April 2025

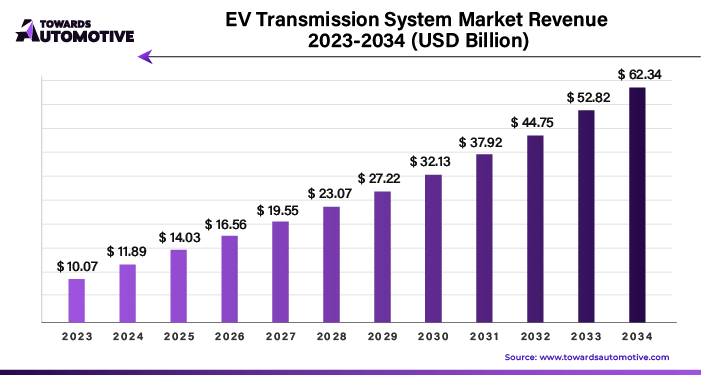

The EV transmission system market is predicted to expand from USD 14.03 billion in 2025 to USD 62.34 billion by 2034, growing at a CAGR of 18.02% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The electric vehicle (EV) transmission system sector is poised for significant growth and innovation, driven by the evolving demands of the automotive industry. This expansion is largely fueled by a global shift toward electric mobility, which necessitates high-performance, reliable, and efficient transmission systems tailored for electric drivetrains. Several key factors are contributing to this trend, including stringent emission regulations, heightened environmental awareness, and advancements in EV technology. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Key Drivers of Growth

The future of the EV transmission system sector looks promising, with a strong emphasis on innovation and efficiency. As the demand for electric vehicles continues to rise, the need for advanced transmission systems that can meet the evolving requirements of the industry will only grow. Key trends to watch include:

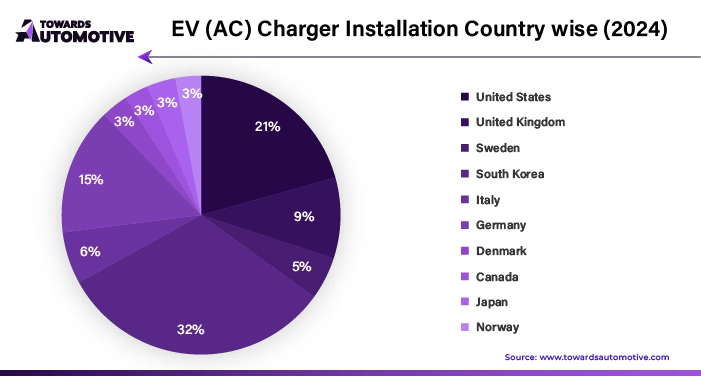

The advancement of charging infrastructure is profoundly shaping the requirements for electric vehicle (EV) transmission systems. As new charging technologies emerge, including fast-charging solutions and diverse charging standards, EV transmission systems must evolve to enhance efficiency, compatibility, and range.

1. Adapting to Charging Patterns

The development of modern charging infrastructure influences EV charging habits, affecting how transmission systems are designed and implemented. These systems must handle varying charging scenarios, such as:

To accommodate these diverse charging conditions, transmission systems must effectively manage power from multiple sources without impairing vehicle performance.

2. Enhancing Safety and Reliability

The safety and reliability of EV transmission systems are paramount, especially given the fluctuations in power and potential voltage spikes from charging processes. To address these challenges:

Autonomous driving technologies are reshaping the requirements for EV transmission systems. These advancements necessitate improvements in design and performance to support the energy demands of autonomous vehicles and extend battery life.

1. Integration with Autonomous Technologies

For autonomous vehicles, transmission systems must seamlessly integrate with advanced driving technologies to achieve:

2. Meeting Safety and Performance Standards

Autonomous driving imposes higher demands on transmission systems, which must:

Global standardization efforts and regulations play a crucial role in shaping the EV transmission systems sector. These initiatives support interoperability, safety, and innovation.

1. Promoting Compatibility and Safety

Standardization ensures that EV transmission systems meet uniform technical and performance specifications, which:

2. Driving Innovation and Technological Advancement

Standardization provides a structured framework for research, development, and testing, leading to:

The integration of Artificial Intelligence (AI) into Electric Vehicle (EV) transmission systems is poised to significantly enhance market growth. AI's ability to analyze vast amounts of data in real-time allows for optimized transmission control, leading to improved efficiency, performance, and energy management. By precisely predicting driving conditions and adjusting power distribution accordingly, AI-driven systems reduce energy wastage and extend battery life, addressing two critical concerns for EV users.

Moreover, AI facilitates predictive maintenance, identifying potential issues before they escalate, thus reducing downtime and repair costs. This capability not only improves the reliability of EVs but also enhances user satisfaction, fostering greater adoption. As automakers strive to differentiate themselves in a competitive market, AI-powered transmission systems offer a compelling value proposition, enabling smoother, more responsive driving experiences.

Furthermore, AI integration supports the development of more advanced and adaptable transmission systems, capable of handling diverse driving environments and user preferences. As a result, the market for AI-enhanced EV transmission systems is expected to witness robust growth, driven by the demand for smarter, more efficient, and user-centric EV solutions.

The supply chain for EV transmission systems is intricate, involving multiple stages from raw material procurement to end-user delivery. Initially, the process starts with sourcing essential raw materials like aluminum, steel, and specialized electronics. These materials are then delivered to component manufacturers who produce key parts such as gears, inverters, and control modules.

These components are then sent to transmission system assemblers, where they are integrated into complete units. Quality checks and testing ensure the systems meet performance standards before being shipped to automotive OEMs (Original Equipment Manufacturers).

Automakers incorporate these transmission systems into electric vehicles during the assembly process. Once the vehicles are completed, they enter the distribution phase, moving through various channels such as dealerships or directly to consumers. Throughout this chain, logistics play a crucial role in managing inventory and ensuring timely delivery.

The supply chain is also influenced by technological advancements and regulatory changes, requiring adaptability and coordination among all stakeholders. Additionally, the global nature of the supply chain necessitates careful management of cross-border logistics and tariffs, making collaboration and communication vital to success.

The EV Transmission Systems market is a vital part of the electric vehicle ecosystem, comprising several key components that enable efficient power delivery from the motor to the wheels. Core elements include electric motors, power electronics, transmission gear systems, and control units. These components work together to ensure smooth acceleration, energy efficiency, and overall vehicle performance.

Various companies contribute to this ecosystem by specializing in different aspects of transmission technology. For instance, electric motor manufacturers provide the heart of the transmission system, converting electrical energy into mechanical motion. Companies in power electronics develop inverters and converters that manage power flow between the battery and the motor. Gear manufacturers focus on creating lightweight and efficient transmission gears that are crucial for maximizing vehicle range. Additionally, software developers create advanced control units that optimize the interaction between the motor and transmission system, enhancing driving dynamics and efficiency.

Collaborations among these companies, along with advancements in materials and engineering, are driving innovation and helping to overcome challenges like weight reduction and energy loss, thereby playing a crucial role in the evolution and adoption of electric vehicles globally.

In the analysis of market concentration, companies are often categorized into different tiers based on their annual revenue, market influence, and geographical reach. This classification helps in understanding the competitive landscape and the positioning of various industry players.

Tier 1: Industry Leaders with Global Influence

Corporations with annual revenues exceeding USD 30 million fall into the Tier 1 category. These companies are characterized by their broad international reach, extensive production capabilities, and a diverse range of products. Holding a significant 30% share of the market, Tier 1 companies cater to a wide array of customer needs, setting industry standards with their advanced technologies and strict adherence to regulatory standards. Notable Tier 1 companies include:

These companies are recognized for their leadership in innovation and their ability to influence global market trends.

Tier 2: Strong Regional Players with Specialized Expertise

Medium-sized companies with annual revenues ranging from USD 10 to 30 million are classified as Tier 2. These companies, which hold a substantial 43% share of the market, are often rooted in specific locations but have a strong influence on both local and international sectors. Their in-depth industry knowledge and focus on specific niches enable them to maintain a competitive edge.

Tier 2 companies are committed to compliance with regulations and are known for adopting innovative technologies in their manufacturing processes. Some of the esteemed players in this category include:

These companies bridge the gap between the large-scale operations of Tier 1 and the more localized focus of Tier 3 companies.

Tier 3: Niche Players with Localized Operations

Tier 3 companies are smaller enterprises with annual revenues of up to USD 10 million. These companies, which account for 27% of the market share, typically operate within specific regions and cater to particular industries. Their limited geographical reach and smaller scale of operations often result in lower competition within their niches.

While Tier 3 companies may lack the formal structure and broad influence of their Tier 1 and Tier 2 counterparts, they play a crucial role in serving localized markets and meeting specialized demands.

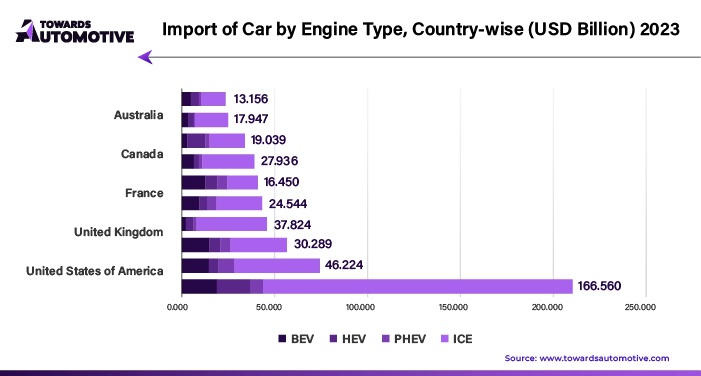

The global market for EV transmission systems is witnessing significant growth, with specific countries emerging as dominant players. This section delves into the country-wise insights, exploring consumer behavior, competitive dynamics, regulatory landscapes, industry sizes, and growth prospects across different regions.

India and China are projected to lead the global EV transmission systems market during the forecast period. Spain, France, and Italy are also making strides, each showing favorable growth rates.

These figures underscore the strong growth potential in these regions, driven by various factors ranging from government initiatives to evolving consumer preferences.

India's EV Market: A Hub of Opportunities

India is expected to dominate the global EV transmission systems market, with an impressive CAGR of 28.2% during the assessment period. The Indian government's active promotion of electric vehicles (EVs) has created a burgeoning domestic market. The government's support includes incentives for setting up EV component manufacturing facilities, tax breaks, and subsidies, all of which are fostering a robust ecosystem for EV transmission systems.

India's potential to become a cost-competitive producer is enhanced by its relatively low labor costs, making Indian-made EV transmissions attractive to global manufacturers. The country also boasts a large population of skilled engineers and technicians, ready to be trained and upskilled for the evolving EV sector. These factors, combined with strong government backing, position India as a key player in the global market.

China's Strategic Growth in the EV Sector

China is emerging as a leader in the EV transmission systems market, with a projected CAGR of 21.3% through 2034. China's well-established automobile industry and rapid adoption of electric vehicles have led to an increasing demand for EV components.

The Chinese government is playing a crucial role in this growth by providing tax incentives, subsidies, and other support to both manufacturers and consumers. In addition, China is aggressively developing the necessary infrastructure for EVs, and there is a concerted push towards localizing EV components to reduce dependence on foreign technology. This combination of factors is driving significant growth in China's EV transmission systems market.

Spain's Clean Energy Focus Driving EV Growth

Spain is poised to become a significant player in the EV transmission systems market, with a forecasted CAGR of 14.1% from 2024 to 2034. The country’s strong commitment to renewable energy is likely to drive the adoption of electric vehicles, which, in turn, will increase the demand for EV components.

Spain's focus on clean energy generation makes EVs an increasingly attractive option for consumers. However, the country faces competition from more established markets, and its ability to capitalize on its renewable energy strengths will be key to maintaining its growth trajectory.

Investors seeking to understand the future outlook and investment potential of the Electric Vehicle (EV) transmission system market will benefit from analyzing the market's leading categories. By segmenting the industry into distinct categories, businesses can gain a comprehensive understanding of the latest trends, key drivers, restraints, and emerging opportunities that shape each segment of the market.

| Battery Electric Vehicles Lead the Charge in Market Share | |

| Segment: | Battery Electric Vehicles (Vehicle Type) |

| Projected Value Share (2024): | 45.0% |

Battery electric vehicles (BEVs) are anticipated to secure a significant value share of approximately 45.0% in 2024, reflecting their rapid growth compared to other types of electric vehicles. This dominance is largely driven by the presence of a robust and well-established EV transmission industry, specifically tailored to meet the needs of BEVs on a global scale.

One of the key advantages of BEVs lies in their electric motors, which deliver high torque across a broad speed range. This capability allows BEVs to operate efficiently with simplified transmissions. Unlike traditional internal combustion engines that require complex multi-speed transmissions, BEVs can focus on optimizing power delivery directly from the motor to the wheels. This streamlined approach not only enhances performance but also contributes to the overall efficiency and reliability of BEVs, making them a preferred choice among manufacturers.

| Single-Speed Transmission: The Preferred Choice for EVs | |

| Segment: | Single-Speed Transmission (Transmission Type) |

| Projected Value Share (2024): | 68.0% |

Single-speed transmissions are set to dominate the transmission type segment, with a projected value share of approximately 68.0% in 2024. These transmissions are gaining popularity due to their ability to provide a wide power band, resulting in strong acceleration and efficiency across various speeds. One of the standout features of electric vehicles is their ability to generate maximum torque even from a standstill, which eliminates the need for multiple gears to achieve optimal starting power.

Manufacturers are increasingly favoring single-speed transmissions because they are simple to manufacture and install, which contributes to lower production costs for EVs. Additionally, these transmissions enhance the operating range of electric vehicles by minimizing energy loss through their fewer moving parts. The simplicity of single-speed transmissions not only reduces maintenance needs but also ensures a smoother driving experience, as there is no need for constant gear changes.

The electric vehicle (EV) transmission system market is poised for significant growth, driven by the global surge in electric vehicle sales. This market, however, remains highly fragmented, with no single player dominating the landscape. This fragmentation presents ample opportunities for new entrants to carve out a niche, particularly as the industry is marked by fierce competition and rapid innovation.

A key trend in the market is the ongoing race to develop superior EV transmission systems. This has led to continuous advancements in both materials and design, with manufacturers competing to create systems that enhance vehicle performance while minimizing power loss. A notable area of competition is between single-speed and multi-speed transmissions, each with its own set of advantages and challenges.

For emerging players and startups, the focus must be on striking a balance between performance and affordability. Innovations in lightweight transmission systems are particularly crucial, as they contribute significantly to the overall efficiency and range of electric vehicles. As technology advances, the market is expected to see some degree of consolidation, with companies that can offer cost-effective, efficient, and lightweight designs likely to emerge as leaders.

Despite these shifts, innovation is anticipated to remain the primary driver of competition, with companies striving to push the boundaries of what is possible in EV transmission technology.

By Vehicle Type

By Transmission Type

By Transmission System

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us