April 2025

Senior Research Analyst

Reviewed By

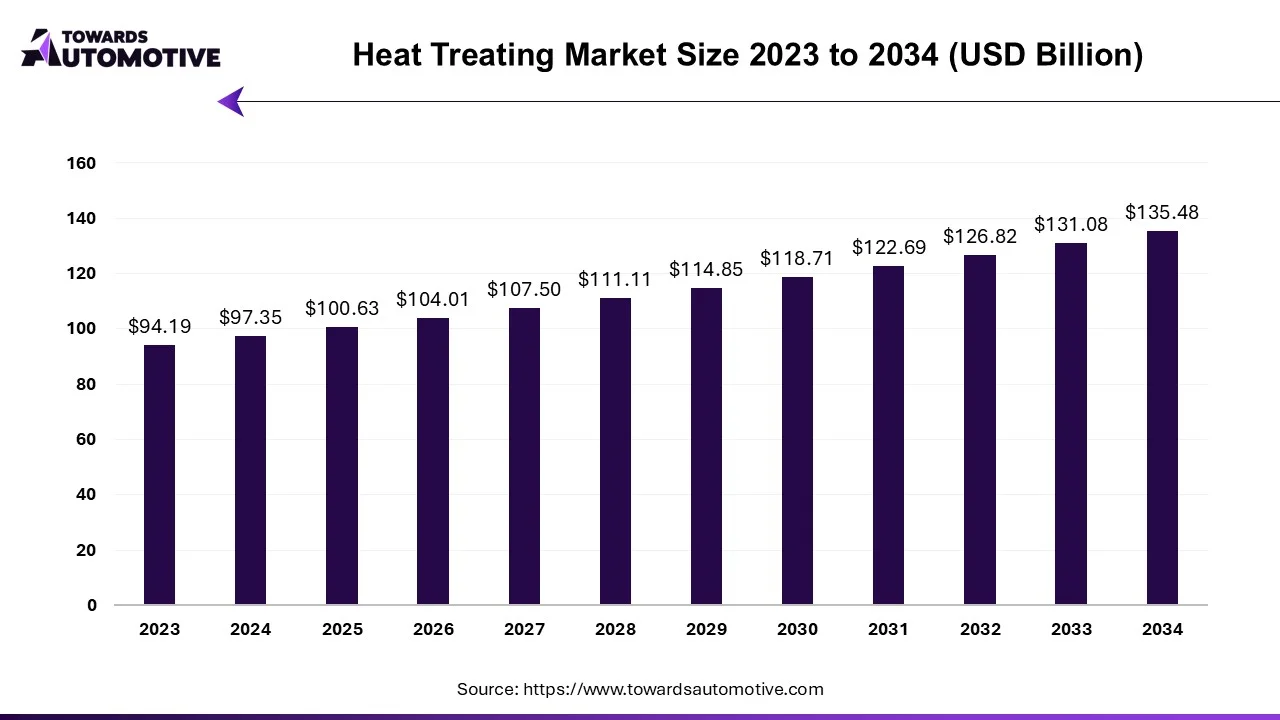

The global heat treating market is projected to reach USD 135.48 billion by 2034, growing from USD 100.63 billion in 2025, at a CAGR of 3.36% during the forecast period from 2025 to 2034.

Heat treatment refers to a series of specialized procedures applied to metallic materials with the aim of enhancing their mechanical properties, including stiffness and durability, through specific temperature modulation techniques. This process effectively elevates the worth of the materials. The evolution of the heat treatment industry plays a significant role in fostering technology-intensive sectors. An advanced heat treatment industry is indispensable for the progress of machinery, automotive, defense, aviation-space, base metal, and metal goods industries-essential components for economic growth and industrial advancement. Heat treatment significantly amplifies the value addition within these industries.

The growth of the global heat treating market is driven by the escalating industrial activities, particularly in sectors such as automotive and aerospace. Additionally, the on-going technological advancements are expected to accelerate the expansion of the global heat treating market. Beyond material innovations, the future landscape of heat treating is characterized by the embrace of state-of-the-art processes that redefine prevailing industry norms. Conventional heat treating approaches are being supplemented and, in certain instances, substituted by inventive techniques that provide enhanced precision, energy efficiency, and meticulous control over the final product's attributes.

Furthermore, the progress in heat treating technologies helps in the manufacturing of lightweight materials that enhances strength, thereby lessening the overall environmental footprint of metal components. Manufacturers are increasingly acknowledging the significance of embracing sustainable practices, not only to fulfil with regulatory standards but also to resonate with consumers who prioritize environmental consciousness.

The development of advanced materials is anticipated to augment the growth of the heat treating market during the forecast period. Researchers and engineers are thoroughly exploring novel alloys and composites capable of withstanding elevated temperatures, demonstrating enhanced strength, and providing superior resistance to corrosion. The on-going development of new steels designed for induction allows for even quicker processing times, while the creation of materials suitable for rapid heating technologies is likely to support the growth of the market. These materials not only expand the realm of possibilities but also significantly enhance the efficiency and durability of components undergoing heat treatment processes.

Also, most of the companies are actively engaged in developing sustainable heat treatment solutions for advanced materials.

For instance,

These innovations contribute to market growth as sustainable heat treatment solutions align with global environmental goals and regulations, reducing the environmental impact of industrial processes. This compliance enhances the market's reputation and opens doors to opportunities in regions with stringent environmental standards.

Due to its considerable environmental impact, the heat treatment industry demands a sharp level of environmental sensitivity. The industry's ecological footprint can be classified into key areas, including energy and water consumption, the utilization of chemicals, and the generation of waste. This positioning makes the heat treatment industry susceptible to compliance with the regulations outlined in the EU Green Deal.

Furthermore, the operations involved in heat treating demand substantial energy that result in a notable carbon footprint. The elevated energy consumption raises environmental concerns, especially in regions heavily reliant on non-renewable energy sources. Furthermore, the integral role of heat treating processes in the steel industry intensifies the impact of high energy usage. As reported by the International Energy Agency (2020), the steel industry accounts for approximately 6-7% of the world's total energy consumption and contributes to around 7-9% of global greenhouse gas emissions. This is expected to lead to more stringent compliance requirements for heat treating operations within the sector. With an increasing global emphasis on sustainability, companies are also facing pressure to enhance their energy efficiency and diminish their carbon footprint.

The evolution of heat treating is closely linked with the predominant shifts toward digitalization and the advent of Industry 4.0. The incorporation of data analytics into heat treating procedures is unveiling new avenues for optimization and increased efficiency. Cutting-edge heat treating furnaces, embedded with sensors and connectivity functionalities, facilitate the continuous real-time monitoring of essential parameters such as temperature and pressure. This not only guarantees heightened quality control but also empowers predictive maintenance, thereby minimizing downtime and enhancing the overall operational efficiency.

Also, the development of Industry 4.0, particularly the integration of IIOT (Industrial Internet of Things), within manufacturing, offers the metal production sector powerful tools to address persistent and costly quality issues. By digitally collecting and transferring data, coupled with the application of statistical analysis, companies can enhance production processes. This involves developing predictive maintenance models, gaining insights into equipment capabilities for efficient processing, and establishing key process parameters for optimal quality. The amalgamation of digital technologies with heat treating is propelling the industry into an era where data-driven decision-making takes precedence in the forefront of process optimization.

Furthermore, the evolution of heat treating is characterized by the incorporation of advanced processes that redefine established industry benchmarks. Traditional methods of heat treating are being supplemented, and in some instances replaced, by inventive techniques that promise amplified precision, energy efficiency, and enhanced control over the characteristics of the final product. A prominent breakthrough in this evolution is laser heat treating, wherein focused laser beams selectively heat specific areas of a metal component. This precise and localized approach minimizes distortion and lowers the risk of unintended material changes, signifying a paradigm shift in the approach to heat treating. As these innovative processes mature, they are positioned to revolutionize the industry by providing manufacturers with unparalleled flexibility and control.

The steel segment held the largest market share of 77.94% in 2023, primarily driven by the escalating demand for steel across diverse industrial domains. This amplified demand is predominantly fueled by the construction and infrastructure sectors. With additional push coming mainly from automotive industry owing to the factors such as population growth, the on-going trend of urbanization, and various governmental initiatives. Numerous U.S. steel producers have conveyed that their automotive clients are anticipating a rise in steel demand extending in future. Given the exceptionally low dealer inventories and the pent-up demand in the automotive sector, the production in the auto industry is anticipated to witness an increase in the coming years.

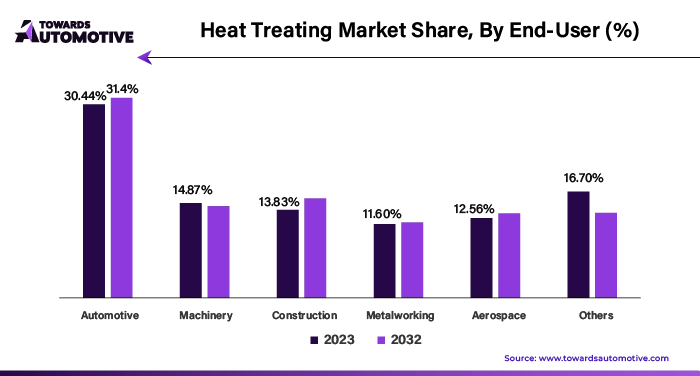

End-user segment dominated the market with share of 30.44% and is expected to grow at a CAGR of 3.73% from 2024 to 2032. The automotive industry is a major consumer of heat-treated steel components. The heat treatment in the automotive industry is used to manufacture gear, shafts, wheels bearings, rings, and bushings. This heat treatment process is applied to safeguard the integrity and longevity of these vital components. As the automotive sector continues to grow, driven by factors such as increased consumer purchasing power, urbanization, and technological advancements, the demand for heat-treated steel for critical components like shafts, gears, and springs also rises. Furthermore, the increasing focus on sustainability and environmental concerns has led to a surge in the demand for electric vehicles which is also likely to fuel the growth of the market in the year come.

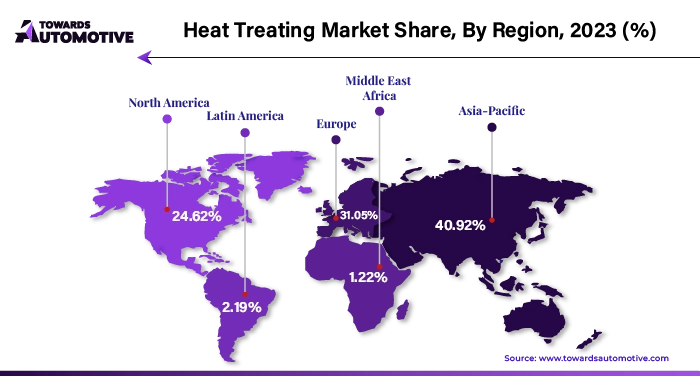

Asia Pacific dominated the global heat treating market with 40.92% of the share of the total market in 2023 and is likely to continue the same trend during the forecast period. This is attributable to the rapid industrialization in countries like China, India, and Southeast Asian nations of the region. Additionally, the increasing production and demand for vehicles are also expected to support the growth of the heat treating market in near future. The primary driver for the growth of the heat treatment industry in India remains the automotive sector. In India, industrial companies predominantly conduct internal heat treatment processes. Additionally, Japan provides support for technology and innovation initiatives related to heat treatment industry equipment. In recent times, Japan has redirected its heat treatment activities towards these markets, responding to the burgeoning development of the metal industry in the Asian region.

North America is likely to witness substantial growth in the heat treating market during the forecast period. The US maintains its global leadership in technology and standards within the heat treatment industry. The country exhibits significant innovation in the realm of production technologies specific to heat treatment. Key sectors propelling the heat treatment industry forward include automotive, aerospace, and defense. Furthermore, the USA has established international standards such as NADCAP in the space, aviation, and defense industries, consistently leading global markets by updating and refining these standards. Recent years have seen a concerted effort by the US to support the domestic industry, particularly in the metal sector, resulting in the on-going development and expansion of capacity within the heat treatment industry.

Some of the key players in heat treating market are Bodycote plc, Ipsen International GmbH, Bluewater Thermal Solutions, SECO/WARWICK, Nitrex Metal Inc., Pacific Metallurgical Inc., Aalberts Surface Technologies, AMERICAN METAL TREATING, INC., FPM Heat Treating and Nabertherm GmbH, among others.

By Material

By Equipment

By Process

By Vertical

By Region

April 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us