October 2025

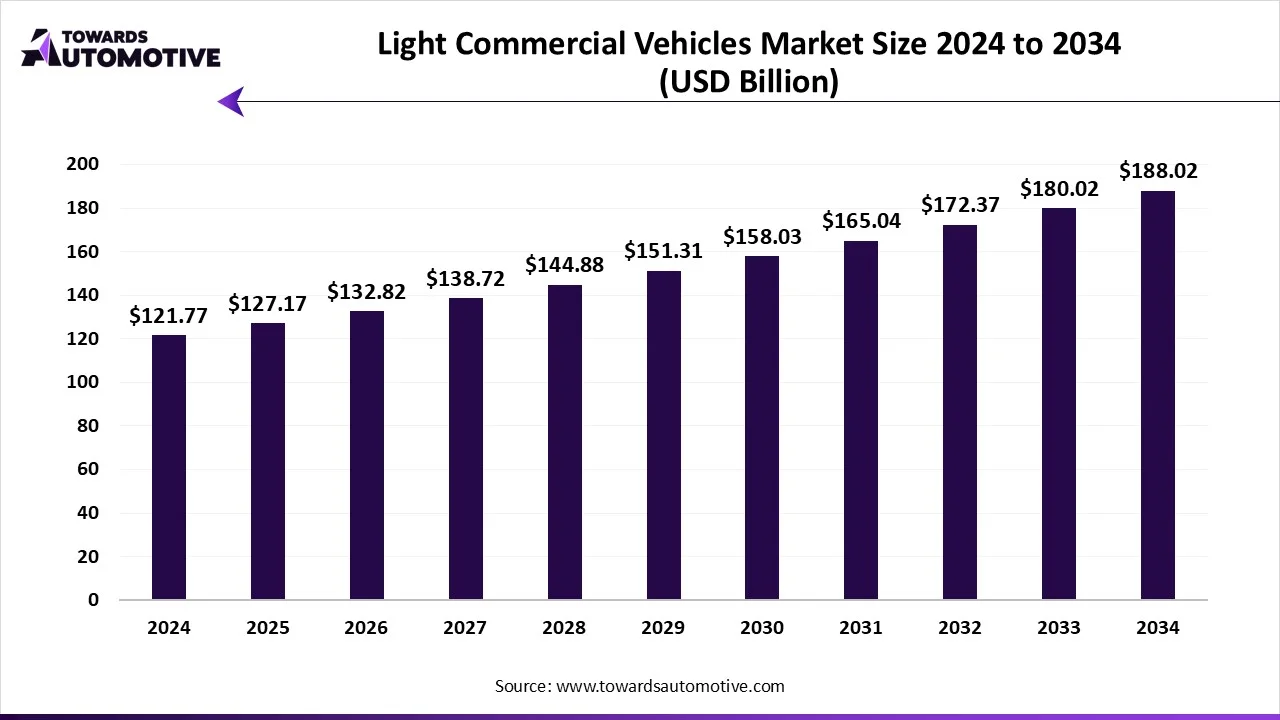

The light commercial vehicles market is forecast to grow from USD 127.17 billion in 2025 to USD 188.02 billion by 2034, driven by a CAGR of 4.44% from 2025 to 2034.

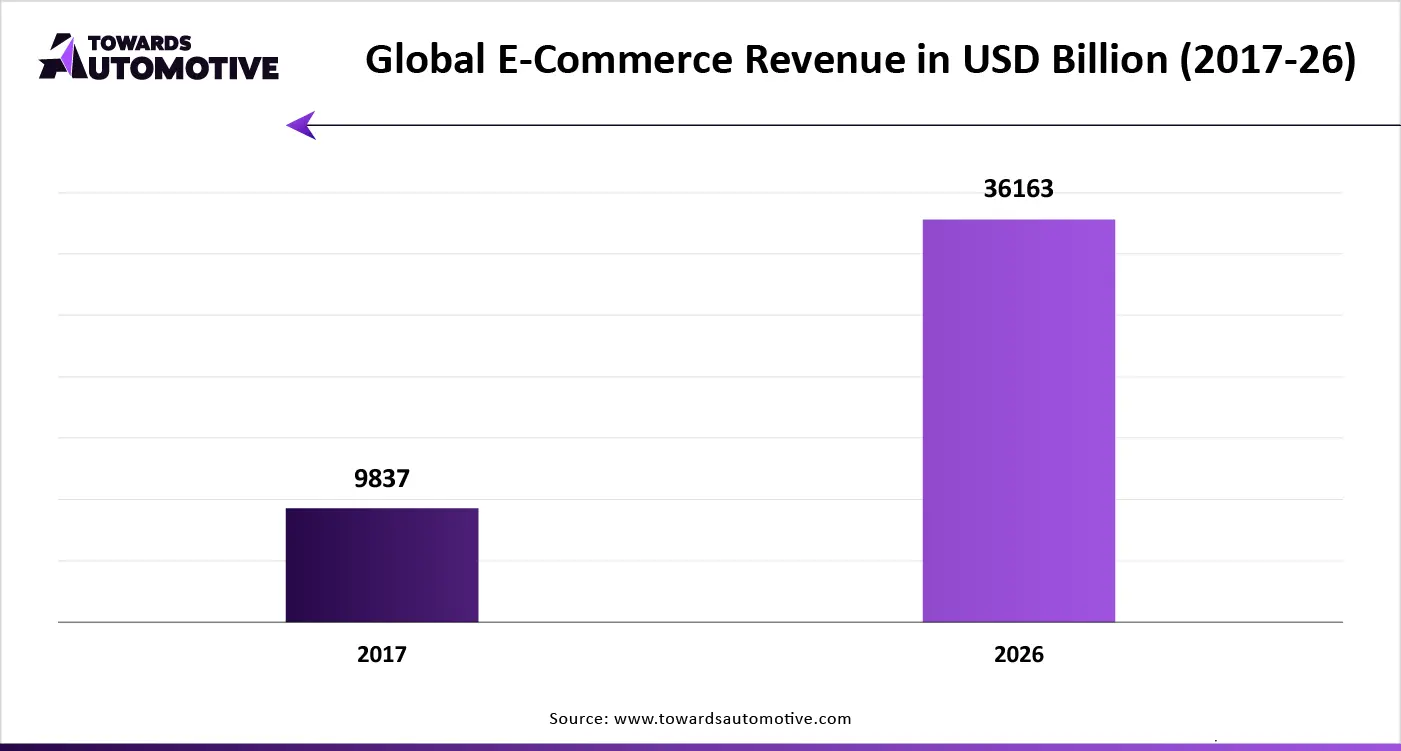

The light commercial vehicles market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of light commercial vehicles in different parts of the world. There are various types of vehicles developed in this sector consisting of trucks, vans, buses and some others. These vehicles are powered by numerous propulsion technology comprising of diesel, gasoline, electric and others. The rising demand for light commercial vehicles in the e-commerce sector has contributed significantly to the industrial expansion. This market is expected to rise significantly with the growth of the electric vehicles industry across the globe.

| Metric | Details |

| Market Size in 2024 | USD 121.77 Billion |

| Projected Market Size in 2034 | USD 188.02 Billion |

| CAGR (2025 - 2034) | 4.44% |

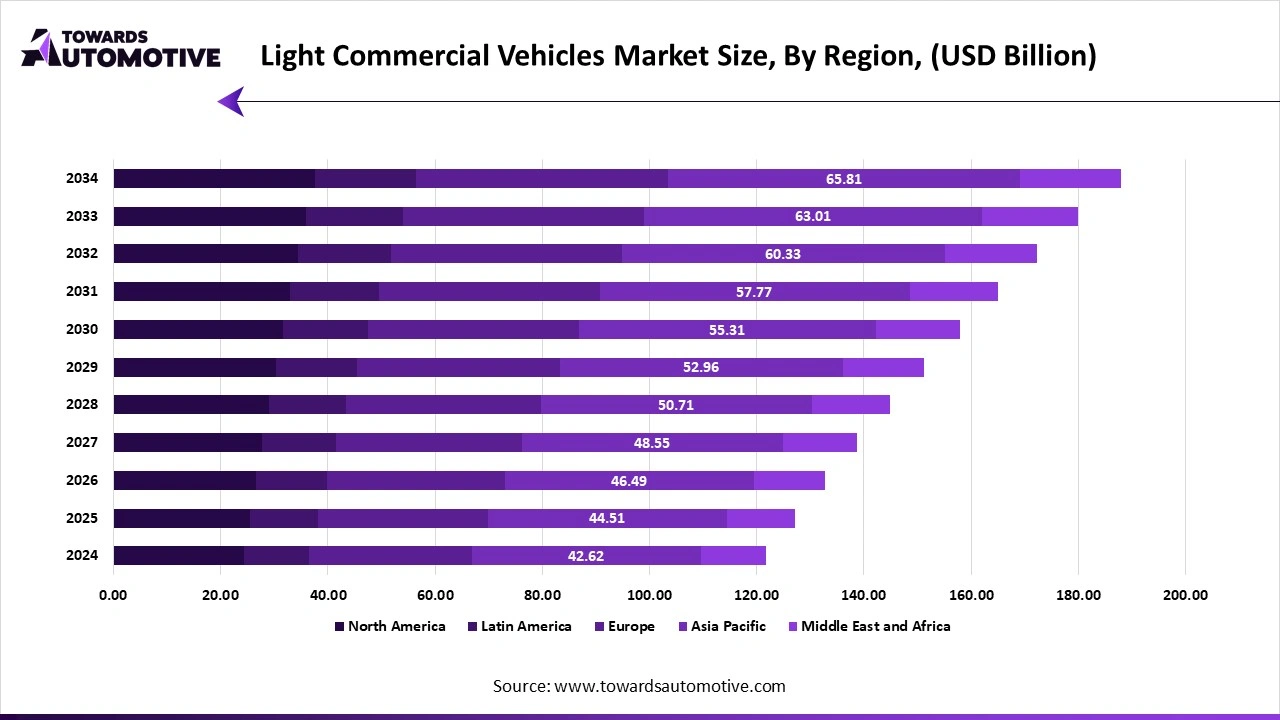

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicles Type, By Fuel Type, By Ownership and By Region |

| Top Key Players | Mitsubishi motor Corporation, PACCAR Inc., Hyundai Motor Company, Nissan Motor Company Ltd. |

The vans segment held a dominant share of the market. The rising demand for passenger vans in different parts of the world has boosted the market growth. Also, rapid adoption of electric vans by fleet operators to maintain sustainability is further accelerating the industrial expansion. Moreover, partnerships and collaborations among various market players to launch advanced vans in different regions is likely to drive the growth of the light commercial vehicles market.

The trucks segment is likely to rise with a notable growth rate during the forecast period. The rising demand for light-duty trucks in e-commerce sector has driven the market expansion. Additionally, rapid investment by automotive companies for developing hybrid trucks along with growing trend of on-the-go delivery is further proliferating the growth of the light commercial vehicles market.

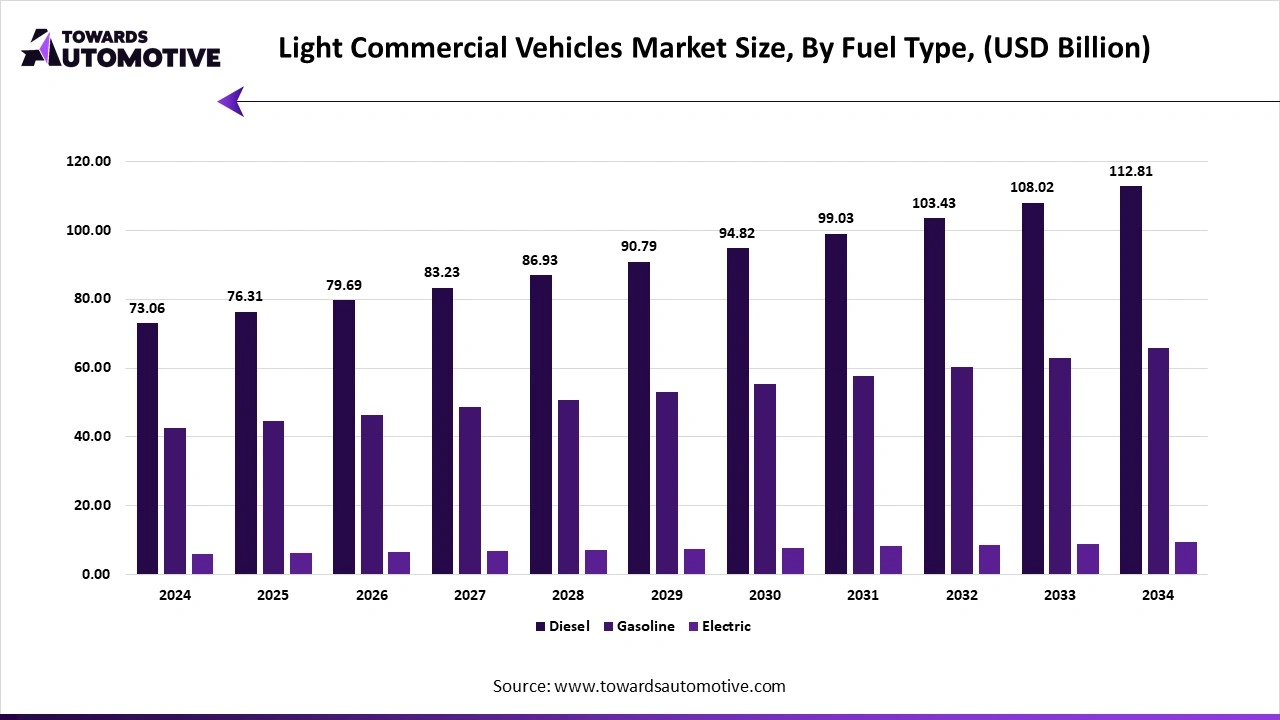

The diesel segment held a significant share of the industry. The rising demand for diesel-powered trucks and diesel-powered buses across the world has driven the market growth. Additionally, the growing adoption of diesel vehicles due to its advantages such as less maintenance, high efficiency and some others is crucial for the growth of the light commercial vehicles market.

The gasoline segment is expected to grow with a considerable CAGR during the forecast period. The rising adoption of vans by rental companies to provide comfortable travel experience to consumers has boosted the market growth. Moreover, the growing demand for gasoline-powered commercial vehicles by private owners is further accelerating the growth of the light commercial vehicles market.

Asia Pacific held the highest share of the light commercial vehicles market. The rising production and sales of light commercial vehicles in countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, the growing developments in the logistics and transportation sector coupled with rapid adoption of electric commercial vehicles is crucial for the industrial growth. Moreover, numerous government initiatives aimed at developing the road infrastructure along with availability of essential raw materials is further driving the growth of the light commercial vehicles market in this region.

China dominated the market in this region. The market is generally driven by the rise in number of automotive companies along with rapid investment by LCV brands for strengthening the automotive sector. Also, surge in demand for small commercial vehicles from various industries such as construction, mining, textiles and some others has further accelerated the market expansion. Moreover, the presence of several market players such as BYD, SAIC Motor, Dongfeng Motor Corporation and some others is driving the market growth in this nation.

India, Japan and South Korea held significant share of the market. In India, the market is generally driven by the rise in number of EV startups. In Japan, technological advancement in the automotive sector is driving the market growth. In South Korea, the growing adoption of commercial vehicles in chemical industry has boosted the industrial expansion.

Europe is expected to grow with a significant CAGR during the forecast period. The growing demand for commercial vehicles from the e-commerce sector has boosted the market expansion. Also, numerous government initiatives aimed at strengthening the EV charging infrastructure coupled with rapid development in construction sector is further accelerating the industrial growth. Moreover, the presence of various automotive brands along with advancements in hybrid technology is driving the growth of the light commercial vehicles in this region.

Germany is the major contributor in this region. The market is generally driven by the rising demand for commercial vehicles from various industries such as chemicals, renewable energy, healthcare, electricals and some others. Also, the growing adoption of electric vans by fleet operators for short-distance commutes along with increasing production of commercial vehicles has played a crucial role in shaping the industrial landscape. Additionally, the presence of various LCV companies such as Volkswagen, Mercedes-Benz, MAN and some others is further driving the market growth in this nation.

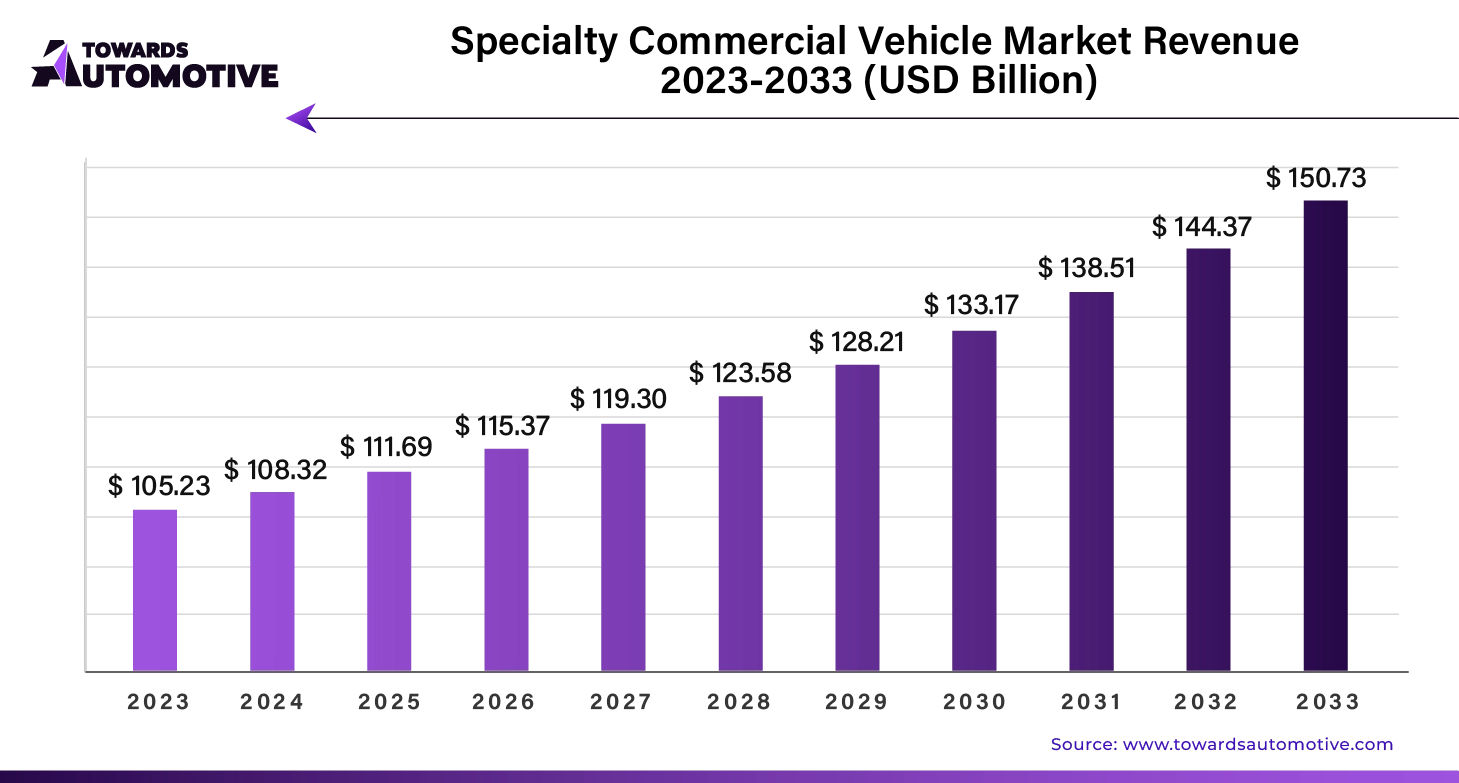

The global specialty commercial vehicle market is forecasted to expand from USD 113.25 billion in 2025 to USD 157.60 billion by 2034, growing at a CAGR of 3.74% from 2025 to 2034.

The specialty commercial vehicle market is witnessing robust growth due to the rising demand for customized vehicles across various industries. These vehicles are designed to meet specific operational requirements in sectors such as construction, agriculture, healthcare, and logistics. The increasing need for efficient and purpose-built vehicles in urbanization projects and infrastructure development is a key driver for this market.

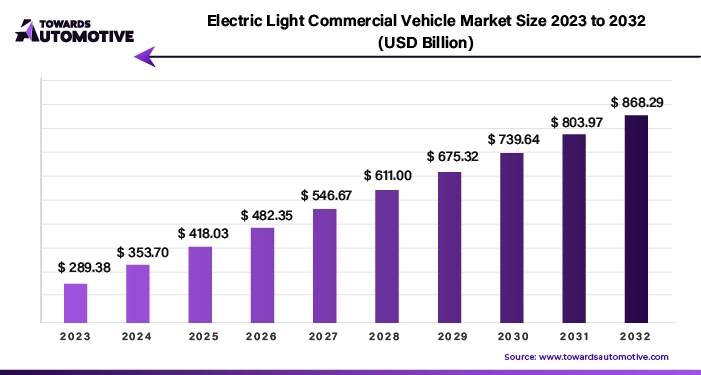

The electric light commercial vehicle market is forecasted to expand from USD 369.44 billion in 2025 to USD 1,108.94 billion by 2034, growing at a CAGR of 12.99% from 2025 to 2034.

The significant growth observed in the electric light commercial vehicle (eLCV) market can be largely attributed to the increasingly stringent environmental regulations and sustainable development measures being implemented across various industries worldwide. Governments are enacting strict standards and regulations aimed at combating air pollution and reducing greenhouse gas emissions, prompting businesses and fleet operators to seek cleaner and more sustainable transportation solutions. eLCVs offer a compelling alternative as they produce zero tailpipe emissions, contributing to cleaner and safer urban environments.

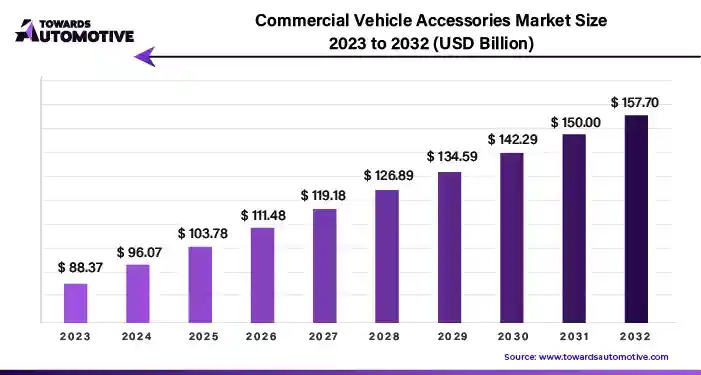

The commercial vehicle accessories market is projected to reach USD 179.42 billion by 2034, growing from USD 100.51 billion in 2025, at a CAGR of 6.65% during the forecast period from 2025 to 2034.

The commercial vehicle accessories market is witnessing robust growth, driven by the increasing demand for efficiency, safety, and customization in commercial fleets. With the rise of e-commerce, last-mile delivery, and logistics services, commercial vehicles play a vital role in supporting economic activities worldwide.

The light commercial vehicles market is a fragmented industry with the presence of a few dominating players. Some of the prominent companies in this industry consists of Volkswagen AG, Renault Trucks, Volvo Group, Ford Motor Company, General Motors, Daimler AG, Mitsubishi motor Corporation, PACCAR Inc., Hyundai Motor Company, Nissan Motor Company Ltd. and some others. These companies are constantly engaged in developing light commercial vehicles and adopting numerous strategies such as collaborations, joint ventures, partnerships, business expansion, launches, acquisitions, and some others to maintain their dominant position in this industry. For instance, in February 2025, Renault Group announced to launch three all-electric light commercial vehicles in France. These LCVs are expected to be launched by the end of 2026.Also, in February 2024, Hyundai partnered with Iveco Group. This partnership is done for developing an electric van.

By Vehicles Type

By Fuel Type

By Ownership

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us