December 2025

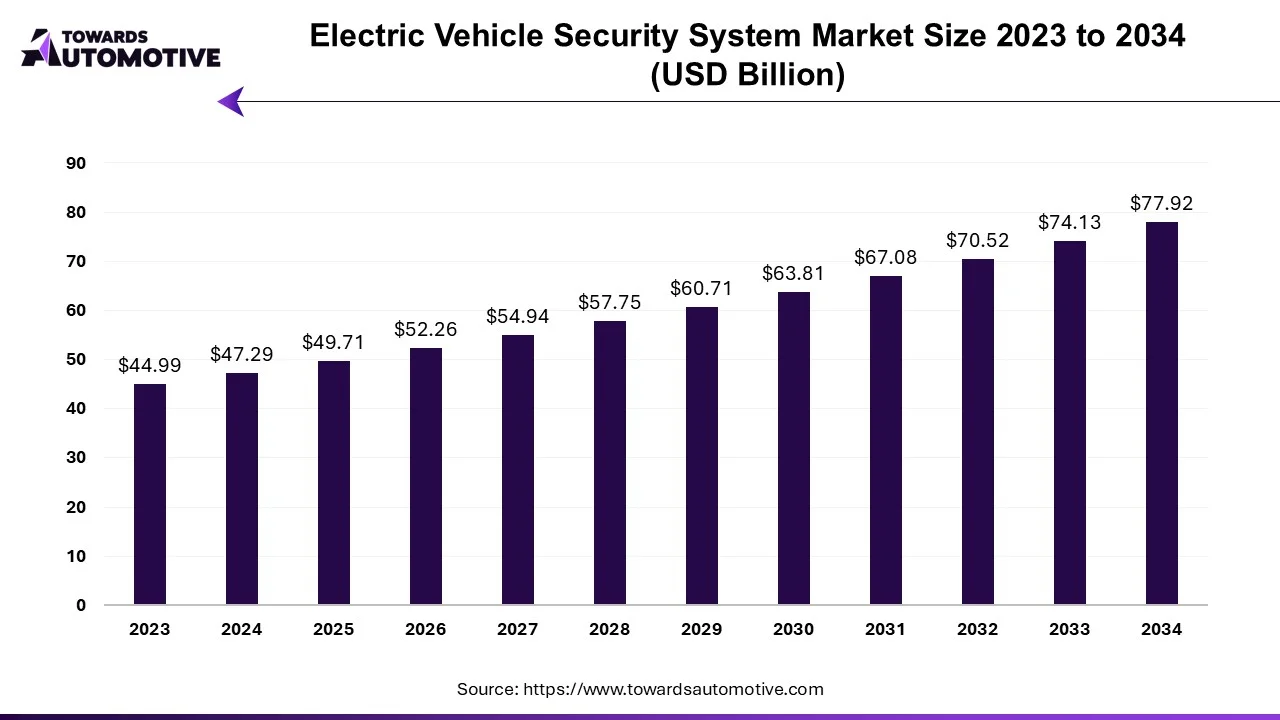

The electric vehicle security system market is forecasted to expand from USD 49.71 billion in 2025 to USD 77.92 billion by 2034, growing at a CAGR of 5.12% from 2025 to 2034.

In the medium term, the market is being driven by the production of more vehicles integrated with Advanced Driver Assistance Systems (ADAS), meeting passenger comfort demands, enhancing safety measures, and complying with government security regulations. Furthermore, the increasing acceptance of autonomous or self-driving vehicles is contributing to market expansion.

Every year, approximately 1.25 million people lose their lives in accidents, with a majority occurring in developing countries. In response, governments worldwide are implementing stricter regulations to prevent traffic accidents. Major Original Equipment Manufacturers (OEMs) are investing in Research and Development (R&D) to develop cutting-edge technology, including advanced braking systems and artificial intelligence-driven safety features. This focus on vehicle safety, coupled with government regulations and the growth of global automobile manufacturing, is expected to bolster market safety during the anticipated surge in electric vehicles.

Many OEMs have already incorporated electronic stability control systems into their products, particularly in large and luxury vehicles. These electronic safety controls have significantly reduced accident rates, demonstrating their effectiveness. As vehicle management technology continues to advance, the market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) exceeding 21% during the forecast period.

The electronic security system market is experiencing growth driven by increasing consumer awareness of emergency services, which is further fueled by the rise in road traffic. Governments worldwide are actively promoting vehicle safety measures, with many countries mandating the installation of electronic security controls.

Factors such as rising disposable income and evolving consumer preferences towards vehicles equipped with safety features are also driving market expansion. The passenger car segment is anticipated to dominate the market, constituting 66% of the global automobile market, supported by the growing number of international passengers.

Governments are implementing laws and regulations aimed at enhancing user protection, with proposals for mandating Advanced Driver Assistance Systems (ADAS) installation in vehicles to mitigate accidents. For instance, the Indian government has mandated Anti-lock Braking Systems (ABS) for motorcycles and is working towards making Electronic Stability Control (ESC) and Automatic Emergency Braking (AEB) mandatory in cars by 2022-2023.

The emergence of autonomous driving technology, particularly for Level 4 and Level 5 autonomous vehicles, is poised to become a significant global market. By 2030, the automotive industry's value in this sector is projected to reach $60 billion, with North America expected to account for 30% of global traffic, followed by China and Western Europe at 24% each. These factors are expected to drive further growth in the electronic security system market.

China stands as one of the world's largest automobile markets, with passenger car sales surpassing 23.56 million units in 2022, marking a 9.5% year-on-year increase from 2021. Despite the pandemic's impact, China remains a key player in global automobile sales, presenting a significant opportunity for predictive technology to establish itself in the Chinese automotive sector. The Chinese government's emphasis on developing various vehicle technologies, including electronic stability control, is expected to yield substantial economic benefits throughout the forecast period.

India, an emerging market, is gradually embracing advanced features in passenger vehicles. With a robust and burgeoning market, India is gradually making strides in the automotive industry in terms of autonomous driving capabilities.

For Instance,

Japan, renowned in the automotive industry, hosts powerful automobile manufacturers whose products are distributed globally. As lidars and cameras emerge as pivotal components of self-driving cars, numerous companies specializing in these technologies are tapping into the burgeoning market by establishing strategic partnerships.

The automotive electronic stability control market is dominated by several major players, including Robert Bosch GmbH, Continental AG, Denso AG, Hitachi Automotive Systems, and Autoliv AG. This market is witnessing rapid growth propelled by the integration of high-end systems even in entry-level vehicles and increasing collaboration among key players to develop advanced safety systems. Such advancements are expected to drive significant economic growth during the forecast period.

For Instance,

Furthermore, in December 2022, Dongfeng Motor (Dongfeng Motor Company) introduced the new Yufeng V9+ bus, optionally equipped with features such as a tire pressure monitoring system and Electronic Stability Control (ESC) system, highlighting the growing emphasis on vehicle safety features in the market.

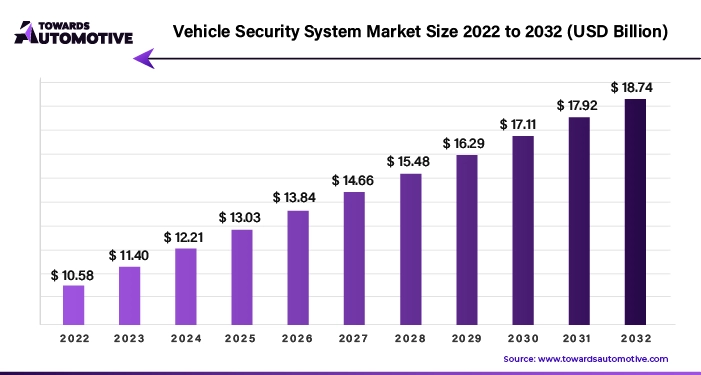

The global vehicle security system market is projected to reach USD 19.12 billion by 2034, growing from USD 12.54 billion in 2025, at a CAGR of 4.86% during the forecast period from 2025 to 2034.

The vehicle security system market is experiencing significant growth as the automotive industry increasingly prioritizes safety and protection against theft, vandalism, and unauthorized access. With the rise in vehicle theft, accidents, and the growing complexity of modern vehicles, there is a heightened demand for advanced security solutions that offer enhanced protection and convenience for vehicle owners. This market encompasses a wide range of technologies designed to safeguard vehicles, including electronic immobilizers, alarm systems, GPS tracking, biometric access, keyless entry systems, and advanced driver assistance systems (ADAS) that improve both physical security and data protection.

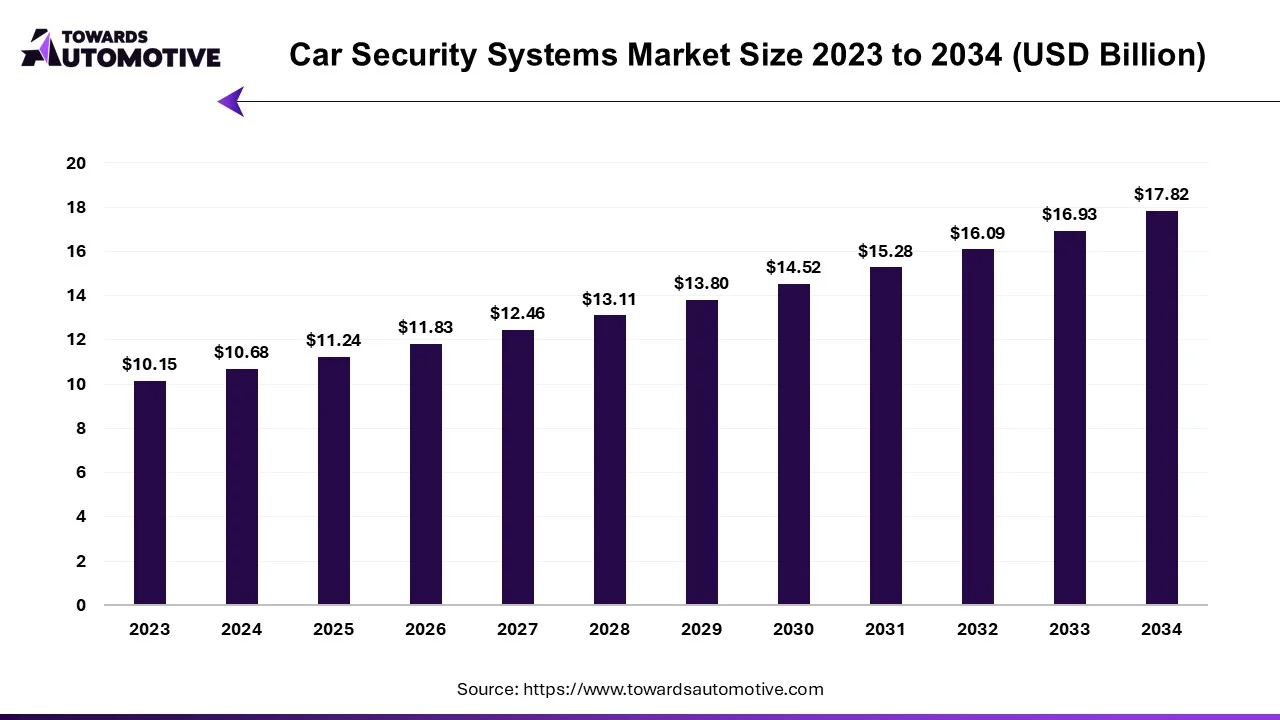

The global car security systems market is projected to reach USD 17.82 billion by 2034, growing from USD 11.24 billion in 2025, at a CAGR of 5.25% during the forecast period from 2025 to 2034.

The car security systems market is witnessing significant growth, driven by increasing concerns over vehicle theft and the rising adoption of advanced security technologies. As the global automotive industry embraces digital transformation, the integration of sophisticated car security systems has become a priority for automakers and consumers alike. These systems, ranging from traditional immobilizers and alarm systems to modern solutions such as biometric authentication, GPS tracking, and advanced driver assistance systems (ADAS), provide robust protection against theft and unauthorized access.

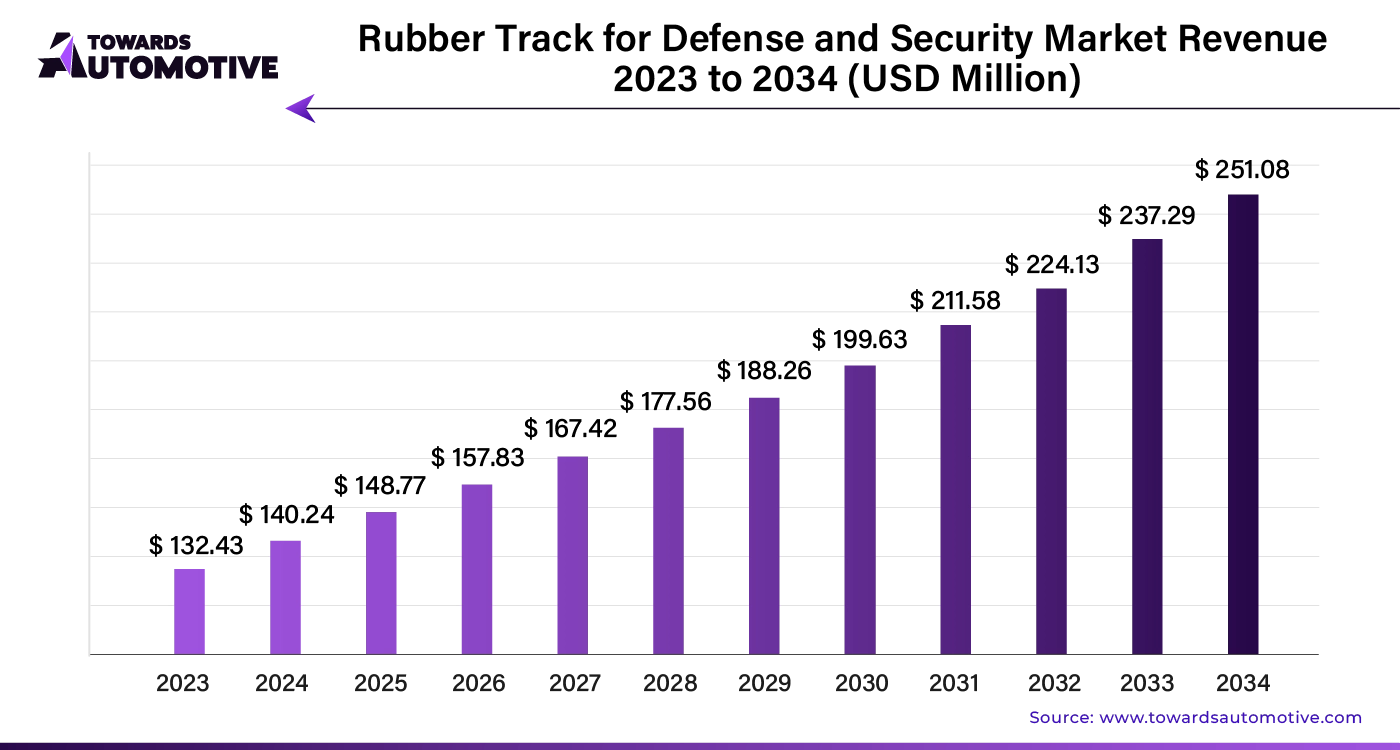

The global rubber track for defense and security market size is calculated at USD 140.24 million in 2024 and is expected to be worth USD 251.08 million by 2034, expanding at a CAGR of 5.90% from 2023 to 2034.

High-performance rubber tracks are increasingly being developed for military tanks and other defense vehicles. Their usage is expanding across various applications, including armored vehicles and unmanned ground vehicles (UGVs). Additionally, the popularity of tracks for robots and drones is on the rise. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

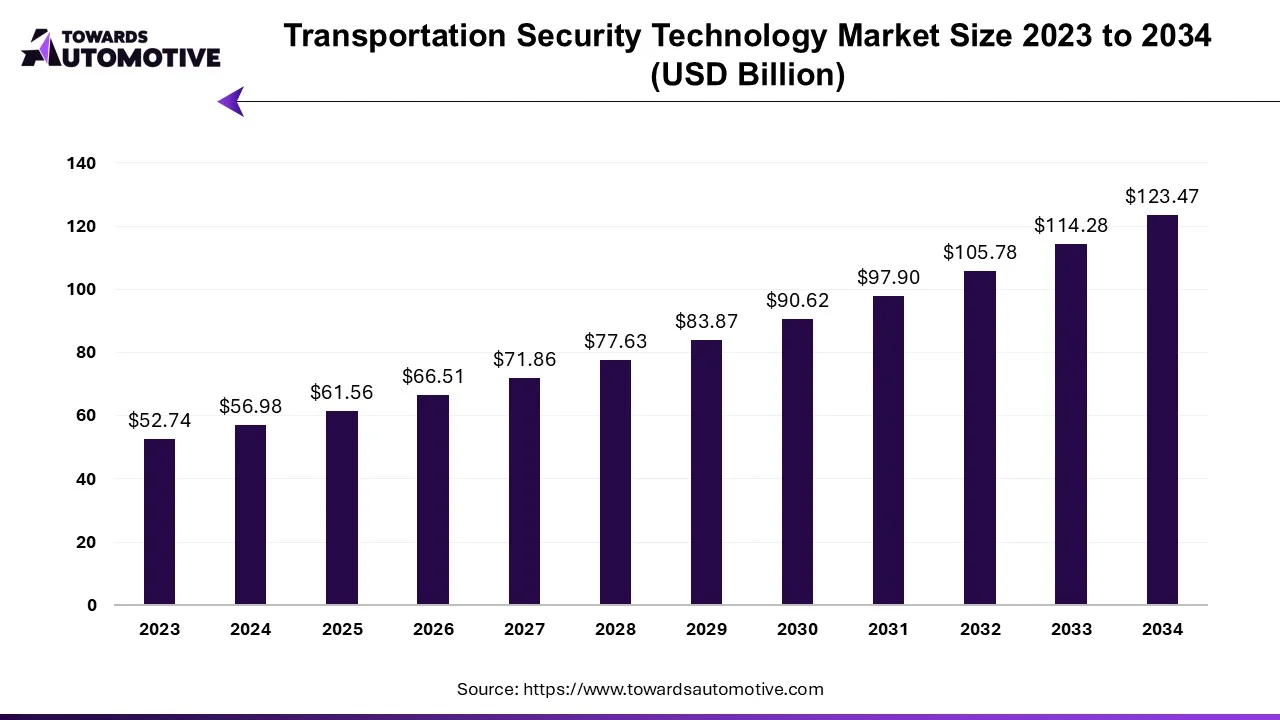

The transportation security technology market is anticipated to grow from USD 61.56 billion in 2025 to USD 123.47 billion by 2034, with a compound annual growth rate (CAGR) of 8.04% during the forecast period from 2025 to 2034.

The transportation security technology market is a crucial sector of the automotive and transportation industry. This industry deals in developing advanced technologies for enhancing security in transportation sector. There are several types of transportation covered under this sector comprising of airways, waterways, roadways, railways and some others. There are several applications of this technologies consisting of video surveillance, passenger & baggage screening system, cargo inspection system, perimeter intrusion detection, access control, nuclear & radiological detection, fire safety & detection system, tracking & navigation system and some others. The rising investment for developing the transportation infrastructure in different parts of the world has contributed to the industrial expansion. This market is expected to grow significantly with the rise of the automotive technology sector around the globe.

In 2023, passenger vehicles are expected to dominate the automotive market, accounting for 66% of the total market share. As global car ownership continues to rise, original equipment manufacturers (OEMs) are ramping up their production of engines tailored for various types of passenger vehicles. Innovations in automotive engine technology, such as multi-fuel engines, variable valve technology (VVT), turbocharging, and Common Rail Direct Injection (CRDI), are driving the development of high-power and high-torque engines, particularly for luxury vehicles. These advancements aim to meet the evolving preferences of consumers seeking enhanced vehicle performance and efficiency.

The automotive electronic stability control system is engineered to manage and uphold vehicle stability, thereby preventing potential accidents and collisions.

The market for vehicle electronic security control is segmented based on several factors including vehicle type, location, sales channel, and region. Vehicle type segmentation includes passenger cars and commercial vehicles. Component segmentation encompasses sensors, electronic control units (ECUs), actuators, and other related components. Sales segmentation categorizes the market into original equipment manufacturer (OEM) and aftermarket segments. Geographically, the market is divided into North America, Europe, Asia Pacific, and the rest of the world.

By Vehicle Type

By Component

By Sales Channel

By Geography

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us