October 2025

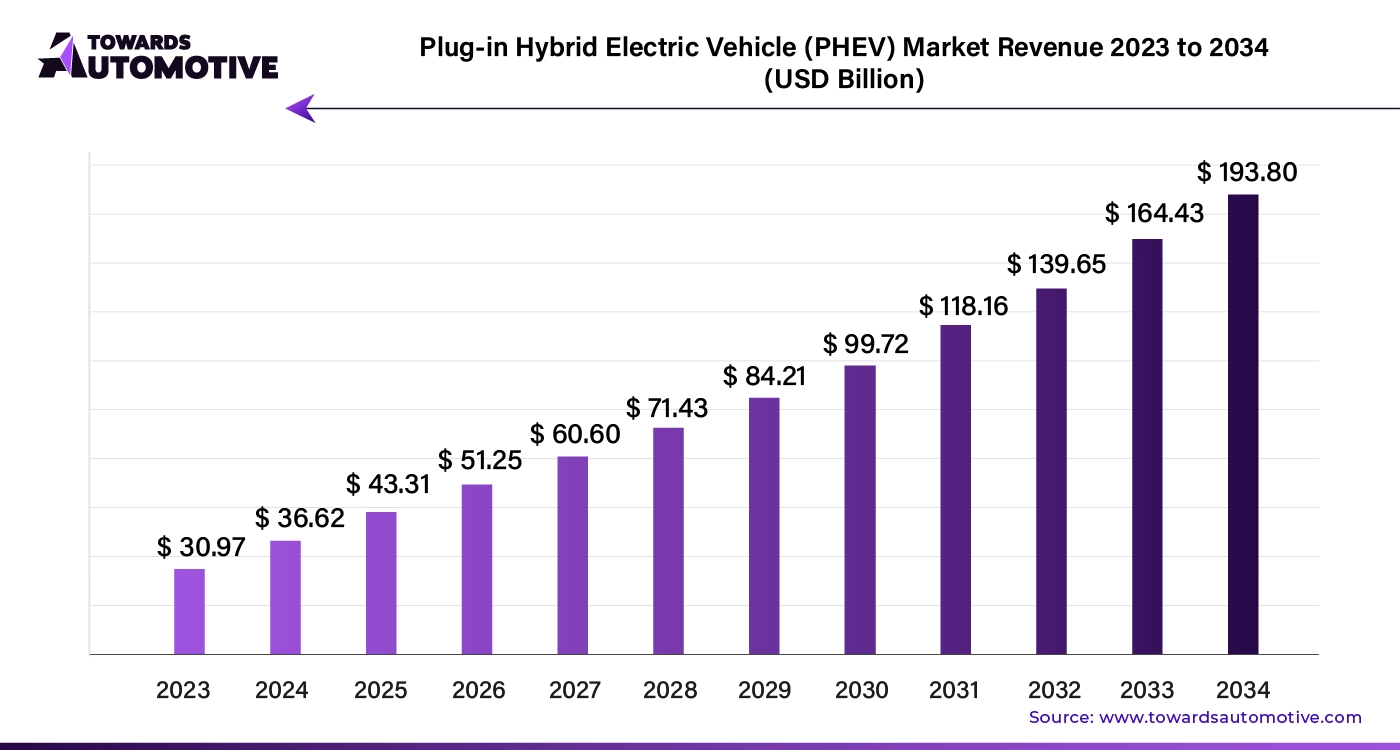

The global plug-in hybrid electric vehicle market size is calculated at USD 36.62 billion in 2024 and is expected to be worth USD 193.80 billion by 2034, expanding at a CAGR of 18.3% from 2023 to 2034.

As governments tighten regulations on greenhouse gas emissions, the push for plug-in hybrid electric vehicles (PHEVs) is gaining momentum. Consumers are increasingly aware of their carbon footprints and are seeking more sustainable transportation options. PHEVs offer an attractive solution, combining the benefits of electric and traditional fuel combustion engines. This hybrid approach significantly reduces emissions and dependence on fossil fuels, making it a compelling choice for eco-conscious drivers.

PHEVs work by using an electric motor to drive the vehicle for short trips, while a gasoline engine kicks in for longer journeys or when the battery is depleted. This dual powertrain system not only decreases overall emissions but also alleviates range anxiety often associated with purely electric vehicles. As technology advances and consumer demand rises, PHEVs are set to play a pivotal role in the transition toward greener transportation solutions. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

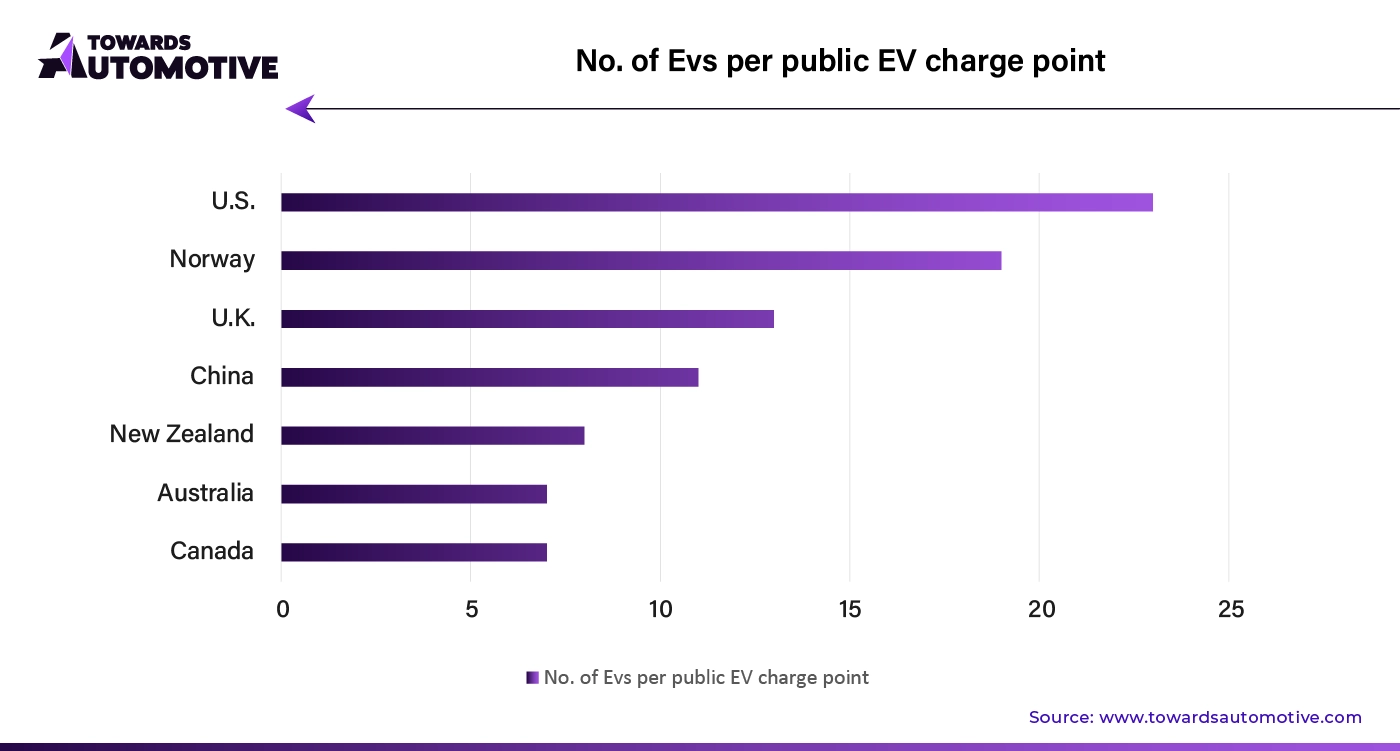

The expansion of charging infrastructure plays a crucial role in accelerating the adoption of plug-in hybrid electric vehicles (PHEVs). Active investments in charging stations by private companies, government bodies, and utility providers are helping to support the growing fleet of electric and plug-in hybrid electric vehicles.

To leverage this trend, PHEV manufacturers are partnering with charging solution providers to ensure that charging options are readily available. These collaborations aim to enhance the convenience and accessibility of charging, making it easier for consumers to switch to PHEVs. As a result, the increased investment in charging infrastructure is not only supporting the existing fleet but also encouraging more drivers to consider adopting PHEVs.

Passenger Cars Drive Market Growth in the Corporate Sector

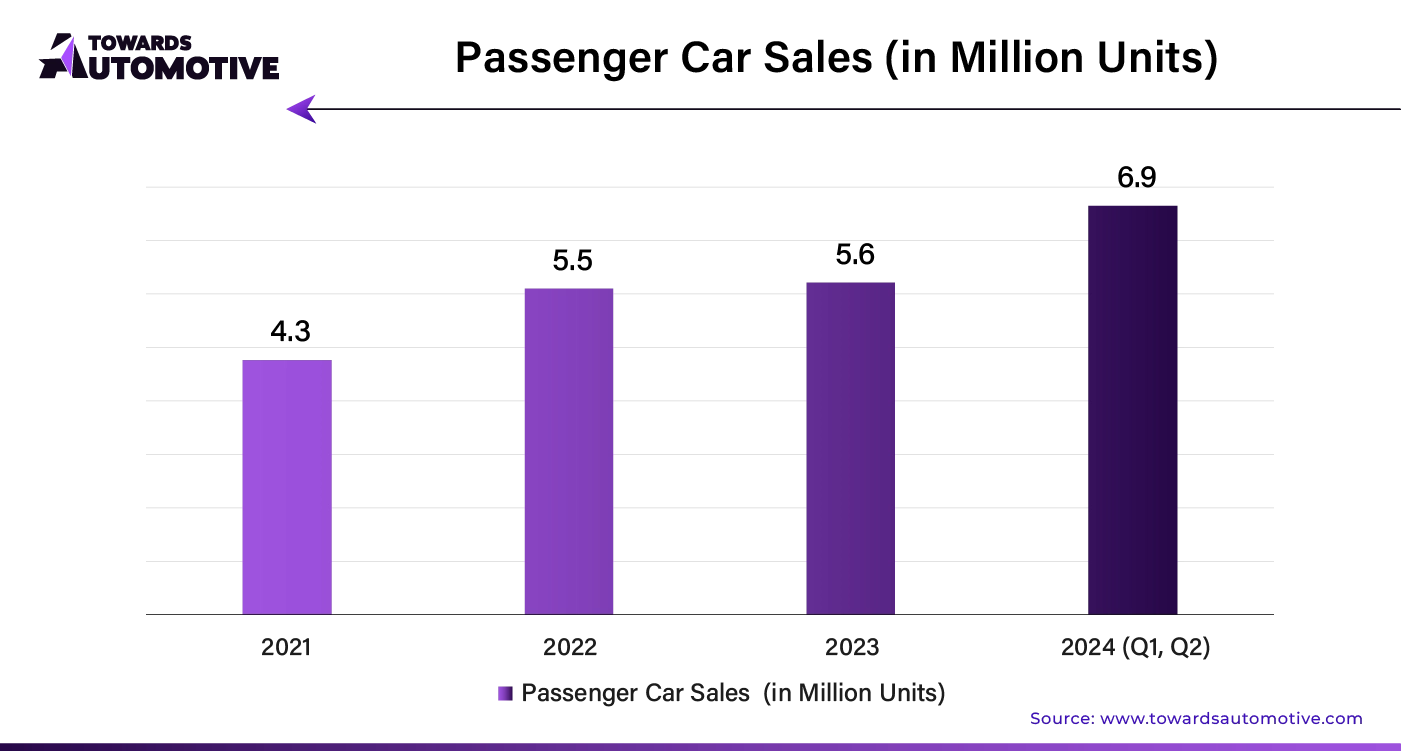

In the plug-in hybrid electric vehicle (PHEV) market, passenger cars are leading the vehicle type category with a notable share of 77.5% in 2024. Their popularity stems from their cost-effectiveness and low maintenance requirements, which resonate strongly with consumers. The rapid expansion of EV charging infrastructure further supports this segment, enhancing the appeal of passenger cars.

Given the high frequency of daily commutes, passenger cars have become a practical choice for many. Fleet managers and corporate entities are increasingly incorporating passenger cars into their fleets to cut operational costs and reduce carbon emissions. This shift is driving up demand as businesses aim to improve their environmental impact and achieve cost savings.

Parallel Hybrids Surge in Popularity

In the powertrain category, parallel hybrids dominate with a substantial share of 80.3% in 2024. Their popularity is attributed to their cost-efficiency and performance improvements, which enhance fuel consumption while delivering robust performance. Parallel hybrid PHEVs offer flexibility, performing admirably in both city and highway driving conditions.

The widespread acceptance of parallel hybrid technology, combined with its reliable performance history, has reinforced its strong market presence. The adaptability and efficiency of parallel hybrids make them a favored option for both consumers and manufacturers, boosting their market share and influence.

AI is revolutionizing the Plug-in Hybrid Electric Vehicle (PHEV) market by enhancing vehicle performance, boosting efficiency, and improving user experience. Through sophisticated algorithms and data analysis, AI optimizes battery management systems, ensuring longer battery life and more efficient energy usage. This technology predicts maintenance needs by analyzing real-time data from vehicle sensors, reducing downtime and repair costs.

Moreover, AI-driven predictive analytics aid manufacturers in designing more efficient PHEVs by analyzing market trends and consumer preferences. These insights help in developing features that cater to evolving consumer demands, thus accelerating market growth.

AI also plays a crucial role in advancing autonomous driving technology. By integrating AI with advanced driver assistance systems (ADAS), PHEVs offer improved safety and convenience, further attracting consumers. Additionally, AI enhances smart grid integration for PHEVs, optimizing energy distribution and promoting sustainable practices.

As AI continues to advance, its impact on the PHEV market will be profound, driving innovations that enhance vehicle performance and appeal, ultimately accelerating market expansion and adoption.

The supply chain for plug-in hybrid electric vehicles (PHEVs) operates through a coordinated network that ensures efficient delivery of components and finished products. The process begins with the procurement of raw materials like lithium, cobalt, and nickel, essential for battery production. Suppliers of these materials are carefully selected to meet quality standards and sustainability goals.

Once raw materials are secured, they are transported to battery manufacturers who assemble these components into high-performance batteries. These batteries are then sent to vehicle manufacturers, where they are integrated into PHEVs. Vehicle assembly involves a series of steps, including the installation of battery packs, electric motors, and other critical components.

After assembly, the finished vehicles are distributed to dealerships through a logistics network that includes warehousing and transportation. Throughout the supply chain, strong communication and technology integration are crucial for managing inventory, tracking shipments, and responding to market demands.

This streamlined approach ensures that PHEVs are produced and delivered efficiently, meeting the growing consumer demand for eco-friendly transportation solutions.

The Plug-in Hybrid Electric Vehicle (PHEV) market ecosystem thrives due to the collaborative efforts of various key players across different segments. Central to this ecosystem are automotive manufacturers, battery suppliers, technology providers, and infrastructure developers.

Automotive giants like Toyota, Honda, and Ford are pivotal, offering a range of PHEVs with advanced features that cater to diverse consumer needs. These manufacturers drive innovation in vehicle design and performance, contributing significantly to market growth. Battery suppliers such as LG Chem and Panasonic play a crucial role by providing high-capacity batteries essential for PHEV operation, enhancing vehicle efficiency and range.

Technology providers, including companies like Bosch and Siemens, contribute by developing sophisticated charging solutions and integrated systems that improve vehicle functionality and user experience. Additionally, infrastructure developers like ChargePoint and EVgo are instrumental in establishing widespread charging networks, which are vital for supporting PHEV adoption.

Together, these components create a robust ecosystem, driving advancements in technology, enhancing vehicle performance, and facilitating widespread adoption of Plug-in Hybrid Electric Vehicles. Their combined efforts ensure a sustainable and growing market.

Europe: Expanding Horizons for Plug-in Hybrid Electric Vehicles (PHEVs)

Europe is emerging as a major market for plug-in hybrid electric vehicles (PHEVs), driven by various key factors across different countries:

North America: Increasing Adoption Driven by Infrastructure and Incentives

In North America, both Canada and the United States are experiencing notable growth in the PHEV market:

Asia Pacific: Diverse Growth Opportunities for Plug-in Hybrid Electric Vehicles

The Asia Pacific region presents a range of growth prospects for PHEVs:

This regional analysis highlights the evolving opportunities and challenges in the plug-in hybrid electric vehicle market across different regions, reflecting the dynamic landscape of PHEV adoption and growth.

The plug-in hybrid electric vehicle (PHEV) market is highly competitive, with numerous manufacturers vying for technological advancements and market share. Each player in this sector brings unique strengths to the table, including innovation, marketing prowess, and specialized expertise, shaping the industry's landscape.

Leading the Charge: Major Players and Their Strategies

Renault SA and Nissan Motor Corporation Limited are at the forefront of electric vehicle (EV) development, with a significant emphasis on PHEV technology. Their leadership in this sector stems from their extensive investment in EV technologies, positioning them strongly in the market.

Volkswagen AG and BMW AG have also made substantial investments in PHEVs, focusing on integrating advanced electrification technologies into their vehicles. Their commitment to innovation is driving the market forward and expanding their presence in the PHEV sector.

Honda Motor Company Limited and Toyota Motor Corporation are notable for their hybrid and electrification strategies. They have successfully blended traditional internal combustion engines with electric powertrains, catering to a diverse range of consumer demands for plug-in hybrid vehicles.

General Motors and Ford Motor Company are intensifying their efforts to meet the growing demand for eco-friendly transportation. Both companies are ramping up their production of electric vehicles to align with the increasing consumer preference for sustainable options.

Daimler AG and Mitsubishi Heavy Industries Ltd. are leveraging their expertise in automotive engineering and electrification systems to establish a strong foothold in the hybrid electric vehicle market. Their contributions are enhancing the technological advancements and market penetration of PHEVs.

The PHEV market is characterized by fierce competition among manufacturers striving to lead in technological innovations. Key factors influencing their strategies include battery efficiency, evolving government regulations, and the development of charging infrastructure. These elements are critical in shaping the competitive landscape and driving the progress of PHEV technologies.

GAC Honda Automobile Co., Ltd.: In June 2022, GAC Honda, a partnership manufacturing Honda vehicles in China, announced the construction of a new electric vehicle facility. This initiative, led by Honda Motor (China) Investment Co., Ltd., aims to expand Honda's EV production capabilities in the region.

As the demand for eco-friendly transportation continues to rise, competition among major PHEV manufacturers is expected to intensify, driving further advancements in technology and market growth.

New Advancement in Plug-in Hybrid Electric Vehicle (PHEV) Market

By Vehicle Type

By Powertrain

By Technology

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us