March 2025

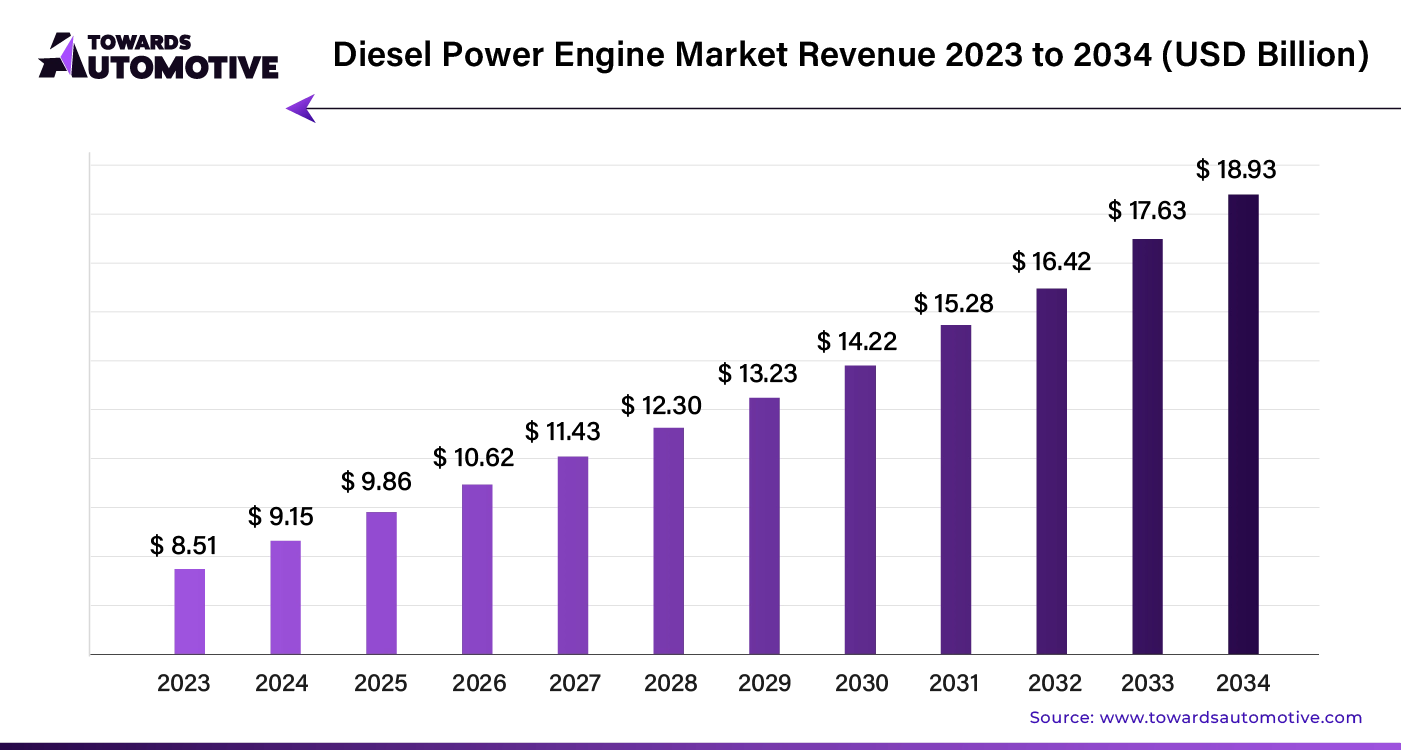

The global diesel power engine market size is calculated at USD 9.15 billion in 2024 and is expected to be worth USD 18.93 billion by 2034, expanding at a CAGR of 7.65% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Diesel engines are gaining traction for their superior fuel efficiency compared to petrol engines, particularly in construction equipment, buses, and trucks. Stringent government regulations are boosting demand for diesel propulsion systems due to their clean technology benefits. Major automakers are incorporating diesel engines into electric and hybrid powertrains to reduce emissions and improve efficiency in off-road machinery and commercial vehicles.

Research is focused on developing alternative fuels like renewable diesel, synthetic diesel, and biodiesel to decrease reliance on fossil fuels and lower greenhouse gas emissions. Additionally, manufacturers are integrating digital technologies and connectivity solutions into diesel engines for enhanced optimization, predictive maintenance, and real-time monitoring. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Artificial Intelligence (AI) is revolutionizing the Diesel Power Engine market by driving significant advancements in efficiency, performance, and maintenance. AI technologies enable real-time monitoring and analysis of engine performance, allowing for proactive adjustments and optimization. This results in increased fuel efficiency and reduced emissions, addressing environmental concerns while meeting regulatory standards.

Predictive maintenance powered by AI reduces downtime by anticipating engine failures before they occur. By analyzing data from various sensors, AI can predict potential issues and recommend timely interventions, minimizing costly repairs and enhancing engine longevity.

Furthermore, AI-driven algorithms optimize fuel injection and combustion processes, leading to better performance and lower operational costs. The integration of AI also fosters innovation in engine design, facilitating the development of advanced technologies such as hybrid powertrains and smart engine controls.

As AI continues to evolve, it will further transform the Diesel Power Engine market, driving growth through enhanced operational efficiency, reduced environmental impact, and improved maintenance practices. Embracing AI is not just a competitive advantage; it's becoming essential for market leaders aiming to thrive in a rapidly evolving industry.

In the diesel power engine market, a streamlined supply chain is crucial for maintaining competitiveness and meeting demand. The process begins with sourcing raw materials like steel and aluminum, which are essential for engine components. Suppliers deliver these materials to manufacturers who assemble the engines using precision machinery. Efficient logistics play a key role here, ensuring timely transportation from suppliers to manufacturing plants.

Manufacturers focus on quality control and efficiency, assembling engines to meet rigorous industry standards. Post-production, engines are distributed to various end-users, including industrial sectors, construction, and marine applications. Distribution centers are strategically located to minimize transportation time and costs, enhancing delivery reliability.

To address market fluctuations and demand variations, companies employ advanced forecasting techniques and inventory management systems. They also establish strong relationships with suppliers to secure a steady flow of critical components. By integrating real-time data analytics, companies can adapt quickly to changes in demand and supply disruptions, ensuring a resilient and responsive supply chain. This efficient supply chain management ultimately supports market growth and customer satisfaction.

The Diesel Power Engine market thrives due to the contributions of several major companies, each playing a vital role in its ecosystem.

Cummins Inc. leads with its robust diesel engines known for reliability and performance in diverse applications, from industrial to automotive. Caterpillar Inc. enhances the market with its innovative engines and comprehensive service solutions, ensuring efficiency and longevity. Rolls-Royce Holdings plc brings advanced engineering to the table, focusing on high-power engines for aerospace and marine sectors.

MAN Energy Solutions provides cutting-edge technology for large-scale power generation, while Volvo Penta offers versatile engines catering to marine and industrial needs. Mitsubishi Heavy Industries delivers high-performance engines with a focus on environmental sustainability.

These companies collectively drive advancements in engine efficiency, emission control, and overall performance, creating a competitive and dynamic market environment. Their contributions ensure that diesel power engines remain integral to various industries, meeting both current and future demands.

The diesel power engine market is witnessing notable growth across various regions, with Japan, the United Kingdom, and the United States leading the way. Japan is emerging as the fastest-growing market, expected to expand at a vigorous CAGR of 8.8% from 2024 to 2034. The United Kingdom and the United States follow, with anticipated CAGRs of 8.3% and 7.7%, respectively.

Among these regions, the United States dominates the market, projected to reach a valuation of US$ 3.2 billion by 2034. This leadership is driven by several factors:

China follows the United States in market size, with an anticipated valuation of US$ 2.5 billion by 2034. The country’s steady growth is driven by:

Japan’s diesel power engine market is also expanding significantly, driven by a CAGR of 8.8%. Key factors contributing to this growth include:

In the diesel power engine industry, the standby operation segment is experiencing the fastest growth, projected to expand at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2034. This surge is driven by increasing demand for backup power solutions, especially for critical applications like emergency power systems. As grid power becomes less reliable, the need for diesel generators to ensure continuous operation is rising. Additionally, the growing IT infrastructure and data center expansions are fueling the need for diesel-powered generators to prevent data loss and minimize downtime.

On the other hand, diesel engines rated up to 0.5 MW are dominating the market in terms of rated power. This segment is expected to grow at a CAGR of 7.2% through 2034. The main drivers behind this growth are the rising need for distributed power generation in remote areas and the versatility of engines rated up to 0.5 MW. These engines are ideal for small communities, telecommunications towers, off-grid installations, and industrial hubs due to their compact size and ability to meet various power requirements.

The global diesel power engine market is highly fragmented, featuring numerous key players. These companies are increasingly collaborating with major automakers to supply their heavy-duty diesel engines.

Automakers are working to boost diesel vehicle sales by updating existing models with diesel engines and incorporating new features.

For example:

By Operation

By Rated Power

By End-user

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us