March 2025

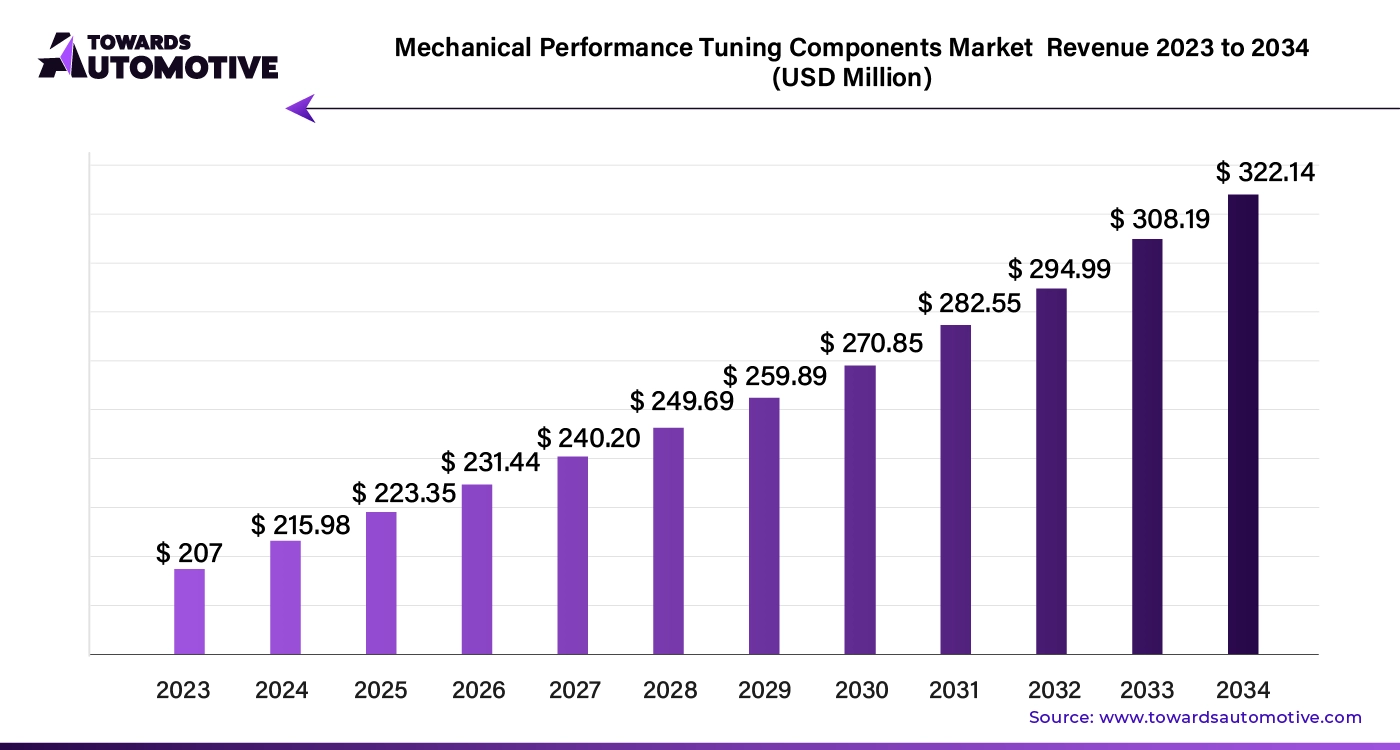

The global mechanical performance tuning components market size is calculated at USD 215.98 million in 2024 and is expected to be worth USD 322.14 million by 2034, expanding at a CAGR of 3.85% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

AI is revolutionizing the mechanical performance tuning components market by enhancing precision, efficiency, and customization. Through machine learning algorithms and real-time data analysis, AI enables more accurate tuning of mechanical components, such as engines, suspensions, and transmission systems. AI-driven systems can analyze vast amounts of data from vehicle sensors and performance metrics to optimize component settings, improving overall performance and fuel efficiency.

In addition to optimizing performance, AI facilitates predictive maintenance by identifying potential issues before they escalate. By monitoring component wear and analyzing operational data, AI can forecast failures and suggest timely interventions, reducing downtime and extending the lifespan of tuning components.

AI also supports customization by allowing for highly personalized tuning solutions based on individual driving styles and preferences. This level of customization enhances the driving experience and ensures that tuning components meet specific performance requirements. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Moreover, AI-driven simulations and modeling help manufacturers design and test tuning components more efficiently, accelerating development cycles and reducing costs. Overall, AI's role in the mechanical performance tuning components market is transformative, driving innovation, improving performance, and delivering tailored solutions to meet the evolving needs of automotive enthusiasts and manufacturers.

The mechanical performance tuning components market is a dynamic sector focused on enhancing and optimizing the performance of vehicles through specialized parts and modifications. This market encompasses a wide range of components designed to improve engine efficiency, suspension dynamics, braking performance, and overall vehicle handling. As automotive technology advances and consumer preferences shift towards personalized driving experiences, the demand for performance tuning components has surged. Enthusiasts and professional tuners alike seek out high-quality, aftermarket parts to upgrade their vehicles, aiming for enhanced speed, agility, and efficiency.

The market includes various components such as turbochargers, high-performance exhaust systems, adjustable suspensions, and precision-engineered engine parts, all of which contribute to achieving specific performance goals. Advances in technology have spurred innovation in this field, with new materials and design techniques leading to more effective and durable tuning solutions. Additionally, the integration of AI and data analytics into the tuning process allows for more precise adjustments and personalized performance enhancements, catering to individual driving styles and preferences.

Regulatory changes and the increasing focus on sustainability also impact the market, driving the development of components that meet stricter emissions and efficiency standards while still providing performance gains. As automotive enthusiasts and professionals continue to seek out ways to push the limits of vehicle performance, the mechanical performance tuning components market is set to grow, offering a range of solutions that enhance both driving pleasure and vehicle capabilities.

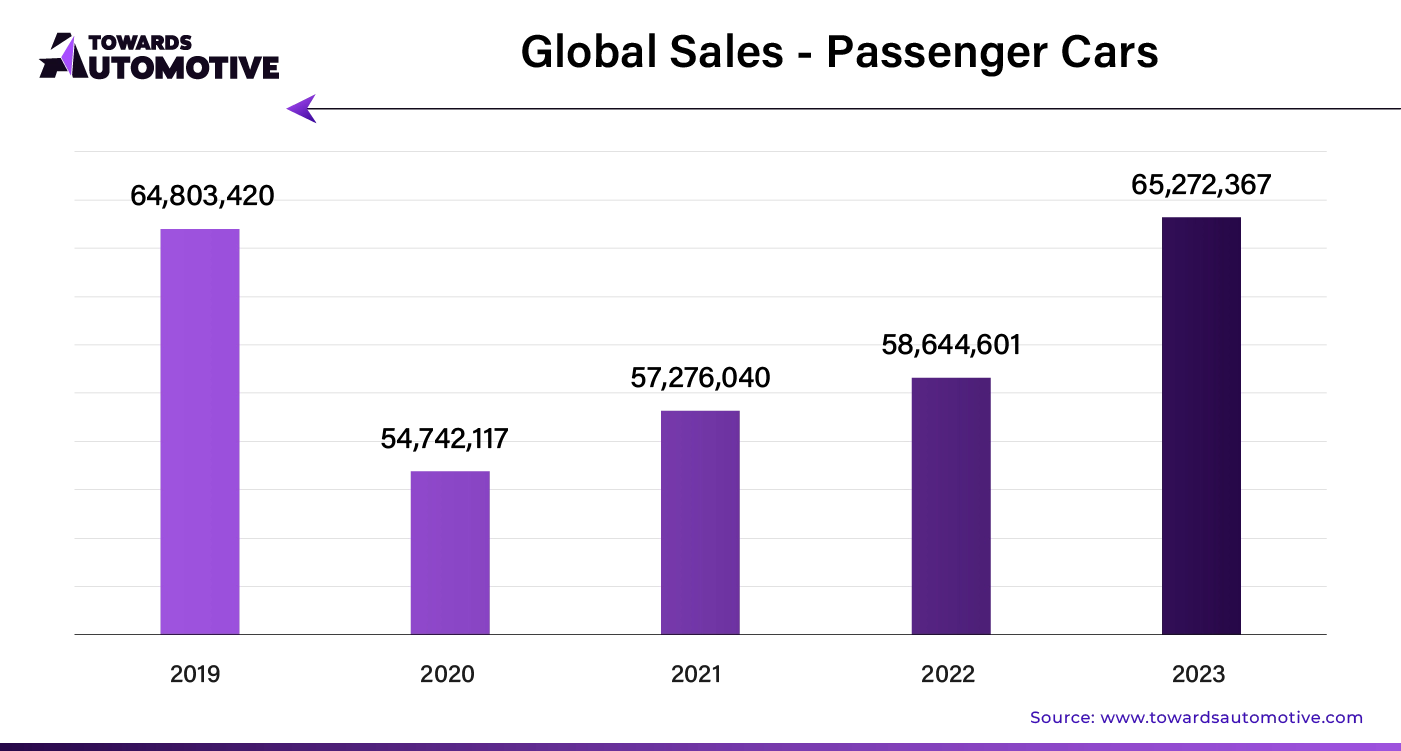

The rising sales of passenger vehicles are significantly driving the growth of the mechanical performance tuning components market. As the number of vehicles on the road increases, so does the demand for aftermarket enhancements that improve vehicle performance, comfort, and aesthetics. Car enthusiasts and drivers looking to customize their vehicles often turn to performance tuning components to achieve specific goals, such as increased horsepower, better handling, and enhanced driving dynamics.

This growing interest in personalized and high-performance vehicles has led to a surge in demand for a variety of tuning components, including high-performance exhaust systems, turbochargers, suspension upgrades, and advanced engine parts. Additionally, the trend towards upgrading new vehicles with aftermarket parts rather than waiting for factory-installed options fuels market growth.

The expansion of the automotive market, combined with advancements in technology and the increasing availability of sophisticated tuning components, has created a robust and competitive environment. Manufacturers are responding by developing innovative solutions that cater to the evolving preferences of drivers and the latest performance standards. As more consumers seek to enhance their driving experience, the mechanical performance tuning components market is poised for continued growth, driven by the rising sales and customization of passenger vehicles.

Regulatory compliance and cost are significant barriers to the growth of the mechanical performance tuning market. Stringent emissions and safety regulations restrict the types of modifications that can be legally performed, limiting the range of services and products available to consumers. Compliance with these regulations often requires expensive testing, certification, and adherence to specific guidelines, increasing operational costs for businesses. Additionally, the high cost of quality performance parts and specialized labor, coupled with increased long-term maintenance and insurance premiums, makes performance tuning a costly endeavor. These factors make the market less accessible to a broader audience, stifling innovation and limiting the market's overall growth potential.

Cloud-based tuning solutions are revolutionizing the mechanical performance tuning market by enabling remote, real-time optimization of vehicle performance. This technology allows tuners to update and customize Engine Control Unit (ECU) settings from anywhere, eliminating the need for physical shop visits. It opens up new opportunities for continuous performance enhancements, as updates can be pushed directly to the vehicle, ensuring it operates at peak efficiency under varying conditions. Additionally, cloud-based solutions facilitate data-driven tuning, allowing tuners to analyze performance metrics and refine settings more precisely, leading to more tailored and effective modifications for a broader range of vehicles. This in turn is expected to create opportunities for the market players in the future.

The braking and engine component segment is expected to grow with a CAGR of 4% during the forecast period. Braking and engine components play a pivotal role in driving the growth of the mechanical performance tuning market by addressing two of the most critical aspects of vehicle performance: power and control. Engine components, such as turbochargers, high-performance exhaust systems, and upgraded fuel injectors, are central to enhancing a vehicle's power output. These modifications allow for significant improvements in horsepower, torque, and overall engine efficiency, which are highly sought after by car enthusiasts and performance-oriented drivers. As consumers continue to demand more power and speed from their vehicles, the market for advanced engine components is expanding rapidly.

Equally important is the role of braking components in the performance tuning market. High-performance braking systems, including upgraded brake pads, rotors, and calipers, are essential for ensuring that vehicles can handle the increased power generated by engine modifications. These components provide better stopping power, heat dissipation, and durability, which are crucial for both safety and performance, especially in high-speed or competitive driving scenarios. The growing popularity of motorsports and track days has further fueled the demand for advanced braking systems, as drivers seek to optimize their vehicles for peak performance. Together, the continuous innovation and demand in both engine and braking components are key drivers of growth in the mechanical performance tuning market.

The authorized service stations segment is observed to grow with a CAGR of 4.3% during the forecast period. Authorized service stations are increasingly driving the growth of the mechanical performance tuning market by offering a blend of expertise, reliability, and manufacturer-backed assurance. Unlike independent tuners, authorized service stations have direct access to original equipment manufacturer (OEM) parts, advanced diagnostic tools, and the latest technical updates.

This ensures that performance tuning is carried out to the highest standards, with components that are specifically designed to work seamlessly with a vehicle’s existing systems. As vehicle technology becomes more complex, the expertise and specialized knowledge found at authorized service stations become even more valuable to consumers looking for reliable and effective performance enhancements.

Additionally, these service stations often offer warranty-backed modifications, providing peace of mind to customers who might otherwise be concerned about voiding their vehicle warranties with aftermarket parts. This official backing helps to alleviate concerns about potential legal or insurance issues, making performance tuning a more attractive option for a broader range of vehicle owners. Moreover, the reputation and trust associated with authorized service stations attract a more diverse customer base, including those who may be new to performance tuning. By ensuring that modifications are done correctly and safely, authorized service stations are playing a crucial role in expanding and legitimizing the mechanical performance tuning market.

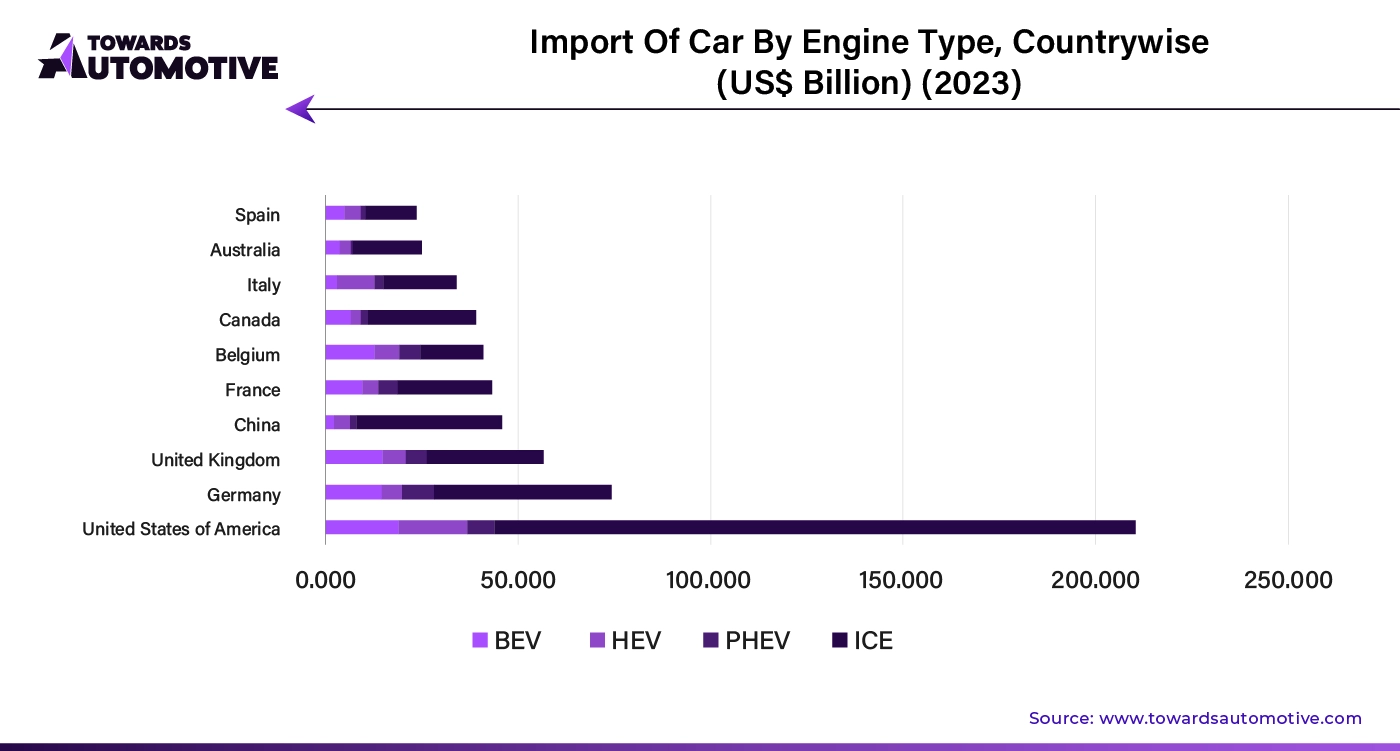

United States is expected to grow with a CAGR of 3.75% during the forecast period. The growth of the mechanical performance tuning market in the USA is driven by several key factors. A strong car culture, particularly around muscle cars and racing, fuels demand for high-performance modifications. Enthusiasts seek to enhance their vehicles’ power, speed, and handling, creating a robust market for tuning services and aftermarket parts. Technological advancements, such as the rise of ECU tuning and sophisticated diagnostic tools, make performance enhancements more accessible and effective. Additionally, the growing popularity of motorsports and car shows in the U.S. drives interest in vehicle customization. The presence of a well-established aftermarket industry, coupled with a large base of skilled professionals, further supports market growth. Moreover, the increasing availability of financing options for aftermarket modifications makes tuning more affordable for a wider audience. Together, these factors contribute to the strong and expanding mechanical performance tuning market in the United States.

China is likely to grow at a CAGR of 3.7% during the forecast period. The mechanical performance tuning market in China is experiencing significant growth due to several driving factors. Rapid economic development has led to a growing middle class with increasing disposable income, fueling the demand for luxury and high-performance vehicles. This, coupled with a rising car culture among younger generations, has created a strong market for vehicle customization and performance enhancements. The expansion of the automotive industry in China, now the largest in the world, provides a vast customer base for tuning services. Additionally, the Chinese government’s support for the automotive aftermarket, through favorable policies and initiatives, has encouraged the growth of the tuning market. The popularity of motorsports and automotive events in China is also on the rise, further boosting interest in performance tuning. As Chinese consumers become more interested in personalizing their vehicles, the mechanical performance tuning market is poised for continued expansion.

Japan is likely to grow at a CAGR of 3.77% during the forecast period. The growth of the mechanical performance tuning market in Japan is driven by a deep-rooted car culture and a passion for automotive innovation. Japan’s strong motorsports heritage, exemplified by events like Super GT and Formula Drift, fuels demand for high-performance vehicle modifications. The popularity of street racing and car customization, particularly in the tuner and JDM (Japanese Domestic Market) scenes, further drives interest in performance tuning. Japan's automotive industry, known for producing iconic performance cars like the Nissan GT-R and Toyota Supra, provides a robust foundation for aftermarket tuning. Additionally, the high level of technical expertise and craftsmanship in Japan allows for the development of advanced tuning solutions, appealing to enthusiasts who seek precision and reliability. The presence of well-established tuning brands and a culture that values quality and innovation also contribute to market growth. As Japanese consumers continue to value both performance and personalization, the mechanical performance tuning market is set for sustained expansion.

South Korea is projected to grow with a CAGR of 3.34% during the forecast period. The mechanical performance tuning market in South Korea is driven by a vibrant automotive culture and a growing enthusiasm for vehicle customization. South Korea's dynamic car scene, bolstered by popular motorsports events and a strong presence of car clubs, stimulates demand for performance enhancements. The increasing disposable income among South Korean consumers allows for greater investment in high-performance parts and tuning services. Additionally, the proliferation of advanced automotive technology and the presence of local tuning brands and workshops contribute to the market's growth. South Korea's automotive industry, known for producing innovative vehicles, provides a fertile ground for aftermarket modifications. The country’s youth-driven car culture and the rising trend of personalizing vehicles further fuel interest in performance tuning. As South Korean consumers continue to embrace automotive performance and customization, the mechanical performance tuning market is poised to experience significant expansion.

By Product

By Distribution Channel

By Vehicle Type

By Region

March 2025

March 2025

August 2024

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us