

As infrastructure development accelerates worldwide, particularly in emerging economies, the demand for durable, high-performance tires is rising significantly. Key industries such as urban construction, road development, and mining rely heavily on machinery equipped with specialized tires that enhance productivity, safety, and cost-efficiency.

Technological advancements have played a transformative role in the market, with innovations such as radial tires, reinforced sidewalls, and self-sealing technologies improving tire lifespan and performance. The focus on sustainability has further driven the adoption of eco-friendly materials and recyclable designs, aligning with global efforts to reduce environmental impacts. Additionally, the replacement tire market is growing steadily, fueled by the wear-and-tear cycles of heavy-duty machinery, ensuring consistent demand.

AI plays a transformative role in the construction equipment tires market, driving innovation, efficiency, and operational safety. One of its primary applications is in predictive maintenance, where AI-powered systems analyze real-time data from tire sensors to monitor pressure, temperature, and tread wear. This proactive approach helps identify potential issues before they lead to failures, reducing downtime and maintenance costs while maximizing tire lifespan. By leveraging machine learning algorithms, fleet managers can optimize tire performance and plan replacements strategically, enhancing overall productivity.

In addition, AI enhances tire design and manufacturing processes. Advanced simulations and predictive analytics enable tire manufacturers to develop products with improved durability, traction, and resistance to wear. These AI-driven innovations are particularly valuable for construction equipment operating in harsh environments, where tire performance directly impacts efficiency and safety.

AI also supports the integration of smart tire technologies. Sensor-equipped tires, combined with AI analytics, provide real-time insights to operators about terrain conditions, load distribution, and fuel efficiency. This level of precision reduces energy consumption and improves equipment handling, addressing the growing demand for sustainable and cost-effective solutions.

Moreover, AI-powered market analysis aids manufacturers in understanding customer preferences and market trends, allowing them to innovate and tailor their products accordingly. As construction projects become more advanced, AI's role in optimizing tire performance and lifecycle management will continue to drive growth in the construction equipment tires market.

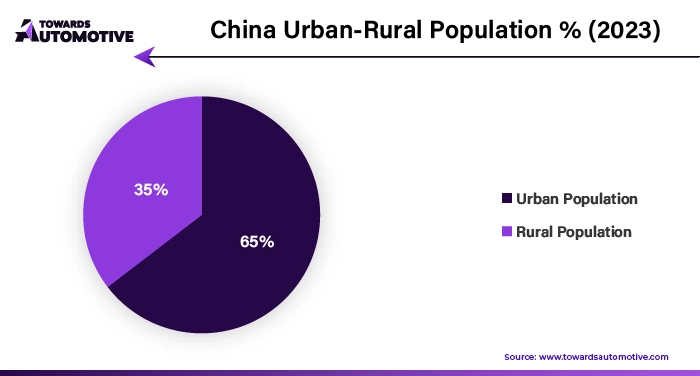

Rising government initiatives for infrastructural development are significantly driving the growth of the construction equipment tires market by fueling demand for heavy machinery and their supporting components. Governments across the globe, especially in emerging economies, are heavily investing in large-scale infrastructure projects such as highways, railways, airports, and urban development initiatives. For instance, projects under China's Belt and Road Initiative, India’s Smart Cities Mission, and the US Infrastructure Investment and Jobs Act have created substantial opportunities for construction equipment, directly increasing the demand for durable and high-performance tires.

These initiatives require a wide range of construction equipment, including excavators, loaders, bulldozers, and graders, all of which rely on specialized tires to ensure optimal performance across diverse terrains and extreme conditions. Construction equipment tires designed with advanced features such as enhanced load-bearing capacity, puncture resistance, and superior traction are increasingly sought after to meet the demands of these projects.

Additionally, many governments are focusing on rural development and connectivity, which involves building roads, bridges, and irrigation systems. These projects often require off-highway construction equipment equipped with tires capable of handling rugged and uneven surfaces. Technological advancements in tire design, such as self-sealing and radial tires, are also gaining traction, further supporting the market’s growth.

The construction equipment tires market faces several restraints that could hinder its growth. High costs associated with advanced tire technologies, such as radial and puncture-resistant tires, pose challenges for small and medium-sized enterprises with limited budgets. Fluctuations in raw material prices, particularly natural rubber and synthetic materials, further impact production costs and pricing. Additionally, the market is affected by stringent environmental regulations that mandate eco-friendly tire production, increasing manufacturing complexities. Limited adoption of advanced tires in developing regions due to lack of awareness and infrastructure also slows market penetration. These factors collectively restrain the growth of the construction equipment tires market.

The advancements in tire recycling processes are creating significant opportunities in the construction equipment tires market by addressing sustainability concerns and resource optimization. With increasing global focus on environmental preservation, the disposal of used tires from heavy construction equipment poses a critical challenge. Modern recycling technologies, such as pyrolysis, devulcanization, and cryogenic grinding, have revolutionized the way tires are processed at the end of their lifecycle, enabling the recovery of valuable materials like rubber, steel, and carbon black. These materials can be repurposed to manufacture new tires or other industrial products, reducing the dependency on virgin raw materials.

The adoption of advanced recycling processes also aligns with stricter environmental regulations and sustainability goals set by governments and organizations worldwide. For instance, the European Union and the United States have implemented policies encouraging tire recycling to minimize landfill waste and carbon emissions. Such regulations are pushing manufacturers to incorporate recycled materials into their tire production, opening avenues for innovation and cost savings.

Moreover, advancements in tire recycling technology have made it possible to produce high-quality recycled rubber with properties similar to virgin rubber, ensuring performance and durability. This has encouraged manufacturers to invest in sustainable practices and develop eco-friendly tire solutions for construction equipment. As sustainability becomes a key focus in the construction industry, the integration of recycled materials into tire manufacturing not only reduces environmental impact but also creates a competitive edge for companies, fostering growth in the construction equipment tires market in the future.

The off-highway construction equipment segment led the industry. Off-highway construction equipment significantly drives the growth of the construction equipment tires market by increasing the demand for robust, durable, and high-performance tires. These vehicles, including loaders, excavators, bulldozers, and dump trucks, are essential for large-scale infrastructure projects, mining, and heavy-duty construction activities. As global investments in infrastructure development rise, particularly in emerging economies, the need for specialized tires capable of withstanding extreme loads, rough terrains, and harsh conditions is expanding.

The versatility and heavy-duty nature of off-highway construction equipment necessitate the use of advanced tire technologies, such as radial and bias-ply tires, which offer enhanced durability, traction, and load-carrying capacity. Additionally, innovations like puncture-resistant and self-healing tires are gaining traction, addressing operational challenges and reducing downtime. These features are particularly beneficial in industries such as mining, where equipment operates under demanding conditions.

The adoption of off-highway construction equipment is also fueled by the growing trend of mechanization in the construction and agriculture sectors. As these industries modernize, the demand for technologically advanced tires tailored for off-highway applications increases. Moreover, the replacement cycle for these tires, due to wear and tear from continuous operation, creates a steady demand in the aftermarket segment.

With the rise in global construction projects, particularly in Asia-Pacific and North America, off-highway construction equipment continues to be a key growth driver, fostering innovation and demand in the construction equipment tires market.

The smooth thread segment dominated the market. The smooth tread segment plays a crucial role in driving the growth of the construction equipment tires market by addressing specific operational needs in industries such as mining, road construction, and material handling. Smooth tread tires are designed for specialized applications that require maximum surface contact, such as working on hard, compacted surfaces like concrete and asphalt. These tires offer exceptional durability and resistance to wear, making them ideal for equipment like compactors, pavers, and loaders used in heavy-duty construction and infrastructure projects.

One of the primary growth drivers of the smooth tread segment is the rise in large-scale infrastructure projects worldwide, especially in developing regions like Asia Pacific and the Middle East. As governments and private players invest in roads, bridges, and urban development, the demand for smooth tread tires tailored for such applications continues to grow. Additionally, these tires are highly resistant to punctures and cuts, which enhances their operational lifespan, reduces downtime, and improves cost efficiency for end-users.

Advancements in tire technology, such as the incorporation of heat-resistant compounds and reinforced sidewalls, have further boosted the performance and reliability of smooth tread tires, driving their adoption. Moreover, the rising emphasis on sustainability has encouraged the development of smooth tread tires made from eco-friendly and recyclable materials, aligning with environmental regulations. These factors collectively position the smooth tread segment as a significant contributor to the growth of the construction equipment tires market.

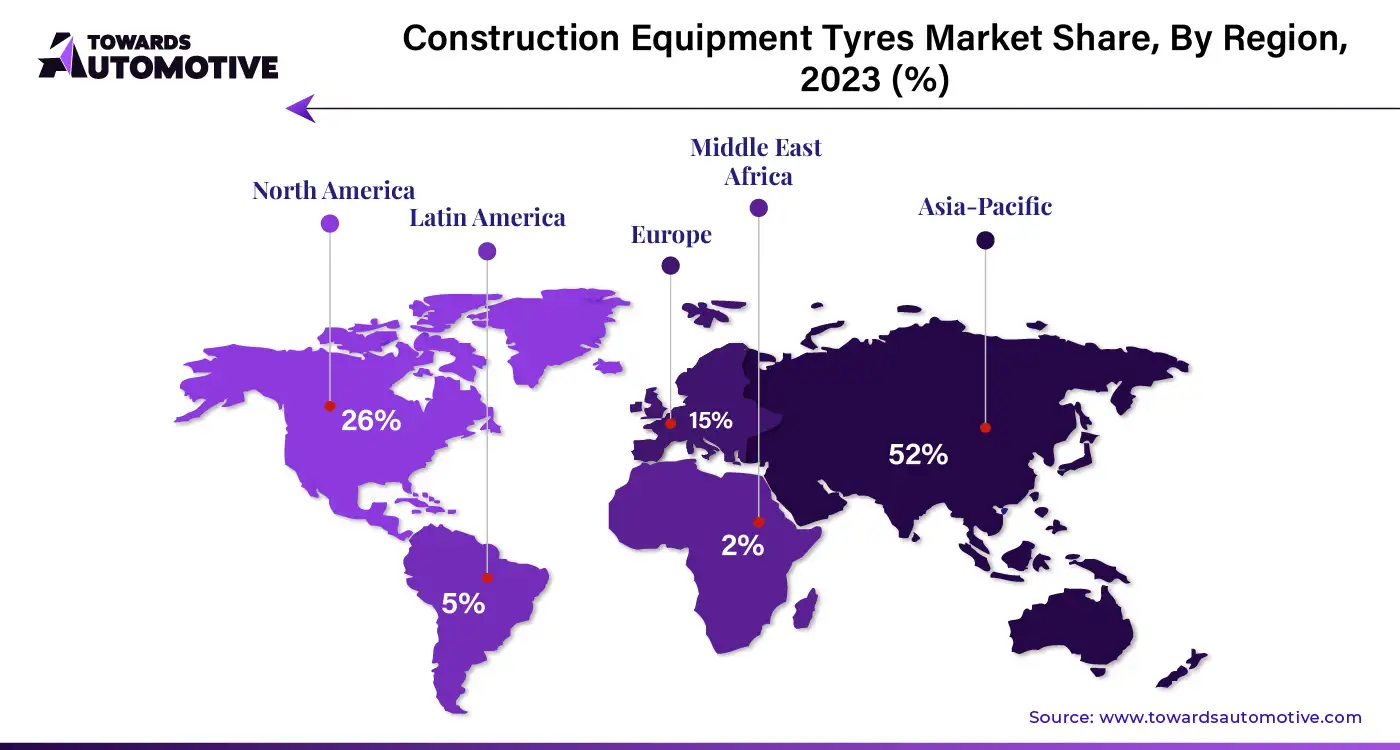

North America dominated the construction equipment tyres market. The construction equipment tires market in North America is driven by several factors, primarily the robust demand for infrastructure development and construction activities across the region. Significant government investments in large-scale projects, such as highway expansions, smart city initiatives, and renewable energy infrastructure, fuel the demand for durable and high-performance tires for heavy machinery. The booming construction sector, particularly in the United States and Canada, drives the need for advanced tire technologies capable of withstanding challenging terrains and high-load applications.

Technological advancements also play a pivotal role in market growth, with innovations such as radial tires, puncture-resistant designs, and self-healing materials gaining popularity. These advancements enhance tire durability and efficiency, aligning with the growing emphasis on cost-effectiveness and operational productivity. Additionally, the adoption of smart tires equipped with sensors and telematics systems is rising, enabling real-time monitoring of tire performance, reducing downtime, and improving fleet management.

The replacement tire segment is another key driver in North America, driven by the regular wear and tear associated with heavy-duty construction equipment. Furthermore, the region’s focus on sustainability has spurred demand for eco-friendly tires made from recyclable materials, catering to environmental regulations and consumer preferences. These drivers collectively position North America as a significant growth region in the construction equipment tires market.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The construction equipment tires market in Asia Pacific (APAC) is driven by rapid urbanization, expanding infrastructure development, and increasing construction activities across the region. Countries such as China, India, and Southeast Asian nations are experiencing significant investments in roads, railways, housing, and energy infrastructure, fueling the demand for durable and high-performance tires for heavy equipment. The rise of industrialization and government-backed initiatives for smart city projects further contribute to the market’s growth.

The advancements in different types of tires such as radial tires, self-sealing technologies, and reinforced designs, are gaining traction in APAC, improving durability and performance. These innovations address the region's diverse and challenging terrains, ensuring safety and operational efficiency in construction and mining applications. Additionally, the adoption of sensor-equipped smart tires is increasing, enabling real-time monitoring of tire pressure, temperature, and wear, which enhances fleet management and reduces downtime.

The booming mining sector in resource-rich countries like Australia and Indonesia also drives demand for specialized tires that can withstand heavy loads and rugged conditions. Moreover, the replacement tire segment sees steady growth due to the regular wear-and-tear cycles of construction machinery. APAC’s cost-conscious market also benefits from locally produced, competitively priced tires, which cater to small and medium-sized enterprises. These drivers solidify APAC's position as a key growth region for the construction equipment tires market.

By Tire Type

By Application

By Vehicle Size

By Thread Pattern

By Region

March 2025

March 2025

March 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us