October 2025

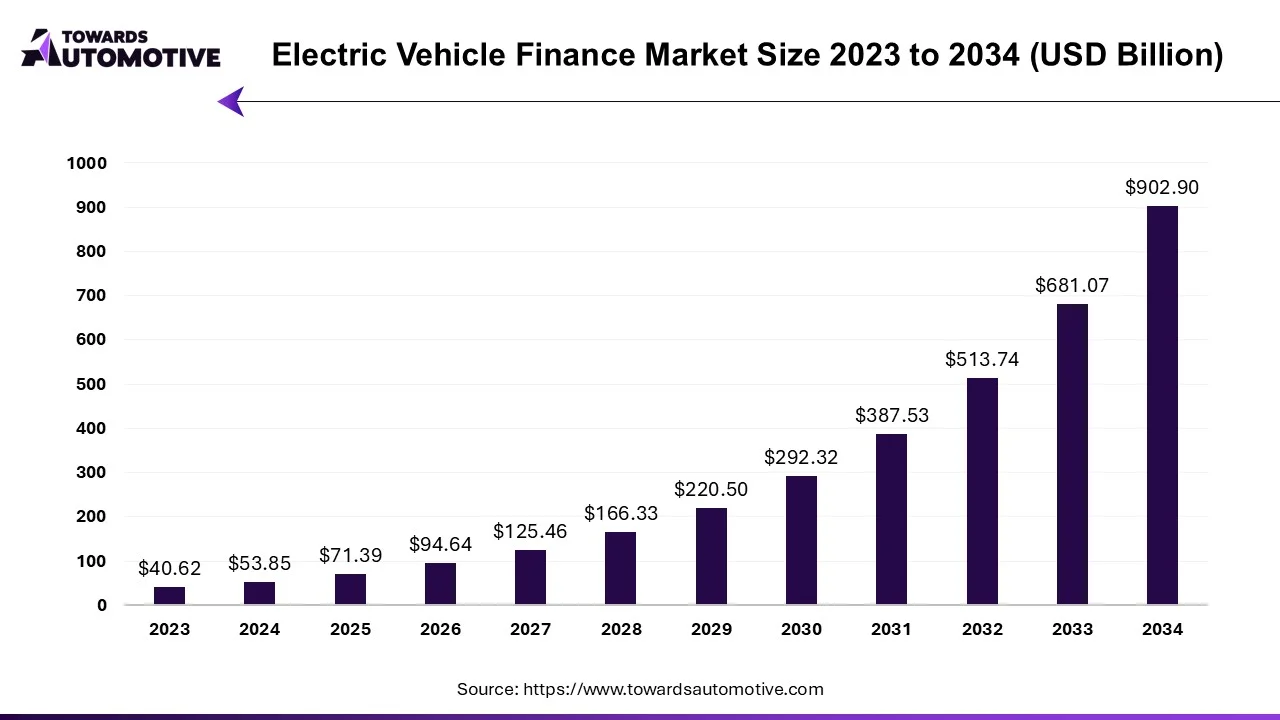

The electric vehicle finance market is predicted to expand from USD 71.39 billion in 2025 to USD 902.90 billion by 2034, growing at a CAGR of 32.57% during the forecast period from 2025 to 2034. The growing sales of EVs in developed nations to curb emission coupled with technological advancements in the BFSI sector is playing a vital role in shaping the industry in a positive direction.

Additionally, the rise in number of EV startups along with numerous government initiatives aimed at providing flexible EMI options to EV consumers has contributed to the market expansion. The rising emphasis on developing the EV charging infrastructure is expected to create ample growth opportunities for the market players in the upcoming years to come.

The electric vehicle finance market is a crucial segment of the BFSI industry. This industry deals in providing loans for purchasing EVs in different parts of the world. These loans are provided by different types of financial institutions including banks, NBFCs and some others. The EV loans are designed for purchasing numerous types of vehicles consisting of passenger cars, commercial vehicles, two-wheelers and three-wheelers. There are several types of finances delivered by this sector comprising of leasing, loans, rent-to-own and some others. The growing adoption of eco-friendly vehicles in different parts of the world has played a crucial role in shaping the industrial landscape. This market is expected to rise significantly with the growth of the automotive sector around the globe.

The bank segment led the market. The growing investment by private banks for providing easy loans to EV consumers at flexible rates has boosted the market expansion. Additionally, the rising consumer preference to available EV loans from government banks due to low interest rate and high security is playing a vital role in shaping the industrial landscape. Moreover, collaborations among EV brands and banks to provide suitable loans for purchasing EVs is expected to propel the growth of the electric vehicle finance market.

The NBFC segment is expected to rise with a significant CAGR during the forecast period. The rise in number of NBFCs in developing nations such as India, Vietnam, Indonesia and some others has driven the market expansion. Also, the increasing emphasis of NBFCs to provide EV loans at moderate interest rates coupled with easy application procedure and flexible repayment options provided by these organizations is adding to the industrial growth. Moreover, joint ventures among NBFCs and EV providers to provide easy loans for purchasing EVs is expected to drive the growth of the electric vehicle finance market.

The passenger car segment dominated the market. The growing sales and production of passenger vehicles in several countries such as the U.S., Germany, China and some others has boosted the market expansion. Additionally, the rising investment by automotive brands for manufacturing EVs coupled with rapid adoption of luxury EVs in developed nations is playing a vital role in shaping the industrial landscape. Moreover, technological advancements in the EV sector along with increasing disposable income of the people is expected to boost the growth of the electric vehicle finance market.

The two-wheeler segment is expected to grow with a notable CAGR during the forecast period. The surging demand for electric two-wheelers in mid-income nations due to rising awareness for reducing emission and high fuel prices has driven the market expansion. Also, the rapid investment by battery manufacturers to develop high-capacity batteries for electric scooters coupled with increasing emphasis of finance companies to provide suitable loans for purchasing electric bikes is contributing to the industrial growth. Moreover, partnerships among two-wheeler manufacturers and battery companies is further accelerating the growth of the electric vehicle finance market.

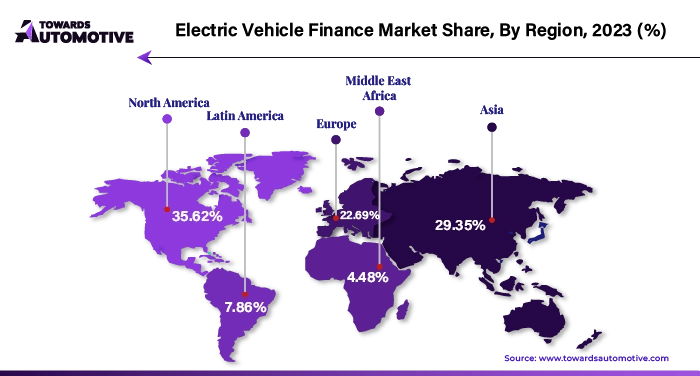

Europe dominated the electric vehicle finance market. The growing adoption of electric vehicles in numerous countries such as Germany, France, Italy, Denmark and some others with an aim to reduce vehicular emission has boosted the market expansion. Additionally, numerous government initiatives aimed at providing loans to automotive companies for manufacturing EVs coupled with rise in number or private banks is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Volkswagen Financial Services, BNP Paribas, KfW IPEX-Bank, IONITY and some others is expected to boost the growth of the electric vehicle finance market in this region.

Asia Pacific is expected to rise with a considerable CAGR during the forecast period. The growing demand for electric SUVs in different nations such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, rapid investment by startup companies to finance EVs coupled with rising adoption of electric two-wheelers by ride-sharing companies is contributing to the industrial growth. Moreover, the presence of numerous market players such as Toyota Financial Services, Nissan Corporation, Kia Motors Corporation and some others is expected to propel the growth of the electric vehicle finance market in this region.

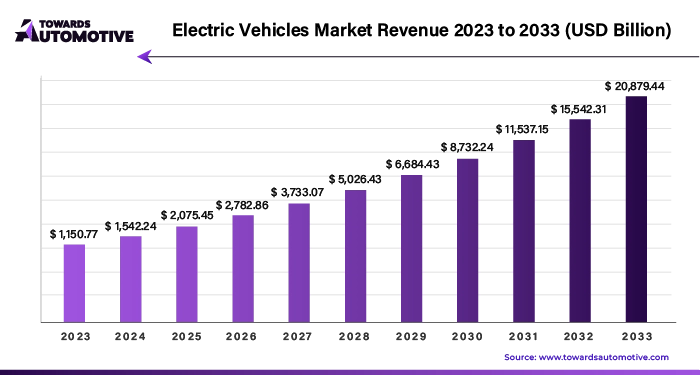

The electric vehicles market is forecast to grow from USD 2,072.80 billion in 2025 to USD 29,283.45 billion by 2034, driven by a CAGR of 34.21% from 2025 to 2034. The increasing demand for eco-friendly vehicles in developing nations along with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape.

Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rise in number of EV startups in developed regions has driven the market expansion. The research and development activities related to solid-state batteries is expected to create ample growth opportunities for the market players in the future.

The electric vehicles market is a prominent segment of the automotive industry. This industry deals in development and distribution of vehicles that are powered by batteries. There are several types of vehicles developed in this sector comprising of scooters, motorcycles, three-wheelers, passenger cars, buses, trucks, and some others. These vehicles are integrated with numerous components including battery pack & high voltage component, motor, brake, wheel & suspension, body & chassis, low voltage electronic components and some others. The end-users of these vehicles comprise of personal users and commercial users. This market is expected to rise significantly with the growth of the battery manufacturing sector around the globe.

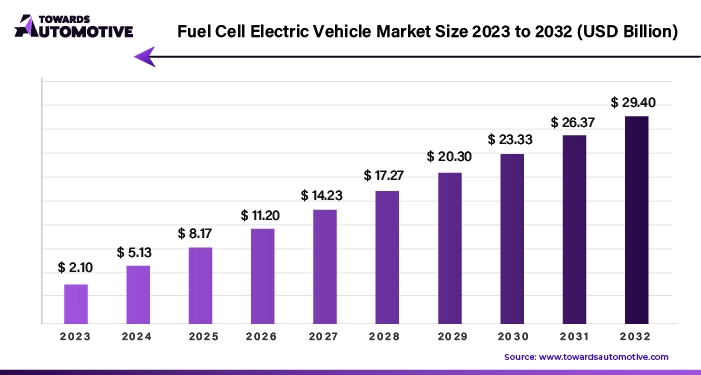

The fuel cell electric vehicle market is forecast to grow at a CAGR of 21.40%, from USD 3.09 billion in 2025 to USD 17.73 billion by 2034, over the forecast period from 2025 to 2034.

The challenges posed by climate change; renewable energy has emerged as a critical component of the global energy landscape. Governments worldwide are enacting favorable regulations, offering subsidies, and providing tax incentives to incentivize entrepreneurs to engage in renewable energy production. This concerted effort aims to stimulate investment in sustainable energy sources and drive economic growth.

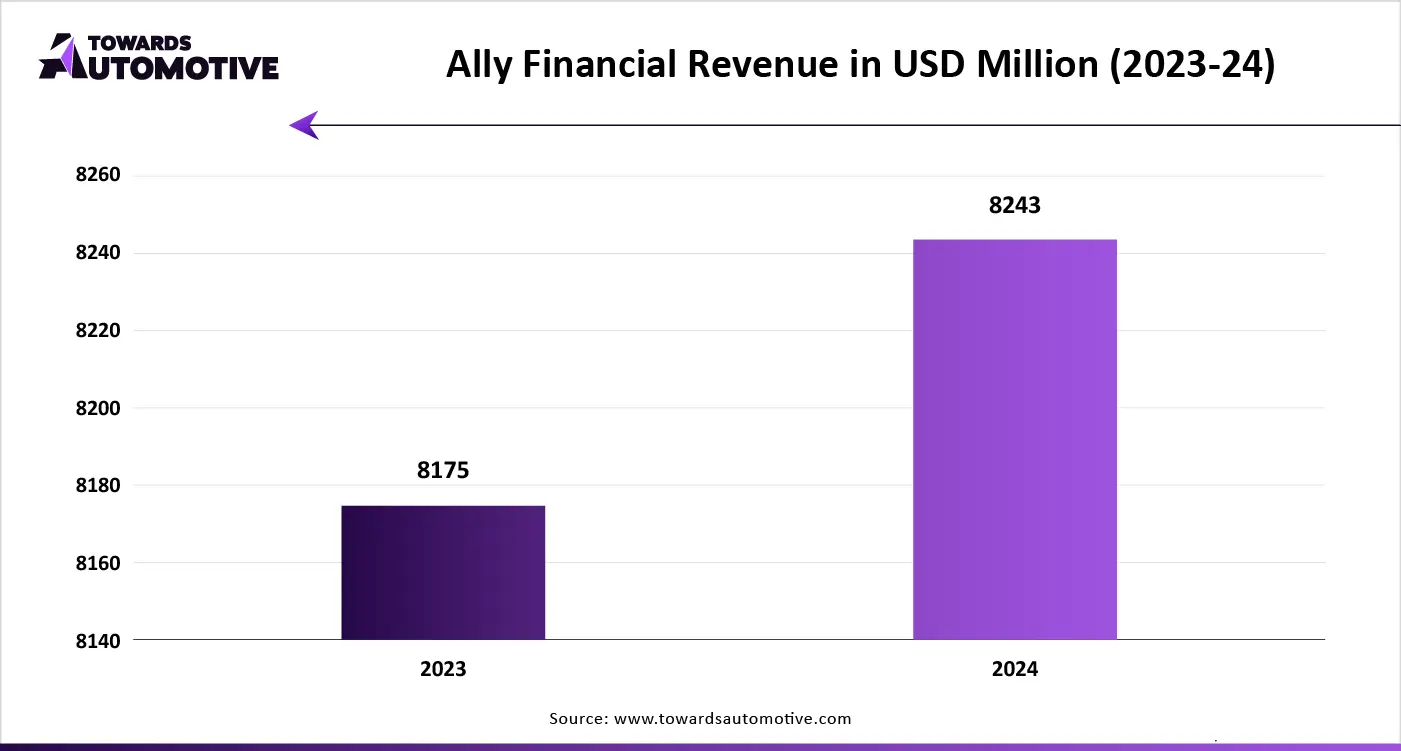

The electric vehicle finance market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Ally Financial, Bank of America, Capital One Auto Finance, Citizens Financial Group, Ford Credit, PNC Financial Services Group, Santander Consumer USA, JPMorgan Chase & Co, Nissan Motor Acceptance Corporation, TD Auto Finance, Tesla Finance, Toyota Financial Services, US Bank, Volkswagen Financial Services and some others. These companies are constantly engaged in providing financial services to EV consumers and adopting numerous strategies such as product launches, partnerships, collaborations, joint venture, business expansion, acquisition, and some others to maintain their dominant position in this industry.

By Financial Institutions

By Vehicle Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us