October 2025

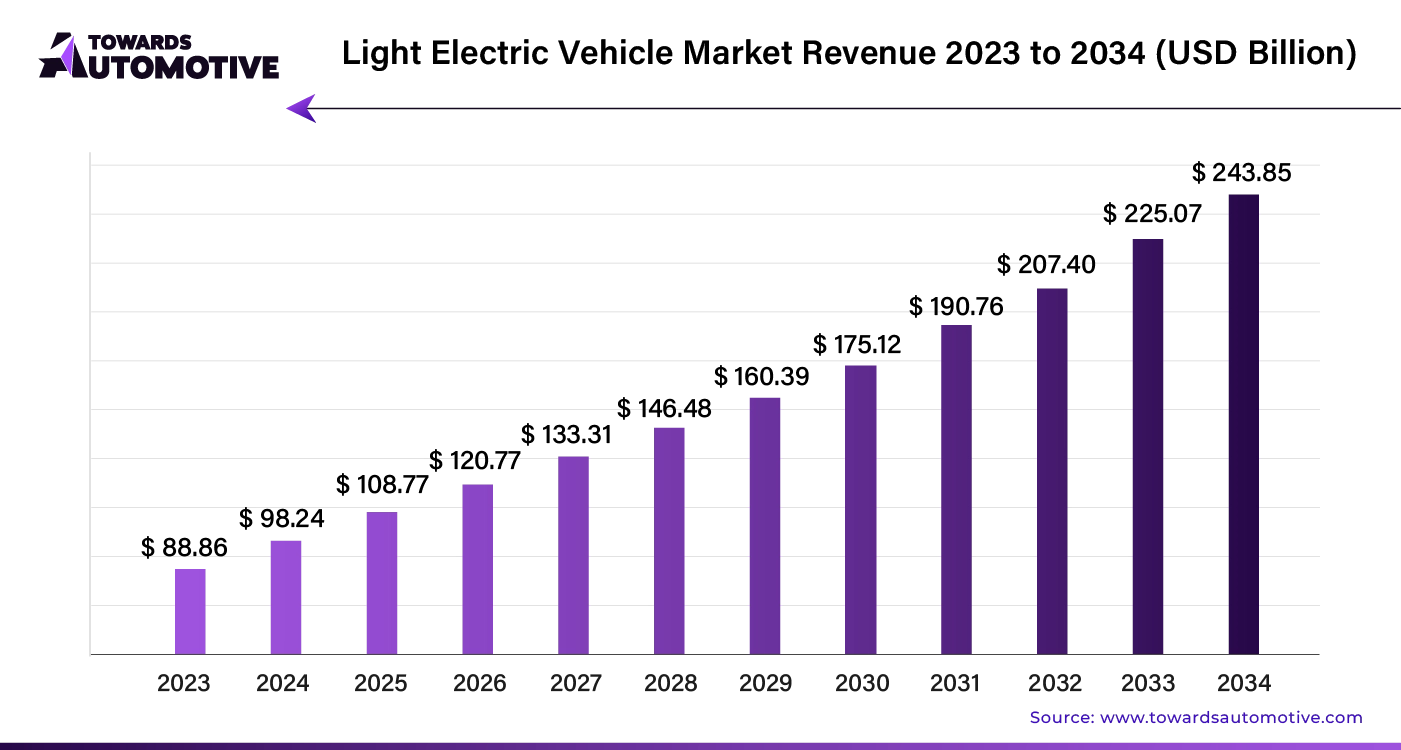

The global light electric vehicle market is forecast to grow from USD 108.77 billion in 2025 to USD 243.85 billion by 2034, driven by a CAGR of 10.63% from 2025 to 2034.

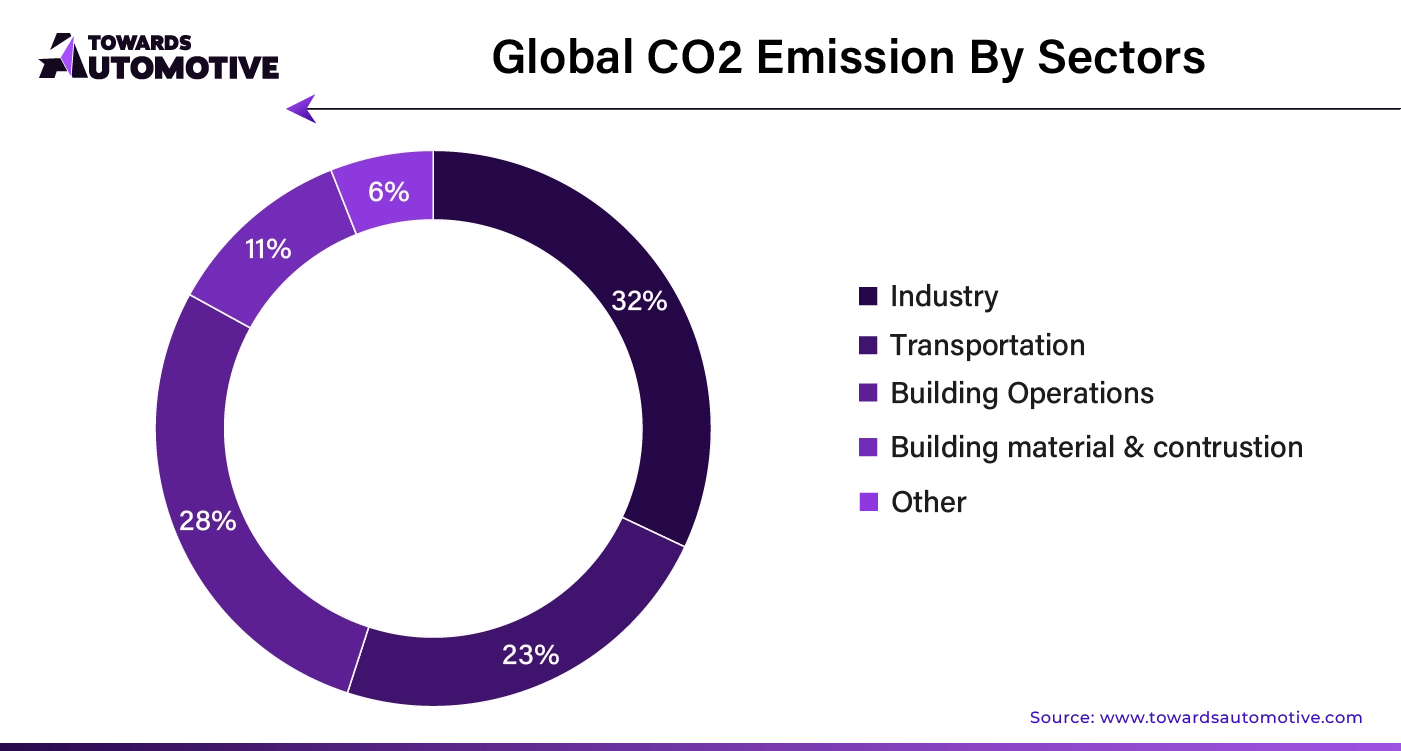

The Light Electric Vehicle (LEV) market is expanding rapidly due to increasing air pollution and a growing demand for clean transportation. LEVs, such as electric bicycles and scooters, are becoming popular in cities facing severe pollution, offering a sustainable alternative to traditional gasoline-powered vehicles.

The surge in eCommerce and the need for efficient last-mile delivery services are also boosting the market. Electric bikes and scooters provide a practical and cost-effective solution for quick deliveries. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Technological advancements are enhancing the appeal of LEVs. Innovations in electric motors, batteries, and charging infrastructure, along with smart features like GPS tracking and real-time monitoring, are making LEVs more reliable and user-friendly.

Government incentives and subsidies are further driving market growth. Regulatory support encourages consumers to choose electric vehicles, aligning with sustainability goals.

Investor interest is rising, with start-ups offering innovative and affordable electric vehicles. Collaborations between established manufacturers and start-ups are expanding market offerings and driving further growth.

AI is transforming the Light Electric Vehicle (LEV) market, driving significant growth and innovation. By integrating AI into LEV systems, manufacturers enhance vehicle performance, safety, and user experience. AI algorithms optimize battery management, leading to more efficient energy use and extended vehicle range. Advanced driver-assistance systems (ADAS) powered by AI improve safety through features like collision avoidance and lane-keeping assistance.

Moreover, AI-driven predictive maintenance helps identify potential issues before they become critical, reducing downtime and repair costs. Smart navigation systems leverage AI to provide real-time traffic updates and optimal routes, enhancing the overall driving experience.

AI also enables the development of autonomous LEVs, which could reshape urban mobility by reducing traffic congestion and lowering accident rates. As AI technology evolves, it will continue to unlock new possibilities for LEVs, fostering market expansion and attracting investment.

In summary, AI integration is not only enhancing the functionality and efficiency of light electric vehicles but also propelling the market toward unprecedented growth. This technological advancement promises a smarter, safer, and more sustainable future for urban transportation.

In the Light Electric Vehicle (LEV) market, an efficient supply chain is critical for ensuring timely production and delivery. The supply chain begins with raw material sourcing, where high-quality components such as batteries, electric motors, and control systems are procured. Suppliers must adhere to rigorous standards to guarantee performance and safety.

Once materials are sourced, they are transported to manufacturing facilities where assembly takes place. Lean manufacturing techniques and just-in-time inventory management help minimize waste and reduce costs. Effective coordination between suppliers and manufacturers ensures that components arrive as needed, preventing production delays.

Post-manufacturing, vehicles undergo quality testing before distribution. The distribution network is crucial, involving logistics partners who manage warehousing and transportation to various markets. Efficient distribution systems ensure that vehicles reach dealers and customers promptly.

Lastly, after-sales support and spare parts availability are essential. A responsive supply chain network must handle maintenance and repair parts to maintain customer satisfaction and vehicle performance.

Overall, a streamlined and responsive supply chain enhances efficiency, reduces costs, and supports the growing demand for light electric vehicles.

Light Electric Vehicles (LEVs) face several key challenges. Their limited range compared to traditional gasoline-powered vehicles means frequent recharging, which can be inconvenient and restrict travel distance. Additionally, the high initial cost of LEVs makes them less accessible to budget-conscious consumers. Although manufacturers are working to reduce production costs through research and development, this process is both time-consuming and expensive. Regulatory inconsistencies across regions also pose a challenge, as varying policies on emissions can create uncertainty for manufacturers. Lastly, intense competition in the LEV market requires companies to stand out with unique features or pricing strategies to attract customers.

The Light Electric Vehicle (LEV) market is driven by a range of key components and industry players that shape its ecosystem. Major manufacturers, such as Gogoro and NIU Technologies, focus on producing innovative e-scooters and e-bikes, enhancing urban mobility with eco-friendly options. These companies lead in developing efficient, high-performance batteries and advanced electric drivetrains, crucial for extending vehicle range and improving user experience.

Battery manufacturers like LG Chem and Panasonic are pivotal, supplying high-capacity lithium-ion batteries essential for LEVs. Their advancements in battery technology increase energy density and reduce charging times, directly impacting vehicle performance and adoption rates.

Charging infrastructure is supported by companies such as ChargePoint and Blink Charging. They build and maintain extensive charging networks, addressing one of the critical barriers to LEV adoption by ensuring convenient and widespread charging access.

Automotive giants like BMW and Honda are also investing in LEV technology, integrating it into their broader electric mobility strategies. Their involvement accelerates innovation and drives the development of LEVs with advanced features and improved safety standards.

Together, these companies and components create a robust ecosystem, advancing the Light Electric Vehicle market and supporting its growth.

2-Wheelers Lead Vehicle Category Market

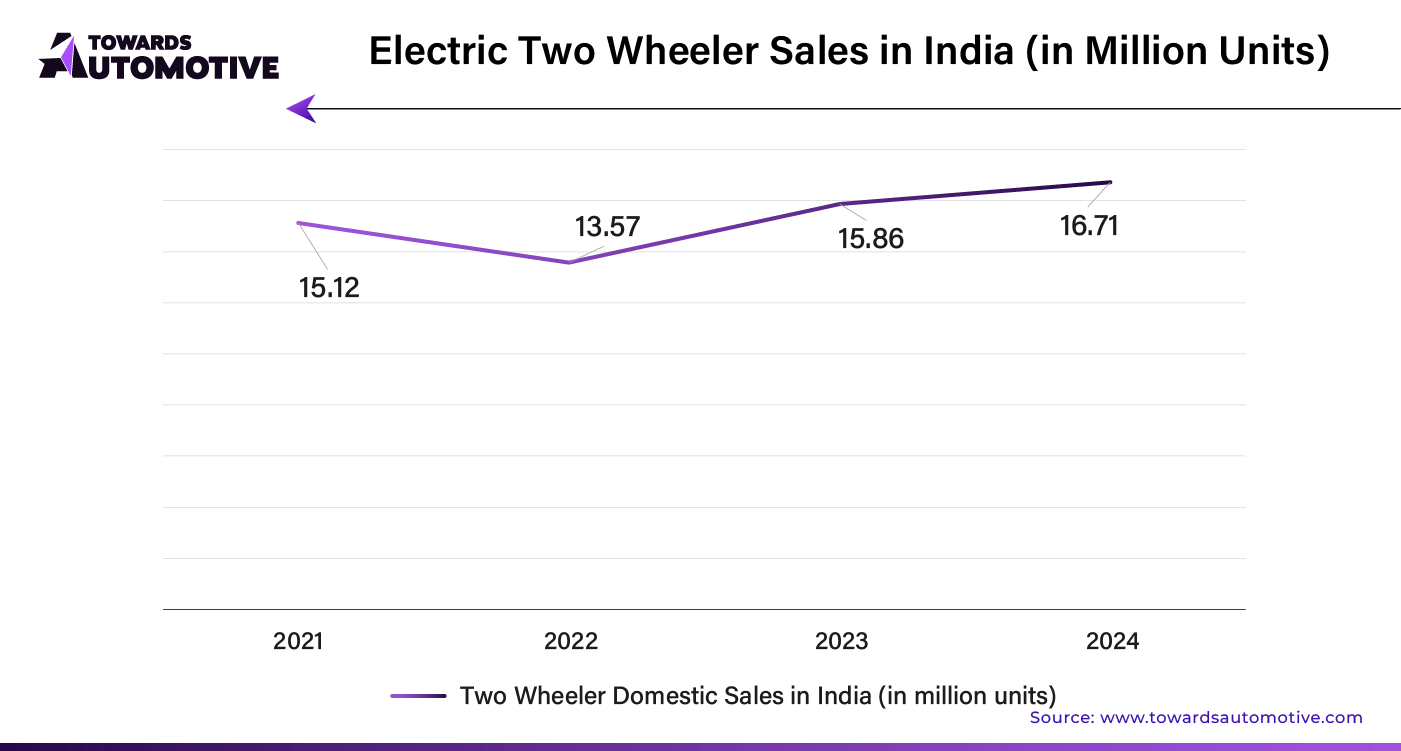

2-wheelers lead the market with a projected CAGR of 10.6% from 2024 to 2034. Their cost-effectiveness makes them a preferred choice for budget-conscious consumers. They are well-suited for navigating crowded urban areas and offer greater parking convenience, making them ideal for city living.

E-Scooters Lead Vehicle Type Market

E-scooters are the top vehicle type, anticipated to grow at a CAGR of 10.4% from 2024 to 2034. Their affordability and user-friendliness make them a popular choice for those seeking convenient and eco-friendly transportation. The segment's expansion is fueled by rising urbanization and a growing emphasis on sustainable travel.

United States: 10.7% CAGR In the U.S., the electric vehicle (EV) market is expanding due to heightened environmental awareness and the need to lower carbon emissions. EVs are increasingly popular for their cost-efficiency compared to gasoline-powered cars. Government incentives and the entry of new market players are enhancing this trend, making EVs an attractive option for both budget-conscious and eco-conscious consumers.

United Kingdom: 11.4% CAGR The UK's growing concern about climate change is driving the demand for lightweight, high-performance materials, including those used in electric vehicles. Many people are choosing EVs and alternative modes of transport like electric scooters and bicycles due to their lower environmental impact and the country’s well-established public transport system.

China: 11.9% CAGR China's electric vehicle market is experiencing rapid growth due to significant government investment in infrastructure and pollution reduction efforts. The affordability of EVs and the rise of e-commerce and delivery services are also contributing to market expansion. The sector remains competitive and evolving, with numerous small and medium-sized players driving innovation.

Japan: 11.8% CAGR Japan continues to lead in EV technology and sustainability, supported by various government incentives such as tax credits and subsidies for charging infrastructure. The need for accessible mobility solutions for an aging population further drives EV demand. Japan’s focus on reducing greenhouse gas emissions supports the growth of advanced manufacturing materials.

South Korea: 12.2% CAGR South Korea is witnessing a notable increase in light electric vehicle adoption due to high fuel costs and growing interest in personal mobility solutions. As urban areas expand, LEVs present a cost-effective and eco-friendly alternative to traditional vehicles, aligning with the country's emphasis on innovation and sustainable development.

The light electric vehicle market is rapidly evolving with increased competition as new players enter the field. Companies are adopting varied strategies: some focus on affordability, while others emphasize performance and luxury features.

In 2022, Textron Ground Support Equipment Inc., a subsidiary of Textron Inc., collaborated with General Motors (GM) and Powertrain Control Solutions (PCS) to electrify its product range. GM and PCS developed an integrated driveline with GM’s lithium-ion battery systems tailored for Textron GSE. This partnership allows Textron GSE to benefit from GM’s advanced electric propulsion technology.

By Vehicle Category

By Vehicle Type

By Component Type

By Application

By Power Output

By Region

The global electric vehicle motor communication controller market, valued at USD 839.49 million in 2024, is anticipated to reach USD 3,540.67 million ...

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us