April 2025

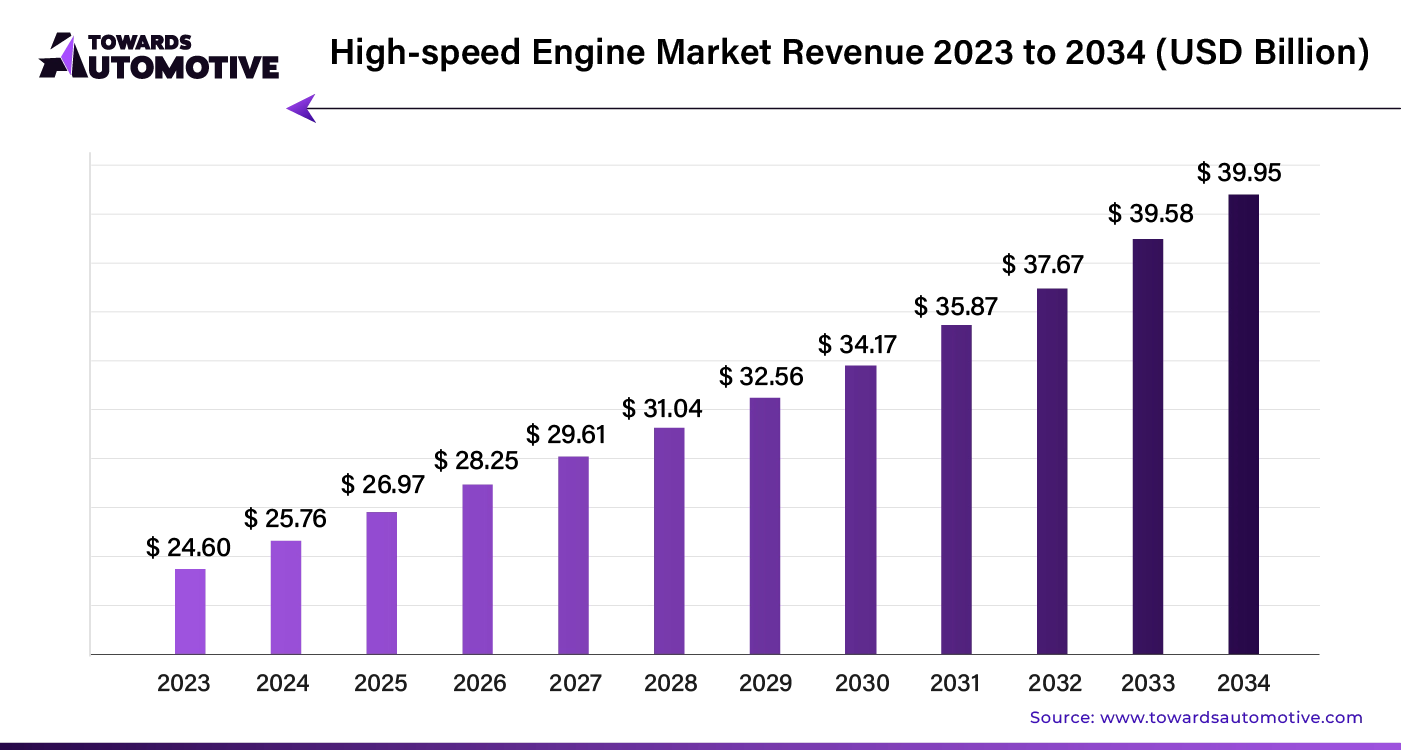

The global high-speed engines market is forecasted to expand from USD 26.97 billion in 2025 to USD 39.95 billion by 2034, growing at a CAGR of 4.83% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

High-speed engines in commercial ships and freight benefit from advanced technology like electronic control systems and modular assembly. The increasing need for reliable backup power and the expansion of international maritime freight are driving demand for these engines. This demand is fueling growth in the global high-speed engines market.

High-speed engine manufacturers are enhancing power units by focusing on strength and compactness to achieve superior speed compared to standard engines. This results in higher power output, improved power density, and greater efficiency. Robust design helps manufacturers diversify their product offerings.

The global demand for high-speed engines is growing due to their essential role in providing reliable power across various industries, including data centers, hospitals, manufacturing facilities, and maritime applications. Technical advancements have further driven this growth by enhancing efficiency, reducing emissions, and expanding applications.

These engines are particularly valued in sectors with continuous power needs, supported by government initiatives that promote local production and use. The increasing need for backup power during outages underscores the global demand for dependable energy solutions. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

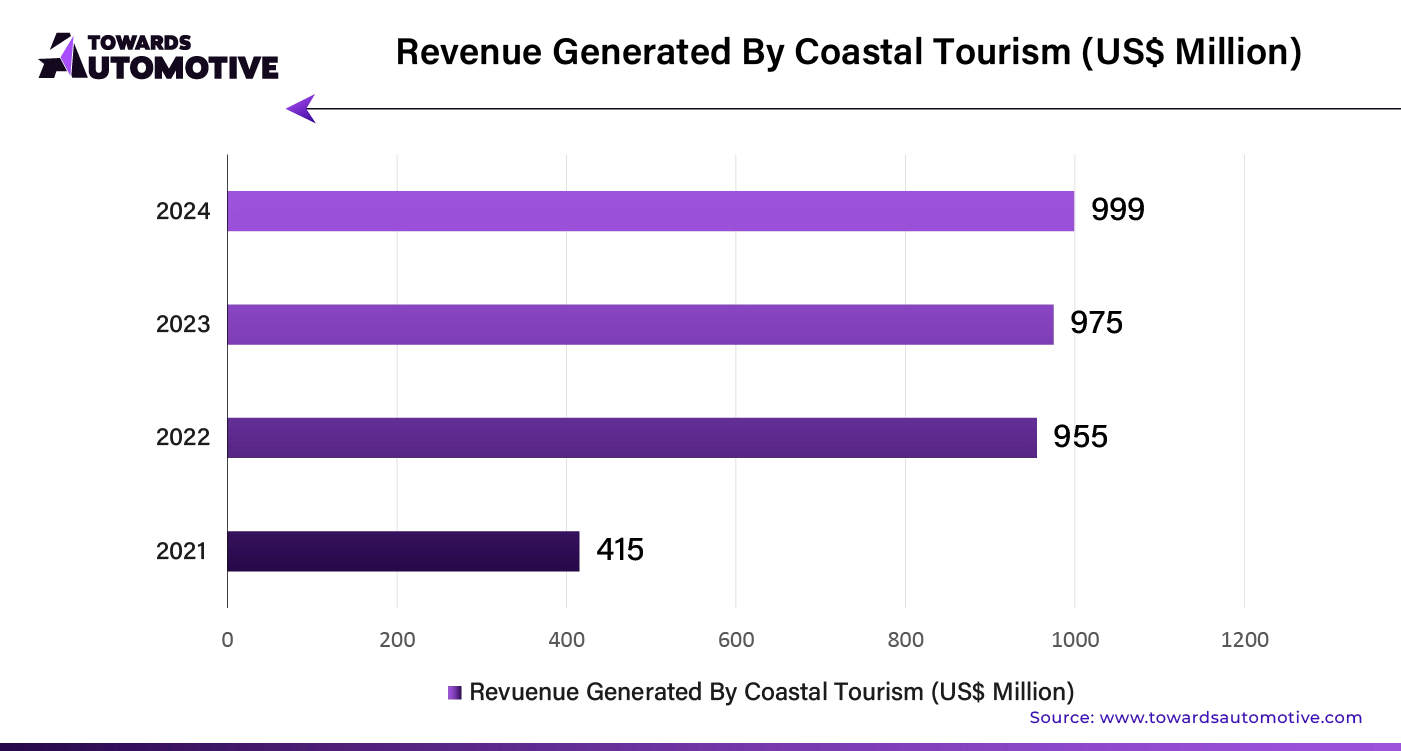

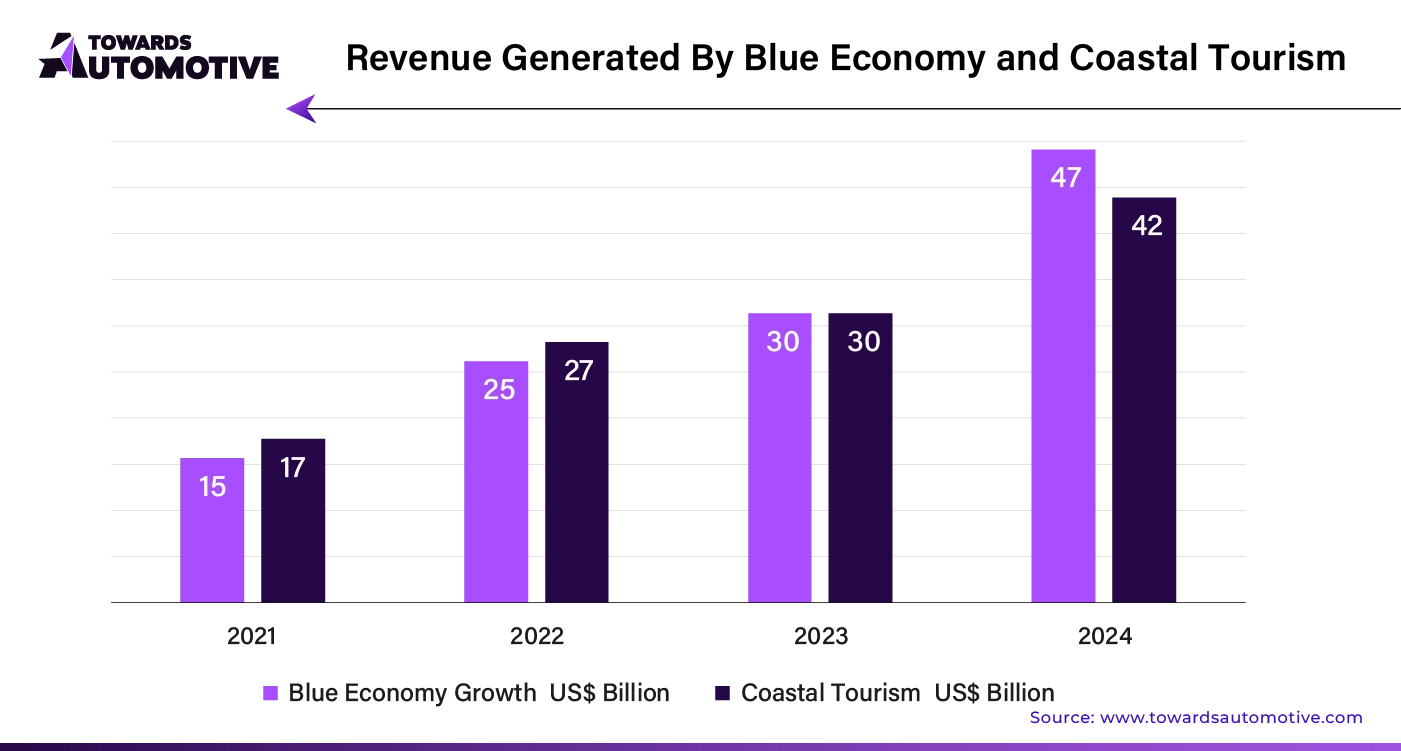

The rise in marine tourism, including cruises, ferries, and luxury yachts, is reshaping global travel. Travelers are increasingly drawn to water transport for its cost-effectiveness and scenic appeal. This trend drives demand for high-speed engines, which are essential for efficient and enjoyable maritime experiences.

As water adventure sports like speed boating, jet skiing, and water skiing gain popularity, the demand for high-speed engines is increasing. Enthusiasts seek powerful and agile engines to ensure safety and enhance performance during these thrilling activities.

The rising need for reliable power due to industrialization and urbanization boosts the demand for high-speed engines in backup power systems. These engines offer dependable and efficient power generation, crucial for maintaining smooth operations during grid disruptions or power outages.

The growing interest in recreational boating and aquatic sports is driving demand for high-speed engines. Modern high-speed engines are designed to offer better horsepower, fuel efficiency, and durability, catering to the needs of both casual and competitive water enthusiasts.

These trends highlight the increasing role of high-speed engines in various sectors, from marine tourism to backup power solutions, and underscore their importance in meeting the evolving needs of global consumers.

High-Speed Engines Operating at 1000 to 1500 RPM

| Speed Range: | 1000-1500 RPM |

| CAGR (2024-2034): | 4.4% |

Engines running between 1000 and 1500 RPM are expected to lead the market, with a projected CAGR of 4.4% from 2024 to 2034. Several factors drive this growth:

High-Speed Engines with Power Output of 0.50 to 0.55 MW

| Power Output: | 0.50 to 0.55 MW |

| CAGR (2024-2034): | 4.2% |

Engines delivering power outputs of 0.50 to 0.55 MW are projected to experience moderate growth, with a CAGR of 4.2% from 2024 to 2034. This represents a slight decrease from the previous CAGR of 5.8% observed from 2019 to 2023. Key drivers include:

This analysis underscores the ongoing growth and significance of high-speed engines within these specific speed and power output categories.

AI integration is set to revolutionize the high-speed engine market by enhancing performance, efficiency, and innovation. AI-powered analytics will enable manufacturers to optimize engine designs with precision, improving fuel efficiency and reducing emissions. By employing machine learning algorithms, companies can predict maintenance needs, minimizing downtime and operational costs.

Moreover, AI facilitates the development of advanced control systems, enabling engines to adapt to varying conditions in real-time. This adaptability enhances overall performance and reliability, making high-speed engines more attractive to industries like automotive and aerospace. AI-driven simulations and modeling will also accelerate the research and development process, leading to quicker advancements in engine technology.

Additionally, AI will streamline production processes by automating complex tasks and ensuring higher precision in manufacturing. This increased efficiency can lead to reduced production costs and faster time-to-market for new engine models. Overall, AI integration will drive innovation, improve operational efficiency, and support sustainable growth in the high-speed engine market.

In the high-speed engine market, an efficient supply chain is crucial for meeting the demands of rapid innovation and production. The supply chain begins with sourcing high-quality materials from reliable suppliers. Manufacturers use these materials to produce engines that meet stringent performance and safety standards. Advanced logistics systems then ensure timely delivery of engine components to assembly plants.

Effective inventory management plays a key role in this process. By employing real-time tracking and data analytics, companies can predict demand accurately and avoid both shortages and overstock situations. Strong partnerships with suppliers and logistics providers help streamline operations and reduce lead times.

After assembly, engines are distributed to customers through a well-coordinated network of distributors and retailers. To maintain a competitive edge, companies continuously assess and refine their supply chain strategies, integrating new technologies and practices that enhance efficiency and reduce costs. Regular feedback from customers and market analysis further drives improvements, ensuring that the supply chain adapts swiftly to changes in demand and technological advancements.

The high-speed engine market thrives due to the concerted efforts of several key players. Leading companies such as General Electric, Rolls-Royce, and Siemens drive innovation with their advanced technologies and extensive R&D investments. These industry giants focus on developing engines that offer superior performance, efficiency, and reliability. General Electric, for example, is known for its cutting-edge jet engines that power both commercial and military aircraft. Rolls-Royce contributes with its high-performance engines that enhance fuel efficiency and reduce emissions. Siemens excels in integrating digital technologies into engine design, improving overall functionality and performance.

Emerging players and startups also play a significant role by introducing novel technologies and challenging established norms. They often bring fresh perspectives and accelerate advancements in engine efficiency and sustainability. Additionally, suppliers and manufacturers of engine components ensure the smooth functioning of the ecosystem by providing essential parts and services.

Regulatory bodies and research institutions further support the market by setting standards and fostering innovation through collaborative research. Together, these stakeholders create a dynamic and evolving high-speed engine market ecosystem, driving progress and shaping the future of aerospace and automotive industries.

United States: Steady Growth in Rail and Road Transportation

In the United States, the high-speed engine market is projected to grow at a CAGR of 5.3% from 2024 to 2034, reaching a value of US$ 7.6 billion by 2034. This growth is slightly lower than the 7.5% CAGR seen from 2019 to 2023. The key drivers include:

United Kingdom: Expanding High-Speed Engine Market

The UK high-speed engine market is anticipated to grow at a robust CAGR of 6.2% until 2034, with the market potentially reaching US$ 1.8 billion. This is down from the previous CAGR of 10.5% between 2019 and 2023. Major factors include:

China: Rising Demand Driven by Infrastructure and Industry

China's high-speed engine market is expected to grow at a CAGR of 4.6% through 2034, reaching US$ 6.1 billion. This is a slight decrease from the 5.0% CAGR recorded from 2019 to 2023. Key trends include:

Japan: Growth in Marine Sports Engines

Japan's market for high-speed engines, especially in marine sports, is set to grow at a CAGR of 6.1% through 2034, with a projected value of US$ 4.8 billion. This is a reduction from the 9.6% CAGR between 2019 and 2023. The key drivers include:

South Korea: Strong Growth in Industrial Applications

South Korea’s high-speed engine market is forecasted to grow at a CAGR of 6.5%, reaching US$ 2.8 billion by 2034. This is lower than the previous CAGR of 12.3% from 2019 to 2023. Main drivers include:

Manufacturers, research institutions, regulatory bodies, and industry associations all play crucial roles in advancing the high-speed engine industry.

Manufacturers lead the charge with significant investments in research and development to enhance engine performance, efficiency, and reliability. They design cutting-edge propulsion systems for diverse sectors such as transportation, power generation, marine, and industrial applications, integrating technologies like electronic fuel injection, turbocharging, and emissions control for superior power and sustainability.

Research institutions and academia advance engine technology through collaborative research and innovation. They explore engine design, combustion dynamics, materials science, and alternative fuels, translating scientific breakthroughs into practical applications that drive industry progress.

Regulatory bodies and industry associations ensure that high-speed engines meet safety, performance, and environmental standards. They work with manufacturers and government agencies to promote sustainable practices, reduce emissions, and improve energy efficiency, setting industry standards and encouraging responsible innovation.

Together, these stakeholders influence the high-speed engine industry's growth, competitiveness, and sustainability, ensuring its continued relevance in the global market.

By Speed

By Power Output

By End-user

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us