April 2025

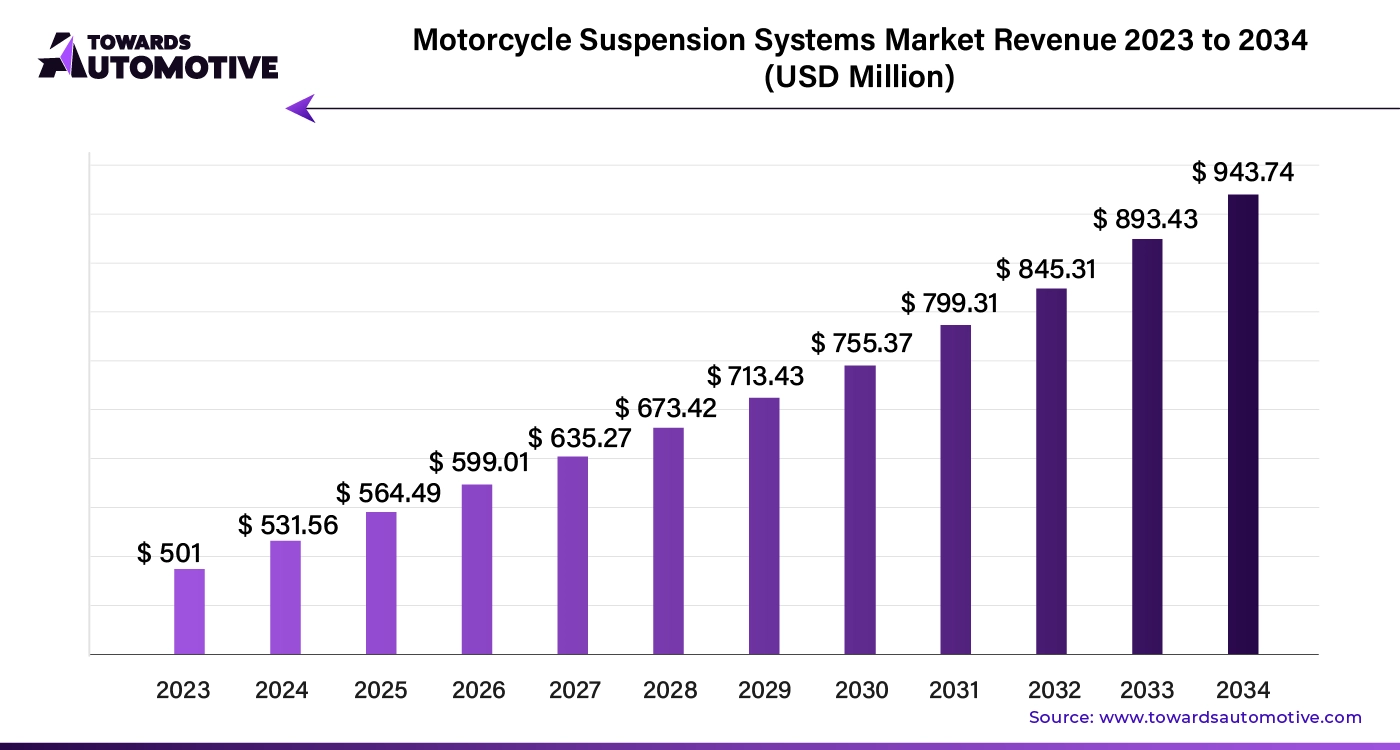

The global motorcycle suspension systems market size is calculated at USD 501 million in 2023 and is expected to be worth USD 943.74 million by 2033, expanding at a CAGR of 6.1% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The motorcycle suspension systems market is an important segment of the automotive industry that plays a vital role in enhancing rider safety, comfort, and overall performance. Suspension systems, which include components such as forks, shocks, and springs, are designed to absorb the impact of uneven terrain, maintain stability, and ensure a smooth ride. As motorcycles become more sophisticated, the demand for advanced suspension technologies has surged, driven by the need for improved handling, customization, and adaptability to various riding conditions.

In recent years, the market has seen significant innovation, with the introduction of electronically controlled suspension systems, AI-driven adjustments, and smart sensors that allow for real-time optimization of suspension settings. These advancements are not only enhancing the riding experience but are also contributing to the growing trend of premium motorcycles that prioritize cutting-edge technology.

Additionally, the increasing popularity of adventure and touring motorcycles, which require robust and versatile suspension systems, is further propelling market growth. As riders seek more personalized and responsive handling, manufacturers are investing in research and development to deliver suspension systems that meet these evolving demands, making the motorcycle suspension systems market a dynamic and rapidly evolving industry. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

AI is revolutionizing the motorcycle suspension systems market by enabling smarter, more adaptive, and highly personalized riding experiences. Traditional suspension systems, which rely on fixed settings or manual adjustments, are increasingly being replaced by AI-powered systems that can dynamically adapt to changing road conditions, rider preferences, and motorcycle performance. These advanced systems use a combination of sensors, machine learning algorithms, and real-time data processing to continuously monitor variables such as speed, terrain, rider weight, and lean angle.

With AI, motorcycle suspension systems can automatically adjust damping, compression, and rebound rates to optimize ride comfort and handling. For instance, AI can detect when a motorcycle is about to encounter a bump or uneven surface and pre-adjust the suspension settings to absorb the impact more effectively, improving both safety and rider comfort. Additionally, AI allows for the creation of predictive maintenance features, where the system can alert riders to potential issues before they become critical, thereby reducing the likelihood of breakdowns and extending the lifespan of the suspension components.

Moreover, AI facilitates the development of fully customizable suspension profiles, where riders can choose or create settings that match their specific riding style or preferences. This level of personalization, coupled with the ability to learn and adapt over time, is driving significant interest in AI-integrated suspension systems. As a result, the motorcycle suspension systems market is experiencing rapid innovation and growth, with AI playing a central role in shaping the future of motorcycle design and performance optimization.

Increasing Demand for Super Bikes

The increasing demand for superbikes is a significant driver of growth in the motorcycle suspension systems market, as these high-performance machines require advanced and specialized suspension systems to meet the rigorous demands of speed, agility, and precision handling. Superbikes, known for their powerful engines, lightweight construction, and superior performance, are designed for both track racing and high-speed road riding, where stability, control, and rider safety are paramount. To achieve the optimal balance between performance and comfort, superbikes are equipped with sophisticated suspension systems that can handle extreme conditions, such as high-speed cornering, rapid acceleration, and sudden braking.

As the popularity of superbikes grows among enthusiasts and professional riders, there is a corresponding increase in the demand for suspension systems that can deliver top-tier performance. Manufacturers are responding by developing innovative suspension technologies, such as electronically controlled suspension (ECS) systems that automatically adjust damping based on real-time data, providing riders with a tailored experience that enhances both safety and comfort. These systems use advanced sensors and algorithms to continuously monitor variables like speed, road conditions, and rider inputs, making instant adjustments to maintain optimal suspension settings.

Furthermore, the trend toward customization in the superbike segment is also fueling demand for premium suspension systems that allow riders to fine-tune their bike's handling characteristics to their personal preferences. This emphasis on performance and personalization is driving significant investment in research and development, leading to continuous advancements in suspension technology and contributing to the robust growth of the motorcycle suspension systems market.

Damping Issues and Leakage Problems

The motorcycle suspension systems market encounters several problems daily. Inadequate damping and leakage in forks or shocks are common issues in motorcycle suspension systems that can significantly impair performance. Poor damping leads to an unstable and uncomfortable ride, while oil leakage from worn seals reduces the effectiveness of the suspension, compromising handling and safety. Both of these factors restrain the market growth.

Development of ECS Systems

Electronically Controlled Suspension (ECS) is creating significant opportunities in the motorcycle suspension market by offering unprecedented levels of performance, customization, and adaptability. ECS systems utilize advanced sensors and microprocessors to monitor real-time data such as speed, terrain, and rider behavior, automatically adjusting the suspension settings for optimal performance. This technology enhances the riding experience by providing superior comfort, improved handling, and increased safety, particularly in changing road conditions. As a result, ECS appeals to a broad spectrum of riders, from casual enthusiasts to professional racers, who demand precise control and responsiveness from their motorcycles.

The growing popularity of ECS is driving innovation and competition within the market, encouraging manufacturers to develop more sophisticated systems that cater to different riding styles and environments. Additionally, the integration of ECS with other smart technologies, such as connectivity features that allow riders to adjust suspension settings via smartphone apps or onboard controls, is further expanding the market’s potential. As motorcycles become more advanced and riders seek higher levels of performance and customization, the demand for ECS-equipped motorcycles is expected to rise. This trend opens up new avenues for manufacturers, not only in producing ECS systems but also in offering aftermarket upgrades and maintenance services, thereby creating opportunities in the motorcycle suspension market.

The mono shock rear suspension segment held the largest share of the market with 61%. Mono shock rear suspension is significantly driving the motorcycle suspension systems market by offering enhanced performance, simplicity, and advanced design. Unlike traditional dual shock setups, the mono shock system uses a single, centrally positioned shock absorber, which provides superior damping and handling by better managing weight distribution and improving rear wheel control. This design reduces unsprung weight, leading to improved ride comfort and stability. Its growing popularity in both high-performance and off-road motorcycles highlights its advantages, such as better adjustability and reduced maintenance. As manufacturers and riders increasingly recognize these benefits, the demand for mono shock rear suspension continues to boost the market.

The aftermarket segment dominated the market with a share of 70%. The aftermarket segment is a key driver of the motorcycle suspension systems market, fueled by the desire of riders to customize and enhance their motorcycles. Aftermarket suspension components allow riders to upgrade their bike’s performance, comfort, and aesthetics beyond factory settings. Enthusiasts and competitive riders often seek high-performance, adjustable, or specialized suspension systems to match their specific riding styles and conditions. This demand for personalization and optimization leads to a vibrant aftermarket industry, with numerous options for advanced and custom suspension solutions. As riders increasingly invest in performance improvements and unique modifications, the aftermarket segment continues to drive significant growth in the motorcycle suspension systems market.

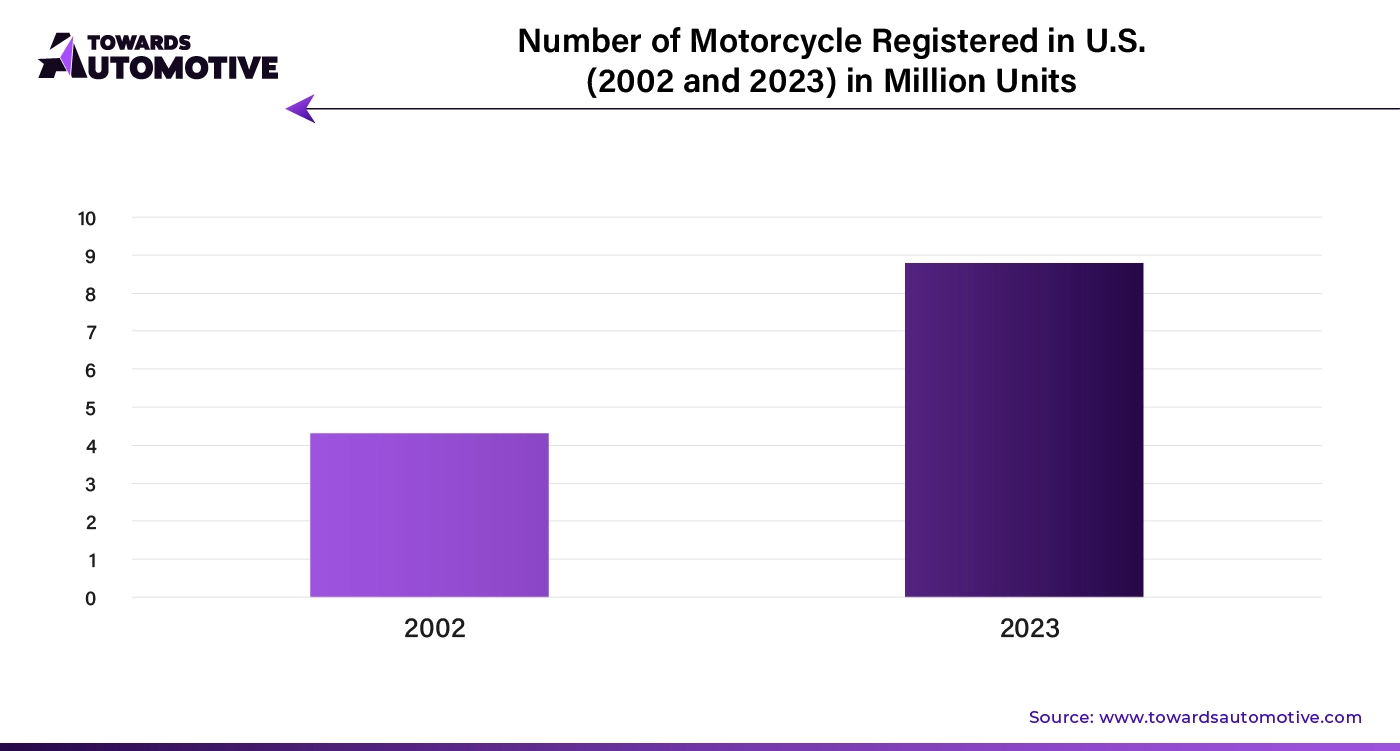

North America dominated the market with a share of 44% in 2022. The motorcycle suspension market in North America is driven by several key factors that reflect the region's diverse and dynamic motorcycling culture. One of the primary drivers is the increasing demand for high-performance motorcycles, particularly in the sportbike and cruiser segments, where riders seek superior handling, comfort, and safety. North American riders often prioritize motorcycles with advanced suspension systems that can provide a smooth ride on both highways and varied terrains, leading manufacturers to develop innovative suspension solutions tailored to these needs. This demand is further amplified by the region's strong interest in customization, with many riders opting for aftermarket suspension upgrades that enhance their motorcycle’s performance and personalization.

Another significant driver is the growing popularity of adventure and touring motorcycles, which require robust and adaptable suspension systems capable of handling long-distance travel and off-road conditions. As more riders in North America embrace adventure touring, there is a rising demand for suspension systems that offer greater adjustability and durability, fueling market growth. Additionally, the increasing awareness of rider safety is pushing the adoption of advanced suspension technologies, such as electronically controlled suspension (ECS) systems, which automatically adjust to changing road conditions, enhancing stability and control.

The shift towards electric motorcycles is also contributing to market expansion. Electric bikes often require specialized suspension systems to accommodate their unique weight distribution and performance characteristics. As North America continues to embrace electric vehicles, the demand for tailored suspension solutions is expected to grow. Furthermore, the region’s strong aftermarket industry and the availability of premium suspension components are boosting sales, as riders look to upgrade their bikes with the latest technologies. Collectively, these factors create a robust and expanding market for motorcycle suspension systems in North America, driven by a combination of innovation, rider preferences, and evolving vehicle technologies.

Europe held the second largest share of the market with 41% in 2022. The motorcycle suspension market in Europe is driven by a combination of technological advancements, stringent regulatory standards, and evolving consumer preferences. European riders, known for their discerning tastes and emphasis on high performance, are increasingly demanding motorcycles equipped with advanced suspension systems that offer superior handling, comfort, and safety. The region's commitment to innovation has spurred the development of cutting-edge technologies, such as electronically controlled suspension (ECS) systems, which automatically adjust to road conditions, providing an optimal riding experience.

Additionally, Europe’s strict safety and environmental regulations have pushed manufacturers to focus on lightweight and efficient suspension components that enhance fuel efficiency while maintaining performance. The growing popularity of electric and hybrid motorcycles in Europe further drives the demand for specialized suspension systems that cater to the unique requirements of these vehicles, such as managing the distinct weight distribution and torque characteristics of electric powertrains.

Moreover, the rise of adventure and touring motorcycles in Europe, favored for long-distance travel and diverse terrains, has increased the need for versatile and durable suspension systems. As European riders increasingly seek customizable and high-quality suspension solutions, the market is experiencing steady growth, fueled by these technological and consumer-driven factors.

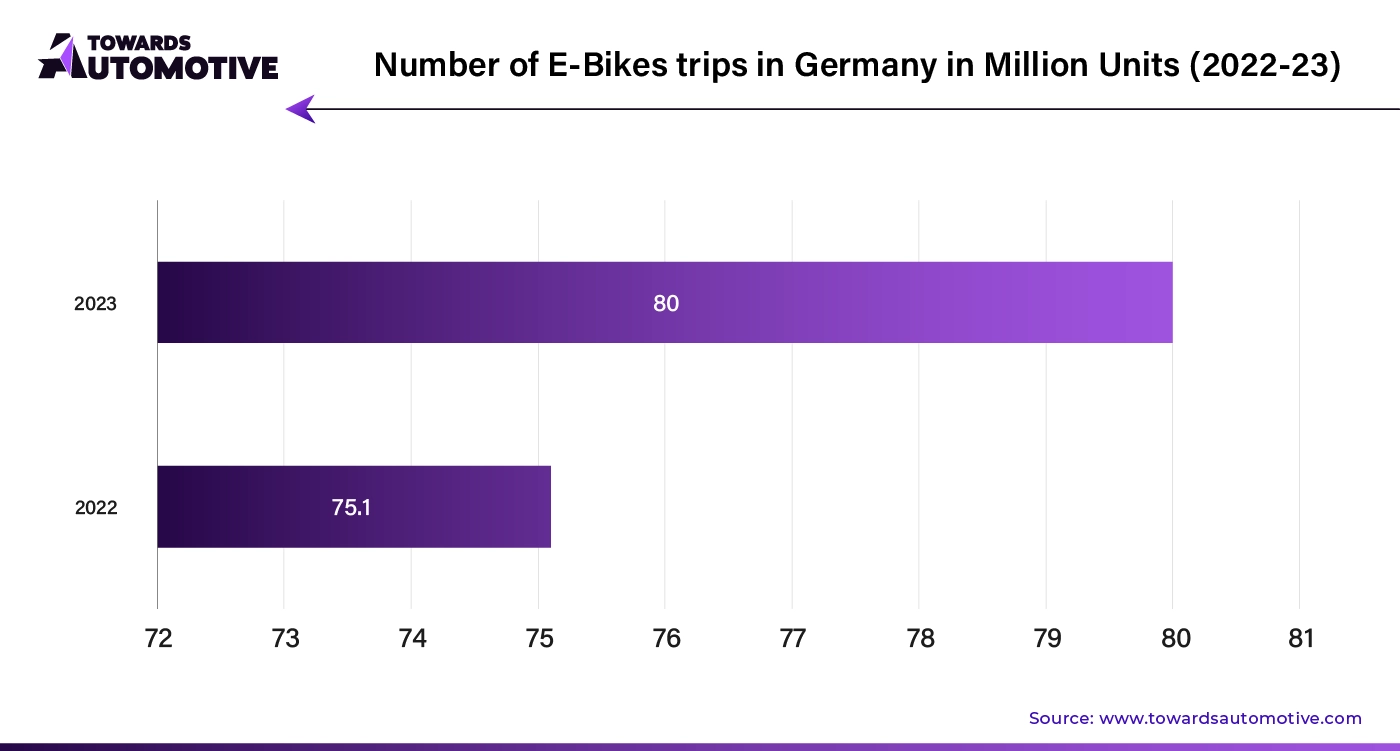

Germany is predicted to grow at a CAGR of 5.7% during the forecast period. The motorcycle suspension market in Germany is driven by the country’s strong engineering heritage, high demand for premium motorcycles, and a focus on performance and safety. German riders often prioritize precision and advanced technology, leading to a growing demand for motorcycles equipped with sophisticated suspension systems that offer superior handling and comfort. The popularity of high-performance motorcycles, particularly in the sport and touring segments, has fueled the need for cutting-edge suspension technologies, such as electronically controlled suspension (ECS) systems that adjust to varying road conditions.

Germany’s stringent safety and environmental regulations also play a crucial role, pushing manufacturers to develop lightweight and efficient suspension components that enhance both performance and fuel efficiency. Additionally, the increasing interest in electric motorcycles in Germany is driving demand for specialized suspension systems tailored to the unique characteristics of electric powertrains. These factors collectively contribute to the robust growth of the motorcycle suspension market in Germany.

In Asia Pacific, China is expected to grow at a CAGR of 7.95% during the forecast period. The motorcycle suspension market in China is experiencing robust growth driven by several key factors. The increasing popularity of motorcycles as a primary mode of transportation in urban and rural areas has heightened the demand for advanced suspension systems that enhance ride comfort and handling. Additionally, China’s expanding middle class and rising disposable incomes are fueling the growth of the premium motorcycle segment, where sophisticated suspension technologies, such as electronically controlled suspension (ECS), are becoming more desirable.

Government initiatives to promote the development of electric vehicles are also influencing the market, as electric motorcycles require specialized suspension systems to address their unique weight distribution and performance needs. Furthermore, China’s focus on improving road infrastructure and increasing consumer awareness of motorcycle safety are driving demand for high-quality, durable suspension components. These factors collectively contribute to the dynamic expansion of the motorcycle suspension market in China.

By Product Type

By Technology

By Motorcycle Type

By Sales Channel

By Region

April 2025

April 2025

February 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us