October 2025

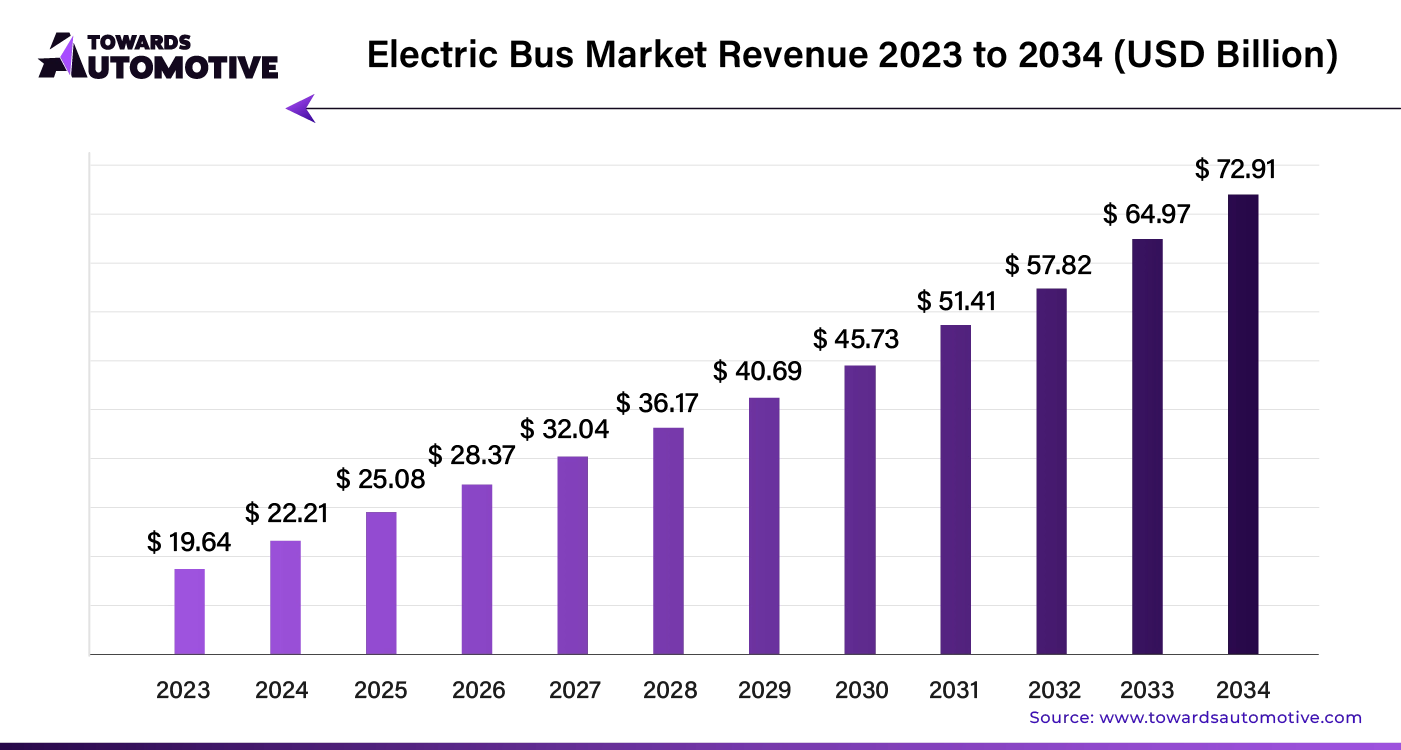

The electric bus market is forecast to grow from USD 25.08 billion in 2025 to USD 72.91 billion by 2034, driven by a CAGR of 12.9% from 2025 to 2034. The increasing adoption of electric buses in urban areas to curb emission along with technological advancements in the EV manufacturing sector is playing a crucial role in shaping the industrial landscape.

Additionally, numerous government initiatives aimed at rising awareness about EVs coupled with rapid investment by automotive brands for opening up new EV bus production facilities has boosted the market expansion. The integration of advanced technologies such as AI and IoT in electric buses is expected to create ample growth opportunities for the market players in the upcoming years.

The electric bus market is a crucial segment of the electric vehicle industry. This industry deals in development and distribution of electric buses across the world. There are numerous types of bus developed in this sector comprising of battery electric buses, plug-in hybrid buses, fuel cell hybrid buses and some others. These buses are powered by different types of batteries including Lithium Nickel manganese cobalt oxide batteries, lithium iron phosphate batteries and some others. The end-user of these buses consists of public and private. This market is expected to rise significantly with the growth of the commercial vehicles industry around the globe.

The major trends in this market consists of government initiatives, partnerships and rapid investment by battery manufacturers.

The battery electric vehicle (BEV) segment dominated the market. The growing sales of electric buses in developed regions with an aim at lowering GHG emission has boosted the market expansion. Also, the increasing adoption of e-buses by airline sector to carry passengers from the aircraft to the airports is playing a crucial role in shaping the industrial landscape. Moreover, technological advancements in battery manufacturing sector is expected to drive the growth of the electric bus market.

The fuel cell electric vehicle (FCEV) segment is expected to expand with a considerable CAGR during the forecast period. The rising emphasis of automotive companies for advancing research and development activities related to FCEV engines has boosted the market expansion. Additionally, the deployment of FCEV buses by transport organizations in numerous developed nations is playing a vital role in shaping the industry in a positive direction. Moreover, growing investment by government of several countries for developing the hydrogen refueling infrastructure is expected to boost the growth of the electric bus market.

The public segment led the market. The deployment of electric buses by municipal corporations in urban areas to reduce vehicular emission has driven the market expansion. Additionally, partnerships among government organizations and bus manufacturers to launch e-buses to enhance intracity transportation is playing a crucial role in shaping the industrial landscape. Moreover, numerous government initiatives aimed at providing sustainable transportation solutions to public is expected to drive the growth of the electric bus market.

The private segment is expected to grow with a significant CAGR during the forecast period. The increasing demand for electric buses by long-route travelers due to enhanced convenience and less ticket price has boosted the market expansion. Additionally, the deployment of e-buses by fleet operators for operating overnight journey with an aim at gaining maximum profits is playing a vital role in shaping the industry in a positive direction. Moreover, the availability of private buses in numerous ticket booking platforms is expected to boost the growth of the electric bus market.

Asia Pacific dominated the electric bus market. The increasing adoption of electric buses in several countries such as China, India, Australia, Singapore and some others with an aim at reducing vehicular emission has boosted the market expansion. Additionally, rapid investment by EV charging providers to open new charging stations coupled with numerous government initiatives aimed at deploying electric buses for public commute is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as BYD, Tata Motors, Hyundai Motor Company and some others is expected to foster the growth of the electric bus market in this region.

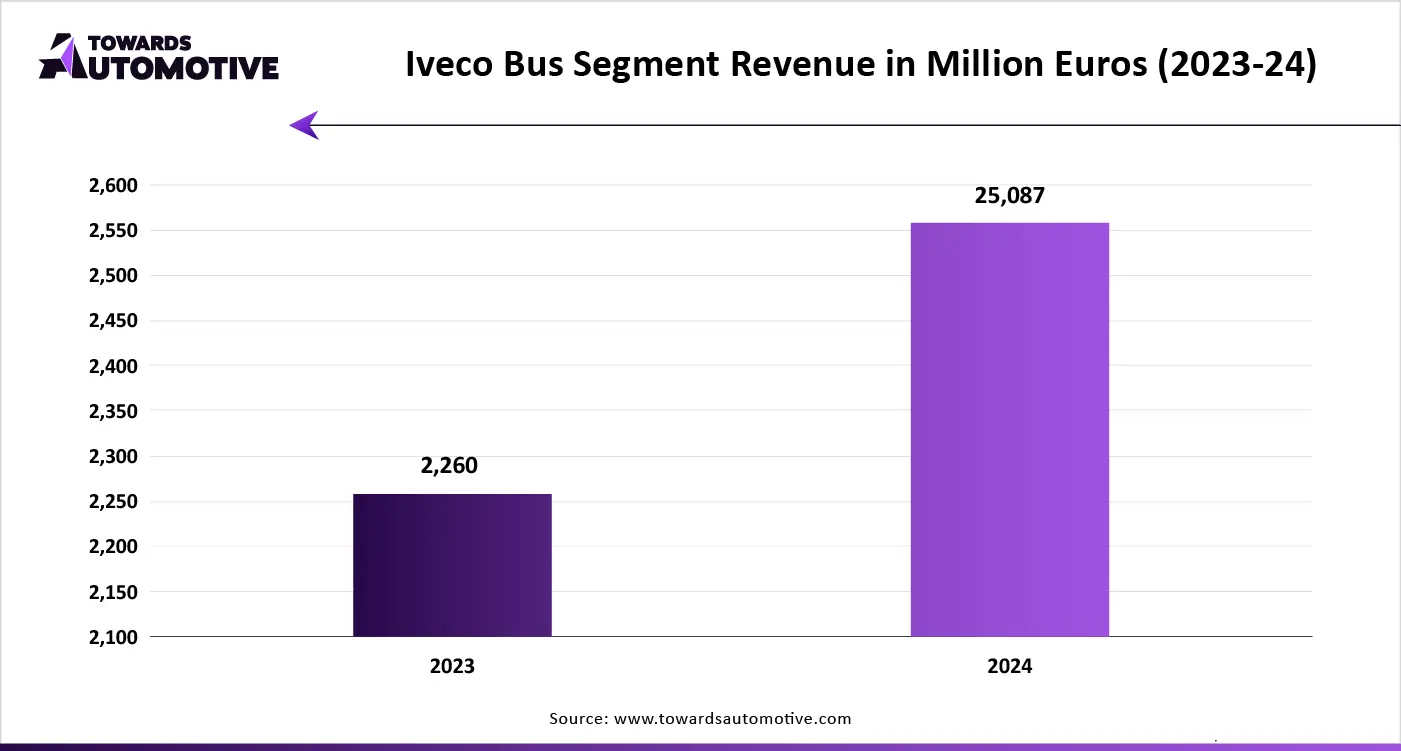

Europe is expected to expand with a significant CAGR during the forecast period. The rising demand for luxury electric buses in prominent nations such as Germany, Italy, France, UK and some others has driven the market growth. Additionally, numerous government initiatives aimed at lowering CO2 emission coupled with rapid deployment of wireless chargers on modern roads is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Volvo, Mercedes-Benz Group AG, Scania and some others is expected to drive the growth of the electric bus market in this region.

The electric bus market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Hyundai Motor Company, BYD Company Limited; AB Volvo; Proterra; Nissan Motor Corporation; Ashok Leyland Limited; Daimler AG; Iveco Group, MAN; Zhengzhou Yutong Bus Co. Ltd.; TATA Motors Limited; and some others. These companies are constantly engaged in developing electric buses and adopting numerous strategies such as joint ventures, acquisitions, launches, partnerships, business expansions, collaborations and some others to maintain their dominance in this industry.

By Type

By Battery Type

By Application

By End-Use

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us