April 2025

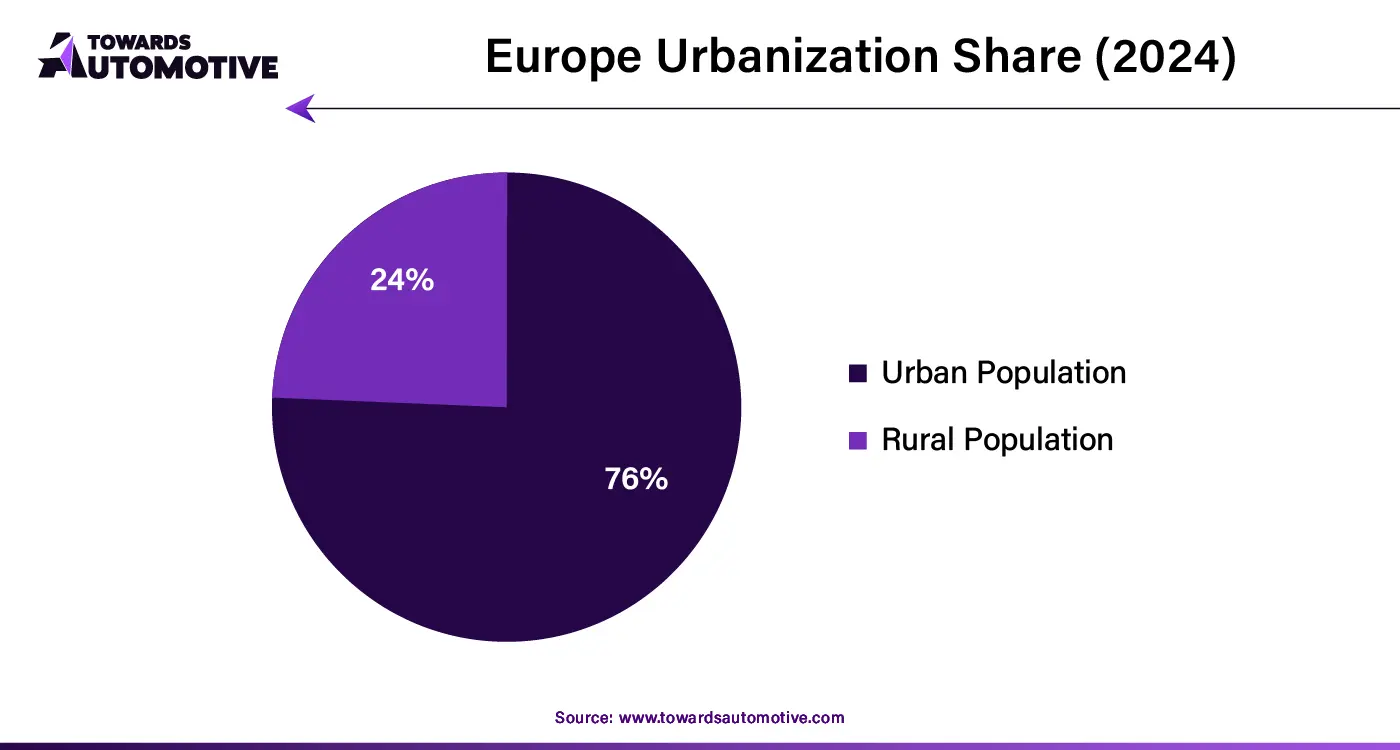

The moto taxi service market is poised for significant growth from 2024 to 2034, driven by increasing urban congestion, rising demand for affordable and convenient transportation, and the expansion of app-based ride-hailing services in emerging economies.

The moto taxi service market is a prominent sector of the automotive services industry. This industry deals in providing motorcycle-based taxi services for consumers around the world. These services are provided by several providers consisting of motorbike drivers, ride-hailing companies, motorbike taxi operators and others. There are various types of services provided by this sector including on-demand services, pre-booked services, subscription-based services and others. It finds applications in commuting, delivery and tourism. The rapid urbanization in different parts of the world coupled with rising traffic congestions has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the ride-sharing industry around the globe.

Unlock Infinite Advantages: Subscribe to Annual Membership

In September 2024,” Thomas Dubaele, the owner of LA Taximoto made an announcement stating,” We're thrilled to launch LA Taximoto and bring a faster, more exciting way to navigate LA. Our passion is helping people reclaim their time, beat the traffic, and enjoy a truly unique experience."

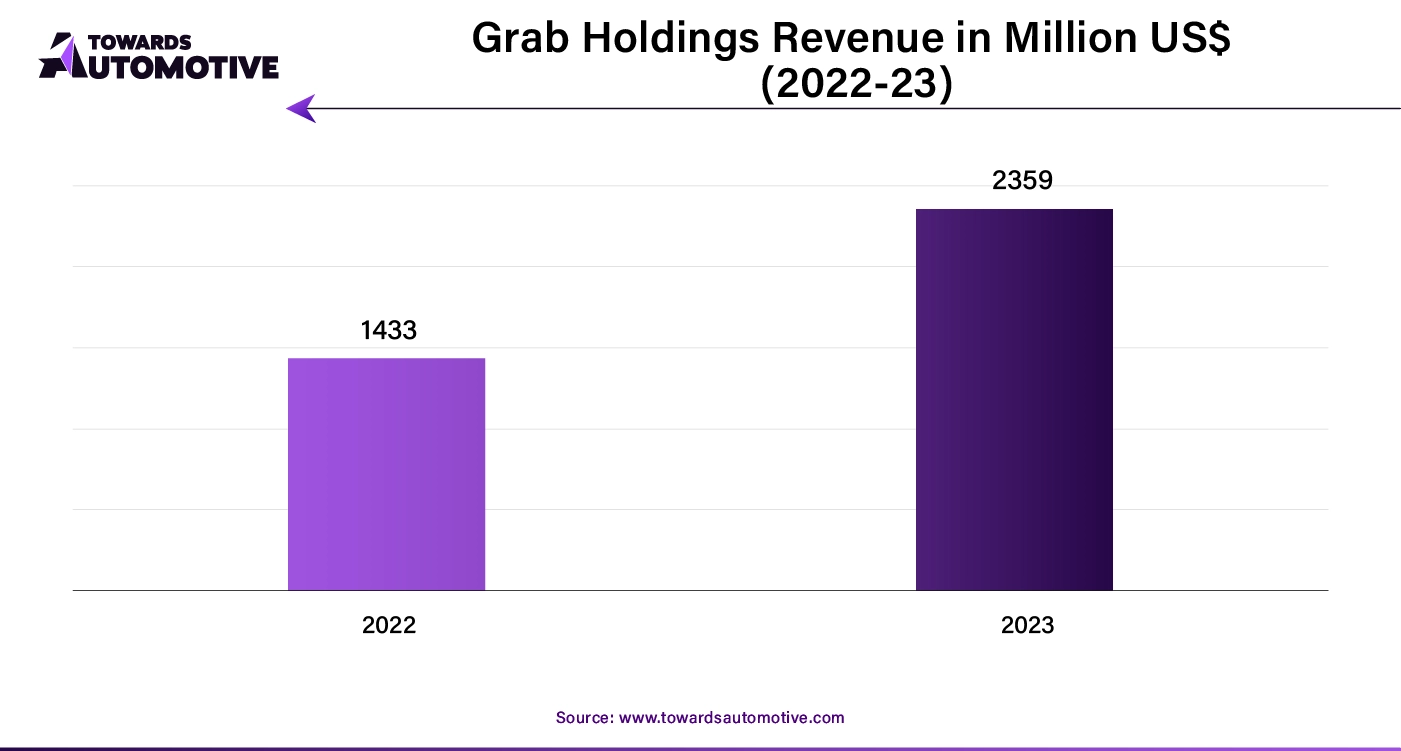

The moto taxi service market is a highly competitive industry with the presence of several dominating players. Some of the prominent market players in this industry consists of Rapido, GOJEK, Pathao Ltd., Uber Technologies Inc., Wunder Mobility, ANI Technologies Pvt. Ltd., Bolt Technology OU, SafeBoda, Grab and some others. These market players are constantly engaged in providing superior moto taxi services for maintaining their dominance in this industry.

By Type

By Application Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us