April 2025

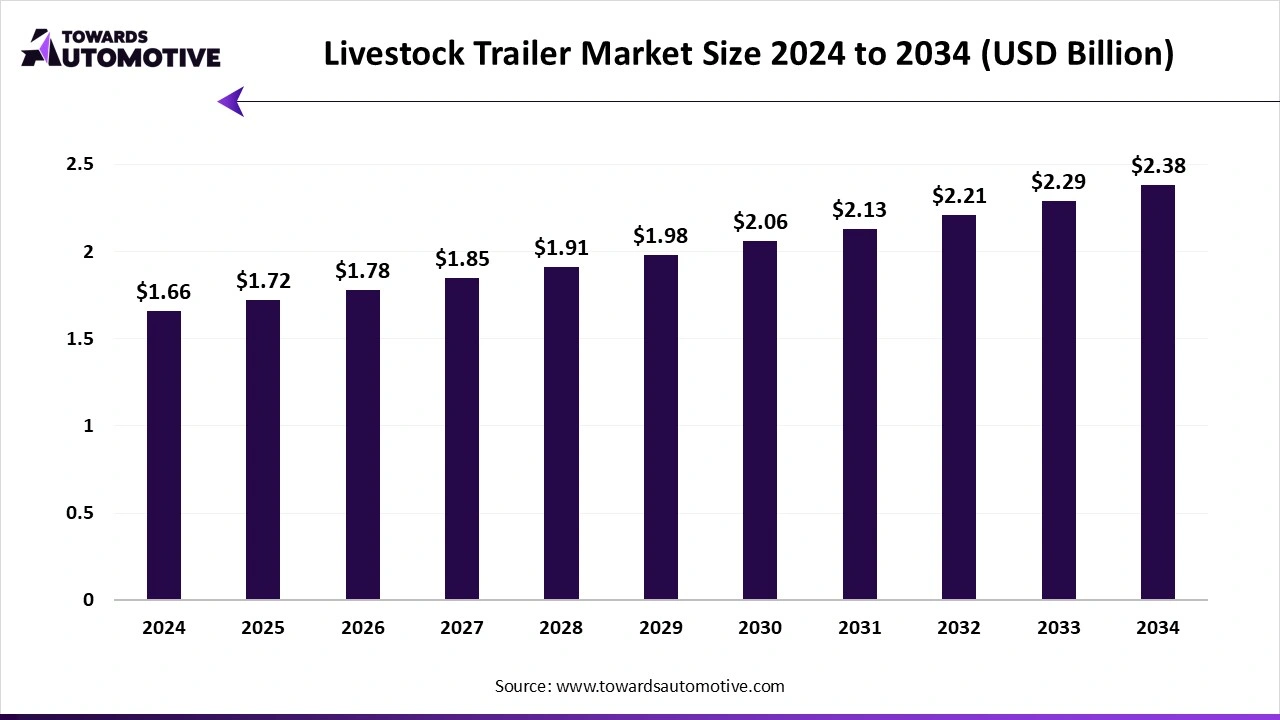

The livestock trailer market is forecast to grow from USD 1.72 billion in 2025 to USD 2.38 billion by 2034, driven by a CAGR of 3.65% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The livestock trailer market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of trailers for the livestock sector. There are various types of trailers developed in this sector consisting of gooseneck trailers, bumper pull trailers, stock trailers, livestock trailers, custom designed trailers and some others.

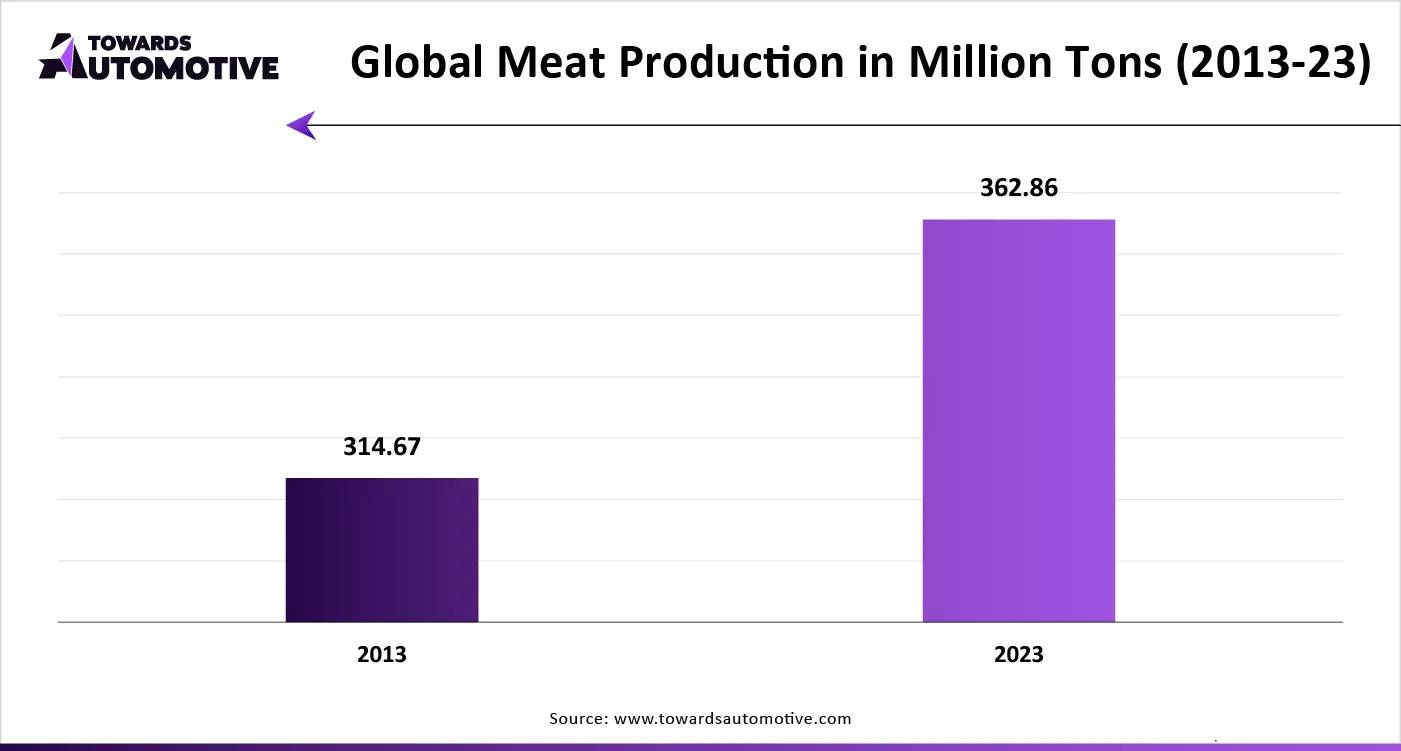

These trailers are manufactured using different materials including steel, aluminum, wood, composite and some others. It is used for transporting numerous livestock comprising of cattle, pigs, sheep, horses and some others. The rising production of meat in different regions has played a vital role in shaping the industrial landscape. This market is likely to rise significantly with the growth of the livestock industry around the globe.

The cattle segment held a dominant share of the market. The growing demand for dairy products such as milk, ghee, curd and some others in the Asia-Pacific region has increased the application of cattle rearing, thereby driving the market growth. Also, several government initiatives aimed at promoting cattle rearing practices coupled with rising demand for beef in countries such as the U.S., Argentina, Pakistan, Uruguay, Brazil and some others is contributing to the industrial expansion. Moreover, surge in demand for leather-based products such as wallets, belts, shoes and some others along with increasing emphasis on manufacturing biogas has boosted the growth of the livestock trailer market.

The pigs segment is predicted to grow with a notable growth rate during the forecast period. The growing demand for pork meat in countries such as Hongkong, Poland, Denmark, South Korea, China and some others has boosted the market growth. Also, government of numerous countries such as India, China, South Korea and some others have started providing subsidized loans to piggery entrepreneurs has further contributed to the industrial expansion. Moreover, the increasing demand for pig-based products including ham, sausage, terrines and some others is expected to drive the growth of the livestock trailer market.

The commercial segment held the lion’s share of the market. The growing demand for gooseneck trailers among meat producers has boosted the market expansion. Also, rapid investment by government in dairy industry for enhancing the transportation of dairy products is another factor that adds up to the industrial growth. Moreover, the rising use of potbelly (PB) trailers and straight-deck trailers in pig companies along with increased preference of consumer towards turkey meat and duck meat in China and Vietnam is driving the growth of the livestock trailer market.

The personal segment is likely to grow with a considerable growth rate during the forecast period. The rising adoption of livestock practices among individuals for personal uses and utilizing leisure has boosted the market growth. Also, the growing demand for chicken-based products such as eggs and meat to fulfill nutritional needs has further contributed to the industrial expansion. Moreover, the increasing interest of people towards cattle rearing for maintaining good health is also expected to propel the growth of the livestock trailer market.

North America held the highest share of the livestock trailer market. The growing demand for beef among the people of the U.S. and Canada has boosted the market growth. Also, the rising investment by government for strengthening the livestock sector along with the rapid popularity of horse racing has contributed to the industrial expansion. Moreover, the presence of several trailer manufacturing brands such as Trail King, Strick Trailers, East Mfg, Premier, and Di-Mond and some others is expected to drive the growth of the livestock trailer market in this region.

The U.S. is a major contributor of this region. The market is generally driven by the rising demand for dairy products as milk and butter. Also, numerous stringent regulations by government agencies related to animal welfare along with rapid adoption of livestock practices in rural areas further contributes to the industrial expansion. Moreover, the growing investment by farmers for adopting advanced trailers to enhance trade activities is also anticipated to proliferate the market growth in this nation.

Europe is expected to grow with a significant CAGR during the forecast period. The growing number of meat consumers in countries such as Germany, Netherlands, UK, France, Georgia, Italy and some others is contributing to the industrial expansion. Also, rapid investment by government for developing the livestock sector along with rising popularity of organic farming has further bolstered the market growth. Additionally, the increasing demand for advanced trailers with modern features such as adequate ventilation, climate control, shock-absorbing systems, and some others is further accelerating the market growth in this region.

France held the largest portion of the market in this region. The market in this nation is generally driven by the rising practices of cattle rearing. Also, France is a leading producer of beef in the European region, that in turn increases the demand for trailers, thereby driving the market growth. Additionally, the rise in number of livestock-based research centers along with presence of numerous trailer manufacturers is driving the industrial expansion in this nation.

The livestock trailer market is a consolidated industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Featherlite, Rolland trailer, Deguillaume authentic, Chalvignac Group, Fortuna Fahrzeugbau, Zavod Kobzarenko, Dangreville, Hillsboro Industries, Ifor Williams Trailers Ltd and some others. These companies are constantly engaged in developing trailers for the livestock sector and adopting numerous strategies such as acquisition, partnerships, collaborations, business expansion, joint venture, product launches and some others to maintain their dominant position in this industry. For instance, in July 2024, Hillsboro Industries launched 500TX. 500TX is a hybrid trailer designed for performing several livestock operations. Also, in October 2023, Featherlite launched 9000 series horse trailers. These trailers are designed for the livestock consumers of the U.S. and Canada.

By Trailer

By Livestock

By Application

By Region

April 2025

April 2025

April 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us