April 2025

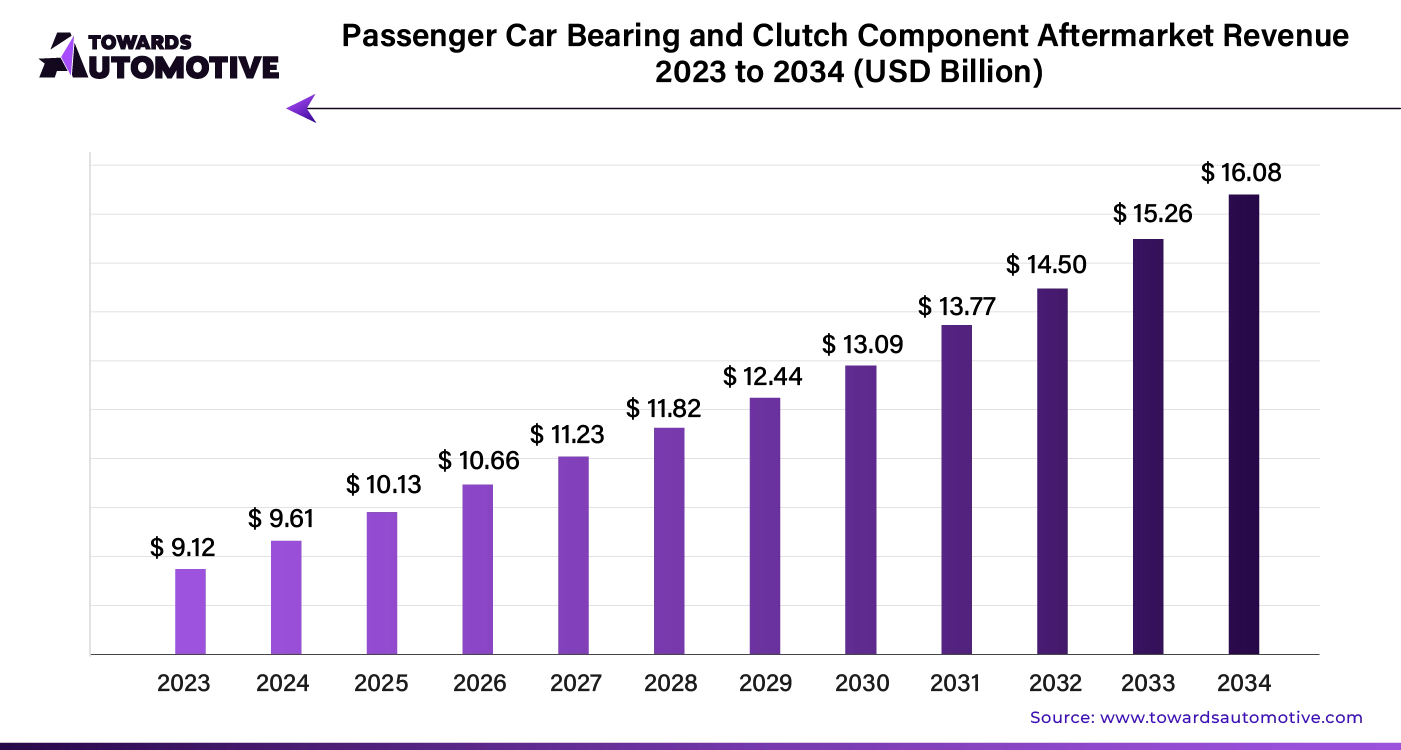

The global passenger car bearing & clutch component aftermarket size is calculated at USD 9.61 billion in 2024 and is expected to be worth USD 16.08 billion by 2034, expanding at a CAGR of 5.26% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The global aftermarket for passenger car bearings and clutch components is set to grow steadily. This expansion is driven by the increasing demand for essential drivetrain parts. Consumers and automotive service providers often opt for aftermarket parts for maintenance, repairs, or upgrades instead of purchasing from original equipment manufacturers (OEMs). These aftermarket parts are usually more affordable and offer high quality and compatibility with various vehicle makes and models.

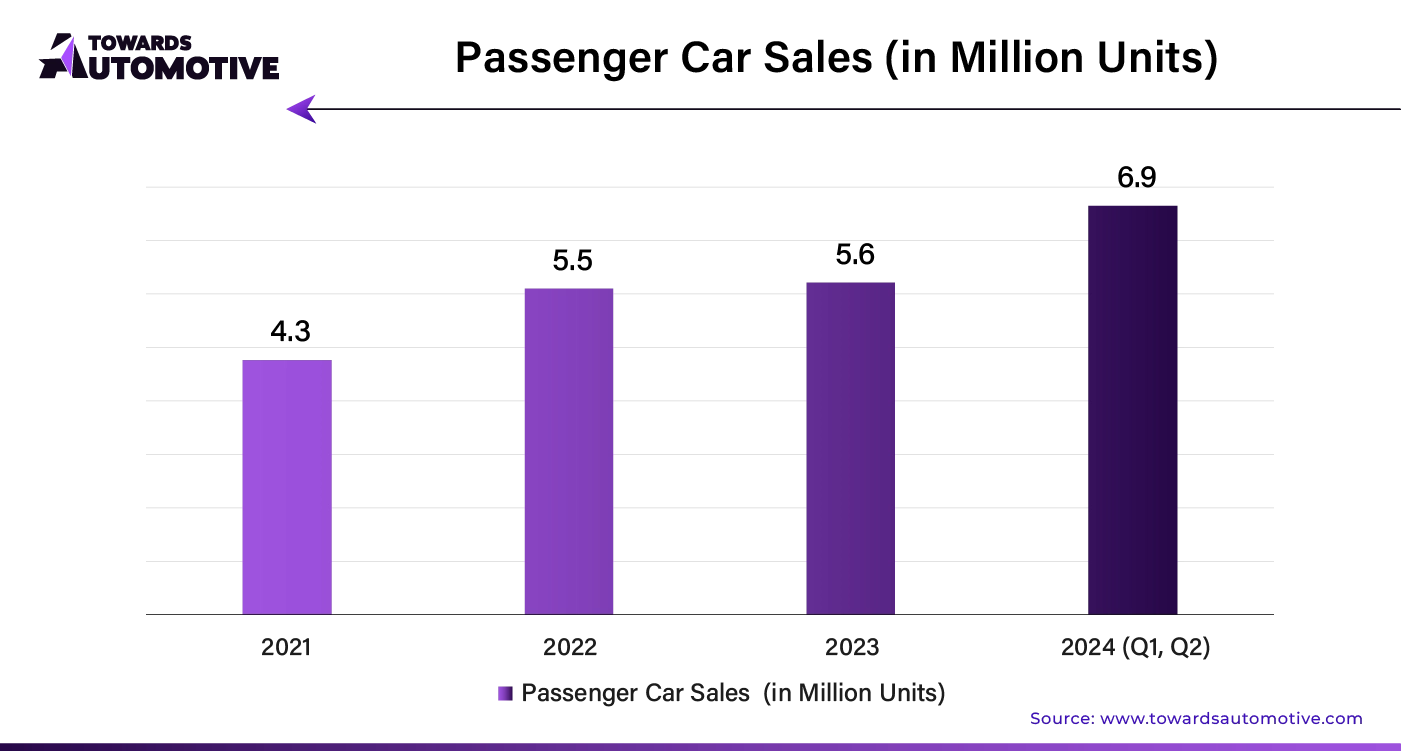

Key factors fueling this growth include the rising number of vehicles on the road and the aging global car fleet. As car ownership increases due to economic growth and population rise, the need for replacement parts such as clutches and bearings grows. Older cars, which require more frequent part replacements, contribute significantly to the demand for aftermarket components.

Industry leaders like AB SKF, Schaeffler AG, The Timken Company, JTEKT Corporation, NTN Corporation, and ZF Friedrichshafen AG are at the forefront of innovation in this sector. They develop advanced, reliable components to meet the needs of an expanding automotive market. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

A notable trend is the rising demand for customized components, especially for off-road enthusiasts. Off-road driving requires specialized bearings and clutches that can handle rugged conditions. Manufacturers are responding by offering heavy-duty wheel bearings, rugged clutch kits, and custom transmission bearings designed for extreme environments.

Additionally, the implementation of stricter regulations is pushing the development of cleaner, more fuel-efficient engines, which will likely boost the aftermarket for bearings and clutch components. The shift towards electrically assisted manual transmissions also presents growth opportunities for aftermarket companies.

With the increase in global vehicle ownership, the demand for replacement parts and maintenance services, particularly for bearings and clutch components, is rising. Consumers are seeking cost-effective aftermarket options for vehicle repairs and upgrades.

North America is projected to maintain its position as the largest market for aftermarket passenger car components, accounting for about 31% of the global market share by 2034. Several factors contribute to this leading position

These factors solidify North America's position as the key market for aftermarket passenger car components.

Clutch kit components are crucial to a vehicle's drivetrain, directly impacting performance and functionality. Their importance is underscored by the constant demand from vehicle owners and repair service providers. Manual transmissions, common in passenger cars, depend on reliable clutch systems, making regular replacement and upgrades essential.

The surge in performance-oriented driving and aftermarket customization further fuels demand for advanced clutch kits. Drivers seeking enhanced vehicle responsiveness and durability often choose aftermarket components to achieve superior performance.

The passenger car bearing and clutch component aftermarket is set for growth due to several key factors:

These factors collectively suggest a robust future for the passenger car bearing and clutch component aftermarket.

Vehicle customization is on the rise, driving demand for unique bearing and clutch components.

Rising Vehicle Ownership and Aging Fleet

The passenger vehicle bearing and clutch component aftermarket is significantly driven by increasing global vehicle ownership and an aging vehicle fleet. As population growth and economic development boost vehicle ownership, the demand for replacement parts like bearings and clutches rises.

Longer vehicle retention leads to a greater need for parts such as wheel bearings and clutch kits. Additionally, an aging fleet necessitates more maintenance and replacements, highlighting the aftermarket's crucial role in extending vehicle life. Stakeholders must anticipate and address the growing needs of both new and existing vehicle owners as the vehicle base expands and ages.

Consumer Preferences and Customization

Consumer preferences and customization are key factors shaping the aftermarket for bearing and clutch components. Today’s drivers seek personalized vehicle features, moving beyond standard options to those that match their specific needs and styles.

As consumers look for unique performance and aesthetic upgrades, demand for specialized bearings and clutches grows. Providers that offer a variety of customizable components can capitalize on this trend, meeting the desires of those who want to differentiate their vehicles.

Staying ahead of evolving preferences and offering tailored solutions will help companies succeed in this competitive market.

Increased Maintenance and Repair Awareness

Awareness about the importance of regular vehicle maintenance is driving growth in the bearing and clutch component aftermarket. As vehicle owners become more proactive about maintaining their cars, the demand for replacement parts rises.

This awareness promotes a culture of responsible vehicle ownership, leading to increased sales of aftermarket components. Consumers are now more likely to engage in preventive maintenance, further boosting the demand for bearings and clutches. The growing emphasis on vehicle upkeep highlights the critical role of aftermarket components in ensuring safety and longevity.

Counterfeit and Low-Quality Products

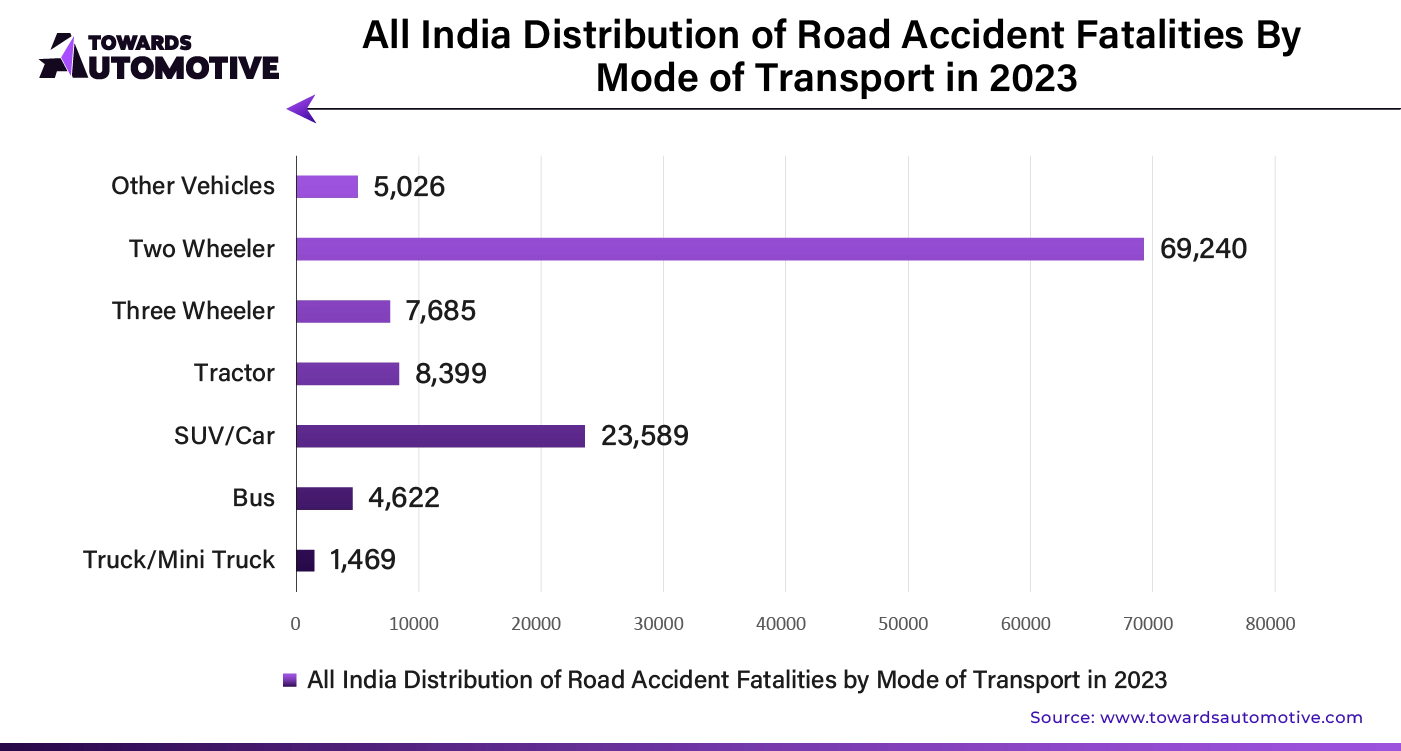

A major challenge in the passenger vehicle bearing and clutch component aftermarket is the proliferation of counterfeit and low-quality parts. These substandard components undermine vehicle safety and performance, eroding consumer trust in the aftermarket industry. Counterfeit products often fail to meet industry standards, leading to reliability and durability issues. To address this, industry stakeholders and regulatory bodies must collaborate to enforce quality standards and develop methods to detect and prevent counterfeit components.

Increasing Vehicle Complexity

Modern vehicles' growing complexity poses a significant challenge for the aftermarket. As vehicles integrate advanced electronics and intricate drivetrain systems, producing compatible bearings and clutch components becomes more complex and costly. This complexity can lead to higher production costs and potential issues with compatibility, making aftermarket parts less competitive. Ensuring these components meet specific vehicle requirements demands ongoing research and development efforts.

AI is revolutionizing the passenger car bearing and clutch component market by boosting efficiency and innovation. Intelligent algorithms can predict component failures before they occur, drastically reducing downtime and maintenance costs. By analyzing vast amounts of data from vehicle sensors, AI enables manufacturers to design more durable and reliable bearings and clutches, tailored to specific driving conditions and usage patterns.

AI-driven automation streamlines production processes, increasing accuracy and reducing labor costs. Advanced robotics, guided by AI, enhance assembly precision and speed. This technology also optimizes supply chain management by forecasting demand and managing inventory more effectively. Additionally, AI-powered simulations allow for rapid prototyping and testing, accelerating product development cycles.

Consumer preferences and market trends are better understood through AI's data analytics capabilities, leading to more targeted product offerings and marketing strategies. AI tools help identify emerging market opportunities and potential threats, allowing companies to adapt swiftly.

Overall, AI integration is set to drive significant growth in the passenger car bearing and clutch component market, fostering innovation, efficiency, and responsiveness to market demands.

In the passenger car bearing and clutch component market, the supply chain operates through a well-coordinated process involving several key steps. Manufacturers source raw materials from trusted suppliers, ensuring high-quality components for production. The production phase involves creating bearings and clutches that meet stringent automotive standards. Once manufactured, these components undergo rigorous testing to ensure reliability and performance.

After testing, the finished products are distributed to automotive OEMs (Original Equipment Manufacturers) and aftermarket suppliers. The logistics network plays a crucial role here, involving transportation and warehousing to maintain an uninterrupted supply of components. Effective inventory management helps balance supply and demand, preventing shortages or overstock situations.

The supply chain also includes collaboration with suppliers to forecast demand accurately and manage production schedules. Real-time data and technology aid in tracking shipments and optimizing routes, reducing delays and improving efficiency. Feedback from OEMs and end-users informs continuous improvement, ensuring that the components remain competitive and meet evolving market needs.

Overall, a streamlined supply chain in this market ensures timely delivery of high-quality components, contributing to the smooth operation of passenger vehicles.

The Passenger Car Bearing & Clutch Component market is driven by several key components and industry leaders. Bearings and clutches are essential for smooth vehicle operation, offering reliability and performance. Major companies like NSK Ltd., NTN Corporation, and SKF Group specialize in high-quality bearings that reduce friction and wear in car engines and wheels. Their advanced technologies enhance vehicle safety and efficiency.

Clutch components, provided by companies such as Valeo S.A., ZF Friedrichshafen AG, and BorgWarner Inc., ensure effective power transmission from the engine to the wheels. These firms develop and produce clutches that withstand high temperatures and pressures, contributing to better vehicle handling and longevity.

Additionally, suppliers like Schaeffler AG and LuK offer comprehensive solutions, including both bearings and clutch systems, integrating their expertise to deliver high-performance components. Their innovations support the growing demand for efficient, durable, and cost-effective vehicle parts.

Overall, these companies play a critical role in shaping the market, driving advancements, and meeting the evolving needs of the automotive industry.

The table below outlines the projected revenues for passenger car bearing and clutch components in key countries by 2034:

| Country | Revenue (USD Million) | CAGR (%) |

| United States | $3,320.0 million | 4.2% |

| China | $1,710.0 million | 5.1% |

| India | $1,015.0 million | 6.5% |

| Germany | $740.0 million | -- |

| Japan | $570.0 million | 4.6% |

United States: Aging Fleet Boosts Demand

The United States passenger car bearing and clutch component aftermarket is projected to reach $3,320.0 million by 2034, with a CAGR of 4.2%. The increase in demand is attributed to an aging vehicle fleet and a strong DIY culture. Advances in automotive technology have enhanced the performance and longevity of aftermarket components. The growth in automotive clutch repair parts further supports this expansion.

China: Rapid Growth in Automotive Sector

China's aftermarket for passenger car bearings and clutch components is expected to grow at a CAGR of 5.1%, reaching $1,710.0 million by 2034. The country's thriving automotive industry and rising middle class drive demand. Government initiatives supporting innovation and increased vehicle maintenance awareness contribute to this growth. The expanding transmission parts aftermarket also presents opportunities.

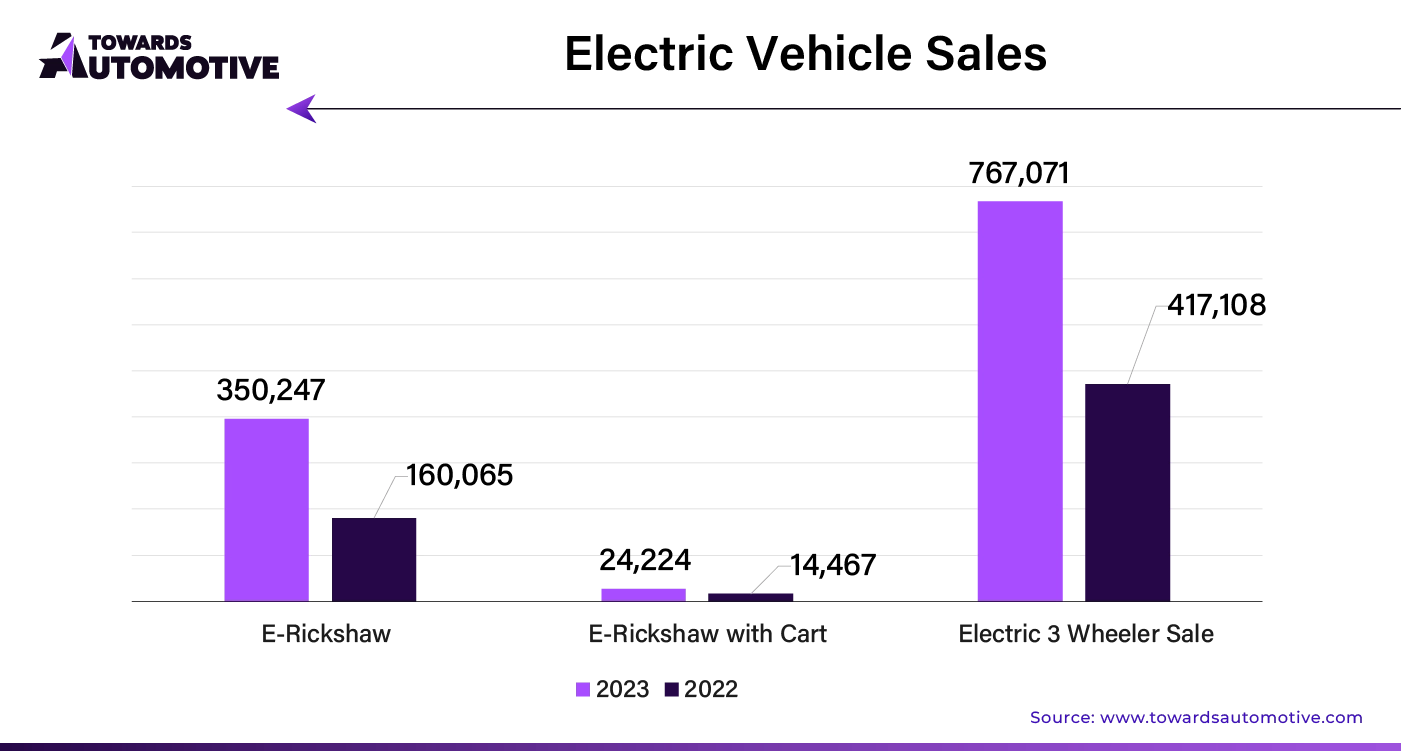

India: Surge in Vehicle Ownership and Manufacturing

India's passenger car bearing and clutch component aftermarket is anticipated to grow at a robust 6.5% CAGR, reaching $1,015.0 million by 2034. The rapid growth of the automotive sector and increased vehicle ownership are significant drivers. India’s advancements in manufacturing and heightened consumer awareness about aftermarket solutions further fuel demand. The expanding market for car clutch system repair parts also offers growth potential.

Sedans are favored for their comfort, affordability, and practicality, leading to higher replacement rates for bearings and clutch components. Their extensive use in both personal and commercial settings results in increased wear and tear, boosting demand for aftermarket parts. Additionally, the common design of many sedan models simplifies the production and availability of these parts.

The demand for replacement clutch components is driven by their essential role in vehicle drivetrains and the need for regular upkeep to ensure peak performance. Rising awareness among vehicle owners about preventive maintenance and the continued popularity of manual transmission vehicles further support the strong demand for clutch kits.

Overall, the expansion of the sedan segment and clutch kit components highlights their critical role in the passenger car aftermarket, presenting opportunities for industry players to innovate and grow their offerings.

The global passenger car bearing and clutch component aftermarket is fragmented, with leading players holding around 20% to 25% of the market share. Bosch, ZF Friedrichshafen AG, AISIN, Valeo Corp., Eaton Corporation Plc, and Aptiv are the top manufacturers and suppliers in this sector.

These companies are focusing on innovative solutions, such as lightweight and high-performance automotive bearings designed for electric vehicles. They are also developing new clutches for passenger cars and light commercial vehicles. To enhance their market presence, top players are pursuing strategies like distribution agreements, mergers, collaborations, acquisitions, and facility expansions.

Recent developments include Schaeffer's launch in May 2022 of a high-performance ball bearing with an integrated centrifugal disc. This bearing improves efficiency and reduces CO2 emissions for electric vehicles by combining the advantages of open and sealed bearings. Additionally, in 2022, The Timken Company, a leading name in industrial motion products, acquired GGB Bearing Technology (GGB).

By Product Type

By Vehicle Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us