April 2025

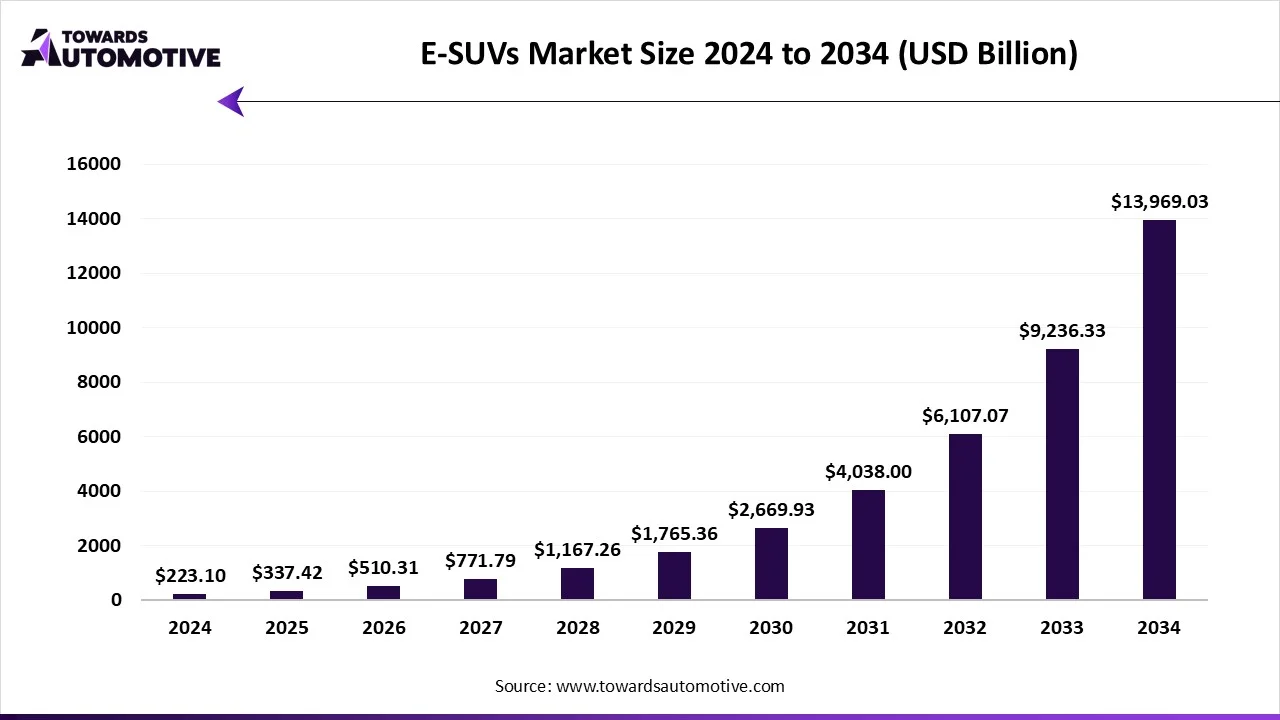

The E-SUVs market is forecast to grow from USD 337.42 billion in 2025 to USD 13,969.03 billion by 2034, driven by a CAGR of 51.24% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

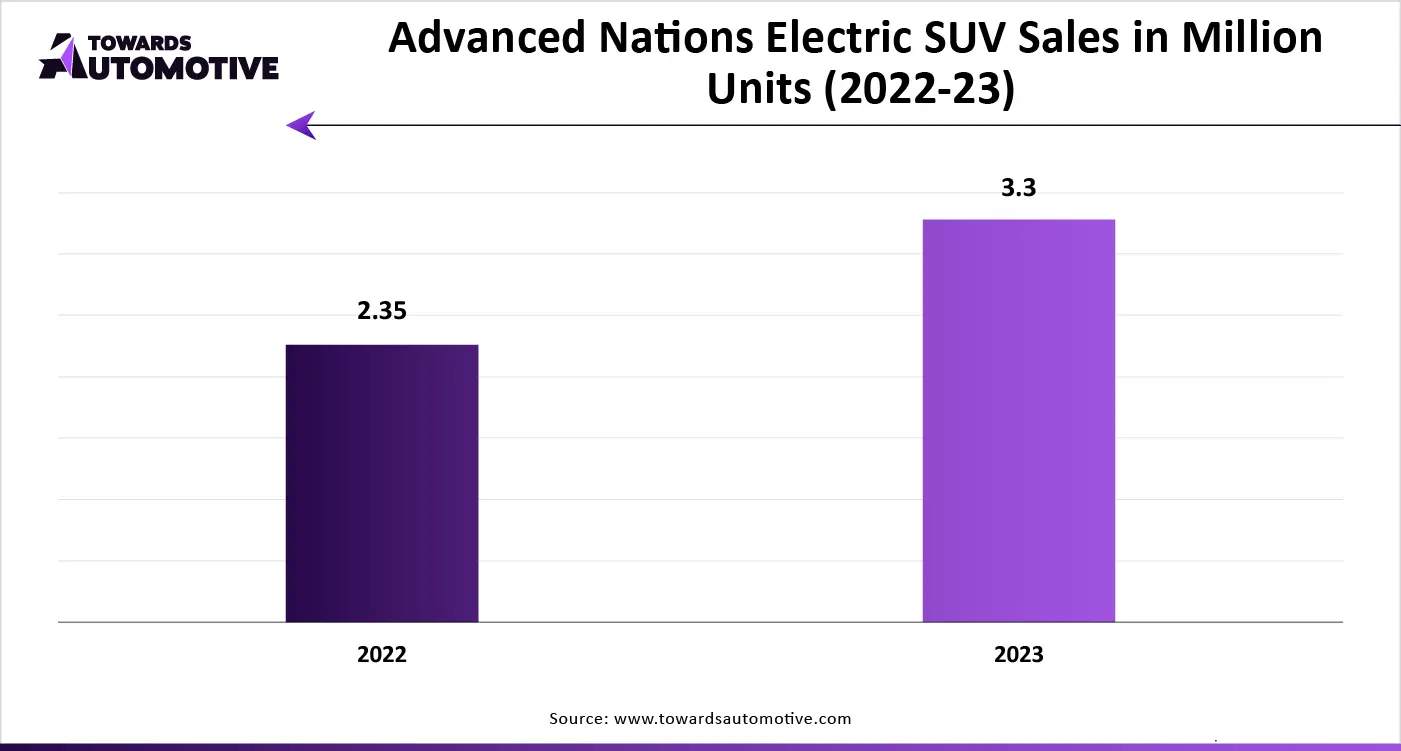

The E-SUVs market is a crucial branch of the electric vehicle industry. This industry deals in manufacturing and distribution of electric SUVs across the globe. There are different types of vehicles developed in this sector including compact SUVs, mid-size SUVs and full-size SUVs. These SUVs are comprises of different components such as body, chassis, powertrain, battery, electronics and some others. It is designed for providing various driving range comprising of upto 150 kms, 150 to 300 kms, above 300 kms and some others. The growing sales of electric SUVs in different parts of the globe has boosted the market expansion. This market is expected to rise significantly with the growth of the automotive sector around the world.

| Metric | Details |

| Market Size in 2024 | USD 223.10 Billion |

| Projected Market Size in 2034 | USD 13969.03 Billion |

| CAGR (2025 - 2034) | 51.24% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Propulsion, By Size, By Driving Range, By Components, By Region |

| Top Key Players | Hyundai Motor Company (South Korea), BYD Company Ltd. (China), Toyota Motor Corporation (Japan), Volkswagen AG (Germany) |

The HEV segment led the industry. The rising demand for vehicles that provides high-driving range has boosted the market expansion. Also, the technological advancements in parallel hybrid powertrain along with rapid investment by automotive companies for developing full hybrid vehicles is crucial for the industrial growth. Moreover, the increasing adoption of hybrid SUVs due to several benefits such as low maintenance, high fuel economy, regenerative braking and some others is expected to boost the growth of the E-SUVs market.

The BEV segment is likely to rise with a significant growth rate during the forecast period. The growing demand for eco-friendly SUVs around the world boosts the market growth. Also, several government initiatives aimed at strengthening the EV charging infrastructure coupled with rising consumer awareness to reduce CO2 emission has played a significant role in shaping the industrial landscape. Additionally, various automotive companies such as Mahindra and Tata are investing heavily for developing advanced electric SUVs is projected to drive the growth of the E-SUVs market.

The mid-size segment led the industry. The rising sales of budget SUVs in middle income countries such as China, India, South Africa and some others has boosted the market growth. Also, the growing consumer preference for comfortable vehicles with 5-seater arrangement is positively driving the market expansion. Moreover, the increasing demand for SUVs with advanced features and high-driving range propels the industrial growth.

The full-size segment is predicted to grow with the highest CAGR during the forecast period. The rising demand for luxury SUVs in different parts of the world has boosted the market expansion. Additionally, the growing consumer preference towards off-roading activities is crucial for the industrial growth. Moreover, the increasing demand for 7-seater vehicles among elite class people is projected to foster the growth of the E-SUVs market.

The 150-300 km segment held the largest portion of the industry. The growing sales of affordable SUVs in developing nations has boosted the market expansion. Also, the rising adoption of EVs among sub-urban commuters due to its versatility and flexibility is playing a vital role in shaping the industrial landscape. Moreover, the increasing use of li-ion batteries in affordable SUVs is projected to drive the market growth.

The above 300 km segment is anticipated to grow with the fastest rate during the forecast period. The rising demand for SUVs with high-driving range propels the market growth. Additionally, the increasing sales of luxury SUVs in developed nations along with technological advancements in EV manufacturing sector is crucial for the industrial expansion. Furthermore, the rapid integration of solid-state batteries in SUVs for delivering high-driving range is expected to foster the growth of the E-SUVs market.

The powertrain segment dominated the market. The rising demand for high-performance powertrain systems in SUVs drives the market growth. Also, the growing research and development activities for developing efficient and powerful drivetrain propels the industrial expansion. Moreover, rapid investment by automotive brands for opening new powertrain manufacturing facility is projected to boost the market growth.

The battery segment is projected to rise with the highest CAGR during the forecast period. The growing demand for SUVs with high-driving range has boosted the market growth. Also, technological advancements in battery manufacturing coupled with numerous partnerships among automotive brands and battery companies is crucial for the industrial expansion. Moreover, rapid developments in li-ion batteries and solid-state batteries is expected to propel the growth of the E-SUVs market.

Asia Pacific held the highest share of the E-SUVs market. The rising investment by government for strengthening the EV infrastructure drives the market expansion. Also, the rising demand for compact SUVs in countries such as India, Nepal, Bhutan and some others propels the industrial growth. Moreover, the presence of numerous EV brands such as Xpeng, Toyota, Suzuki, Tata Motors, BYD and some others is likely to drive the market growth in this region.

China dominated the market in this region. The growing consumer awareness to reduce emission in the environment along with availability of raw materials at low prices is driving the market expansion. Also, the developments in the battery industry with the presence of numerous market leaders such as CATL, BYD, CALB and some others has boosted the market growth.

India, Japan, South Korea also contributed significantly to the market growth. In India, the market is generally driven by the growing demand for mid-sized SUVs. In Japan, rapid technological advancements in the automotive sector fosters the market growth. In South Korea, this industry is boosted by the presence of various market players such as Hyundai, Kia and some others.

North America is expected to grow with a significant CAGR during the forecast period. The growing demand for luxury SUVs drives the market growth. Also, rapid investment by government for developing the EV charging infrastructure further propels the market expansion. Moreover, rapid adoption of EVs due to increasing prices of diesel and gasoline also accelerates the industrial growth in this region.

The U.S. is a major contributor of this industry. The market is generally driven by the rising deployment of fast chargers in EV charging stations. Also, the rising demand for sustainable transportation along with government initiatives aimed at developing the EV industry propels the market growth. Moreover, the presence of various market players such as Ford, Rivian and some others is expected to boost the market expansion.

The E-SUVs market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Hyundai Motor Company (South Korea), BYD Company Ltd. (China), Toyota Motor Corporation (Japan), Volkswagen AG (Germany), Mercedes-Benz (Germany) and some others. These companies are constantly engaged in developing E-SUVs and adopting numerous strategies such as product launches, partnerships, business expansion, acquisition, and some others to maintain their dominant position in this industry. For instance, in December 2024, Toyota launched the Urban Cruiser EV. Urban Cruiser EV is a SUV that is available in two battery options including 49-kWh and 61-kWh.

By Propulsion

By Size

By Driving Range

By Components

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us