April 2025

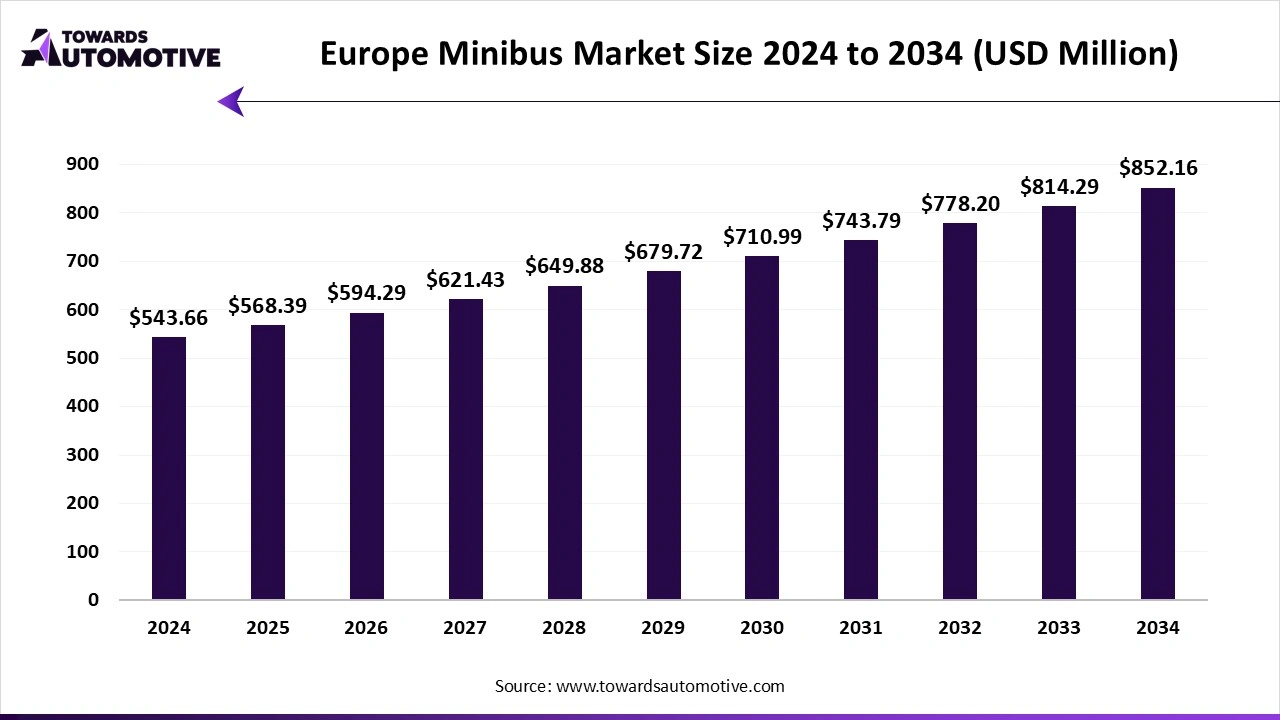

The Europe minibus market is predicted to expand from USD 568.39 million in 2025 to USD 852.16 million by 2034, growing at a CAGR of 4.55% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Europe minibus market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of minibuses across Europe. There are several types of buses developed in this sector comprising of M2 buses and M3 buses. These buses are powered using different propulsion technologies consisting of diesel, electric, hybrid, alternative fuel and others.

The minibuses are available in different seating capacities such as below 10 seats, 10-20 seats and above 20 seats. It finds application in various sectors including school, tourism, public transport, intercity, tourist and some others. The rapid urbanization in different parts of the Europe has contributed to the market expansion. This market is likely to rise significantly with the growth of the EV industry in this nation.

The below 10 seats segment held a dominant share of the market. The rising application of these minibuses for attending family meetings has boosted the market growth. Also, availability of minibuses with less than 10 seats in numerous rental platforms has enabled small group of travelers to book these buses online, thereby proliferating the industrial expansion. Moreover, the growing demand for these buses due to their high fuel efficiency and easy drivability along with its rapid adoption in shuttle services is likely to foster the growth of the Europe minibus market.

The 10-20 segment is predicted to grow with a notable growth rate during the forecast period. The rising demand for 10-20 seater minibuses from government and corporate sector for short commute of their employees has boosted the market expansion. Also, the rapid adoption of these buses in sports sector for transporting athletes from hotels to airports is another factor aiding to the market growth. Additionally, the increasing use of these vehicles in public transportation in isolated areas and school transportation is projected to bolster the growth of the Europe minibus market.

The school segment held the lion’s share of the market. The rising adoption of eco-friendly vehicles in schools for lowering emission has driven the market growth. Also, rapid investment by government for strengthening the educational sector along with rise in number of schools in rural areas has further bolstered the industrial expansion. Additionally, the increasing demand for effective transportation by students and teachers is likely to propel the growth of the market growth in this region.

The public transport segment is likely to grow with a considerable growth rate during the forecast period. The rising demand for sustainable public transportation in European nations such as Germany, UK, France, Italy and some others has contributed to the development of the market. Also, numerous government initiatives aimed at developing the public transportation sector is playing a vital role in shaping the industrial landscape. Moreover, the rapid deployment of minibuses with more than 20 seats in public transportation is projected to drive the growth of the Europe minibus market.

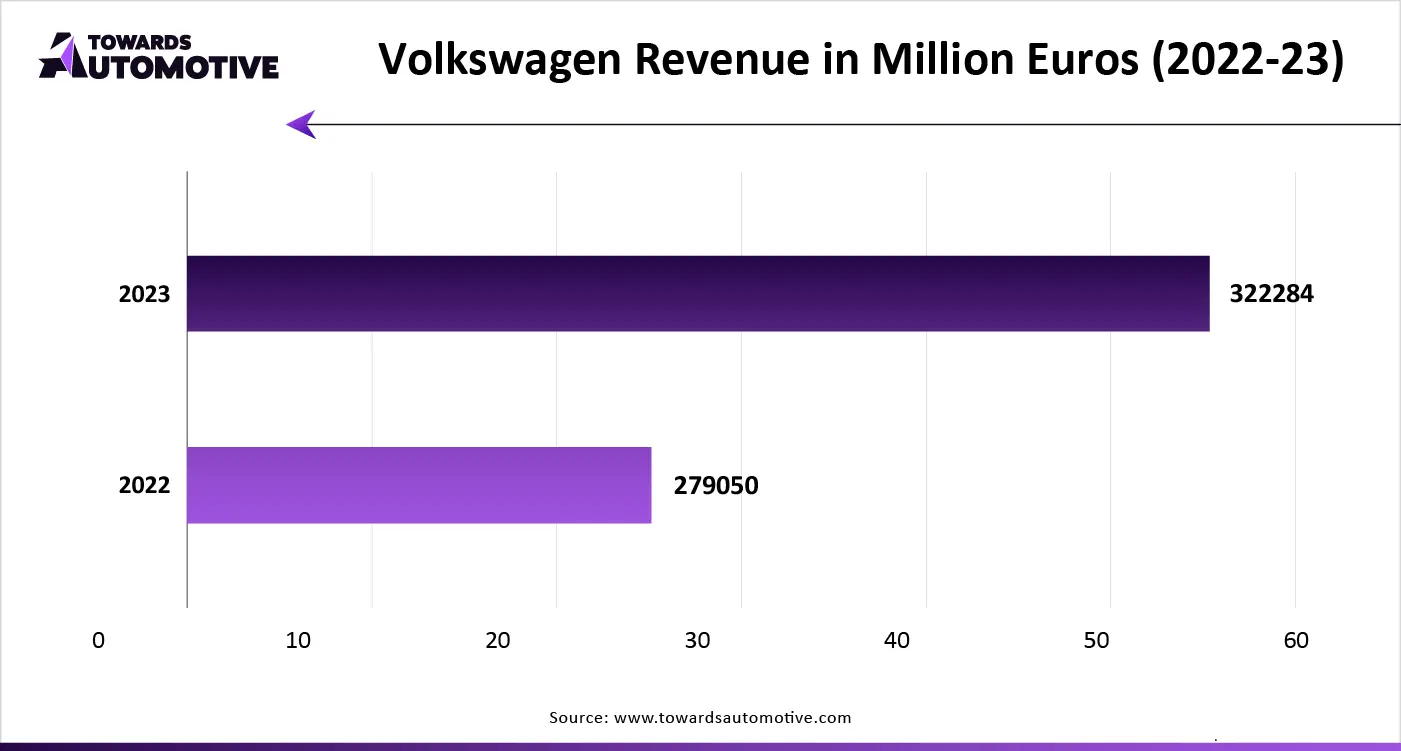

Germany held the highest share of the Europe minibus market. The rising demand for environment-friendly transportation solutions along with technological advancements in automotive sector has boosted the market expansion. Additionally, the growing application of minibuses in airports coupled with rapid shift towards electric vehicles is adding to the industrial growth. Moreover, several government initiatives aimed at strengthening the transportation sector as well as presence of numerous automotive brands such as Mercedes Benz, Volkswagen, Opel and some others has driven the market growth in this nation.

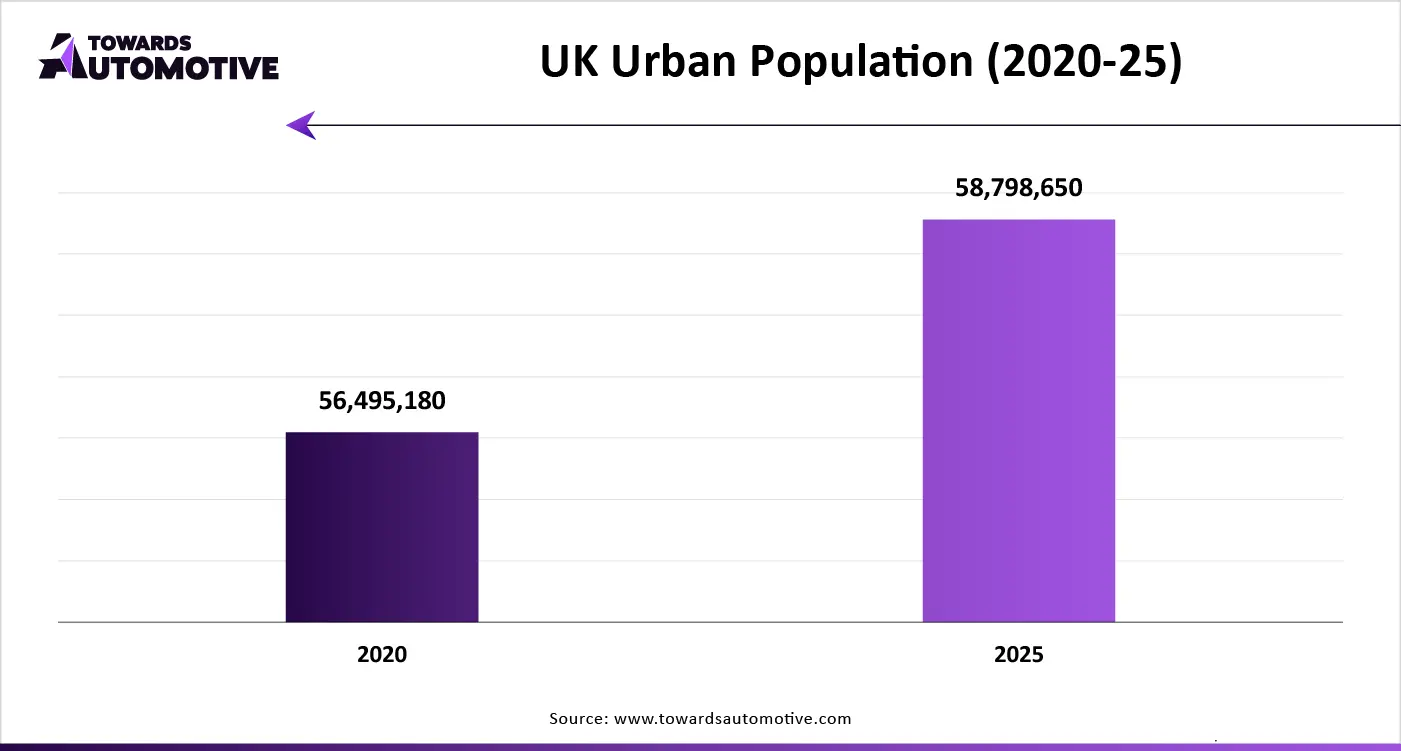

UK is expected to grow with a significant CAGR during the forecast period. The rise in number of corporate companies has increased the demand for minibuses, thereby driving the market expansion. Also, the growing adoption of minibuses by airports coupled with rapid investment in EV sector by private companies has further boosted the industrial growth. Moreover, the increasing demand for 10-20 seater minibuses from hotels and resorts of the UK is playing a vital role in the growth of the Europe minibus market.

The Europe minibus market is a competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Mercedes-Benz Group (Daimler AG), Opel Automobile GmbH, Fiat Chrysler Automobiles, Ford Motor Company, Iveco S.p.A., MAN SE, Peugeot S.A., Renault SA, Volvo Group, Altas Auto, Volkswagen and some others.

These companies are constantly engaged in developing minibuses and adopting numerous strategies such as collaborations, business expansion, acquisition, partnerships, joint venture, product launches and some others to maintain their dominant position in this industry. For instance, in March 2025, WeRide partnered with Renault Group. This partnership is done for launching an autonomous minibus in Barcelona, Spain. Also, In October 2024, Altas Auto launched Altas Novus City V7 in Europe. Altas Novus City V7 is an electric minibus with a seating capacity of 16 seats.

By Seating Capacity

By Propulsion

By Application

By Region

April 2025

April 2025

April 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us