April 2025

The luxury buses market is expected to increase from USD 24.66 billion in 2025 to USD 34.28 billion by 2034, growing at a CAGR of 3.73% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The luxury buses market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of luxury buses across the globe. There are several types of buses manufactured in this sector comprising of coach buses, sleeper buses, double decker buses and minibuses. These buses are powered by different types of propulsion technology including diesel, CNG, electric, and hybrid. It finds application in various sectors consisting of tourism, corporate transport, public transport and some others. The expansion in the tourism sector is expected to contribute significantly to the industrial expansion. This market is expected to rise drastically with the growth of the travel and tourism industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 23.77 Billion |

| Projected Market Size in 2034 | USD 34.28 Billion |

| CAGR (2025 - 2034) | 3.73% |

| Leading Region | North America |

| Market Segmentation | By Bus Type, By Application, By Fuel Type, By Seating Capacity and By Region |

| Top Key Players | Van Hool, Scania, Volvo, Komatsu, MCI, Bluebird, Iveco, MAN, Gillig |

The coach buses segment held a dominant share of the market. The rising demand for luxury buses with seating capacity of around 50 people has boosted the market expansion. Also, rapid investment by automotive manufacturers for developing luxury coaches to enhance the traveling experience of passengers has further bolstered the industrial growth. Moreover, numerous bus manufacturers are launching advanced coach buses to attract maximum consumer attention is anticipated to propel the growth of the luxury buses market.

The sleeper buses segment is likely to rise with a notable growth rate during the forecast period. The growing consumer preference towards luxury road-trips has boosted the market expansion. Additionally, the rising proliferation of night bus services coupled with increasing adoption of electric luxury buses is contributing to the industrial growth. Moreover, the growing investment by bus makers to develop chassis for sleeper buses has driven the growth of the luxury buses market.

The tourism segment held a significant share of the industry. The rising adoption of luxury buses for traveling long-distances has boosted the market expansion. Also, numerous government initiatives aimed at developing the tourism sector coupled with availability of booking applications in Play Store and Apps Store has contributed to the industrial growth. Moreover, rapid investment by fleet operators to deploy advanced buses to cater the demands of the tourists, thereby propelling the growth of the luxury buses market.

The corporate transport segment is expected to grow with a considerable CAGR during the forecast period. The rise in number of travel programs organized by corporate companies to enhance team building has boosted the market expansion. Also, numerous partnerships among business organizations and fleet operators for providing luxury transportation to employees is further contributing to the industrial growth. Moreover, several bus manufacturers are launching luxury buses to cater the consumers of corporate sector, thereby fostering the growth of the luxury buses market.

The diesel segment held the largest share of the industry. The rising demand for luxury buses that provides superior mileage and high comfort has boosted the market expansion. Also, numerous technological advancements related to developing high-performance diesel engines for buses is further adding to the industrial growth. Moreover, the growing adoption of diesel-powered luxury buses for traveling long-distances is expected to propel the growth of the luxury buses market.

The electric segment is predicted to rise with a highest CAGR during the forecast period. The rising demand for eco-friendly tourism has boosted the market growth. Also, numerous government initiatives aimed at developing the EV charging infrastructure coupled with technological advancements in EV powertrain for delivering superior driving range is playing a vital role in shaping the industrial landscape. Moreover, several EV brands are developing electric buses for maintaining sustainability in the environment, thereby fostering the growth of the luxury buses market.

North America held the highest share of the luxury buses market. The growing demand for luxury transportation in countries such as the U.S. and Canada has boosted the market growth. Also, numerous government initiatives aimed at deploying EV chargers along with rising adoption of sleeper buses by fleet operators is contributing to the industrial expansion. Moreover, the presence of various bus service providers such as Megabus, Orleans Express, Greyhound, Megabus and some others is projected to boost the growth of the luxury buses market in this region.

U.S. is the major contributor of this region. In U.S., the market is driven by rising consumer interest towards eco-friendly transportation. Also, the increasing demand for luxury buses from government organizations and private companies is contributing to the industrial expansion. Additionally, the presence of several market players such as Temsa Global, Blue Bird Corporation, Proterra Inc and some others is anticipated to foster the market growth in this nation.

Europe is expected to grow with the highest CAGR during the forecast period. The rising trend of double-decker luxury buses in nations such as France, UK, Germany and some others has boosted the market growth. Additionally, rapid adoption of hybrid buses coupled with growing number of fleet operators is contributing to the industrial expansion. Furthermore, numerous government initiatives for strengthening the tourism sector has further bolstered the market growth in this region.

UK, Germany and France are the major contributors of this region. In UK, the market is generally driven by the rising demand for sleeper buses. In Germany, the rising investment by bus manufacturing brands for developing luxury buses is adding to the industrial expansion. In France, the rise in number of fleet operators has boosted the market growth.

In March 2024, Oskars LÅ«sis, the CEO of OsaBus made an announcement stating that, “Our investment in these new Setra and Volvo buses is a clear indicator of our commitment to providing the highest standards of travel experience to our clients, these buses are equipped with cutting-edge technology, luxurious interiors, and are designed to ensure the utmost safety and comfort for our passengers. We are excited to see how these new vehicles will enhance our service offerings in Bavaria and across Germany.”

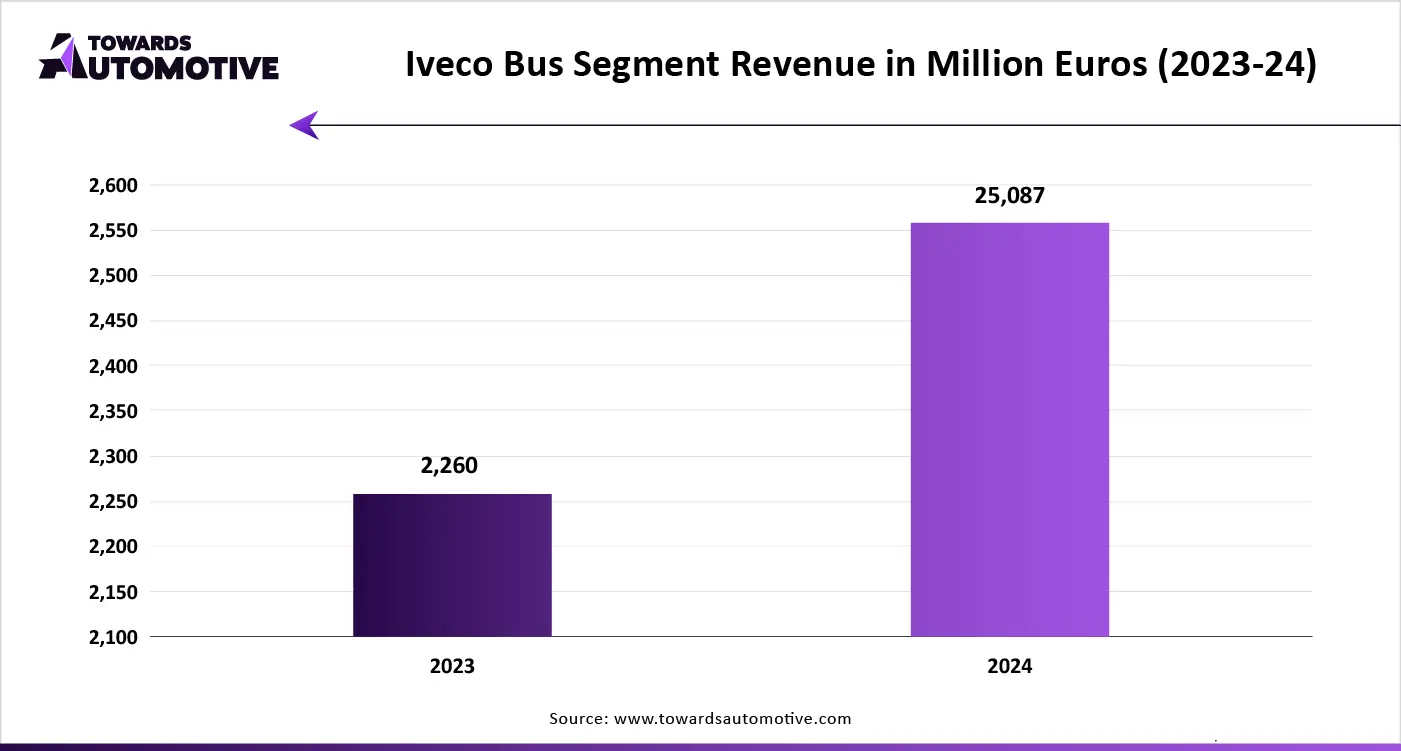

The luxury buses market is a fragmented industry with the presence of a few dominating players. Some of the prominent companies in this industry consists of Marcopolo, Setra, Van Hool, Scania, Volvo, Komatsu, MCI, Bluebird, Iveco, MAN, Gillig, and some others. These companies are constantly engaged in developing luxury buses and adopting numerous strategies such as collaborations, joint ventures, launches, partnerships, business expansion, acquisitions, and some others to maintain their dominant position in this industry. For instance, in December 2024, Iveco launched Crossway Low Entry Elec and the Crossway Normal Floor Mild Hybrid. These luxury buses are equipped with advanced features that provides comfortable journey to the consumers of Europe. Also, in July 2024, MAN launched Neoplan bus series. Neoplan is a series of luxury buses equipped with ADAS and advanced electronic components.

By Bus Type

By Application

By Fuel Type

By Seating Capacity

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us