April 2025

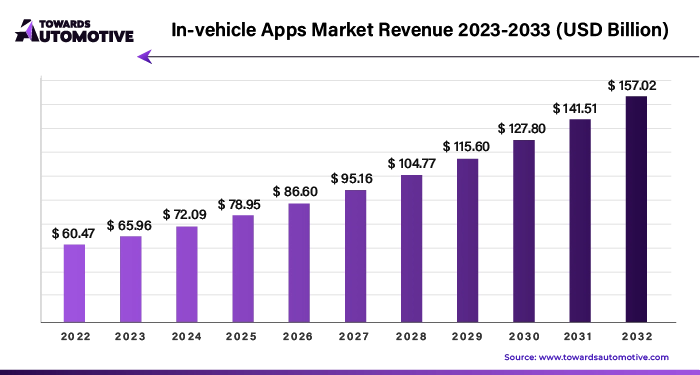

The in-vehicle apps market is predicted to expand from USD 78.95 billion in 2025 to USD 190.41 billion by 2034, growing at a CAGR of 10.12% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The in-vehicle apps market is experiencing robust growth, driven by increasing consumer demand for connectivity, convenience, and personalized driving experiences. In-vehicle apps, which range from navigation and entertainment to safety and vehicle diagnostics, have become integral to the modern driving experience. As automakers increasingly integrate smart technologies into vehicles, these apps offer drivers seamless access to a variety of services, enhancing comfort and functionality on the road. The growing popularity of connected cars, which rely on internet access and digital interfaces, further fuels the expansion of this market.

One key factor driving growth in the in-vehicle apps market is the rising adoption of smartphones and mobile applications, which has created a demand for similar features in vehicles. Consumers expect their cars to mirror the connectivity and convenience of their smartphones, pushing automakers to develop user-friendly app ecosystems. Moreover, the development of 5G technology is set to revolutionize the market by enabling faster data transfer, reducing latency, and allowing real-time updates for apps like navigation, traffic monitoring, and vehicle maintenance alerts.

Additionally, the push towards electric and autonomous vehicles is opening new opportunities for in-vehicle apps, as these vehicles rely heavily on software to optimize performance and improve the driving experience. With automotive manufacturers collaborating with tech companies to offer more advanced in-vehicle services, the market is set for continued expansion.

AI plays a transformative role in the in-vehicle apps market by enhancing the functionality, personalization, and safety of modern vehicles. AI-powered in-vehicle apps are capable of learning drivers' preferences and behaviors, allowing for more personalized experiences. For example, AI can adjust climate control, suggest navigation routes based on past trips, or recommend music and media preferences, creating a tailored driving environment. This personalization helps improve user satisfaction and engagement, making in-vehicle apps more integral to the driving experience.

In addition to personalization, AI significantly enhances safety features in in-vehicle apps. AI-powered systems can analyze real-time data from sensors and cameras to detect potential hazards, monitor driver attention, and provide real-time alerts to prevent accidents. This includes AI-driven applications like advanced driver assistance systems (ADAS), lane departure warnings, and predictive maintenance alerts, all of which improve vehicle safety and reduce the risk of accidents. These safety applications contribute to the increasing demand for AI-based in-vehicle apps.

AI also supports voice recognition and natural language processing (NLP) in in-vehicle apps, allowing drivers to interact with their vehicles hands-free. Voice-activated controls for navigation, music, and communication reduce distractions, enabling drivers to focus on the road while still enjoying the full range of in-vehicle features.

Lastly, AI plays a crucial role in predictive analytics for vehicle maintenance. AI-based in-vehicle apps can monitor a vehicle's performance in real time, predicting potential mechanical issues and notifying drivers to take preventive action, reducing downtime and maintenance costs.

The growing demand for telematics apps significantly drives the growth of the in-vehicle apps market by enhancing vehicle connectivity and providing real-time data to both drivers and fleet operators. Telematics apps enable a range of functionalities, including vehicle tracking, diagnostics, and performance monitoring, which are increasingly essential for optimizing operations in commercial fleets and improving safety for individual drivers. With the rise of e-commerce and logistics services, businesses are turning to telematics solutions to manage their fleets more efficiently, ensuring timely deliveries and reducing operational costs.

Furthermore, telematics apps support features such as predictive maintenance, alerting drivers and fleet managers about potential issues before they escalate, thus minimizing downtime and repair costs. The integration of telematics with in-vehicle navigation systems enhances route planning by considering traffic conditions and vehicle performance, ultimately leading to fuel savings and improved efficiency. Additionally, as consumers become more health-conscious and eco-aware, telematics apps that monitor driving behavior can promote safer, more efficient driving practices, reducing environmental impact. This growing emphasis on vehicle efficiency and safety propels the demand for telematics apps, thereby contributing to the overall expansion of the in-vehicle apps market as automakers and developers respond to evolving consumer needs.

The in-vehicle apps market faces several restraints that could limit its growth. One key challenge is data privacy and security concerns, as vehicles become more connected and reliant on external networks. The risk of cyberattacks and unauthorized access to personal information poses a significant hurdle. Additionally, high development costs and the need for regular software updates can strain automakers and app developers. Compatibility issues across different vehicle models and operating systems further complicate widespread adoption. Lastly, limited internet connectivity in rural areas may hinder the functionality of certain apps, affecting user experience and market expansion.

Advancements in autonomous driving technology are creating significant opportunities in the in-vehicle apps market, as the shift toward self-driving vehicles transforms how drivers and passengers interact with their cars. With autonomous driving systems taking over the task of driving, the focus for in-vehicle apps is increasingly shifting toward enhancing the passenger experience, enabling a wide range of entertainment, productivity, and communication functionalities. This shift opens up new possibilities for app developers and automakers to provide innovative services tailored to autonomous vehicle users.

As drivers become less engaged in operating the vehicle, infotainment apps will play a more prominent role in keeping passengers entertained during journeys. From streaming movies, playing games, or accessing social media, to virtual assistants that manage personal tasks like scheduling appointments or shopping, in-vehicle apps will cater to a more relaxed and connected experience. Passengers may also use productivity-focused apps to work, attend virtual meetings, or access cloud-based services during travel, further expanding the use cases for in-vehicle apps.

Moreover, autonomous driving technology creates opportunities for real-time data and app integration for vehicle diagnostics, route optimization, and safety monitoring. Apps that analyze sensor data from the vehicle and environment will improve safety and efficiency, notifying passengers of road conditions, potential hazards, or suggesting alternative routes.

The economical cars segment held the largest share of the market. Economical cars are playing a significant role in driving the growth of the in-vehicle apps market. As demand for affordable vehicles rises, automakers are increasingly integrating advanced in-vehicle technologies to enhance the overall driving experience. While economical cars are traditionally known for their cost-effectiveness, manufacturers are now equipping them with advanced infotainment systems, navigation apps, and vehicle diagnostics, making them more appealing to tech-savvy consumers. These in-vehicle apps provide features such as real-time traffic updates, turn-by-turn navigation, and hands-free calling, enhancing convenience without significantly increasing the vehicle's price.

The growing consumer preference for connectivity, even in lower-priced vehicles, is fueling this market. Drivers of economical cars, particularly younger and first-time buyers, seek access to smartphone integration, entertainment, and safety features that in-vehicle apps provide. To meet this demand, automakers are offering more affordable cars with built-in support for popular apps like Apple CarPlay and Android Auto, bridging the gap between premium and budget segments.

Additionally, in-vehicle apps are increasingly seen as tools for improving fuel efficiency and driving behavior. Economical cars, which are often chosen for their efficiency, can benefit from apps that offer fuel-saving tips, eco-driving scores, and route optimization, allowing drivers to further reduce fuel consumption. These features enhance the appeal of budget-friendly vehicles by offering more value through smart technology.

The infotainment apps segment led the industry. Infotainment apps are a key driver of growth in the in-vehicle apps market, transforming the driving experience by providing a wide range of entertainment, navigation, and communication services. These apps, integrated into modern infotainment systems, offer drivers and passengers seamless access to music streaming, video playback, GPS navigation, and hands-free communication, all through user-friendly interfaces. As consumer demand for connected and smart driving experiences increases, the integration of infotainment apps has become a standard feature in both premium and economical vehicles.

One of the primary factors behind the growth of infotainment apps is the rising adoption of smartphone integration technologies such as Apple CarPlay and Android Auto. These platforms allow drivers to mirror their smartphone screens on the vehicle’s infotainment system, granting access to their favorite apps, music, and messaging services while keeping their hands on the wheel. This trend is especially appealing to tech-savvy consumers who prioritize seamless connectivity and access to media while on the go.

In addition, advancements in voice recognition technology are enhancing the usability of infotainment apps. Drivers can now control various functions such as making calls, changing playlists, or setting navigation routes through simple voice commands, improving both safety and convenience. The rise of 5G technology is also expected to boost the capabilities of infotainment apps, enabling faster data transmission for real-time traffic updates, streaming, and cloud-based services.

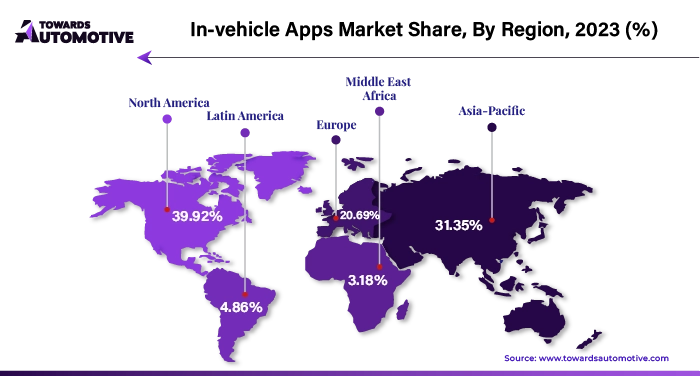

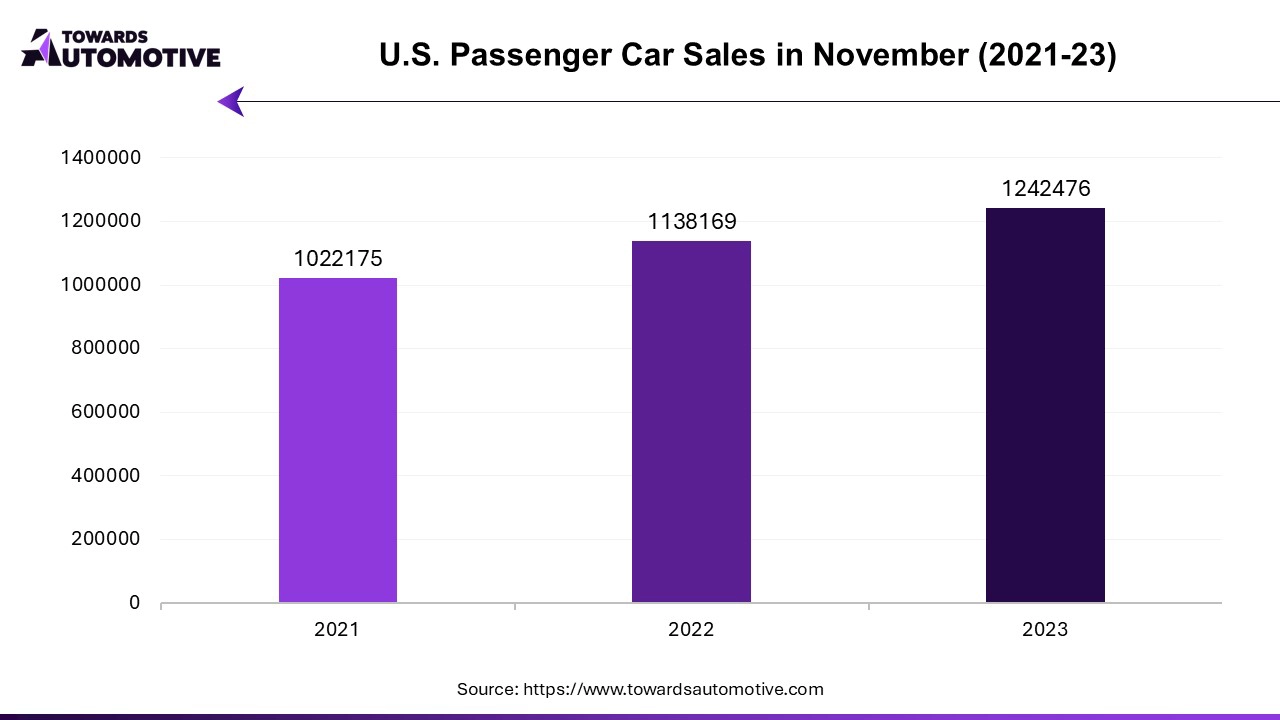

North America dominated the in-vehicle apps market. The growth of the in-vehicle apps market in North America is significantly driven by the increasing demand for passenger cars, the availability of charging networks, and advancements in autonomous driving technologies. Passenger cars remain a dominant segment in the region, with consumers seeking enhanced connectivity and entertainment options during their commutes. In-vehicle apps offering navigation, entertainment, and communication features cater to this growing demand, providing a more comfortable and seamless driving experience. This trend is further amplified by the rising interest in smart, connected vehicles equipped with advanced infotainment systems.

The widespread availability of charging networks for electric vehicles (EVs) across North America is another critical factor boosting the market. As EV adoption continues to rise, in-vehicle apps are essential for EV owners to locate charging stations, monitor battery status, and optimize charging times. Governments and private companies are expanding charging infrastructure across the U.S. and Canada, making it easier for EV drivers to rely on these apps for convenience and efficiency. This increased infrastructure supports the growing ecosystem of connected EVs, driving the demand for in-vehicle apps tailored to electric mobility.

Additionally, advancements in autonomous driving technologies are creating new opportunities for the in-vehicle apps market. Autonomous vehicles (AVs) rely heavily on real-time data, sensor integration, and connectivity, making in-vehicle apps crucial for navigation, vehicle diagnostics, and entertainment during autonomous operation. As the region moves closer to fully autonomous vehicles, the demand for more sophisticated in-vehicle apps that enhance the user experience during self-driving trips is expected to grow significantly.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The in-vehicle apps market in the Asia-Pacific (APAC) region is experiencing significant growth, driven by several key factors. One of the main drivers is the rapid adoption of connected and smart vehicles across countries such as China, Japan, South Korea, and India. With the rise of digital ecosystems in these countries, consumers increasingly demand advanced in-vehicle technologies that provide convenience, entertainment, and safety, fueling the market for in-vehicle apps.

Technological advancements in the automotive sector are also contributing to the growth of in-vehicle apps in APAC. Automakers in the region are heavily investing in integrating cutting-edge technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT) into their vehicles. The rollout of 5G networks, particularly in China and South Korea, enhances the connectivity of vehicles, allowing faster data transmission and real-time updates for apps such as navigation, traffic alerts, and vehicle diagnostics. This technological leap is creating a favorable environment for the adoption of more sophisticated in-vehicle apps.

The region’s growing electric vehicle (EV) market also plays a crucial role in boosting the in-vehicle apps market. EVs rely on in-vehicle apps for key functions like battery management, charging station navigation, and energy optimization. With governments in APAC encouraging the adoption of EVs through incentives and policies, the demand for these applications is increasing.

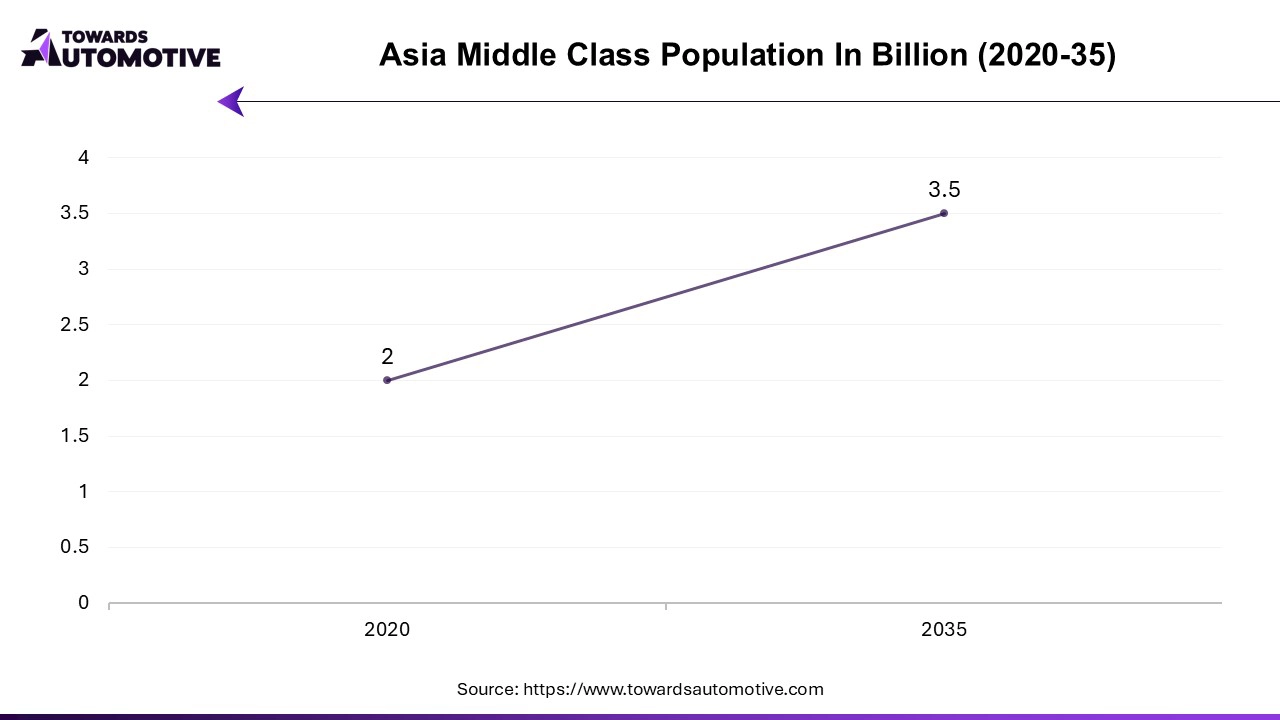

Additionally, the rising middle-class population and increasing disposable income in APAC are driving consumer interest in premium cars equipped with advanced infotainment systems and in-vehicle apps. As consumers seek greater comfort and convenience during their commutes, the demand for enhanced in-vehicle experiences continues to rise, propelling the growth of the market.

By Propulsion Type

By Component

By Technology

By End-User

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us