March 2025

Senior Research Analyst

Reviewed By

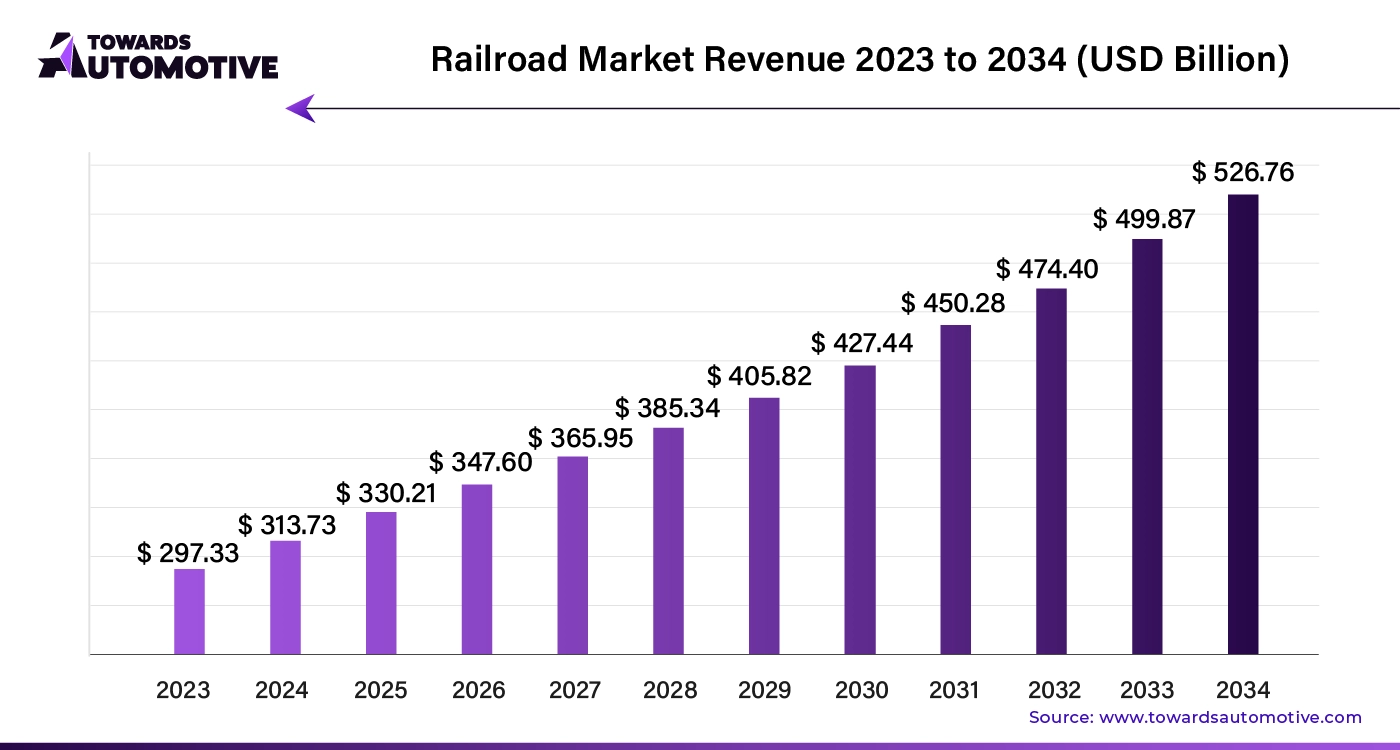

The global railroad market size is calculated at USD 313.73 billion in 2024 and is expected to be worth USD 526.76 billion by 2034, expanding at a CAGR of 5.5% from 2024 to 2034.

Rail transit stands out as an eco-friendlier and energy-efficient logistics option compared to other transportation modes. Advances in digital technology have transformed the rail sector, making reservations simpler and improving the passenger experience. Private sector investments are now driving new commercial ventures, technological advancements, and infrastructure upgrades in the rail service industry.

The railroad sector is poised for growth as sustainability and eco-friendly transportation gain importance. Increased investments from both public and private sectors are expected to drive the expansion of the railroad equipment market.

Urbanization has made underground railways essential in many cities. To meet the rising demand for subway systems, leading railroad equipment suppliers have adapted their offerings. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

High-speed trains, or bullet trains, have enhanced the appeal of rail travel for both long-distance passengers and businesses. The growing adoption of bullet trains in emerging economies is likely to further stimulate rail infrastructure development.

Artificial Intelligence (AI) is poised to revolutionize the railroad industry by enhancing operational efficiency and driving market growth. AI's predictive maintenance capabilities allow rail operators to foresee equipment failures before they occur, significantly reducing downtime and repair costs. This proactive approach ensures smoother and more reliable rail operations.

AI-powered analytics optimize route planning and train scheduling, leading to improved energy efficiency and reduced operational costs. By analyzing vast amounts of data, AI can identify patterns and suggest adjustments that maximize throughput and minimize delays.

Moreover, AI enhances safety through advanced monitoring systems. Real-time surveillance and anomaly detection help prevent accidents and ensure compliance with safety regulations. Autonomous trains, guided by AI, promise to improve precision and reliability, further boosting the industry's efficiency.

In customer service, AI-driven chatbots and virtual assistants streamline ticketing and customer support processes, enhancing user experience and satisfaction. As AI technologies advance, they will increasingly contribute to the railroad market's growth, positioning it for a future of enhanced efficiency and innovation.

In the railroad market, supply chain management is pivotal for efficient operations. The process begins with procurement, where rail operators source materials like rails, ties, and signaling equipment from suppliers. These materials are then transported to manufacturing facilities, where they are assembled into rail components.

Once manufactured, rail components are distributed to various locations, including railway maintenance facilities and construction sites. This distribution relies on a network of logistics providers who ensure timely delivery and minimize delays. Effective inventory management at these locations is crucial to prevent disruptions in rail operations.

Coordination between different stakeholders, including suppliers, manufacturers, and logistics providers, ensures that the supply chain operates smoothly. Advanced tracking technologies and real-time data integration play a significant role in monitoring inventory levels and managing shipments.

Furthermore, maintaining strong relationships with suppliers and adopting just-in-time strategies can help reduce inventory costs and improve efficiency. Regular review and optimization of the supply chain processes enable rail operators to adapt to market changes and enhance overall performance.

The railroad market ecosystem comprises several crucial components, including locomotives, rolling stock, track infrastructure, signaling systems, and maintenance services. Companies like Siemens and Alstom are pivotal in manufacturing advanced locomotives and rolling stock, enhancing efficiency and performance. Bombardier focuses on high-quality rail vehicles, contributing to passenger and freight transport improvements.

In the track infrastructure segment, companies such as Vossloh and Plasser & Theurer provide essential rail track components and maintenance equipment, ensuring safety and durability. Additionally, signaling systems from firms like Thales and Hitachi ensure efficient train operations and collision avoidance.

Maintenance services are vital for operational reliability, with companies like GE Transportation and Knorr-Bremse offering comprehensive solutions for locomotive and rail vehicle upkeep. Together, these companies support the railroad market by delivering innovative technologies and services that improve operational efficiency, safety, and sustainability in rail transport. Their contributions are integral to maintaining and advancing the global railroad infrastructure, catering to both passenger and freight needs.

The global railroad market is experiencing varied growth rates across different countries, with India emerging as the fastest-growing market. It is projected to expand at an impressive annual growth rate of 7.5% through 2034. This surge is largely due to substantial federal investments aimed at upgrading the nation's rail infrastructure, extending existing networks, and advancing rail technology.

China is also seeing significant growth, with an expected annual increase of 7.0% over the next decade. The country’s Belt and Road Initiative (BRO) is a major driver of this expansion, with investments in international rail projects designed to enhance regional connectivity and create business opportunities for Chinese railroad companies in neighboring countries.

Australia is a notable player in the railroad industry within the Pacific and Oceania regions, with a projected year-on-year growth rate of 4.7% until 2034. This growth is fueled by ongoing efforts to expand and modernize the country's rail networks, aiming to improve connections, capacity, and operational efficiency.

In comparison, the United States, with a growth rate of 2.9% annually, remains a key market due to significant private sector investments. For instance, Union Pacific Railroad Corporation has invested approximately US$ 35 billion in its infrastructure and operations between 2013 and 2022, underscoring the vital role of private investments in supporting and enhancing the U.S. rail network.

India stands out as the fastest-growing market, while the United States continues to lead through substantial private sector investments. China and Australia are also making significant progress, with China’s growth driven by international projects and Australia’s by domestic infrastructure improvements.

At the same time, the agriculture sector is anticipated to become the top end user of railroad equipment, with a notable 34.2% market share this year. Governments across the globe recognize the importance of railroad infrastructure for transporting bulk agricultural goods, especially in Asia and Africa, where its contribution is expected to increase.

While passenger rail remains the largest segment, the agriculture sector is emerging as a significant force in the market.

The global railroad market is dominated by a few major manufacturers, leading to market consolidation. New entrants can gain traction by introducing innovative products for specific railway needs and maintaining product differentiation.

By Type

By End User

By Region

March 2025

February 2025

January 2025

January 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us